Written by: Alex Liu, Foresight News

Chain source: Bubblemaps

Recently, the crypto community has erupted in intense discussions about "insider manipulation" surrounding the LIBRA token, which briefly received endorsement from Argentine President Javier Milei, and the MELANIA token associated with First Lady Melania Trump. Blockchain data analysis company Bubblemaps has revealed, for the first time with on-chain evidence, that the teams behind these two projects are actually the same group of people, profiting over $100 million through tactics such as "sniping trades" and liquidity extraction.

Background: From Presidential Endorsement to Collapse Controversy

The "Presidential Farce" of the Libra Token

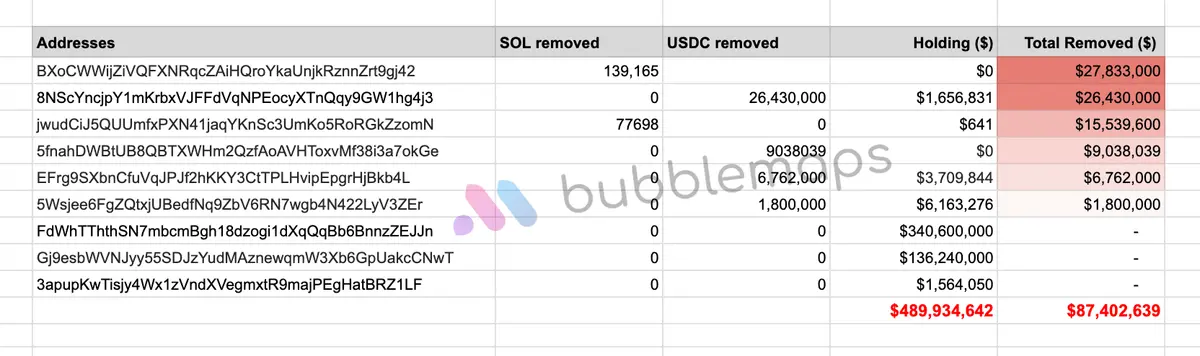

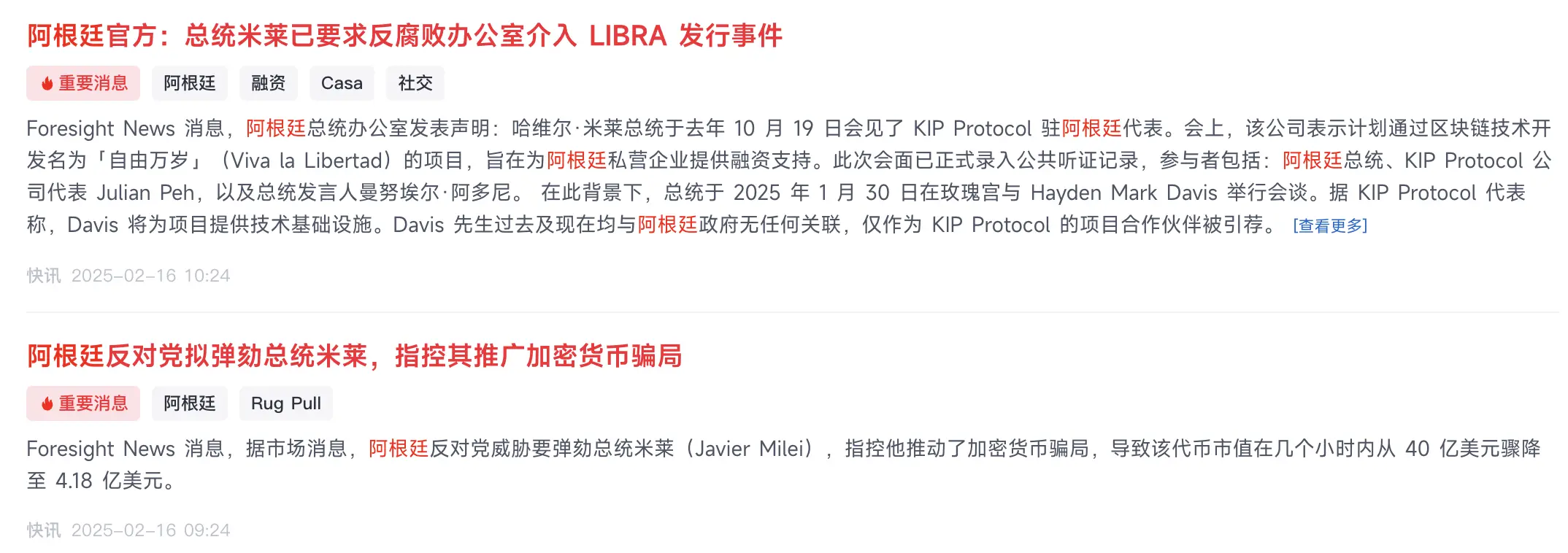

On January 30, 2025, Argentine President Milei met with project technical advisor Hayden Davis and promoted the Libra token on social media, sparking market frenzy. However, just hours after the token launched, the project team withdrew $87 million in USDC and SOL from the liquidity pool, causing the price to plummet by over 80%. Milei subsequently deleted the tweet and initiated an anti-corruption investigation, but significant losses had already been incurred by investors.

Market data source: GMGN

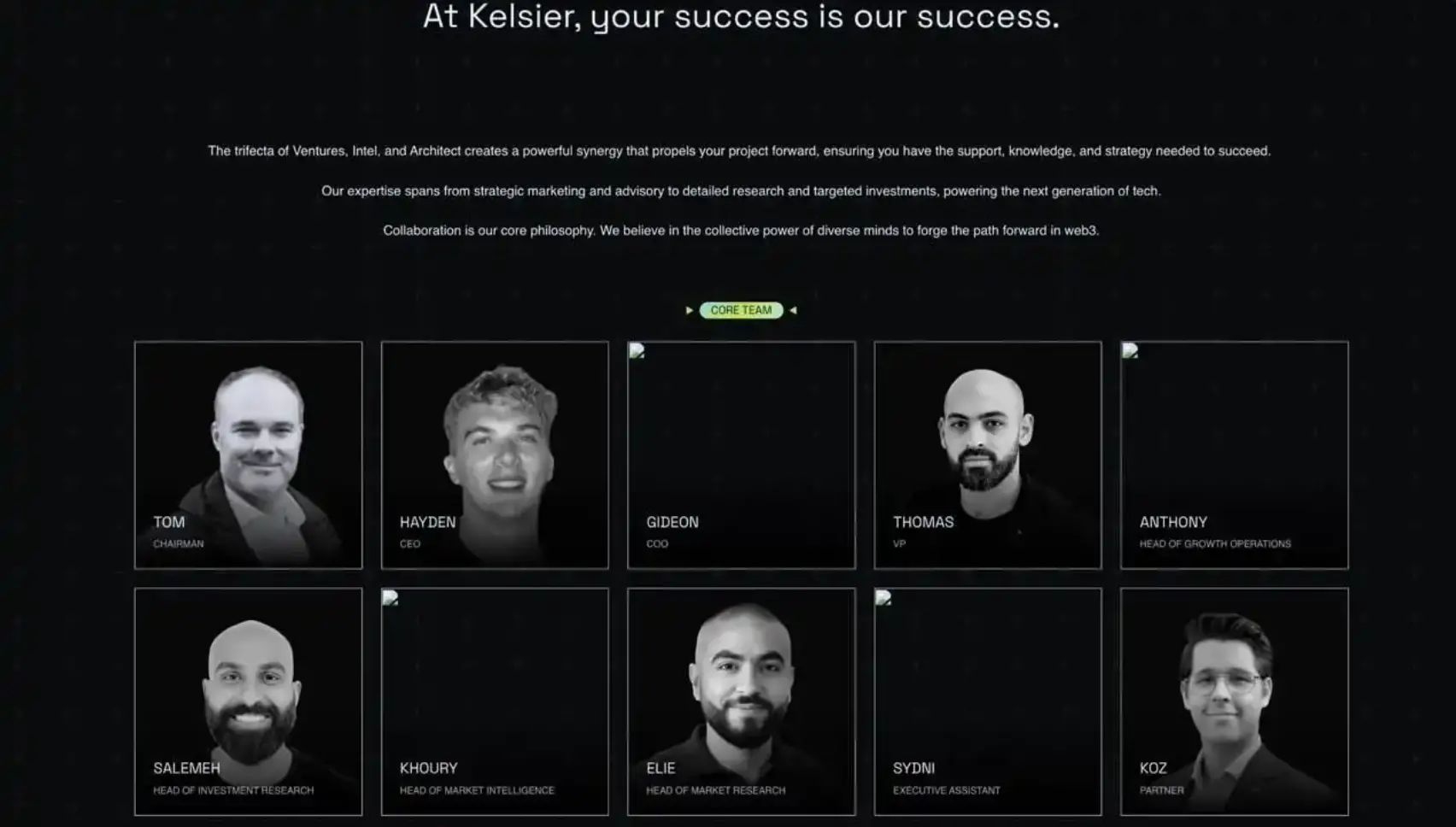

The project team shifted blame internally: KIP Protocol claimed it was only responsible for technical oversight, while market maker Kelsier Ventures' Hayden Davis accused the presidential team of "backtracking" at the last minute, causing panic.

The "Political Stunt" of the Melania Token

In January 2025, the Melania token endorsed by Melania Trump saw its market cap exceed $10 billion on its first day, but quickly collapsed due to insider selling, shrinking its market cap to less than $2 billion. Its model is highly similar to LIBRA, relying on celebrity effects to attract retail investors, followed by liquidity extraction.

Market data source: GMGN

Evidence: The "Harvesting Chain" Controlled by the Same Team

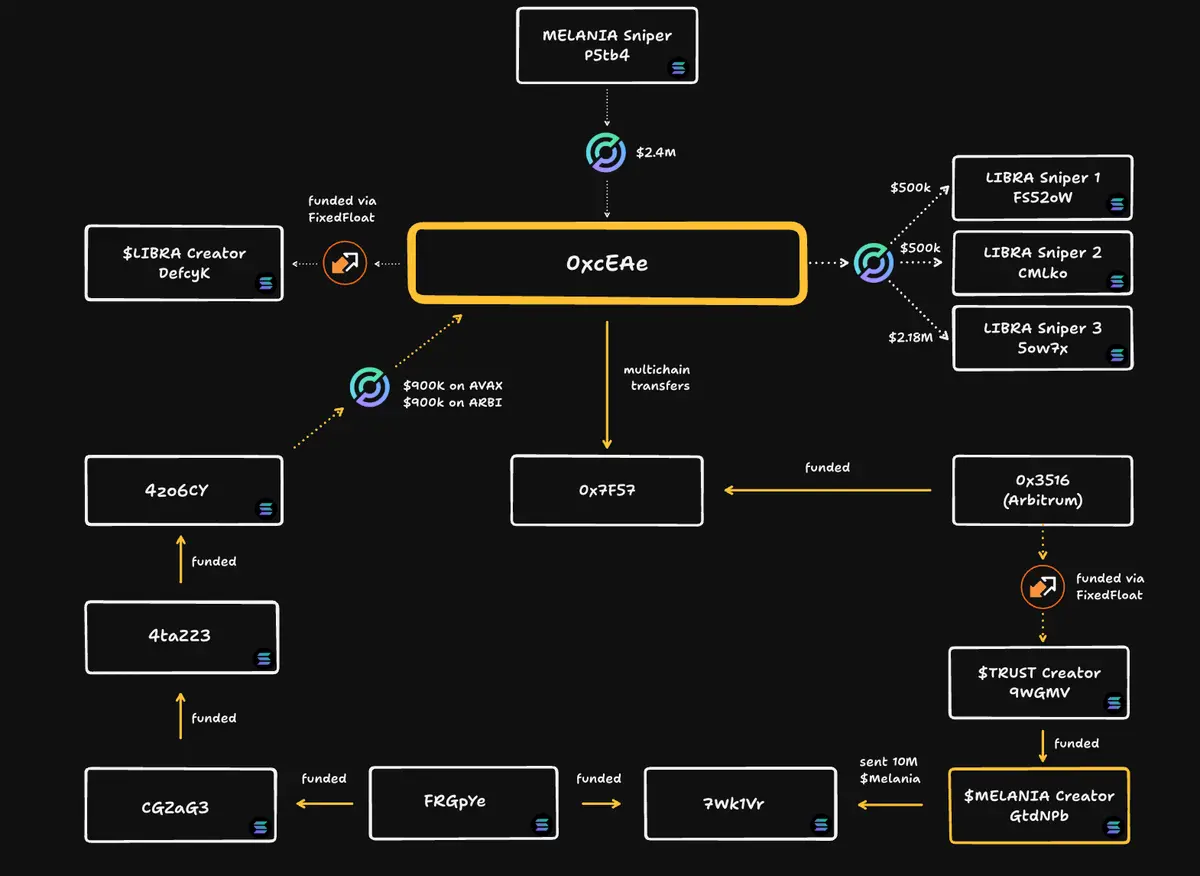

Bubblemaps' analysis revealed the following chain:

The "Self-Directed" Melania Token

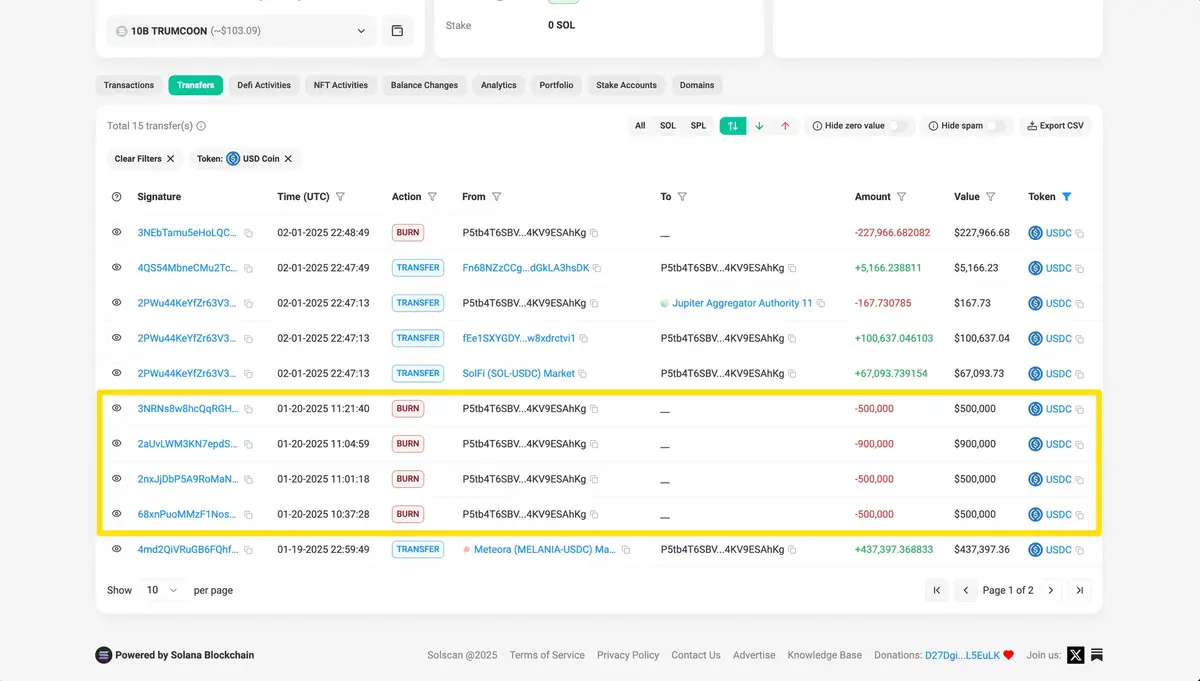

Address P5tb4 profited $2.4 million by sniping the Melania token, then transferred the funds via cross-chain protocol (CCTP) to 0xcEA. The latter has been confirmed as an associated address of the Melania token creator.

The team used insider information to buy the token in advance and sold at the price peak, forming a typical "pump and dump" model.

The "Same Script" of the Libra Token

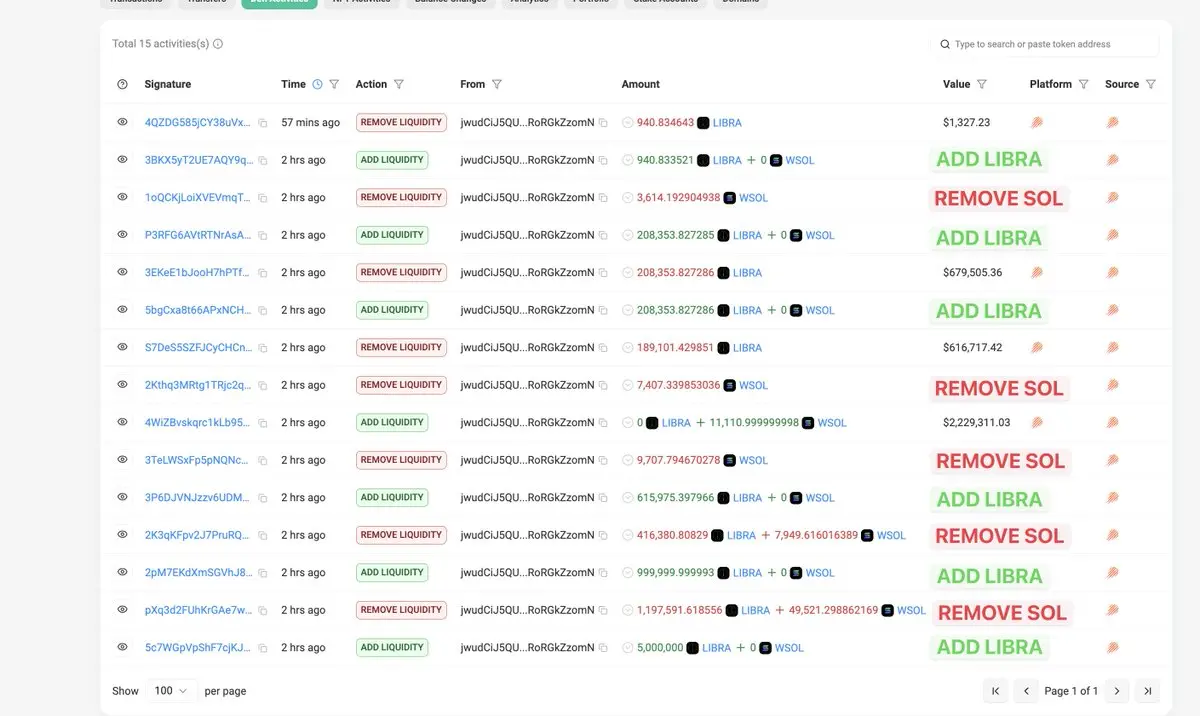

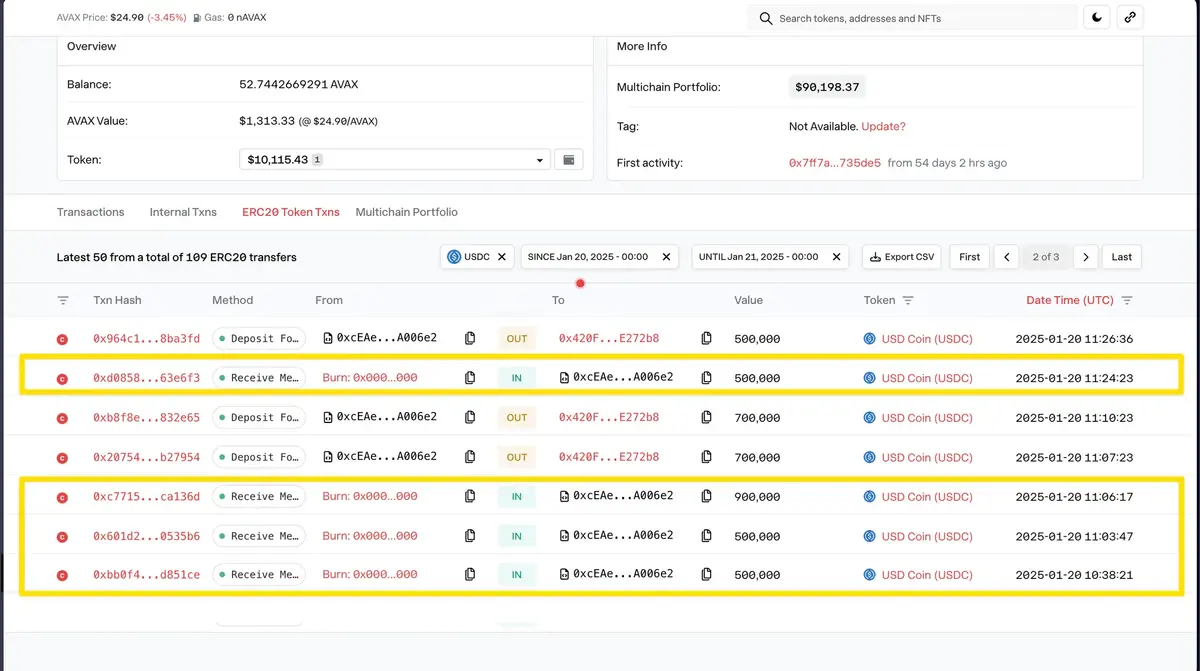

Address 0xcEA reappeared, providing funding support for Libra token creator DEfcyK, and executed "front-running trades" through multiple associated wallets, profiting $6 million. Meanwhile, the Libra team withdrew $87 million from the liquidity pool, further exacerbating the collapse.

On-chain data shows that wallets that purchased Libra early are highly overlapping with those of the Melania token, and are also associated with TRUST, KACY, VIBES, and other Rug Pull projects, indicating that the same group has long manipulated multiple tokens.

The "Ironclad Evidence" of Cross-Chain Fund Flows

By analyzing on-chain records from Solana and Avalanche, Bubblemaps found that the 0xcEA address frequently used cross-chain protocols to transfer funds, concealing the true flow. For example, profits from the Melania token were converted to USDC via CCTP and then flowed into the wallet of the Libra creator.

Related Parties and Interest Network

Key Individuals and Institutions

Kelsier Ventures: Accused of being the market maker for Libra, its founder Hayden Davis' family (father Tom Davis, brother Gideon Davis) has been referred to by crypto KOLs as a "family crime syndicate."

KIP Protocol: Although denying involvement in the token issuance, its representative Julian Peh was suggested by Hayden Davis to be a scapegoat.

The Gray Chain of "Celebrity Endorsement"

Members of Milei's government have been exposed for accepting bribes to promote the token. For instance, a confidant of Milei received $5 million to facilitate the president's promotion of LIBRA.

Community Reflection and Calls for Regulation

The "Trust Crisis" in the Crypto Community

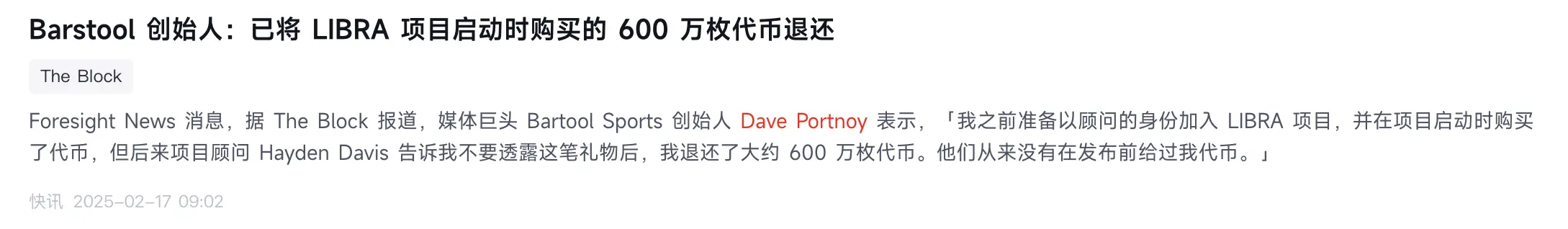

Developer Farokh has called for the exposure of all KOLs who received marketing fees, while KOL Dave Portnoy revealed he had insider information, further exposing industry corruption.

The founder of Argentina's Lambda Class pointed out that such events severely damage the reputation of the country's crypto industry, affecting many honest builders.

The Urgent Need for Regulation and Transparency

The Argentine government has established a cross-departmental investigation team to integrate financial, anti-money laundering, and other agencies for accountability.

Industry experts are calling for enhanced application of on-chain monitoring tools and the establishment of disclosure rules for celebrity-endorsed tokens to reduce information asymmetry.

The Game of Greed and Warnings

The incidents involving Libra and Melania tokens reveal the darkest side of the crypto market: the triple trap of celebrity halo + insider manipulation + liquidity fraud. Bubblemaps' on-chain analysis not only provides accountability evidence for victims but also serves as a warning to the community:

- Beware of "politically endorsed" tokens: Celebrity endorsements are often signals of short-term speculation rather than value support.

- Strengthen on-chain investigative capabilities: Ordinary investors can use tools to track large wallets and fund flows to identify suspicious patterns.

- Promote industry self-discipline: Project teams need to disclose token distribution and liquidity management plans to reduce information black boxes.

This farce may just be the tip of the iceberg, but only transparency and accountability can clear the obstacles for the long-term development of the crypto ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。