1. Market Observation

Keywords: SOL, ETH, BTC

After the UK and the US reached a trade agreement, Trump immediately encouraged investors to "buy stocks now," igniting optimistic sentiment in the market. According to the agreement, tariffs on UK steel and aluminum exports to the US will be eliminated, and auto tariffs will be significantly reduced from 27.5% to 10%. However, the previously imposed 10% "reciprocal tariff" by the US will remain. This boost led to a collective rise in the three major US stock indices, with the S&P 500 index rising nearly 1.6% at one point, and the Nasdaq soaring by 2%. Meanwhile, the US dollar index returned above the 100 mark, causing most non-US currencies to weaken, and gold faced pressure due to the strengthening dollar, with spot gold briefly falling below $3,300 overnight, a decline of nearly 2%.

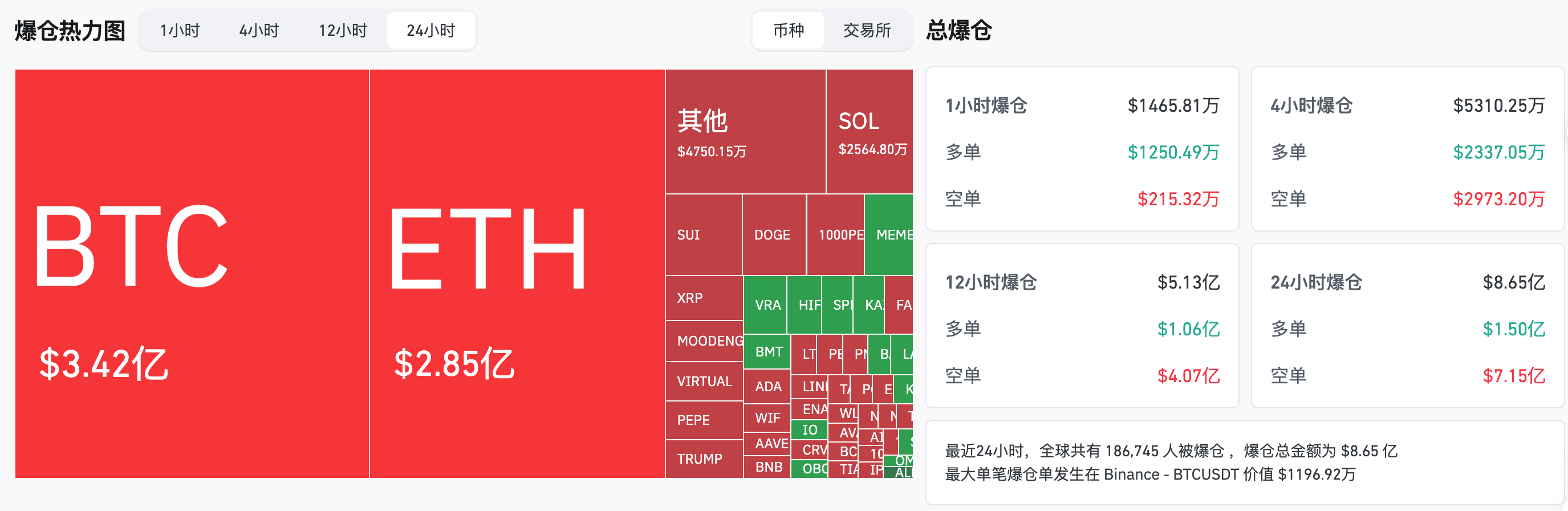

The cryptocurrency market was also buoyed by Trump's announcement, with Bitcoin breaking the $100,000 mark for the first time since February, reaching $104,000 this morning and briefly surpassing Amazon to become the fifth-largest asset globally. This strong surge led to a liquidation of $836 million in short positions yesterday, marking the largest single-day short liquidation in history. Standard Chartered's head of digital assets, Geoffrey Kendrick, stated that the previous target of $120,000 for Bitcoin in the second quarter "may have been too conservative." However, BTSE COO Jeff Mei also reminded investors to be cautious of the "sell in May" seasonal pattern—historical data shows that Bitcoin fell 35% in May 2021 and 15% in May 2022.

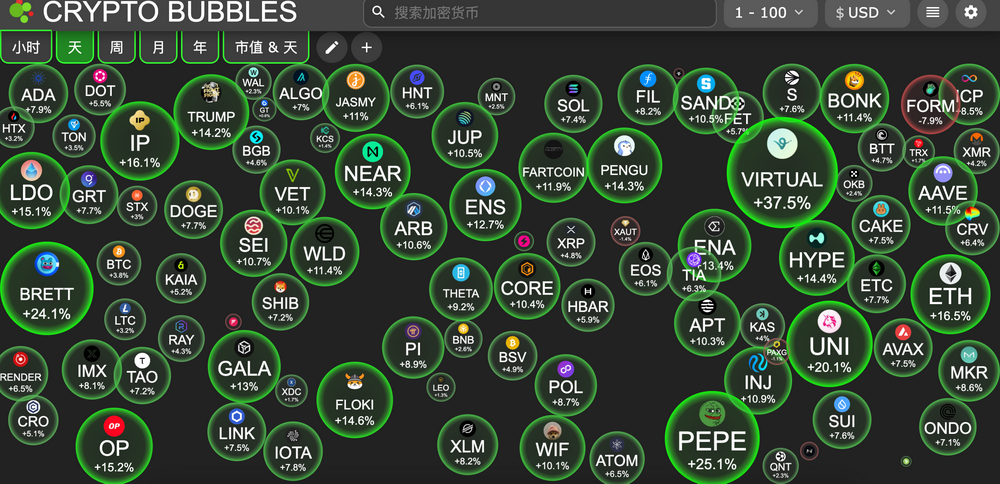

Ethereum performed even more impressively, surging over 20% in a single day, breaking through $2,200, and the ETH/BTC ratio returned to the 0.02 level after a month. Nevertheless, to return to the historical high of 0.05, Ethereum still has significant room for growth. It is worth noting that despite the price increase and the recent Pectra upgrade on the network, Ethereum's network activity remains subdued, with weak growth in trading volume and active addresses. Since 2021, on-chain activity has stagnated, and institutional demand has shown an overall downward trend, so the sustainability of its upward trend remains to be seen.

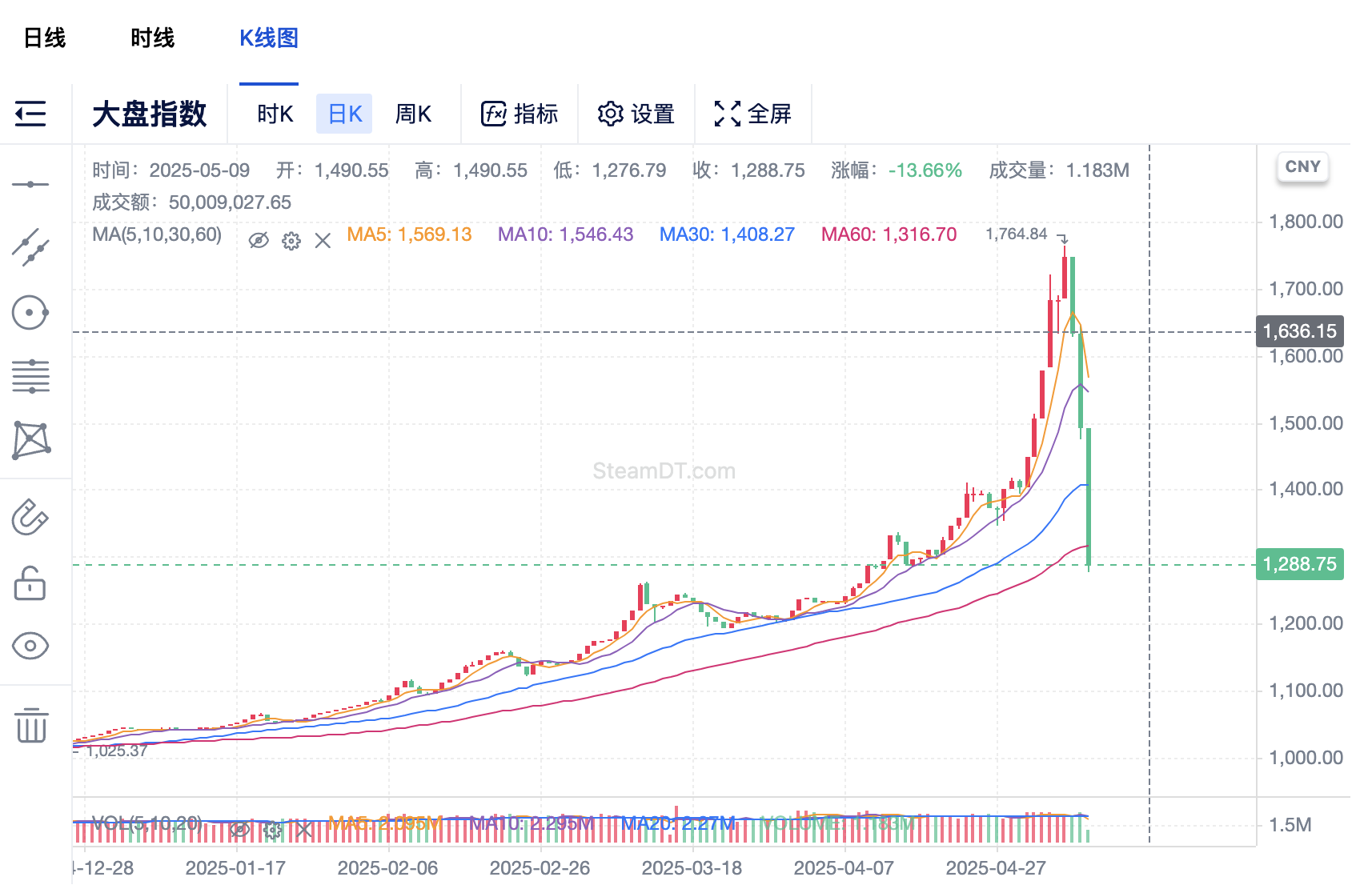

The altcoin market followed the mainstream coins with a broad rally, with some strong coins rising over 20%. Several projects within the Ethereum ecosystem performed particularly well, such as MOODENG, NEIRO, PEPE, EIGEN, LQTY, and ETHFI, all rising over 30%. In contrast, Solana's rise was relatively moderate, increasing only 8% to $162, and its on-chain activity seems to have been diverted to the secondary market, with no quality fast transactions in the past 24 hours. Interestingly, there is a clear flow of funds between crypto assets and other digital asset markets—the CS jewelry market recently experienced a significant decline, showing an almost opposite trend to the crypto market, effectively reversing the gains of the previous week.

Significant decline in the CS jewelry market

2. Key Data (As of May 9, 12:00 HKT)

(Data Source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN, Steamdt)

Bitcoin: $102,546 (Year-to-date +9.78%), Daily Spot Trading Volume $47.583 billion

Ethereum: $2,214.65 (Year-to-date -33.49%), Daily Spot Trading Volume $37.764 billion

Fear and Greed Index: 73 (Greed)

Average GAS: BTC 1.01 sat/vB, ETH 1.07 Gwei

Market Share: BTC 63.4%, ETH 8.3%

Upbit 24-Hour Trading Volume Ranking: XRP, LAYER, BTC, ETH, VIRTUAL

24-Hour BTC Long/Short Ratio: 0.9623

Sector Performance: Meme sector up 10.14%, AI sector up 9.98%

24-Hour Liquidation Data: A total of 186,745 people were liquidated globally, with a total liquidation amount of $865 million, including $342 million in BTC, $285 million in ETH, and $25.86 million in SOL.

BTC Medium to Long-Term Trend Channel: Upper line ($97,519.88), Lower line ($95,588.79)

ETH Medium to Long-Term Trend Channel: Upper line ($1,914.51), Lower line ($1,876.60)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (As of May 8)

Bitcoin ETF: $117 million

Ethereum ETF: -$16.11 million (Net outflow for three consecutive days)

4. Today's Outlook

Coinbase plans to launch around-the-clock Bitcoin and Ethereum futures trading on May 9

Movement (MOVE) will unlock approximately 50 million tokens at 8 PM on May 9, accounting for 2.0% of the current circulation, valued at approximately $8.7 million;

Top 500 Largest Gains Today: MOODENG up 100.15%, PNUT up 48.05%, NEIRO up 42.06%, VIRTUAL up 32.50%, EIGEN up 30.49%.

5. Hot News

CleanSpark's quarterly revenue increased by 62.5% year-on-year, Bitcoin assets nearing $1 billion

Mining company MARA's Q1 revenue grew by 30%, Bitcoin holdings surged to 47,531 coins

Acurast will launch its token sale on CoinList at 1 AM on May 16

Coinbase's Q1 revenue fell short of expectations, trading activity decreased by 10%

Trump: The US will raise $6 billion in external revenue by imposing a 10% tariff on the UK

Coinbase will acquire the crypto options platform Deribit for $2.9 billion

Missouri may exempt cryptocurrency and stock capital gains tax

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。