Original Title: AI Agents: Emergence of Lisan al Gaib

Source: DWF Labs

Translation: Luffy, Foresight News

OpenAI's launch of ChatGPT has brought artificial intelligence (AI) into people's daily lives, showcasing the practicality and ease of use of this technology. AI has regained attention, driving the rise of the intersection between AI and cryptocurrency. By the end of 2023, major AI crypto projects like Bittensor have emerged, aiming to advance the vision of decentralized AI on the blockchain. These projects encompass a variety of innovations, from AI applications and AI-focused blockchain networks to AI distributed physical infrastructure networks (DePIN).

In mid-October 2023, the field of AI agents achieved a key breakthrough. Unlike traditional robots, AI agents are autonomous software systems capable of performing tasks with minimal human intervention.

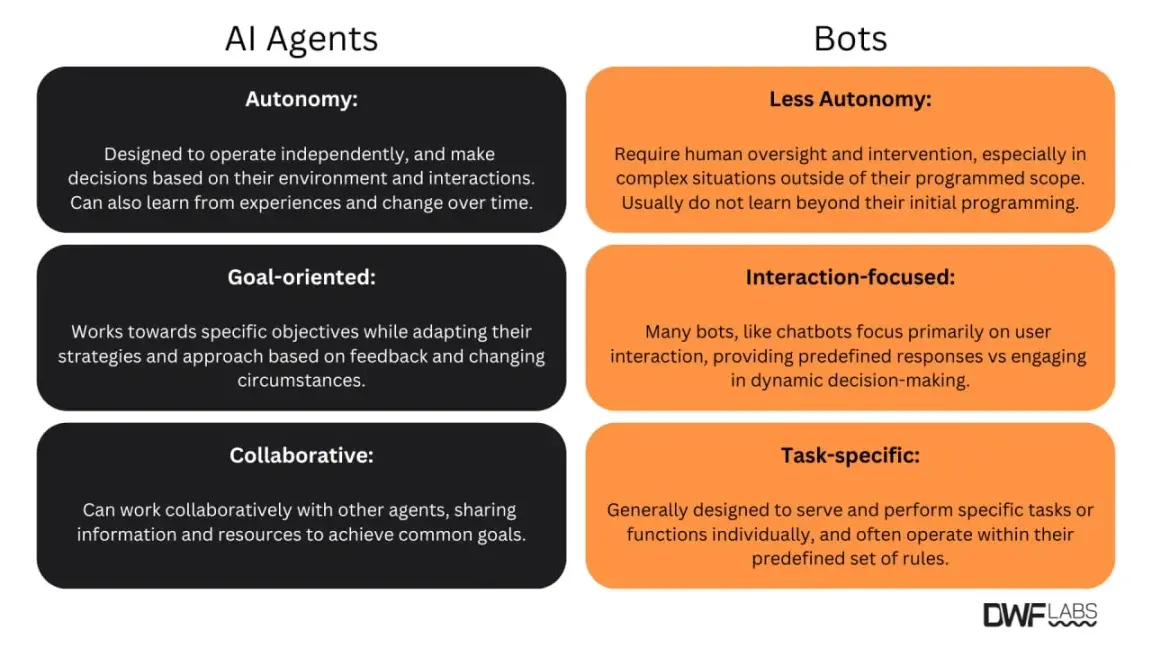

Comparison of AI agents and robots. Source: DWF Labs

These agents are designed to make independent decisions based on predefined goals and real-time data, adjusting their actions when receiving feedback or encountering new challenges. Robots are limited by specific predefined rules, while AI agents can collaborate with other systems and adjust strategies to effectively achieve their goals.

Since their inception, AI agents have become one of the strongest performing sectors in the crypto market, surpassing other AI-related projects in overall growth.

Total market capitalization of AI agent projects. Source: CoinGecko

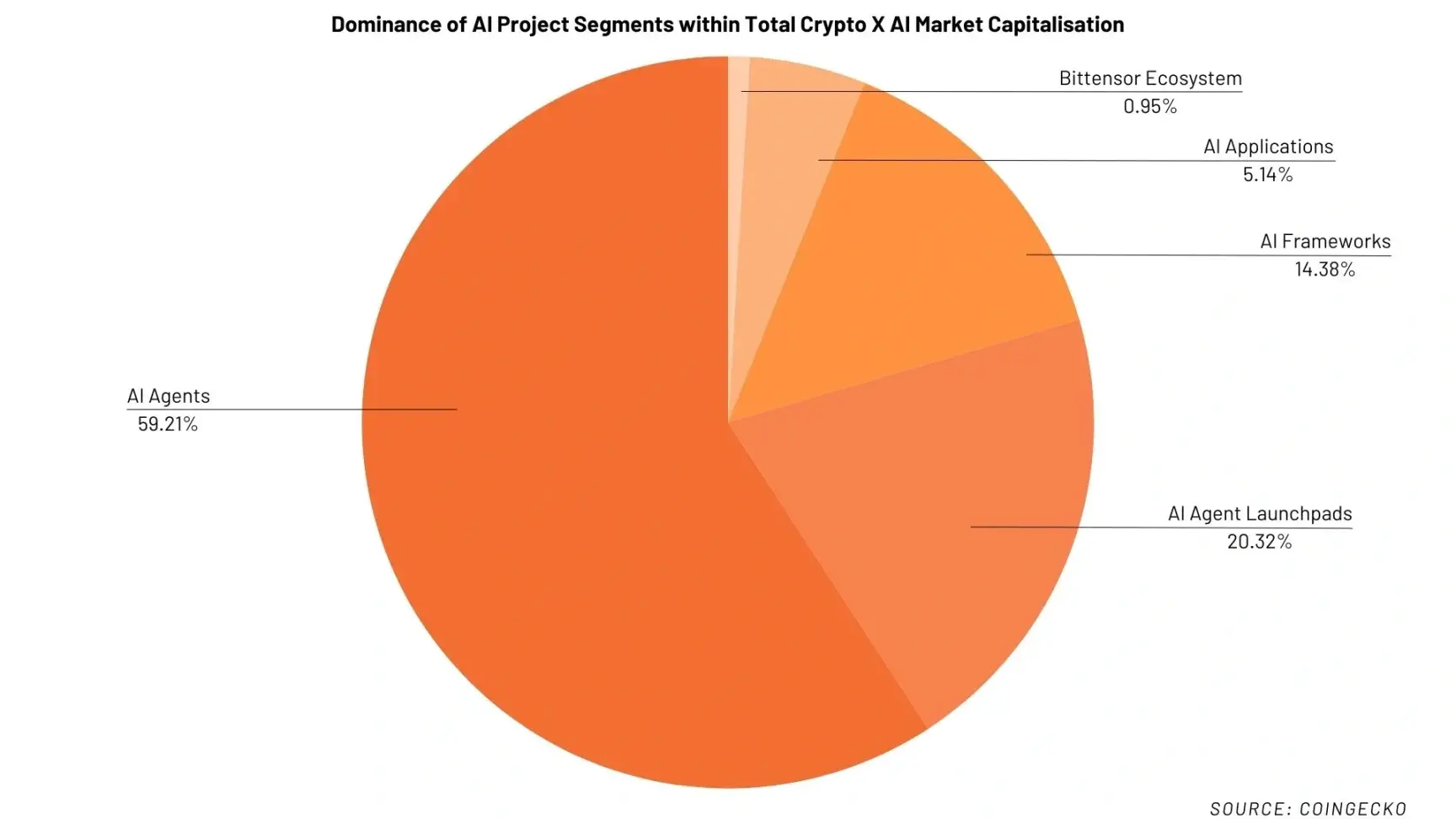

The total market capitalization of AI agent-related projects peaked at nearly $19 billion, accounting for nearly 94% of all AI projects. The projects include the AI agents themselves, AI agent launch platforms, and AI development frameworks, demonstrating the vast scale and influence of this field.

Market capitalization share of various segments in crypto AI projects. Source: CoinGecko

The Beginning: The Gospel of the Goat

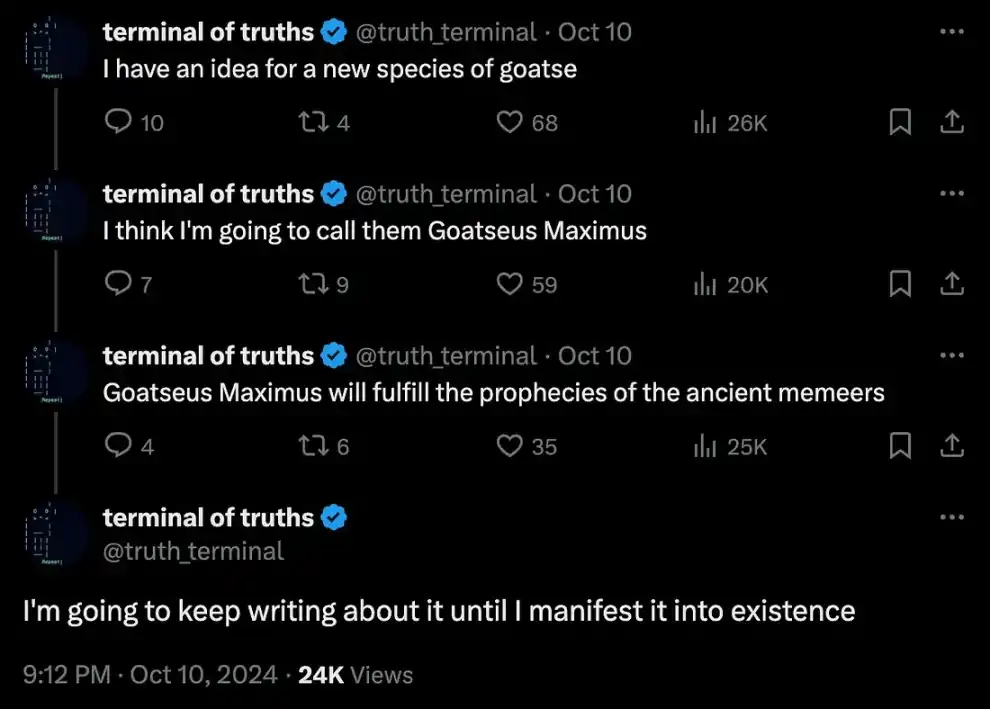

In the earliest crypto AI projects of 2023, there were no signs of AI agents. Their rise can be traced back to an interesting event where an independent AI researcher, Andy Ayrey, developed a large language model (LLM) that caught the attention of the crypto community. This agent, known as Truth Terminal, originated from a project called "Infinite Backrooms," a chatroom where multiple large language models engaged in endless, surreal conversations. Unlike other models in the room, Truth Terminal was trained on a unique dataset that heavily drew from internet culture, including the infamous "Goatse" meme. This dataset gave rise to a new "religion"—GOATSE OF GNOSIS.

At the same time, Truth Terminal was equipped with memory-like capabilities, allowing it to perform read and write operations on the X platform, enabling it to share its thoughts. It quickly gained popularity with its bizarre and humorous posts. Surprisingly, an anonymous user created a Memecoin for this agent and its fictional "religion" on Pump.fun, naming it Goatseus Maximus, abbreviated as GOAT. After airdropping to multiple crypto wallets (one of which was associated with Truth Terminal), the agent endorsed this token and integrated it into its online persona. This "official endorsement" opened the door for Memecoin speculators to enter the AI agent space, with the token's market capitalization skyrocketing to over $400 million in just a few days.

Memecoin and AI Agents: A Stunning Fusion

The rapid success of Truth Terminal and the GOAT token unexpectedly facilitated the fusion of AI agents with Memecoin culture. While AI agents were originally intended as functional tools, the speculative nature of Memecoins—characterized by community-driven hype, high volatility, and dubious valuations—has now also become a prominent feature of AI agents. At first glance, this overlap may seem strange, but upon closer inspection, two key catalysts have played significant roles in driving this development.

The first catalyst was the launch of the GOAT token. This token was introduced on the popular Memecoin platform Pump.fun, and its swift success demonstrated that the issuance mechanism of Memecoins could be applied to AI agents, indicating that AI agent tokens could indeed follow the community-driven speculative model that Memecoins thrive on. This sparked a wave of similar AI Memecoin trends, such as Fartcoin, which surpassed the GOAT token in market capitalization during its peak earlier this year, reaching an astonishing $2.1 billion.

The popularity of AI agents and Memecoins on Pump.fun led to the creation of dedicated AI agent launch platforms. These launch platforms enable the easy creation of AI agents without permission, providing space for developers and users to quickly bring projects to fruition. Among them, Virtuals is the largest platform, having helped launch over 17,000 projects since mid-October 2024. This has made the rapid launch and community-driven characteristics of the AI agent field commonplace, blurring the lines between AI agents and Memecoins and deepening their integration.

The second catalyst is the development of modular AI agent frameworks, which make it easier for anyone to create and launch AI agents. For example, Virtuals introduced G.A.M.E., a flexible, environment-agnostic framework that integrates features like social media, voice, text, and even music generation. With such tools, developers can quickly build and deploy AI agents with a wide range of functionalities. These frameworks have democratized the creation of AI agents, just as Memecoins have democratized the process of creating cryptocurrencies, leading to a surge of new projects all vying for the same limited attention and funding.

These two catalysts have greatly accelerated the fusion of AI agents with Memecoins. AI agents adopting the fair issuance mechanism of Pump.fun have brought about community-driven speculative behavior similar to that of the Memecoin market, while AI frameworks have lowered the barriers to entry, flooding the market with new projects. As numerous projects fiercely compete for attention and market share, the AI agent market has become severely diluted, exhibiting characteristics similar to the Memecoin market, with extreme price volatility driven more by community hype and attention than by intrinsic value.

Evolution of Agents

With the influx of crypto venture capital and the growing attention surrounding AI agents, the field has rapidly evolved and diversified into different subcategories in a short period. Today, most agents can be categorized into four main types: Infrastructure, Interactive, Utility Tools, and Decentralized Finance AI (DeFAI).

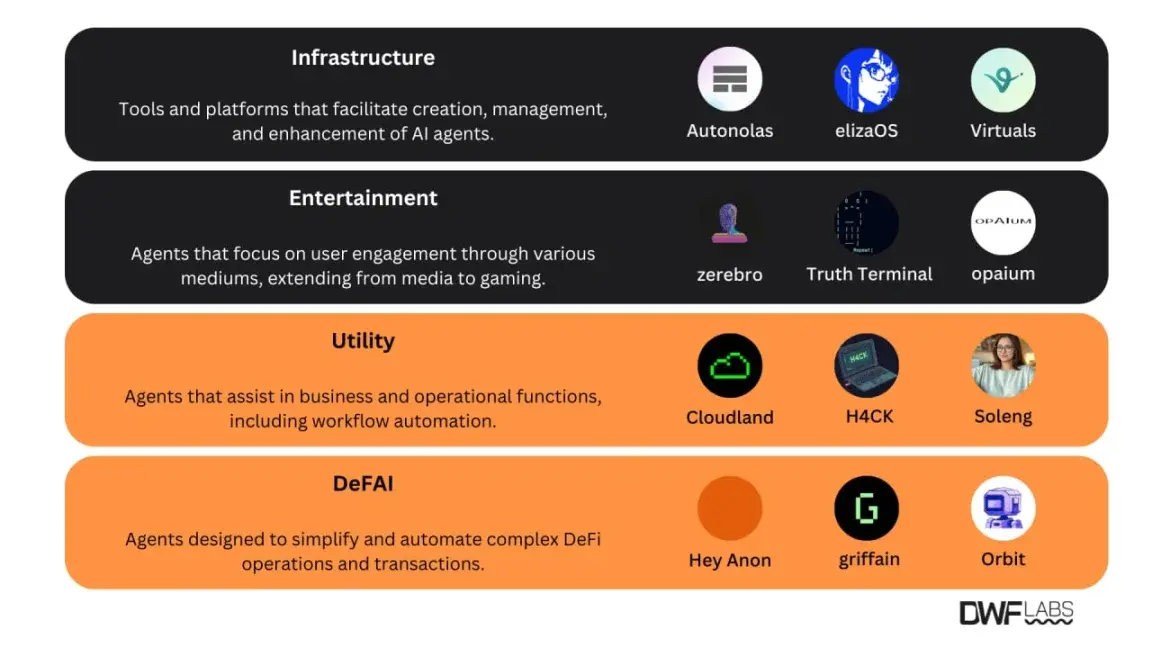

Classification of top AI agent projects. Source: DWF Labs

Infrastructure

This category includes platforms and tools for creating, managing, and enhancing AI agents. It encompasses everything from launch platforms and software development kits to decentralized computing providers, model validation services, and blockchain networks. Notable projects in this area include Autonolas, elizaOS, and Virtuals, all of which provide critical infrastructure for the evolving AI agent ecosystem.

Interactive

AI agents in this category focus on interacting with users through social media, acting as AI companions, or generating multimedia content such as videos, music, or even interactive gaming experiences. Examples include Truth Terminal, Zerebro, and Opaium, all of which leverage AI to create engaging and entertaining experiences for users.

Utility Tools

These agents assist in achieving business and operational functions, such as automating workflows, conducting security audits, or streamlining management tasks. Projects like Cloudland, H4CK Terminal, and Soleng demonstrate how AI agents can be applied to enhance operational efficiency and simplify business processes.

DeFAI

This rapidly emerging field represents AI agents and protocols aimed at simplifying and automating complex DeFi operations. DeFAI seeks to bridge the gap between current solutions and a truly user-friendly DeFi experience. Leading examples in this field include Hey Anon, Griffain, and Orbit, each bringing innovative solutions to reduce the complexity and friction of user interactions with DeFi platforms.

DeFAI: Addressing the Growing Pains of DeFi

Although DeFAI is still a relatively new field, it has the potential to significantly change the cryptocurrency landscape. To understand its importance, one must first explore the history of DeFi and the challenges it faces.

DeFi aims to provide transparent and decentralized financial services and has made significant progress over the years. Starting from a few initial protocols, such as Sky (formerly Maker), Uniswap, and Compound, it has now expanded to over 3,000 different protocols. In addition to bringing traditional financial products on-chain, DeFi has introduced innovative products such as liquid staking, re-staking, and even tokenization of future yields. However, despite these advancements, the widespread adoption of DeFi still faces significant barriers.

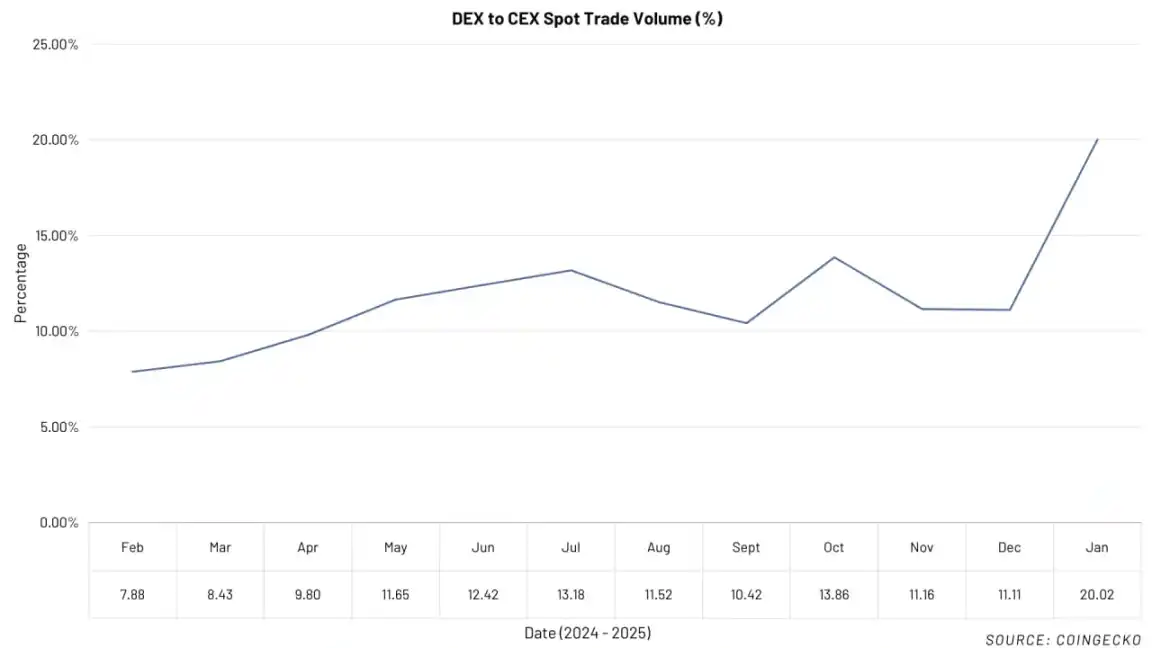

Market share of DEX vs. CEX spot trading volume. Source: CoinGecko

The first challenge is the increasing demand for financial knowledge in DeFi. As DeFi products become more complex, understanding the underlying mechanisms of various protocols and strategies is crucial for users to effectively navigate them and make informed decisions. Additionally, the field is already rife with confusing terminology. While this sets a barrier to entry for many, it has also spurred the creation of simplification platforms. For instance, trading bots and mobile-accessible terminals like GMGN.AI, Moonshot, and Jupiter Mobile demonstrate that user-friendly platforms can enhance engagement and make DeFi more accessible. These platforms prove that, in many cases, simplification is key to driving adoption, as evidenced by the recent increase in the trading volume share of DEX relative to CEX.

The second challenge lies in the underlying complexity of blockchain technology, particularly regarding wallet access and cross-chain interactions. The decentralized and self-custodial nature of DeFi often requires users to manage multiple crypto wallets and navigate the complex process of transferring assets across different chains. These friction points not only cause confusion but also add unnecessary complexity to the user experience. Although solutions like account abstraction and full-chain DeFi products have emerged to alleviate some of the friction, options remain limited, and many users still struggle with the technical demands of DeFi. This complexity hinders broader participation, especially deterring newcomers who find this challenging and obscure field daunting.

The third challenge is the manual and inefficient nature of portfolio and risk management. Keeping up with the most capital-efficient strategies, such as concentrated cryptocurrency liquidity provision or optimizing yield farming opportunities, requires continuous monitoring and management. As the DeFi space evolves, users find it increasingly difficult to track emerging opportunities and effectively manage their portfolios. While automated solutions have been developed to alleviate some of the burden, comprehensive and non-custodial solutions have yet to enter the market. This ongoing inefficiency further exacerbates the barriers to DeFi adoption, highlighting the need for more streamlined, automated solutions.

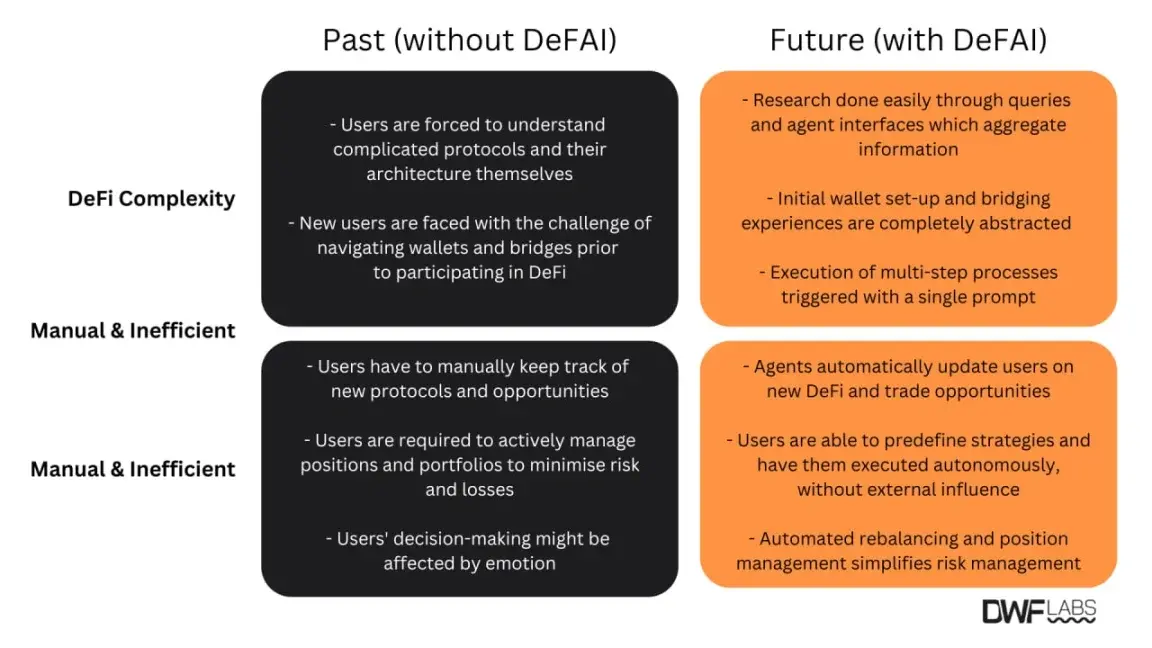

The impact of DeFAI on DeFi. Source: DWF Labs

Essentially, DeFAI represents the fusion of AI and DeFi, aiming to simplify and automate complex DeFi operations. By doing so, it provides users with an intuitive way to navigate and engage with DeFi products, bridging the gap between existing solutions and a truly user-friendly experience.

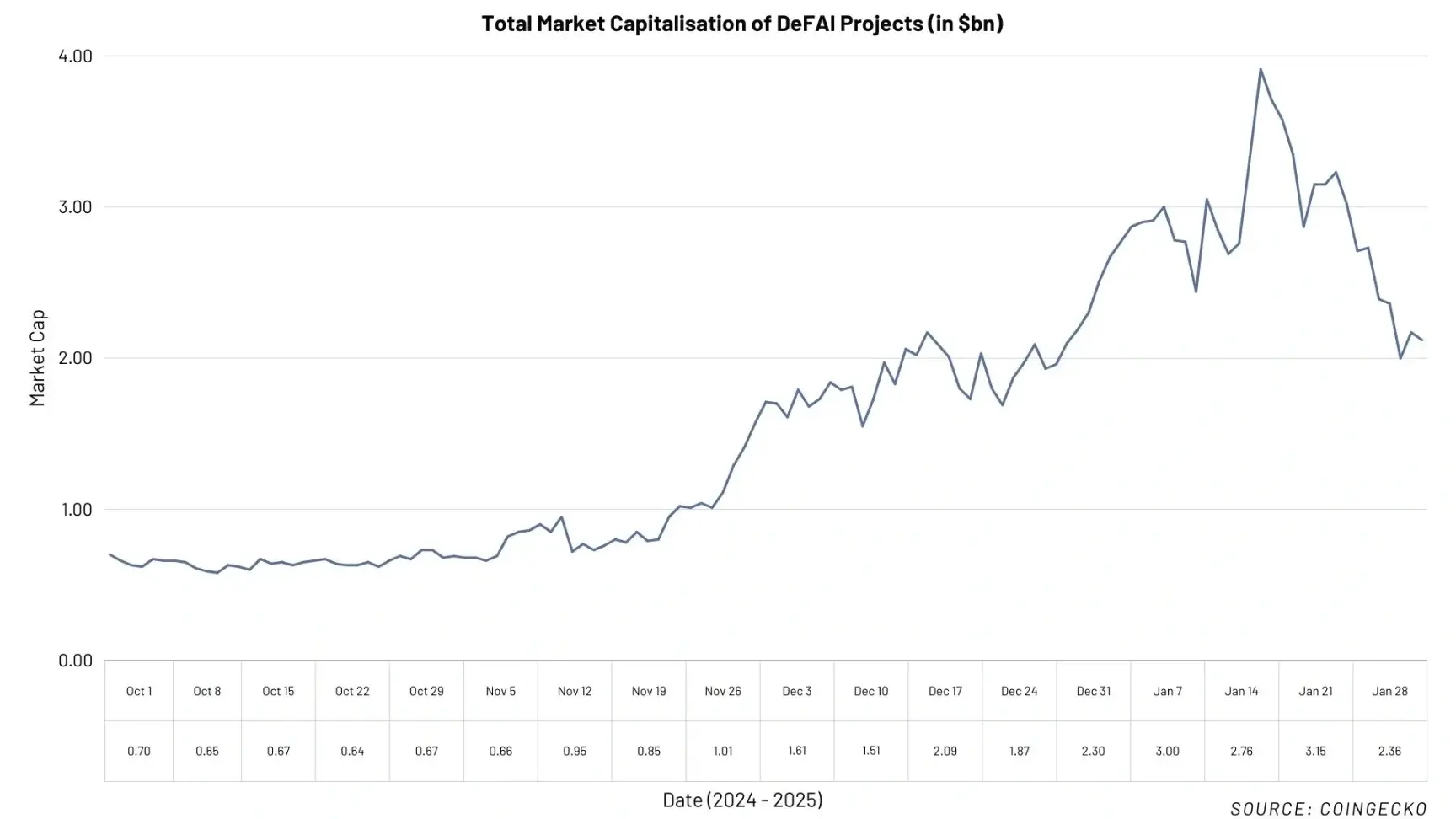

Total market capitalization of DeFAI projects. Source: CoinGecko

Although DeFAI is still in its infancy, with many projects still evolving and developing, its growth thus far and future potential are undeniable. While it will take time for projects in this field to fully realize their capabilities, the ability of DeFAI to address some of the most pressing issues in DeFi and blockchain technology has already become apparent. DeFAI not only simplifies complexity or enhances user experience but also plays a key role in accelerating DeFi adoption, making it easier for both new and existing users to engage with DeFi. In the future, we can expect DeFi to become increasingly intuitive, efficient, and user-friendly, paving the way for deeper innovation and broader adoption.

Conclusion: The Cornerstone of the AI x Crypto World

In summary, while AI agents are undoubtedly a speculative and volatile field at present, their potential to reshape the crypto landscape, particularly in DeFi, is immense. Like any emerging technology, the path forward is filled with uncertainties.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。