World Liberty Financial’s (WLFI) new stablecoin has secured a place among the top ten fiat-pegged cryptocurrencies by market capitalization. The token, USD1, now sits squarely between Blackrock’s BUIDL and Ethena’s USDTB, with a current valuation of $2.125 billion—predominantly issued on Binance Smart Chain (BSC).

Democrats like Elizabeth Warren are not too pleased with the President’s stablecoin venture.

A decisive 2.113 billion USD1 tokens—accounting for over 99% of total issuance—are currently active on Binance Smart Chain, while Ethereum’s share comprises just 14.49 million coins. Trading volume concentrates primarily on Pancakeswap v3 and Uniswap v3, with 24-hour swap activity totaling $26,565,282, reflecting relatively modest liquidity.

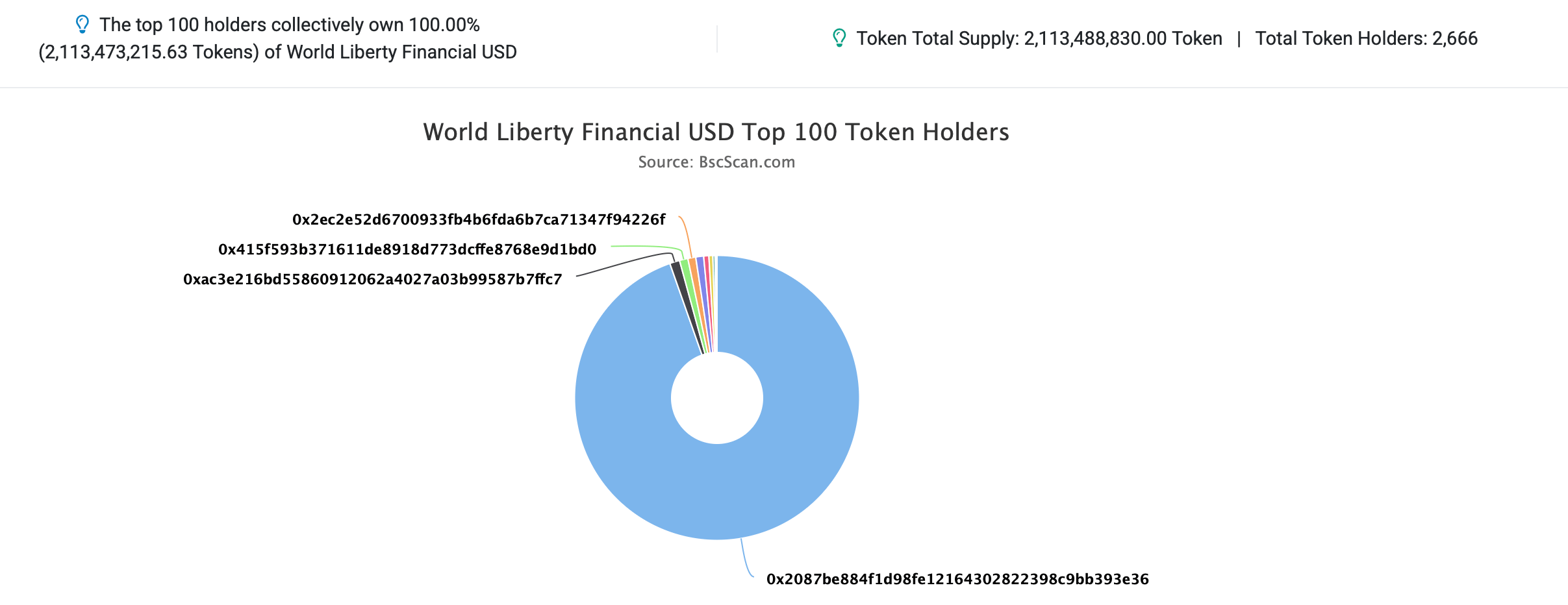

USD1 Binance Smart Chain distribution.

The BSC allocation reveals extraordinary supply concentration: address “0x2087” maintains a commanding position with $2 billion in USD1 tokens, representing 94.6303% of the circulating supply. Secondary holder “0xAC3E” possesses 23,990,000 coins (1.1351%), followed by “0x415f” with 19,986,009.79 of WLFI’s stablecoin tokens (0.9456%). On Ethereum, the supply distribution shows interesting characteristics—the leading wallet contains 5 million USD1. It initially held 10 million but reduced its supply by 50%.

Address “0x041c” maintains a dual-chain presence, securing 2,499,000 USD1 on Ethereum while commanding a far more substantial 12.49 million tokens on BSC. Uniswap v3 emerges as a notable custodian, hosting the third and fourth largest Ethereum-based USD1 wallets with balances of 2,242,886.31 and 1,460,686.88, respectively. Meanwhile, Ethereum wallet “0xeEa8” splits its holdings evenly across both chains, retaining 1 million USD1 on Ethereum and an identical sum on BSC.

While a single BSC address hoards a staggering 2 billion USD1, the remaining 113 million are dispersed across 2,666 wallets. Transaction activity further highlights the chain’s dominance, with 136,644 transfers recorded to date. Ethereum, by contrast, shows more modest engagement—490 unique wallets currently hold USD1, facilitating 5,188 transfers since launch.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。