Author: Ignas

Compiled by: Felix, PANews

What changes have occurred in cryptocurrency over the years? Crypto KOL Ignas has published an article summarizing this, believing that HODLing ETH is the biggest mistake made in this cycle. "Quick in and out" may be the profit rule in crypto, but the only exception to the "quick in and out" strategy is BTC. Additionally, in the macro context, he interprets the future direction of cryptocurrency in the new world order. Below are the details.

The reason for loving cryptocurrency and making it a part of finance and trading is that the market clearly tells you what is right and what is wrong.

Especially in this dystopian world filled with politics, art, news, and many other industries, the line between truth and lies is blurred, while cryptocurrency is straightforward: if you judge correctly, you can make money; otherwise, you will lose money—very simple.

However, the traps individuals fall into are also simple: not reassessing the portfolio when market conditions change. When trading altcoins, being overly confident in one's "HODL" strategy, especially with ETH.

Of course, adapting to new realities is easier said than done.

The number of variables we need to input is overwhelming, so ultimately, we can only adopt a simple strategy like "HODL," without the need for active market monitoring.

But what if the "HODL" strategy is outdated? What role does cryptocurrency play in a constantly changing world? What have we overlooked?

This article will share the significant changes that have occurred in the market.

HODL is Dead

Let's go back to early 2022:

ETH dropped sharply from $4,800 and is currently trading at around $3,000. BTC is priced at $42,000. However, due to interest rate hikes, the collapse of CeFi, and the closure of FTX, both will drop another 50%.

Despite this, ETH enthusiasts remain bullish: ETH is about to migrate to a PoS system, and just a few months ago, the ETH burn proposal (EIP) was also launched. The narrative of ETH as a sound money and an environmentally friendly blockchain remains strong.

For the remainder of 2022, ETH and BTC performed poorly, but SOL was hit hard, plummeting 96% to $8.

Ethereum won the Layer1 competition, while alt Layer1s should migrate to Layer2, or they will face extinction.

I remember attending some conferences during the bear market. The vast majority believed that ETH would rebound the strongest, so they bought a lot of ETH while underestimating BTC and ignoring SOL.

Just hold on, then sell at the top in 2024/2025. It's that simple.

But things didn't go as planned…

Since then, SOL's price has rebounded, while ETH has faced the worst FUD in history. The sound money narrative is dead (at least for now), and the environmental narrative never really took off.

For individuals, HODLing ETH is the biggest mistake made in this cycle. This is true for many people as well.

The bullish reasoning at the time was that ETH would become the most value-creating asset in crypto history:

Re-staking would give ETH superpowers, allowing it to secure not only Ethereum but also the entire critical DeFi and crypto infrastructure. The (re)staking yields of ETH would rise significantly, and as long as ETH is re-staked, airdrop rewards would continue to accumulate.

As yields increased, demand for ETH and its price should rise. In short—prices would soar!

Clearly, this did not happen, as the value proposition of re-staking was never clear, and Eigenlayer also made mistakes in token issuance.

So, what does all this have to do with the demise of the HODL philosophy?

For many, ETH is an asset to "hold" and forget. If BTC skyrockets, ETH will rise even faster, making holding BTC meaningless.

When the bullish argument for ETH based on the re-staking narrative failed to materialize, I should have realized this and made adjustments. However, I became lazy and complacent, unwilling to admit my mistakes. ETH would rebound one day, wouldn't it?

"Holding still" (HODL) is not only bad advice for ETH; it is even worse for all other assets, with BTC perhaps being an exception (which will be detailed later).

Cryptocurrency changes too quickly; it is unrealistic to expect to hold for months or years and rely on it for retirement. Looking at the charts, most altcoins have given back the gains from this bull market cycle. Clearly, profits come from selling, not holding.

This successful memecoin trader explains that he usually does not "HODL," and the time he holds memecoins is often less than a minute before selling.

Some people still try to sell you the dream of "HODLing," but in reality, it is more like a "quick in and out" cycle rather than long-term holding.

BTC is the Only Macro Crypto Asset

The only exception to the "quick in and out" strategy is BTC.

Some attribute BTC's outstanding performance to Saylor's infinite buy orders, as we have successfully promoted the idea of BTC as digital gold to institutions.

But the battle is not over.

Many crypto commentators still view BTC as a risk-on asset, believing its trading volatility is higher than that of the S&P 500 index.

This contradicts BlackRock's research, which found that the risk and return drivers of BTC differ from those of traditional risk assets, thus not fitting into the traditional financial frameworks of "risk-on" and "risk-off" adopted by some macro commentators.

What do you think the truth is?

Personally, I believe BTC is shifting from the hands of those who see it as a high-leverage stock bet to those who view it as a digital safe-haven asset similar to gold. Mexican billionaire Ricardo Salinas, who holds BTC, is an example.

BTC is the only true macro crypto asset. The valuations of ETH, SOL, and other assets are assessed based on fees, trading volume, and TVL, while BTC has transcended this framework to become a macro asset recognized even by Peter Schiff.

This transformation is not over, but this period of transition from risk assets itself is an opportunity. Once BTC is widely regarded as a safe-haven asset, its price will reach $1 million.

Decline of the Private Market

When every relatively successful influencer starts to transform into a "venture capitalist," investing at low prices and then cashing out during token generation events (TGE), I realized something was wrong.

However, Noah's article better reflects the current state of the cryptocurrency private market.

I recommend reading the full text, but here are the key points regarding the changes in the private market over the years.

In the early days (2015 to 2019), private market participants were true believers. They supported Ethereum, funded DeFi pioneer projects like MakerDAO and ETHLend (Aave), and valued long-term holding. Their goal was not just to make quick profits but to create something meaningful.

This was a phase of believers.

The "DeFi Summer" from 2020 to 2022 was a massive transformation. Suddenly, everyone wanted newer, hotter tokens. Venture capital firms poured money into funding tokens with outrageous valuations and no practical value.

The rules of the game were simple: buy low in the private round, hype the project, then sell to retail investors. When retail investors crash, we need to clean up and learn lessons. But nothing changed.

This was a phase of greed.

After the FTX incident (2023 to 2025), the private market became nihilistic. VCs now invest in "soulless token machines" (projects with outdated ideas, questionable founder backgrounds, and no real application scenarios).

The pricing in private rounds is 50 times revenue (if there is revenue), forcing the public market to bear the losses. As a result, 80% of tokens issued in 2024 fell below the private price within six months.

This was a phase of extraction.

Today, retail trust is gone, and venture capital firms have suffered heavy losses.

Many VC trades are priced below the valuations at the seed round, and some KOL friends are also in a losing position.

However, there are signs of improvement in the private market:

- The co-founder of Movement and Gabagool (former Aerodrome football team player) faced strong opposition and was expelled. We need further purification.

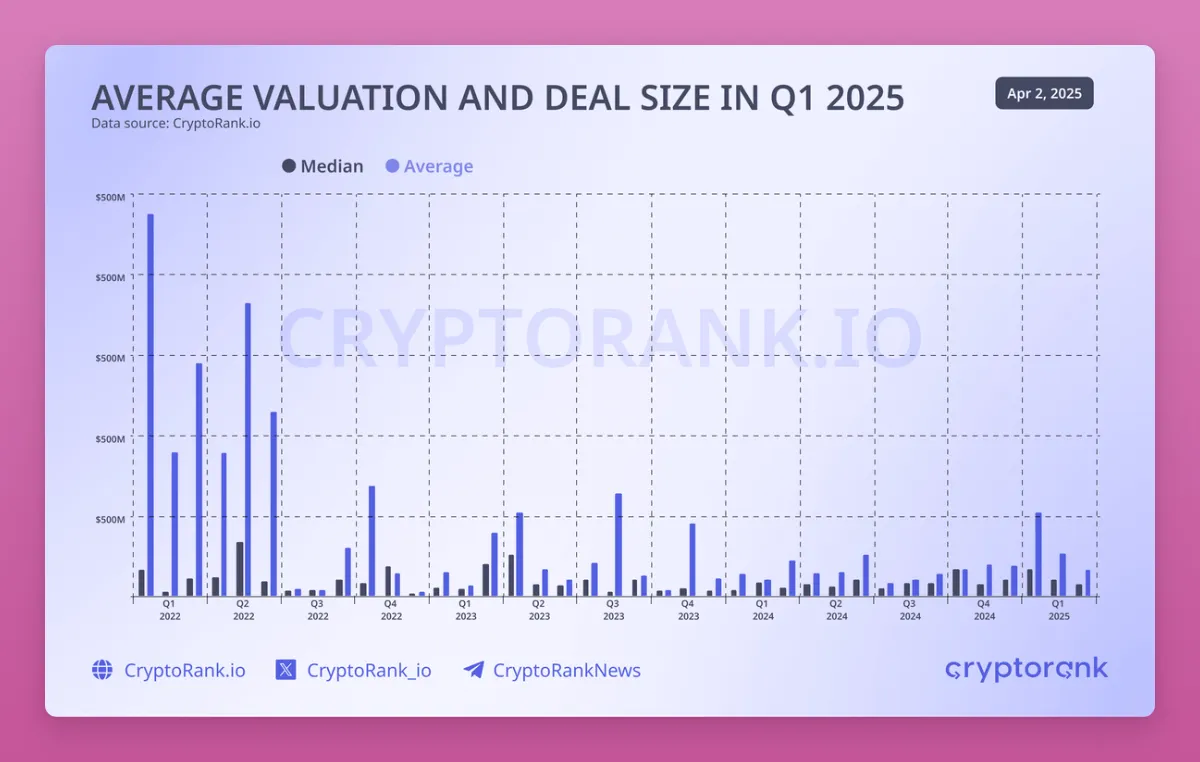

- Both private market and public market valuations are declining.

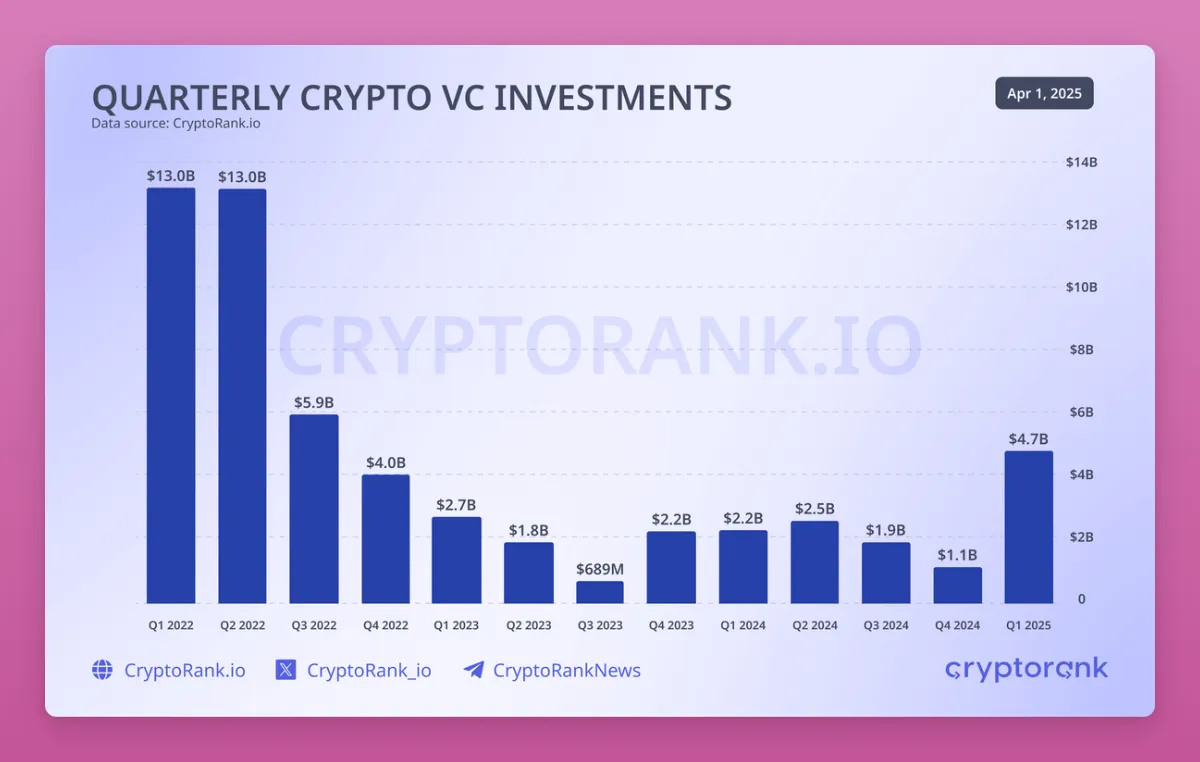

- Crypto venture capital funding has finally shown signs of recovery, reaching $4.8 billion in the first quarter of 2025, the highest level since the third quarter of 2022, with funds flowing into areas with practical use.

The first quarter of 2025 is the strongest quarter since the third quarter of 2022. Binance's $2 billion trade played a core role, but another 12 large financings exceeding $50 million also indicate renewed interest from institutional investors.

Funds are flowing into areas with utility and revenue potential, including CeFi, blockchain infrastructure, and services. New focus areas such as AI, DePIN, and RWA have also garnered strong attention. DeFi leads in the number of funding rounds, but the scale of financing is smaller, reflecting more conservative valuations. — CryptoRank 2025 Q1 Report on Crypto Venture Capital Status

We are trying new token issuance models to reward early supporters rather than insiders.

Echo and Legion are at the forefront, with Base launching a group on Echo. Kaito's InfoFi (information finance) outlook is optimistic, as even those without financial capital but with social influence can benefit.

The market seems to have received the message, and the ecosystem is reviving (even though KOLs are still reaping the benefits).

Farewell to DeFi, Welcome On-Chain Finance

Do you remember the fleeting story of yield aggregators? Yearn Finance pioneered the way, followed by multiple forks.

We are now in the era of yield aggregator 2.0. We call it the "Vault Strategy."

As DeFi protocols have increased, DeFi has become increasingly complex, and vaults have become more attractive: deposit assets to obtain the best risk-adjusted returns.

However, the biggest difference between early yield aggregators and now is the increasing centralization of asset management.

Vaults have "strategists"—usually a team of "institutional investors" who use your funds to chase the best investment opportunities. For them, it's a win-win: they use your funds and earn fees from it.

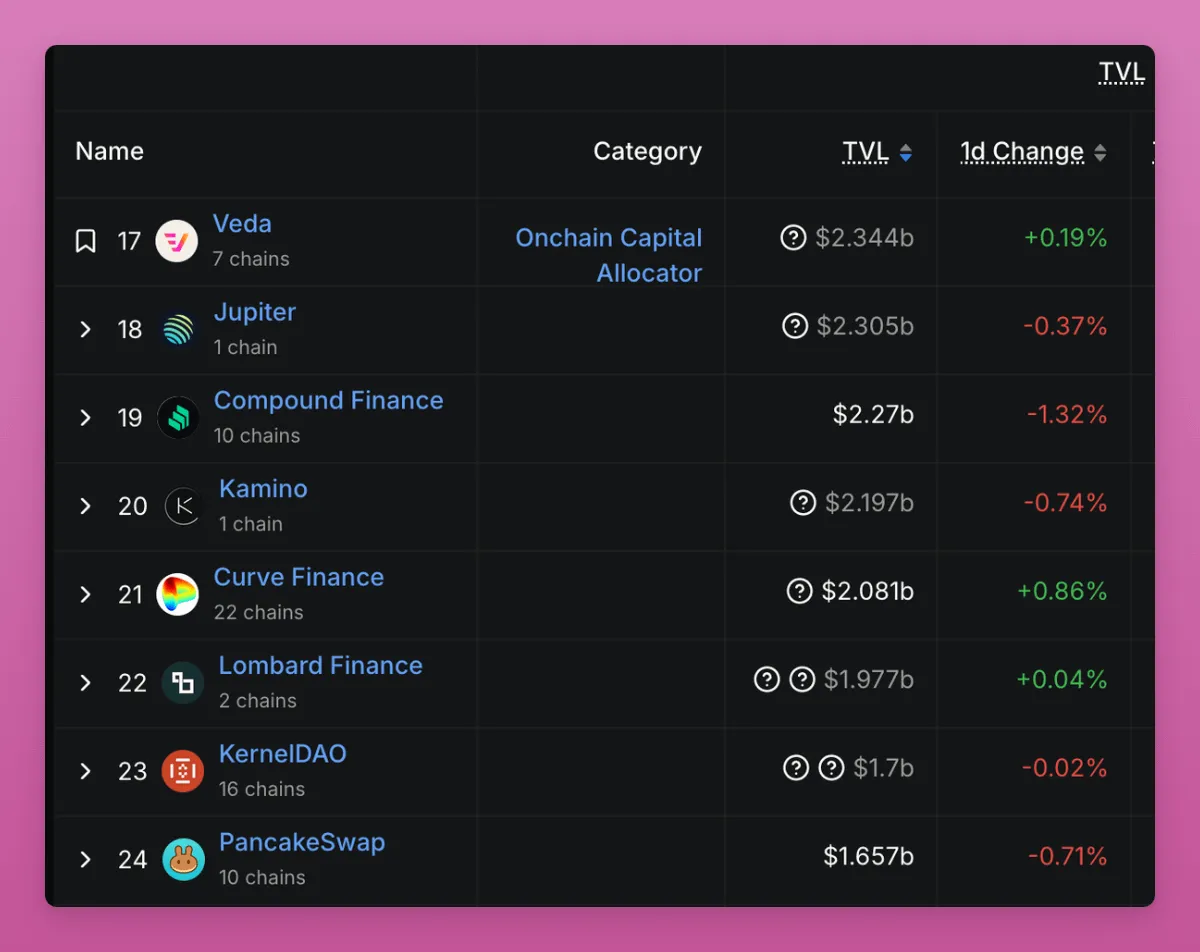

These strategists include MEV Capital, Seven Seas, Gauntlet, Veda, and many companies collaborating with protocols like Etherfi, Upshift, and Mellow Protocol.

Veda itself is the 17th largest "protocol" in DeFi, surpassing Curve, Pancakeswap, or Compound Finance.

However, vaults are just the tip of the iceberg. The true vision of decentralization in DeFi has long been shattered; it has evolved into on-chain finance.

Think about it: the fastest-growing RWAs in DeFi and crypto, yield-generating stablecoins like Ethena and BlackRock's BUIDL, and delta-neutral stablecoins are far from the original vision of DeFi.

Or consider multi-signature contracts like BTCfi (and BTC L2s), where you must trust that custodians won't run off with your funds.

Note: There is no implication against Lombard here; it is merely an example of the trend fusion between Vault and BTCfi.

Since Maker shifted from decentralized DAI to yield-generating RWA protocols, this has been the case. Truly decentralized protocols are few and small in scale (Liquity is one example).

This is not necessarily a bad thing: RWAs and tokenization allow us to break free from the cyclical, leverage-based DeFi Ponzi scheme era.

This means that risk factors are expanding, making it more complex to understand where funds are truly going. If you see CeDeFi protocols abusing user funds, don't be surprised.

Remember: hidden leverage always finds a way to infiltrate the system.

DAO is a Shell of Its Former Self

The same illusion of decentralization is shattering with DAOs.

The past concept was based on a16z's "progressive decentralization" theory promoted in January 2020.

Protocols first find PMF (product-market fit) → As network effects grow, the community gains more power → The team "hands over to the community," ultimately achieving full decentralization.

Five years later, we are returning to centralization. Take the Ethereum Foundation as an example; it is becoming more actively involved in scaling L1. The DAO model faces numerous issues:

- Voter apathy

- Increasing lobbying (bribery) risks

- Execution paralysis

The two DAOs, Arbitrum and Lido, are moving towards more centralized control (through more active team participation or BORGs), while Uniswap is undergoing a significant transformation.

The Uniswap Foundation voted to provide $165 million in liquidity mining rewards to promote the development of Uniswap v4 and Unichain. Alternatively, another conspiracy theory suggests this is to meet the liquidity threshold required to obtain Optimism OP funding rewards.

In short, DAO representatives are furious. Why should the foundation pay all $UNI rewards while Uniswap Labs (a centralized entity) can earn millions in fees from the Uniswap frontend?

A top 20 representative recently resigned from their position as a Uni representative.

I recommend reading the full article, but his points are as follows:

- Governance theatrics: Uniswap's DAO appears open but marginalizes dissenting opinions. Proposals follow processes (discussion, voting, forums), but it feels predetermined, reducing governance to a "ritual."

- Power concentration: The Uniswap Foundation rewards loyalty, suppresses criticism, and values appearance over accountability.

- Decentralization failure: If DAOs prioritize branding over substance, they risk becoming irrelevant. Without true accountability mechanisms, they devolve into "superfluous dictatorships."

Interestingly, a16z is a major token holder of Uniswap, but Uniswap has yet to achieve true decentralization.

It may not be an exaggeration to say that DAOs are just a facade; we need a coherent narrative to evade the regulatory scrutiny that centralized crypto companies may face.

Thus, tokens that serve merely as voting tools are no longer worth investing in. True profit-sharing and utility are key.

DEX (Hyperliquid) Challenges CEX

Now, I want to share my conspiracy theory.

FTX launched Sushiswap because they were concerned that Uniswap might take over its spot market. Even if they didn't launch it directly, they likely provided close support in development and funding.

Similarly, the Binance team (or BNB, however you want to call it) launched PancakeSwap for the same reasons.

Uniswap once posed a significant threat to CEXs, but this threat has largely been mitigated, as Uniswap does not challenge their more profitable perpetual contract trading business.

How profitable is it? From the comments, it's hard to say.

Hyperliquid presents another threat. It not only ventures into the perpetual contract business but also targets the spot market. Meanwhile, it is building its own smart contract platform.

Hyperliquid's market share in the perpetual contract market is steadily increasing, now reaching 12.5%. (Real-time statistics can be viewed here or here.)

I was shocked to see Binance and OKX openly attacking Hyperliquid with JELLYJELLY. Although Hyperliquid has survived, HYPE investors must now take the risk of potential future attacks very seriously.

This may not be a similar attack but rather regulatory pressure, as CZ is becoming a "national-level strategic crypto advisor." What do you think he will say to politicians? Oh, those criminal exchanges that don't do KYC are terrible, maybe?

In any case, I hope Hyperliquid can surpass the CEX spot market business and launch a more transparent listing service that won't collapse the financial status of the protocol.

There is much more to say about HYPE, as it is my largest holding of altcoins. But Hyperliquid has already become a movement challenging CEXs, especially after the Binance/OKX attack incident.

Protocol → Platform

You may have seen my subtle recommendation for Fluid in the context of protocols evolving into platforms on X. The focus is on the risk that protocols may become commoditized infrastructure, while user-facing applications reap most of the benefits.

Has Ethereum fallen into the commoditization trap?

To escape this predicament, protocols need to become like the Apple Store, allowing third-party developers to build on top of them so that value can remain within the entire ecosystem.

Uniswap v4 and Fluid are trying to achieve this through Hooks, while teams like 1inch and Jupiter are building their own mobile wallets. LayerZero has also just announced vApps.

This trend will accelerate. Those who can capture liquidity, attract users, and find ways to monetize liquidity while rewarding token holders will become the biggest winners.

Cryptocurrency in a Changing World Order

I intended to explore more significant changes in the crypto space, from stablecoins to the increasingly blurred lines of CT (Crypto Twitter) as cryptocurrencies become more complex.

As the crypto industry is no longer as closed as it once was, the exclusive news that Twitter now provides has decreased.

Previously, we could launch Ponzi schemes with simple rules, while regulators either misunderstood cryptocurrencies or ignored them, hoping they would disappear on their own.

Year after year, discussions about regulation have become more common on CT. Fortunately, the U.S. is gradually supporting cryptocurrencies, and with stablecoins, tokenization, and Bitcoin becoming a store of value, it seems we are on the verge of mass adoption.

But this situation may change quickly: the U.S. government may eventually realize that Bitcoin is indeed undermining the dollar's position.

Outside the U.S., the regulatory and cultural environment is vastly different. China currently shows no signs of supporting cryptocurrencies.

The EU is increasingly focused on control, especially as it shifts from a welfare state to a war state, where controversial decisions may be forcibly implemented in the name of "security."

The EU has not prioritized cryptocurrencies; instead, it views them as a threat:

- The European Central Bank warns that U.S. promotion of cryptocurrencies could trigger financial contagion.

- The EU will ban anonymous cryptocurrency accounts and privacy coins by 2027.

- If blockchain data cannot be deleted individually, "this may require deleting the entire blockchain."

- EU regulators will impose punitive capital requirements on insurance companies holding cryptocurrencies.

We need to assess people's attitudes toward cryptocurrencies in the current overall political climate. The major trend is de-globalization and countries closing their borders.

- The EU is about to impose a visa ban on investment-based citizenship.

- The European Court has halted the "golden visa" program.

The biggest unknown is what role cryptocurrencies will play in the new world order and during the transition period.

Will cryptocurrencies become tools for capital freedom, especially as capital controls begin to be implemented? Or will countries attempt to suppress cryptocurrencies by enacting increasingly strict regulations?

Vitalik explains in his article "The Year Ring Model of Culture and Politics" that cryptocurrencies are still forming their norms and are not yet as established as banking law or intellectual property law.

The internet of the 1990s adhered to the philosophy of "let it develop!" with almost no rules and high freedom. By the early 2000s and the 2010s, attitudes toward social media shifted to "this is dangerous. We need to control it!" As we enter the 2020s, cryptocurrencies and artificial intelligence are still struggling between openness and regulation.

Governments were slow to act in the past, but they are now catching up.

Hopefully, they choose to embrace openness; however, the trend of global border lockdowns is very concerning.

Related reading: Dialogue with Arthur Hayes: The China-U.S. Trade War is a Long-Term Trend, Bitcoin Will Break $1 Million Before 2028

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。