You need to work hard to accumulate wealth and build your own little empire.

Written by: Tulip King

Translated by: Block unicorn

Preface

Content coins are a scam, and this is self-inflicted. Decentralized finance (DeFi) is not better than traditional finance (TradFi); it is just different. Feudalism will replace modern states.

Cryptocurrency is regulatory arbitrage

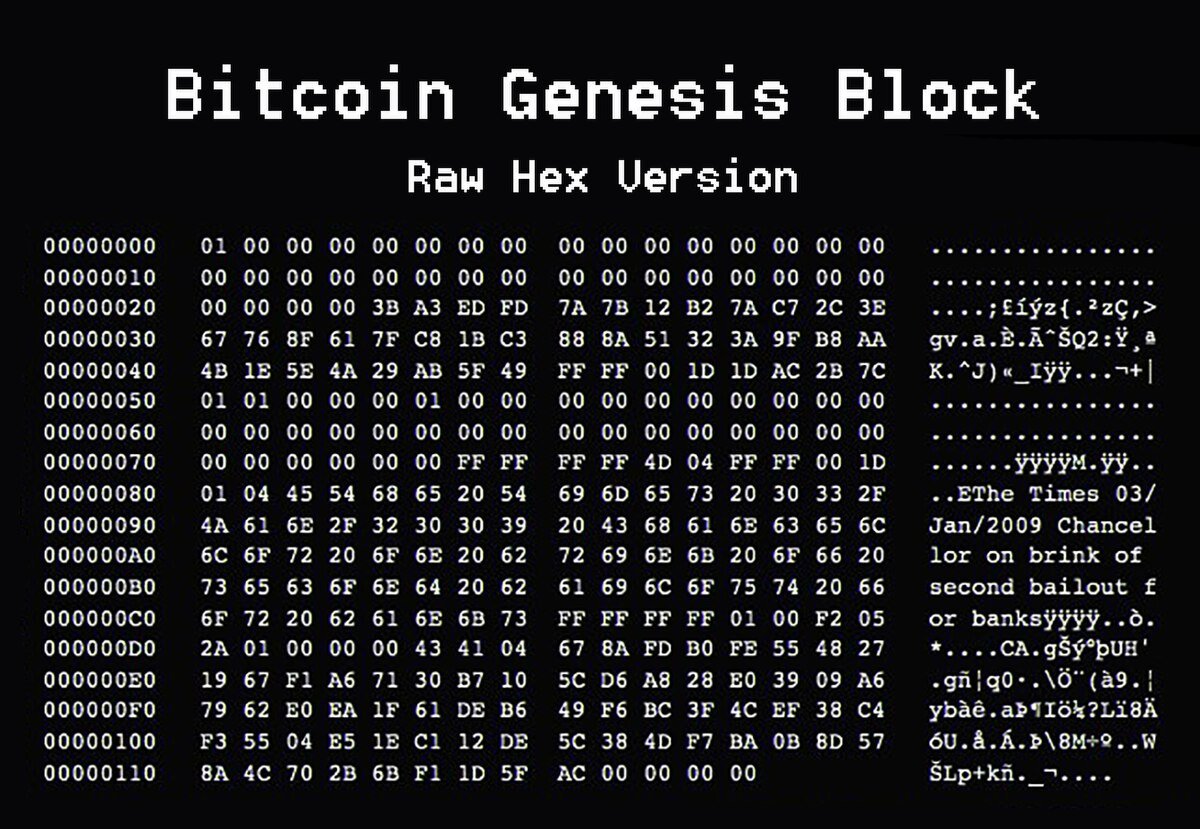

Let’s be honest: if governments were not burdened with massive debt and bankruptcy, if the Federal Reserve had not enriched the upper class through money printing, if governments had not bailed out companies on the brink of collapse, or if governments cared about reducing inflation and raising wages, there would be no need for cryptocurrency. Bitcoin did not arise from some divine mathematical inspiration. Bitcoin arose from disgust. The message in the Genesis block from Satoshi Nakamoto is not subtle: "The Chancellor on brink of second bailout for banks." This is not a random headline—it is a deliberate provocation against a system that refused to allow creative destruction to run its natural course after 2008.

Bitcoin Genesis Block and Newspaper Headline

There was a turning point where the government could have chosen to let the economy run on its own. They could have chosen to let banks fail, let businesses collapse, and embrace creative destruction. It would have been painful, but in the long run, we would be better off. Unfortunately, the baby boomer generation has shown a complete lack of self-sacrifice, determined to kick the can down the road until they are all dead, and it is no longer their problem (to be fair, I might do the same).

The crypto ecosystem has not invented new finance; it has invented a new platform. By transferring familiar services—payments, lending, market-making—into nominally "permissionless" code, projects have exploited the gaps left by over-regulation after 2008.

Look at DeFi: it primarily recreates traditional financial services without compliance costs. Lending? Compound or Aave are examples. Options and derivatives? Just look at dYdX or Synthetix. Exchanges? Uniswap is just a market maker with a better user experience and no KYC. The innovation is not in the services but in providing these services permissionlessly.

Unless mainstream regulation becomes more adaptive, this cat-and-mouse game of innovation through arbitrage will continue. We have not fundamentally changed finance. We have merely moved it to a jurisdiction with fewer police.

Not better, just different

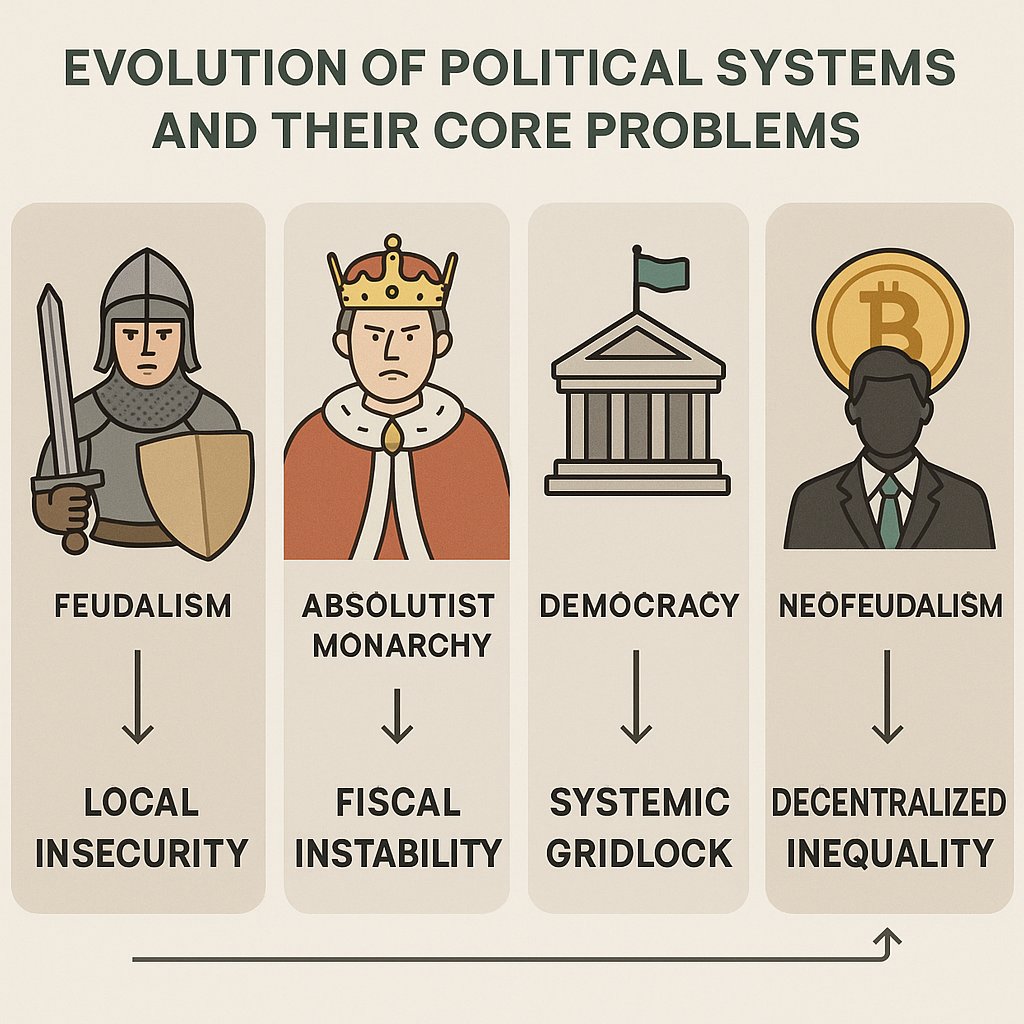

You need to view the economy, politics, and technology as dynamic and responsive systems. They are all essentially the same thing—a human coordination mechanism that continuously evolves to address any imminent survival threat. Human society constantly rewrites its "rules of the game" to solve the most pressing issues of the moment, so ranking any system by a single standard is meaningless.

A brief history lesson:

Feudalism: It arose during the decline of the Roman Empire when Europe lacked a standing army or reliable roads. By pledging land to armies, lords could quickly establish small-scale defensive systems to fend off Viking and Magyar invasions, providing protection for peasants that distant kings could not. This was not "primitive"—it was a rational response to fragmentation and insecurity.

Absolute monarchy: It emerged in the 17th century to fund the enormous costs of standing artillery and infantry forces. By centralizing tax and judicial power, the "fiscal-military state" could quickly mobilize revenue and manpower sufficient to survive great power wars. Kings were not "evil"—they were a solution to the increasingly expensive problem of war funding.

Mass democracy: Developed to govern industrial societies. Industrialization concentrated educated workers in cities and expanded wealth. Broader suffrage allowed taxation, conscription, and public education to persist politically under these new social pressures. Democracy is not "progressive"; it is an adaptation.

The evolution of political systems and their core issues

Because threats, technologies, and social norms are constantly changing, the "correct" political order is also constantly changing. A system that protected farmland for 1000 years or funded armies in 1700 could never manage railroads and factories in 1900. Judging these systems outside the context of their birth is like asking whether a plow or a microchip is a "better" tool—it entirely depends on the task at hand. This means that cryptocurrency is not better than our current financial system; it is just different and hopes to be more suited to the times we are in.

I can almost say I am a cryptocurrency enthusiast. I believe cryptocurrency is better suited to the current economic/political/technological environment than any other solution. We will ultimately prevail. But it is unrealistic to assume that cryptocurrency will not create as many problems as it solves. You can or should expect that these problems will continue to escalate over the next few hundred years until they fundamentally change the world again.

Unintended consequences

It turns out that when you provide people with permissionless capital markets, the first thing they do is deceive each other. This is both amusing and tragic. The true consequences of cryptocurrency have already emerged, and they are not all positive:

Theft and hacking: In 2022 alone, North Korea's Lazarus Group stole about $1.7 billion in cryptocurrency. Think about it—a rogue state with nuclear weapons funding its weapons program by hacking your DeFi protocol. In traditional finance, at least there are mechanisms to freeze accounts and recover stolen funds. In cryptocurrency? Ha, the money is gone. "Code is law" sounds great until someone finds a vulnerability in your code and instantly wipes out your life savings.

Loss of funds: Self-custody means being your own bank, which sounds empowering until you realize that most people are simply not good at being banks. About 20% of Bitcoin is permanently lost due to people losing private keys, forgetting passwords, or sending to the wrong address. No customer service, no refunds, no FDIC insurance. Just permanent, irreversible loss. Your funds are not "safe"—they are just a step away from disappearing due to a hardware failure or a mental lapse.

Hyper-financialization: We are rapidly adding price data to everything. People are tokenizing themselves—literally minting personal tokens tied to their reputation or output. Soon, your Twitter followers, personal brand, and even your relationships may have trading pairs and order books. Think about how you would feel when your value as a person is publicly priced for speculation? What about when your personal "stock" plummets 40% due to a bad opinion? When your value as a person becomes as volatile as a meme coin?

These are not bugs; they are features. The permissionless nature that frees you from government control also allows scammers to escape punishment. The self-custody feature that frees you from banks also burdens you with unbearable security responsibilities. The tokenization feature that creates new financing models also commodifies human existence.

The edge of freedom is sharp. Many who shout for liberation find themselves at a loss for what to do once they are free.

New feudalism

You need to think about what it means if Bitcoin (and cryptocurrency) succeeds. It means we will completely remove currency and markets from state regulation. A literal separation of currency from the state. This will reshape society on a scale comparable to the separation of church and state. Modern states are so reliant on controlling currency that once they lose that control, they are destined to collapse completely.

Without control over currency, states will lose their primary levers of power:

They cannot effectively enforce taxation

They cannot control monetary policy

They cannot impose financial sanctions

They cannot fund social projects or armies

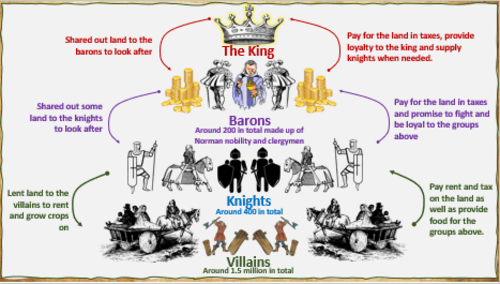

What will fill this power vacuum? I envision modern states being replaced by something more akin to feudalism. We call it new feudalism. New feudalism will exist in the form of patronage, with cryptocurrency moguls sitting atop small personal empires (I am not joking).

Studying the patronage system in feudal societies

This is not a radical theory—it is already taking shape. Look at how mainstream protocols operate. The largest token holders have disproportionate influence over governance. Whales can single-handedly determine the fate of proposals. Founders are revered almost religiously. Discord servers have strict hierarchies from "OG" to newbies.

Combine this with Balaji Srinivasan's concept of "network states"—essentially cloud communities that have their own currency, governance, and possibly even physical territory. These are not "states" in the traditional sense. They are digital territories with charismatic leaders, loyal followers, and sources of wealth and power operating outside traditional jurisdictions.

When currency exists under neutral protocols rather than state control, power will concentrate in the hands of those who control capital, not elected officials. Cryptocurrency billionaires will become the new feudal lords, providing protection, opportunities, and resources to those who join their networks. They will not call themselves "lords"—they will be founders, thought leaders, or protocol governors. But this dynamic will feel eerily familiar to medieval historians.

Think I am exaggerating? We have already seen crypto moguls saving entire protocols, creating personal venture funds larger than the GDP of some countries, and amassing followers who obey their every word. The fragments of new feudalism are gradually taking shape: concentrated wealth, networks of personal loyalty, privatized security and governance, and increasingly weakened state power.

This system may be more elitist and fluid than old feudalism. You can "swear allegiance" to different network states with just a few clicks, without being born a serf. But the fundamental power dynamic—powerful capital holders providing security and opportunity to loyal network participants—will astonishingly echo medieval themes.

Summary and advice

My advice remains consistent. In a world dominated by cryptocurrency, where individuals are empowered beyond the constraints of today's superstates—you need to become an exceptional individual. You need to work hard to accumulate wealth and build your own little empire.

Specifically:

Maximize your skills and reputation. In the new feudal world, your value comes from what you can do, not from your certificates or job titles. Focus on becoming a top expert in a field that people need. Even in feudal times, skilled artisans, engineers, and strategists could always find protection. Build a traceable public reputation that can follow you across different networks.

Accumulate hard assets across different systems. Do not fully commit to the old world or the new world. Hold Bitcoin as a hedge against state collapse, but also own gold, productive land, and income-generating investments. As the world reorganizes, cross-system hedging is the safest strategy.

Actively build your network. Start cultivating your own "micro-empire" now. This could be a Discord community, a DAO, or simply a strong network of excellent allies. In the new feudalism, your security comes from your network. Lone wolves will be devoured, while strong networks will thrive.

Develop self-sovereignty skills. Learn to operate securely, best practices for self-custody, and independent living skills. The protection of large institutions may not last forever. Those who can manage their own security (both digital and physical) will have a significant advantage.

Position yourself near power. If you cannot become a lord, then be a trusted advisor or deputy. In any political system, those close to power benefit the most. Find promising protocols, communities, or network states, and become an indispensable part of them as early as possible.

The fundamental fact is that the skills needed to prepare for new feudalism are the same as those required to succeed in the cryptocurrency space today: self-reliance, technical ability, networking, and capital accumulation.

Whether we ultimately enter a truly new feudal order or merely fall into a more fragmented world composed of competing systems, those who gain early insight into this shift and position themselves accordingly will thrive. Those who cling to the old assumptions of wealth and power will struggle.

Cryptocurrency promises to free us from the constraints of the state and achieve freedom. It may indeed deliver on this promise—along with all the responsibilities, dangers, and power dynamics that true freedom brings. Be careful what you wish for.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。