Despite the significant drop in BTC prices below the $100,000 mark, the overall upward trend remains intact.

Written by: BitpushNews Mary Liu

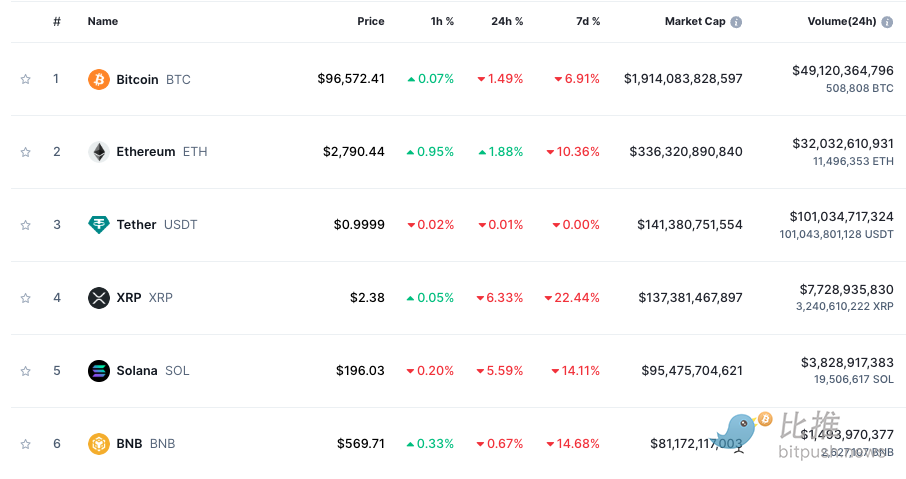

The cryptocurrency market saw a slight decline on Wednesday, giving back some of yesterday's gains. According to Bitpush data, Bitcoin is currently consolidating around $96,500, down 1.6% in the past 24 hours. Ethereum rose 2% to $2,790. Meanwhile, XRP fell 7% to $2.4, and Solana (SOL) dropped 6% to $196. The total market capitalization of cryptocurrencies decreased by 1.8% in the past 24 hours, falling to $3.17 trillion.

Trump's Tariff Agreement Causes Continued Market Volatility

As the market retreats, uncertainty surrounding U.S. economic policy and regulatory changes persists. Although Trump's suspension of tariffs on Canada and Mexico has temporarily eased market pressure, investors remain cautious about increasing volatility, inflationary pressures, and upcoming legislative developments.

Antonio Di Giacomo, a senior market analyst at XS.com, stated, "With the Mexican president reaching an agreement with Trump, the market outlook has turned positive." However, despite the price rebound, he warned that volatility in the cryptocurrency market remains high.

Di Giacomo noted, "Bitcoin continues to face challenges from Federal Reserve monetary policy, government regulation, and the behavior of large investors. Experts believe that the $100,000 level may become a strong resistance in the short term, and without new catalysts, sustained growth will become difficult."

What Does Market Sentiment Indicate?

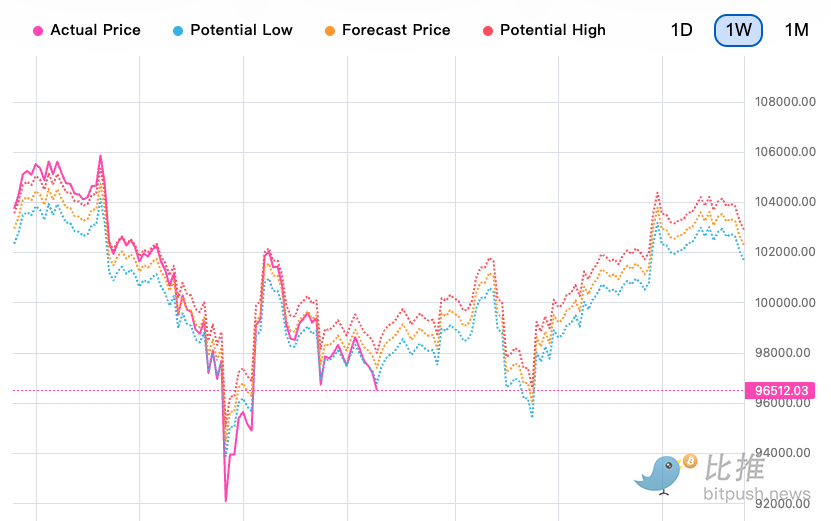

According to a daily timeframe chart released by chart analyst Trivedi, Bitcoin recently rebounded from a low of $92,000 and retested the 50% Fibonacci resistance level. However, the price failed to break through the 20-day EMA resistance and continues to trade below it, indicating a lack of sufficient buying momentum in the market.

Despite the significant drop in BTC prices below the $100,000 mark, the overall upward trend remains intact. As long as the price stays above $90,000, bulls will continue to dominate and may restart the upward trend.

According to Coinglass data, the long-to-short ratio is currently at 0.9849, indicating a slight improvement in market sentiment. However, open interest (OI) has decreased by 2.30%, falling to $58.84 billion.

Current key support levels are at $95,000 and $92,000, while resistance levels are at $100,000 and $105,000.

Optimistic Forecast: Targeting $170,000 in Months, Potentially Reaching $500,000 by 2028

Market analyst best_analysts pointed out in their latest post on the X platform that if historical price trends repeat, Bitcoin may be on the verge of a larger breakout. Based on long-term trend analysis, BTC is expected to rise to around $170,000 in the coming months, with the specific increase depending on its ability to maintain the current trend.

Meanwhile, CryptoGoos mentioned in their post that BlackRock has been continuously increasing its holdings of BTC and ETH during the recent market pullback. This move corresponds with the ongoing decline in exchange supply, indicating that demand for the asset is gradually increasing.

Historically, a decrease in exchange supply has often been an important signal for an impending rebound in cryptocurrency assets. Additionally, as BTC prices have experienced a significant pullback from their highs, the market may be building momentum for the next round of recovery towards historical highs (ATH).

The traditionally aggressive Standard Chartered has predicted in its latest report that Bitcoin (BTC) prices could reach $500,000 by 2028. This prediction is based on two key factors: the popularity of spot Bitcoin ETFs and a decrease in volatility.

Geoffrey Kendrick, head of global digital asset research at Standard Chartered, noted in the report that as the U.S. spot Bitcoin ETF market matures, Bitcoin's volatility will gradually decrease. He stated that with the support of Trump administration policies, access to Bitcoin is improving, and the trend of institutional funds flowing into spot Bitcoin ETFs will continue to grow.

Kendrick believes that the optimized dual-asset allocation ratio of Bitcoin and gold will gradually increase, driving long-term price appreciation for Bitcoin. He wrote, "As portfolios approach their optimal state, Bitcoin prices will achieve long-term appreciation."

Standard Chartered's predictions for Bitcoin are as follows:

End of 2025 target: $200,000

2026 target: $300,000

2028 target: $500,000

Kendrick emphasized that this upward trend will gradually materialize during President Trump's term and will be sufficient to push Bitcoin to $500,000 before he leaves office.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。