JPMorgan believes that this "zero-sum game" will continue for the remainder of the year.

Written by: Bu Shuqing, Wall Street Insights

JPMorgan points out that as "de-dollarization trading" has stalled, a "zero-sum game" situation has emerged between gold and Bitcoin. Since April 22, gold prices have dropped nearly 8% after reaching a peak of $3,500, while Bitcoin prices have risen 18% during the same period.

This contrast is also reflected in the flow of funds. According to reports from the trading desk, JPMorgan's latest report indicates that over the past three weeks, there has been an outflow of funds from gold ETFs, while Bitcoin and cryptocurrency ETFs have attracted inflows.

JPMorgan expects that the "zero-sum game" between gold and Bitcoin will continue for the remainder of the year, leaning towards the belief that specific catalysts for cryptocurrencies will create more upward space for Bitcoin in the second half of the year. The report notes that in addition to the support from funds flowing out of gold, Bitcoin also benefits from several cryptocurrency-specific catalysts, including companies like MicroStrategy increasing their holdings and New Hampshire passing legislation allowing state finances to invest in Bitcoin.

A Major Reversal in Safe-Haven Assets

The report notes that in the fourth quarter of 2024, gold prices and Bitcoin prices showed a synchronized upward trend, especially during and after the U.S. elections, as market concerns about dollar depreciation benefited both assets. However, entering 2025, this "de-dollarization" trading has clearly stalled, shifting to a "zero-sum game" relationship between gold prices and Bitcoin.

The flow of funds reflects three main characteristics:

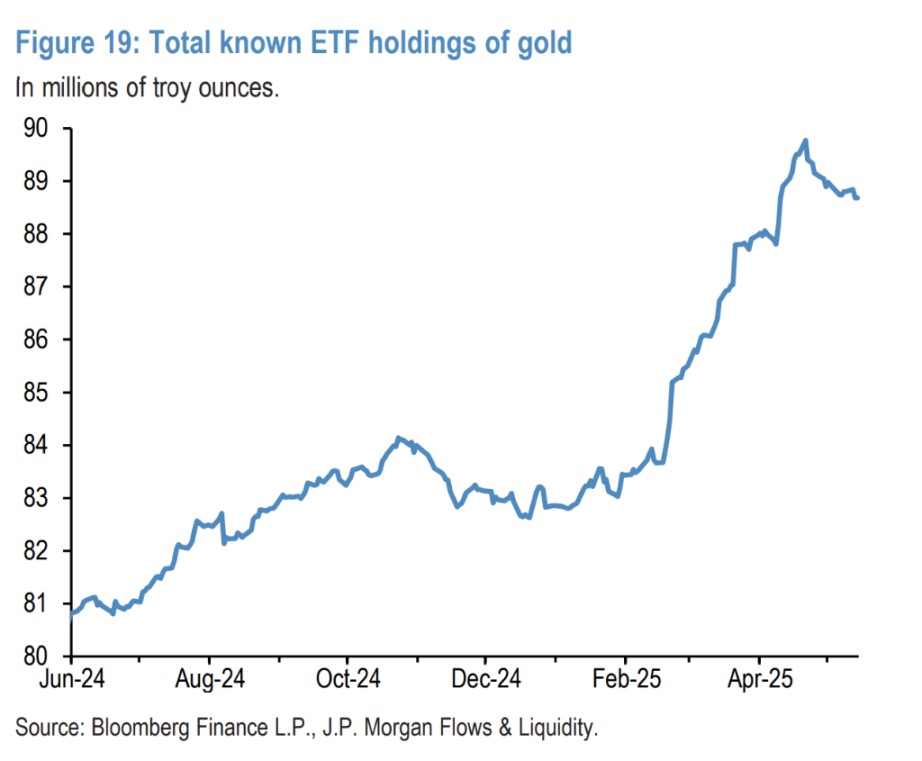

From the perspective of the flow of funds in physical gold and spot Bitcoin/cryptocurrency ETFs, there has been an outflow of funds from gold over the past three weeks.

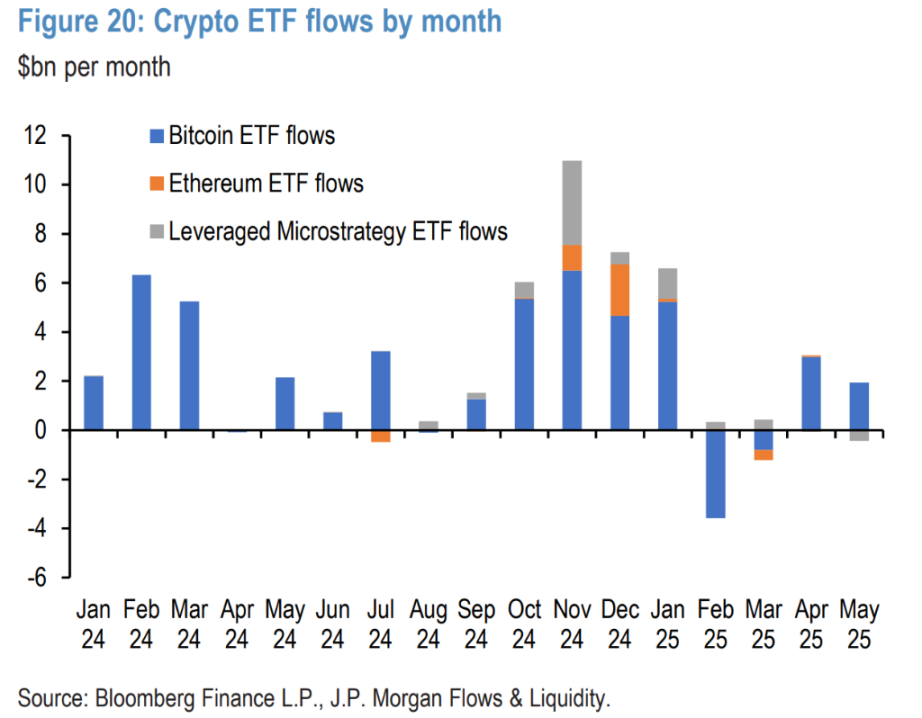

During the same period, Bitcoin/cryptocurrency ETFs recorded inflows.

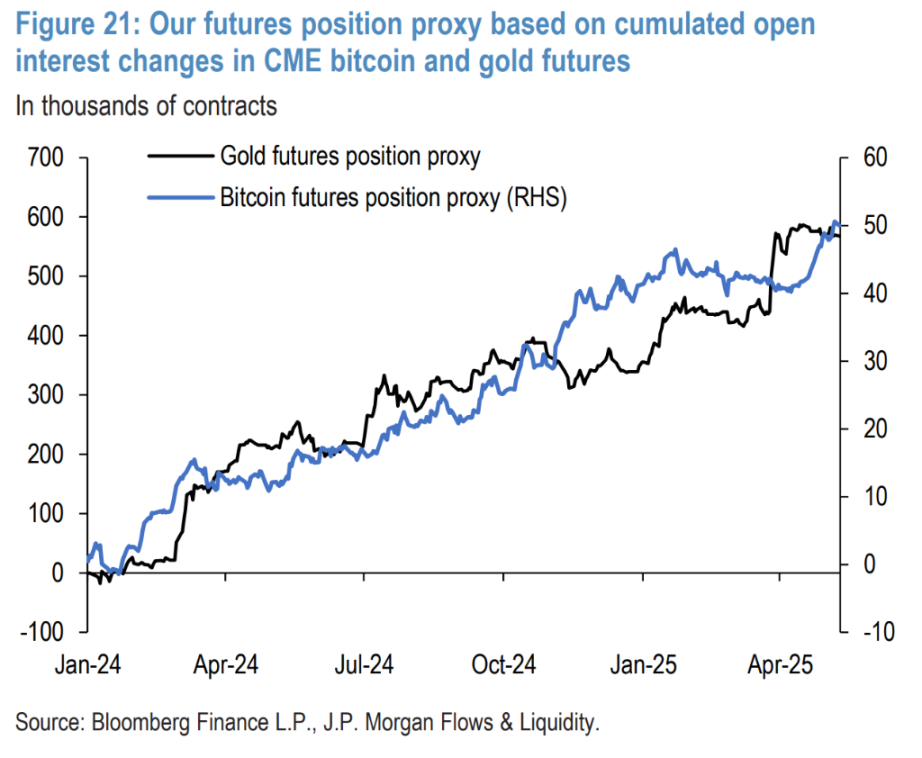

Futures position data shows that gold futures positions continue to decline, while Bitcoin futures have seen a significant increase.

The rotation of funds is closely related to changes in the market environment. JPMorgan points out that the tariff tensions from mid-February to mid-April this year drove a strong rise in gold, while Bitcoin performed weakly along with risk assets. In the past three weeks, as market risk appetite improved, this trend has completely reversed.

This also indicates that under specific market conditions, investors will rotate their allocations between these two types of safe-haven assets:

During tariff tensions: Gold rises, Bitcoin falls.

During periods of improved risk appetite: Gold corrects, Bitcoin rises.

JPMorgan expects that the zero-sum game relationship between gold and Bitcoin will continue for the remainder of 2025, but based on the unique catalysts for cryptocurrencies, Bitcoin may have greater upward potential than gold in the second half of the year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。