Source: Cointelegraph Original: "{title}"

According to data from the cryptocurrency financial services platform Matrixport, Bitcoin's (BTC) dominance has reached a new high as the brief rally of altcoins gradually fades.

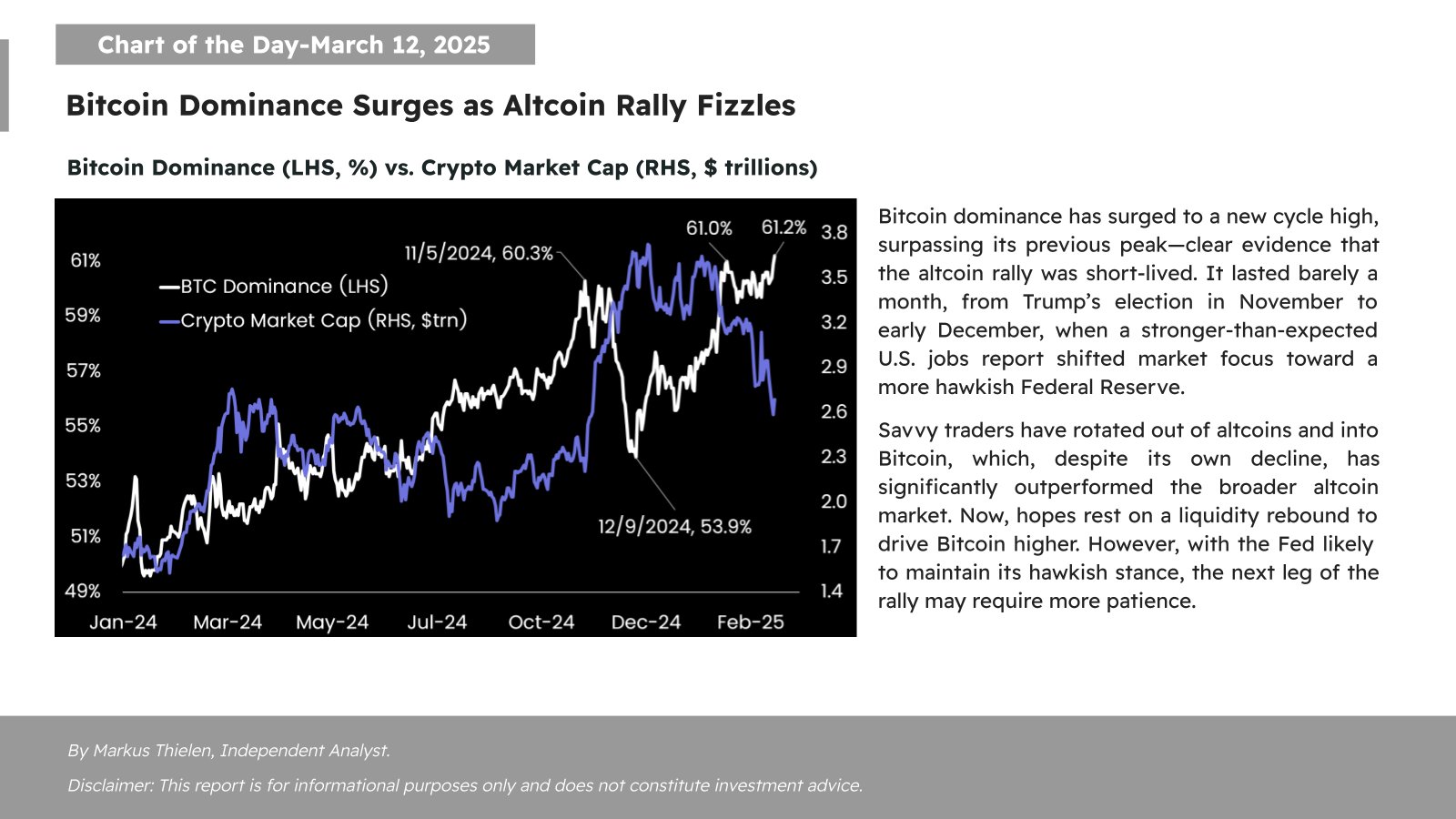

As of March 12, Bitcoin's dominance (a measure of Bitcoin's share of the total cryptocurrency market capitalization) reached 61.2%, up from a cycle low of about 54% in December last year.

In a post on social platform X, Matrixport stated that the rise in Bitcoin's dominance "clearly indicates that the rally of altcoins is temporary."

Matrixport noted, "This rally lasted only about a month, from the election of U.S. President Trump in November last year until early December, when a stronger-than-expected U.S. employment report shifted the market's focus to a more hawkish Federal Reserve."

Typically, as the market cycle nears its end and funds flow into digital assets other than Bitcoin—altcoins—Bitcoin's dominance tends to decline.

Bitcoin's dominance makes a comeback. Source: Matrixport

Focus on Interest Rate Dynamics

In January this year, in light of strong U.S. employment data, the Federal Reserve chose to keep interest rates unchanged and did not initiate a new round of rate cuts.

The Fed's hawkish tone has impacted the stock and cryptocurrency markets. Since the Fed announced this decision on January 29, Bitcoin's spot price has dropped by about 20%. As of March 12, Bitcoin was trading at approximately $82,750. In December last year, Bitcoin had reached a historical high of over $109,000.

Altcoins are even more sensitive to macroeconomic fluctuations than Bitcoin. Matrixport stated, "Savvy traders have shifted from altcoins to Bitcoin, and although Bitcoin itself is also declining, its performance is significantly better than the overall cryptocurrency market."

Matrixport pointed out that the next round of Bitcoin's rise largely depends on whether the Federal Reserve will choose to raise interest rates to curb inflation.

The U.S. Consumer Price Index (CPI) for February, released on March 12, came in below expectations at around 2.8%.

A post by Kobe West Communications on social platform X stated, "This marks the first decline in both the overall Consumer Price Index and the core Consumer Price Index since July 2024. Inflation in the U.S. is cooling down."

Data from the U.S. derivatives exchange CME Group shows that the vast majority of the market expects the Federal Reserve to keep interest rates unchanged at its next meeting in March.

Related: U.S. CPI below expectations, is a rate cut coming?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。