Author & Editor: Scof, ChainCatcher

Recently, influenced by macro policies, the cryptocurrency market has generally continued to fluctuate and show a downward trend. As the meme craze gradually subsides, many meme-related coins have also cooled down. However, the meme coin TST on the BNB Chain has unexpectedly experienced explosive growth, attracting widespread attention.

From being obscure to a market capitalization soaring to hundreds of millions of dollars, TST's rise has not only caught the market's eye but also sparked intense discussions about Binance's listing logic.

This article will review the ins and outs of the TST event, exploring the market logic and controversies behind it. From the initial test token to its listing on Binance's spot trading, every step of TST has been dramatic. Under Binance's "light-speed listing" operation, TST's market capitalization skyrocketed from $500,000 to $500 million, an increase of over 100 times. However, the subsequent crash after its listing caused significant losses for many investors, raising questions about Binance's listing process.

Next, we will analyze TST's birth, explosion, and controversies step by step.

$TST Makes Its Debut

According to the official TST website, $TST is a test token deployed on the four.meme platform by BNB Chain.

The first public mention of $TST occurred on February 6, when CZ shared a tutorial video on Twitter about how to launch tokens using four.meme. In this tweet, CZ specifically clarified that $TST is not a token released by the BNB Chain team or any official organization, but merely exists as a test token in the tutorial video. At the end of the tweet, a link was provided to the trading pair of TST and BNB on four.meme. This statement may indicate that the emergence of $TST initially did not have official support but was a purely experimental project.

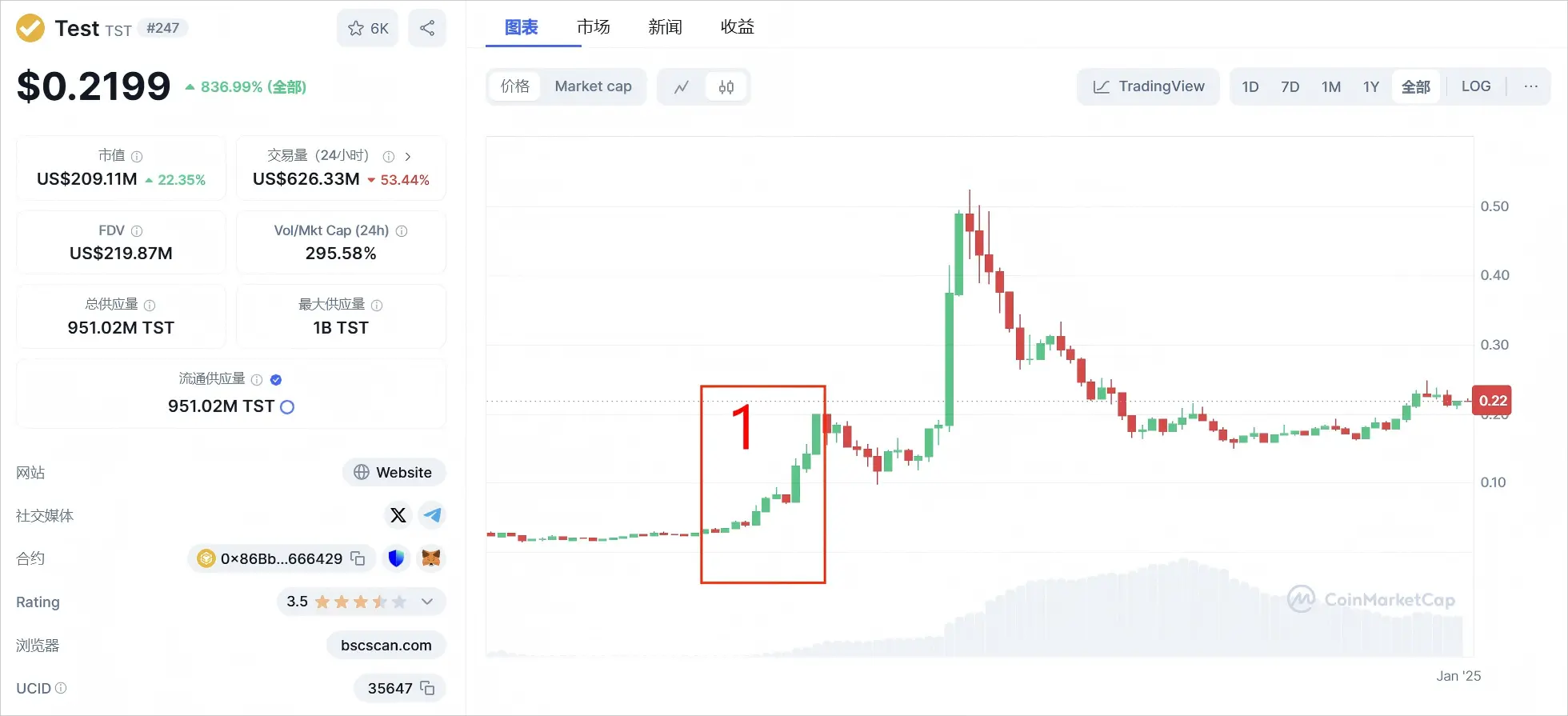

Stage One: Test Price Surge

On February 7, $TST received its first more formal promotional push. At that time, four.meme held a Space live stream titled “Let’s Talk About $TST” in the early morning. Although this live stream did not attract widespread attention, it paved the way for the subsequent explosion. On the same day, multiple platforms, including XT Exchange, Bingx, and Bitget Wallet, successively listed $TST, almost simultaneously. Additionally, CoinMarketCap and CoinGecko updated the relevant information about the token, further enhancing its market exposure.

By February 8, Binance Alpha Projects also joined the $TST lineup, marking the official debut of the token. This series of actions brought strong market attention to $TST and initiated its first price increase phase—the test price surge phase, lasting from 3 PM to that evening on February 8. The increase during this phase laid the foundation for $TST's subsequent performance.

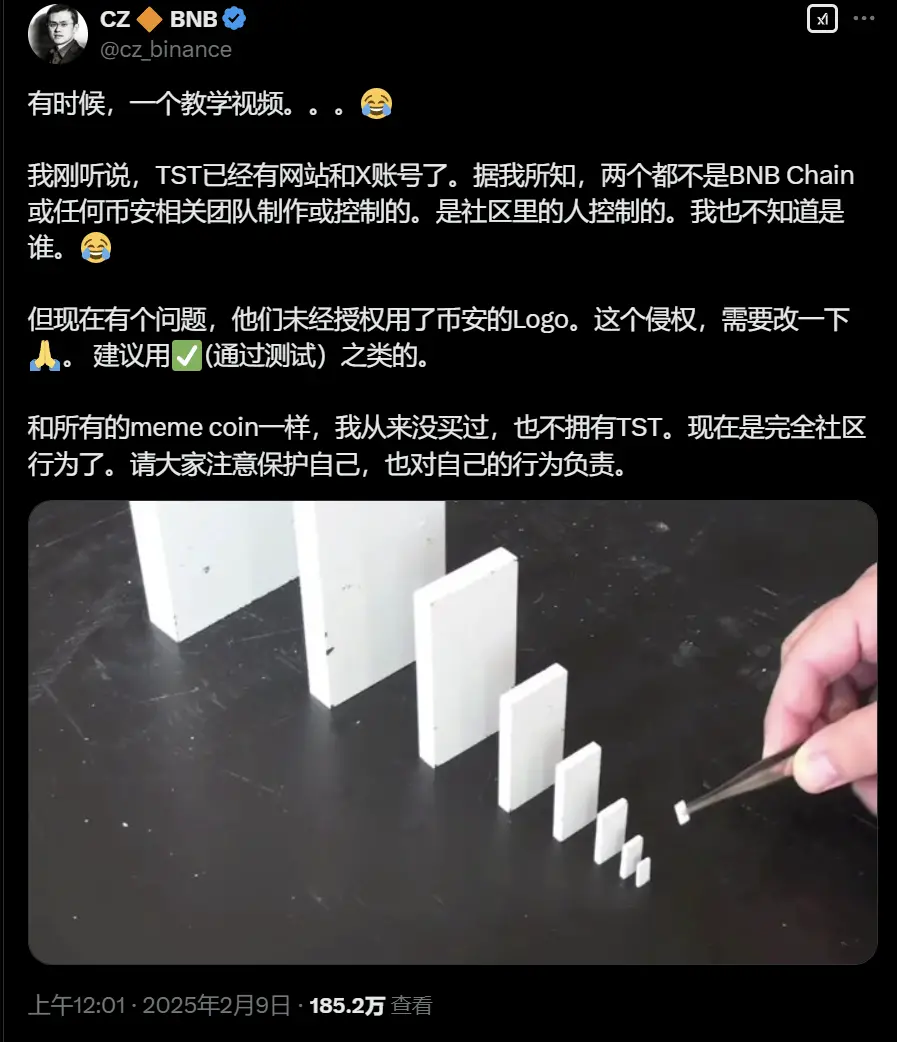

Stage Two: Consolidation - Explosive Surge

On February 9, with the end of the test price surge, TST's price rose from $0.026 to $0.19, with a market capitalization exceeding $40 million, an increase of over 6 times, and it slowly entered a consolidation phase.

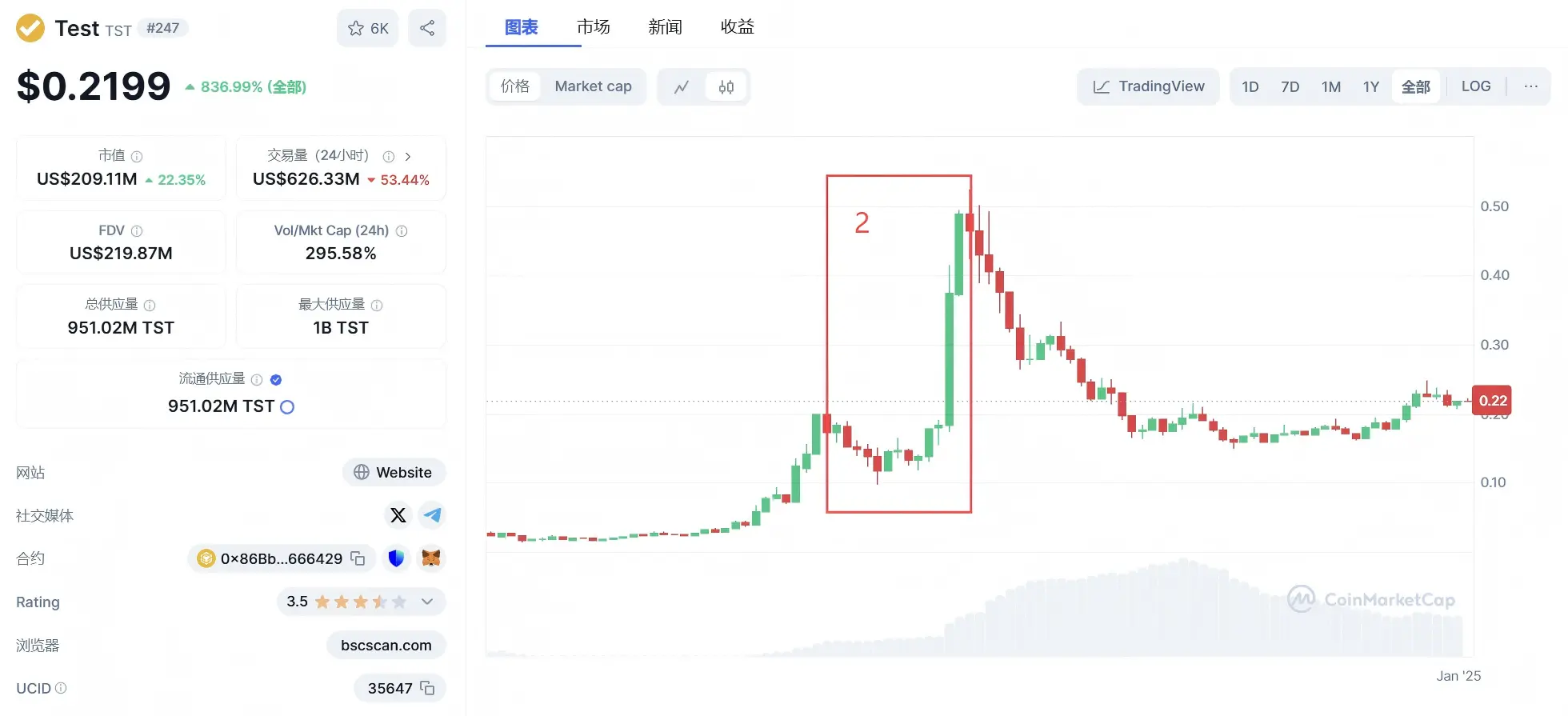

Just as market sentiment hit a low point, and many retail investors began to doubt TST's future, even experiencing FUD sentiment, an unexpected turnaround occurred—Binance founder CZ posted a statement about TST on Twitter. Although the main content of this tweet was to clarify that he "never owned TST," this action unexpectedly triggered a strong market reaction.

CZ's tweet not only did not lead to a drop in TST's price but acted like a shot of adrenaline, quickly igniting market enthusiasm. Investors seemed to read more signals from this tweet: CZ's attention and voice, to some extent, brought additional exposure and trust endorsement to TST. Although he clearly stated that he did not hold TST, the market interpreted it as a potential recognition or attention. This sentiment quickly spread, driving TST's price to rise against the trend, with its market capitalization surpassing $100 million in a short time.

But the story does not end here. In the early morning of February 9, @Binance officially announced that TST would be listed on Binance's spot trading pairs, including TST/USDT and TST/USDC. This news instantly ignited market enthusiasm, with TST's market capitalization soaring from $500,000 to $500 million in just a few days, an increase of over 100 times. This rapid listing phenomenon inevitably reminded people of the previous Trump coin, which also quickly landed on mainstream exchanges due to extremely high market attention and community enthusiasm. This time, the protagonist changed to TST.

Stage Three: Crash

"A coin relies on narrative and consensus before being listed on a major exchange, but after being listed, it is purely a game of capital."

Originally, it was thought that TST, backed by Zhao Changpeng, would continue its previous trend after being listed on Binance, at least not looking too bad. However, its subsequent performance clearly did not break the recent "listing on Binance leads to a drop" curse, as the price quickly fell from a high of $0.52, repeatedly halving to the current $0.17, with a retracement of over 60%. During this period, although there were consolidations and rebounds, this was clearly a drop in the bucket for many retail investors who bought at high points, and many exchange users suffered heavy losses in this rapid PVP.

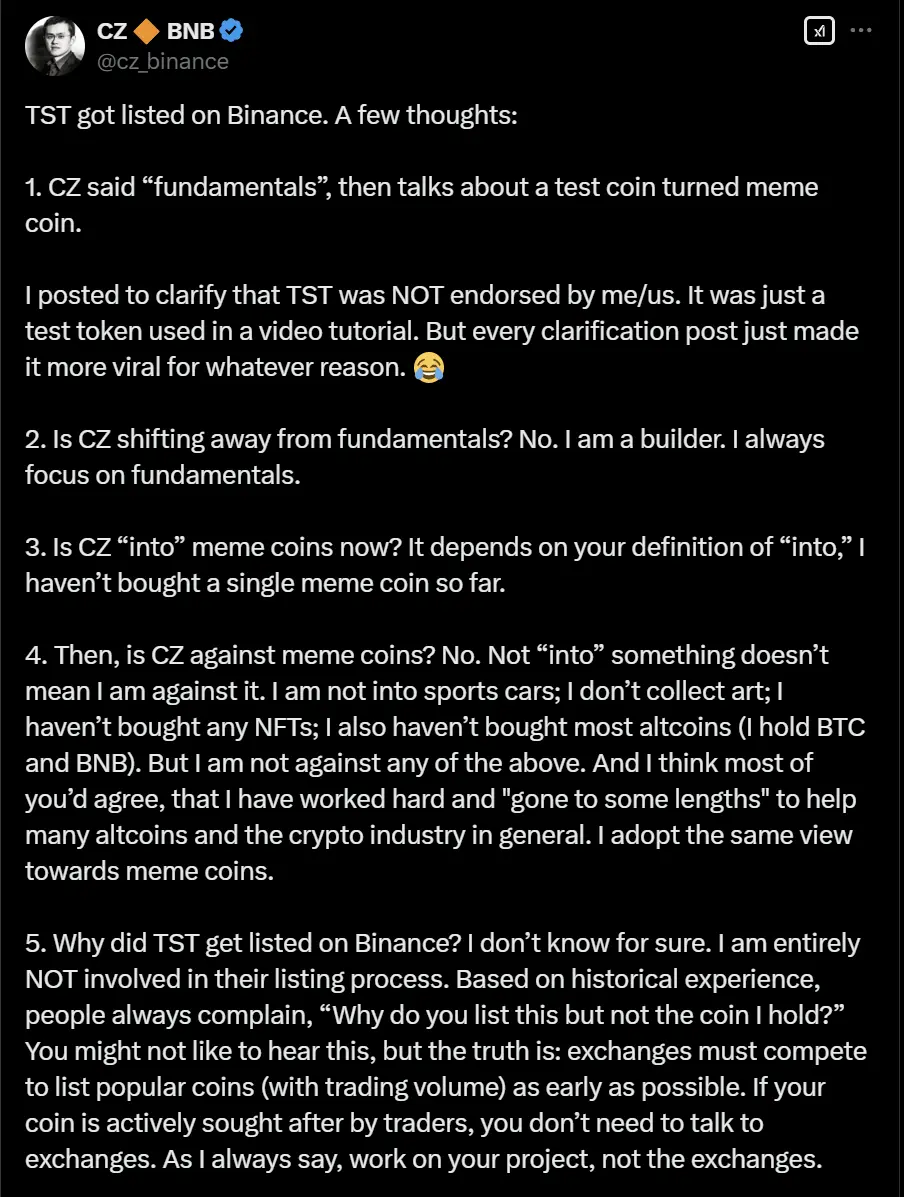

During this phase of the crash after being listed on Binance, CZ released another statement, covering seven points of reflection on the TST event, mentioning that he "had no involvement in their listing process," essentially reiterating his disconnection from TST and Binance's decision-making.

"Light-Speed Listing" Sparks Controversy: Binance's Review Process and Market Hotspot Game

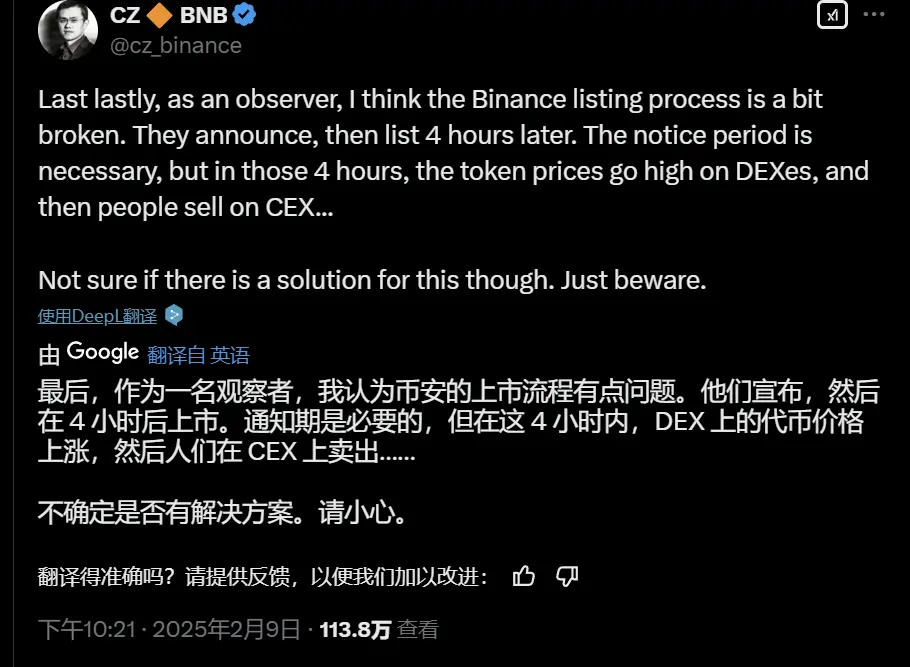

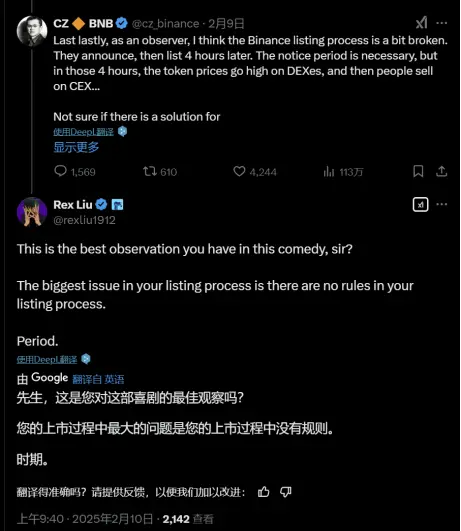

Such results quickly raised questions in the market about Binance's listing strategy, especially since TST went from inception to listing in just a few days, leading the community to question Binance's review process. Even CZ himself believed that there were issues with Binance's listing process, pointing out in a tweet:

"As an observer, I think there are some problems with Binance's listing process. The platform first announces, then lists 4 hours later. While a notice period is necessary, during these 4 hours, the token price can be pushed up on DEX, and then someone sells on CEX."

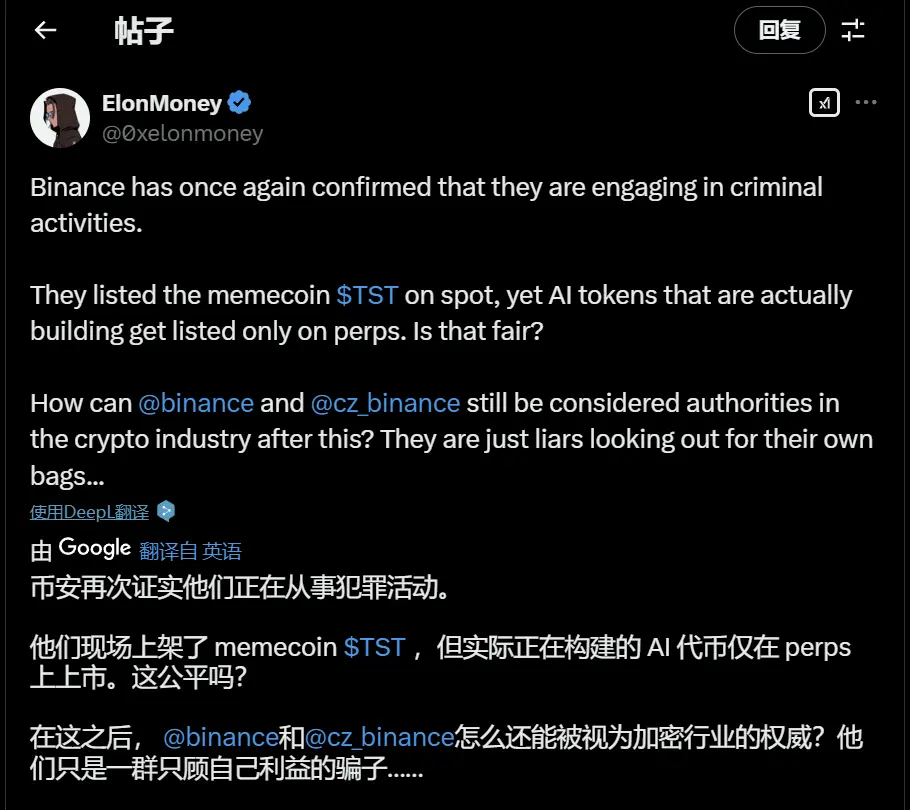

He Yi has repeatedly emphasized that Binance has a strict and complex listing review process aimed at ensuring the compliance and safety of every listed project. However, the listing of TST was surprising—only a few days passed from the token's birth to its listing on Binance's spot trading. This "light-speed" listing operation inevitably led some community members to begin questioning: Does Binance really conduct thorough reviews of every project as claimed? Or was TST granted some sort of "fast track" privilege to support the development of the BNB Chain ecosystem?

Some voices in the community believe that Binance's rapid listing this time may be to leverage TST's popularity to boost the activity of the BNB Chain ecosystem. After all, TST's explosive rise drew more attention to the technical capabilities and community vitality of the BNB Chain. However, whether this "fast track" would affect the fairness and rigor of Binance's listing process has also become a focal point of discussion.

Nevertheless, the enthusiasm for TST has not completely faded. Binance added a "seed label" to it, meaning users need to pass a risk test and accept the terms of use to trade, further highlighting its high-risk nature. CZ's recent discussions about the listing process also raise the question of whether CEX should automatically list tokens like DEX to respond to rapid market changes?

In any case, this incident undoubtedly cast a shadow of controversy over Binance's listing process and prompted more people to think: In the rapidly evolving cryptocurrency industry, how should the review process balance efficiency and safety?

The story of TST, from an initial test token to a market capitalization soaring to $500 million, and then crashing after being listed on Binance, almost encapsulates all the characteristics of the cryptocurrency market: emotion-driven, community power, exchange games, and market uncertainty. Its rise and fall are not only a controversial attempt at Binance's listing strategy but also a microcosm of the entire cryptocurrency market ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。