Don't get caught up in picking winners; instead, take a broader view and seize overall industry development opportunities through diversified investments.

Written by: Matt Hougan, Chief Investment Officer of Bitwise

Translated by: Luffy, Foresight News

Last week, a significant event occurred in the crypto market: Ethereum began a strong recovery.

After enduring several months of tough times, with Ethereum's price dropping nearly 60%, this second-largest crypto asset rebounded sharply. It rose 53% from its low on April 12, with an astonishing increase of 37% in just the past week.

The reasons behind Ethereum's price surge are numerous, including the successful implementation of major blockchain upgrades and a shift in overall market risk appetite.

This rise has led many investors to ponder: besides Bitcoin, should they also allocate to other crypto assets to diversify their portfolios?

This is indeed a question worth exploring.

Bitcoin is the king of crypto assets; it not only has the highest market capitalization and best liquidity but also the most solid market foundation. In my view, Bitcoin is like "digital gold" and is the only crypto asset with the potential to become a globally significant currency.

Nevertheless, I still believe that most investors should not limit their focus to Bitcoin and should also allocate to other crypto assets.

Why is that? Looking back at history may provide the answer.

Investing in the Internet in 2004

Imagine wanting to invest in the internet sector in 2004. At that time, search was dominant, and Google was the industry leader.

You might think: the future of the internet has vast potential, so I will buy into this core sector's leading company.

From that decision alone, it seems like a wise move. Over the past 20 years, Google's stock price has increased by a staggering 6309%, rewarding investors who held Google shares handsomely.

However, the internet is a general-purpose technology. It can be used not only for search but also for retail, social media, video, and enterprise software, among many other fields.

This means that in 2004, besides buying Google, you could also invest in leading companies across various verticals, such as e-commerce giant Amazon, streaming pioneer Netflix, and enterprise software provider Salesforce.

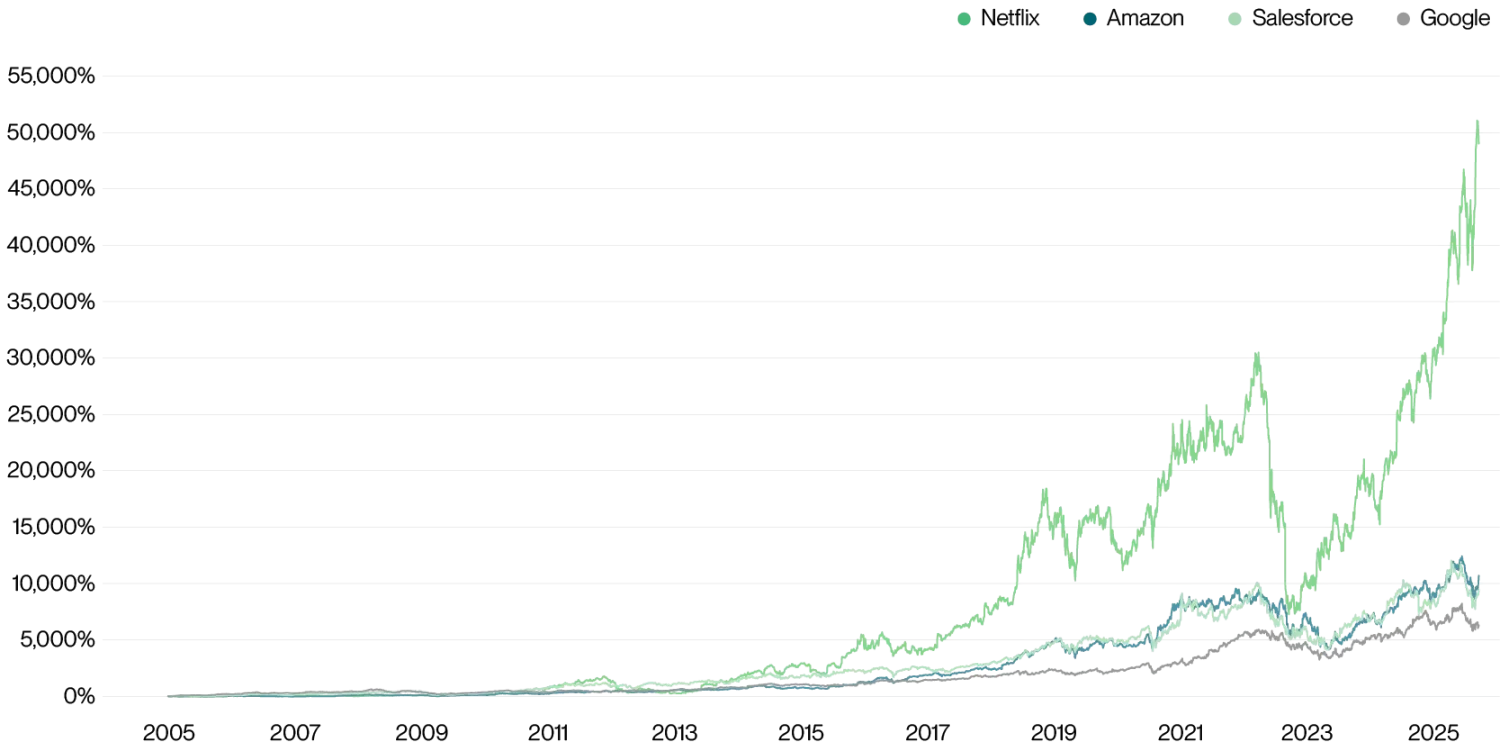

Let's see what returns would have been achieved if such a diversified investment strategy had been adopted at that time:

Performance of tech giants (2004 to present), data source: Bitwise, Yahoo Finance

Google's performance is indeed impressive, now ranking among the world's most valuable assets. But companies in other sectors also performed well, with Netflix being the most surprising, as it became the highest-gaining company, a result that was nearly impossible to foresee in 2004.

Blockchain as a General-Purpose Technology

Like the internet, blockchain is also a general-purpose technology.

With blockchain technology, people can create new forms of currency, such as Bitcoin; build programmable networks for transferring real-world assets, like Ethereum and Solana; develop innovative applications like DeFi and DePin; or create middleware that serves other blockchains, such as Chainlink. Additionally, traditional companies supporting the development of the crypto economy, like Coinbase, Circle, and Marathon Digital, have emerged based on blockchain technology.

I believe that in the future, blockchain will give rise to even more applications that we cannot currently imagine.

Due to the diversity of blockchain technology applications, the returns that different crypto assets can bring in long-term investments can vary significantly. Here are the annual returns of Bitcoin, Ethereum, Solana, and Chainlink over the past five years:

Performance of crypto assets (2020 - 2024), data source: Bitwise Asset Management

So, which crypto asset will perform best from now until 2030? That's a good question.

What This Means for Investors

This does not mean that everyone should invest beyond Bitcoin.

If you believe that the value of blockchain lies solely in being an alternative to fiat currency, protecting against potential risks in the traditional monetary system, then investing only in Bitcoin may be sufficient. After all, in the realm of "digital currency," Bitcoin's leading position is hard to shake, and it is nearly impossible for other crypto assets to replace it.

However, if you agree that blockchain is a general-purpose technology and are optimistic about its future potential to gradually bring various assets on-chain, then historical experience suggests that diversifying your crypto asset allocation is the better choice. Consider building a portfolio that includes various crypto assets like Bitcoin, Ethereum, Solana, and Chainlink.

Finally, I want to share a piece of data that has impressed me even after years of deep involvement in the ETF and cryptocurrency industries: over the past 20 years, actively managed U.S. stock funds have underperformed their benchmark indices 97% of the time.

In the rapidly changing and uncertain field of crypto assets, this data is also worth reflecting on for every investor.

My advice is: don't get caught up in picking winners; instead, take a broader view and seize overall industry development opportunities through diversified investments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。