Bitcoin ETF Momentum Continues With 4th Straight Week of Gains As Ether Funds See Weekly Red

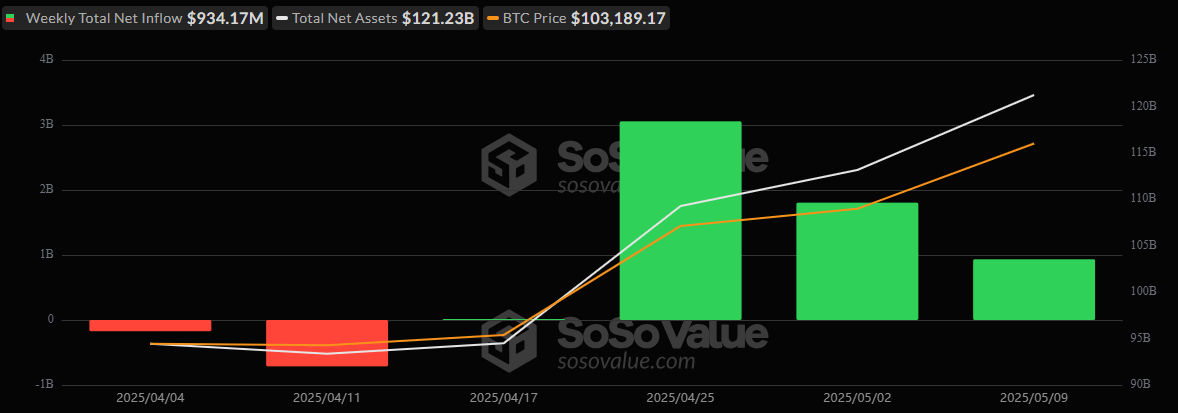

Institutional appetite for bitcoin ETFs hasn’t cooled; if anything, it’s heating up. The week ending May 9 delivered $934.17 million in net inflows, capping off four consecutive weeks of gains for U.S. spot bitcoin ETFs.

Leading the charge was Blackrock’s IBIT, which alone accounted for $1.03 billion in net inflows. Other standouts included Fidelity’s FBTC with $62.44 million, Ark 21shares’ ARKB with $45.59 million, and Vaneck’s HODL with a modest $5.06 million.

However, the weekly tally wasn’t without outliers. Grayscale’s GBTC registered a steep $171.45 million outflow, while Bitwise’s BITB and Franklin’s EZBC posted $26.77 million and $11 million in weekly redemptions, respectively.

Source: Sosovalue

The only day of outflows was Tuesday, May 6. But strong sessions, including a $425 million inflow on Monday, kept the weekly balance firmly positive.

Meanwhile, ether ETFs continued to struggle. Total weekly outflows hit $38.15 million, led by Fidelity’s FETH, which lost $37.17 million, and Grayscale’s ETHE, with $26.21 million exiting the fund. Blackrock’s ETHA also shed $4.17 million. The only bright spot was Grayscale’s Ether Mini Trust, pulling in $3.19 million in fresh capital.

As bitcoin ETFs extend their rally, ether ETFs remain under pressure, reflecting diverging investor sentiment between the top two digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。