Cognitive Upgrade at Special Moments

Written by: Tokyo

Translated by: Asher

A Journey of Growth and Evolution

In the recent market, Bitcoin plummeted over 20%, Ethereum dropped nearly 30%, and many altcoins even saw declines of around 70%. Whether you are a seasoned investor or a newcomer, such significant fluctuations can catch anyone off guard. It is certain that this market reshuffle is not a unique experience for some, but a collective pain shared by the entire crypto world.

Everyone is bleeding, not just you

When prices are in free fall, many people inevitably feel anxiety and helplessness. I have also faced considerable losses; despite having experienced bull and bear cycles in the past, each major drop still tightens my chest. The market downturn brings not only a numerical shrinkage but also a heavy blow to faith and emotions. We are accustomed to the rapid operation of the market, where the frenzy during rises and the panic during falls are almost routine, but this time's violent fluctuations have made everyone feel the weight and helplessness of losses. Regardless of how you adjust your positions, the pain felt in this wave is shared.

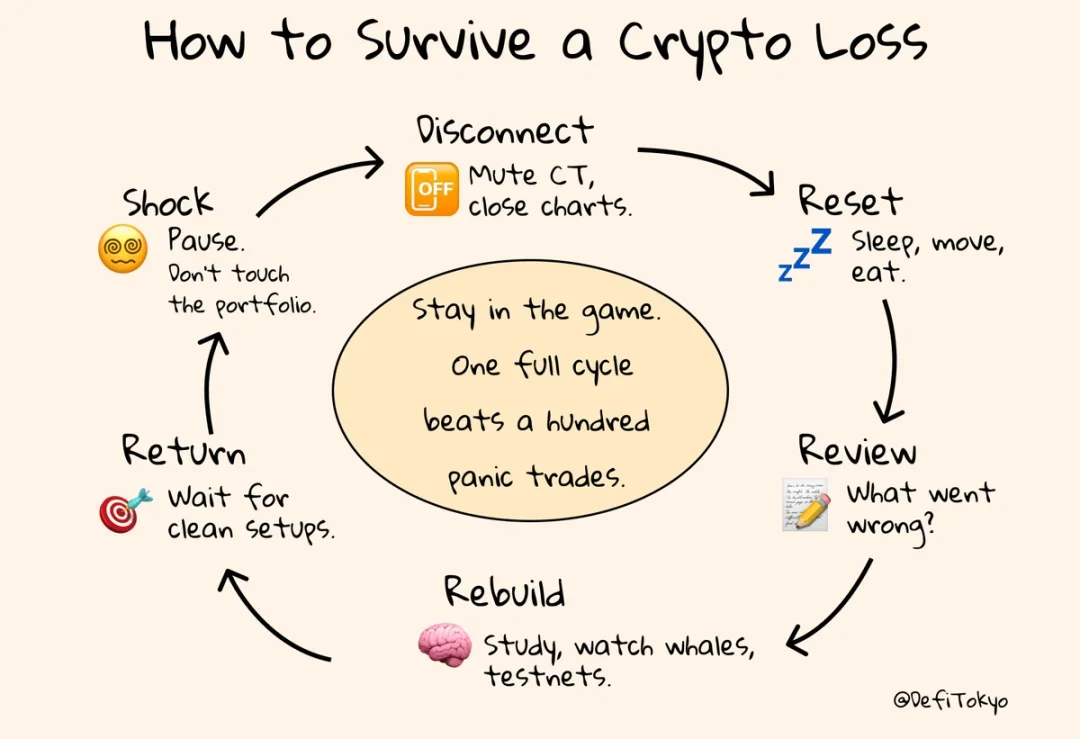

First, please stop and take care of yourself

Market volatility can be sudden, and many people act hastily out of panic, trying to recover losses quickly. At this moment, the most crucial thing is not how to quickly regain losses, but to first learn to stop, adjust your emotions. Please turn off those constantly refreshing candlestick charts, temporarily leave social media, and do not let the external noise and negative news further disturb your mind. Give yourself a period of quiet recovery, enjoy a warm meal, get enough sleep, or take a leisurely walk, allowing your body and mind the necessary rest and reset. Only when you have regained your calm can you have clear judgment to face the market again.

Power Down and Restart, Starting from Body and Mind

Sometimes, the simplest adjustments can bring the greatest changes. Pausing the flow of information that causes you anxiety and focusing on basic daily routines is an important first step out of emotional lows. Try to spend an entire day away from computer and phone screens, giving yourself an "offline" opportunity. When you put down your phone, close your eyes, and quietly experience the rhythm of your breath, that sense of peace will gradually help you regain your inner strength. As we often say, only by first repairing your body and mindset can you then repair the numbers in your account, which is the right path out of the valley.

Calmly Review and Rationally Face Losses

Once your emotions have stabilized, take out paper and pen, and seriously reflect on and review this trading journey. This step is not to let you wallow in self-blame and regret, but to identify the fundamental reasons for the losses. During this process, you can ask yourself: Did I have too heavy a position? Did I ignore stop-loss settings? Did I blindly follow trends? Or did I trust some unverified information? Write down these thoughts specifically, recording each lesson and reflection; this is not only a way of self-growth but also helps you avoid repeating the same mistakes in future markets. Losses are painful, but only by learning from them can you seize the opportunity in the next market turnaround.

Rebuilding Starts from the Basics, Step by Step

The most urgent thing now is not to rush to find new profit opportunities, but to bring yourself into a stable and orderly state of life. Readjust your daily schedule, ensure adequate sleep and a healthy diet, and maintain moderate exercise; these seemingly ordinary habits will lay a solid foundation for rebuilding your inner self and trading system. When you can restore daily routines, the restlessness and panic within will gradually subside. Rebuilding oneself is not just about re-entering the market; it starts from the most basic details of life, making you stronger and more composed.

Regroup and Focus on What You Can Control

Although you cannot control the market's movements, you can fully control your learning and thinking. Try to deeply review each past trade, carefully studying the reasons behind those successes or failures. At the same time, pay attention to on-chain data tools like Nansen, DeBank, etc., to gain first-hand information and data support. Additionally, you can monitor the movements of large holders or "whale addresses" to understand their investment strategies and operational logic. Through continuous learning and accumulation, you will gradually discover that the power of rationality and data can determine your investment outcomes far more than momentary emotions. True winners are not just those who can seize opportunities amid volatility, but those who continuously enhance their cognitive levels in calmness.

Remember: Don't Rush to Win Back

Under the stimulus of losses, many people are eager to recover, hoping to quickly regain lost funds. However, this often leads to self-destruction. Rushing to recover can easily trap you in a vicious cycle of high leverage and frequent trading, ultimately leading to a complete account wipeout. At this time, what you need most is calmness and patience, not blind following of trends. Wait for the market to regain rationality, wait for signals to become truly clear, and then act decisively to effectively avoid the risks of impulsive trading. Truly smart investors know to stabilize their emotions during volatile periods and wait for that crucial best moment to act.

Growth Through Pain, Cognition Makes You Stronger

After experiencing this market baptism, you will find that pain ultimately transforms into valuable wealth. The market's lows have made you see your own flaws and shortcomings, and have made you understand the importance of steady progress. Perhaps you are moving slowly at this moment, but every decision you make in the future will become more calm and rational. You will learn how to seize long-term opportunities, rather than pursuing profit in every single trade. It is in such adversity that you will grow to become more resilient and insightful, gradually reclaiming your value and belief.

If You Are Still Holding On, You Are Already Ahead

When you finish reading these words, it means you still choose to walk with the market, rather than completely leaving due to a temporary setback. Compared to the 90% who choose to give up, you already possess more courage and persistence. Losses do not define your identity; rather, it is about how you face them and learn from them. It is these experiences that will ultimately make you a mature, rational, and more capable investor in dealing with market fluctuations.

Slow Down, Adjust Yourself, and the Future Holds Infinite Possibilities

The market will have its ups and downs, and you will also grow with each fluctuation. Remember, a stable mindset and continuously improving cognition are the keys to your long-term success. Broaden your perspective; once you complete your self-adjustment and cognitive upgrade, the next opportunity will surely come quietly. By then, you will stand at the market's highest point with a more composed and determined posture, welcoming a clearer future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。