In early April, Trump's reciprocal tariff policy triggered a global asset crash, but Trump later softened his stance, admitting that tariffs "will be significantly reduced" and confirming that Federal Reserve Chairman Powell will continue to serve, alleviating concerns about turmoil in the Fed's leadership. After investors were reassured, a new wave of risk appetite emerged, with Bitcoin leading a strong rally.

From the data perspective, although the macroeconomic hard indicators such as consumption and employment in the U.S. in April have not yet been substantially impacted, risks have clearly increased: in March, the U.S. non-farm payrolls added 151,000 jobs (expected 170,000), and the unemployment rate rose to 4.1%, with data better than expected; on the other hand, the Trump administration's "reciprocal tariff" policy implemented in April saw the average tax rate soar from 2.4% to 21.4%, leading to an 18.6% year-on-year increase in the import price index. The pre-tariff rush for cars drove a 1.4% month-on-month surge in March retail sales, but the actual consumption momentum excluding automobiles only grew by 0.5%, a decrease of 0.15 percentage points from February.

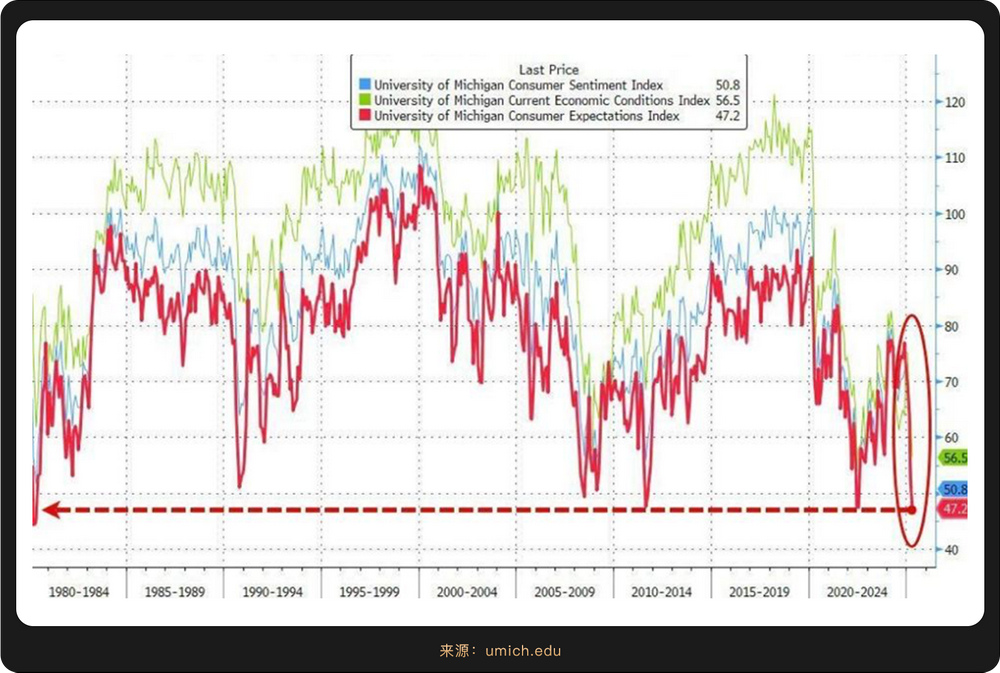

This policy-driven short-term consumption overdraw stands in stark contrast to the consumer confidence index in April, which recorded the largest decline since 1978: the preliminary value of the University of Michigan consumer confidence index in April was 50.8, significantly below the expected 53.5, with the previous value in March at 57, marking the fourth consecutive month of decline. The preliminary value of the one-year inflation expectation from the University of Michigan in April surged to 6.7%, the highest since November 1981, with an expectation of 5.2% and a previous value of 5%; the preliminary value of the five-year inflation expectation was 4.4%, the highest since June 1991, with an expectation of 4.3% and a previous value of 4.1%. The significant weakening of expectation-type soft indicators reveals various unsustainabilities.

The U.S. economy is facing a stagflation dilemma of "high inflation - low growth - policy conflict," and the backlash effect of the tariff policy will soon accelerate through three channels: the supply chain, the job market, and consumer confidence. The International Monetary Fund (IMF) released the latest World Economic Outlook report, downgrading the global economic growth forecast for 2025 from 3.3% to 2.8%, with the U.S. growth forecast halved to 1.8% and the Eurozone down to 0.7%.

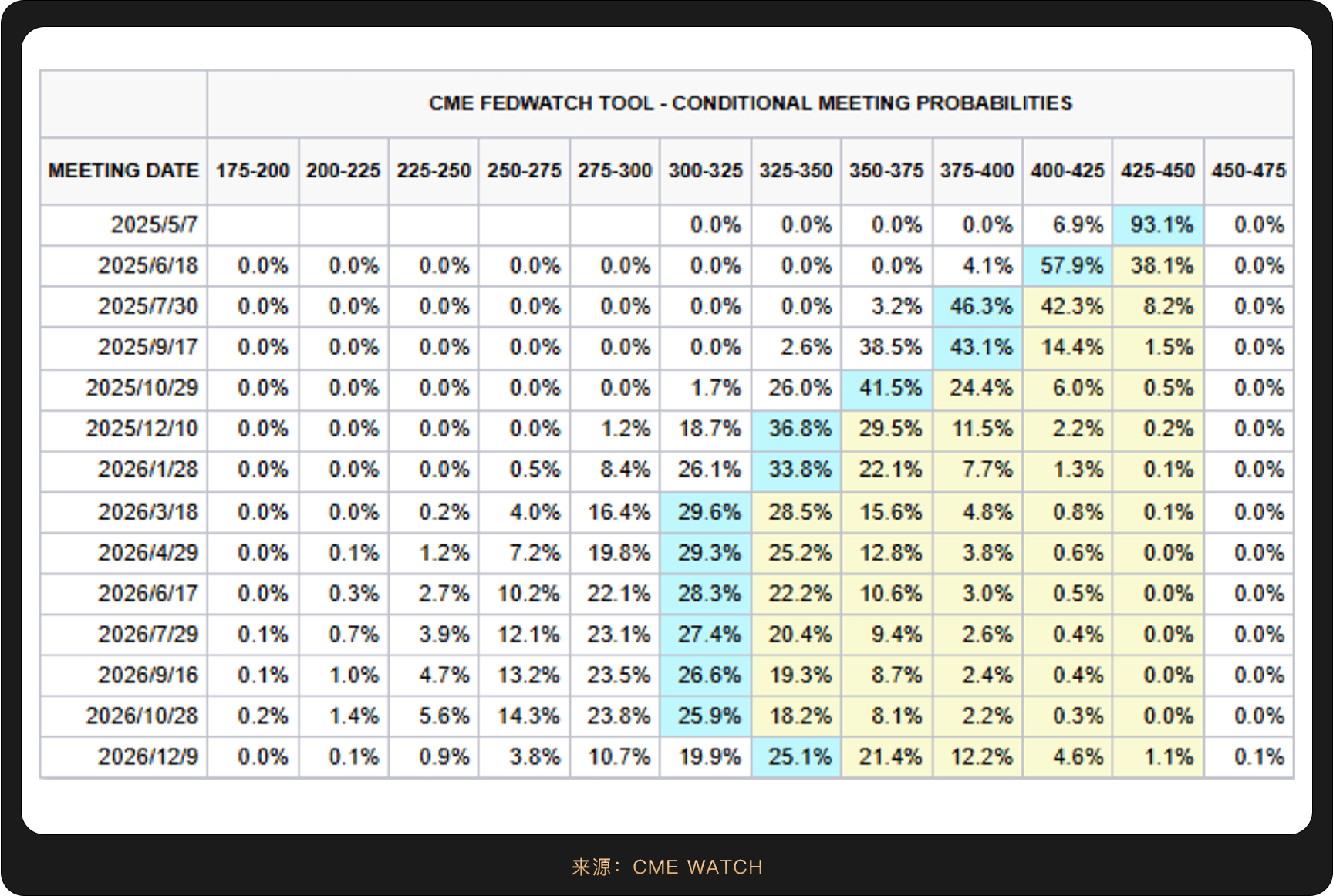

Looking at the Federal Reserve, the PCE inflation rate has been above the 2% target for 14 consecutive months, and in April, short-term inflation expectations jumped to 3.8%, the highest since 1982. In this context, the Federal Reserve's decision to maintain the federal funds rate in the range of 4.25%-4.50% during the March 19 meeting clearly indicates a triple dilemma: cutting rates may exacerbate inflation expectations, raising rates will accelerate economic recession, while maintaining the status quo faces pressure from the president. Federal Reserve Chairman Powell stated that policymakers will continue to monitor economic conditions, especially inflation and growth data, and will consider adjusting interest rates only after waiting for clearer signals.

As the "anchor point" of global monetary policy, the Federal Reserve is undergoing the most severe policy imbalance test in nearly forty years. According to widespread predictions, in the most optimistic scenario, if inflation declines faster than expected, the Federal Reserve may shift to a neutral rate more quickly, potentially starting to cut rates in the first half of 2025 (in May or June).

Throughout April, dollar assets faced a dual blow from policy uncertainty and economic downturn, especially in the first half of the month when market sentiment was extremely pessimistic; first, on April 3, the three major U.S. stock indices experienced historic declines, with the Dow Jones Industrial Average falling 5.50% in a single day, the Nasdaq plummeting 5.82%, and the S&P 500 dropping 5.98%, marking the largest single-day decline since March 2020. Tech stocks were hit hard, with companies like Apple, Tesla, and Nvidia significantly dropping due to rising supply chain costs and export restrictions, while Nike fell 14.44% in a single day due to high tariffs affecting Vietnam and Indonesia. Bruce Kasman, chief economist at JPMorgan, even raised the probability of a U.S. recession to 79%, reflecting deep market concerns about the long-term negative impact of tariff policies.

U.S. stocks saw a significant rebound at the end of the month. On April 23, the S&P 500 rose 9.52% in a single day, and the Nasdaq index increased by 12.16%, marking the second-largest single-day gain in history. This rebound was partly due to market expectations of potential adjustments to tariff policies, such as the U.S. Customs and Border Protection announcing tariff exemptions for certain electronic products. Additionally, some tech giants' earnings reports exceeded expectations, boosting market confidence, such as Google's AI business growth and a $70 billion stock buyback plan.

Although U.S. stocks recovered most of the tariff-related losses by the end of the month, the uncertainty of Trump's policies and the U.S. economic downturn may create a stronger resonance, with U.S. stocks likely to remain the first to be affected. Wall Street generally believes that this rebound may only be a "technical correction in a bear market." Bank of America strategist Michael Hartnett warned that investors should "sell on rallies," as the market still faces policy uncertainty and recession risks. Goldman Sachs also pointed out that if tariff policies are not substantially relaxed, U.S. stocks may come under pressure again.

Before the Federal Reserve resumes rate cuts and progress is made in tariff negotiations, the short-term rebound in U.S. stocks remains overshadowed.

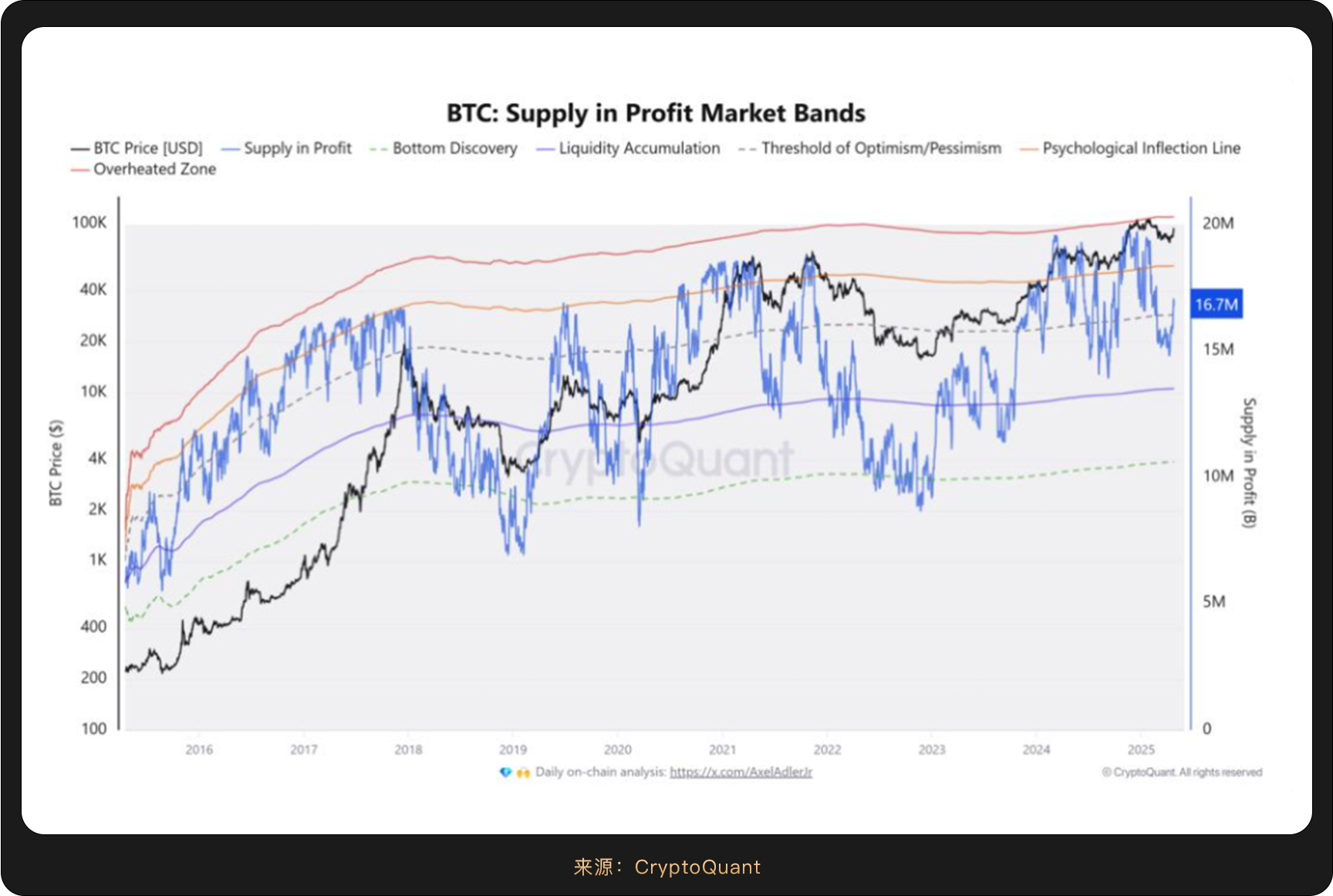

Despite also suffering from the impact of tariffs in April, Bitcoin outperformed market expectations, redefining its position among global assets:

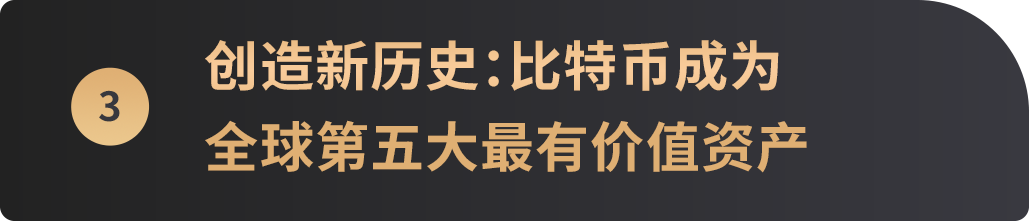

First, in mid to late April, Bitcoin's price strongly broke through the $94,000 mark, with a single-day increase of over 3%, reaching a new high for the year. This surge corresponded with gold's simultaneous new high, highlighting its attributes as "digital gold." Moreover, in stark contrast to the U.S. stock market, which was impacted by tariff policies during the same period, Bitcoin's volatility significantly decreased in April. This stability attracted medium to long-term funds to accelerate their entry—between April 21 and 23, U.S. Bitcoin spot ETFs saw a net inflow of over $900 million for three consecutive days, pushing the total market capitalization of global cryptocurrencies above $3 trillion and reigniting bullish sentiment across the entire cryptocurrency market, with investor confidence reaching its highest level in over two months. U.S. media referred to it as an alternative choice in search of a safe haven. During this wave of price increase, the wealth of long-term holders (LTHs) significantly grew. According to CryptoQuant data, from April 1 to 23, the market value of long-term holders increased from $345 billion to $371 billion, an increase of $26 billion, indicating that long-term holders are reaping rewards for their persistence.

According to CryptoQuant statistics, from January to early April, Bitcoin experienced a correction of over 30%, which aligns with historical market cycle patterns from 2013, 2017, and 2021, where corrections typically occur after reaching new highs, flushing out weaker investors before resuming an upward trend. Additionally, the decoupling of Bitcoin from traditional markets and the demand for non-correlated assets (such as gold prices rising to a new high of $3,500) have strengthened long-term holders' confidence in Bitcoin as a store of value.

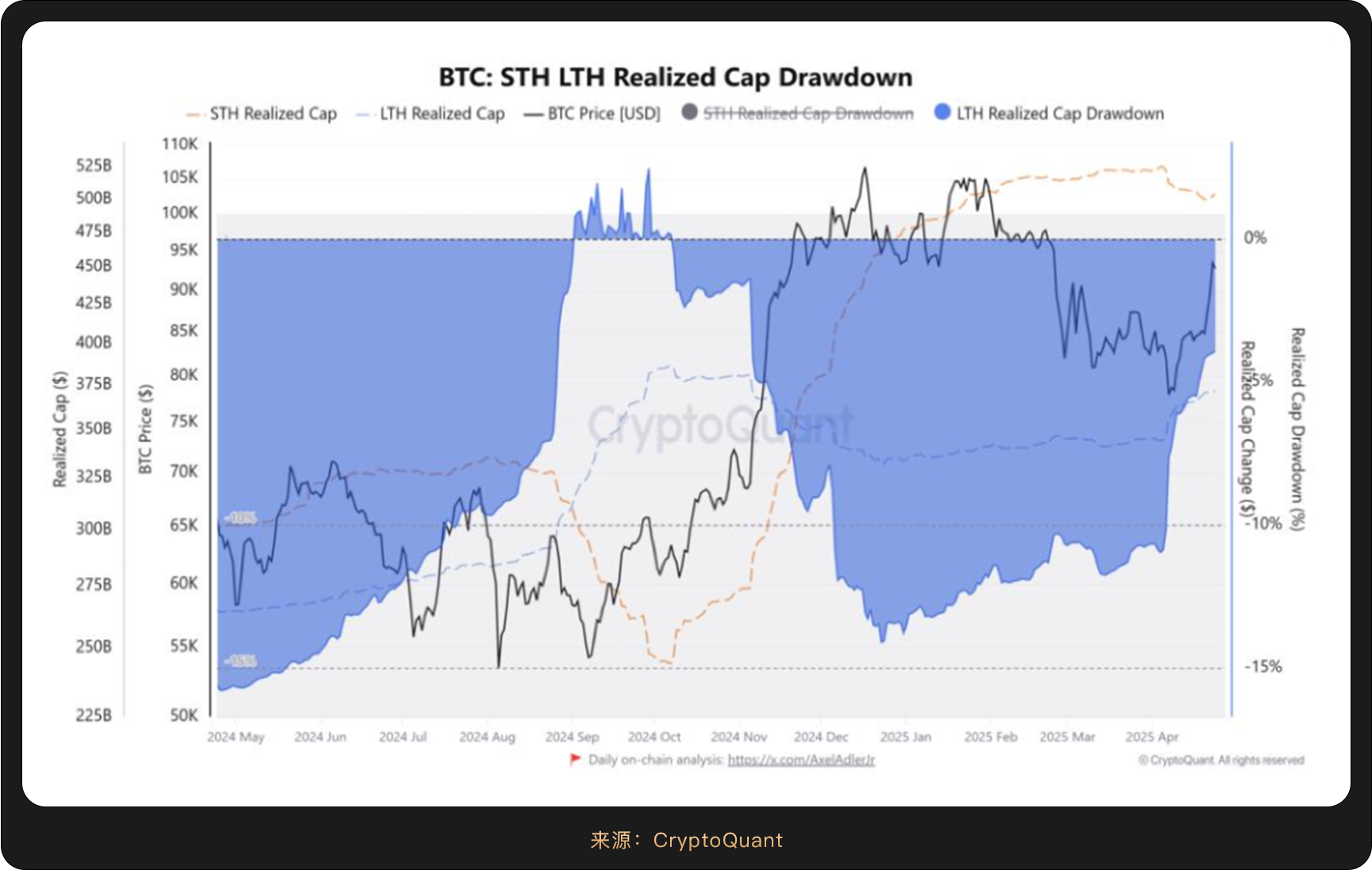

Data from Cointelegraph shows that currently, there are 16.7 million BTC in profit across various wallets—this level is often referred to as the "threshold of optimism." Historically, similar patterns in 2016, 2020, and early 2024 have led to bull markets. When profitable supply remains above this threshold, it often boosts investor confidence and triggers sustained price momentum, typically pushing Bitcoin to new historical highs within a few months. After breaking through the $90,000 mark, the number of active addresses on the blockchain surged by 15%, and the number of whale wallets (holding over 1,000 BTC) reached a four-month high, further validating the bullish consensus among investors.

Driven by the surge in Bitcoin prices, the total market capitalization of global cryptocurrencies surpassed $3 trillion on April 23, with Bitcoin's market cap reaching $1.847 trillion, exceeding that of Alphabet (Google) and Amazon, the two global tech giants, as well as precious metal silver, making it the fifth-largest asset after gold ($22.344 trillion), Apple ($3.000 trillion), Microsoft ($2.726 trillion), and Nvidia ($2.412 trillion).

This ranking improvement makes Bitcoin the only digital asset in the top ten global assets list. Notably, Bitcoin's long-term correlation with U.S. tech stocks (especially the Nasdaq 100 index) has shown signs of "decoupling." During April, Bitcoin's price surged by 15%, while the Nasdaq 100 index only rose by 4.5%, highlighting its independent market performance and changing asset attributes. Compared to the stock market volatility caused by tariff policies in April, Bitcoin has recently demonstrated stronger price stability and lower volatility, which may encourage more publicly traded companies to consider allocating cryptocurrency assets in their financial strategies.

Undoubtedly, crypto assets are rewriting the underlying logic of global asset pricing. In April, ARK Invest founder Cathie Wood raised the Bitcoin price target for 2030 from $1.5 million to $2.4 million, based on increased institutional interest and the growing acceptance of Bitcoin as "digital gold."

Currently, the market rebound in April is a temporary alleviation of concerns about market collapse and economic recession triggered by tariffs. Further developments will depend on whether the tariff war can be resolved in a timely manner and the trajectory of the U.S. economy. Given that the most optimistic rate cuts are still a month away, market divergences remain, and short-term fluctuations are inevitable. As traditional financial markets face turbulence due to the tariff war and economic cycles, the independence and counter-cyclical properties of crypto assets may attract more funds seeking diversified asset allocation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。