Source: Cointelegraph Original: "{title}"

U.S. lawmakers are set to engage in a heated debate over stablecoin regulation, with key industry leaders expected to outline their visions for the future of digital asset regulation.

Charles Cascarilla, co-founder and CEO of stablecoin issuer Paxos, plans to testify before the House Financial Services Committee, urging lawmakers to establish a "cross-jurisdictional reciprocity mechanism" for stablecoin regulation.

In his prepared testimony, Cascarilla pointed out that Paxos's global dollar stablecoin (USDG) faces some existing barriers that are concerning due to its issuance through a regulated subsidiary in Singapore.

Cascarilla wrote in his remarks: "We are concerned that products like Paxos's USDG stablecoin, issued by a regulated subsidiary in Singapore, may become stalled in the decision-making processes of various departments and agencies."

The U.S. must act to prevent stablecoin regulatory arbitrage

Cascarilla suggested that U.S. lawmakers strengthen the existing "international reciprocity provisions" to clearly outline an accelerated timeline for the U.S. Treasury to designate overseas jurisdictions for stablecoin regulation.

The executive stated: "This timeline would encourage parties to act swiftly to avoid delays caused by bureaucracy while ensuring a comprehensive review of foreign regulatory regimes."

Source: House Financial Services Committee

Cascarilla emphasized that any potential delays in taking such actions would pose significant obstacles to the adoption and promotion of stablecoins like USDG in the U.S., as well as conducting cross-border business.

Cascarilla said: "Reciprocity is not about lowering standards, but about raising standards globally." He added: "By establishing a framework that recognizes jurisdictions with similar regulatory regimes (covering reserve requirements, anti-money laundering measures, and cybersecurity protocols), the U.S. can prevent regulatory arbitrage, where issuers profit from lax regulatory environments abroad."

Paxos-issued stablecoins deemed non-compliant in the EU

Cascarilla made these remarks as some stablecoins issued by Paxos face compliance issues following the implementation of the EU's cryptocurrency regulatory framework, the Markets in Crypto-Assets Regulation (MiCA).

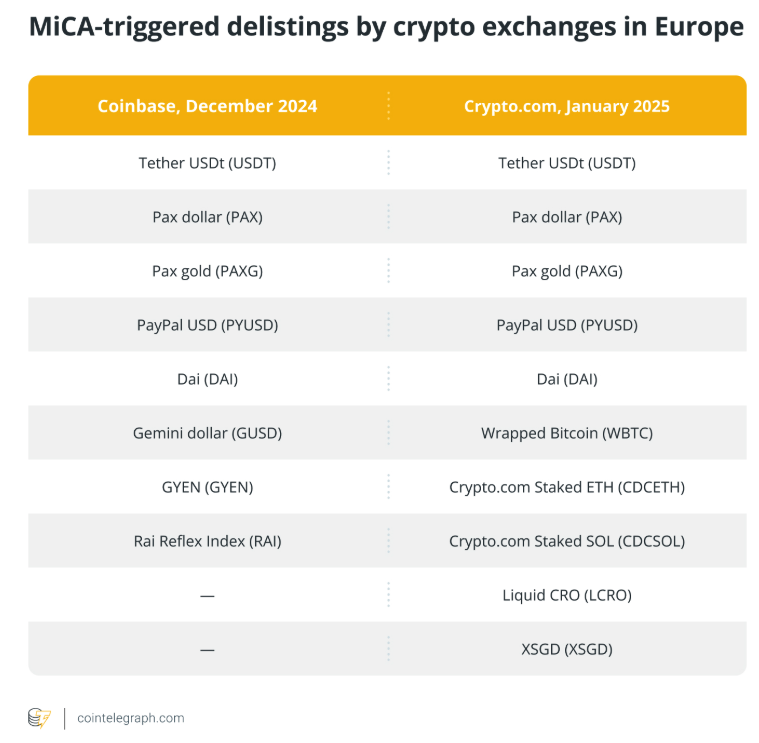

Since the MiCA framework fully comes into effect in December 2024, several crypto asset service providers in the EU, including Crypto.com and Coinbase, have announced the delisting of Paxos-issued stablecoins, such as PAX and PAXG.

While Paxos's Cascarilla is now calling for urgent action from the U.S. to push for a global framework for stablecoin issuers regulated outside the U.S., some industry CEOs are urging all stablecoin companies to accept regulation domestically.

In February of this year, Jeremy Allaire, co-founder of Circle, argued that all U.S. dollar-based stablecoin issuers should register in the U.S. to protect consumers and ensure fair competition in the cryptocurrency market. He stated: "Whether you are an offshore company or headquartered in Hong Kong, if you want to offer your dollar stablecoin in the U.S., you should register in the U.S., just as we must do elsewhere."

Circle's U.S. dollar stablecoin (USDC) is issued and regulated in the U.S. and was officially approved in 2024 as the first stablecoin compliant with MiCA regulations.

Related: Thai regulators approve Tether (USDT) and USD Coin (USDC) stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。