1. Market Observation

Keywords: BNB, ETH, BTC

The BSC ecosystem remains robust, with He Yi initially promoting ecological Meme projects. Influenced by his comments and attention, the Meme coins BUBB and TAT on the Binance Chain have become recent hits. Meanwhile, competition within the Solana ecosystem has intensified, with Pump.fun launching the native decentralized exchange PumpSwap, and Raydium is developing a Meme coin issuance platform called LaunchLab.

In terms of the overall market, BTC has recently been fluctuating around $85,000, closely following stock market trends. The latest data from CryptoQuant shows that the Bitcoin bull market score index has dropped to its lowest point in two years, at just 20, down 23% from its peak. Historical data indicates that a strong rebound only occurs when this index is above 60, and the current prolonged low may signal the formation of a bear market trend. From an institutional trading perspective, a report from Greeks.live shows that large trades are primarily concentrated in the Bitcoin options market, with a notable buy risk reversal trade amounting to $33.445 million, indicating that institutional investors are actively positioning to hedge against downside risks. Community reactions show a divergence in market outlook between Chinese and English-speaking investors, with some closely monitoring the critical level of $83-85K, while others expect a brief rise in Bitcoin before continued fluctuations, with some aggressive views predicting Bitcoin could rise to $444,000. BitMEX co-founder Arthur Hayes recently expressed the view that Bitcoin's $77,000 may have formed a temporary bottom. However, he also cautioned investors to remain flexible and hold sufficient cash, as the stock market may require further adjustments, which often impacts the cryptocurrency market.

The SEC recently made a significant decision, determining that PoW mining activities do not constitute a securities offering. At the same time, NYSE Arca has submitted a rule change application to the SEC for the Bitwise Ethereum ETF, with BlackRock's digital asset head Robert Mitchnick stating that the Ethereum ETF has performed poorly since its launch last July, primarily due to issues with obtaining staking yields. Additionally, Ripple's CEO expects to launch an XRP ETF by the end of 2025, while Bitnomial has announced the launch of the first XRP futures product regulated by the CFTC in the U.S.

On a macro level, QCP Capital analysis points out that the Federal Reserve's decision to begin tapering its quantitative tightening (QT) program in April provides a significant upward catalyst for the market, which was also one of the key factors driving Bitcoin's price above $85,000. However, considering the Fed's expected three rate cuts in 2025 and the current divergence in market sentiment, traders need to pay special attention to the performance of price support levels and manage risks accordingly. Meanwhile, retail investor sentiment remains cautious, with the latest survey from the American Association of Individual Investors (AAII) showing bullish sentiment at only 21.6%, well below the historical average of 37.5%, while bearish sentiment has reached 58.1%, remaining above 57% for the fourth consecutive week.

2. Key Data (as of March 21, 13:30 HKT)

Bitcoin: $84,384.27 (Year-to-date -9.82%), Daily Spot Trading Volume $2.4648 billion

Ethereum: $1,972.88 (Year-to-date -40.89%), Daily Spot Trading Volume $1.3189 billion

Fear and Greed Index: 31 (Fear)

Average GAS: BTC 2 sat/vB, ETH 0.44 Gwei

Market Share: BTC 60.6%, ETH 8.6%

Upbit 24-hour Trading Volume Ranking: XRP, AUCTION, BTC, VANA, LAYER

24-hour BTC Long/Short Ratio: 0.9818

Sector Performance: SocialFi sector up 3.25%, RWA sector up 2.48%

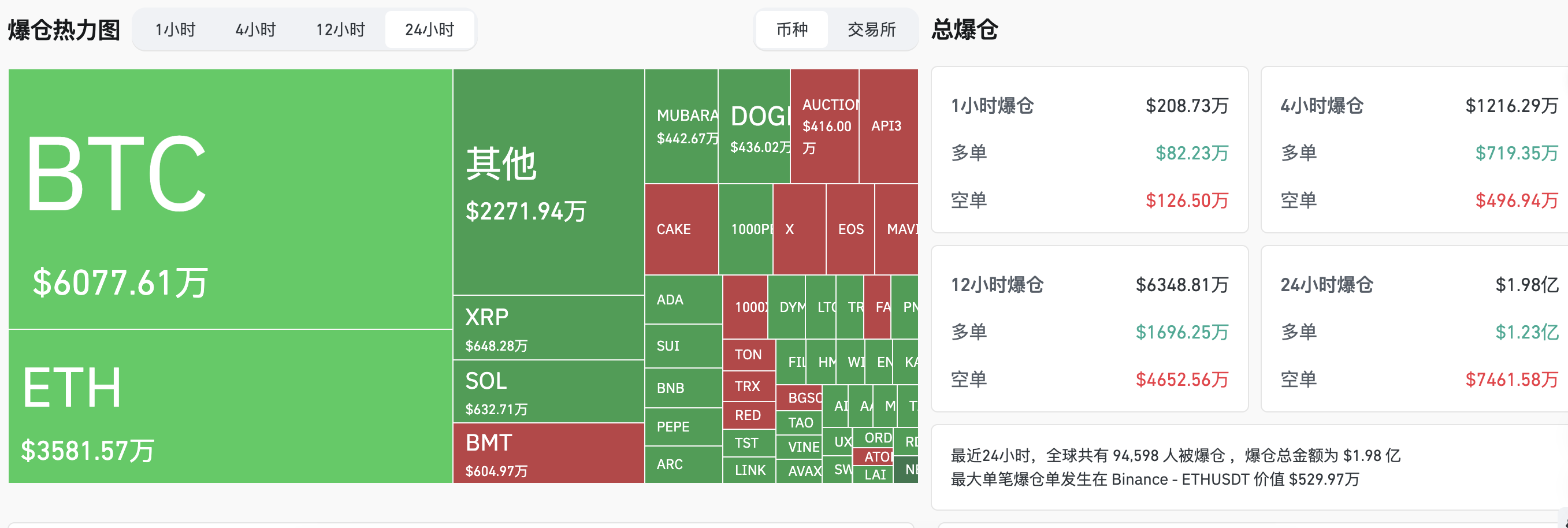

24-hour Liquidation Data: A total of 83,084 people liquidated globally, with a total liquidation amount of $191 million, including $64.04 million in BTC and $33.12 million in ETH.

3. ETF Flows (as of March 20 EST)

Bitcoin ETF: $166 million

Ethereum ETF: -$12.4093 million

4. Today's Outlook

Binance Launchpool will launch Nillion (NIL) and will list NIL spot trading pairs on March 24

Starknet is about to launch STRK Staking V2 voting, with a testnet launch planned in a few weeks

The SEC's cryptocurrency working group will hold its first roundtable meeting on March 21

Binance supports the renaming of BinaryX (BNX) and token exchange for Four (FORM)

BNB Chain: TVL incentive program extended by one month, deadline is March 21

Immutable (IMX) will unlock 24.52 million tokens at 8 AM Beijing time on March 21, accounting for 1.39% of the current circulation, valued at approximately $13.4 million;

SPACE ID (ID) will unlock 78.49 million tokens at 8 AM Beijing time on March 22, accounting for 18.23% of the current circulation, valued at approximately $19.3 million;

MANTRA (OM) will unlock 5 million tokens at 8 AM Beijing time on March 23, accounting for 0.51% of the current circulation, valued at approximately $32.8 million;

Murasaki (MURA) will unlock 10 million tokens at 8 AM Beijing time on March 23, accounting for 1.00% of the current circulation, valued at approximately $7.4 million;

Today's top gainers among the top 500 by market cap: Orca (ORCA) up 67.54% in 24 hours, Bone ShibaSwap (BONE) up 28.10%, X Empire (X) up 23.78%, Vana (VANA) up 19.32%, LayerZero (ZRO) up 18.49%

5. Hot News

A trader turned $304 into $482,000 by trading BUBB tokens, achieving a return of 1586 times

BlackRock's Digital Asset Head: Approval for staking could be a "huge leap" for the Ethereum ETF

YZi Labs announces Jane He as its General Partner to lead biotechnology investments

NYSE Arca applies to the SEC to add staking functionality for the Bitwise Ethereum ETF

The SEC states that proof-of-work mining does not involve securities law

Canary has submitted the S1 form application for the PENGU ETF

Walrus Protocol announces token economic model: 10% allocated for Walrus user airdrops

The TON Foundation, based on Telegram, raises over $400 million through token sales

ZachXBT: "Hyperliquid high-leverage whale" may be fraudster William Parker

Binance Launchpool will launch Nillion (NIL) and will list NIL spot trading pairs on March 24

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。