Author: BitpushNews Mary Liu

After U.S. President Donald Trump announced a 25% tariff on imported steel and aluminum, the cryptocurrency market experienced a slight decline on Tuesday.

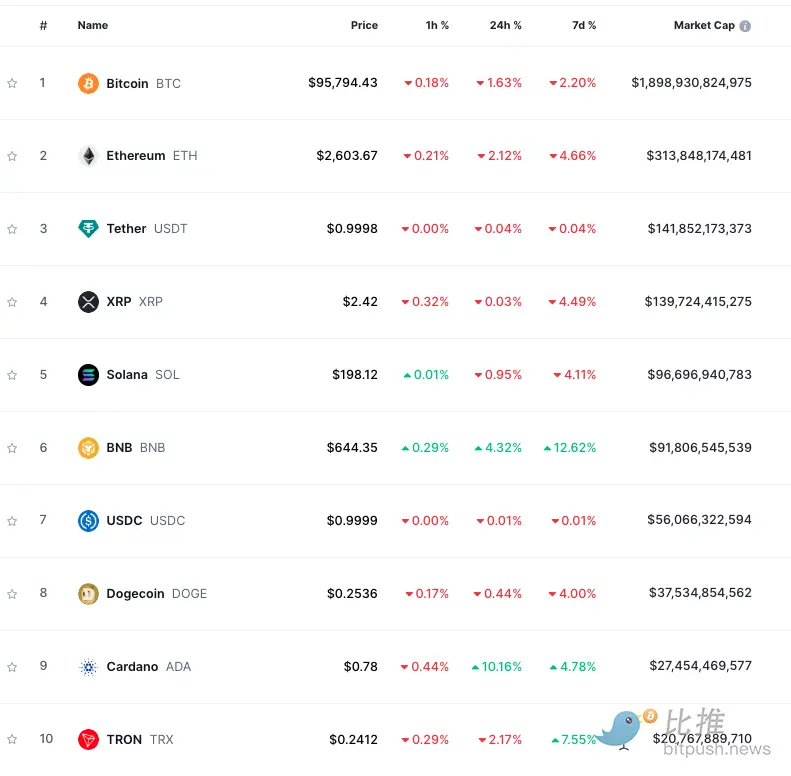

According to Bitpush data, Bitcoin fell 1.63% in the past 24 hours, currently trading below $96,000, while Ethereum dropped 2.12% to around $2,600. XRP and Solana (SOL) showed little volatility.

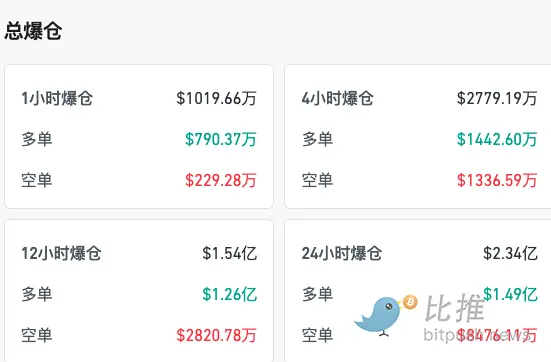

In the past 24 hours, the total market capitalization of cryptocurrencies decreased by 0.98% to $3.15 trillion. CoinGlass data shows that the total liquidation across the crypto market during the same period reached $233 million, primarily in long positions, amounting to about $149 million.

Trump's Tariffs and Macroeconomic Uncertainty

Tracy Jin, Vice President of the cryptocurrency exchange MEXC, attributed the market's movement mainly to the Federal Reserve's recent decision to maintain interest rates, along with broader macroeconomic concerns. In uncertain conditions, investors tend to seek safer assets like gold or the U.S. dollar, which usually coincides with a decline in interest in risk assets, including cryptocurrencies.

Matt Britzman, a senior equity analyst at Hargreaves Lansdown, noted in a report on Tuesday that history shows that trade war concerns triggered by tariff threats often "come quickly and go quickly, but this time, savvy investors are not so sure; currency, bond, and commodity traders are hedging their bets, with the dollar, U.S. Treasury yields, and gold prices rising as tensions escalate."

Joel Kruger, a currency strategist at LMAX Group, believes this is more about the market reacquainting itself with Trump's strategies rather than any substantial risks associated with extreme tariff measures.

Joel Kruger stated, "While the new announcement may bring short-term volatility, we believe this risk will not trigger any significant turmoil, and we expect crypto assets to continue to receive good support from medium to long-term participants looking to buy on dips."

$92,000 Support Level Becomes Key

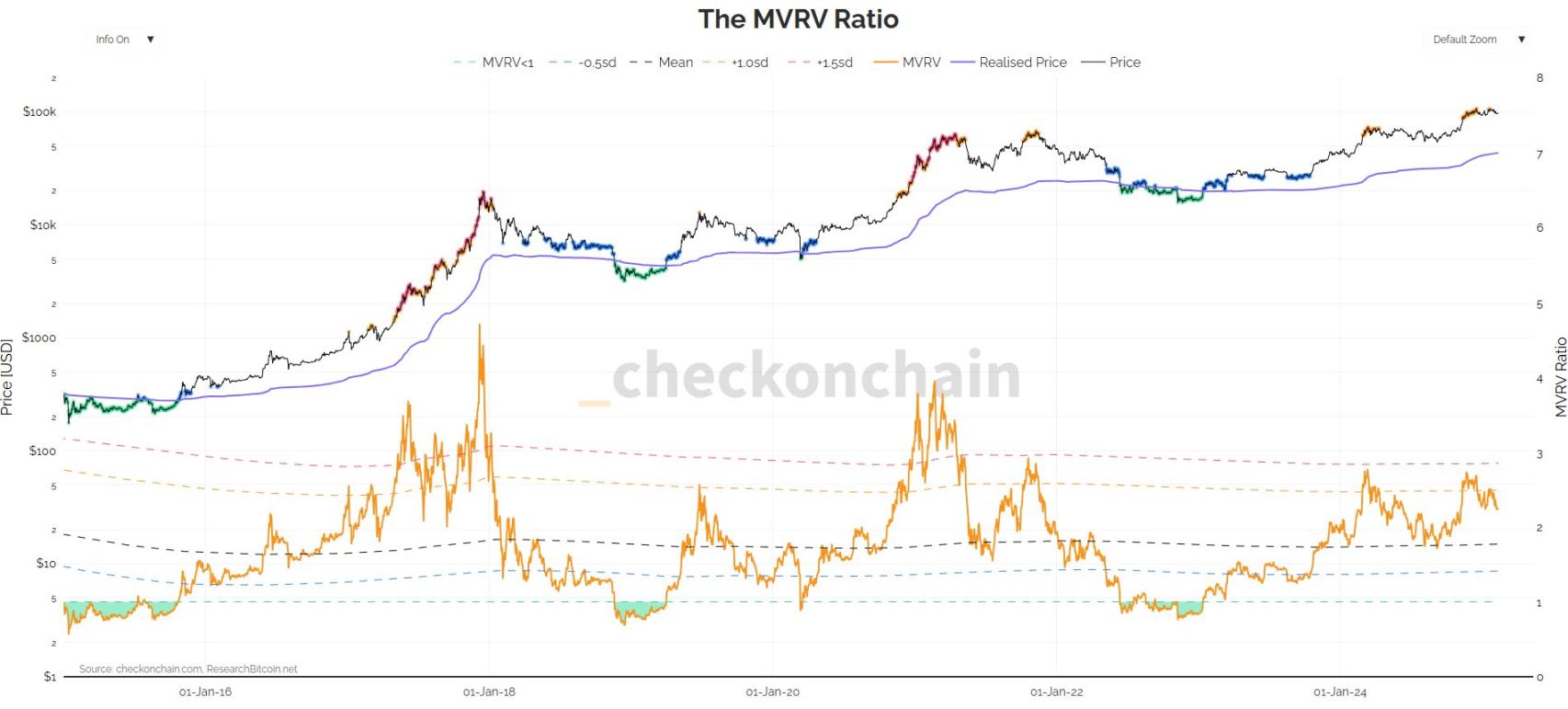

Checkonchain data shows that the market value to realized value ratio (MVRV) for short-term holders (STH) has dropped to 1.05.

MVRV is a key indicator of Bitcoin holders' profitability. When MVRV is above 1, it indicates that investors are still in profit; below 1 means investors are at a loss. The current MVRV has fallen to 1.05, indicating that the profit margin for short-term holders is shrinking. If MVRV continues to decline, it could put more pressure on Bitcoin's price, as it means more short-term holders are approaching the breakeven point.

Currently, MVRV remains above 1, indicating that selling pressure from short-term holders is not yet significant. However, attention should be paid to the cost basis of short-term holders, which is around the $92,000 level. This price point is a key support level for Bitcoin, reflecting the average cost at which short-term investors purchased BTC. If Bitcoin's price drops towards $92,000, it may trigger more selling, as short-term holders might choose to cut losses. If this support level is breached, market sentiment could further deteriorate, leading to accelerated price declines.

In addition to the MVRV indicator, liquidity zones are areas where a large number of orders are concentrated, typically acting as support or resistance. Bitcoin has recently tested lower points multiple times to absorb liquidity, currently hovering below $94,000, which is also an important liquidity area. If this pattern continues, Bitcoin may further test the $92,000 level. If it fails to hold this key support level, selling behavior from short-term holders may intensify downward pressure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。