Recently, the Sa Jie team made a surprising discovery that the well-established American cryptocurrency exchange Kraken is actively providing cryptocurrency services to residents in mainland China. Partners can log into its official website without using a VPN and can complete KYC using their Chinese phone numbers and ID/passport information (even selecting China as their country of residence…). After completing registration and reaching the immediate level, residents in mainland China can withdraw up to $100,000 per day per individual account.

After inviting several partners to test USDT, the Sa Jie team found that it is indeed convenient to withdraw funds through Kraken, with no issues transferring funds to Hong Kong or US accounts.

Today, Sa Jie will discuss whether Kraken will become a "frozen friend" savior in the near future, and whether there are risks for partners who use Kraken for long-term deposits and withdrawals.

01. Kraken Testing: Can mainland IPs and IDs complete withdrawals?

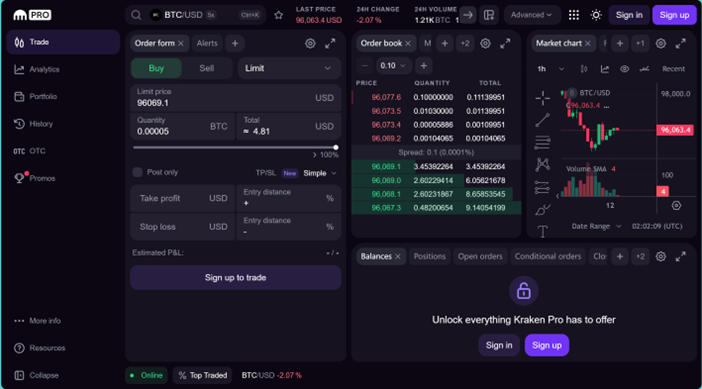

After discovering that Kraken seems to be targeting residents in mainland China, the Sa Jie team invited several partners to conduct withdrawal tests on Kraken from mainland China. As of the publication of this article, Kraken's official website (http://kraken.com) still allows unrestricted access from mainland Chinese IP addresses.

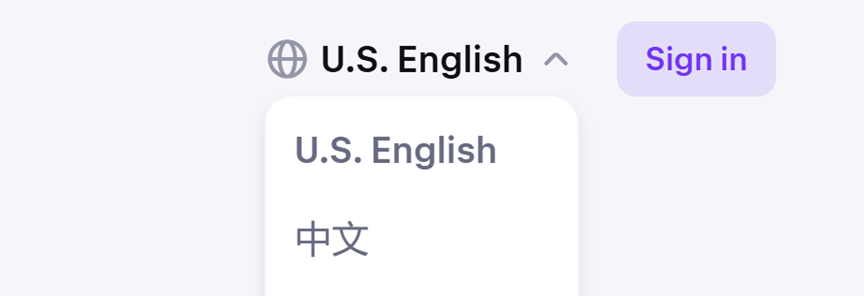

Upon entering the website, users can seamlessly use their real ID cards for KYC. Even more astonishing to the Sa Jie team is that Kraken allows users to switch the language to "Chinese" on the official interface, making it incredibly convenient for residents in mainland China.

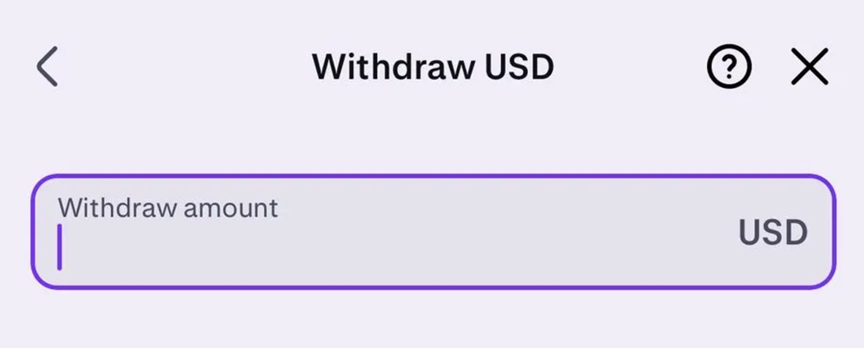

Taking USDT withdrawal as an example, after completing registration, users can select Deposit in the Transfer section, input their USDT into the deposit address generated by Kraken, and then choose to withdraw in USD for convenience.

After the exchange is completed, partners have tested that commonly used crypto-friendly banks in the crypto community, such as Hong Kong Zhong An and iFastx, can facilitate the transfer of funds. If there is a need to deposit funds within mainland China, users can use Wise to convert the funds (if the amount is not too large) into RMB for deposit into domestic accounts or for use on platforms like Taobao.

However, it is important to note that Wise itself is not a crypto-friendly financial service provider and generally does not accept direct transfers from Kraken. In practice, partners often receive funds into Hong Kong or iFastx accounts before transferring to Wise.

The Sa Jie team believes that Kraken's increasingly bold operations may be related to the successful rise of the "understanding king" and the appointment of closely related individuals to key positions in his government.

According to a report by the New York Post on February 7, Kraken's former legal chief and well-known crypto lawyer Marco Santori has been listed as a potential member of the "understanding king" government's digital asset market working group. Although this is currently just a nomination and Santori is no longer serving at Kraken, it is evident that Kraken, established in 2011, seems to be experiencing a resurgence—its logo has appeared at several important political gatherings in the US.

02. Is Kraken's behavior compliant? Are there risks in long-term use of Kraken?

Is Kraken's behavior compliant?

The Sa Jie team can provide a clear answer: Kraken's activities targeting residents in mainland China constitute illegal financial activities under Chinese law and have crossed the criminal red line.

According to the "Notice on Further Preventing and Dealing with Risks of Virtual Currency Trading Speculation" (referred to as the "9.24 Notice") issued by the central bank and ten other departments in 2021, the first clause states: "Activities related to virtual currency are considered illegal financial activities." Specifically, Chinese regulatory authorities consider the following activities involving cryptocurrencies to be illegal: conducting exchanges between legal currency and virtual currency, exchanges between virtual currencies, acting as a central counterparty for buying and selling virtual currencies, and providing information intermediary and pricing services for virtual currency trading…

The third clause of the first article of the 9.24 Notice further clarifies that foreign virtual currency exchanges providing services to residents in China via the internet also constitute illegal financial activities.

Therefore, Kraken's provision of official Chinese services, recognition of clients selecting mainland China as their location, and acceptance of mainland Chinese ID/passport information for KYC essentially indicate a blatant engagement in cryptocurrency financial business targeting residents in mainland China.

After the issuance of the 9.24 Notice, common charges against entities conducting cryptocurrency trading in China include illegal business operations (such as illegal currency exchange and illegal provision of payment settlement services) and illegal use of information networks. If the exchange is used by others as a tool for money laundering or concealing criminal proceeds, it may also become an accomplice to other crimes, posing a high criminal risk.

Are there risks in long-term use of Kraken?

Do partners face risks in long-term use of Kraken? Can "frozen friends" consider Kraken as a safe withdrawal channel in the future? These are likely concerns for partners.

First, we need to reiterate: the 9.24 Notice prohibits only the provision of cryptocurrency financial services or other business services within China or to Chinese residents, but it does not prohibit Chinese residents from holding and engaging in occasional small-scale cryptocurrency trading activities. Therefore, even if partners use Kraken for normal deposit and withdrawal activities, it does not constitute illegal or criminal behavior, which should be reassuring.

As for whether it is feasible to use this channel long-term, the Sa Jie team believes that, as mentioned earlier, Kraken's operations in China are inherently illegal financial activities that may involve various crimes and are likely to face regulatory intervention in the near future. Thus, while "frozen friends" can use it as a withdrawal channel for now, the Sa Jie team does not recommend long-term use.

However, it should be noted that Kraken, as a regulated cryptocurrency exchange abroad, generally has good compliance regarding fund channels. So far, there have been no reported cases of accounts or USDT being frozen due to using this exchange. The likelihood of funds exchanged through Kraken being frozen by public security after being transferred to China is also relatively low.

03. In Conclusion

The Sa Jie team advises all friends, both new and old, not to imitate Kraken's reckless engagement in cryptocurrency-related financial activities within China. Currently, Kraken still operates in a phase of stealthily expanding during a regulatory gap, and it is only a matter of time before it is discovered.

At the same time, we must recognize that Kraken has certain peculiarities. Due to its former executives potentially securing key positions in the future "understanding king" government, combined with its financial contributions during the "understanding king" campaign, Kraken has the potential to become one of the future American "red-top" exchanges.

Therefore, friends should not imitate this approach, as it is not replicable and could lead to crossing criminal red lines.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。