Author: Trend Research

Since the release of the research report on April 24, 2025, ETH has risen from around $1800 to nearly $2400, with an increase of about 30% within a month. The prediction made before the report was even more optimistic, starting from $1450. As a target asset with a scale of hundreds of billions, it presents a rare opportunity for large funds to achieve high returns in the short term. The main reasons for the strong bullish outlook at that time included: ETH still possesses robust financial data, and its status as an important infrastructure in the crypto space remains unchanged; the significant adjustment from the recent high (over 60% drop in 4 months); the large scale of short positions in the derivatives market, which, after a surge in spot volume at the bottom, climbed to an important support and resistance exchange area; and the continuous layout of traditional finance and gradual inflow of ETFs. Currently, our prediction for ETH is that in the long term, it could break through $5000, and in an optimistic scenario, if BTC rises to over $300,000, ETH could potentially reach $10,000, while also capturing long-term opportunities related to the ETH ecosystem.

1. Valuation Prediction for ETH

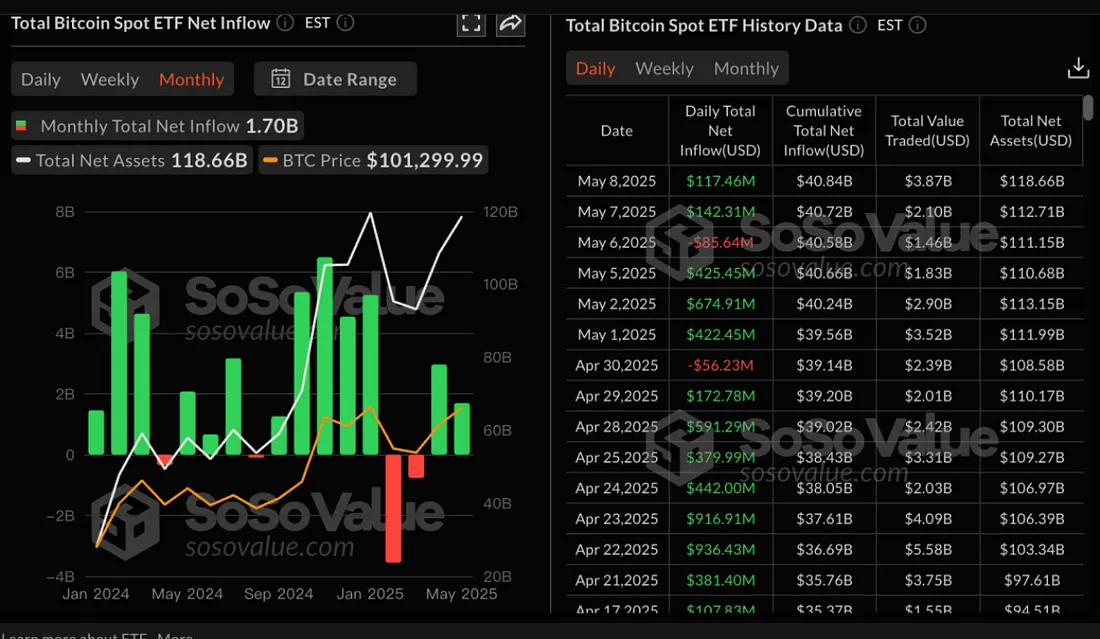

An important background for the new valuation of ETH is the capture of the trend of integration between key digital assets and traditional finance. We note that BTC, as the most important digital asset, has begun to be included as a strategic reserve asset by various states in the U.S. following the approval of spot ETFs, gradually becoming a scale expansion of dollar assets and a certain degree of strategic alternative. Currently, it ranks 6th in global asset market capitalization, with the U.S. BTC spot ETF managing about $118.6 billion in assets, accounting for about 6% of Bitcoin's total market capitalization. The trend of integration between crypto assets and traditional finance is no longer in doubt. CZ stated in an interview in Dubai in May that Bitcoin's price in this market cycle could reach between $500,000 and $1,000,000.

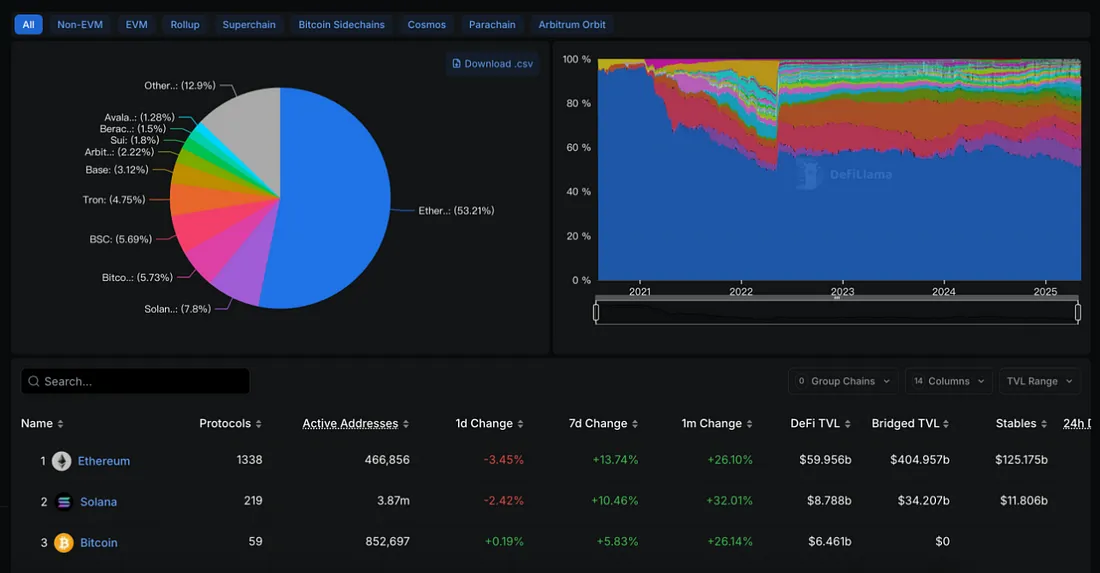

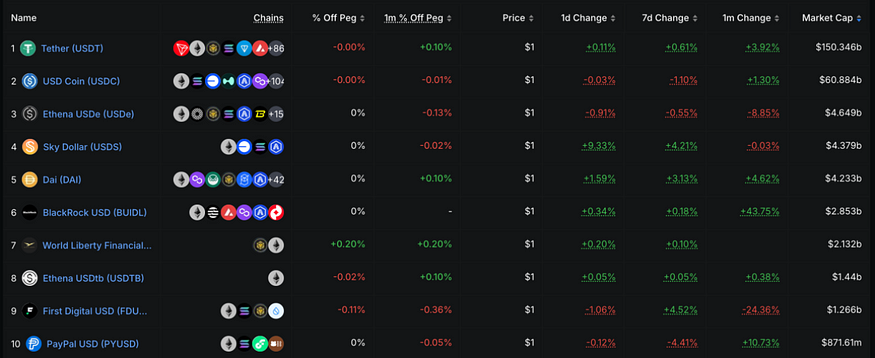

ETH still possesses robust financial data, and its status as the most important infrastructure in crypto finance remains unchanged. The total TVL of Ethereum DeFi is about $60 billion, accounting for over 53% of the global DeFi market, while the market capitalization of stablecoins is $124 billion, making up over 50% of the total market capitalization of stablecoins globally. The total AUM of Ethereum ETFs is $7.2 billion, with BlackRock's tokenized money market fund BUIDL investing approximately $2.7 billion in the Ethereum ecosystem, accounting for 92% of its total assets.

In 2024, ETH quickly fell to around $1300 after reaching three peaks at $4000, with an ATH of over $4800. Based on the following potential factors, we predict that ETH's price will reach $5000 in this cycle:

- The imminent end of the U.S. QT and the further start of interest rate cuts

- The new SEC chairman may bring breakthroughs in advancing tokenization on the ETH chain and related staking legislation

- The management and route repair of the ETH Foundation, maintaining a certain degree of infrastructure innovation

- Sustained growth of the on-chain financial ecosystem

Under a long-term optimistic forecast, ETH is expected to challenge $10,000 in the new cycle, provided the following conditions are met:

- BTC rises above $300,000

- ETH brings impressive infrastructure innovations beneficial to DeFi

- U.S. institutions promote ETH as an important native venue for asset tokenization

- Demonstration effects drive global asset tokenization

2. Three ETH Ecosystem Projects Not to Be Overlooked

1. UNI (Uniswap): The Largest DEX Protocol in the Crypto Market

Uniswap is the earliest and largest DEX protocol in the crypto market, with a TVL of $4.7 billion and daily trading volume exceeding $2 billion, generating $900 million in revenue annually. UNI is fully circulated, with about 40% locked for governance, currently having a circulating market cap of $4 billion and an FDV of $6.6 billion.

Currently, there is a certain decoupling between UNI's token economics design and protocol revenue, as the revenue generated by the protocol is not automatically distributed to UNI token holders. UNI mainly serves as a governance token, allowing holders to vote on the use of the treasury, which can indirectly have a positive effect on the price of UNI through governance proposals, such as the DAO voting to repurchase 10 million UNI in 2024.

The decoupling between protocol revenue and token earnings is mainly due to previous SEC regulatory risks regarding the classification of securities. Currently, as U.S. crypto regulation gradually becomes more lenient and standardized, the protocol distribution of UNI may have upgrade potential in the future.

Recent major developments for Uniswap include the expansion of Uniswap V4 and Unichain, and the preliminary activation of the "Fee Switch" mechanism.

2. AAVE (Aave): The Largest Lending Protocol in the Crypto Market

AAVE is the largest lending protocol in the crypto market, with a TVL of $23 billion and generating $450 million in revenue annually, with 100% of its tokens in circulation, currently valued at $3.3 billion.

Similar to UNI, there is no direct dividend relationship between protocol revenue and AAVE, but it is influenced indirectly through governance.

Recent major developments for Aave include the development of Aave V4, cross-chain expansion of the native stablecoin GHO, and advancing the Horizon project for RWA business exploration.

3. ENA (Ethena): The Largest Synthetic Stablecoin Protocol in the Crypto Market

Since 2025, Ethena's synthetic dollar USDe has become the third-largest dollar-pegged asset in the crypto market, with an issuance scale only behind USDT and USDC, and USDe is the only synthetic stablecoin among them. In terms of revenue, Ethena is also a lucrative DeFi protocol, generating $315 million in revenue annually. ENA currently has a market cap of $2.18 billion and an FDV of $5.6 billion.

Recently, Ethena has made comprehensive business progress: Ethena will collaborate with Securitize to launch the "Converge" blockchain network, aiming to bridge traditional finance and DeFi, planning to launch a stablecoin product iUSDe for traditional financial institutions, integrating its stablecoin sUSDe into the Telegram application, and building an ecosystem based on its stablecoin sUSDe, including a perpetual and spot exchange Ethereal based on its own application chain and an on-chain options and structured products protocol Derive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。