Author: Weilin, PANews

New Hampshire, the birthplace of the "Bretton Woods" agreement, hosted representatives from 44 countries at the Bretton Woods Conference in July 1944, establishing a fixed exchange rate system linked to the U.S. dollar and gold, which laid the foundation for the dollar's status as the global reserve currency.

After more than 80 years, on the evening of May 6, New Hampshire became the first state in the U.S. to include "digital gold" Bitcoin in its state financial reserves, establishing a legal status and policy framework for Bitcoin. Governor Kelly Ayotte officially signed HB 302, announcing that the state would create a "strategic Bitcoin reserve," allocating no more than 5% of state financial funds for holding precious metals, Bitcoin, and other digital assets with a market value exceeding $500 billion (currently, only Bitcoin meets this standard).

New Hampshire Signs HB 302: The First State Bitcoin Strategic Reserve Bill in the U.S.

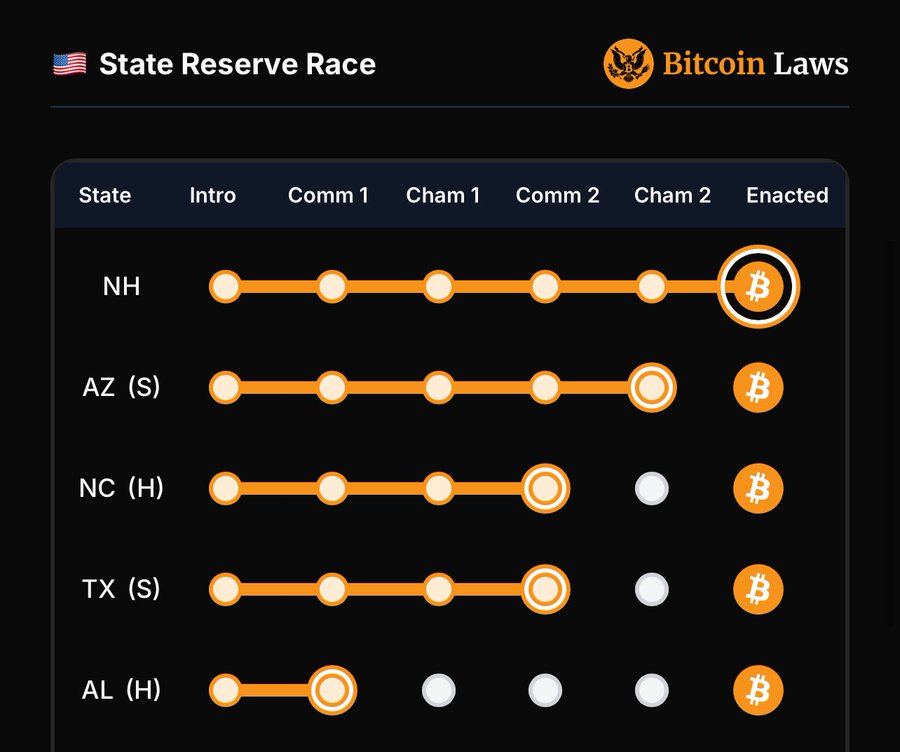

At the federal level, President Trump signed an executive order on March 6, 2025, officially establishing a strategic Bitcoin reserve and reserves for other cryptocurrencies. Although state-level legislators supporting crypto have been drafting Bitcoin strategic reserve bills, they have recently faced resistance.

However, on May 6, New Hampshire's HB 302 made history. The New Hampshire Department of Treasury holds approximately $3.6 billion in funds in its latest annual report, meaning the state could purchase up to $181 million worth of precious metals or Bitcoin.

The bill was initially proposed by several Republican legislators, including Representative Keith Ammon (the bill's drafter), Calvin Beaulier, Mark Warden, Jason Osborne, and State Senators Daryl Abbas and Kevin Avard. Based on a version provided by the advocacy organization Satoshi Action, the bill was simplified to make it easier to understand, accept, and implement during the legislative process.

Under the framework of the bill, the New Hampshire Department of Treasury is authorized to invest in Bitcoin and other digital assets with a market value exceeding $500 billion. Currently, only Bitcoin meets this market cap threshold. According to the bill's drafters, the core purpose of this policy is to provide a tool for hedging against inflation and diversifying the investment portfolio for the state financial system.

The law requires that any Bitcoin or digital assets included in the reserves must be custodied within the U.S. regulatory framework, including multi-signature wallets controlled by the state government, qualified custodians, or U.S. listed exchange-traded products (ETPs). This move aims to provide taxpayers with the highest level of security, long-term stability, fiscal responsibility, and transparency.

From Concept to Legislation: A Review of the HB 302 Passage Process

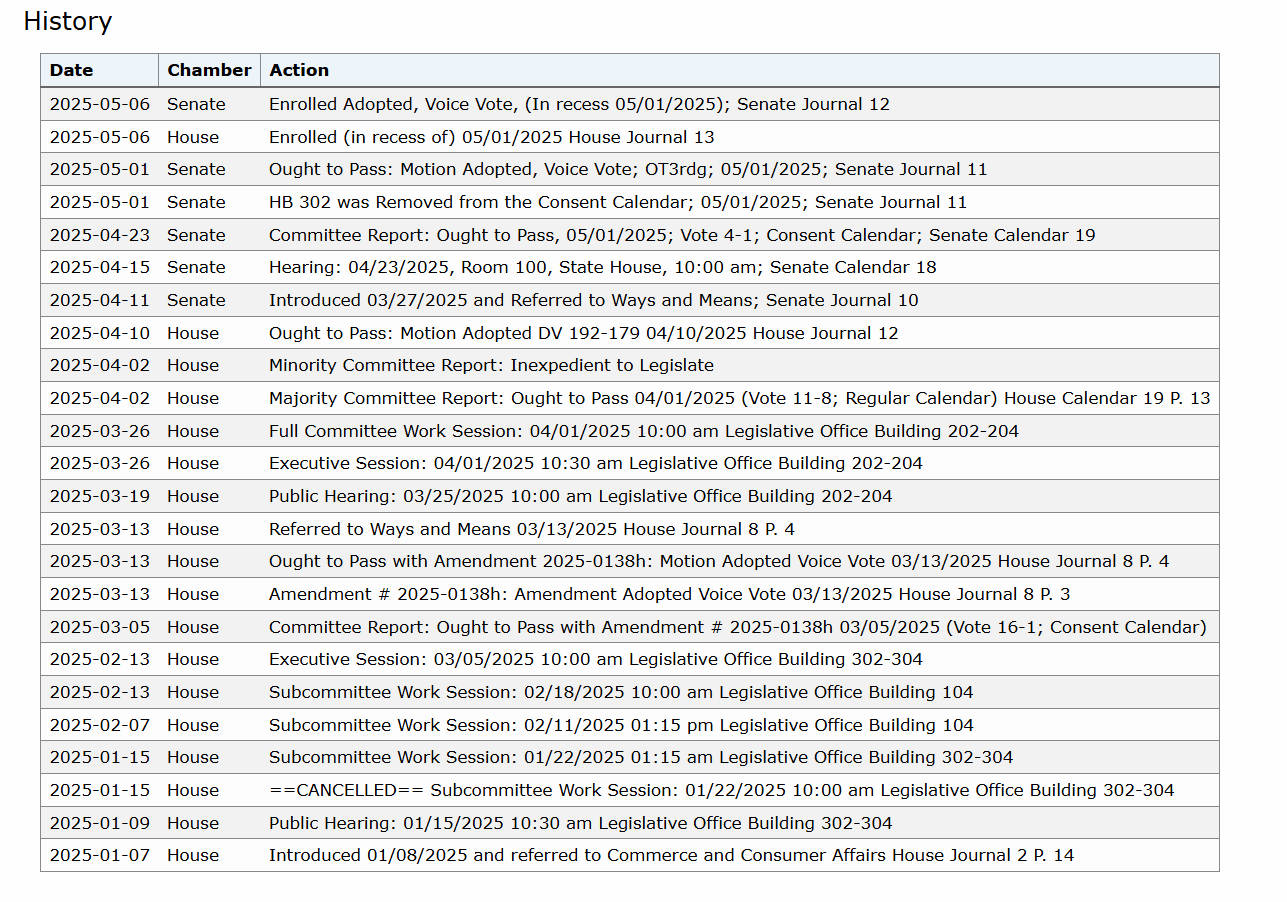

The HB 302 bill was introduced in the House in January. In New Hampshire, a bill must first be drafted to pass. The draft can be proposed by any of the 400 representatives or 24 senators in the New Hampshire General Court. If state agency heads, the governor, citizens, or interest groups wish to propose legislation, they must find a legislator to act as the sponsor.

Next, the bill is submitted to the legislative body: the drafted bill is first submitted to the clerk of either the Senate or the House, depending on which chamber the proposing legislator belongs to. When the House passes a motion to consider a bill, it is formally introduced by its number.

Afterward, all bills submitted to committees must hold a public hearing unless two-thirds of the attending legislators agree to suspend the rules. New Hampshire is one of the few states that require public hearings for all bills.

The next step is the committee review of the bill: the committee's review takes place in an executive session, requiring a majority of members to be present to take action. The public may observe the final voting process. The committee submits a report to the chamber clerk, with conclusions that may include: "Ought to pass," "Ought to pass as amended," "Inexpedient to legislate," "Refer to interim study," or "Re-refer to Committee."

Subsequently, the bill is reviewed in the chamber: after the committee report is published in the "Legislative Calendar," the bill may be reviewed the following day. Major amendments proposed by the committee must be listed in the calendar. All bills must pass both chambers in identical text before being submitted to the governor for signing. After passing both chambers, the bill is sent to the Committee on Enrolled Bills for registration and formatting review.

The bill is ultimately accepted or rejected. If the legislature is still in session, the governor has five days to decide whether to sign the bill, veto it, or take no action.

On May 4, according to documents from the Arizona state website, Governor Katie Hobbs vetoed Senate Bill 1025 (SB 1025), which would have allowed public funds to be invested in virtual currencies. Hobbs stated in her veto message that Arizona's retirement system is one of the strongest in the nation, thanks to its sound and prudent investment strategies. She emphasized that the retirement funds of state residents are not suitable for unproven investments like virtual currencies.

On May 6, Florida House Bill 487 and Senate Bill 550 were "indefinitely postponed and withdrawn from consideration" on May 3. These two bills were originally intended to allow the state treasury to invest up to 10% of certain public funds in Bitcoin, establishing a state-level crypto reserve. However, the Florida legislature did not pass the relevant legislation before the end of the May 2 meeting, officially withdrawing from the state-level Bitcoin reserve bill competition. Similar bills have also failed in South Dakota, Montana, and other states.

May Spark Nationwide Imitation, Core Advocate Representative Keith Still Has Two Crypto Bills Pending Review

HB 302 is not only a breakthrough in local fiscal strategy but is also seen as a new benchmark for digital asset policy across U.S. states. Dennis Porter, CEO and co-founder of Satoshi Action, celebrated this achievement: "Satoshi Action drafted the model, and New Hampshire has written it into law. Now, financial officers across the country can follow this roadmap. HB 302 proves that you can diversify reserves while protecting taxpayer funds and safeguard the future of state finances—while embracing the safest currency network on the planet. New Hampshire has not only passed a bill; it has sparked a movement."

Satoshi Action is a nonprofit policy organization dedicated to promoting Bitcoin-friendly legislation and was involved in drafting the model for this bill. Nationwide, the organization has helped pass six laws supporting Bitcoin and facilitated the introduction of over 20 Bitcoin reserve bills, continuously promoting robust, bipartisan policy development in the digital asset space.

Behind the passage of HB 302 is a group of long-time supporters of digital assets. Among them, Representative Keith Ammon is the bill's drafter, representing the 40th district of Hillsborough, and has consistently played a role as a promoter in the legislative process. He is also the chair of the New Hampshire Blockchain Council and a member of the Business and Consumer Affairs Committee. Additionally, House Majority Leader Jason Osborne and Ian Huyett, a member of the New Hampshire Blockchain Council, played key roles in the bill's review.

It is worth mentioning that HB 302 is just one of several crypto-friendly bills that Keith is advancing. He currently has two other Bitcoin and blockchain-related bills in progress, both of which have passed the House and are now under Senate review:

Bill HB310 proposes the establishment of a committee to study the possibility of creating a regulatory framework for stablecoins, tokenized real assets, and blockchain-based trusts in New Hampshire. It is currently under Senate review; House status: passed/approved with amendments. The most recent hearing was on April 29, 2025.

Keith stated that the privacy issues surrounding stablecoins are crucial to him and plans to engage in in-depth discussions with relevant experts from Wyoming.

Bill HB639 concerns the use of blockchain and digital currencies and their related controversies. This bill adds a chapter called "Blockchain Basic Law" to the New Hampshire legal system, aiming to establish a new legal framework to protect the rights and interests of blockchain technology and its users. It is currently under Senate review, having been passed/accepted by the House. The most recent hearing was on April 29, 2025.

Half of the content of this bill is based on the model provided by Satoshi Action, while the other half comes from suggestions from other experts. The bill currently faces some resistance in the Senate, with some environmentalists concerned about the noise pollution and environmental impact caused by crypto mining.

Overall, with the formal signing of HB 302, New Hampshire has not only taken a crucial step in fiscal policy but has also opened a new chapter for the legalization of Bitcoin in public asset allocation. The implementation of this bill not only demonstrates the state's forward-looking policies in the digital finance sector but may also inspire other states to follow suit, potentially becoming an important historical process in the era of digital currency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。