As Bitcoin prices return to the $100,000 high and MSTR stock prices continue to rise, the market's divergence in the valuation of Strategy (formerly MicroStrategy) is accelerating.

Written by: Nancy, PANews

As Bitcoin prices return to the $100,000 high and MSTR stock prices continue to rise, the market's divergence in the valuation of Strategy is accelerating. On one hand, several large global institutions are quietly increasing their holdings in MSTR stock, viewing it as an important financial tool for indirect exposure to Bitcoin; on the other hand, its highly volatile and deeply leveraged asset structure has also attracted the attention of Wall Street short sellers. As Strategy continues to increase its Bitcoin exposure, it is evolving into a barometer for Bitcoin price trends and a focal point for capital leverage games.

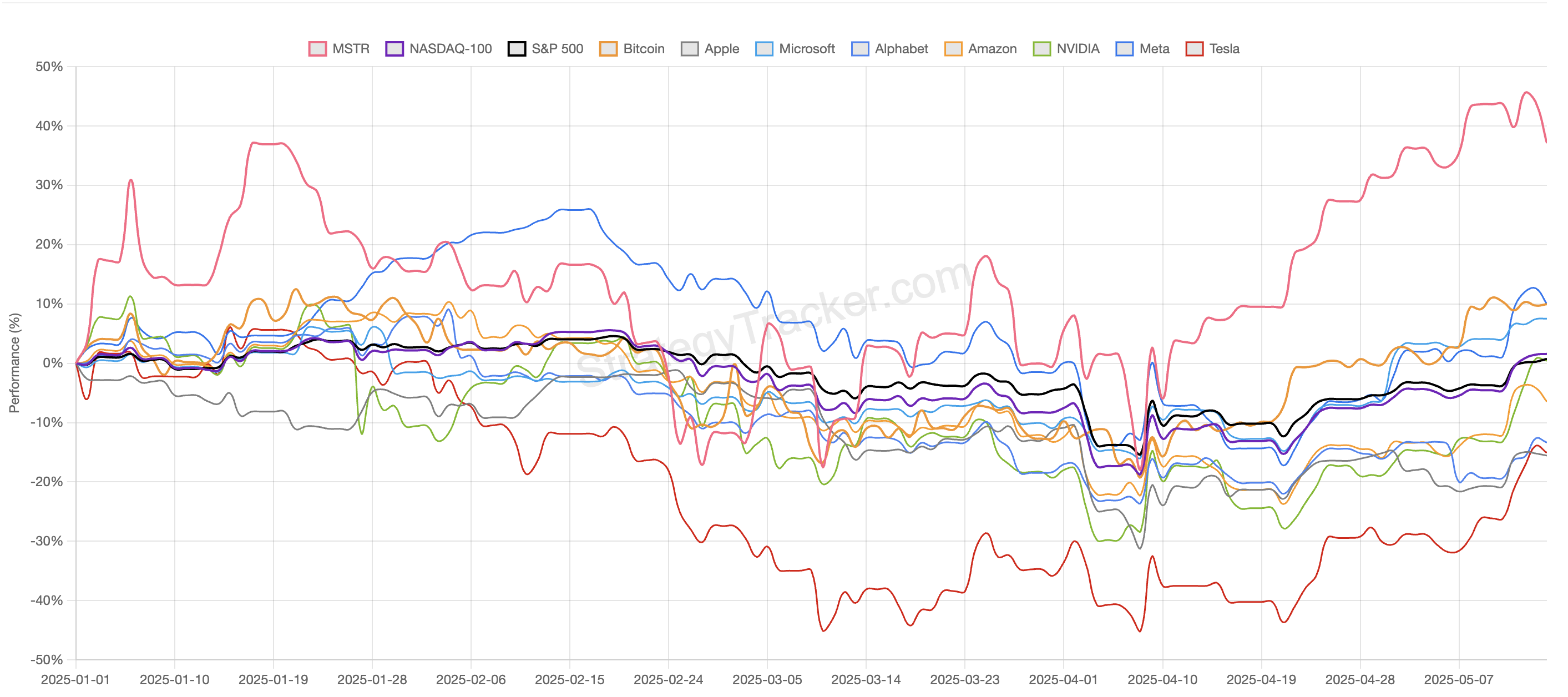

Stock prices outperform tech giants, attracting Wall Street shorts

At the recent Sohn Investment Conference in New York, legendary Wall Street short seller and former hedge fund manager Jim Chanos stated that he is shorting Strategy while simultaneously buying Bitcoin, calling it an "arbitrage opportunity of buying at $1 and selling at $2.5."

He pointed out that Strategy holds over 500,000 Bitcoins through high leverage, and the current stock price has a high premium compared to its actual holdings. He criticized the emergence of a group of companies mimicking Strategy, selling the concept of purchasing Bitcoin through corporate structures to retail investors in order to achieve high valuations, calling this logic "absurd."

Over the past year, MicroStrategy's stock price has risen over 220%, while Bitcoin has only increased by about 70%. Chanos believes this trade serves as a "barometer" for observing retail speculative behavior.

Chanos is a highly influential investor on Wall Street, known for his focus on short-selling strategies as the founder of the hedge fund Kynikos Associates. He is renowned for his deep fundamental analysis and keen ability to identify corporate financial fraud and business model flaws, with classic short-selling cases including Enron, WorldCom, and Luckin Coffee. However, in recent years, he has also faced significant losses from shorting Tesla, leading to the closure or adjustment of some funds.

It is worth noting that this is not the first time Strategy has become a target for well-known short sellers. In December of last year, the well-known short-selling firm Citron Research announced it was shorting Strategy, despite its overall bullish stance on Bitcoin, arguing that MSTR had significantly deviated from Bitcoin's fundamentals. This news caused MSTR to drop sharply in the short term, but due to the optimism in market sentiment driven by Bitcoin's rise and the increased visibility and liquidity from MSTR being included in the Nasdaq 100 index, this short-selling attempt ultimately failed.

Recently, in addition to external short-selling pressure, Strategy executives have also frequently reduced their shareholdings. It has been disclosed that Jarrod M. Patten, who has served as a company director for over 20 years, has cumulatively sold about $5.2 million worth of stock since April of this year and plans to continue reducing his holdings by $300,000 this week.

Despite this, MSTR's stock price performance remains strong. According to MSTR-tracker data, Strategy currently has a total market capitalization of $10.982 billion, ranking 183rd in global asset market value. This year, MSTR has accumulated a rise of about 37.1%, outperforming Bitcoin and also leading tech giants like Microsoft, Nvidia, Apple, and Amazon.

Q1 financial report shows a loss of over $4 billion, with over a thousand institutions betting on it

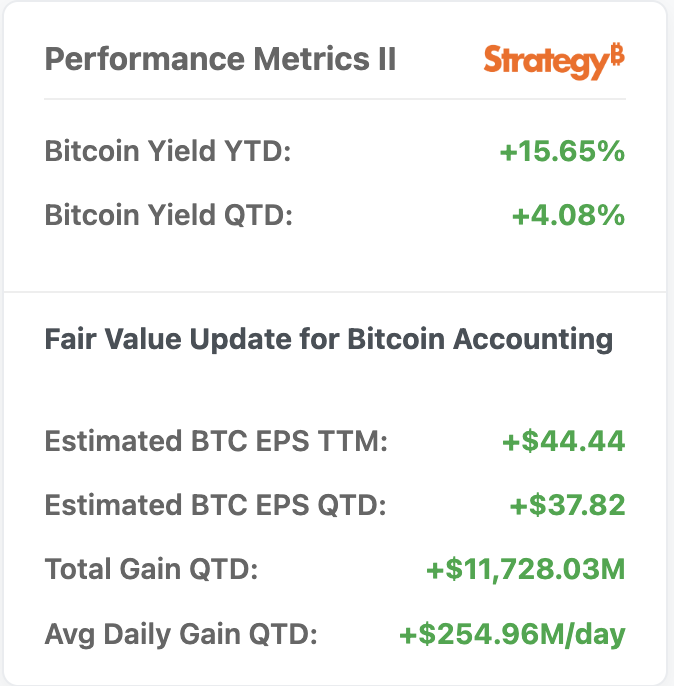

MSTR-tracker data shows that as of May 16, Strategy holds a total of 568,840 BTC, with a year-to-date Bitcoin investment return of 15.65%. Based on the latest data estimates, the expected Bitcoin earnings per share (EPS) for this quarter is $37.82.

However, in contrast to the considerable Bitcoin return rate, Strategy's latest quarterly financial performance has come under pressure due to the pullback in Bitcoin prices in the latter part of Q1 this year. The company's recently released Q1 2025 financial report shows that revenue decreased by 3.6% year-on-year to $111.1 million, falling short of market expectations, with a net loss reaching as high as $4.23 billion (loss per share of $16.49), significantly exceeding market expectations.

To alleviate financial pressure and further expand its Bitcoin asset exposure, Strategy is accelerating its capital operation strategy. Earlier this month, Strategy announced a new $21 billion public offering plan for common stock and has raised its BTC yield target from 15% to 25%, and its BTC dollar revenue target from $10 billion to $15 billion. Following this, Strategy further announced the launch of a new "42/42 plan," aimed at raising $84 billion over two years for purchasing Bitcoin. In response, Wall Street analysts expressed support, with Benchmark and TD Cowen analysts reaffirming their buy ratings on the company, believing its capital raising strategy is feasible.

Unlike most company stocks that correspond to the market sales performance of company products, Strategy's stock is positioned as "smart leverage" for Bitcoin. Its founder Saylor elaborated on this narrative when the company was renamed to Strategy. There is a gap of about 45% between traditional assets (such as SPDR S&P 500 ETF and Invesco QQQ Trust, which have volatility levels between 15-20) and Bitcoin (which has volatility levels between 50-60). The target volatility for Strategy's common stock is even higher than Bitcoin itself, aiming to reach a volatility level of 80-90, while maintaining what Saylor calls "smart leverage" through a combination of equity issuance and convertible bonds.

Although there are short-selling attacks, many large institutional investors are also betting on Strategy's strategy, which has recently boosted market confidence. Fintel data shows that to date, a total of 1,487 institutions hold Strategy stock, with a total holding of 139 million shares, currently valued at approximately $55.175 billion.

Citadel Advisors

Citadel Advisors is one of the largest hedge funds in the world. According to 13F filings, as of Q1 this year, Citadel Advisors holds MSTR stock worth over $6.69 billion, approximately 23.22 million shares, making it one of Strategy's largest shareholders.

Vanguard Group

As of Q1 2025, Vanguard Group, one of the largest public fund management companies in the world, holds approximately 20.58 million shares of MSTR, valued at over $5.93 billion.

Susquehanna International Group

Susquehanna International Group is a globally recognized hedge fund company. As of Q1 2025, the company holds MSTR stock worth over $5.73 billion, approximately 19.88 million shares.

Jane Street

According to 13F filings, as of Q1 2025, Jane Street, one of the top hedge funds in the world, holds over 16 million shares of MSTR, valued at nearly $4.63 billion.

Capital International

According to the 13F filings submitted by Capital International in Q1 this year, the institution holds nearly 14.68 million shares of MSTR, valued at approximately $4.23 billion.

BlackRock

As of Q1 this year, BlackRock, one of the largest asset management giants in the world, holds approximately 14.42 million shares of MSTR, valued at over $4.15 billion.

CalPERS

CalPERS is the second-largest public pension fund in the United States, managing over $300 billion in assets. As of Q1 2025, CalPERS holds 357,000 shares of MSTR, valued at approximately $10.2 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。