Author: Matt Hougan, Chief Investment Officer of Bitwise

Translation: Luffy, Foresight News

Currently, there exists an interesting binary phenomenon between institutional investors and retail investors in the cryptocurrency space.

On one hand, institutional investors are very optimistic about the prospects of cryptocurrency. Today, when investment professionals look at cryptocurrency, they see institutional funds pouring into the crypto market through exchange-traded funds (ETFs) at an unprecedented scale, while Washington has transformed from one of the biggest threats to cryptocurrency into one of its strongest supporters.

What we could only dream of a year ago (such as a national strategy to adopt Bitcoin as a strategic reserve) now seems to be on the verge of becoming a reality. The biggest risks facing cryptocurrency, such as government bans or legal threats to software developers, have become distant nightmares.

From a risk-adjusted perspective, it can be said that now is the historically best time to invest in cryptocurrency.

However.

Retail investors are currently mired in despair. They seem to be living in another parallel reality. At Bitwise, we have a proprietary cryptocurrency market sentiment score that assesses the sentiment of crypto investors by analyzing on-chain data, fund flows, and derivatives; currently, this score is at one of its lowest points in history.

Cryptocurrency sentiment index. Data source: Bloomberg, CoinMarketCap, Glassnode, NilssonHedge, Alternative.me, and Bitwise Europe.

This aligns with the atmosphere I perceive from "Crypto Twitter" and other sentiment indicators in the market.

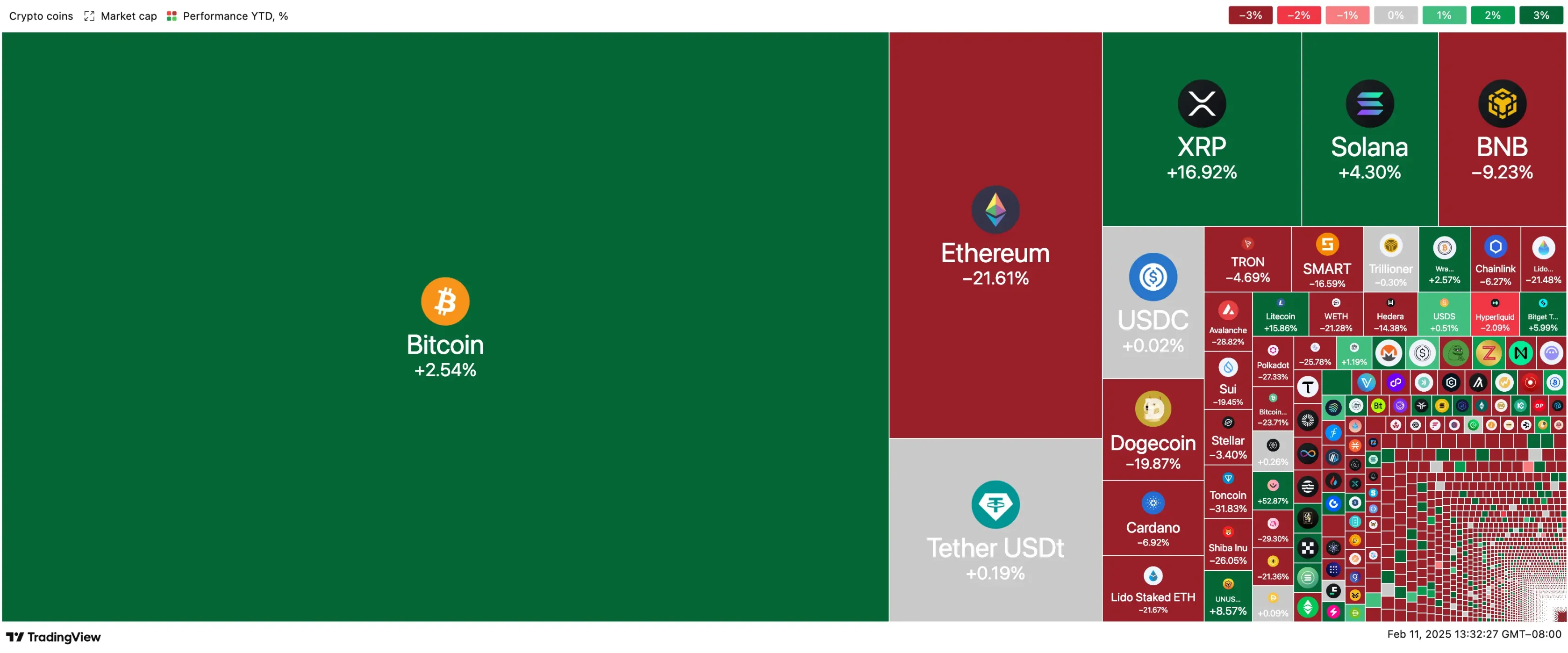

Retail investors feel frustrated because cryptocurrencies outside of Bitcoin (often referred to as "altcoins") are performing poorly. The heatmap from TradingView below shows the year-to-date returns of all cryptocurrencies. While there are a few highlights, most notably Bitcoin, Solana, and XRP, overall, it is mostly red. So, from a broader perspective, crypto assets are taking a beating.

Year-to-date returns of cryptocurrency assets, source: TradingView. Data as of February 11, 2025.

If we extend the analysis to the past 12 months, the situation has not improved much. Bitcoin has risen 95% over the past year; Ethereum has only risen 2%. Retail investors are eager to speculate on altcoins, and the absence of an "altcoin bull market" has left them feeling down.

So the key question arises: who is right?

The Answer: Institutions Are Right

My intuition tells me that the answer is "institutional investors."

Indeed, it is currently easy to be optimistic about Bitcoin. So far this year, ETFs have purchased about 47,000 Bitcoins, corporations have bought about 57,000 Bitcoins, while the Bitcoin network has only mined about 18,000 new Bitcoins. It is not hard to imagine that over time, this supply-demand dynamic will drive Bitcoin prices to new all-time highs.

I also acknowledge that the situation for altcoins is more complex. Currently, there are no significant new applications sparking massive interest in the crypto space like during the bull markets of 2020-2021 (DeFi bull market) or 2017-2018 (ICO bull market). The closest thing to a bull market in the altcoin space today is the Memecoin craze, but most investors understand what it is: a short-term gamble. It is hard to convince oneself that a new and better world can be built on Fartcoin or Hawk Tuah token.

But in the long run, I believe the foundation for altcoins is more solid than ever before. Over the past four years, altcoins have largely existed in a regulatory gray area, with the U.S. Securities and Exchange Commission (SEC) claiming that most altcoins are illegal securities offerings. This has hindered their application in the real world, making large companies and talented developers hesitant to enter the space.

Now, everything is getting better. The U.S. has made the development of stablecoins a national priority, which will support the growth of Ethereum and Solana. The largest institutions globally are beginning to build in the crypto space, bringing DeFi applications to the masses.

If you look closely, you can see signs of this shift in things like the recent all-time high in stablecoin asset management or Ondo Finance's recent tokenization of U.S. stocks and ETFs. Such projects would have been impossible to launch under previous government oversight.

I suspect that within a year or two, you will see a transformation in the situation for altcoins; its impact will be evident and overwhelming.

It is difficult to pinpoint specific catalysts that will trigger a rebound in altcoins in the coming months; but it is even harder to imagine that the market size will not significantly expand in the coming years.

Currently, the sentiment among retail investors in the cryptocurrency space is very low, which, in my view, signals opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。