撰文:Token Dispatch, Thejaswini M A, Nameet Potnis, Prathik Desai

编译:Block unicorn

前言

这就是 Nakamoto(不,不是中本聪本人)那台打字机风格的网站上关于加密货币最新企业比特币储备挑战者的文字描述。

就在两周前,由巨头(例如 Tether、Cantor 和软银)领导的另一家公司推出了一家纯粹的比特币公司,挑战迈克尔·塞勒的 Strategy 之后,Nakamoto 控股以 7.1 亿美元的资金储备和一套让中本聪引以为傲的策略闯入了这场派对。

在今天的企业比特币储备文章中,我们将告诉你:

-

Nakamoto 的推出如何加剧了企业 BTC 储备竞赛

-

伯恩斯坦 3300 亿美元的预测让每个人都跃跃欲试

-

为什么企业比特币储备突然成为加密货币中最热门的话题

-

一家酒店公司现在持有的比特币比第六大国家比特币持有者还要多

Nakamoto 的比特币策略

由《比特币杂志》首席执行官大卫·贝利创立的 Nakamoto 控股宣布与医疗服务供应商 KindlyMD 合并,这笔交易将一家治疗阿片类药物的公司转变为比特币最新的企业储备竞争者。

为什么要命名为 Nakamoto 呢?

「定义了历史篇章的金融机构都以其创始人的名字命名:美第奇、罗斯柴尔德、摩根、高盛。今天,我们将这一遗产押注在中本聪身上,」贝利说。

使命?「在全球资本市场建立比特币标准。」

这是 Nakamoto 华丽网站上的文字。

此举是在杰克·马勒斯的 Twenty One Capital 推出其 40 亿美元比特币企业储备计划后的两周。

如果你认为马勒斯的纯粹比特币企业储备是一个开创性的赌注,那就等着听听贝利的计划吧。他正在打造他所谓的「首家公开交易的比特币公司集团」。

贝利的财务策略包括一笔完全承诺的 5.1 亿美元私募股权公开配售(PIPE 融资)和 2 亿美元的可转换债券。

PIPE 融资吸引了来自六大洲的 200 多名投资者,其中包括亚当·巴克(Adam Back)、巴拉吉·斯里尼瓦桑(Balaji Srinivasan)、埃里克·塞姆勒(Semler Scientific 首席执行官)和西蒙·格罗维奇(Metaplanet 首席执行官)等人,这表明该计划拥有雄厚的资金支持。

这与塞勒的 Strategy 和马勒斯的 Twenty One 有何不同?

「Nakamoto 的愿景是将比特币带入全球资本市场的中心,将其包装成股票、债券、优先股和新的混合结构,让每个投资者都能理解和拥有。我们的使命很简单:在全球每个主要交易所上市这些工具,」贝利解释了这一方法。

企业储备竞赛加剧

在 Nakamoto 盛大登场的同时,Strategy(原名 MicroStrategy)又度过了一个普通的周一。再次购买了价值 13.4 亿美元的 13,390 个 BTC。

Strategy 的比特币企业储备现在达到惊人的 568,840 个 BTC,约占比特币总供应量的 2.8%。

仅在 2025 年就增加了 122,440 个 BTC,比大多数公司的企业储备持有量都要多。

杰克·马勒斯的项目定位为比 Strategy 更纯粹的玩法,但现在面临贝利更广泛的「比特币公司生态系统」方法的竞争。

甚至 Coinbase 也透露,其在上一季度购买了价值 1.53 亿美元的加密资产,主要是比特币。

「在过去的 12 年里,肯定有一些时刻我们想,哇,我们应该把 80% 的资产负债表投入加密货币——特别是比特币,」阿姆斯特朗对彭博社说。「我们对风险做出了明智的选择。」

今天,这场竞赛已经从简单的比特币积累演变为企业身份的较量。

谁能最令人信服地重新定位为「比特币公司」?Strategy 从软件公司转型,Twenty One 引入了传统金融玩家,现在 Nakamoto 正在与一家医疗服务供应商合并。共同点?是对比特币的无限渴望。

这种渴望也在太平洋彼岸得到响应。

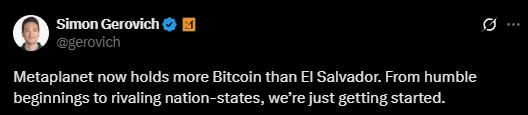

Metaplanet,一家去年才开始购买比特币的日本公司,向其资产负债表新增了 1,241 个 BTC,总计 6,796 个比特币,价值约 7 亿美元。这比第六大国家持有者萨尔瓦多的加密货币还要多。

而且 Metaplanet 并非孤军奋战。东京的 Beat Holdings 上周批准将其比特币投资上限从 680 万美元提高到 3400 万美元。

原因?「当各国面临去全球化和不断升级的贸易时,它们似乎往往会通过实施扩张性货币和财政政策来增强流动性,」该公司表示。

该公司现在持有 143,230 个单位的黑石 iShares 比特币信托。

3300 亿美元的问题

这场企业比特币寻宝游戏能走多远?

伯恩斯坦分析师的最新估计表明,我们才刚刚开始。

企业比特币储备战略可能在 2029 年之前将惊人的 3300 亿美元注入企业比特币储备里。

「低增长高现金的小公司更适合 MSTR 的比特币策略,它们在价值创造方面看不到明显的前景,而 MSTR 模式的成功为它们提供了一条罕见的增长路径,」分析师在最近的一份报告中写道。

简单来说,按照当前价格,未来四年内企业储备将吸纳大约 330 万个比特币。这意味着在未来五年内,超过 15% 的比特币总供应量将被锁在企业的金库中。

还在困惑为什么比特币需求如此旺盛?Coinbase 在一则简短的广告中给出了答案。

当每家公司都想分一杯 2100 万枚比特币的羹时,会发生什么?随着每个新企业的加入,比特币企业储备策略变得更加合法化,可能会形成一个加速采用的反馈循环。企业的 FOMO(错失恐惧)周期才刚刚开始。

我们的观点

比特币储备巨头的战斗已不仅仅是企业竞相积累 BTC。它正在改变公司对其资产负债表的看法。

我们完全同意贝利的宣言:「我们相信,未来每个资产负债表——无论是公开还是私人的——都将持有比特币。」我们正在见证一个新金融范式的早期阶段。

这场企业比特币热潮中浮现出几个关键维度。

首先,速度令人震惊。想想看:Metaplanet 在一年内超过了整个国家的比特币持有量。Strategy 在不到五个月内增加了 122,440 个 BTC。企业采用的速度甚至超过了以往周期中最乐观的预测。

其次,参与者的多样性表明比特币的吸引力正在扩大。从软件公司到医疗服务供应商,从日本酒店集团到投资公司,比特币正在跨越行业界限。一些美国科技公司试验一种世界其他地区很少涉足的神秘货币的时代已经过去。比特币现在是一个跨越行业和大陆界限的全球现象。

第三,竞争动态正在改变市场结构。每个新企业的加入不仅增加了购买压力,还创造了合法化的反馈循环,使下一家公司更容易跟进。Strategy 促成了 Twenty One Capital,Twenty One 促成了 Nakamoto,Nakamoto 将使下一个比特币企业储备项目成为必然。

随着越来越多的比特币被锁在企业金库中,散户投资者的可用供应量减少,可能会造成一个供应冲击,即使是最保守的模型也未能完全考虑到这一点。

竞赛已经开始。不仅仅是为了积累比特币,更是为了在未来的金融秩序中占据一席之地。今天采取这些行动的公司不再仅仅押注于比特币的价格升值;它们正在一个新的金融体系中确立自己的位置,在这个体系中,比特币是企业和国家选择的储备资产。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。