Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Liquid staking has always been a hot topic in the market, but most liquid staking tokens remain at the stage of "yield packaging tools," lacking composability and strategic flexibility. This leaves users with a dilemma: sacrifice asset liquidity for yield or forgo yield to participate in more complex DeFi strategies.

Glow Finance aims to address this issue. Glow integrates lending and trading functions to help users enhance capital efficiency, manage risks flexibly, and execute complex strategies.

What is Glow Finance?

Glow is a decentralized margin trading protocol that offers a complete set of financial tools designed to maximize capital efficiency and broaden yield opportunities. Its cross-margin account feature allows for dynamic interaction between assets, enabling users to manage, borrow, and operate positions within a unified framework.

At the core of Glow Finance is the liquidity engine of "margin accounts + modular components." Users can engage in lending, trading, and asset management through non-custodial margin accounts, avoiding frequent platform switching. The accounts also support sub-account functionality, similar to the sub-account operations of centralized exchanges, facilitating advanced strategy deployment and risk isolation.

Glow Finance product matrix:

- Glow Margin Accounts: Achieve cross-protocol, composable leverage, unlocking trading capabilities.

- Glow Recipes: Automated yield strategies that help users execute complex DeFi operations.

- $glowSOL: A liquid staking token (LRT) supported by Solayer super validators, providing quality yields on Solana.

Team Background and Project Progress

Nicholas Roberts-Huntley, co-founder of Glow Finance, holds a master's degree in evidence-based policy evaluation and economics from the University of Oxford. From 2013 to 2018, he worked as a physician in the medical field, focusing on urological oncology, emergency medicine, and colorectal surgery. After 2018, he transitioned into venture capital, serving as a venture architect at Virtual Ventures, then as a vice president at Point72, and founded Concrete in 2022.

Image source: Nicholas Roberts-Huntley

Glow Finance originated from the lending platform Jet Protocol. In October 2024, Blueprint Finance acquired Jet and undertook a comprehensive restructuring, updating the technical architecture and redefining the product positioning. It is reported that the Blueprint Finance team previously developed the yield protocol Concrete within the Ethereum ecosystem, which has currently accumulated over $650 million in TVL.

On April 14, Glow Finance officially launched on the Solana mainnet, but the team's vision does not stop at Solana. Nicholas Roberts-Huntley stated that Glow's architecture is already prepared for future expansion to include new-generation on-chain ecosystems based on the Solana Virtual Machine (SVM), such as Fogo and Atlas.

How Glow Finance Works

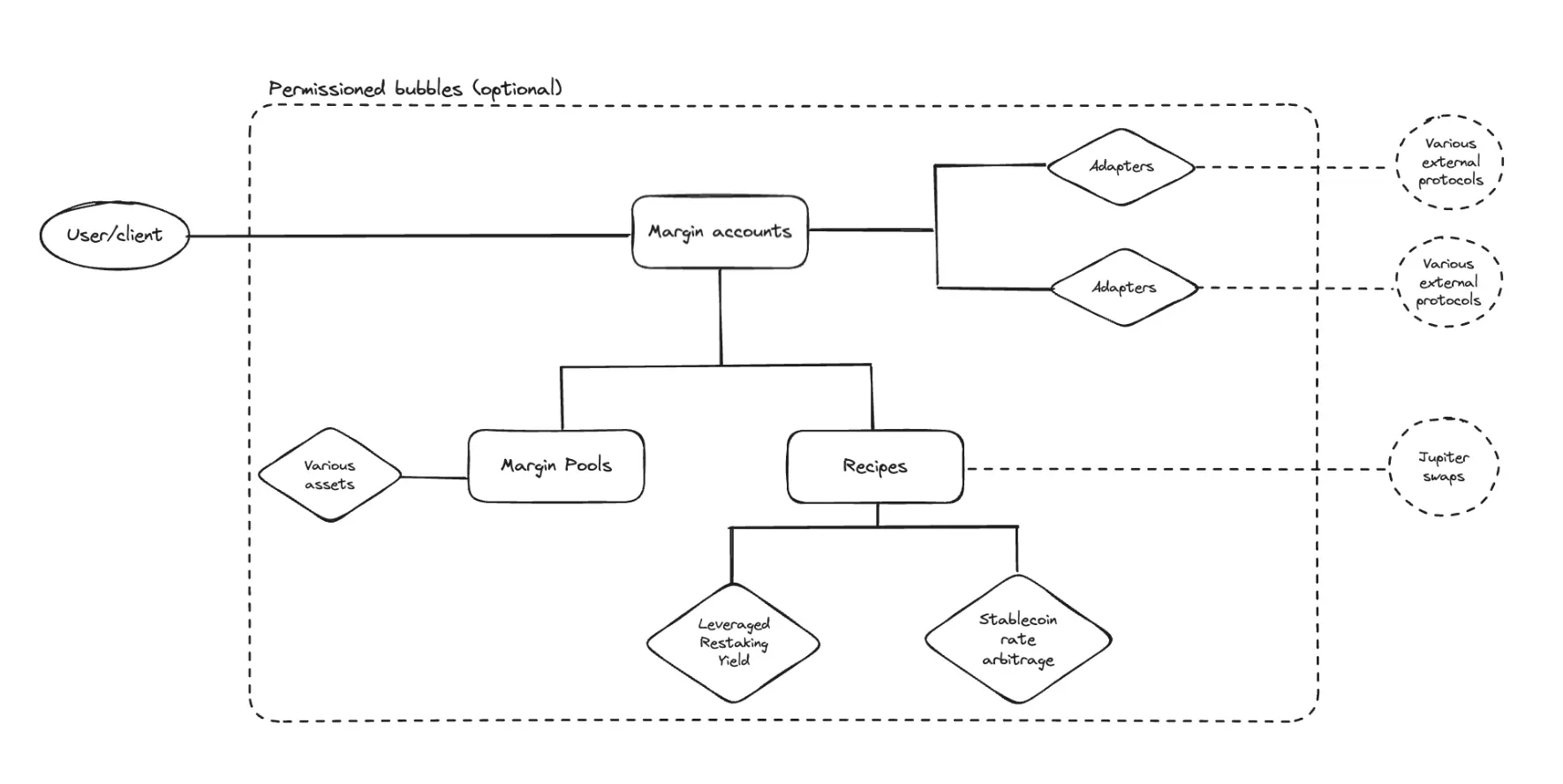

Glow Finance provides a suite of complementary DeFi tools built around margin accounts, pooled lending, and automated strategies.

Glow centralizes user assets into margin accounts and connects them to margin pools and external protocols through adapters, ensuring that users optimize capital efficiency while accessing various DeFi services.

Core architecture and functions of Glow

The leveraged SOL re-staking strategy is Glow's flagship strategy, designed to maximize yields and points from both Glow and Solayer while avoiding exposure to SOL price volatility. This strategy creates a position with a customizable leverage multiple by using glowSOL and sSOL (Solayer's liquid staking token).

Users can earn multiple SOL re-staking yields in a separate margin account while earning dual points from Solayer and Glow, all while avoiding the risk of SOL price fluctuations. This position is also effectively isolated from risk due to Glow's independent margin account mechanism, preventing liquidation due to SOL volatility.

Specific operation steps:

Users create a Glow margin account and enter the "Leveraged glowSOL Re-staking" page;

Guided by the application interface, users can choose to deposit SOL from their wallet or existing margin account and allocate it to the strategy;

The glowSOL held by users will continuously appreciate as staking rewards accumulate, allowing them to earn yields in a neutral position without price risk;

glowSOL also encapsulates sSOL, meaning users can earn Glow points and Solayer points, with the number of points increasing based on the selected leverage multiple;

Users borrow SOL and hold glowSOL, thus keeping their position essentially neutral to SOL price changes, avoiding downside price risk while enjoying the yields from staking rewards. Users will not face liquidation risk unless the peg between SOL and sSOL breaks.

(This article only introduces early projects and does not constitute investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。