Can open bottles and "open markets".

Written by: Deep Tide TechFlow

Let me tell you a ghost story: Bitcoin is about to return to $100,000.

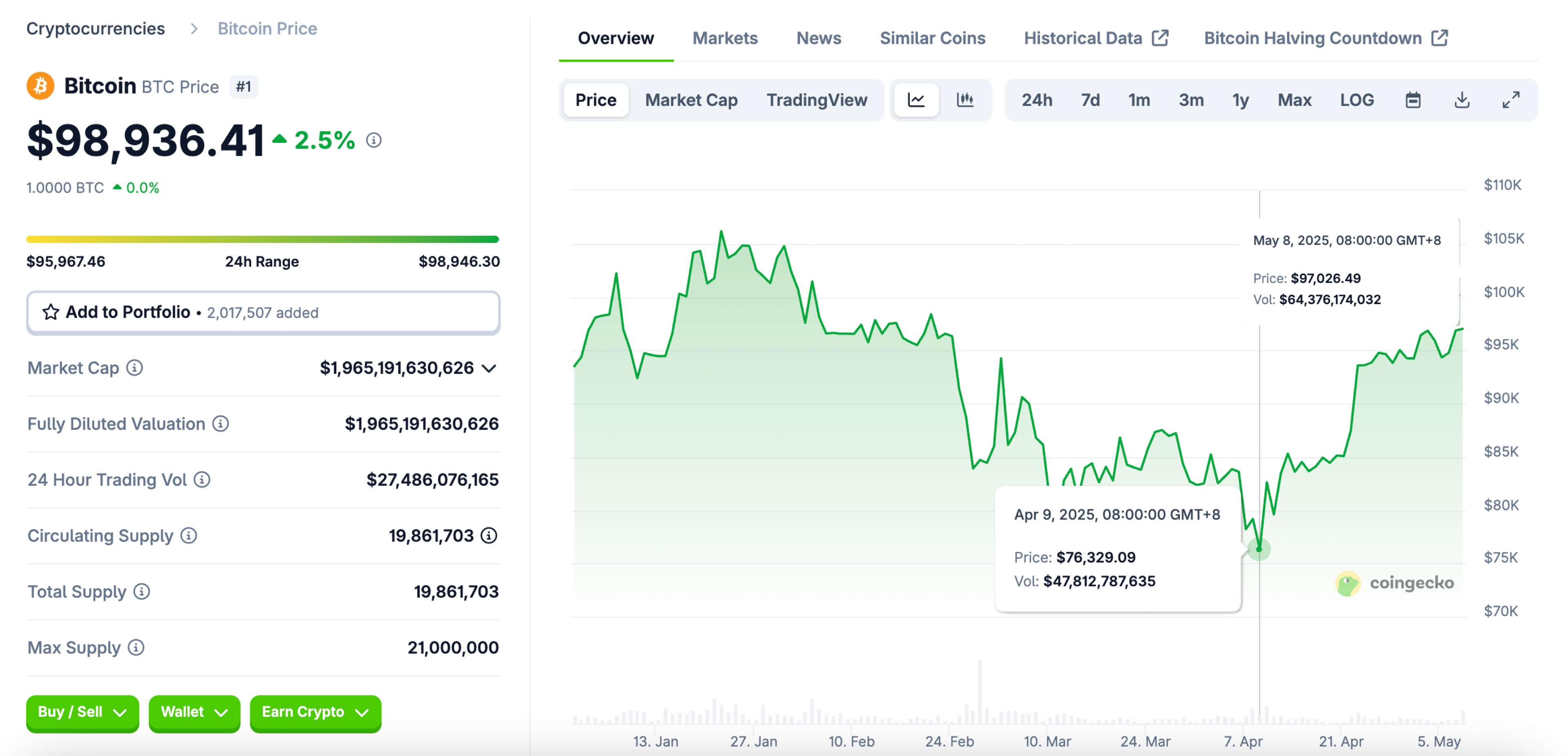

Since Bitcoin broke through $100,000 at the beginning of 2025, its price has plummeted to around $76,000 due to changes in the global economic and political landscape, especially with the U.S. elections and tariff policies.

When faced with the collapse of various altcoins, liquidity shortages, and various criminal activities during the "crime season," many shouted, "My crypto is over," but Bitcoin has returned.

It seems unaffected by the turmoil in the crypto market; Bitcoin is still the same Bitcoin.

Bitcoin perfectly embodies the script of "Yesterday, you ignored me; today, you can't reach me"; looking back over the past decade, it remains at the peak among all asset returns.

Along the way, it has had no rivals, but also no friends.

The lack of friends is because, for a long time, the public and mainstream finance have been confused and cautious about this thing, mostly still "not understanding";

At the same time, there are too many high-yield, high-volatility narratives in the crypto space, and when the market is good, insiders tend to "look down on" its returns.

But now, everyone wants to be friends with Bitcoin.

From an investment perspective, Bitcoin is one of the few friends that can share both joy and hardship with you across cycles (provided you have patience); just look at the performance of ETH holders and other altcoins during good market conditions.

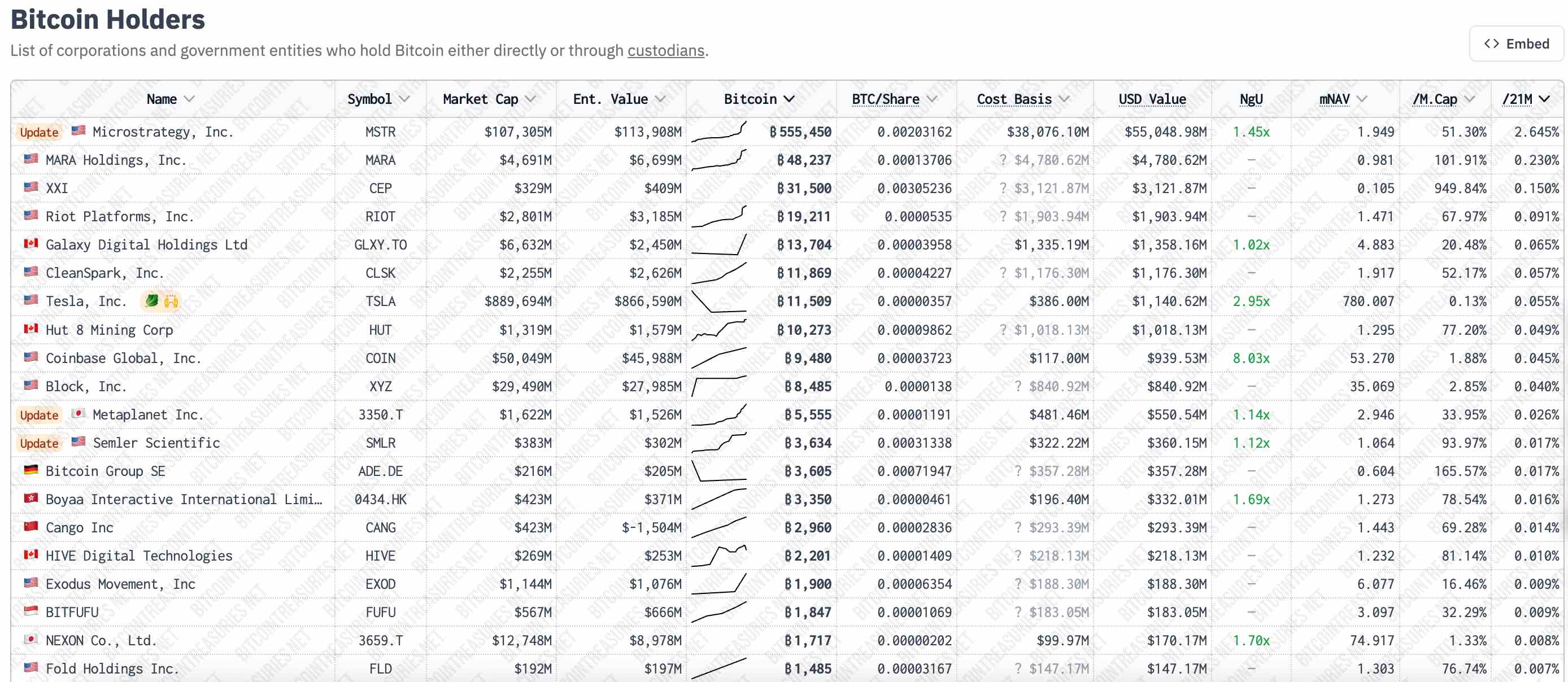

Not only do insiders understand this, but there are also more large companies and government organizations globally starting to include Bitcoin in their asset allocation and strategic reserves.

Today's Bitcoin is increasingly resembling a "Swiss Army knife" facing changes in the global economic environment.

Can open bottles and "open markets"

Have you seen this thing? A small yet versatile red knife.

It was born in the late 19th century, originally designed as a tool for Swiss soldiers, but because it combines various functions such as blades, screwdrivers, bottle openers, scissors, and even tweezers, it has become synonymous with "one tool solving multiple problems."

Whether you need to open a package or start a fire and cut something in the wild, it can come in handy.

Today's Bitcoin is an investment tool capable of handling various complex economic environments, in a sense, just like this Swiss Army knife:

**It can serve as a store of value, preserving worth like gold in turmoil; it can also act as a hedge against inflation, resisting currency devaluation; and even in high-risk, high-return environments, it can transform into a growth asset, bringing in **excess returns.

It may not be the most "dedicated" investment, but it is the most adaptable "jack of all trades" in complex market environments.

Especially in the uncertain year of 2025, Bitcoin's multifunctionality is on full display.

Since the beginning of 2025, the global economic and political environment has been like a roller coaster, with constant ups and downs.

On the economic front, inflationary pressures remain high in Europe and the U.S., supply chain issues remain unresolved, and the monetary policies of major economies are sometimes tightening and sometimes wavering, causing market anxiety; the performance of the U.S. dollar index (DXY) during certain key periods has been weak, raising concerns about the stability of the traditional currency system.

At the same time, political bombs have been dropping one after another, especially the "Liberation Day" tariff policy announced by Trump on April 2, 2025, which directly ignited the fuse of a global trade war. The market generally believes this could exacerbate geopolitical tensions, and panic quickly spread, with the S&P 500 index dropping 6.5% in just one month.

The crypto market has not been able to escape unscathed either. This round of altcoins has seen one after another collapse, liquidity issues have frequently arisen, and various criminal operations that "take a hit" in traditional financial markets have caused many to gradually lose confidence in several projects.

Of course, top P players and perpetual earners have indeed made money, but the premise is that you might be exiting liquidity.

In the chaotic situation of multiple uncertainties overlapping, what assets can ordinary people rely on? One of the answers points to Bitcoin.

Data does not lie. Despite market turmoil, it remains "steady as a rock."

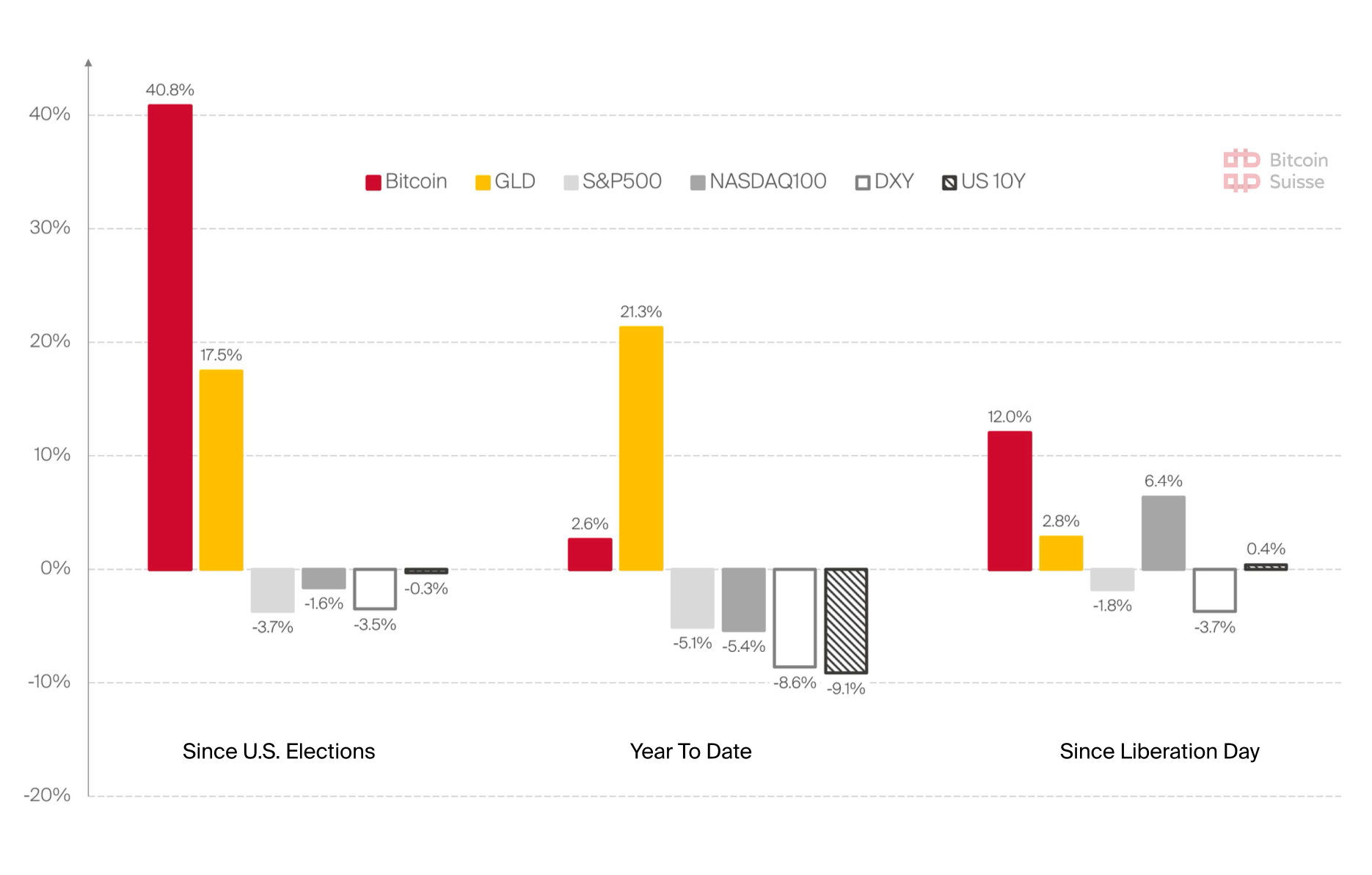

Recently, a comprehensive report released by the crypto asset management firm Bitcoin Suisse in April compiled the returns of various assets at several key time points this year:

Since the U.S. presidential election, Bitcoin has risen by 40%, gold by 17.5%; during the same period, the S&P 500, Nasdaq 100, U.S. dollar index, and 10-year Treasury yields have returned -3.7%, -1.6%, -3.5%, and -0.3%, respectively;

Since the announcement of the "Liberation Day" tariff policy, Bitcoin has risen by 12%, gold by 2.8%; during the same period, the S&P 500, Nasdaq 100, U.S. dollar index, and 10-year Treasury yields have returned -1.8%, +6.4%, -3.7%, and +0.4%, respectively;

If we start counting from January 1 of this year, Bitcoin has risen by 2.6%, gold by 21.3%; during the same period, the S&P 500, Nasdaq 100, U.S. dollar index, and 10-year Treasury yields have returned -5.1%, -5.4%, -8.6%, and -9.1%, respectively;

In comparison, risk assets related to the U.S. economy and the dollar cannot compete with Bitcoin and gold.

Of course, gold remains the king, but isn't that normal? Gold has long been a consensus for safe-haven assets, and for investors, it is more about "holding the bottom line" rather than "bringing surprises."

The surprise is Bitcoin, which was once considered an outlier.

It has demonstrated safe-haven properties, resisting market volatility caused by policy shocks, and may gain additional growth due to increased demand for alternative assets, continuously proving itself in the cycle of being repeatedly questioned and killed.

Here, we must bring out an old meme that perfectly showcases the upgrade in people's perception of Bitcoin:

People can have biases, errors, and misses; but the best thing is to change. Astute politicians and profit-seeking companies will naturally not turn a blind eye to the data.

In the past year or two, you can also see more and more crypto-friendly policies being introduced in the U.S., from mining, regulation, and strategic reserves to the president personally getting involved… You can doubt their sincerity, but you cannot deny their keen sense of profit.

And MicroStrategy (now known as Strategy) has been increasing its BTC holdings month by month like a reckless person, which has gradually made traditional companies realize that this may not only benefit short-term stock price increases but could also be a serious and correct choice.

Swiss Army knife, everyone should have one; it can handle different scenarios, which is great.

Embrace Bitcoin, away from shame

Crypto practitioners have always had a sense of theft and shame.

Except for the already successful big shots, more people in photos from dinner parties tend to cover their faces with cartoon avatars, calling it anonymous culture; when introducing their positions, they always embellish and lean towards compliance and high-end narratives.

Practitioners seem to lack a sense of recognition and confidence in what they do, and are more afraid of others digging into and seeing through them.

Ultimately, some people struggle to reconcile the lack of value in their profession, are aware that their business may be somewhat complicit in wrongdoing, and harbor great doubts about finding connections in their work and life in reality.

If you feel tired of conspiracy, why not try to embrace Bitcoin, the biggest open conspiracy.

No matter what position you hold, gradually accumulating Bitcoin in various ways may help achieve the best balance of energy, identity, and security.

Next time, if a practitioner feels ashamed to express themselves, they might as well change their title:

You ask me who I am? I am a Bitcoin holder.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。