In the past week, many friends have called me to inquire about the market situation. I feel it's necessary to publicly share my thoughts and disclose my views on the current market stage—

What Has Changed

Future Developments

Long-time followers among my family know that I am a long-term investor. Therefore, since 2019, I have had an annually updated strategy, and this piece roughly outlines my thoughts for 2024-2025 for discussion with family.

1. DeepSeek Burst the Bubble

Once DeepSeek emerged, regardless of whether it truly trained such an AI with $5 million, the narrative is clear: [Algorithm Improvement] has at least temporarily triumphed over [Computational Power Improvement].

Don’t get caught up in whether this is real—since the market unanimously acknowledges the $5 million claim, you must treat it as true.

As we approach the end of 2024 in the crypto industry, aside from memes, I reluctantly admit that there is objectively only one narrative left: AI Agent, which can be seen as the hope of the entire village.

However, no one anticipated that the AI Agent would be ruthlessly shattered by the real AI track, DeepSeek.

The team at DS consists of true IQ 200 individuals, fresh graduates from top universities, and numerous Olympiad medalists.

In contrast, our industry tends to idolize second-tier programmers who are either laid off from big companies or secretly working side gigs as AI engineers, which sometimes forces us to operate at an IQ of 50.

So…

On January 27, I tearfully took profits on all my AI token positions. I didn’t sell at the peak and had to sell off during the retracement, so it’s not untrue to say I felt pain.

But the colder truth is that this situation has turned our entire AI Agent track into a joke, and that might indeed be true.

The reason the "narrative" comes before the "event" is that the "event" hasn’t materialized yet and can only rely on the "narrative." Once the story can’t continue, the decline of the track becomes truly irreversible.

2. The President and the Mob of Followers

I don’t know how everyone felt during the New Year, but my physical experience is that many friends and family were asking how to register on BN or OKX, simply because they wanted to buy Trump Coin.

The last time they were this crazy was during the National Day holiday when they wanted to open accounts to jump into A-shares.

Shanghai Composite Index Trend Source: Tencent Securities

If I remember correctly, those brave souls who entered the A-shares on October 8 are still stuck at that peak.

After taking profits on AI, to be honest, the more I think about it, the more scared I become, and then I saw this post.

In summary: The president seems to be losing a lot, but there are two possible reasons:

- He isn’t making money in the way you can see.

- He is a fool.

I know for sure that the answer cannot be 2.

Yes! Memes are now something the president is playing with, and he can also make money through channels unknown to us.

To be fair, can our meme play be compared to sitting at the same table as Trump?

A Thai hippopotamus, an American squirrel, a bottle of longevity medicine that extends the life of flies—can they really sit at the same table as Trump, who is firmly in the Oval Office?

During the New Year, adults sit at one table, and children at another.

Adults drink fine liquor, while children only deserve Sprite.

So, that day, I basically sold off all my meme holdings. My meme positions once had huge unrealized gains, but due to actively lowering my IQ to 50, I didn’t complete a great retreat but kept joining the great revolution.

It felt like a dream.

3. A Top Signal: The High Schooler Earns Millions

I believe all meme players, even those who don’t play memes, have heard about this legendary story recently.

A high schooler sat idly for a month and suddenly hit the jackpot with Jelly, making millions at a super low cost.

Of course, as the story spread, it became more and more outrageous, and there are many rumors. I can’t guarantee this is 100% true, but I know the vibe is right.

Looking back at the 69K historical peak in 2021, in the 1-3 days before it, I was reflecting:

- Interns easily outperform fund managers.

- Grassroots community contributors of ENS received millions from airdrops.

At that time

Just like

This moment

I liked this post where a TIME editor (who could also be a hacker) could instantly harvest countless SOL with a fake tweet.

I ask you, what does this mean?

It’s not that making money is wrong—experts can always make money, even at the bottom of a bear market.

But if the subject changes to ordinary people:

Interns make big money, ENS contributors make big money, high schoolers make big money, editors make big money.

It means: [At this moment, everyone’s hands are particularly loose.]

Friends who often play cards know that only when there are extremely high unrealized gains do people become loose with their hands.

This indicates that the greed index has truly reached its peak.

This is a super top signal.

So, on the 30th, I cleared out almost all my altcoins, keeping only BTC and a small portion of mainstream coins ETH/SOL/DOGE/exchange tokens.

Although there were still losses, I managed to leave with a few fruits of victory.

I admire the high schooler’s brilliant operation, and I also respect the market rules of this alternative investment.

4. Questions About BN and BN's Response

Honestly, I don’t want to discuss this topic.

As a former CEX practitioner, I have seen this consultant - listing - selling routine too many times, from initial anger to gradual numbness, and I’m no longer surprised.

However, in the past, this kind of thing was kept under the table, belonging to "small corruption is a lubricant for development";

It belonged to "water that is too clear has no fish," where a little murkiness beneath the surface was part of the game rules.

After all, we don’t live in a utopia; we don’t live in a vacuum.

But the most taboo thing about this is bringing it from under the table to the surface.

I have no intention of criticizing BN or the leading figure, as this issue exists in almost every CEX.

If this were in the traditional world, to exaggerate, it would be a huge scandal that could lead to hundreds of layoffs and dozens of arrests.

Perhaps the leading figure would have been better off not responding, learning from celebrities to handle it coldly, giving retail investors a glimmer of hope.

However, our industry is predominantly skeptical, and a huge scandal is a heavy blow, striking hard on the hearts of every holder.

It has shattered the faith of many.

Our industry truly needs "gods" because it relies on consensus.

But when everyone discovers that the "servants" beneath the "gods" also want to make a quick buck, faith suddenly evaporates, and it quickly projects onto the gods—every altcoin on BN is now facing immense skepticism and scrutiny from retail investors. If AI and HOOK are like this, can other coins really be any better?

5. Future Scenarios

If we follow the perspective of "carving a boat to seek a sword," this drop is very similar to May 19, and I suggest everyone review the trends after May 19.

The trend after May 19, 2021, Source: Bitfinex

If we follow the May 19 script, the next phase will be a repeated two-month oscillation until even the most loyal are shaken out, followed by a new $Bitcoin ATH.

Of course, some suspect this is the beginning of the bear market, akin to December 4.

From my inner inclination, I hope this is like May 19.

After all, the U.S. national strategic reserve for Bitcoin is becoming clearer, and never underestimate the immense impact of this matter, truly.

Even if Bitcoin reaches 85K-88K, I would still be willing to add some positions.

6. My Position Distribution

My current positions are:

- 40% BTC

- 20% Mainstream Coins (ETH, SOL, DOGE, BNB/MNT)

- 40% Stablecoin Investments

Bitcoin is my eternal faith; I think I will never sell BTC again, nor will I engage in swing trading.

The reason for holding ETH:

To be honest, my faith in ETH is weakening.

However, objectively speaking, the president's DeFi project is buying ETH.

I don’t know how many family members are trading U.S. stocks, but many regret not following the trades of [Nancy Pelosi, the stock market goddess of Capitol Hill].

Image Source: 天下杂志

Once, Pelosi's highlight moment was as the Speaker of the House, which is only the third position in American politics.

Now, Trump is the legitimate president, and this crypto president is holding a significant position in ETH (even though it has now been deposited into untraceable Coinbase custody), which cannot be underestimated.

Secondly, ETH has already dropped to its current position, and I feel it has reached the peak of FUD; there might be thoughts of a rebound. I can't buy when no one cares, but at least I won't sell when no one cares.

Reasons for holding SOL:

- There is a small probability of an ETF;

- However, the cooling of the AI narrative and the short-term slump of MEME are two small clouds.

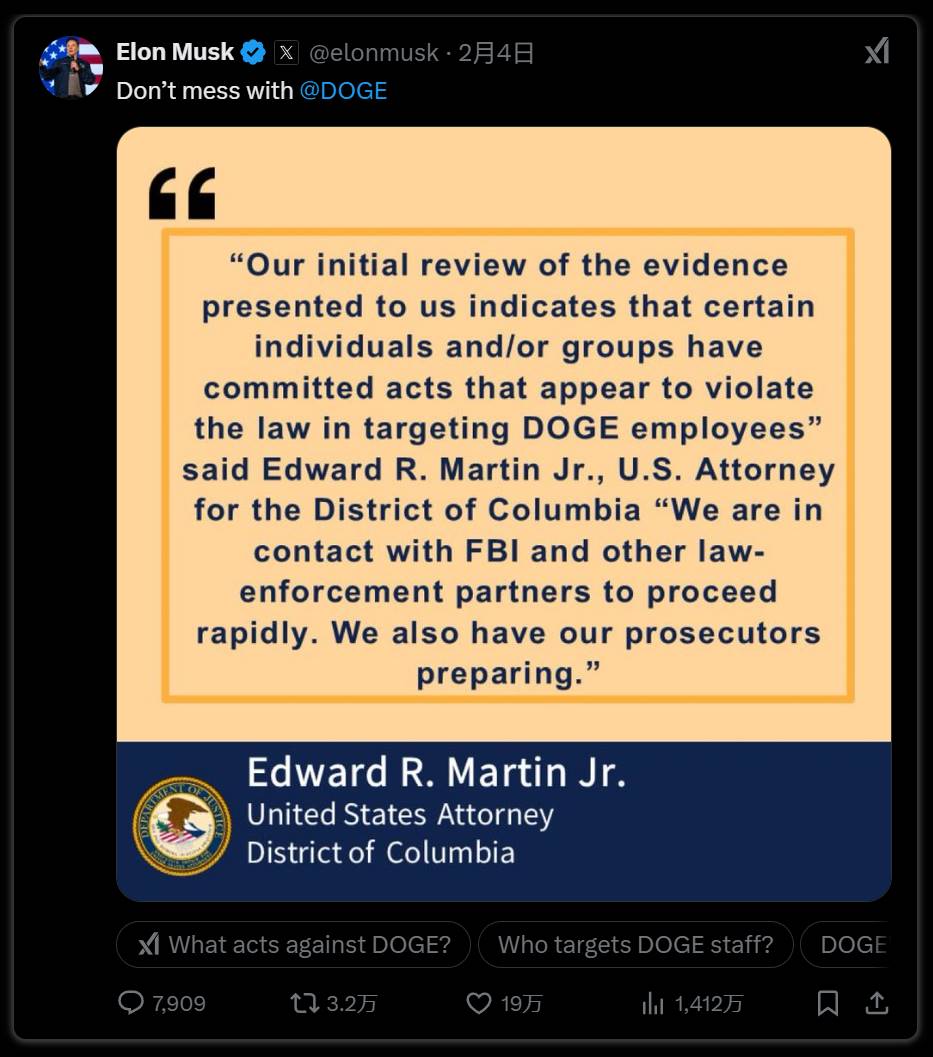

Reasons for holding DOGE:

- Grayscale has launched a Dogecoin trust, and Doge also has a small probability of an ETF;

- Additionally, Musk is working hard in the D.O.G.E department;

- Being in the same vehicle as the world's richest man and the "Director of the U.S. National Development and Reform Commission," I think I can sleep well.

Reasons for holding exchange tokens:

To be blunt, exchanges have no possibility of stepping onto a bigger stage.

Coinbase will not list BNB, and Binance will not list MNT.

However, exchanges are the only institutions in our industry that can make money and offer benefits;

If a bear market truly arrives, exchange tokens are relatively more resilient, and occasionally an IEO can help recover losses; in a bear market, we can only rely on this.

7. Harsh Viewpoint: The Good Days for Old Investors Are Over

Aside from the above, I will likely not hold any altcoins in large positions in the short term— the reason is simple: inflation is too fast.

The speed at which new users and new funds enter the market cannot keep up with the speed at which these token issuers are printing.

Source: Decrypt

A few days ago, there was a statistic showing that the top account on Pump Fun issued 17,000 tokens in three months.

Not 170, not 1,700, but 17,000! His contribution alone may exceed the total number of tokens issued during the entire bull market of 2017.

Why have the investment strategies of old investors become ineffective?

There are too many choices!

Too many angles!

Even within the same angle, there are numerous CA,

How can old investors' altcoins compete?

The strategy old investors love most: buy a mid-tier altcoin at a valuation of 100M or 200M.

Hold it for 2-3 months, betting it will outperform Bitcoin.

However, now it seems they might not even outperform ETH.

And the strategy that Marshal P loves most: buy a project valued at 10K in the internal market.

Run away 30 minutes later.

Real men never look back at explosions.

Clearly, in today's environment of massive token inflation, Marshal P far surpasses old investors.

I do not call on everyone to become a P junior; I just hope everyone at least doesn't become an old investor.

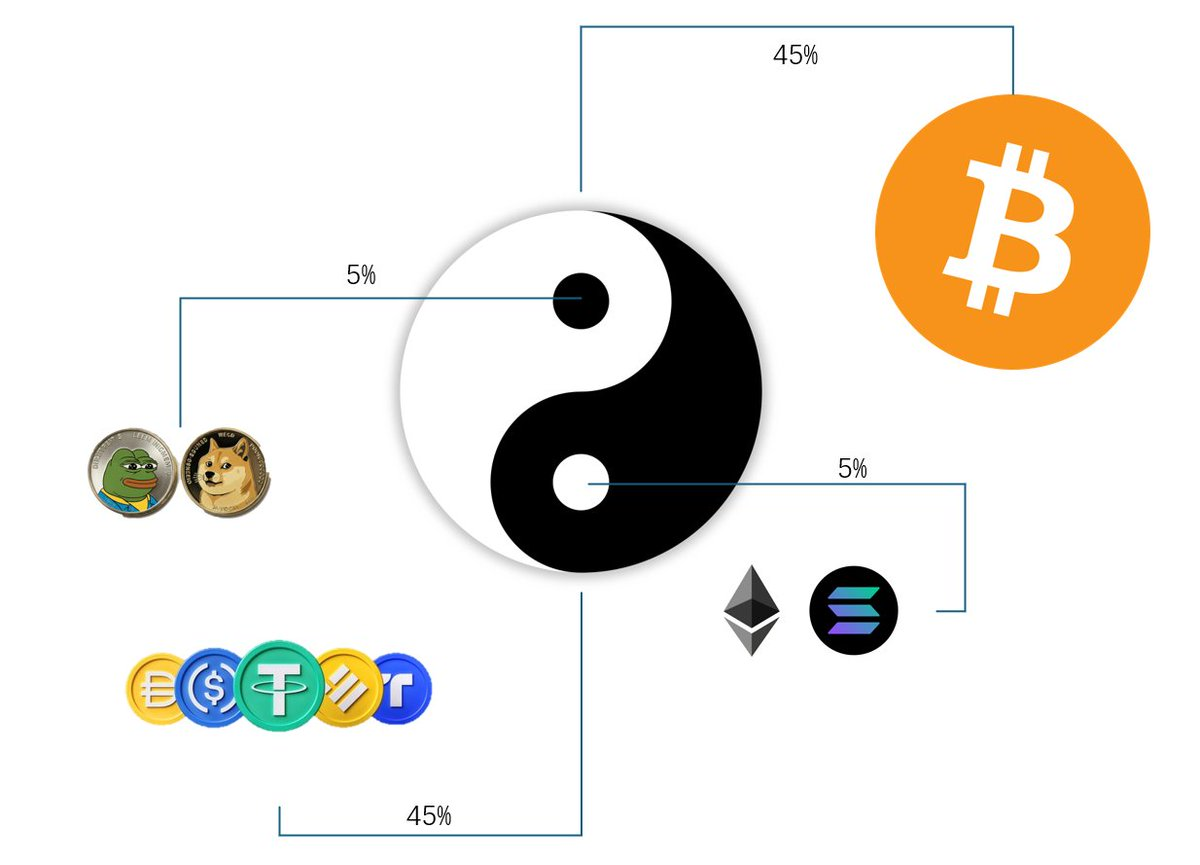

8. Best Position: 50% Bitcoin + 50% Stablecoin Investments

Additionally, I sincerely suggest everyone hold a certain amount of USDT to get through the upcoming time.

You must accept a fact: no one can truly sell at the super peak.

There’s a peak every four years, and in over a thousand days, finding a day to sell gives you a 1/1000 chance; naturally, very few can achieve it, and they are all super lucky.

At this stage, holding half is the best choice.

Invest 50% of your principal in financial products; we won't talk about mining or arbitrage.

Let’s just do the simplest Ethena USDE, where Pendle can still offer an 18% interest rate.

If Pendle is too lazy to manage, just throw it into AAVE or mainstream CEX financial products, which still yield about 10%.

The other 50% should be primarily in Bitcoin, quietly waiting for the day the U.S. Bitcoin strategic reserve arrives.

You’ll have both interest cash flow,

And dreams and faith,

You’ll definitely feel comfortable,

And secure.

Of course, you can also allocate another 5% to a few altcoins you truly believe in, whether it’s ETH, SOL, DOGE, or any coin you have faith in.

You can also set aside 5% of your funds to play a couple of PVP games; if you win, enjoy it once, and if you lose, consider it a cost to maintain your skills—how wonderful is that?

Finally, this will form a distribution resembling a Tai Chi diagram.

PS: This is also the distribution I want to gradually adjust my holdings to. Source: 0xTodd

9. Finally

I am quite satisfied with my current positions, as this is my eighth year in the crypto industry, and after such a long time, I have gained some experience.

The only regret I have is that I was playing in Osaka during the New Year and got lazy, not organizing these thoughts and sharing them in a timely manner.

The same strategy I mentioned a few days ago could have helped many people, but saying it a few days later turns it into a post-event review.

However, it’s never too late to mend the fold.

I hope every family member can achieve their own great results in the crypto market.

Of course, if you can’t achieve great results, then retaining some small results and earning some spiritual and social wealth is also worthwhile.

Finally, I wish all family members—a year of the snake, with the golden snake dancing wildly.

Todd

February 5, 2025

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。