77.4% of users have seen phishing links, and 60.8% of users have been tempted by "authoritative" insider information and trading signals.

Written by: Deep Tide TechFlow

In recent years, the crypto world has gradually developed into one of the most vibrant investment fields. However, in this rapidly evolving digital realm, risks and opportunities coexist, and security issues require constant vigilance.

Based on this, Binance conducted a survey on "Cryptocurrency User Security and Anti-Fraud Awareness," collecting a total of 7,967 Chinese-language questionnaire responses.

Deep Tide TechFlow analyzed the data from this survey and produced this report, aiming to help users find direction and move forward safely in this crypto jungle.

This survey delved into users' security awareness and risk management capabilities in cryptocurrency trading, aiming to enhance users' anti-fraud abilities and strengthen risk management awareness, thereby better protecting their asset security. Binance's industry research not only provides users with practical educational resources but also reflects its ongoing investment and commitment to user security education, highlighting Binance's responsibility and commitment as a leading platform in promoting the security construction of the crypto ecosystem.

Highlights Summary:

- The cryptocurrency user group demonstrates strong security awareness, such as actively taking protective measures, improving risk identification capabilities, and effectively utilizing the risk control mechanisms of centralized trading platforms:

80.8% of Binance users have enabled 2FA identity authentication.

Nearly four-fifths of users carefully verify the recipient address or smart contract address before each transfer.

The proportion of users who save private keys/mnemonic phrases on paper (47.8%) far exceeds those who store them on electronic devices (30.7%).

58.9% of users would first contact the exchange to freeze assets after encountering fraud, showing significant trust in the exchange.

85.5% of respondents stated that they trust the exchange's protection mechanisms (such as SAFU "Binance Emergency Fund").

As high as 97.2% of users are willing to participate in anti-fraud simulation tests organized by trading platforms.

- In the face of new types of fraud, continuous strengthening of user security education is needed to enhance users' awareness of potential threats:

X (formerly Twitter, 63.9%) and Telegram (38.7%) are recognized by most as the most common channels for the dissemination of scam information.

77.4% of users have seen phishing links, and 60.8% of users have been tempted by "authoritative" insider information and trading signals.

Less than half (48.9%) of users explicitly stated that they have not encountered scam information.

Chinese Cryptocurrency User Security Survey Report

This report is divided into the following five parts:

Part 1: Overview of the Survey Population

Part 2: Security Awareness and Behavioral Habits

Part 3: Experiences with Fraud and Responses

Part 4: Demand for Exchange Security Services

Part 5: Security Features and Educational Preferences

Part 1: Overview of the Survey Population

This section aims to create a comprehensive profile of respondents by collecting and analyzing basic information such as trading experience, trading frequency, and asset scale of cryptocurrency traders. This will provide strong support for subsequent research and analysis.

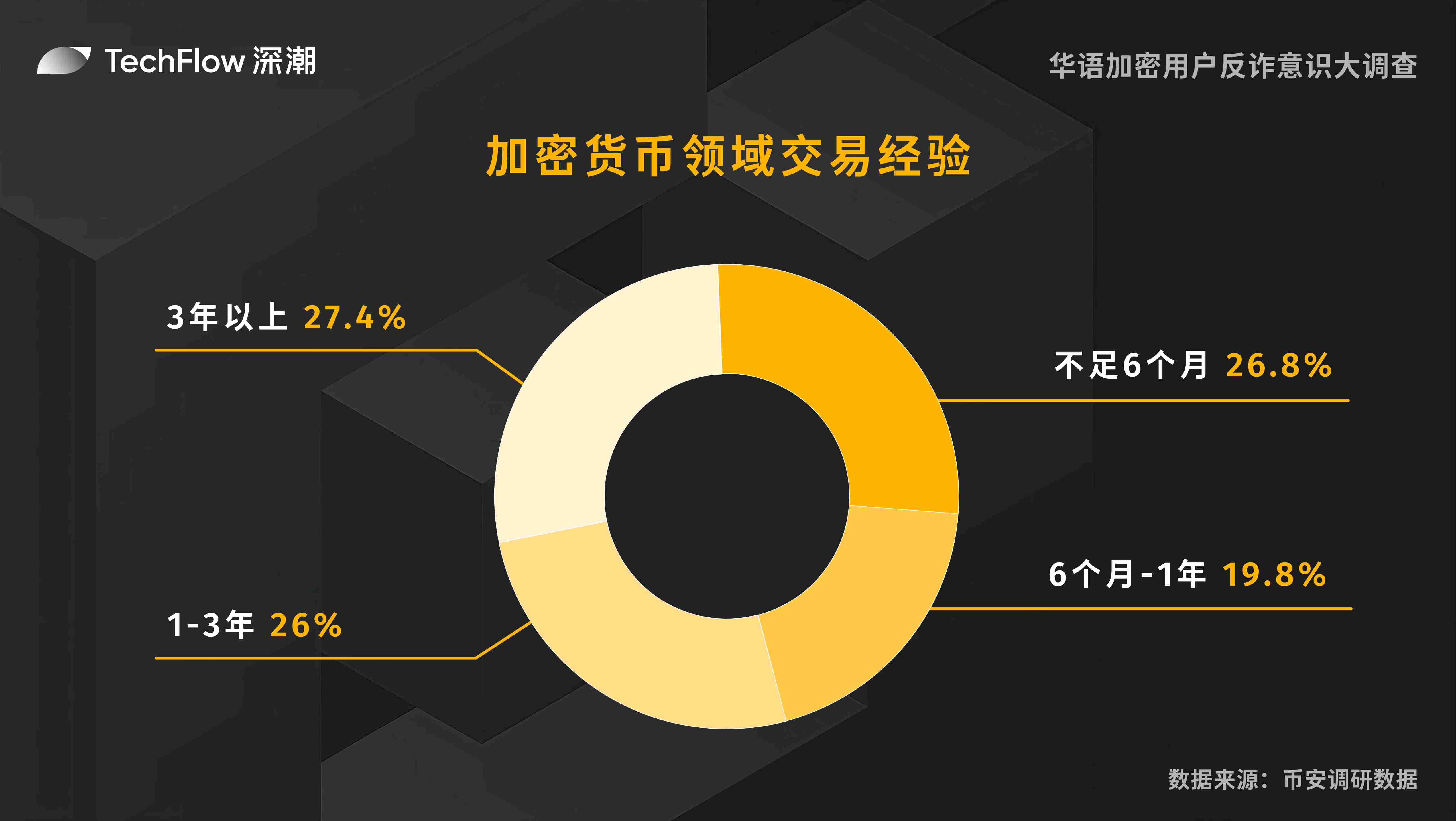

- Cryptocurrency Trading Experience

In this survey, we statistically analyzed the trading experience of respondents. The data shows that the experience distribution of Chinese users in cryptocurrency trading is relatively balanced, providing a solid and diverse user base for the Chinese crypto market, which is conducive to long-term market development.

Specifically, respondents with over 3 years of trading experience account for the highest proportion at 27.4%; followed by those with less than 6 months of experience at 26.8%; and those with 0.5-1 year and 1-3 years of experience account for 19.8% and 26%, respectively. This phenomenon of new users entering the market while old users remain reflects the dynamism and vitality of the market.

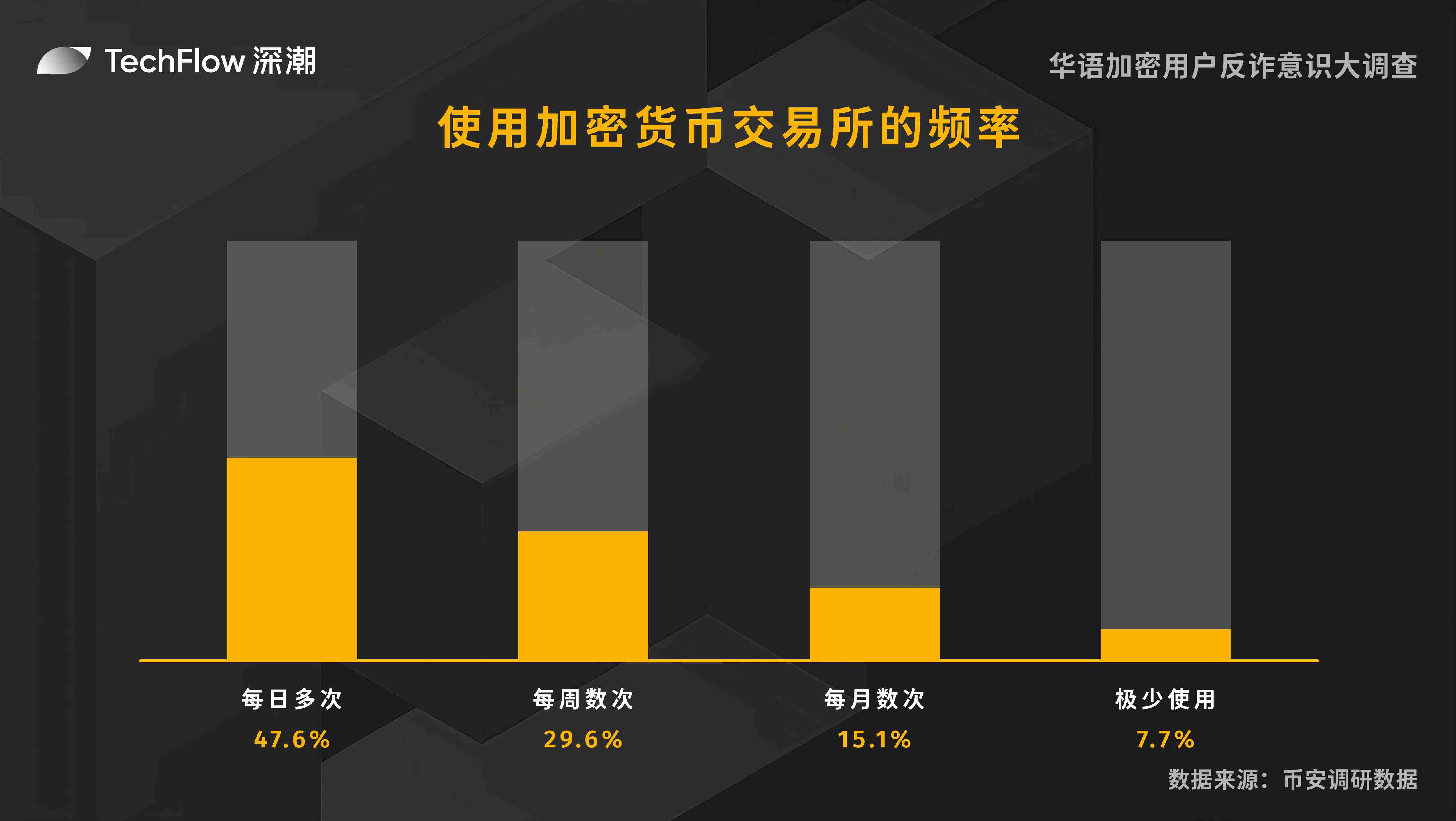

- Frequency of Using Cryptocurrency Exchanges

In this survey, we statistically analyzed the frequency of cryptocurrency traders using exchanges. The data shows that users who use exchanges multiple times a day account for the largest proportion, indicating that most traders are highly dependent on exchanges.

Specifically, respondents who use cryptocurrency exchanges multiple times a day account for 47.6%, those who use them several times a week account for 29.6%, those who use them several times a month account for 15.1%, while those who use them rarely account for only 7.7%.

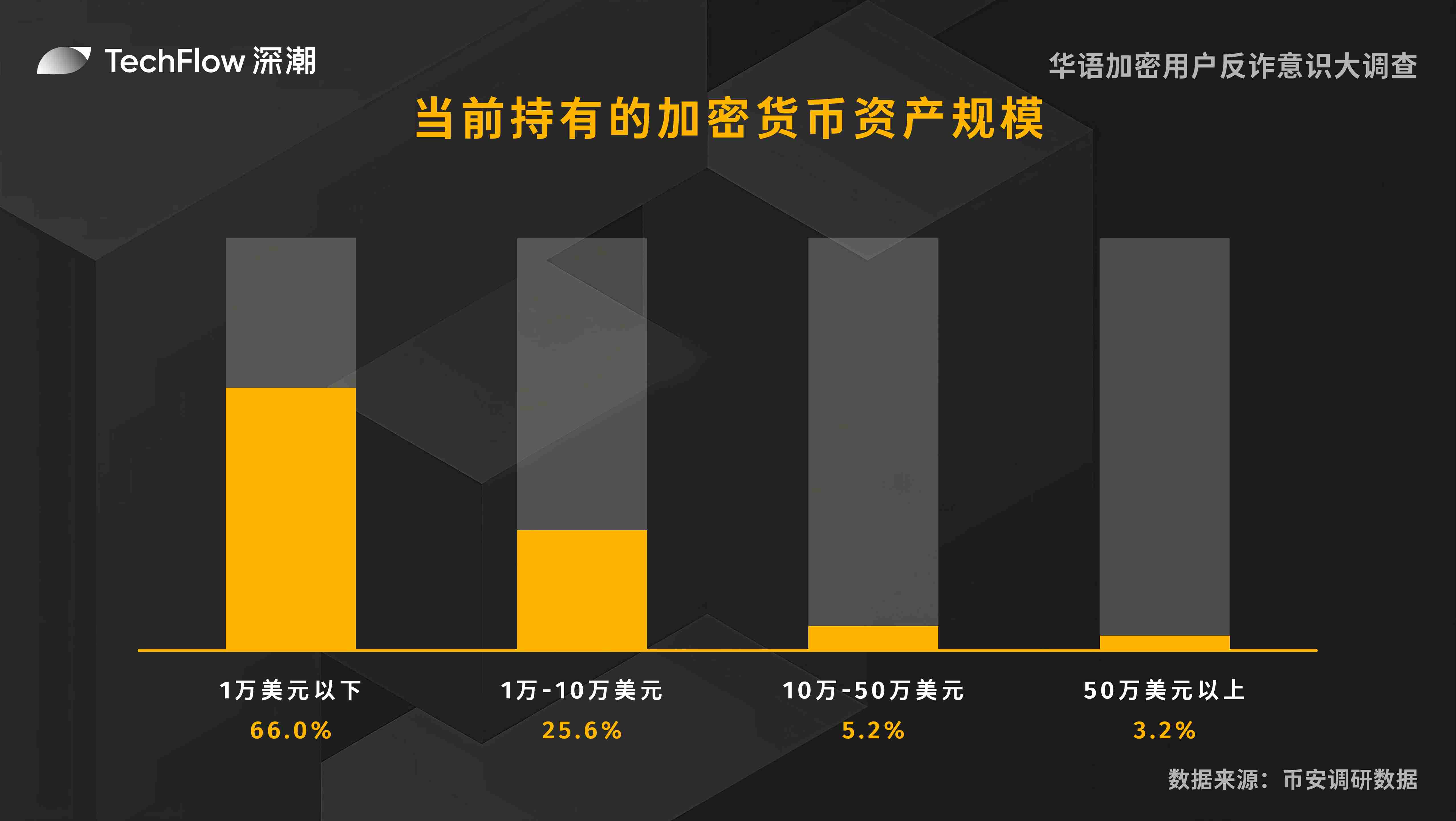

- Current Scale of Cryptocurrency Assets Held

Among cryptocurrency holders, most people's asset scale is concentrated below $10,000, accounting for 66.0%. This indicates that most investors are still in a relatively cautious investment stage, possibly due to high market volatility or limited investment experience.

Investors holding assets between $10,000 and $100,000 account for 25.6%, and this group may have a deeper understanding and confidence in the market, thus willing to invest more funds. Investors holding between $100,000 and $500,000 account for only 5.2%, while high-net-worth investors holding over $500,000 account for only 3.2%.

Part 2: Security Awareness and Behavioral Habits

In the cryptocurrency field, security and trust are among the most concerning issues for users. This section collects and analyzes the security measures enabled by respondents in their Binance accounts to gain deeper insights into users' security awareness and strategies, covering enabled security measures, methods of saving private keys, types of fraud encountered, and other issues, revealing the security challenges users face in cryptocurrency trading.

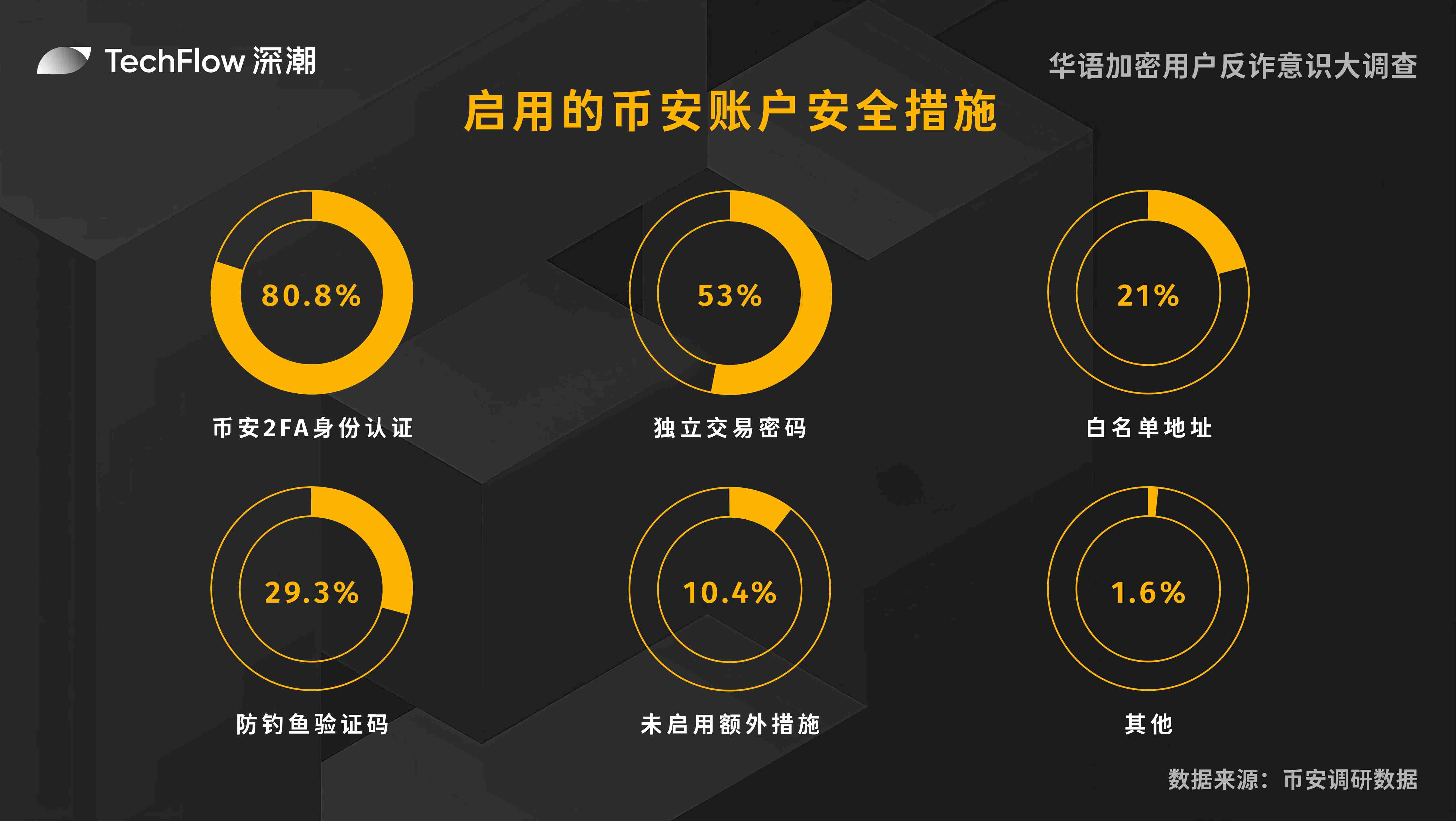

- Enabled Security Measures for Binance Accounts

In this survey, we conducted a detailed statistical analysis of the security measures enabled by respondents for their Binance accounts. This question allowed multiple selections, so each respondent could choose multiple options. Specifically:

The proportion of users who have enabled 2FA identity authentication is the highest at 80.8%—such a high percentage indicates that most users recognize the importance of two-factor authentication and prioritize this measure to protect account security. Additionally, independent trading passwords are also valued, with over half (53%) of respondents setting an independent trading password. The proportion of users who have enabled whitelisted addresses is 21%, which can effectively prevent funds from being transferred to unauthorized addresses. The usage rate of anti-phishing codes is 29.3%, indicating that some users have a certain level of awareness against phishing attacks. Furthermore, 1.6% of users chose other security measures, showing diversity in users' security strategies.

However, 10.4% of users have not enabled any additional security measures, which may be due to a lack of security awareness or the perception that setting up security measures is too complicated.

Overall, most users have taken various security measures to protect their Binance accounts, but some users still need to strengthen their security awareness and measures.

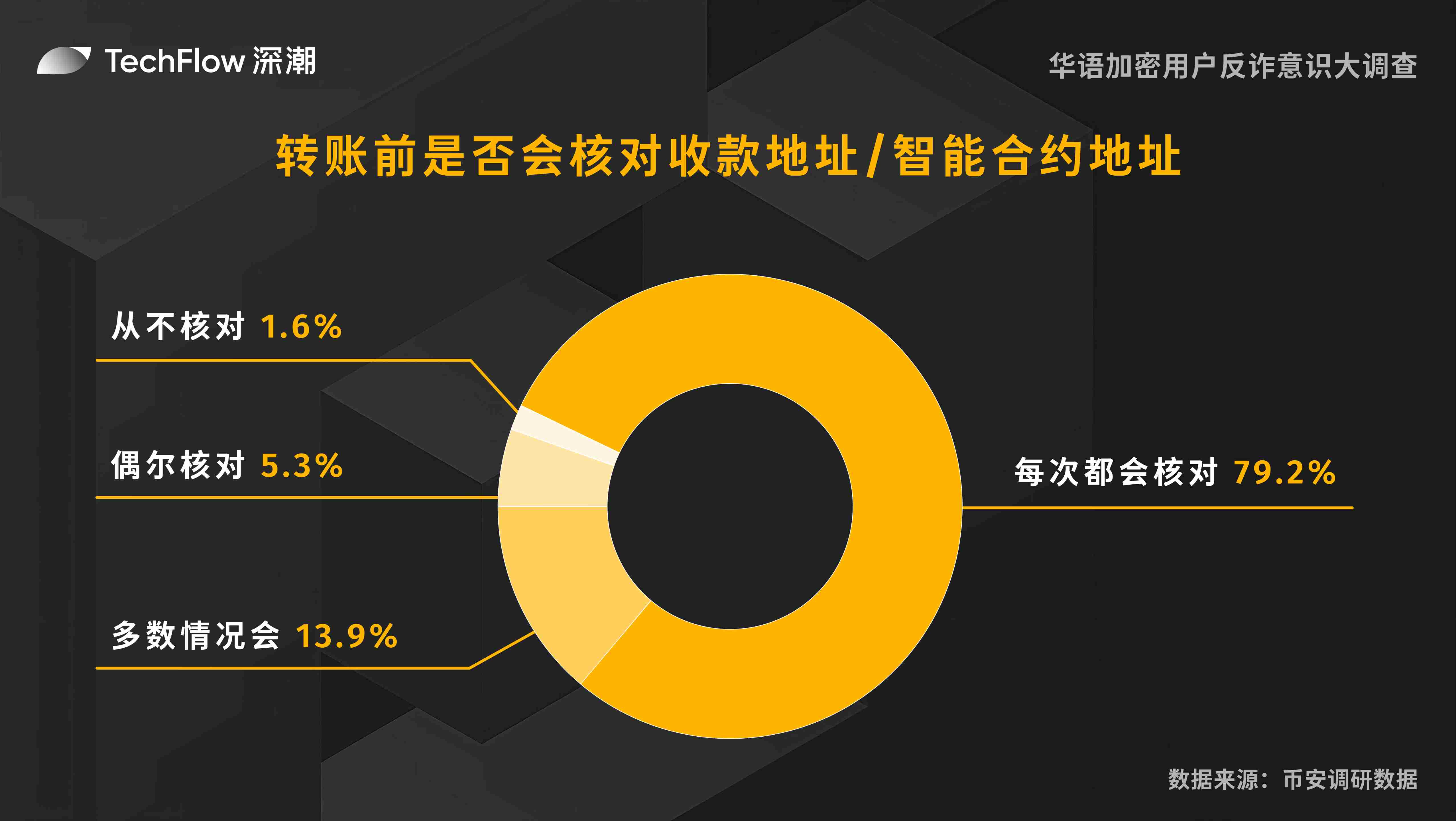

- Do you verify the recipient address/smart contract address before transferring?

According to the survey data, most users carefully verify the recipient address or smart contract address before transferring, with a proportion of 79.2%, indicating that users generally recognize the importance of verifying addresses to avoid transfer errors and potential financial losses.

13.9% of users remain cautious most of the time but may not check the address in certain situations.

Users who occasionally verify addresses account for 5.3%, indicating that they may recognize the importance of verification but have not developed a stable habit.

From the overall data, the vast majority of users verify the recipient/smart contract address before transferring, reflecting a high level of concern for fund security. It is worth noting that 1.6% of users never verify transfer addresses, indicating a need to strengthen attention to transfer security.

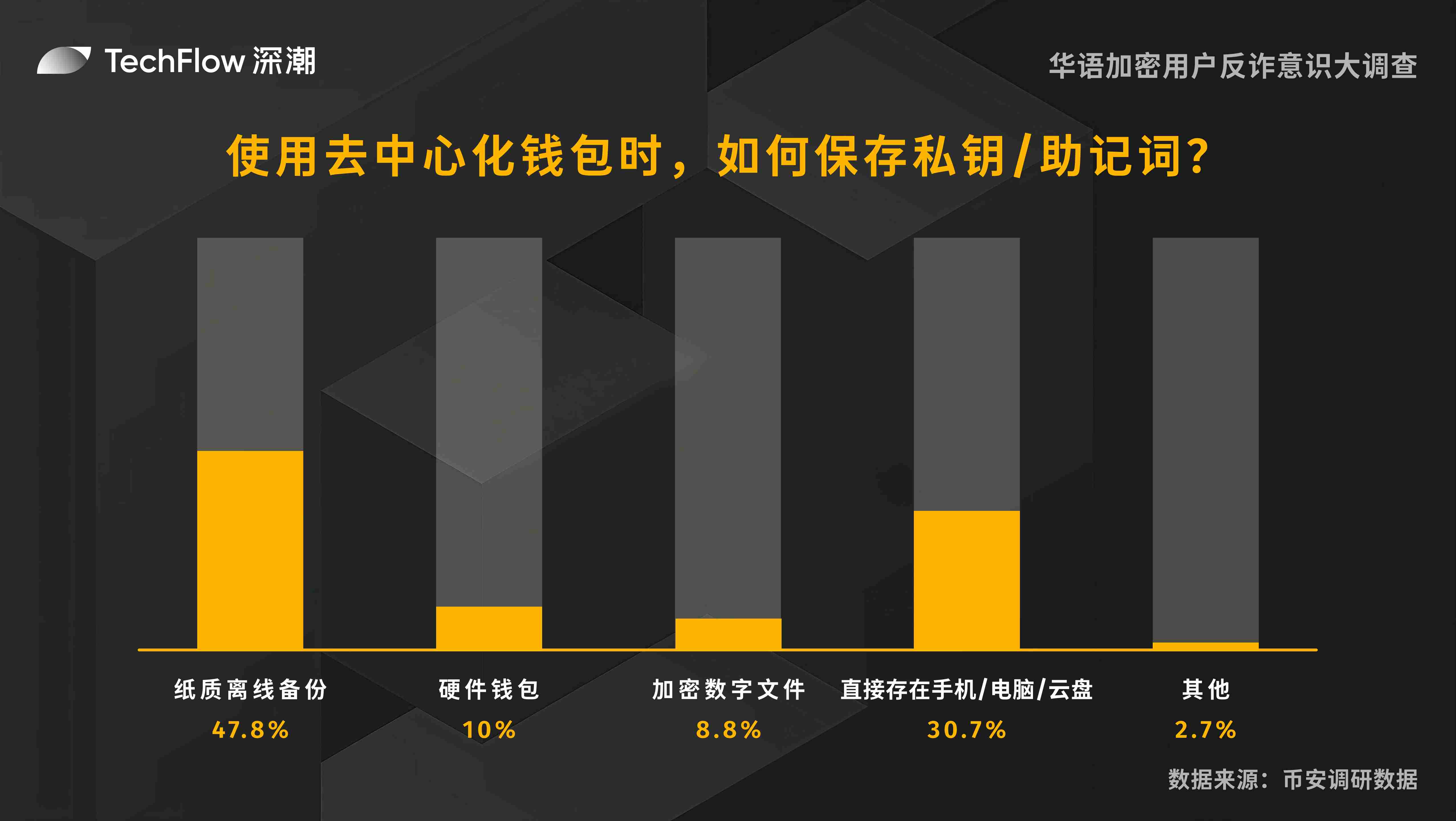

- How do you save private keys/mnemonic phrases when using decentralized wallets?

Decentralized wallets allow users to fully control their private keys and assets, but they also face management difficulties and the risk of losing private keys. In the survey, 47.8% of users chose paper offline backups when using decentralized wallets, which is a traditional and secure method that effectively prevents issues from digital device failures or network attacks. Users who save private keys or mnemonic phrases using hardware wallets account for 10%, indicating that this group prefers to use specialized devices to enhance security. Meanwhile, 8.8% of users choose to store encrypted digital files, which provides convenient access while protecting privacy.

A significant proportion (30.7%) of users choose to store private keys or mnemonic phrases directly on their phones, computers, or cloud drives. Although this method is convenient, it carries security risks such as device theft or network attacks.

Additionally, 2.7% of users chose other storage methods, showing diversity in users' security strategies.

Overall, most users tend to use relatively secure methods to save private keys or mnemonic phrases, but some users still need to improve their security awareness to avoid potential risks.

- Types of Fraud Encountered

In this survey, we collected statistics on the types of cryptocurrency fraud that respondents have encountered. The survey shows that although the types of fraud are increasing, phishing link fraud remains the most common type. This question allowed multiple selections, so each respondent could choose multiple options. The proportions of each option are:

77.4% of users have seen phishing links, a common online scam that typically disguises itself as a legitimate website to steal user information.

60.8% of users have encountered so-called insider information or trading signals from "authoritative" figures, a scam that exploits users' trust in authority to mislead investment decisions.

51.7% of users have seen scams that leak private information, such as passwords, private keys, or mnemonic phrases, which directly threaten users' asset security.

56.6% of users have seen scams involving fake airdrops, giveaways, or token presales, which exploit users' pursuit of free or discounted offers to commit fraud.

51.6% of users have seen fake exchange apps or wallets, which scam users by masquerading as legitimate applications to steal assets.

48.8% of users have encountered Ponzi schemes and multi-level marketing scams, which attract investors by promising high returns, but actually rely on funds from later investors to pay earlier ones.

Victims of malware attacks account for 33.2%, with these attacks stealing user information or controlling user devices through implanted malware.

False investment promises (such as high-yield mining pools) are also a common type of scam, seen by 44.9% of users, which often lure investors with unrealistic high returns.

2.3% of users have seen other types of scams, indicating that scam tactics are becoming increasingly diverse and difficult to guard against.

Part 3: Experiences with Fraud and Responses

This section focuses on the actual fraud incidents encountered by respondents, covering loss amounts, remedial measures taken after encountering fraud, and common channels for scam information. By comprehensively analyzing these real scenarios, we aim to help users raise their vigilance and more effectively prevent cryptocurrency fraud.

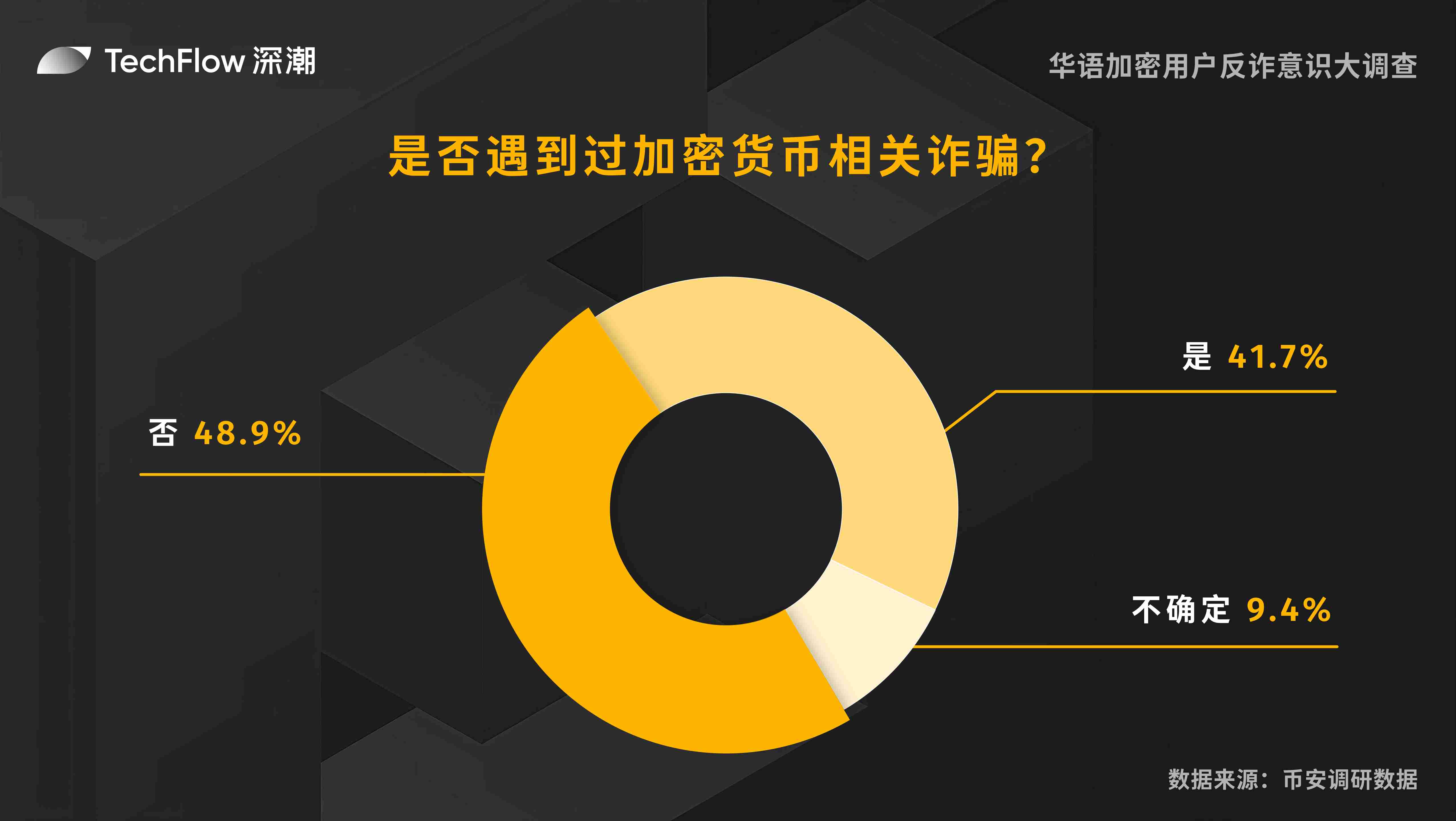

- Have you encountered cryptocurrency-related fraud?

We surveyed users on whether they have encountered cryptocurrency fraud, and surprisingly, nearly half (41.7%) of users have experienced cryptocurrency-related fraud; among the remaining users, 9.4% are unsure if they have encountered fraud, while only 48.9% explicitly stated they have not encountered fraud.

Overall, cryptocurrency fraud remains a significant security issue today, necessitating increased vigilance and discernment among users.

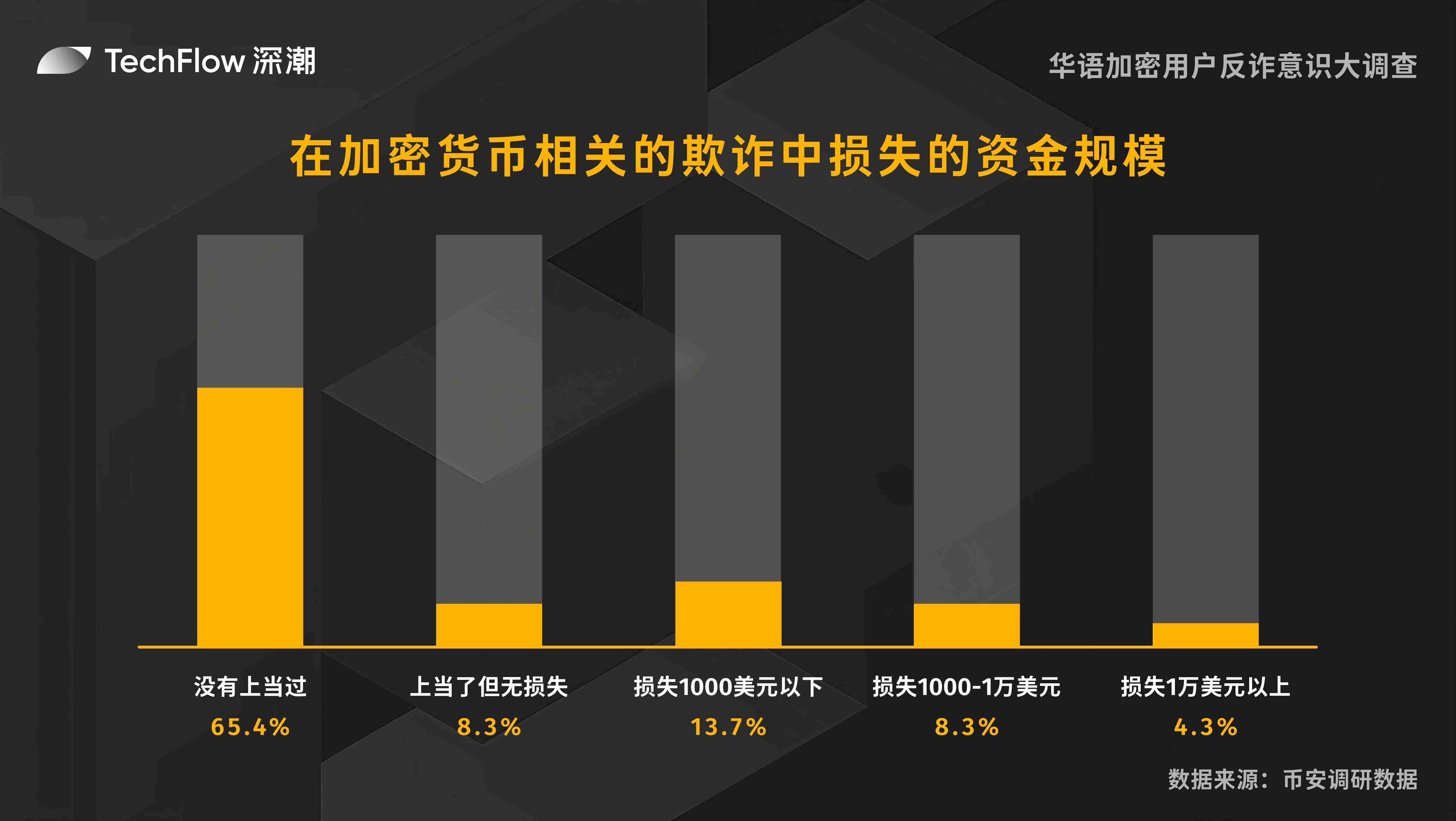

- Scale of funds lost in cryptocurrency-related fraud

We investigated the scale of funds lost by users in cryptocurrency-related fraud, and the data shows:

65.4% of users did not fall victim to scams, indicating strong preventive awareness.

8.3% of users fell victim but did not incur losses, possibly due to timely remedial measures.

13.7% of users lost less than $1,000, indicating that small losses are relatively common.

8.3% of users lost between $1,000 and $10,000, suggesting that medium-scale losses also occur.

4.3% of users lost over $10,000, indicating that a small number of users experienced severe financial losses.

Overall, while most users did not incur losses, there is still a need to strengthen prevention to avoid potential economic losses.

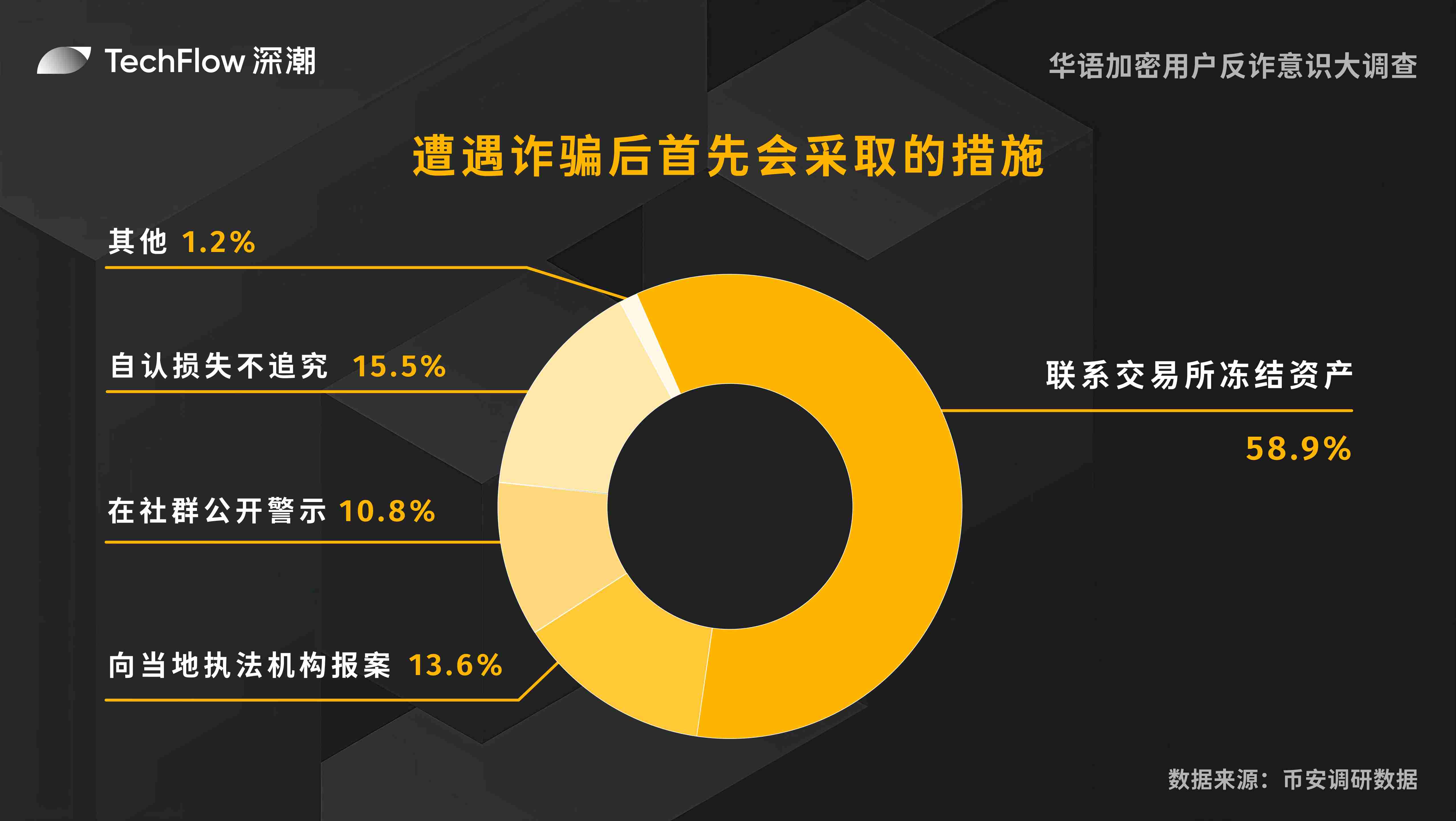

- Measures taken first after encountering fraud

Due to the decentralized nature of blockchain, stolen cryptocurrencies are often difficult to recover. Our survey shows that over half of users would first contact the exchange to freeze their assets after encountering fraud. Notably, the second-highest proportion of users chose to accept their losses and not pursue further action. Specific data includes:

58.9% of users would first contact the exchange to freeze their assets, showing a focus on protecting their funds.

13.6% of users choose to report to local law enforcement, indicating their desire to resolve issues through legal means.

10.8% of users publicly warn in communities, aiming to alert others to similar risks.

15.5% of users accept their losses and do not pursue further action, possibly due to small losses or the belief that pursuing action would be futile.

1.2% of users take other measures, indicating diversity in response strategies.

Overall, most users tend to take proactive measures to protect their interests, with contacting the exchange being the choice of the majority, indicating users' trust in exchanges led by Binance; however, some users choose to accept their losses, reflecting the difficulty of recovering from cryptocurrency fraud, which warrants more attention.

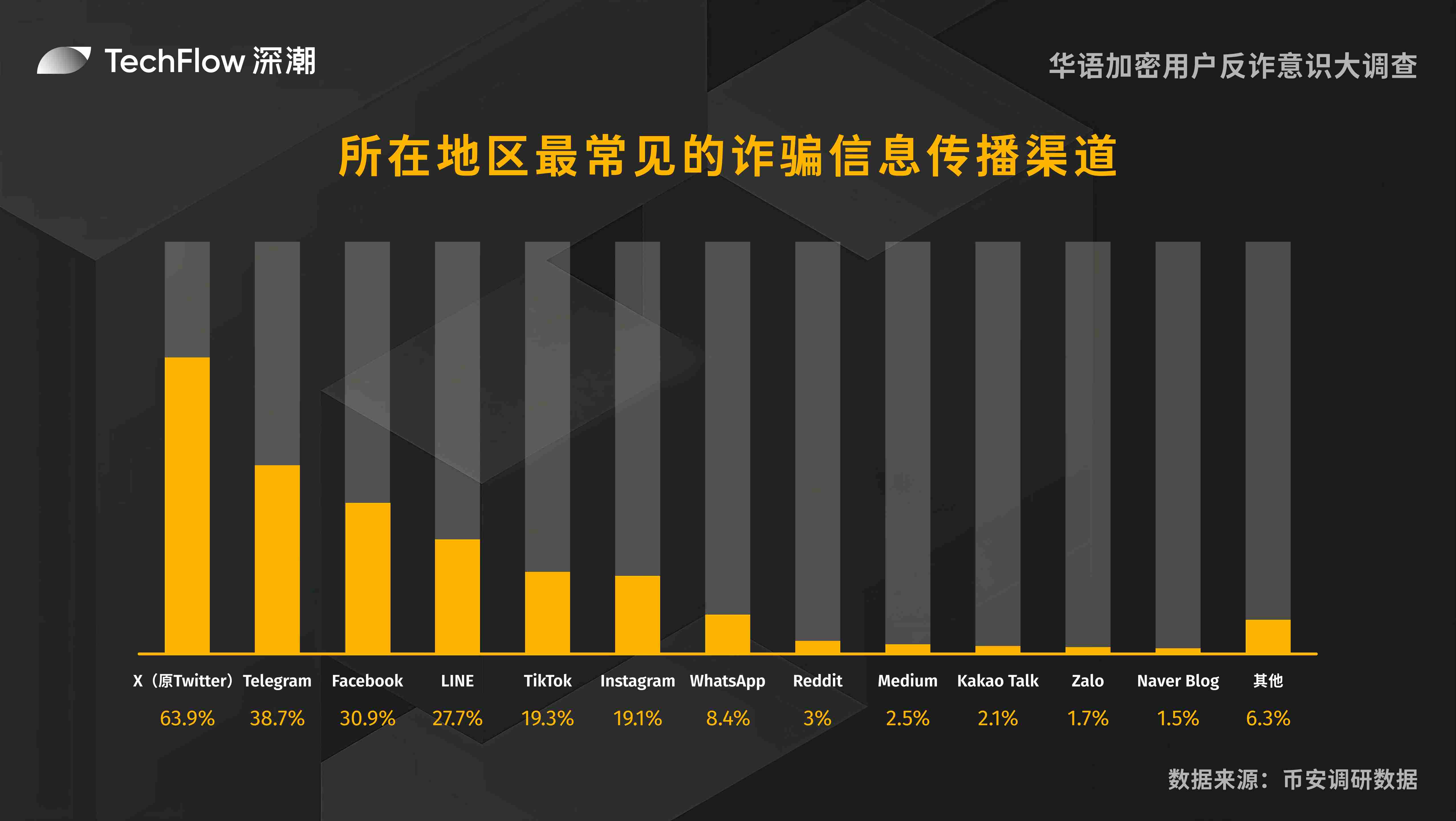

- Social media channels where scam information is most commonly seen in the region

In this survey, we conducted a detailed statistical analysis of the most common channels for disseminating scam information in the respondents' regions. This survey helps us understand the influence of different social media platforms in spreading scam information. This question allowed multiple selections, so each respondent could choose multiple options.

Main dissemination channels:

X (formerly Twitter): 63.9% is the most common channel for scam information dissemination, demonstrating its strong influence in information dissemination.

Telegram: 38.7% also occupies a significant proportion, indicating its widespread use in the cryptocurrency community.

Facebook: 30.9% and LINE: 27.7% are also frequently mentioned, showing the popularity of these platforms in certain regions.

Secondary dissemination channels:

TikTok: 19.3% and Instagram: 19.1% indicate that these visual content platforms have also become channels for spreading scam information.

WhatsApp: 8.4% and other channels: 6.3% reflect that users occasionally encounter scam information on other platforms.

Less frequently mentioned channels:

- Reddit: 3%, Medium: 2.5%, Kakao Talk: 2.1%, Zalo: 1.7%, Naver Blog: 1.5%, etc., have lower proportions, indicating differences in user preferences across different regions.

Overall, while some platforms like X and Telegram dominate the dissemination of scam information, other social media platforms should not be overlooked. Users need to remain vigilant across all platforms to prevent the harm of scam information.

Part 4: Demand for Exchange Security Services

This section focuses on the role Binance plays in helping users respond to cryptocurrency fraud. The questions range from Binance's official verification channels, discerning the authenticity of Binance information, seeking help from Binance, desired security measures for exchanges/decentralized wallets, to Binance's security products and anti-fraud education, depicting Binance's attempts to prevent cryptocurrency fraud.

- Binance official verification channels

Binance's official verification channels provide a method for users to verify employee identities. Users can input a website, email address, phone number, Telegram, or social media account to check if the source is verified and comes from Binance. In this survey, we collected data on whether respondents are aware that they can confirm if someone is a Binance official employee through the "Binance Official Verification Channels" page.

The data shows: 50.5% of respondents indicated that they know they can confirm employee identities through the "Binance Official Verification Channels." Meanwhile, 49.5% of respondents indicated that they are unaware of this verification channel.

Although half of the users are aware of the verification channel, there is still a need to strengthen the promotion of official verification methods.

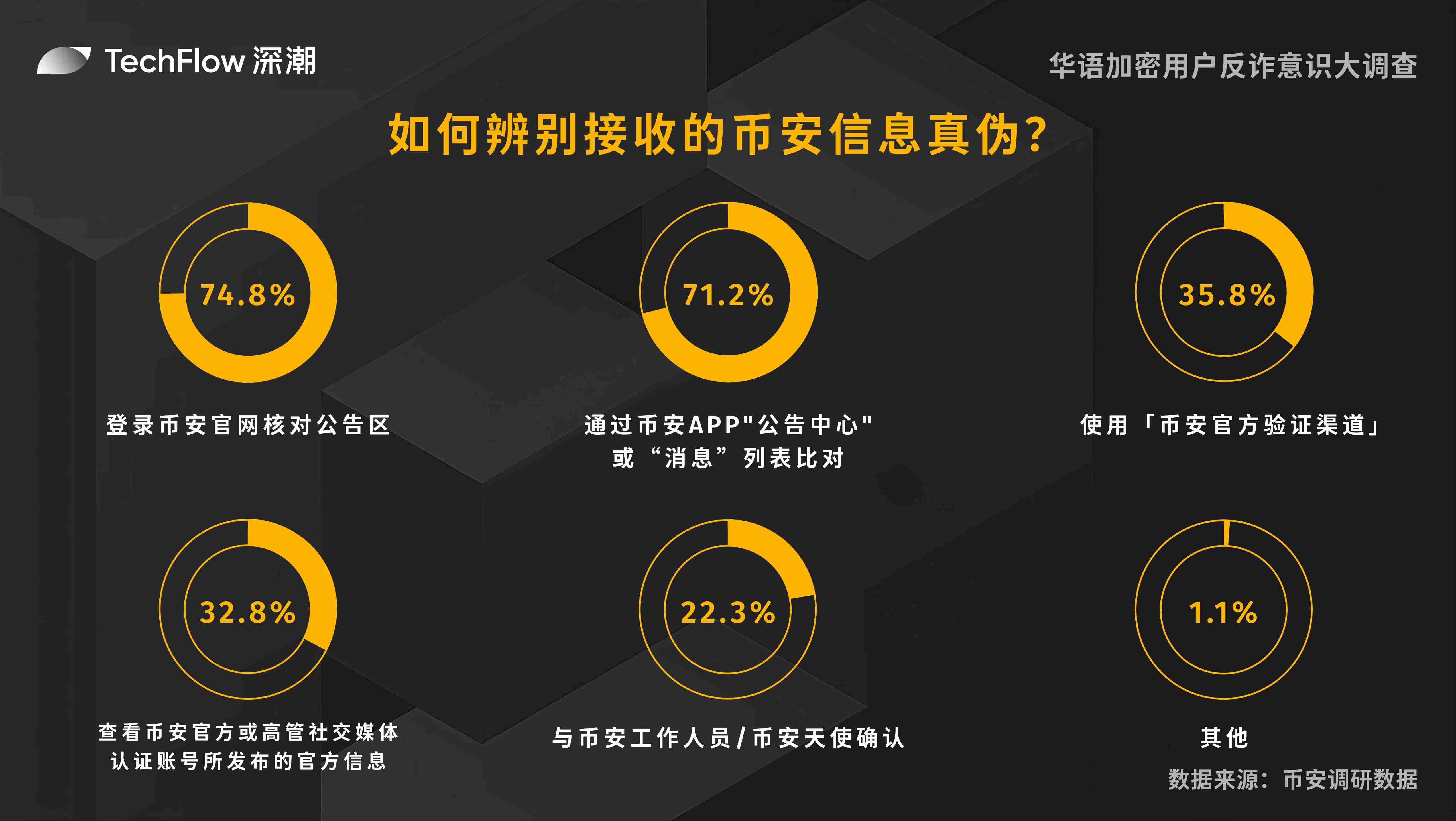

- Discerning the authenticity of received Binance information

In this survey, we conducted a detailed statistical analysis of the methods respondents use to discern the authenticity of Binance information. This survey helps us understand the different measures users take to confirm the authenticity of information. This question allowed multiple selections, so each respondent could choose multiple options. Based on the survey results, we categorized users' discernment methods into three types:

Primary discernment methods:

Log in to the Binance official website to check the announcement area: The most commonly used method, with most users (74.8%) preferring to obtain authoritative information through the official website.

Compare through the Binance APP's "Announcement Center" or "Message" list: Chosen by 71.2% of users, authoritative official announcements are often the most trusted verification method for users.

Secondary discernment methods:

Verify sender information in the "Binance Official Verification Channels": Although this is also an official channel, only a portion of users (35.8%) choose this method, likely due to unfamiliarity with this channel.

Check official information published by Binance's official or executive social media verified accounts: 32.8% of users rely on social media for information.

Other methods:

Confirm with Binance staff or Binance Angels: 22.3% of users choose to communicate with staff in the community to verify information.

Others: A very small number (1.1%) of users use other unique methods for verification.

Overall, most users rely on official channels and applications to confirm the authenticity of information, but some users also engage in multiple verifications through social media and direct communication. This indicates that users adopt diverse strategies to ensure the accuracy and reliability of information, but more users will confirm official website information first, using official announcements as the standard.

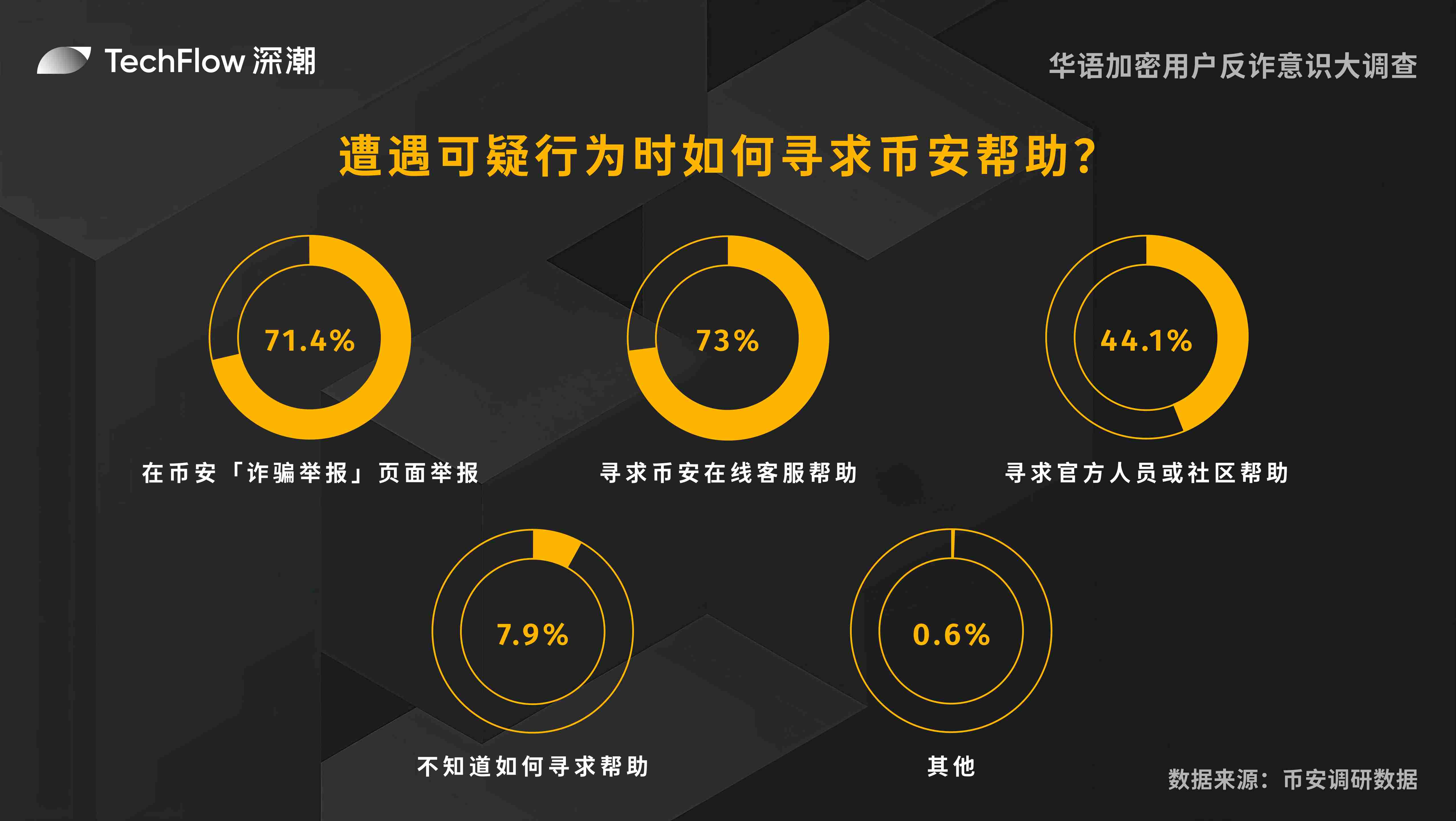

- How to seek Binance's help when encountering suspicious behavior during transactions?

In this survey, we conducted a detailed statistical analysis of the methods respondents use to seek help when encountering suspicious behavior during transactions. This survey helps us understand users' responses to potential risks. This question allowed multiple selections, so each respondent could choose multiple options. We categorized the methods users seek help into three types:

Primary methods of seeking help:

Most users (73%) prefer to directly contact Binance's online customer service for assistance.

71.4% of users report scams on Binance's "Scam Reporting" page after encountering fraud.

Secondary methods of seeking help:

- 44.1% of users seek help from official personnel or the community for additional support and advice.

Other methods:

Notably, 7.9% of users are unclear about how to seek help when encountering issues.

0.6% of users employ other uncommon methods to seek help.

Overall, most users tend to seek help through official channels such as customer service and reporting pages. The Binance "Scam Reporting" link is also familiar and chosen by more users. However, some users still rely on community support or are unsure how to respond, indicating that there is still a need to strengthen user safety education to ensure all users can receive timely help when encountering issues.

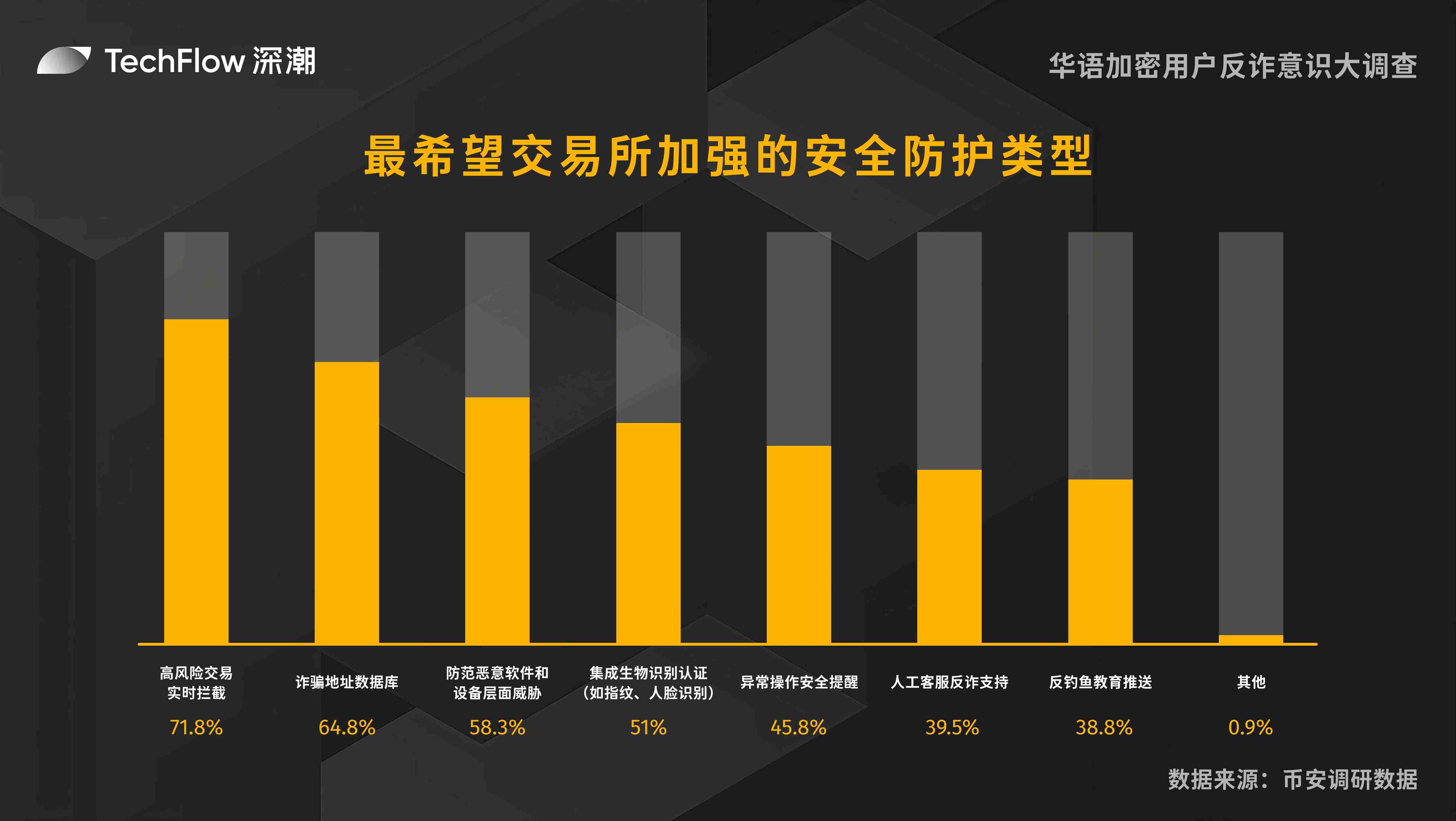

- Types of security protections users most want exchanges to strengthen

In this survey, we conducted a detailed statistical analysis of the types of security protections users want exchanges to strengthen. This survey helps us understand users' specific needs for enhanced security during transactions. This question allowed multiple selections, so each respondent could choose multiple options. We categorized the results into three types based on priority:

Primary concerns:

71.8% of users want exchanges to implement real-time interception of high-risk transactions, indicating a strong awareness of potential immediate risks during transactions and a desire for exchanges to proactively identify and prevent potential threats.

64.8% of users express a desire for exchanges to provide a comprehensive scam address database for verification before transactions. This reflects users' awareness of known scam tactics and their need for preventive protection from exchanges.

Secondary concerns:

58.3% of users are concerned about device security and hope exchanges can provide solutions to prevent malware. This indicates users' recognition of the importance of device security for overall transaction safety.

51% of users show interest in enhancing security through biometric technology, hoping exchanges will strengthen the integration of biometric authentication, indicating a positive attitude towards the application of new technologies in identity verification.

Other concerns:

45.8% of users want to receive alerts in case of abnormal operations, reflecting expectations for exchanges to timely notify users of potential risks.

39.5% of users hope for human customer service to provide anti-fraud support, emphasizing the importance of human support in complex fraud situations.

38.8% of users want exchanges to provide more anti-phishing education, indicating a certain demand for users to enhance their security awareness.

0.9% of users expressed other specific personalized security needs.

Overall, users' demand for security protections from exchanges mainly focuses on real-time monitoring, preventive measures, and the application of emerging technologies, while also hoping to enhance their security awareness through education and human support. This indicates that exchanges need to adopt a dual approach in technology and services to meet users' diverse security needs.

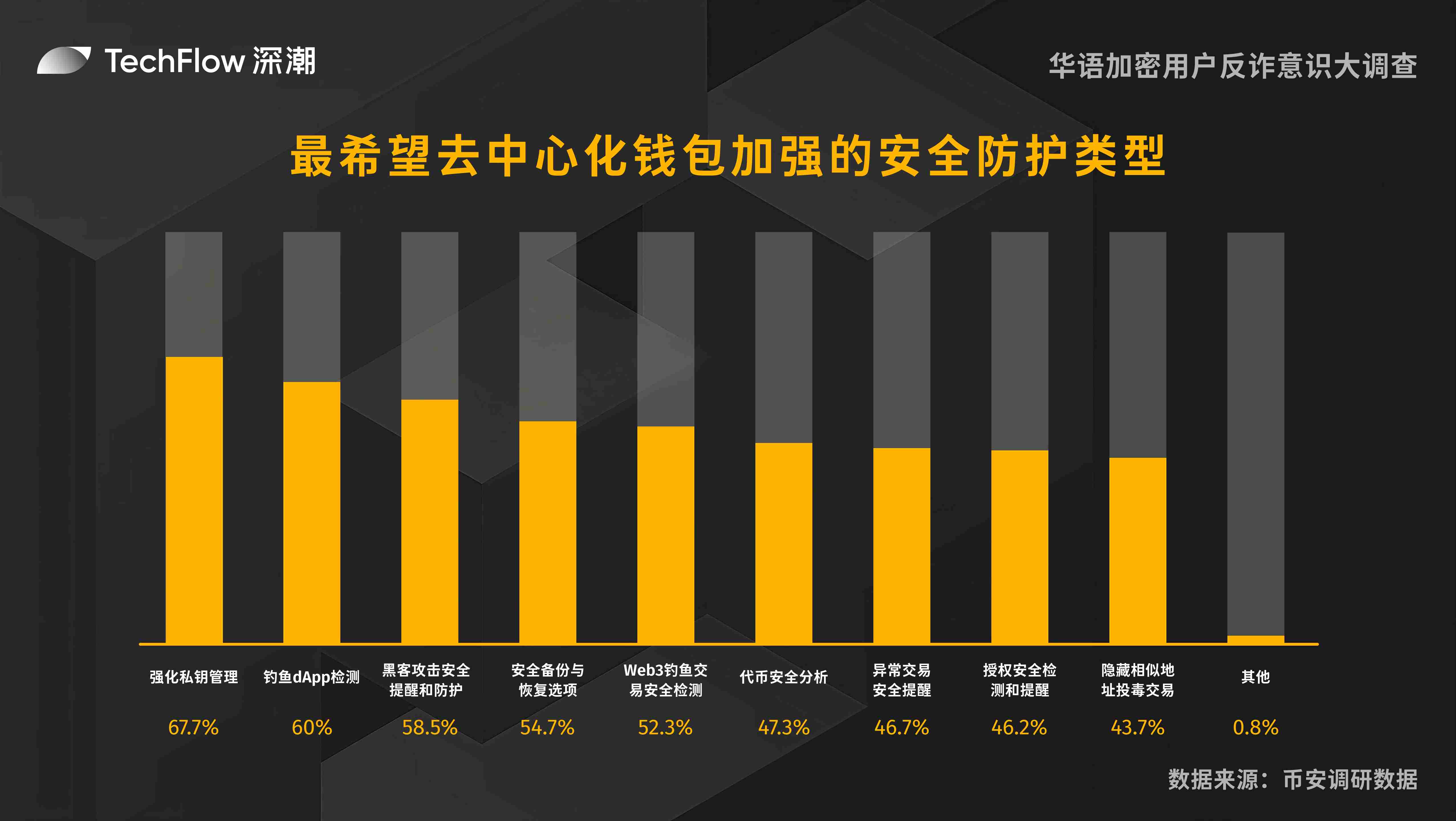

- Types of security protections users most want decentralized wallets to strengthen

We investigated users' specific needs for wallet security protections. This question allowed multiple selections, so each respondent could choose multiple options.

In terms of wallet security, 67.7% of users want wallets to strengthen private key management, and 54.7% of users want enhanced security backup and recovery options.

Regarding external risks, 60% of users emphasize the importance of phishing dApp detection, 52.3% of users want to enhance detection of phishing transactions, and 58.5% of respondents hope to identify hacker attacks more efficiently. Additionally, 47.3%, 46.7%, 46.2%, and 43.7% of users want to strengthen monitoring of token, transaction, authorization, and similar address poisoning transactions.

0.8% of users proposed other personalized security needs.

These data indicate that users have diverse demands for the security features of decentralized wallets, especially in private key management and phishing attack prevention, providing a direction for subsequent platform optimization.

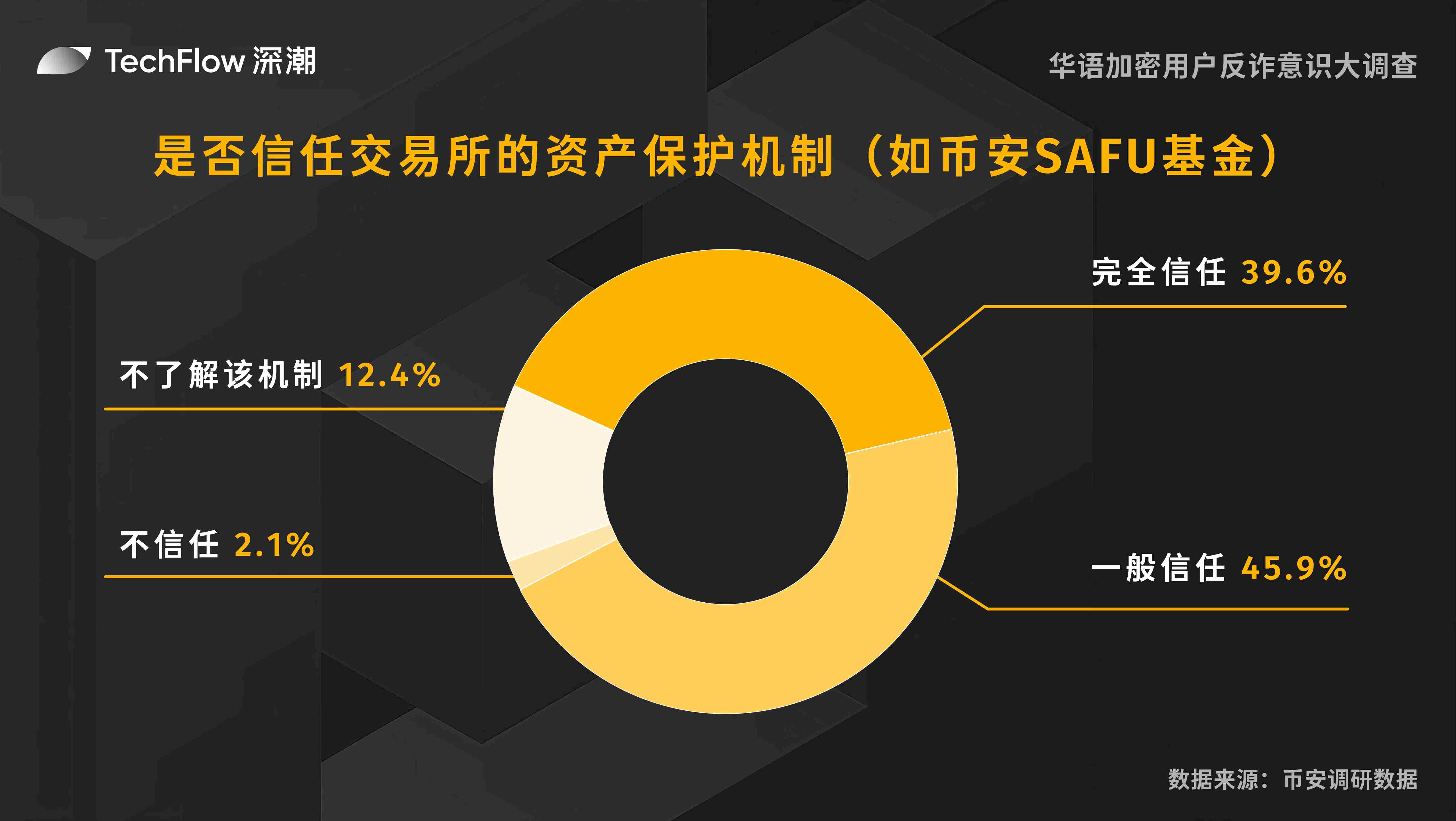

- Do you trust the asset protection mechanisms of exchanges (such as Binance's SAFU fund)?

In cryptocurrency trading, the asset protection mechanisms of exchanges (such as Binance's SAFU fund) play an important role. We surveyed users' trust levels in these mechanisms.

Specifically, 39.6% of users expressed complete trust in the asset protection mechanisms of exchanges; 45.9% of users hold a general trust attitude; only 2.1% of users expressed distrust, while 12.4% of users indicated they are unaware of these mechanisms.

The survey results show that the vast majority of users have a certain level of trust in the asset protection mechanisms of exchanges. However, there is still a portion of users who need more information to enhance their understanding and trust in these mechanisms. Exchanges can further improve users' confidence in their security measures through transparent information disclosure and user education.

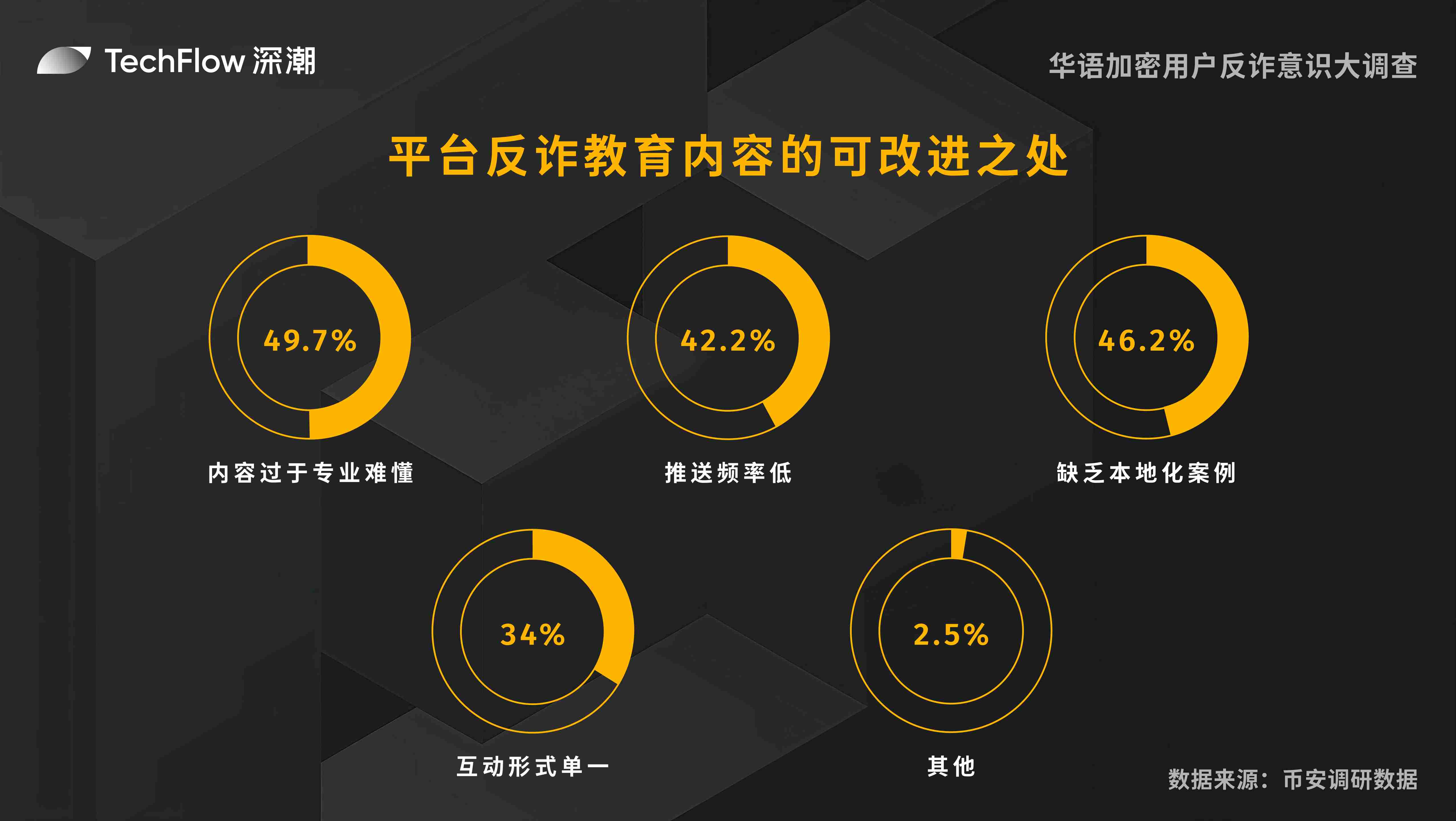

- Areas for improvement in platform anti-fraud education content

As cryptocurrency-related scams continue to evolve, the importance of platform anti-fraud education content is increasingly highlighted. We surveyed users on several aspects they believe could be improved. This question allowed multiple selections, so each respondent could choose multiple options.

49.7% of users believe that anti-fraud education content is too technical and difficult to understand, with nearly half of users hoping the content could be more accessible to better understand and apply.

42.2% of users indicated that the frequency of anti-fraud content delivery is too low, suggesting an increase in delivery frequency to enhance users' vigilance and knowledge level.

46.2% of users pointed out that anti-fraud education content lacks localized examples, hoping to see real cases related to their living environment to improve the relevance and practicality of the content.

34% of users believe that the current interactive format is too singular, suggesting the adoption of more diverse interactive methods to enhance user engagement and learning effectiveness.

Additionally, 2.5% of users proposed other improvement suggestions, indicating users' personalized needs for anti-fraud education content.

The survey results indicate that users' understanding and acceptance of platform anti-fraud education content need to be improved, and enhancing the efficiency of anti-fraud education in a way that better meets user needs can help users better identify and prevent online scams.

Part 5: Security Features and Education Preferences

This chapter focuses on users' awareness of fraud prevention, emphasizing users' willingness to receive security alerts and participate in platform-organized anti-fraud simulation tests, which can help platforms more effectively assist users in identifying cryptocurrency-related scams and prevent potential issues.

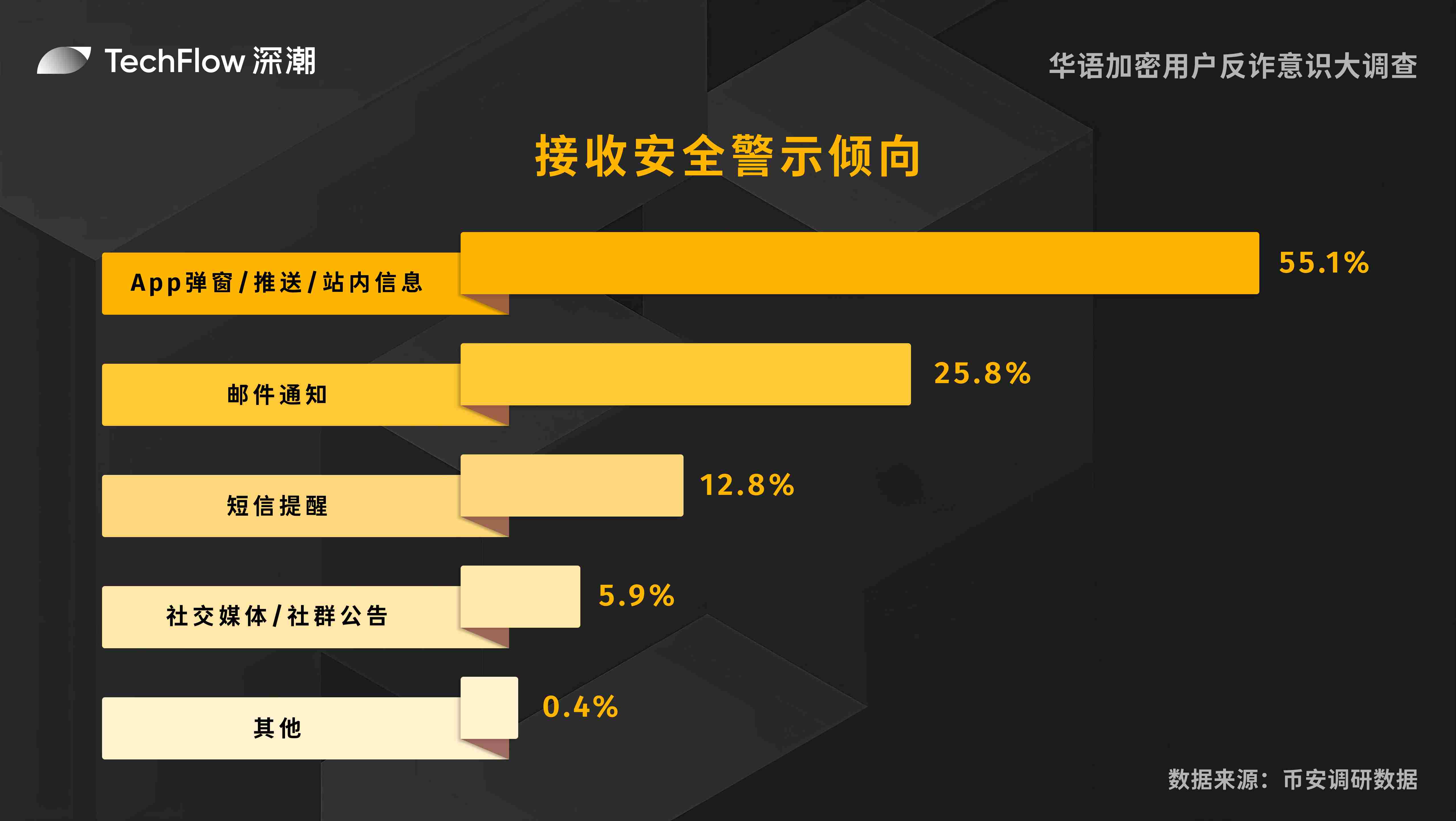

- Willingness to receive security alerts

In today's world, where information security is increasingly important, users have different preferences for receiving security alerts. We surveyed users' specific preferences in this regard.

55.1% of users prefer to receive security alerts through app pop-ups, push notifications, or in-app messages. This immediate notification method is considered the most effective reminder by most users.

25.8% of users prefer to receive security alerts via email. This method is suitable for users who frequently check their emails in work or daily life.

12.8% of users choose SMS reminders, reminding us that traditional methods should not be overlooked.

5.9% of users prefer to receive security alerts through social media or community announcements, which may not be widely accepted due to users' inability to access information immediately.

0.4% of users suggested other methods of receiving alerts, indicating a small number of users' personalized needs.

The survey results show that most users prefer to receive security alerts through immediate app notifications. However, to meet the preferences of different users, platforms can provide multiple notification methods to ensure that security information is communicated timely and effectively to all users.

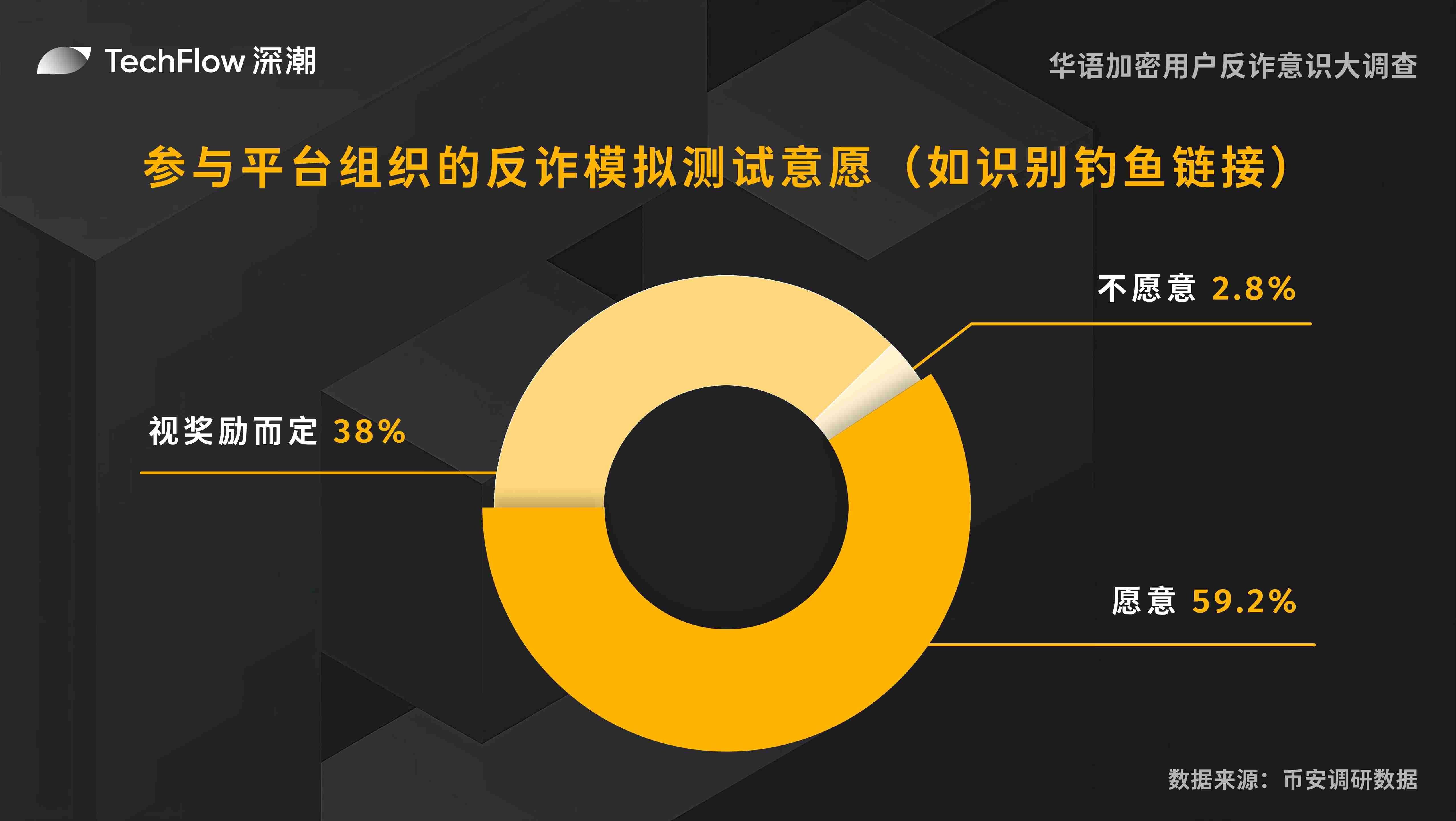

- Willingness to participate in platform-organized anti-fraud simulation tests (such as identifying phishing links)

Anti-fraud simulation tests are an important means to enhance users' security awareness and skills. We surveyed users' willingness to participate in platform-organized anti-fraud simulation tests.

Specifically, 59.2% of users expressed willingness to participate in anti-fraud simulation tests, 38% of users' willingness depends on rewards, and only 2.8% of users are unwilling to participate.

This indicates that the vast majority of users have an open attitude towards participating in such tests. Platforms can also enhance user participation by designing reasonable incentive mechanisms, thereby improving users' security prevention capabilities and awareness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。