KOLs have influence, and some of their actions can impact projects. Typically, a project involves KOLs buying in first, then sharing in their communities, and finally posting on public channels like Twitter. If we have the addresses of KOLs, we can know what they bought, when they increased their positions, and when they took profits or cut losses.

This article shares some methods for finding KOL addresses and how to use these addresses.

1. Using gmgn

gmgn is a comprehensive platform with trading, data analysis, monitoring, and other features, run by Chicken Brother @haze0x. Website: https://gmgn.ai/?ref=sxsy7oyJ

On gmgn, users can bind their Twitter accounts to addresses, and we can use this feature to find KOL addresses.

For example, if we want to know the address of 0xsun, we can enter "0xsun" in the search box, and at the bottom of the search results, 0xsun's address will appear, as shown in the image.

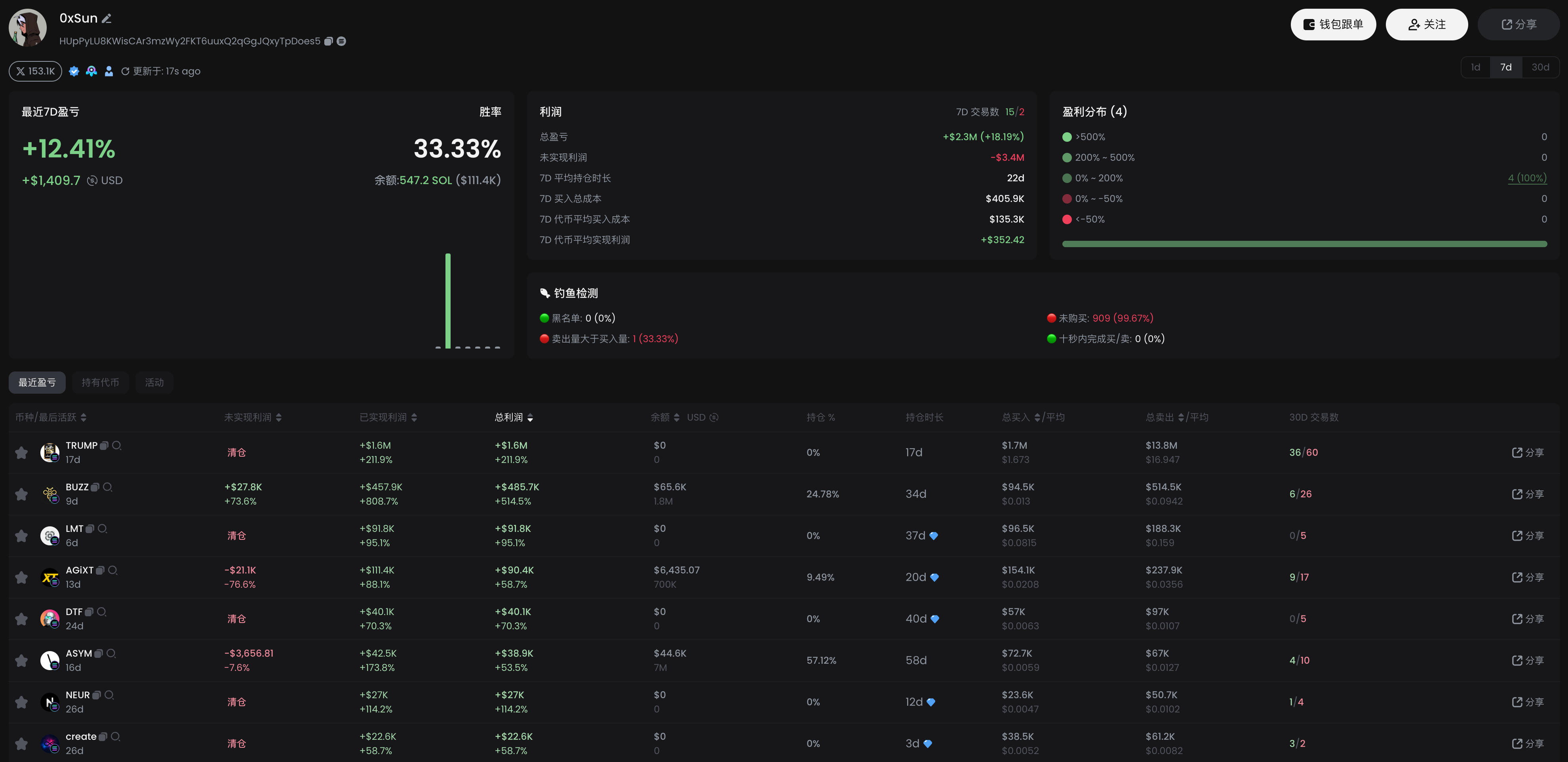

By clicking on the address in the search results, we can see detailed information about 0xsun's address, as shown in the image. We can see his Twitter follower count, which links to his Twitter; we can see his win rate; and we can see his profit and loss over the last 7 days, with a profit of 2.3 million USD.

Thus, when we want to know a specific KOL's address, we can search on gmgn to see if he has bound an address, and if so, we can find it.

2. Using chain.fm

chain.fm is an on-chain monitoring platform where users have uploaded many smart money addresses, including many KOL addresses, run by @zen913.

Before the New Year, chain.fm launched a search function that supports keyword searches, allowing us to use this feature to find KOL addresses.

I mentioned this method in my tweet https://x.com/0x_zibu/status/1882345639218118884.

There are two ways to find KOL addresses using chain.fm:

1. Directly search for specific KOL names

Continuing with the example of 0xsun, we can enter "0xsun" in the input box and see several addresses appear, as shown in the image.

The first address in the search results is included in 426 channels, which likely means it is 0xsun's address. We can also verify on gmgn to see if 0xsun has authenticated this address.

2. Search using the keyword "KOL"

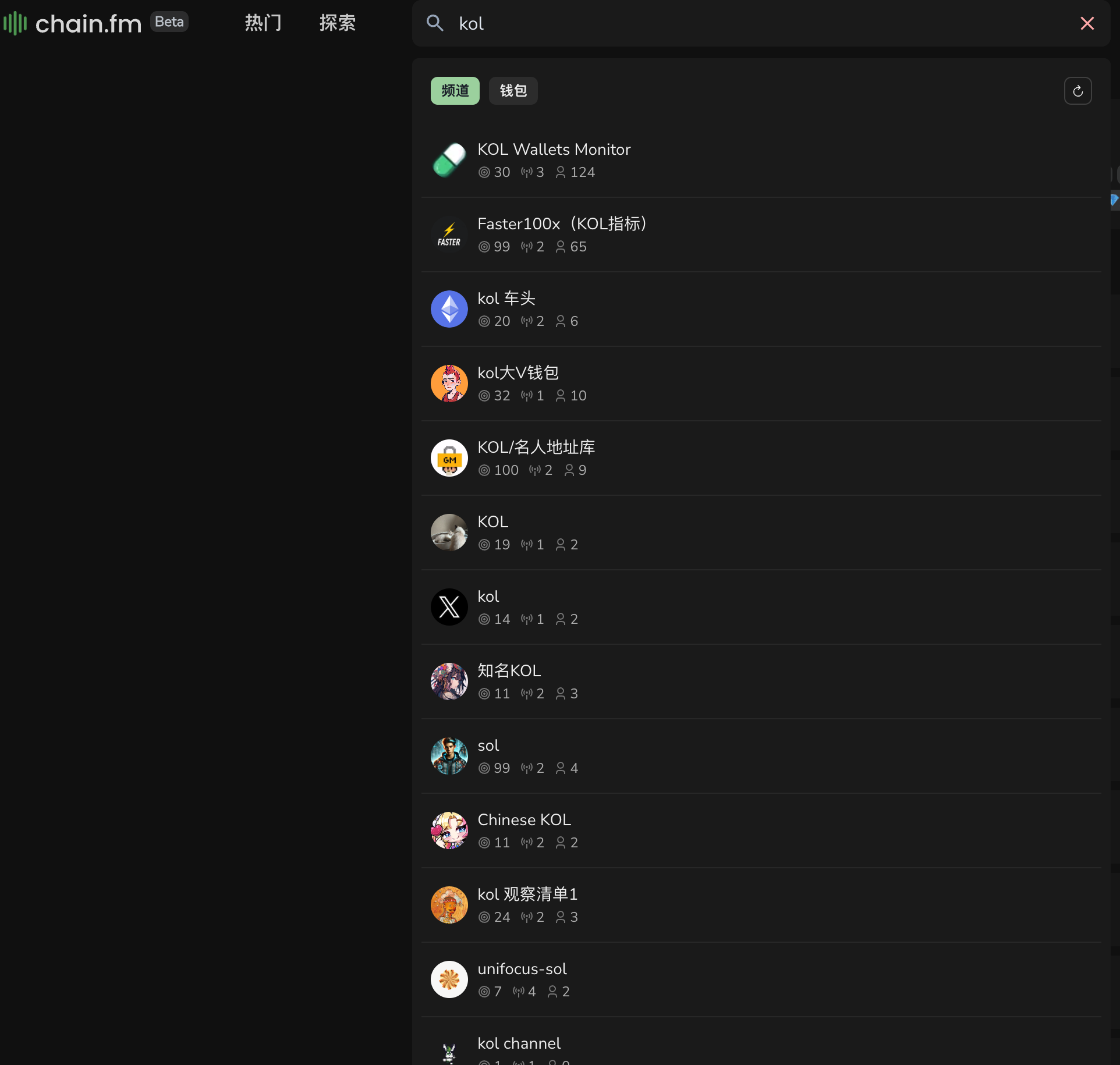

We can also enter the keyword "KOL" to find all related information on chain.fm, as shown in the image.

When we enter "KOL," it will find all related channels, which contain KOL addresses organized by the channel owners; we just need to verify their authenticity.

In the wallet options, using the keyword "KOL" will also find addresses with this information, as shown in the image.

The addresses found through chain.fm are based on what the channel owners uploaded, so we cannot guarantee 100% accuracy; we need to cross-verify with gmgn, Twitter, or other channels.

3. Analyzing clues based on Twitter

The above two methods are relatively simple; as long as you are willing to spend time organizing, you can find them. However, some KOLs do not actively disclose their addresses, in which case we need to find them through other means.

1. Clear sharing of trades

Some KOLs will share their trades in tweets, with specific transaction information such as transaction time, whether it was a buy or sell, transaction amount, and quantity of coins. This makes it particularly easy to find, as we have specific transaction information to filter through.

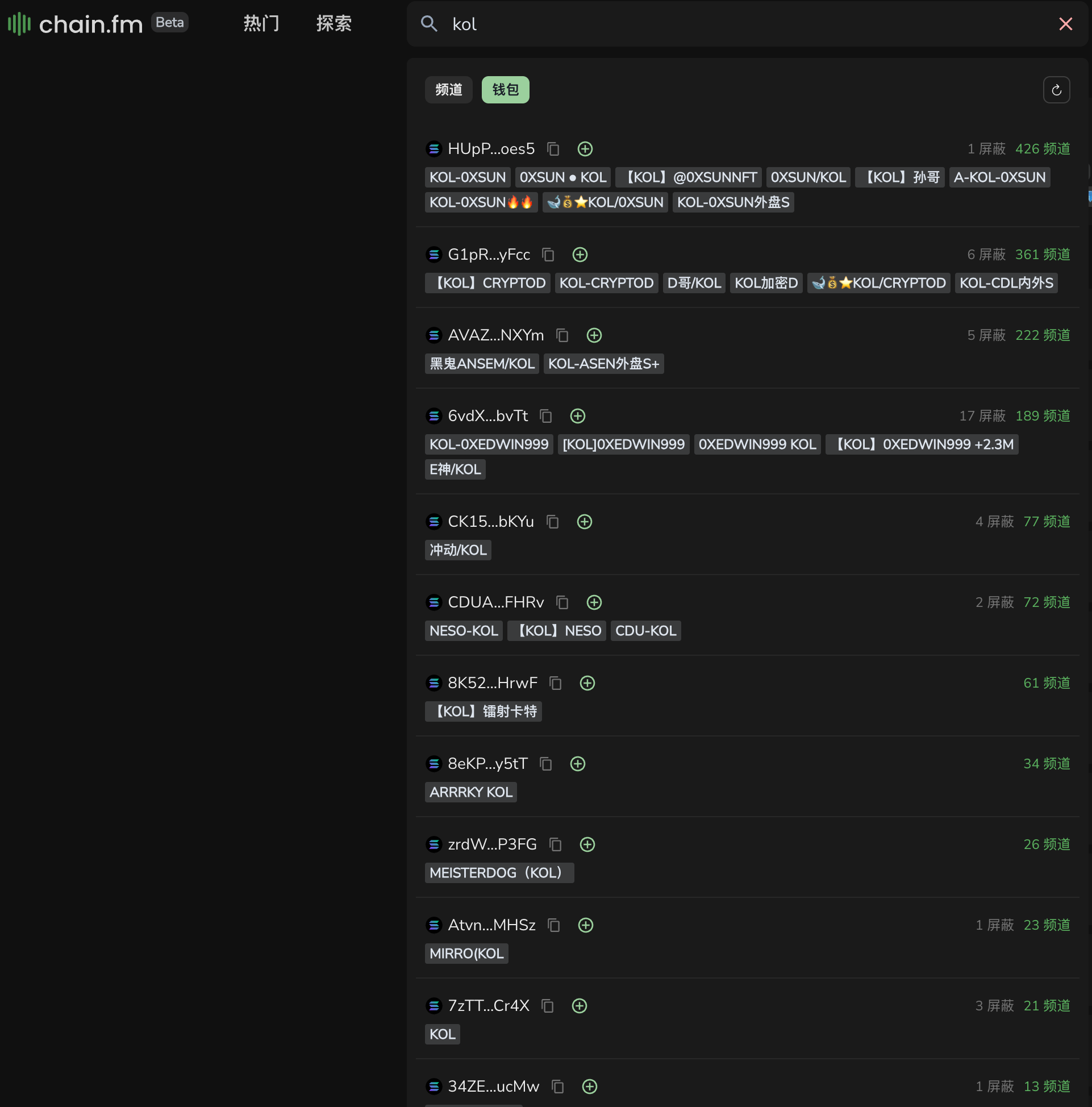

For filtering shared trades, I recommend using Eagle (https://dexscreener.com/), where we can filter based on transaction time, transaction type (buy or sell), transaction amount, and quantity of coins, as shown in the image.

Eagle has the most comprehensive manual filtering features among the tools I have used, unlike other tools where the filtering features are merely decorative, probably even the PM doesn't use them.

However, the downside of Eagle is that it cannot track trades on platforms like OKX that use aggregated routing; for those, we can only check on OKX's website (https://www.okx.com/zh-hans/web3).

2. Vague information

Sometimes KOLs may not directly share their trades on Twitter but might mention buying a certain coin at a specific market cap. In such cases, the information is limited, and we can only filter a rough range based on a single tweet; we may need to combine multiple tweets to filter out the specific address.

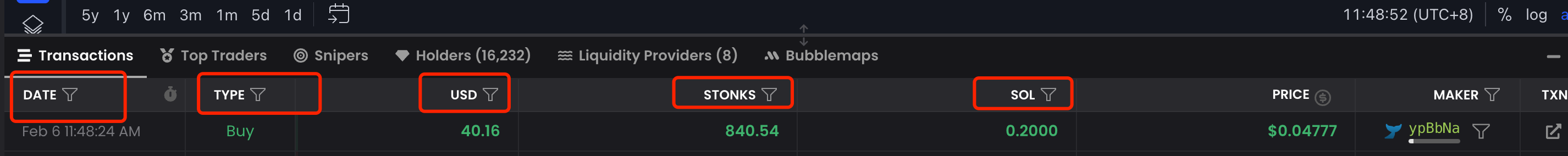

For example, the cycle hand cow shared the address situation of Burder yesterday, as shown in the image. How should we find this address?

First, we gather all valid information:

(1) The tweet was posted at 2.5 9:53.

(2) According to the tweet, Burder first bought $Ncat and $Noland, then bought $Calicoin.

(3) The image in the tweet provides rich information, as shown. We can see:

a. The holding quantity of $Calicoin is 4M.

b. The holding quantity of $Noland is 37.6M.

c. The holding quantity of $Ncat is 30M, but it only accounts for 57% of the holdings.

d. At the time of the screenshot, their holding duration was only 2 minutes.

(4) The opening time of $Calicoin is 2.5 8:23.

From the above information, we can deduce that Burder's trading time was between 8:23 and 9:53. Considering the image's holding duration of 2 minutes, the latest possible trading time could be 9:51. Since Burder was late in the tweet, the earliest trading time would be sometime after the opening, but we don't have detailed information on how long after, so we can only start filtering from 8:23.

With the above information, we can proceed as follows:

a. Write a script to fetch trading data.

We will extract all buy transactions for the three coins between 8:23 and 9:53, looking for addresses that bought all three coins within this timeframe, matching the order and quantity with the information we collected above.

b. Query using dune (https://dune.com/).

Compared to writing a script to fetch trading data, the data on dune is readily available. At this point, we can use AI to help write the dune query statement, filter out the addresses, and then manually verify them.

4. Analyzing address trading styles and win rates

After finding a KOL's address, we need to analyze it in detail. We should look at their trading style: do they prefer playing the first or second phase of the market; do they like to chase highs or ambush; how do they take profits and cut losses; what is their win rate; and what is their overall profit and loss situation.

Currently, good platforms for analyzing addresses include gmgn and debot.

1. gmgn

gmgn (https://gmgn.ai/?ref=sxsy7oyJ) offers rich data analysis with various metrics.

For example, for 0xsun's address, we can see his profit and loss over 1 day, 7 days, and 30 days, win rate, and total profit and loss. In the recent profit and loss section, we can see the trading coins over the last 30 days and sort them by various metrics. By clicking on a specific coin, we can also see detailed trading records, as shown in the image.

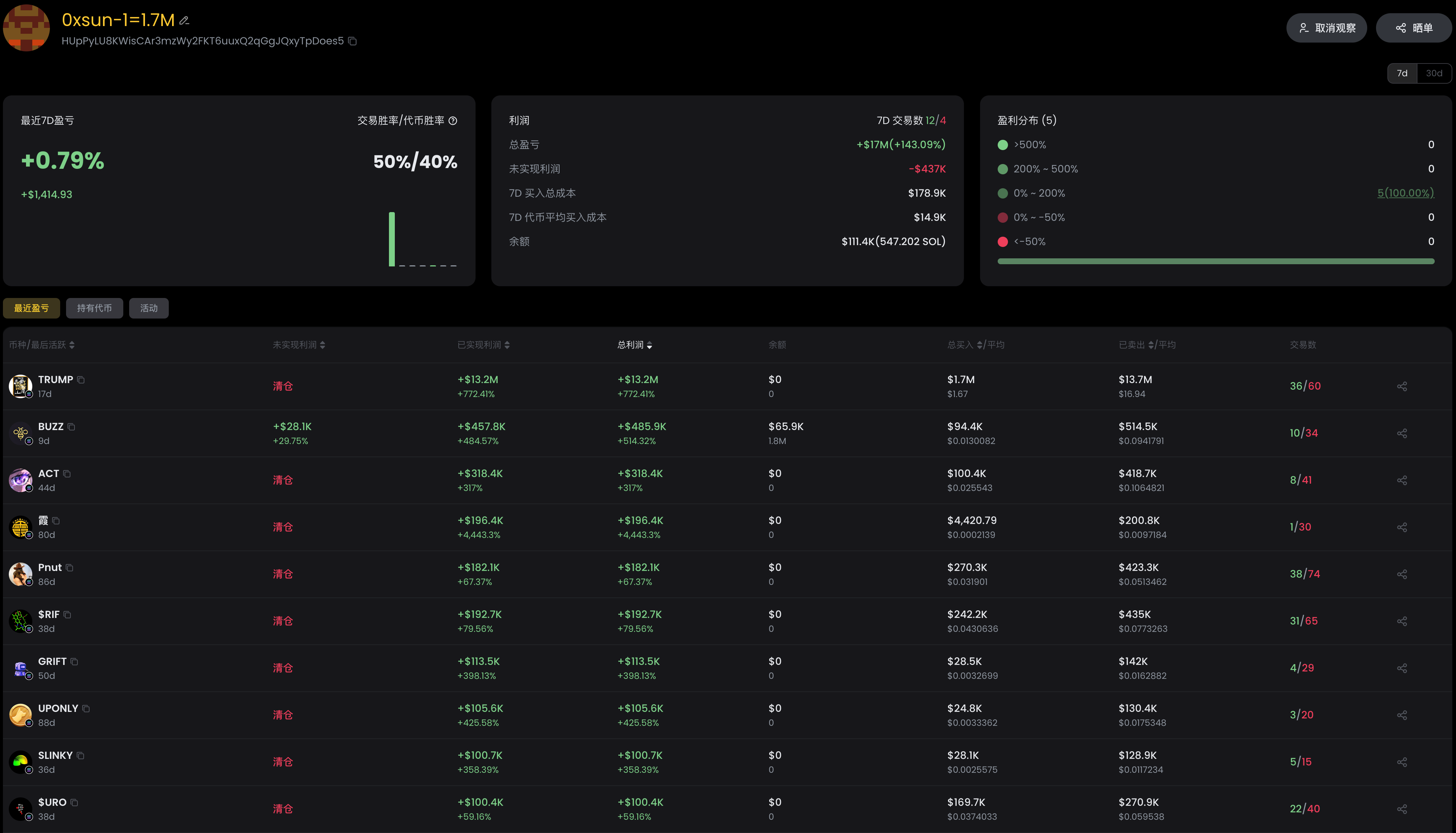

2. debot

debot (https://debot.ai?inviteCode=175623) has similar functionalities to gmgn, although the algorithms differ slightly, leading to some discrepancies in the displayed data. The data for 0xsun's address is shown in the image, which can be compared with gmgn.

As for which is better between gmgn and debot, my suggestion is to use both together for mutual reference, preventing the analysis from being affected by data loss or errors from a single tool.

5. Monitoring

After identifying KOL addresses and conducting data analysis, we need to label and categorize each address, then use tools to monitor these addresses. This way, when they make transactions, we can know immediately, ahead of the community and Twitter.

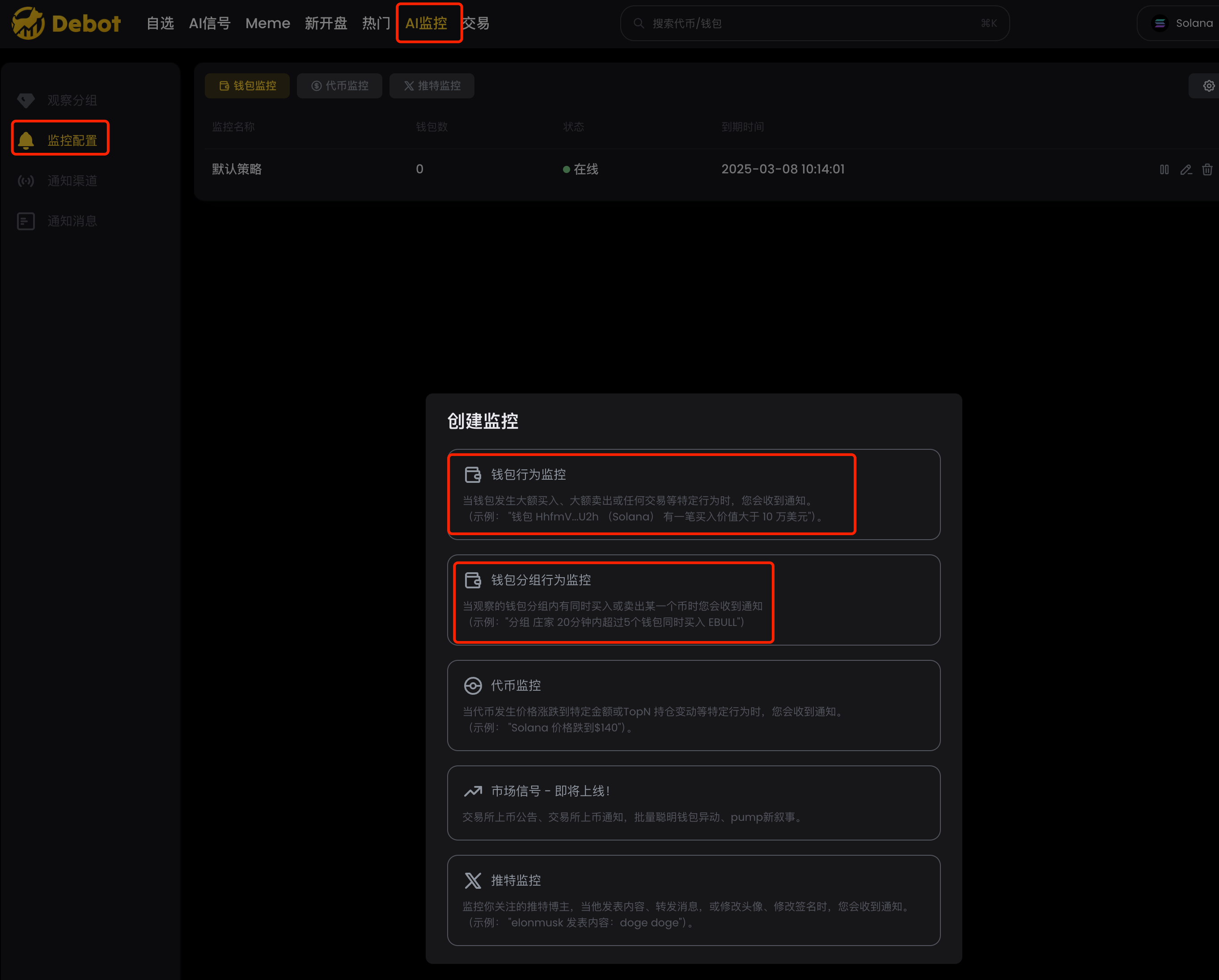

For monitoring, I highly recommend debot (https://debot.ai?inviteCode=175623), as it is currently the most feature-rich and granular monitoring product I have used. Its AI signals are also strong, and the trading experience is very smooth.

debot offers two types of wallet monitoring: wallet behavior monitoring and wallet group behavior monitoring, as shown in the image.

1. Wallet Behavior Monitoring

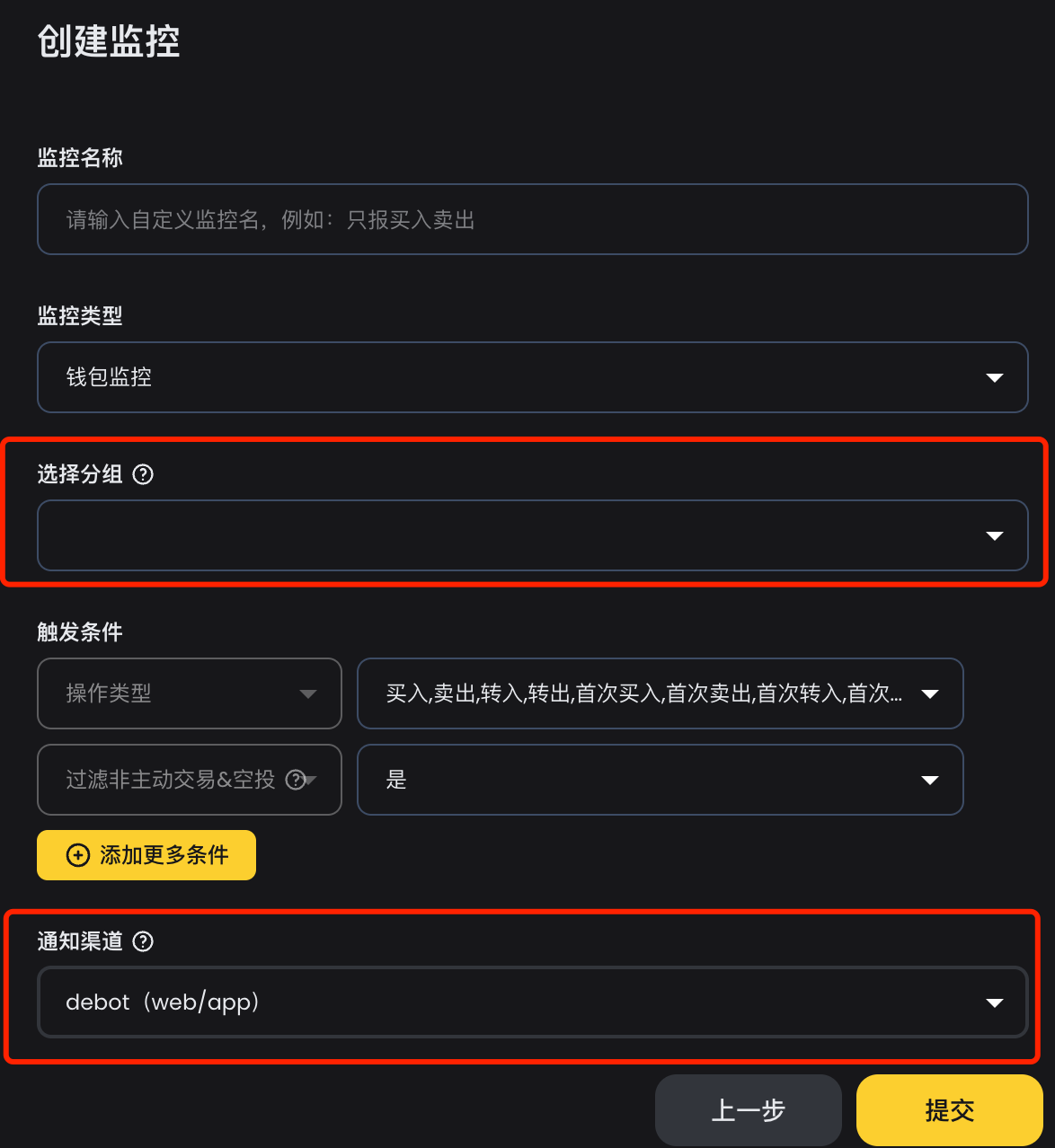

This monitoring is a standard feature available in all tools. However, while other tools push all addresses to a single Telegram group, debot allows addresses to be grouped and then pushed to different Telegram groups based on their categorization, as shown in the image.

This way, we can create different Telegram groups for different labels, such as internal players, external phase two players, key addresses, etc. A tool that can categorize monitoring information is a good tool. Previously, when I used abot for monitoring, I had to label addresses first and then develop a secondary distribution based on the labels after the Telegram group received the monitoring messages. Now, with debot, there is no need for secondary development.

2. Wallet Group Behavior Monitoring

If we are monitoring a large number of addresses, there is an unavoidable issue: too many push messages. When there are too many messages, the human brain cannot process them, leading to a desire to ignore them, which defeats the purpose of monitoring. To address this issue, my previous strategy was to develop a secondary distribution for the push messages, setting a threshold for the number of different addresses that must be reached within a certain time frame before pushing, for example, if five different addresses bought within 30 minutes, then push the message. I used this strategy for about a year, and it worked very well, reducing many messages while still not missing out on popular coins.

The wallet group behavior monitoring in debot perfectly implements my above strategy and does it more finely, with more granular metrics, as shown in the image. We can monitor based on buys and sells, set monitoring time frames, transaction amounts, notification frequencies, and market cap sizes. This feature can fully meet various monitoring needs, and I strongly recommend it.

6. File of KOL Addresses

Based on the methods above, I have compiled a list of nearly a hundred KOL addresses, as shown in the image.

You can analyze and label each address according to the analysis methods in section four, identifying addresses that fit your preferences for monitoring.

The file is uploaded in my Telegram channel and can be downloaded here.

Please retain the source when sharing this file!

7. Conclusion

The above text introduced methods for finding KOL addresses and explained how to analyze and monitor these addresses. For KOL addresses not included in the file, you can use the methods above to search for them. Additionally, the addresses that KOLs disclose are just one of the many they use; everyone has multiple addresses, and you can use the addresses above to find their associated addresses. The more addresses you collect, the richer your address database will become.

Each KOL has a different style; some KOLs may also cut losses while following others, so you should not blindly trust KOL addresses but rather select those that suit your own trading style.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。