Author: Jaleel Jia Liu, BlockBeats

Editor's Note: In the past few years, Sun Yuchen has almost become the "last survivor" in the cryptocurrency circle. Whether it was regulatory crackdowns, market crashes, or the fall of major figures in the crypto world, he has always navigated through it all, firmly standing at the center of the industry. Recently, his name has once again become a topic of discussion, still filled with drama.

First, he made headlines by purchasing a banana for a staggering $6.2 million, a ridiculous "luxury purchase" that topped the news in major media outlets. Recently, he has been riding high, associating with the family of former U.S. President Trump. Just yesterday, Sun Yuchen engaged in a public spat with Huobi founder Li Lin, accusing him of concealing financial loopholes during a settlement process, leaving a $30 million "funding gap" that he had to cover out of his own pocket. Whether it’s the financial dispute with Li Lin or the $6.2 million banana, the essence of these stories revolves around a core theme: wealth, power, and influence. This has been the most exciting microcosm of the cryptocurrency world over the past decade, with Sun Yuchen always at the center of this grand drama.

The editor-in-chief of the well-known American crypto media CoinDesk was also fired just before Christmas.

The reason for his dismissal was an article that was taken down by his own parent company, in which the author ridiculed Sun Yuchen extensively. Compared to CoinDesk's expertise in "exposing the truth," it felt more like a "personal attack." The article compiled negative news about TRON and Sun Yuchen from the past two years, titled "I watched Sun Yuchen eat the world's most expensive banana, and I really don't understand," after all, who doesn't enjoy seeing the media mock the rich? According to CoinDesk employees, Sun Yuchen pressured them to delete the article, which directly led to the firing of three employees from the most well-known crypto media, CoinDesk, including editor-in-chief Kevin Reynolds.

From Sun's perspective, this is indeed infuriating. Because TRON is one of the two top sponsors of the upcoming Consensus Hong Kong conference in March, and the Consensus conference is one of CoinDesk's main sources of income. Anyone encountering such a situation—receiving money while being insulted—would likely struggle to remain calm, especially since the article lacked the detailed evidence that CoinDesk had when exposing the issues with FTX back in the day.

In 2022, it was CoinDesk that "fired the first shot" at the then-thriving FTX, with an article revealing the balance sheet of crypto market maker Alameda, triggering a "butterfly effect" that caused a massive crash in the crypto market, leading to numerous institutions collapsing. No one expected that the dominoes falling would also include CoinDesk itself, as DCG (CoinDesk's original parent company) faced bankruptcy of its important revenue source Genesis due to the fallout from FTX, ultimately leading DCG to sell CoinDesk at a low price. The new owner is the trading platform Bullish, which is the same Bullish that took down the controversial article and fired CoinDesk's editor-in-chief.

Compared to Sun Yuchen's acquisition of Huobi two years ago, the Bullish trading platform does not seem to be a well-known name; most people know Bullish because of EOS.

In 2018, a company called Block.one raised $4.2 billion and created the "established star public chain" EOS, launching a year-long ICO. A few years later, Block.one "divorced" from EOS, taking the $4.2 billion with it to create a compliant trading platform, which is Bullish.

During the boom of public chains, TRON and EOS, which launched ICOs at the same time, were entangled yet mutually supportive. Back then, the combined market capitalization of TRON and EOS was less than 10% of Ethereum's (Ethereum is currently the second-largest public chain and cryptocurrency by market cap, after Bitcoin). To topple Ethereum, the best way was to temporarily "ally." Sun Yuchen once said in an interview, "TRON is Liu Bang, EOS is Xiang Yu, Ethereum is the Qin Dynasty. He must first defeat Ethereum, and then divide the world with EOS."

Fast forward seven years, and no one expected that the current landscape of the crypto world has overturned many people's perceptions.

Today, using that metaphor to view the crypto circle, the Ethereum Qin Dynasty that Sun Yuchen spoke of is still standing, but the EOS Xiang Yu has already committed suicide, with EOS's market cap being only 5% of TRON's. As a public chain, EOS is undoubtedly a failure.

However, the parent company behind EOS cannot be considered a failure. Many people do not know that EOS's parent company Block.one is currently the second-largest holder of Bitcoin, after MicroStrategy (the publicly traded company that holds the most BTC), owning a total of 160,000 BTC. Moreover, Block.one also holds nearly $2.2 billion in U.S. Treasury bonds. It is worth noting that most of MSTR's BTC was purchased through stock issuance, meaning that as a publicly traded company, MSTR's BTC belongs to all public market investors, while Block.one, as a private company, owns all its assets outright. The initial funds used to purchase these assets trace back to 2017 when EOS launched its ICO and raised $4.2 billion.

In the following years, Block.one did not invest all the money into development but instead hoarded a large amount of assets. The largest expenditure during these years was a $24 million fine paid to the SEC (U.S. Securities and Exchange Commission), which was undoubtedly worth it, as it resolved the issue of EOS raising funds from the public without registering with regulatory agencies. According to current popular terminology, this allowed Block.one to completely "go onshore," and today, this company has become a compliant crypto giant with no legal risk issues.

From the perspective of "cash flow is king," Block.one is very successful today, just like how almost no one remembers what MicroStrategy's main business is. Even though EOS has been in decline since 2019, Block.one, holding $16 billion worth of Bitcoin reserves, is still doing well today and has launched its own trading platform, Bullish, which is seeking to go public and obtain licenses in Nasdaq and Hong Kong.

After EOS, the trading platform, which is the most liquid and profitable sector in the crypto circle, has become the main business of its parent company after "lying down and winning for five years." This is a decision that both EOS and TRON have made independently.

In 2019, Sun Yuchen acquired the famous cryptocurrency trading platform Poloniex. After taking over, he quickly removed strict KYC requirements, significantly increasing the platform's user base.

In addition to Poloniex, in 2022, Sun Yuchen also acquired Huobi for about $1 billion, which caused the price of HT (Huobi's trading platform token) to surge nearly 50% in a short time.

In July 2021, Block.one launched the trading platform Bullish, initially funded with $100 million in cash, 164,000 BTC, and 20 million EOS, and completed an additional $300 million in strategic investments. Bullish Global now has over $10 billion in cash and digital asset capital. Notable investors leading this $300 million financing include PayPal co-founder Peter Thiel and Hong Kong tycoon Li Ka-shing.

Bullish's positioning has been clear from the start: scale is not important, but compliance is crucial, as Bullish's ultimate goal is not to make a profit in the crypto world but to go public in the U.S. stock market.

Before officially operating, Bullish reached an agreement with the publicly traded company Far Peak to invest $840 million to acquire 9% of the company's shares and conduct a $2.5 billion merger, thereby achieving a backdoor listing and lowering the traditional IPO threshold.

Bullish's CEO is a professional manager named Farley, who has a strong compliance background: he was appointed as the Chief Operating Officer and President of the New York Stock Exchange, where he excelled and established deep connections with Wall Street giants, CEOs, and institutional investors. Another noteworthy point is that during his tenure at the New York Stock Exchange, under his leadership, the exchange created a Bitcoin index and made a private equity investment in what was then known as the Bitcoin wallet Coinbase.

However, compliance has proven to be much more challenging than they anticipated. After U.S. regulators signaled a crackdown, Bullish's original merger agreement was terminated at the end of 2022, and the 18-month "listing plan" was temporarily shelved. Bullish has also begun to consider other compliance routes, such as acquiring FTX, and is currently focusing resources in Hong Kong, applying for a virtual asset trading platform license from the Hong Kong Securities and Futures Commission. Bullish now has 260 employees globally, with 110 based in Hong Kong, while the rest are distributed across the U.S., Singapore, and Gibraltar.

This path of starting from scratch can ensure compliance from the beginning, but the drawbacks are also quite obvious: inefficiency. While Huobi rapidly attracted users worldwide, Bullish was still struggling with its trading volume and brand recognition.

Like most trading platforms, Bullish has also purchased some media services. In a paid feature in The Wall Street Journal, Bullish claimed that "since starting operations in November 2021, trading volume has exceeded $300 billion, consistently ranking among the top three globally in Bitcoin and Ethereum spot trading volume."

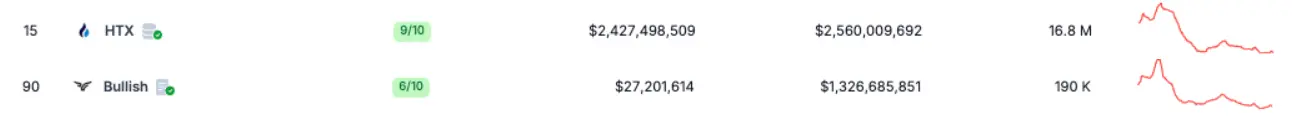

However, objective data seems unable to corroborate the advertising claims. According to CoinGecko, Bullish's "normalized trading volume" (excluding suspicious wash trades common in cryptocurrency trading platforms) rarely exceeds $40 million in daily trading volume within 24 hours. At the time of writing, Bullish's 24-hour trading volume was $27 million, which is a significant gap from the reported average daily trading volume of $700 million.

Whether it's the largest exchange platform Binance or the largest compliant exchange platform in the U.S., Coinbase, their trading volumes far exceed Bullish. Just how significant is the gap? Even Huobi's trading volume in the past 24 hours is nearly 100 times that of Bullish.

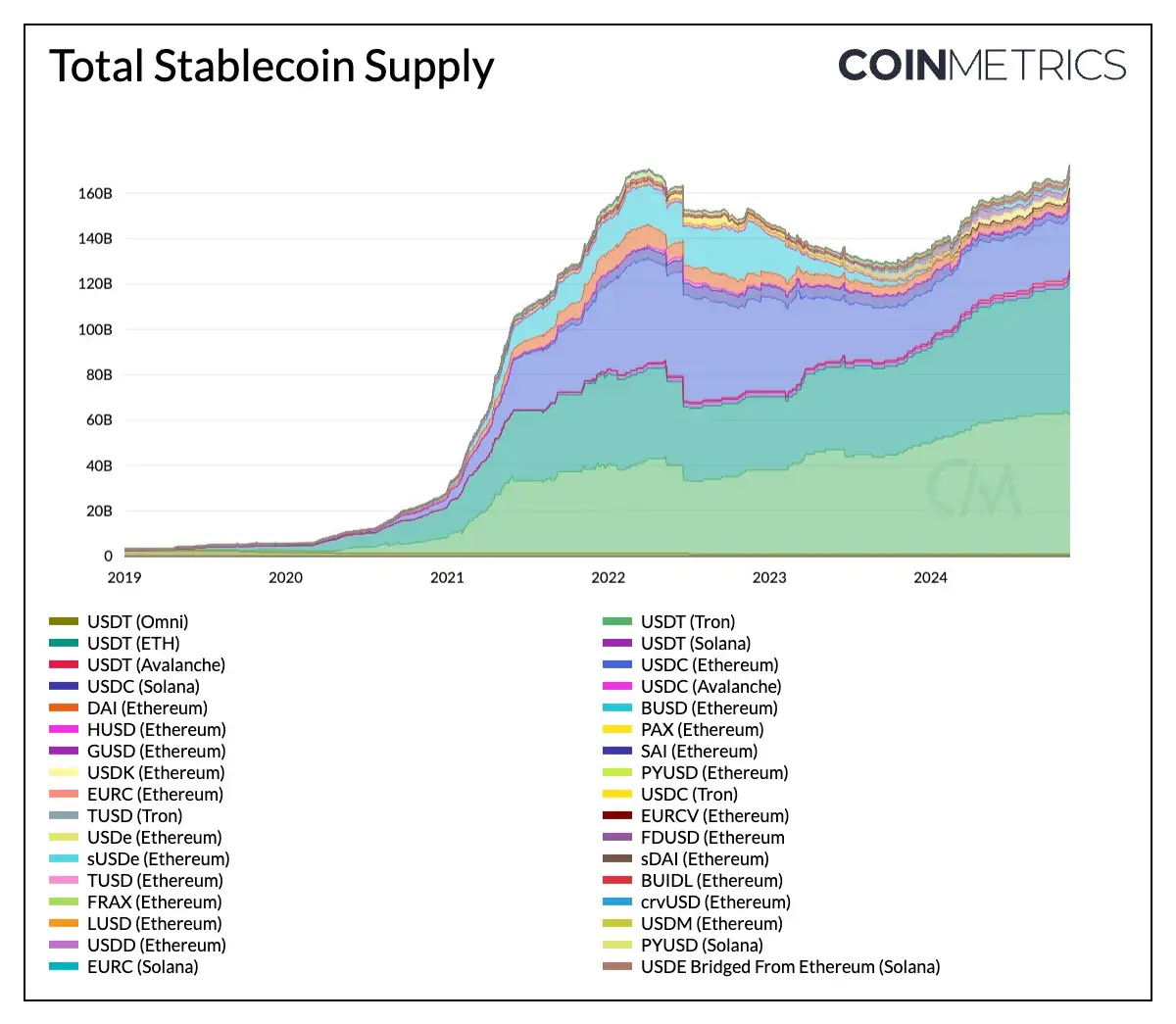

In addition to its poor operational performance, an excessive focus on compliance is also one of the reasons for Bullish's slow development. The most obvious example is that all stablecoin trading pairs on Bullish use USDC (a stablecoin created in 2018 through a partnership between Circle and Coinbase), rather than USDT (Tether, created by Tether Limited, is the earliest and largest stablecoin, currently with a total market cap of $130 billion).

As USDT has faced increasing scrutiny from the U.S. SEC over the years, the team is considering relocating its headquarters to El Salvador, and its dominant position has somewhat declined. Meanwhile, compliant USDC has seen a surge in trading volume over the past six months. According to a recent report from Kaiko, USDC trading volume on centralized exchanges (CEX) is on the rise, reaching a historical high of $38 billion in March, far exceeding the average level of $8 billion in 2023. Another well-known exchange platform, Bybit, along with Bullish, accounts for 60% of USDC trading volume on trading platforms, making them the two largest centralized trading platforms for USDC.

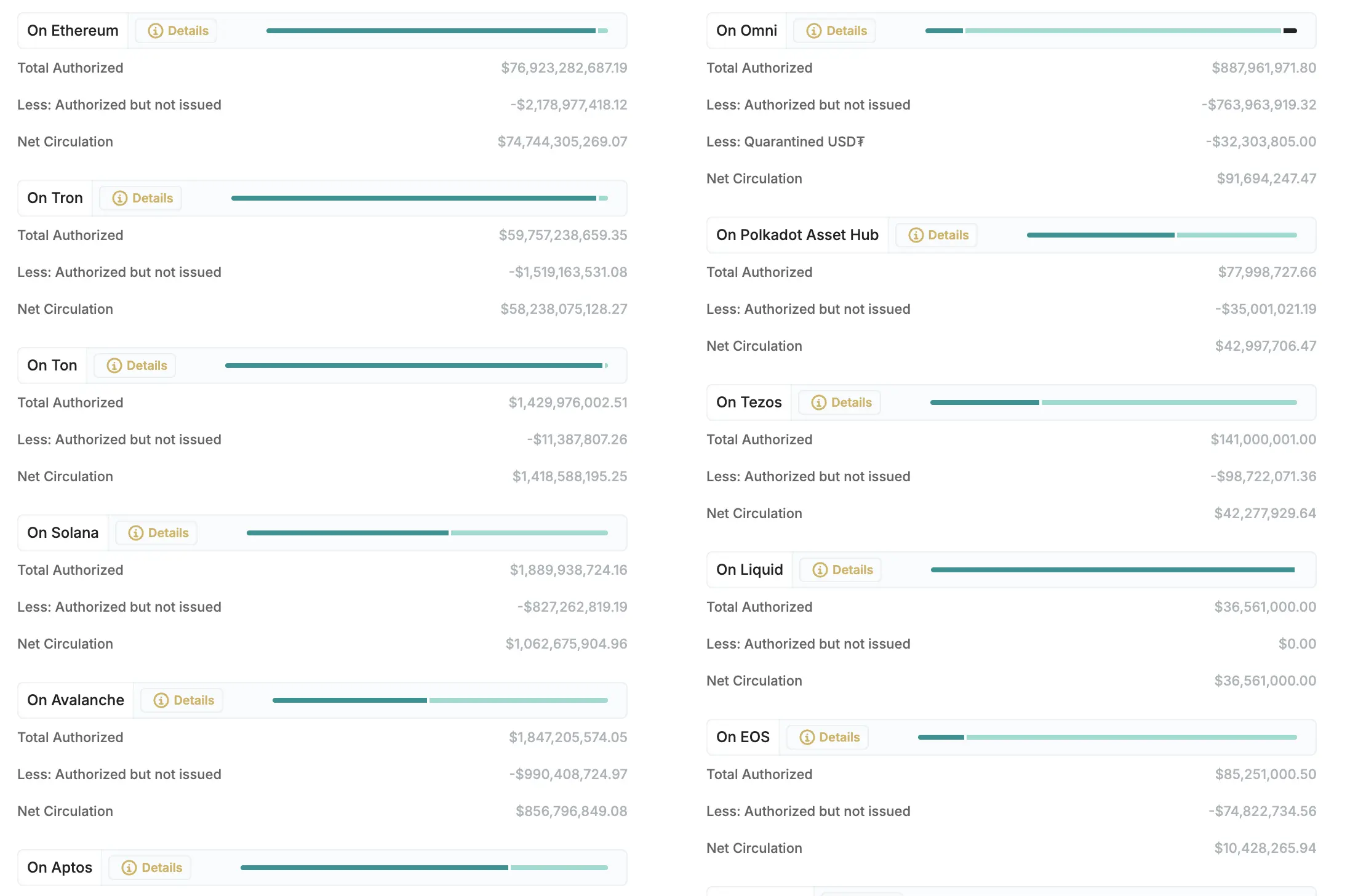

Nevertheless, USDT remains the dominant force in the crypto world. As of the time of writing, the total issuance of USDC is $46 billion, while the total issuance of USDT is $140 billion.

When USDT was first established, Tether chose to launch USDT on Bitcoin's second-layer protocol, Omni Layer. However, users quickly encountered issues; Omni's speed was still too slow, and transferring the OMNI version required a minimum of 4 USDT, sometimes even as much as 10, making it very unprofitable for small transactions.

As a result, Tether turned to Ethereum, which was then gaining popularity (the second-largest public chain after Bitcoin). Ethereum somewhat alleviated this issue, but the pursuit of faster speeds and lower fees is a permanent goal. Thus, Tether began to experiment with issuing USDT on more public chains, leading to a situation where the issuance of assets on a public chain using USDT became a hallmark of that chain's mainstream recognition in the industry. After all, USDT represents real money, and the issuance of so many assets on a public chain proves that Tether, as an industry giant, recognizes the security and usability of that chain. Moreover, the real on-chain users and fee income brought by USDT are highly sought after by various public chains, which both TRON and EOS recognized back then.

In April 2019, Tether issued the TRC-20 version of USDT on TRON. No one knows how Sun Yuchen managed to secure this with Tether.

Six months later, EOS, which was late to the mainnet party, also issued 5 million USDT. Optimistically speaking, the EOS version of USDT offered faster transactions and quicker arrival times compared to TRON. However, the speed of the crypto industry is much faster than that of traditional industries, and many things can happen in six months.

At that time, a comparison of various versions of USDT

Since deploying the Tether contract in April 2019, TRON has gradually shifted its focus to promoting and marketing USDT, launching promotional activities such as "hundreds of millions in interest subsidies."

At that time, Sun Yuchen and CZ were still in a "honeymoon period" of mutual support, with Binance stepping in to support TRON by launching an event—deposit TRC20-USDT to enjoy a 16% annualized return. In addition to Binance, several other trading platforms, including OK and Huobi, announced their support for TRC20-USDT.

Sun Yuchen himself frequently voiced support on Weibo, almost daily posting about TRC20-USDT, putting considerable effort into promoting "TRON as the dominant public chain for stablecoins."

"USDT issued on the TRON blockchain will soon become the largest stablecoin in the world," Sun Yuchen confidently stated regarding this matter.

On the other hand, EOS was slow to act, completely wasting its unique advantages. Brock Pierce, one of the co-founders of Block.one, was also a co-founder of Tether, and EOS was in a prime position to capitalize on this.

As a result, early community KOLs in EOS lamented, "I have always valued USDT and its development. Initially, what I looked forward to most in the EOS ecosystem was the EOS version of USDT, but unfortunately, Block.one did not promote it, and leading trading platforms did not push it either. It wasn't until eosfinex launched on Bitfinex that it was introduced, but it was already too late."

Moreover, transferring on EOS requires renting various resources and filling out memo notes, which leaves some new users "confused," making the user experience less convenient than that of Ethereum and Bitcoin. This has also affected EOS's widespread adoption.

"As demand grows, EOS-USDT may also issue more. But it will definitely not issue hundreds of millions or billions of dollars, because the entire network value or transmission value of EOS is limited." An analyst remarked at the time.

Thus, after letting the situation unfold for a while, EOS missed the best opportunity to overtake TRON. As of the time of writing, data from Tether's official website shows that the issuance of USDT on the EOS chain is 8.525 million, while the number on TRON is 59.7 billion.

Data Source: Tether Official Website

On October 22, 2020, an internal member of an EOS wallet published a passionate article titled "A Plea to Block.one," which quickly spread across the internet. In a lengthy tirade against Block.one and BM, Sun Yuchen, the founder of TRON, unexpectedly received a "compliment": "In this regard, I really appreciate Sun Yuchen. Regardless of whether BM, as a technical person, sees him as a copycat, at least he is responsible for TRX holders and is making real contributions to the TRON public chain, especially in terms of operations, promotion, and support for the TRON project."

Today, USDT has long become a true "peer-to-peer digital cash," realizing Satoshi Nakamoto's vision ahead of BTC. High-ranking officials in Russia use USDT to bypass trade restrictions to purchase goods. Since the comprehensive sanctions began in 2022, Russian companies engaged in trading metals such as nickel and steel, as well as bulk commodities like timber, have faced various challenges: collecting payments for goods, procuring equipment and raw materials, and more. However, USDT, which is pegged to the dollar at a 1:1 ratio, is difficult to sanction, providing support for Russia's international standing.

In the Western Hemisphere, Argentina has the highest ratio of cryptocurrency users. However, Argentinians are not playing a lottery game with cryptocurrencies, nor are they looking to get rich through the next hot token. They typically buy and hold USDT, a stablecoin that maintains a 1:1 price with the dollar, with a market cap of $138 billion, viewed by most citizens as a safe means of wealth storage, helping to combat Argentina's staggering inflation rate of 276%.

Cryptocurrency exchange points are ubiquitous in Argentina, image source: Twone, Uncommons

Not only in Argentina, but locals in Turkey, facing a similar high inflation crisis with their national currency, also hold large amounts of cryptocurrency to combat the severe depreciation of the Turkish lira, with USDT being the preferred choice.

Local cryptocurrency exchange points in Istanbul, image source: Reddit

Additionally, some foreign trade merchants in Yiwu, China, also settle their foreign exchange through USDT. A research team once conducted a survey in Yiwu and found that almost all merchants received inquiries from buyers about whether they could use cryptocurrency for payments. Compared to more volatile cryptocurrencies like Bitcoin, Tether's USDT stablecoin, pegged to the dollar at a 1:1 ratio, is easier for calculating and settling payments in imports and exports.

In Cambodia, there is a "gray market version of Alipay" product with local official backing—Huione Pay. This platform was established in 2014, initially starting with foreign exchange services, headquartered on Norodom Boulevard in Phnom Penh, just a few steps from the Royal Palace, in the most prime location in the city. In foreign currency exchange and guarantee services, USDT is the most important channel.

Huione Group Headquarters

In addition, USDT is widely used in various markets, such as purchasing channels for scientific internet access and payment channels for Twitter follower platforms.

For example, the popular pirated video platform loved by international students, Ai Yifan, includes USDT payment options in its membership recharge channels, and the only network it supports is TRC-20, which is the token format for USDT on the TRON network. Apart from TRON, USDT currently operates on several other mainstream chains. However, Ai Yifan only supports the TRON network and even offers an 20% discount for payments made through this method.

"Ai Yifan is extremely popular among overseas Chinese, and it may currently be the largest pirated video website in the world by user count. In 2020, it had over 6 million unique users, and after the pandemic, it experienced explosive growth, with the current user base at least 10 million," a deep user of Ai Yifan introduced to us.

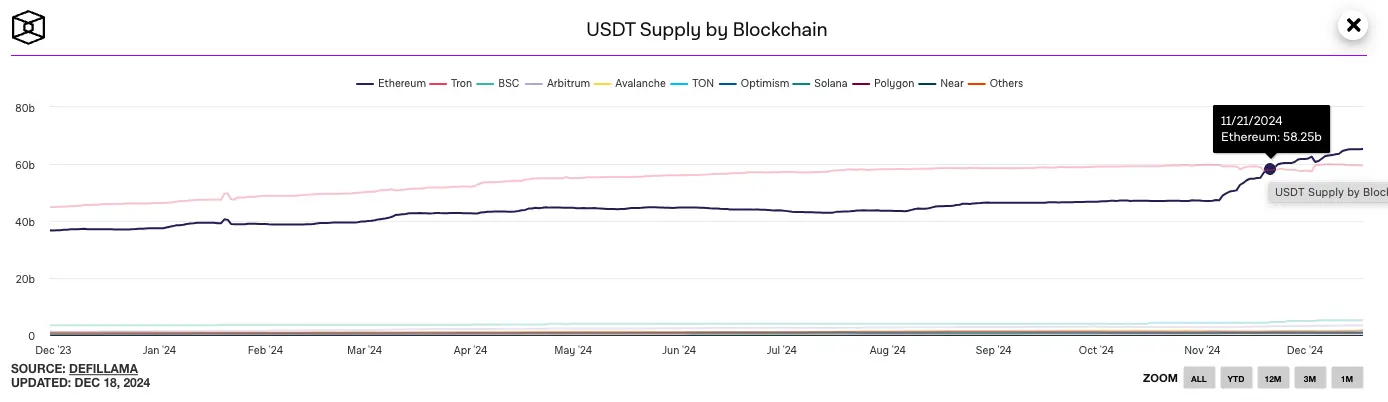

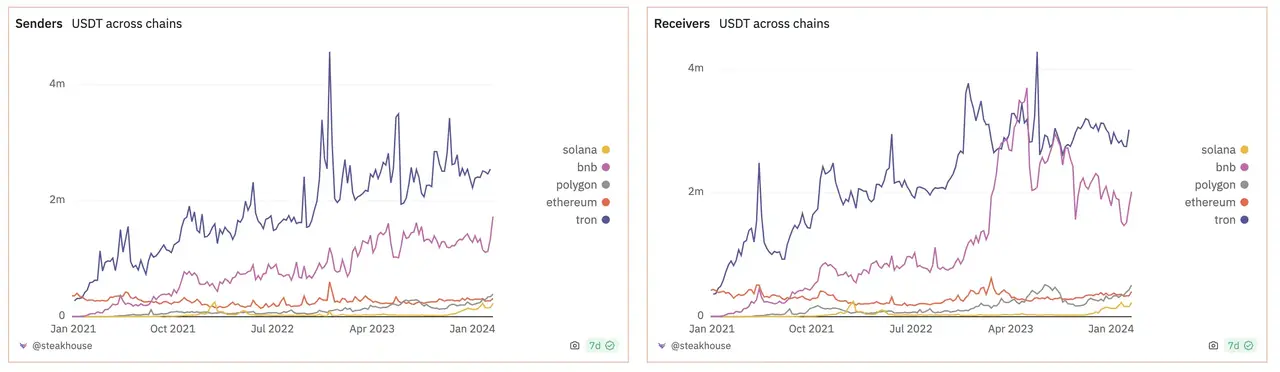

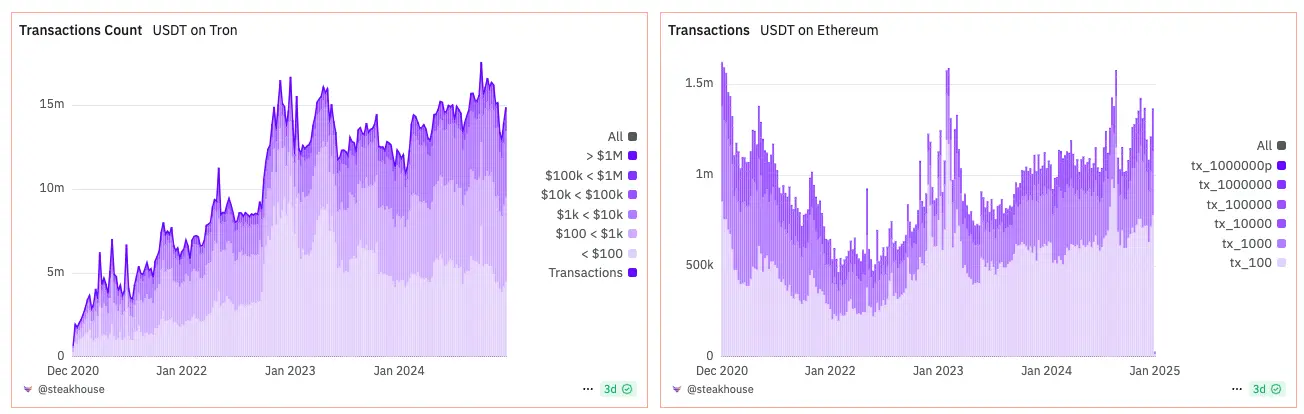

Today, much of the demand for USDT transfers is met by TRON. Until November of last year, the issuance of USDT on TRON was the highest among all chains, with Ethereum being the other chain with the most USDT issuance. Although recently, the issuance of USDT on Ethereum has surpassed that on TRON for the first time, the difference is still not significant, only $600 million apart.

According to blockchain data platform Dune, on the TRON network, both the cross-chain receiving and sending volumes of USDT are higher than those on other networks. The daily receiving and sending volume on TRON is around $7 million, while on Ethereum, it is about $600,000, nearly 11 times less.

Data Source: Dune

While Bitcoin was still becoming a financial trading asset through ETFs, USDT had already taken a step ahead of Bitcoin to achieve the mass adoption often sought in the Web3 circle, with TRON becoming the biggest beneficiary after Tether.

In the stablecoin market, TRON is undoubtedly the "king of the central plains." Looking back five years later, this decision laid the foundation for 99% of TRON's market value.

With high trading volumes, the revenue naturally increases. In terms of income, TRON's total revenue for 2024 is $2.12 billion, with a single-day total revenue record reaching $21.66 million. In the first week of the new year 2025, TRON generated $43.74 million in fees, surpassing Ethereum's $30.63 million.

Source: Coin Metrics Network Data Pro

In the face of TRON's current glory, Tether has added to the desolation of EOS. In June of last year, Tether decided to stop issuing USDT on EOS, stating that it would prioritize support for community-driven blockchains, implying that EOS lacked community support.

"This is the glory of one city and the fall of another."

After the EOS mainnet went live, it did not perform as expected; instead, it faced numerous vulnerabilities, even giving rise to a specialized code auditing security industry due to frequent code vulnerabilities. BM casually altered the "constitution" of EOS, leading to a severe crisis of trust within the community. EOS's development took a sharp downturn, user groups shrank, and major developers left one after another, causing the price of EOS tokens to plummet from $23 in May 2018 to the current $0.6. Although "gambling and high-risk" applications attracted a large number of users, the value they generated was far less than that of TRON, and "gaming" applications failed to gain popularity as they did on Ethereum.

"EOS had already committed suicide in 2019," many OGs in the crypto circle now agree with this statement. Mismanagement is also one of Block.one's significant issues. From the perspective of EOS founder BM at the time, he saw himself as the Wei Emperor Cao Mao, while Block.one's founder BB was Sima Zhao. Block.one's senior management appointments relied entirely on personal relationships, with key positions such as Chief Strategy Officer and Head of Communications filled by childhood friends or family members of BB, lacking external challenges and professional perspectives.

The final outcome could only be BM's departure, with continuous declines in technical development and code quality, leading to a plummeting market performance for EOS. Block.one even prepared to sell off a large amount of EOS, causing the entire EOS ecosystem—from investors to developers to nodes—to become restless, and everyone was very dissatisfied with Block.one.

The EOS Foundation, as a community representative, began negotiations with Block.one. However, over the course of a month, both parties discussed various proposals but failed to reach an agreement. Ultimately, the EOS Foundation, in conjunction with 17 nodes, revoked Block.one's power status and expelled it from the EOS management team. Without its parent company, EOS increasingly resembled a DAO.

After the split between EOS and Block.one, the EOS community engaged in a years-long lawsuit over the ownership of the funds raised initially, but to date, Block.one still retains ownership and usage rights to the funds.

How Block.one uses the $4.2 billion raised during the EOS ICO is undoubtedly the most concerning question for everyone.

In an email dated March 19, 2019, BM disclosed part of the answer to Block.one shareholders: as of February 2019, Block.one's total assets (including cash and invested funds) amounted to $3 billion.

Of this $3 billion, approximately $2.2 billion was invested in U.S. government bonds, which were referred to in the email as "liquid fiat assets."

Some of the funds invested can be found in publicly available information: gaming company Forte, NFT platform Immutable, and a resort hotel in Puerto Rico, among others. In summary, the companies invested in share a common characteristic: they have little to do with EOS.

Before Bullish became the core business, Block.one still had a trump card, the social product Voice, deployed based on the EOSIO smart contract, which was the only product with a business relationship with EOS. To develop Voice, Block.one invested $150 million, with the largest single expenditure being $30 million to purchase a domain name from MicroStrategy, a publicly traded company that holds the most Bitcoin.

However, it seems to be a curse of fate; Voice's first launch event lasted half an hour, and the content fell short of expectations, leading to a lot of disappointment and causing the price of EOS to drop in response. More than half a year later, when the Voice iOS version launched on the Apple Store, various issues and bugs arose, with the Voice official webpage displaying "Error 1020," stating that the site was "using security services to protect itself from online attacks." EOS holders were thoroughly disappointed, and Voice finally announced in September 2023 that it would gradually shut down.

Projects launched by Block.one

The loud thunder and little rain seem to be a consistent style of Block.one's investment projects. After this, Block.one did not make any significant investment moves and began to completely lie flat. Today, Block.one holds 164,000 Bitcoins, which means its wealth has grown from $3 billion in 2019 to $16 billion now, a fivefold increase, making it a master of liquidity management.

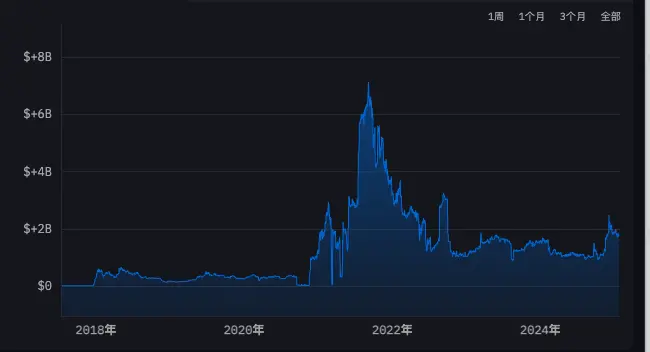

While Block.one hoards Bitcoin, Sun Yuchen is humorously referred to as the "E Guardian" trading master. In 2020, Sun Yuchen's on-chain assets remained around $300 million, but in just one year, this figure skyrocketed 23 times to reach $7 billion.

Data Source: Arkm

"If Sun Yuchen doesn't have a professional investment research team, then he is a very successful trader." Some in the community have commented, "Timing the market tops and bottoms is Sun Yuchen's forte."

In addition to selling over 100,000 Ethereum at a price of $3,674 in the past few months, from June to July last year, when the price of ETH hovered around $1,870, he quickly sold nearly 39,000 ETH, after which the price fell to around $1,500.

Besides trading, Sun Yuchen, who has been active on social media for years, is also an on-chain degen, actively participating in the DeFi (Decentralized Finance) space, excelling in arbitrage and mining. Simply put, DeFi mining is somewhat akin to traditional finance's "high-interest fixed deposits," where users deposit their cryptocurrencies into liquidity pools on decentralized exchanges to earn returns.

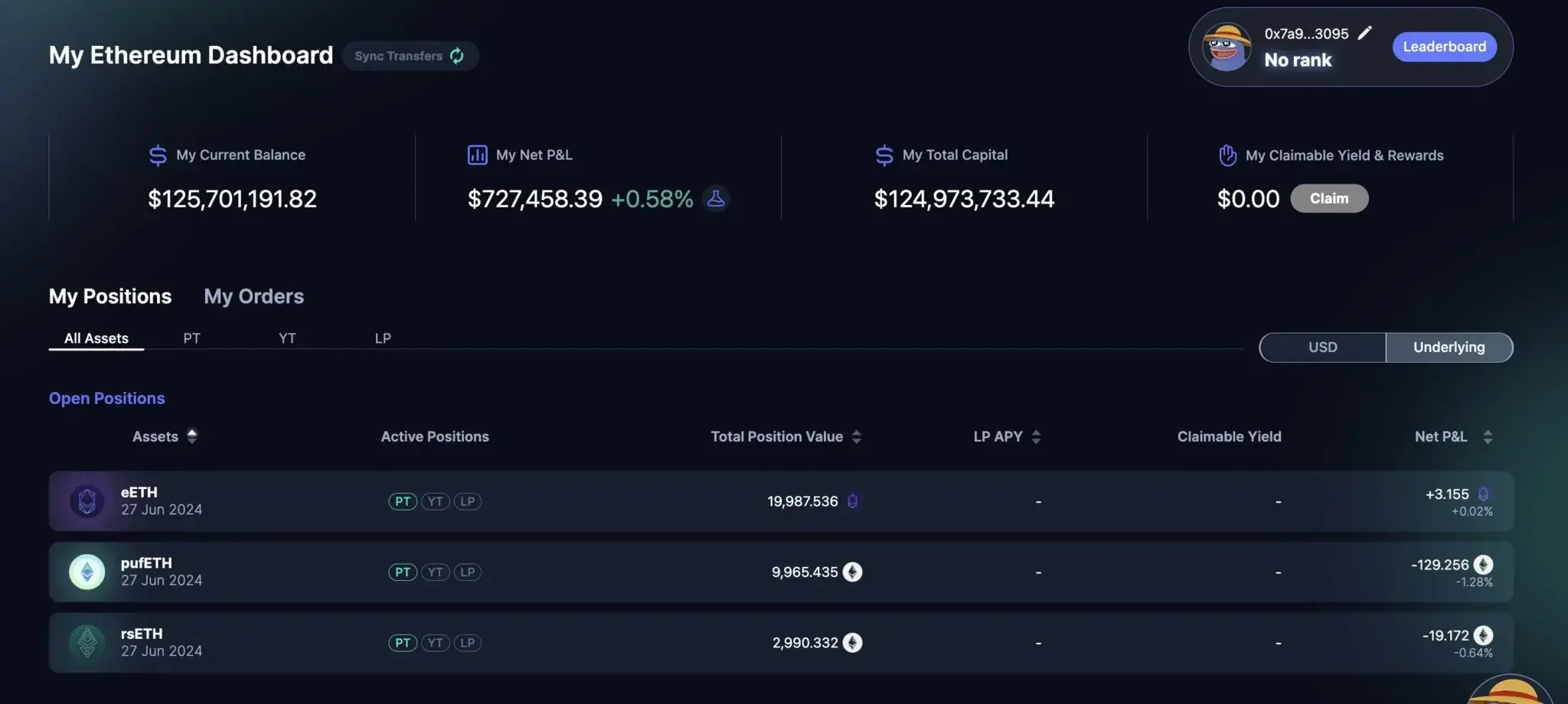

A typical operation for Sun Yuchen in 2024 was his purchase of Pendle's PT token in June. Within just two days, he invested 33,000 ETH (approximately $60 million), precisely allocating it to different DeFi projects such as Ether.fi, Puffer, and Kelp, each offering quite substantial yields.

Sun's previous position in Pendle, sourced from Ai Yi

Taking traditional financial market yields as an example, U.S. Treasury yields typically range from 3% to 5%, while bank deposit rates are even lower, possibly below 1%. In contrast, the yields from several DeFi mining projects that Sun Yuchen participated in may seem somewhat aggressive to traditional finance professionals: Ether.fi: By holding until maturity, Sun Yuchen could earn a 1% return in 22 days, equivalent to an annualized rate of 17.33%; Puffer: This investment has an even higher annualized yield of 18.93%; Kelp: Slightly lower, but still boasts a 14.33% annualized yield.

Similar to Sun Yuchen's investment style, TRON's development appears more bold and decisive compared to Block.one's somewhat laid-back approach. From the progress of TRON's projects, it is evident that Sun Yuchen has invested substantial funds and resources over the past few years, ultimately successfully elevating TRX into the "ten billion dollar market cap club."

TRON's daily revenue has grown from $1,000 in 2020 to $2 million in 2024, a 2,000-fold increase. In this bull market, there are not many "old altcoins" that have reached historical highs; the names that come to mind seem to be SOL, BNB, TON, and OKB. TRX is also among them, even reaching a historical high before Ethereum.

Today, TRON has a market cap of $20 billion, while EOS has a market cap of $1.5 billion, only one-third of its fundraising amount from back then.

Moreover, the funds raised by TRON back then were only one-tenth of EOS's.

Let's rewind to 2017, when both of these public chains were just starting out.

At that time, the crypto circle had already experienced the explosive growth of ICOs and the significant crash of '94, entering the "year of regulatory reckoning" for cryptocurrencies. Bitcoin's price fell from a peak of $19,870 to around $3,000, Ethereum was preparing for its 2.0 upgrade two to three years after its launch, and Binance had risen to become the largest trading platform globally, with two more years until Solana's emergence.

In 2017, Ethereum's two major competitors almost simultaneously stepped onto the historical stage. Sun Yuchen, just past his 27th birthday, put aside his original social app, gathered a few classmates from Peking University, leveraged the support of influential figures behind him, and returned to the crypto circle with ambition to create a TRON chain; on the other hand, BM, who had even clashed with Satoshi Nakamoto, had let go of his first two projects and teamed up with marketing expert BB to plan the creation of the first-generation Ethereum killer and blockchain 3.0.

In August 2017, TRON launched its ICO two months later than EOS but ended its fundraising nine months earlier due to the arrival of "9.4." Chinese project teams and trading platforms fell silent, quickly fleeing and vowing never to engage in blockchain again from their ancestors to their descendants.

In later recollections, Sun Yuchen described the scene at that time: "The demands for refunds outside were like scenes from 'The Walking Dead' or 'Train to Busan'; as soon as the glass door opened, you would be trampled to death." The community urged Sun Yuchen to refund quickly, with those blocking the door holding knives to their throats, "Either you bleed, or I bleed; just return Ethereum to us immediately."

That was the most desperate time for TRON; the early team had basically all left, and partners had resigned out of safety concerns.

"My six years of entrepreneurial journey, the first three years were basically wasted," Sun Yuchen said. By the end of the ICO, TRON had raised a total of $400 million, and not much was left after refunds.

Some were happy, while others were sad.

On the other hand, EOS, which had both advanced technology and idealism, raised $4.2 billion during its year-long ICO period. Not only that, but they had also prepared well on the regulatory front, with a strong legal team providing support. The audience during the ICO was mostly Chinese and Korean, with relatively little fundraising in the U.S. Ultimately, when pursued by the SEC, Block.one only paid a fine of $24 million. Fortunately, at the same time, Telegram and TON, which were also targeted by the SEC, had their $1.7 billion token issuance plan directly halted. Because the team members were all U.S. citizens, the '94 regulatory incident had almost no impact on EOS.

The vastly different treatment, "I merely stole a corn, but they bombarded me with cannons," Sun Yuchen described his situation at that time.

In EOS's first year, everything went smoothly. However, starting in the second half of 2018, the price of EOS continuously fell to new lows, and rumors circulated within the community that BM was going to leave EOS, until in 2019, BM really did leave.

It is said that some large holders were exceptionally angry at that time, especially those who had followed BM since 2013. Feeling abandoned by BM, they turned their love into hatred and created a Telegram group to discuss how to deal with BM, with some even offering a bounty of 100 Bitcoins to assassinate BM through the dark web. This prompted BM to quickly rejoin the EOS community's TG group, where he frequently provided advice to the community and was afraid to show up in real life for a long time.

Moreover, with the strong regulation from the U.S. SEC, both EOS and Block.one have been cautious and restrained over the years.

Speaking of regulation, this is something Sun Yuchen takes some pride in: "I am very good at dealing with regulators." After all, apart from Sun Yuchen, perhaps no one knows the truth and details of that year, how he resolved the '94 regulation? Was he really under border control at that time? Did he go to Korea after hearing the news? And how did he ultimately bypass the border control?

But in all versions of the story, there is a common point: Sun Yuchen understands regulation very well. On July 25, 2019, Sun Yuchen sent an apology letter, expressing gratitude and apologies, repeatedly mentioning "the leaders and regulatory agencies that care for and protect me." In addition, Sun Yuchen began to seek refuge in "tiny countries" around the world: in 2021, he served as Grenada's permanent representative to the WTO and ambassador extraordinary and plenipotentiary; he was elected as the Prime Minister of Liberland (a micro-nation not recognized internationally).

Recently, Sun Yuchen has been riding high.

Unlike his previous engagements with small countries, he has recently connected with the family of the world's largest country, U.S. President Donald Trump's family. In November last year, Sun Yuchen announced that he would purchase $30 million worth of World Liberty tokens, a DeFi project launched by the Trump family.

For ordinary investors, the appeal of purchasing and holding World Liberty tokens is not significant, as they cannot share in the company's profits or resell them. It is said that of the initial $30 million raised, 75% went directly into Trump's company account, making it look more like a donation than an investment; in other words, it was a good opportunity to make a political contribution.

Therefore, when the first batch of World Liberty tokens sold out and the second round of supplementary sales began, TRON DAO continued to increase its stake, investing an additional $45 million, bringing the total investment to $75 million.

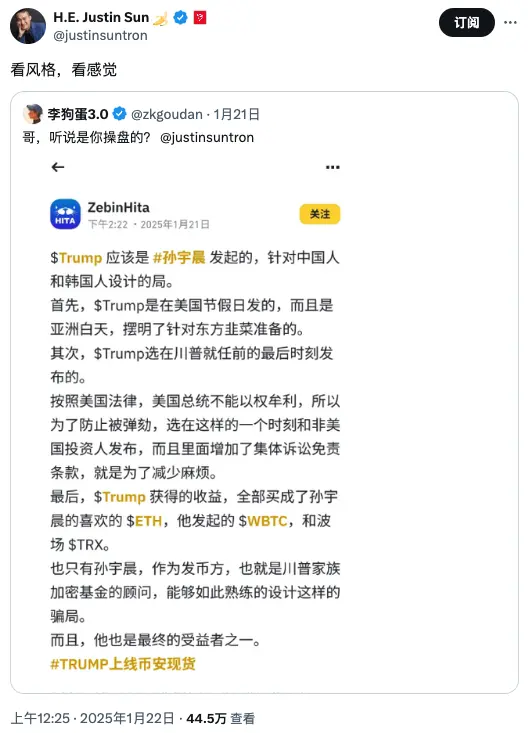

As the top player, Sun Yuchen successfully became an advisor for the project, and World Liberty gradually purchased TRON (TRX) tokens to enrich its treasury. There are even rumors that the virtual currency $TRUMP, released by Trump just before he took office, also has Sun Yuchen's influence, and Sun Yuchen's attitude on his personal social media remains ambiguous.

From the current results, compared to other crypto bigwigs, Sun Yuchen has indeed shown flexibility under regulatory pressure. The fate of FTX founder SBF is destined to be spent in prison, while CZ has temporarily "bought out" his freedom issues with $4.3 billion and a few months of prison life. Meanwhile, TRON's users remain on-chain, without the KYC forms of trading platforms; the only regulatory issue that can be identified is the sanctions and money laundering issues in its USDT transactions. However, since the issuer of USDT is Tether, and TRON merely provides the infrastructure, the network service providers will not face issues before Tether does, regardless of the circumstances.

Eight years ago, Sun Yuchen returned to China to start a business, proclaiming in a speech, "I measure a person's worth by how much money they make." He said it and indeed acted on it. Setting aside the lofty ideals of a literary youth, Sun Yuchen began to walk a path of pragmatism that was almost ruthless in "making money."

Today, eight years later, 35-year-old Sun Yuchen has assets worth $2 billion in his on-chain wallet, and rumors suggest his net worth is $100 billion. He can casually spend $6.2 million to buy a banana art piece; he has maximized the rules, leveraged resources, and won this game of "exploding coins" for himself.

What is even more intriguing is that at every fork in the road, EOS and Block.one, which have always been at odds with TRON, now have 164,000 Bitcoins worth $16 billion lying on their accounts.

Thus, fate has achieved a certain absurd "different paths leading to the same goal." TRON and EOS have also written a tale of two cities in the crypto era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。