Author: DE Analytics

Compiled by: Felix, PANews

This article aims to explore the revenue potential of Celestia, pointing out common misconceptions and narratives that are flawed or at least lack substance. Finally, hypotheses will be presented to illustrate Celestia's true revenue potential.

"Is DA a Commodity?"

A common criticism regarding Celestia's revenue model is that, in the long run, DA (Data Availability) should be viewed as a commodity, meaning that fees will inevitably trend towards the bottom.

For this statement to hold, DA as a resource must be the same across all services. However, this is not the case for the following reasons:

Celestia DA ≠ Any Other DA

An important point to note here is that Celestia not only provides DA but also offers consensus for rollups. Clearly, some DA providers offer stronger security guarantees than others. Additionally, some providers will have stronger network effects. This differentiation in DA services means that it is not, by definition, a commodity.

Let’s look at it from the rollup's perspective.

Rollup POV

Rollups are consumers of DA and consensus. They do not choose based solely on who is the cheapest; they must also consider security. Furthermore, they want to use what others are using, ensuring they won't be taken advantage of, as it has been battle-tested.

Moreover, seeing other protocols switch can enhance confidence, further distinguishing DA providers from others. This, in itself, is a network effect—one that is non-forkable and difficult to replicate.

So, DA is not purely a commodity—how should it be evaluated?

Given that DA is not a commodity, it is reasonable for the transaction price to carry a certain premium over its cost, but it should not be so high as to deter rollups from choosing it. After all, it should provide positive outcomes for these rollups. Currently, this positive factor is a significant reduction in fees. Let’s look at the data:

Fees Deliberately Set Very Low

You may have seen complaints on Twitter that Celestia's current revenue is too low and its valuation too high, even after a significant drop from its ATH. But they completely overlook that the current revenue is intentionally suppressed. The reasons are as follows:

Winning Market Share

Low fees are a strategic choice by Celestia to gain market share and defeat competitors. The goal is to attract users with free DA, allowing them to try the product and subsequently develop dependency. Once a large user base (rollups) is established, monetization is not a challenge. However, winning users and defeating competitors is difficult, which is why you cannot set high fees from the start and expect a large influx of users.

On this point, Celestia co-founder Mustafa Al-Bassam has previously discussed.

Estimated Annual Revenue of Celestia

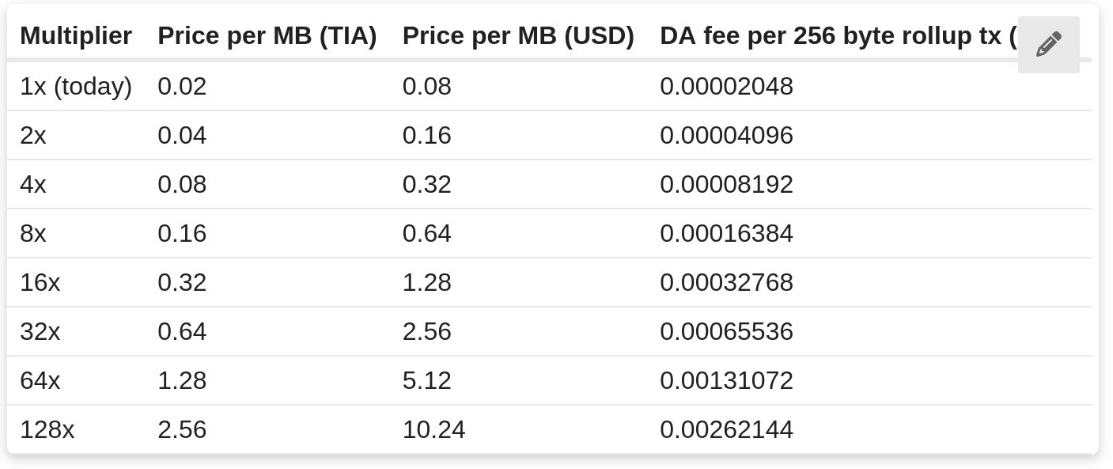

Recently, Mustafa Al-Bassam initiated a discussion on the Celestia forum about gradually increasing current fees. The initial proposed increase is fourfold (possibly more), with a table showing fee increases ranging from two to 128 times.

There is also discussion about anchoring fees to the dollar and preventing them from being affected by TIA fluctuations. It is worth noting that this is just the beginning and still open for discussion.

Now that some numbers are available, we can attempt to assess DA fee revenue. This is a daunting task, so some assumptions must be made.

Assumptions

As more modular projects enter the mainnet, the total data published by Celestia will significantly increase (currently at 1.5TB). So far, we have only seen Eclipse stress-testing its chain, and more is expected in the future.

To provide some context, Initia, Movement, and Abstract are just a few of the many projects laying the groundwork for killer applications. But what do all these applications have in common? They will rely entirely on having secure, fast, and cheap DA.

With this in mind, let’s assume that Celestia will eventually publish 50TB of data annually, and that will continue to grow.

TIA Revenue Estimate

As of now, the total fees paid by TIA amount to 313,000 tokens. If TIA is at $3.2, that’s about $1 million. But again, these fees are intentionally set very low.

If fees are increased by 15 times, it would still be much cheaper than ETH DA. Without adding too much cost, it remains an excellent choice for rollups: about 66 times cheaper than EIP-4844. While it can be adjusted higher or lower, we will use 15 times as a baseline.

Current revenue would be $15 million.

Next, we will plug the DA demand into the formula:

$15 million × 50TB = $750 million in annual revenue.

If the total data published increases year over year, annual revenue could easily exceed $1 billion.

Final Thoughts

In reality, there are many variables that will affect this calculation, and things are clearly not that simple. Adjusting or reducing certain variables will correspondingly adjust revenue. However, since people like exact numbers, we provide a figure that most can agree upon.

Of course, the numbers can be adjusted further to yield different revenues. But my personal view is that achieving $1 billion in annual revenue is quite feasible.

The above is just a personal opinion; DYOR.

Related Reading: Celestia is questioned for "pumping and dumping": Selling tokens packaged as financing before large unlocks

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。