Author: Jack Inabinet, Bankless

Source: Bankless Official Website

Translation: Deng Tong, Jinse Finance

After more than a decade of regulatory uncertainty and four tumultuous years under the Biden administration, the IPO window for cryptocurrencies has opened, thanks to the inauguration of the first U.S. president to support cryptocurrencies!

It is reported that several large cryptocurrency companies are currently preparing to go public. Will this ultimately become the moment when cryptocurrencies take over Wall Street? Here are the top five contenders for IPOs in 2025 that we are watching.

Gemini

Founded in 2014 by billionaire Winklevoss twins, Gemini is a cryptocurrency exchange, custody provider, and stablecoin issuer. The company first expressed its intention to go public over four years ago in January 2021.

After the catastrophic collapse of FTX, Gemini was forced to halt withdrawals from its "Earn" program, which had provided loans to the bankrupt exchange through a third-party lender named Genesis. Gemini later reached a $50 million settlement with New York State regarding this matter and was fortunate enough to return 100% of the funds owed to depositors.

Although the subsequent arrival of the cryptocurrency bear market led to a valuation crash and forced Gemini to shelve its IPO ambitions, recent reports from Bloomberg indicate that the Winklevoss twins are considering an IPO in 2025.

Gemini's only external funding was announced in November 2021, raising $400 million at a valuation of $7.1 billion.

Circle

No list of top IPO contenders in cryptocurrency would be complete without Circle. The company is the largest audited stablecoin issuer, with $56 billion in dollar-pegged assets flooding all major existing blockchains!

Circle terminated its plans to go public through a SPAC merger with Concord Acquisition Corp in December 2022, but disclosed in January 2024 that it had "secretly" submitted a U.S. IPO application to the Securities and Exchange Commission. Depending on "market and other conditions," the company's IPO could occur at any time after the SEC completes its registration review process.

In September of last year, Circle CEO Jeremy Allaire announced plans to relocate the company's headquarters to the heart of New York City's financial district, with offices occupying an entire floor on the 87th floor of the iconic One World Trade Center.

Since its founding in 2013, Circle has raised approximately $1.5 billion in multiple funding rounds, with a valuation of $9 billion before abandoning the SPAC merger.

Kraken

Shortly after the competitive cryptocurrency exchange Coinbase went public with a valuation of $47 billion in April 2021, Kraken CEO Jesse Powell announced plans to list the exchange in the second half of 2022.

Although the company's IPO ambitions seemed to fade after Powell resigned in September 2022, Bloomberg reported last June that Kraken was seeking to raise $100 million through a pre-IPO funding round and confirmed last month that it had secured $27 million in primary capital from this issuance.

Kraken has undergone over 20 rounds of independent financing and was reportedly valued at $20 billion during its Series D funding round near the peak of the cryptocurrency market in 2021.

Digital Currency Group

Digital Currency Group is one of the oldest venture capital groups focused on cryptocurrency and has been an indispensable part of the crypto capital markets since its inception!

As of early 2023, DCG held stakes in over 160 portfolio companies but was forced to divest some of these stakes (including its entire interest in cryptocurrency publisher CoinDesk) to raise funds through its lending subsidiary Genesis to pay off bad loans from FTX. Notably, cryptocurrency asset management company Grayscale remains a wholly-owned subsidiary of Digital Currency Group.

While a $700 million equity financing in November 2021 valued DCG at $10 billion, the company's recently disclosed fourth-quarter 2023 shareholder letter marked its valuation down to just $4.4 billion; this figure has undoubtedly increased in the following months as the crypto market rebounded.

Consensys

Consensys was founded in 2014 by Ethereum co-founder and former Goldman Sachs vice president Joseph Lubin. Initially an independent software engineering company, it supports Ethereum development through third-party applications (such as its popular MetaMask wallet).

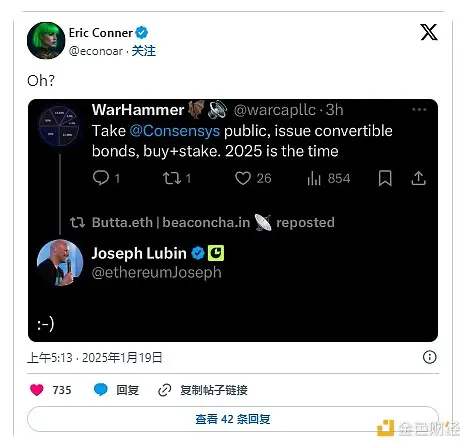

Although Consensys has not officially announced an IPO, Lubin responded to a tweet with a smiley emoji in January 2025, which urged Consensys to go public and adopt an Ethereum reserve accumulation strategy, possibly indicating that an IPO is on the horizon.

Consensys last raised funding in a Series D round in 2022, securing $450 million at a valuation of $7 billion.

In addition to Circle and Kraken, cryptocurrency-native asset management firm Bitwise also pointed out in its "2025 Ten Predictions" report that infrastructure providers Anchorage Digital, tokenization company Figure, and analytics service Chainalysis are major candidates for upcoming IPOs.

Reportedly, cryptocurrency exchange Bullish Global, backed by Peter Thiel, acquired DCG's ownership in CoinDesk and is currently considering collaborating with Jefferies Financial Group and JPMorgan to develop a public listing strategy; meanwhile, the SEC's impending resolution of the XRP lawsuit (currently on appeal in the Second Circuit) may pave the way for Ripple's IPO.

Buckle up; this year could be significant.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。