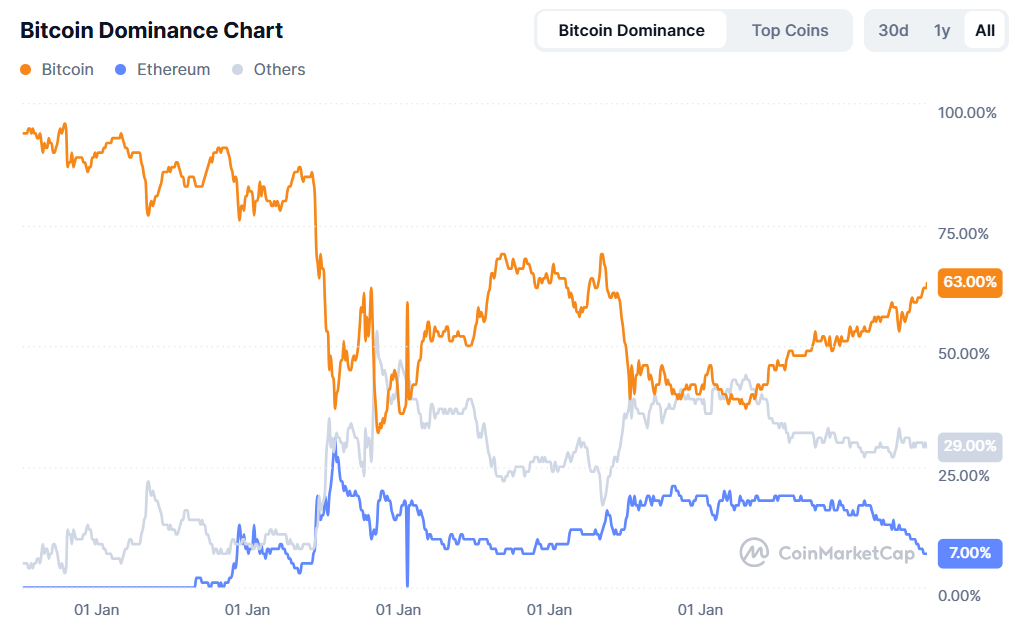

Bitcoin (BTC), the world’s leading digital currency, is showing promise as it has regained dominance in the cryptocurrency space. According to CoinMarketCap data, Bitcoin Dominance (BTC.D) has hit 63.5% after its price skyrocketed by 3%.

Bitcoin reclaims market share as altcoins retreat

For clarity, BTC.D refers to the percentage of the total crypto market capitalization that comprises Bitcoin. This recent rise signals that Bitcoin has rebounded and is dominating the crypto market's list of assets.

Related

Sat, 02/22/2025 - 12:37 Bitcoin Dominance Soars Higher — Adam Back Shares Take on Bybit Ethereum Hack

Yuri Molchan

Notably, despite being a leading asset, Bitcoin has not reached the 60+% level since March 3, 2021, when it reached 60.3%. Interestingly, BTC.D is ascending and could climb to between 66% and 70% before the end of the next quarter.

Bitcoin Dominance Chart. Source: CoinMarketCap

This resurgence after a long 48-month period suggests that Bitcoin’s price might record a significant uptick in the coming days, despite reservations about the current bull rally.

As of press time, Bitcoin is changing hands at $90,250, following a 3.26% increase in its price. Investors have also shown significant interest, as trading volume jumped by 35.68% to $36.87 billion.

Bitcoin is currently 18.58% away from its previous all-time high (ATH) of $109,114.88, which it achieved in January 2025.

The current development is likely to support BTC's breach of the psychological $100,000 level. If momentum is sustained, the asset could push toward a new ATH, as some projects predict BTC will reach $150,000 before the end of 2025.

Meanwhile, Ethereum’s dominance has dropped by 1.63% to 7.1%. The remaining altcoins stand at 29.4%.

Bitcoin builds momentum amid investor confidence

Related

Tue, 04/22/2025 - 12:03 NBA Legend Scottie Pippen Issues Important Bitcoin Call

Yuri Molchan

The resurgence in Bitcoin Dominance might have triggered investors to pivot to digital assets after U.S. tariff concerns. Despite the 90-day pause, the global market still remains on the edge.

This dilemma might see investors shifting from traditional assets like bonds to crypto, with Bitcoin a clear favorite.

In the last 24 hours, Bitcoin’s open interest has registered a 7.09% uptick as investors commit to the asset’s future. A total of 710,620 BTC, valued at $63.73 billion, have been committed to Bitcoin’s future price action.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。