作者:佐爷歪脖山

在 Luna-UST 崩溃后,稳定币彻底告别算稳时代,CDP 机制(DAI、GHO、crvUSD)一度成为全村的希望,但是最终在 USDT/USDC 包围下冲出重围的是 Ethena 和其代表的收益锚定范式,既避免超额质押带来的资金效率低下问题,又能用原生收益特性打开 DeFi 市场。

反观 Curve 系,在依靠稳定币交易打开 DEX 市场后,逐步进军借贷市场 Llama Lend 和稳定币市场 crvUSD,但是在 Aave 系的光芒下,crvUSD 发行量长期徘徊在 1 亿美元左右,基本只能被当做背景板。

不过 Ethena/Aave/Pendle的飞轮启动后,Curve 的新项目 Yield Basis 也想来分一杯稳定币市场的羹,也是从循环杠杆贷入手,但这次是交易,希望用交易抹除 AMM DEX 的痼疾——无偿损失(IL,Impermanent Loss)。

单边主义消除无偿损失

Curve 系最新力作,现在你的 BTC 是我的了,拿好你的 YB 站岗吧。

Yield Basis 代表文艺复兴,在一个项目里,你能看到流动性挖矿、预挖、Curve War、质押、veToken、 LP Token 还有循环贷,可以说是集 DeFi 发展之大成。

Curve 创始人 Michael Egorov 是 DEX 发展的早期受益者,在 Uniswap的 x*y=k的经典 AMM 算法上进行改进,先后推出 stableswap 和 cryptoswap 算法,用以支持更“稳定币的交易”,以及效率更优的通用算法。

稳定币大规模交易,奠定了 Curve 对于 USDC/USDT/DAI 等早期稳定币链上“拆借”市场,Curve 也成为前 Pendle 时代最重要的稳定币链上基础设施,甚至 UST 的崩盘也直接源于 Curve 流动性撤换时刻。

代币经济学上,veToken 模式,以及随后的“贿赂”机制 Convex 一举让 veCRV 成为真正具备实际作用的资产,不过四年的锁定期后,大多数的 $CRV 持有人心中苦楚,不足为外人道也。

在 Pendle 和 Ethena 崛起后,Curve 系的市场地位不保,核心是对于 USDe 而言,对冲源于 CEX 合约,导流使用 sUSDe 捕捉收益,稳定币交易本身的重要性不再重要。

Curve 系的反击首先来自 Resupply,2024 年联合 Convex 和 Yearn Fi 两大古早巨头推出,然后不出意外的暴雷,Curve 系首次尝试失败。

Resupply 出事,虽然不是 Curve 官方项目,但是打断骨头连着筋,Curve 如果再不反击,则很难在稳定币新时代买一张通向未来的船票。

行家一出手,确实与众不同,Yield Basis 瞄准的不是稳定币、也不是借贷市场,而是 AMM DEX 中的无偿损失问题,但是先声明:Yield Basis 的真实目的从来不是消除无偿损失,而是借此促进 crvUSD 的发行量暴涨。

但还是从无偿损失的发生机制入手,LP(流动性提供者)取代传统的做市商,在手续费分成刺激下,为 AMM DEX 的交易对提供“双边流动性”,比如在 BTC/crvUSD 交易对中,LP 需要提供 1 BTC 和 1 crvUSD(假设 1BTC = 1USD),此时 LP 的总价值是 2 USD。

与之对应,1 BTC 的价格 p 也可以用 y/x 来表示,我们约定 p=y/x,此时,如果 BTC 价格发生变化,比如上涨 100% 至 2 美元,则会发生套利情况:

A 池:套利者会用 1 美元来购买 1 BTC,此时 LP 需要卖出 BTC 获得 2 美元

B 池:在价值达到 2 美元的 B 池内卖出,套利者净赚 2-1=1 美元

套利者的利润本质上就是 A 池 LP 的损失,如果要量化这种损失,可先计算 LP 在套利发生后的价值 LP(p)= 2√p(x,y 同时用 p 来表示),但是 LP 如果简单持有 1 BTC 和 1 crvUSD,则认为其没有损失,可表示为 LP~hold~(p)= p +1。

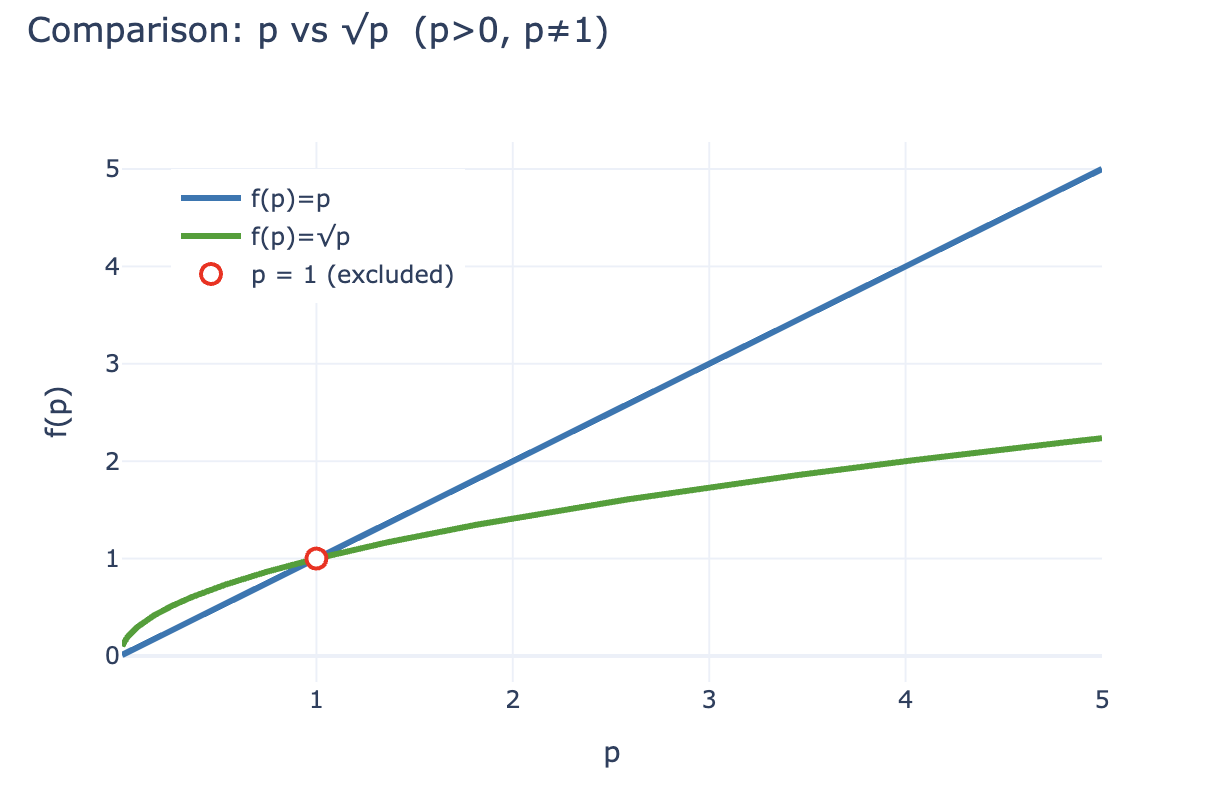

根据不等式,在 p>0 且不为 1 的情况下,始终可得 2√p p + 1,而套利者获得收入本质上来源于 LP 的损失,所以在经济利益的刺激下,LP 倾向于撤出流动性而持有加密货币,而 AMM 协议必须通过更高的手续费分成和代币刺激来挽留 LP,这也是 CEX 能在现货领域保持对 DEX 优势的根本原因。

图片说明:无偿损失

图片来源:@yieldbasis

无偿损失从整个链上经济系统的视角而言,可以视为一种“期望”,LP 选择了提供流动性,就不能再要求获得持有的收益,所以,本质上无偿损失更多是一种“会计”式的记账损失,而不应该被作为一种真实的经济损失,相比于持有 BTC,LP 也可以获得手续费。

Yield Basis 不是这样认为的,他们不是从提高流动性、提高手续费比例来消除 LP 的预期损失,而是从“做市效率”入手,前文提到,相比于持有的 p+1,LP 的 2√p 永远跑不赢,但是从 1 美元投入的产出比来看,初始投资 2 美元,现价 2√p 美元,每一美元的“收益率”是 2√p/2 = √p,还记得 p 是 1 BTC 的价格吗,所以如果你简单持有,那么 p 就是你的资产收益率。

假设 2 美元的初始投资,那么在 100% 的增幅后,LP 收益变化如下:

• 绝对增加值:2 USD = 1 BTC(1 USD) + 1 crvUSD -> 2√2 USD (套利者会拿走差值)

• 相对收益率:2 USD = 1 BTC (1 USD) + 1 crvUSD -> √2 USD

Yield Basis 从资产收益率角度入手,让 √p 变为 p 即可在确保 LP 手续费同时保留持有性收益,这个很简单,√p²即可,从金融角度看,就是要 2x 杠杠,而且必须是固定的 2x 杠杆,过高或过低,都会让经济系统崩坏。

图片说明:p 和 √p 的 LP Value Scaling 对比

图片来源:@zuoyeweb3

也就是让 1 个 BTC 发挥自身两倍的做市效率,天然不存在对应的 crvUSD 参与手续费分润,BTC 只剩自身参与收益率比较,也就是从√p 变身 p 本身。

不管你信不信,反正 2 月份 Yield Basis 官宣融资 500 万美元,说明有 VC 信了。

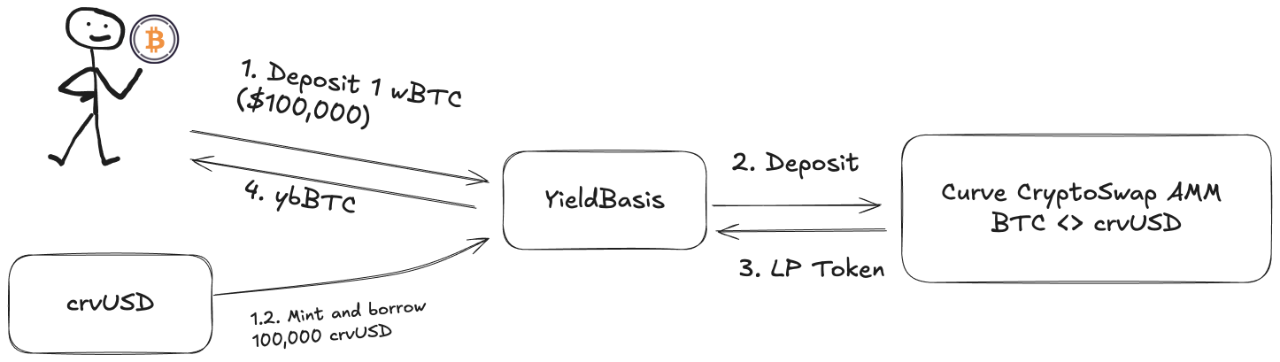

但是!LP 添加流动性必须是对应 BTC/crvUSD 交易对,池子里都是 BTC 也没法运行,Llama Lend 和 crvUSD 顺势而为,推出双重借贷机制:

1. 用户存入(cbBTC/tBTC/wBTC)500 BTC,YB(Yield Basis)利用 500 BTC 借出等值 500 crvUSD,注意,此时是等值,利用闪电贷机制,不是完全的 CDP(本来约为 200% 质押率)

2. YB 将 500BTC/500 crvUSD 存入 Curve 对应的 BTC/crvUSD 交易池,并铸造为 $ybBTC 代表份额

3. YB 将价值 1000U 的 LP 份额当做质押物再去 Llama Lend 走 CDP 机制借出 500 crvUSD 并偿还最初的等值借款

4. 用户收到代表 1000U 的 ybBTC,Llama Lend 得到 1000U 的抵押物并消除第一笔等值借贷,Curve 池得到 500BTC/500 crvUSD 流动性

图片说明:YB 运作流程

图片来源:@yieldbasis

最终,500 BTC “消除”自身的贷款,还得到了 1000 U 的 LP 份额,2x 杠杆效果达成了。但请注意,等值贷款是 YB 借出的,充当了最关键的中间人,本质上是 YB 向 Llama Lend 承担剩下的 500U 的借款份额,所以 Curve 的手续费 YB 也要分成。

用户如果认为 500U 的 BTC 能产生 1000U 的手续费利润,那么是对的,但是认为都给自己,那就有点不礼貌了,简单来说,不止五五分成,YB 的小心思在于对 Curve 的像素级致敬。

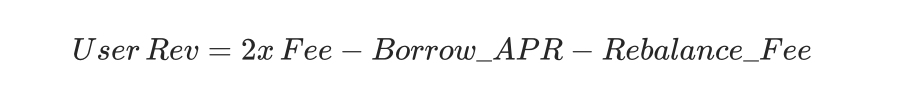

来计算一下本来的收益:

其中,2x Fee 意味着用户投入 500U 等值 BTC 可以产生 1000 U 手续费利润, Borrow_APR 代表 Llama_Lend 的费率,Rebalance_Fee 代表套利者维持 2x 杠杆的费用,这部分本质上依然要 LP 出。

现在有一个好消息和一个坏消息:

• 好消息:Llama Lend 的借贷收入全部回到 Curve 池中,相当于被动增加了 LP 收益

• 坏消息:Curve 池的手续费固定分 50% 给池自身,也就是 LP 和 YB 都要在剩下的 50% 手续费中分

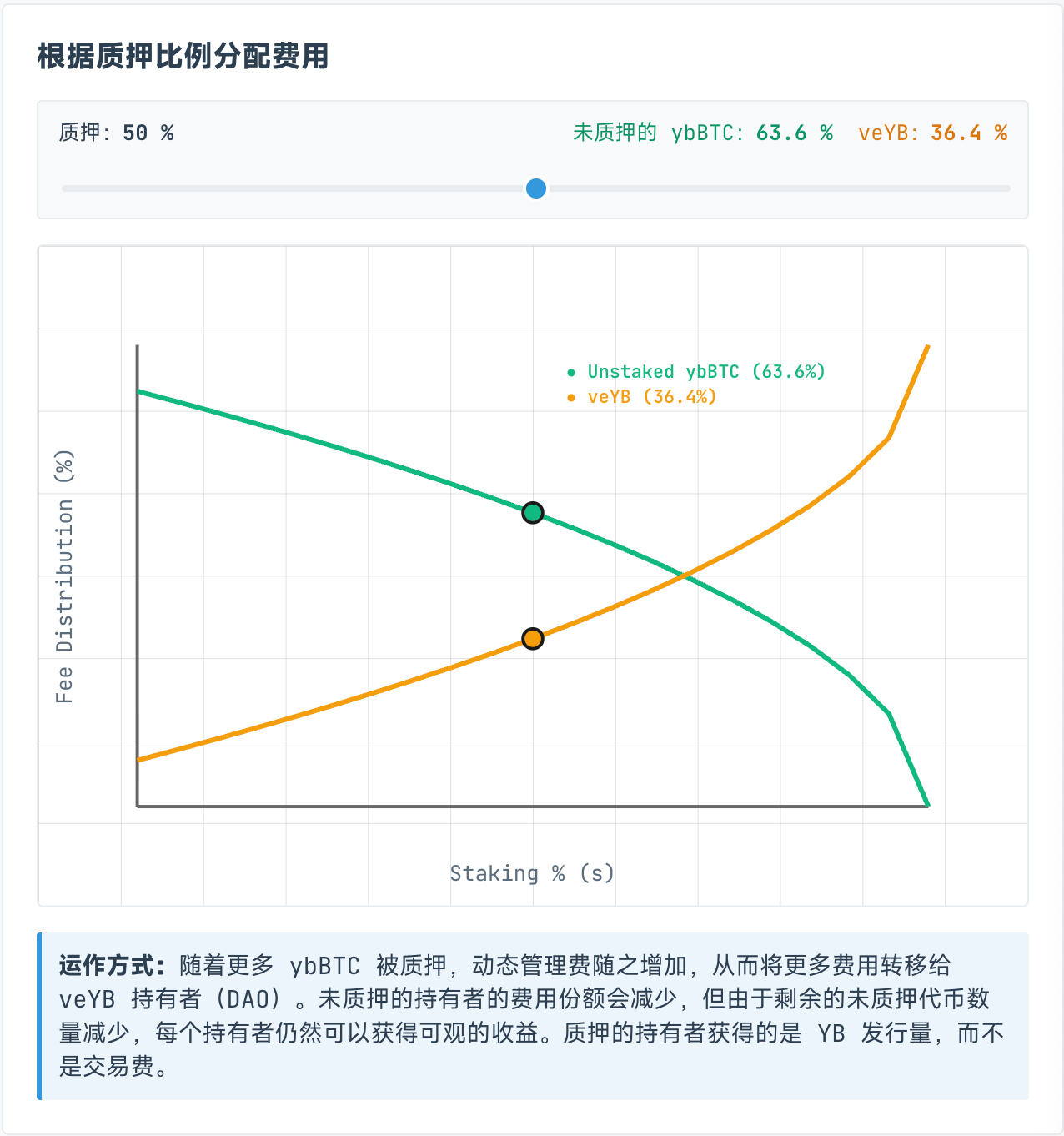

不过分配给 veYB 的手续费是动态的,其实是要在 ybBTC 和 veYB 持有人中动态划分,其中 veYB 固定最低 10% 保底分成,也就是说,即使所有人都不质押 ybBTC,他们也只能获得原始总收入的 45%,而 veYB 也就是 YB 自身可获得总收入的 5%。

神奇结果出现,即使用户都不质押 ybBTC 给 YB,也只能拿到 45% 的手续费,如果选择质押 ybBTC,则能拿到 YB Token,但是要放弃手续费,如果想两者都要,那么可以继续质押 YB 换成 veYB,则可以获得手续费。

图片说明:ybBTC 和 veYB 收入分成

图片来源:@yieldbasis

无偿损失永远不会消失,只是会转移。

你以为你用 500U 等值 BTC 发挥出 1000U 的做市效果,但是 YB 可没说做市收益都给你,而且你质押成 veYB 后,解质押两次,veYB->YB, ybBTC->wBTC 才能拿回原始资金和收益。

但是如果要获得 veYB 完整投票权,也就是贿赂机制,那么恭喜你,获得了四年锁仓期,否则投票权和收益随质押期逐步降低,那么锁仓四年的收益和舍弃 BTC 流动性获得 YB 到底值不值,就看个人考虑了。

前文提到过,无偿损失是一种记账损失,只要不撤出流动性就是浮亏,现在 YB 的消除计划,本质也是“记账收入”,给你一种锚定持有的收益的浮盈,然后培育自身的经济学系统。

你想用 500U 撬动 1000U 的手续费收入,YB 想“锁定”你的 BTC,把自己的 YB 卖给你。

多方协商拥抱增长飞轮

收益大时代,有梦你就来。

基于 Curve,使用 crvUSD,虽然会赋能 $CRV,但也新开 Yield Basis 协议和代币 $YB,那么 YB 四年后能保值增值吗?恐怕…

在 Yield Basis 复杂的经济学机制外,重点是 crvUSD 的市场扩张之路。

Llama Lend 本质上是 Curve 的一部分,但是 Curve 创始人竟然提案要增发 6000 万美元的 crvUSD 用以供给 YB 初始流动性,这就有点大胆了。

图片说明:YB 未动,crvUSD 先发

图片来源:@newmichwill

YB 会按照计划给与 Curve 和 $veCRV 持有人好处,但核心是 YB Token 的定价和增值问题,crvUSD 说到底是 U,那 YB 真的是增值性资产吗?

更别说再出现一次 ReSupply 事件,影响的就是 Curve 本体了。

故此,本文不分析 YB 和 Curve 之间的代币联动和分润计划,$CRV 殷鉴未远,$YB 注定不值钱,浪费字节没意义。

不过在为自己增发的辩护中,可以一窥 Michael 的奇思妙想,用户存入的 BTC 会“增发”出等值的 crvUSD,好处是增加 crvUSD 供应量,每一枚 crvUSD 都会被投入池中赚手续费,这是真实的交易场景。

但本质上这部分 crvUSD 储备金是等值而非超额的,如果不能提高储备金比例,那么提高 crvUSD 赚钱效应也是个办法,还记得资金相对收益率吗?

按照 Michael 的设想,被借出的 crvUSD 会与现有交易池高效协同,比如 wBTC/crvUSD 会和 crvUSD/USDC 联动,促进前者的交易量,也会促使后者交易量增加。

而 crvUSD/USDC 交易对的手续费会分 50% 给 $veCRV 持有人,剩下 50% 分给 LP。

可以说,这是一个非常危险的假设,前文提到的 Llama Lend 出借给 YB 的 crvUSD 是单开池专供使用,但是 crvUSD/USDC 等池是无准入的,此时的 crvUSD 本质上是储备金不足,一旦币值震荡,非常容易被套利者薅羊毛,随后就是熟悉的死亡螺旋,crvUSD 出问题会连带 YB 和 Llama Lend,最终影响整个 Curve 生态。

务必注意 crvUSD 和 YB 是绑死的,50% 的新增发流动性要进入 YB 生态,YB 使用的 crvUSD 发行隔离,但是使用没有隔离,这是最大的潜在暴雷点。

图片说明:Curve 分润计划

图片来源:@newmichwill

Michael 给出的计划是用 YB Token 25% 的发行量贿赂稳定币池保持深度,这个就已经接近笑话的程度了,资产安全性:BTC>crvUSD>CRV>YB,危机来临时,YB 连自己都保护不了,又能保护啥呢?

YB 自己的发行就是 crvUSD/BTC 交易对的手续费分润产物,想起来了吗,Luna-UST 也是如此,UST 是 Luna 销毁量的等值铸造物,两者互为依仗,YB Token>crvUSD 也是如此。

还可以更像,按照 Michael 的计算,根据过去六年的 BTC/USD 交易量和价格表现,他算出来可以保证 20% 的 APR,并且保证在熊市也可以达成 10% 的收益率,2021 年牛市高点可达 60%,如果赋能一点点给 crvUSD 和 scrvUSD,赶超 USDe 和 sUSDe 不是梦。

因为数据量太大,我没有回测数据去验证他计算的能力,但是别忘了,UST 也保证过 20% 的收益,Anchor + Abracadabra 的模型也运行了相当长时间,难道 YB+Curve+crvUSD 的组合会不一样吗。

至少,UST 在崩溃前疯狂的购买 BTC 当做储备金,YB 是直接基于 BTC 来做杠杆储备金,也算是巨大进步。

忘记等于背叛。

从 Ethena 开始,链上项目才开始找真实的收益,而非只看市梦率。

Ethena 利用 CEX 对冲 ETH 进行收益捕捉,通过 sUSDe 进行收益分发,使用 $ENA 财库战略维持大户和机构信任,多方腾挪才稳住 USDe 百亿美元发行量。

YB 想寻找真实的交易收益,本身没有任何问题,但是套利和借贷并不同,交易即时性更强,每一枚 crvUSD 都是 YB 和 Curve 的共同负债,而且抵押物本身也是借用户而来,自有资金高度接近于零。

crvUSD 目前的发行量很少,在前期维持增长飞轮和 20% 回报率并不难,但是一旦规模膨胀,YB 价格增长、BTC 价格变动、crvUSD 价值捕捉能力下降都会造成重大抛压。

美元是无锚货币,crvUSD 也快要是了。

不过,DeFi 的嵌套性风险已经被定价进链上整体系统性风险里,所以对所有人都是风险就不是风险,反而不参与的人会被动分摊掉崩盘的损失。

结语

世界会给予一个人机会闪耀,能把握住才是英雄。

传统金融的 Yield Basis 是美债收益率,链上的 Yield Basis 会是 BTC/crvUSD 吗?

YB 逻辑能成立是链上交易足够大,尤其是 Curve 本身交易量巨大,在这种情况下,消除无偿损失才有意义,可以类比一下:

• 发电量等于用电量,不存在静止的“电”,即发即用

• 交易量等于市值,每一个代币都在流动,即买即卖

只有在不断、充分的交易中,BTC 的价格才能被发现,crvUSD 的价值逻辑才能闭环,从 BTC 借贷中增发,从 BTC 交易中获利,我对 BTC 长期上涨抱有信心。

BTC 是加密小宇宙的 CMB(Cosmic Microwave Background,宇宙微波背景),从 08 年金融大爆炸之后,只要人类不想以革命或者核战方式重启世界秩序,BTC 的总体走势就会上涨,不是因为对 BTC 的价值凝聚更多共识,而是对美元及一切法币通胀抱有信心。

但我对 Curve 团队的技术实力中等信任,ReSupply 之后对他们的道德水平持深切怀疑态度,但是,也很难有其他团队敢于在这个方向尝试,无可奈何钱流去,无偿损失有缘人。

UST 在灭亡前夕疯狂购入 BTC,USDe 储备金波动期间换成 USDC,Sky 更是疯狂拥抱国债,这一次,祝 Yield Basis 好运吧。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。