The Key to Being an Excellent Trader: Go with the Trend and Adjust Your Framework Timely.

Author: Tulip King, Chief Technology Officer at MessariCrypto

Compiled by: Deep Tide TechFlow

Investment Strategy: Alpha Priority

Let the market tell you which coins are performing well and which are not. Buy those that have already confirmed strength and sell those that are underperforming. You don’t need to be the first to enter; just make sure you’re not the last to exit.

Invest time and effort. Look for coins that contradict your assumptions and delve into the reasons behind them.

Operate independently. Relying on copy trading often leads to unsatisfactory results.

The Market is Always Right, and Traders Need to Go with the Trend

Indeed, going against the trend can often yield higher returns. In an ideal world, everyone wishes to buy at the lowest point and sell at the highest. However, this is not realistic. If investors can more calmly follow market trends, many unnecessary losses can be avoided. For example, chasing coins that surge by 40% in a single day while decisively selling those that have dropped more than 10% for several consecutive days.

The market never makes mistakes: The market's movements are always correct—only personal opinions can be wrong. This means that regardless of how you think the market should operate, the actual market movements are the undeniable facts.

Profit is the only correct validation: Determining correctness is not about predicting market movements but about whether one can make a profit. Even if a trader's judgment about market direction is correct, poor execution or mistimed actions can still lead to losses. The true "correctness" lies in profitable trades, not in theoretically accurate predictions.

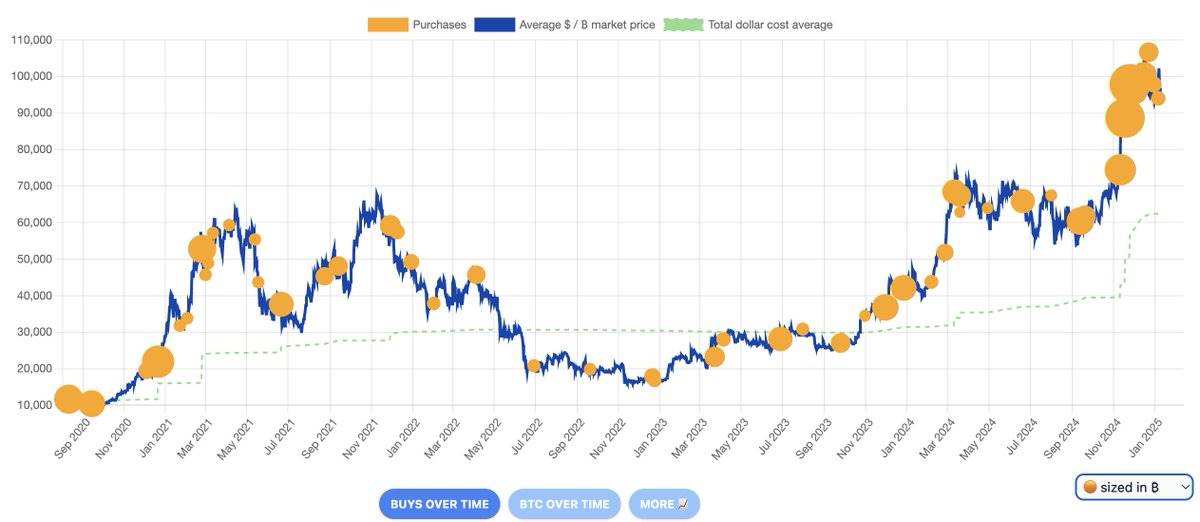

You will find that investors like Saylor (Michael Saylor, founder of MicroStrategy) will make significant purchases even at price peaks.

Instead of trying to predict market reversals, learn from the strategies of successful traders: identify and follow strong areas in the market. This includes: daring to buy assets that have already risen significantly, quickly cutting losses when market sentiment shifts, and avoiding trying to save losing positions by averaging down.

Excellent traders focus more on risk management rather than being fixated on the correctness of their judgments. This means: timely taking profits when there are opportunities, not stubbornly holding through significant drawdowns, and being willing to re-enter when market conditions improve.

@slingdeez: “Oh my, over the past year, I’ve probably experienced a six-figure ‘roller coaster’ about 15 times, always treating unrealized gains as if they were already realized profits.

In fact, even if I had chosen to take profits at that time, I could have easily bought back the same tokens at a lower price later. But I always fell into a state of self-paralysis, and almost every time, on the same day or the next, others started taking profits, and my funds returned to square one.

Although the overall performance was decent, I was indeed a bit self-deceiving. But it’s not a big deal.”

We have all experienced times like this.

Price movements are the only truth in the market. When your position incurs losses, the market is actually telling you that your trading logic may be flawed. A wise strategy is to accept small losses rather than holding on and incurring larger ones.

When your holdings experience a significant pullback, it is crucial to stop and reflect: Is this part of the overall market trend? Has the market focus shifted to other coins? Have I overlooked certain information? Most importantly, you need to ask yourself: Is it necessary to endure this decline? When the market contradicts your assumptions, remain humble and reassess your logic, adapting to the ever-changing market environment.

Market Signals: AICC Case Study

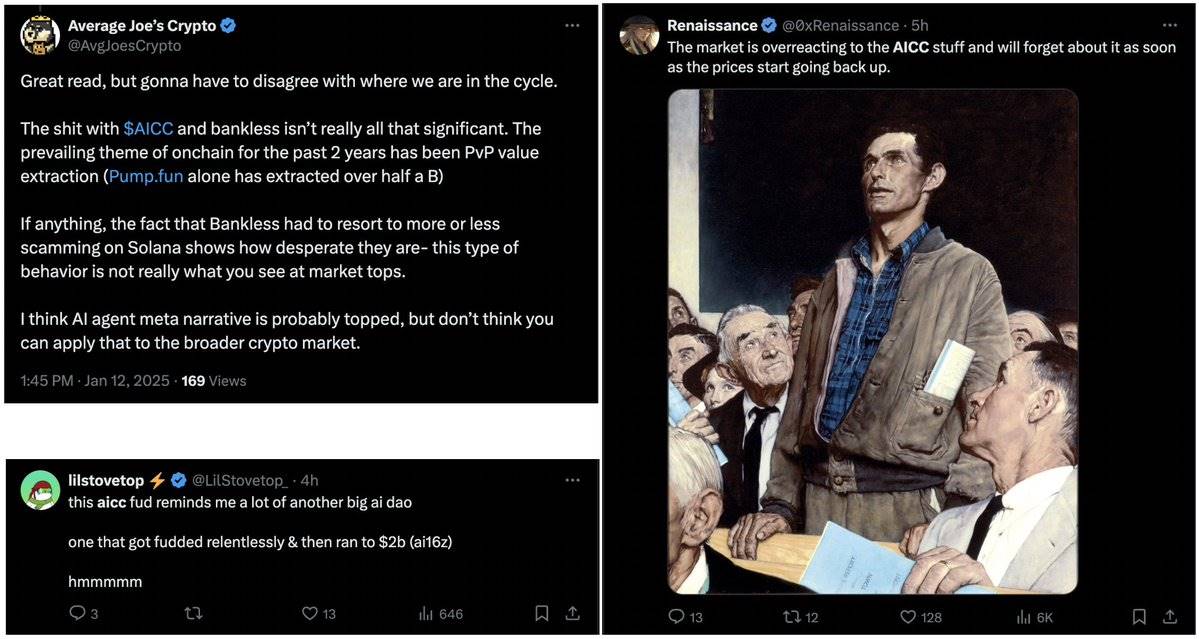

AJC is a smart investor and a friend of mine, and I want to emphasize our different perspectives on market interpretation.

The current market reaction to AICC provides us with an important lesson about market psychology. Here are the key points: If your interpretation of AICC differs from the market, you need to face two possibilities and take immediate action:

The market is right, and your judgment is wrong.

The market is selling off for reasons you have not identified.

In either case, going against the trend is dangerous. If you cannot explain the reasons for a price drop, it becomes difficult to determine when the decline will stop. As Buffett said, “You only find out who is swimming naked when the tide goes out”—if you cannot understand market movements, you expose yourself to unseen risks.

Let Go of Obsession and Adapt to Market Changes

In the fast-changing cryptocurrency market, there is only one asset that can truly be “held long-term without question”: Bitcoin. This is not an extremist viewpoint but a pragmatic judgment based on Bitcoin's unique position. As digital gold, Bitcoin possesses unparalleled network effects, true decentralization, and widespread institutional recognition. In other areas of digital assets, active management is not just advisable but essential for survival.

Although ai16z has recently attracted a lot of attention, the market had already hinted weeks ago that the focus should shift to DeFAI.

The cryptocurrency market demands a unique mindset: a deep understanding of the market while being able to adjust strategies at any time. Successful traders always maintain what Andy Grove called “professional vigilance,” a state of continuous reflection—every position needs to be questioned, every assumption needs to be re-evaluated, and every profit needs to be seen as potentially fleeting. This is not pessimism but a clear-eyed recognition of reality—where the speed of narrative change in this market can be faster than updates on Discord.

In the cryptocurrency space, the most dangerous trap is not leverage or poor entry timing, but emotional dependence on positions. We have all seen situations where traders become “hold the line” types when losing, investors double down because they tie their personal identity to a failed assumption, or community members become stubborn in the face of changing market conditions instead of acknowledging reality. This “emotional obsession” is far more destructive to capital than any smart contract vulnerability.

To succeed in this market, one must not only be “always online” and gather information from multiple sources but also possess emotional management skills to analyze information objectively without being swayed by existing biases. Your beliefs should be strong enough to take action but flexible enough to adjust quickly when market conditions change. Think of yourself as a surfer observing the waves rather than a captain trying to control the ocean.

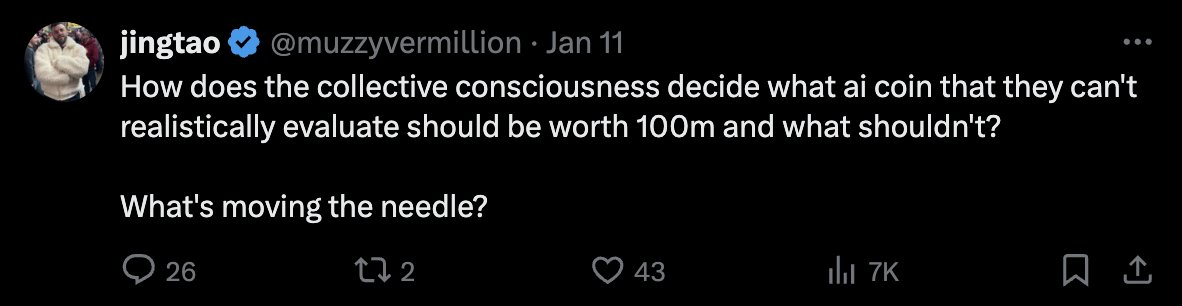

@muzzyvermillion: “Why does the collective consciousness believe that certain AI tokens, which cannot be practically assessed for value, can be worth $100 million while others cannot? What exactly is driving the market changes?”

The Key to Being an Excellent Trader: Go with the Trend and Adjust Your Framework Timely.

The most successful cryptocurrency traders share a common trait: their views are very clear, but these views are like a loose garment that can be taken off at any time when the market sends different signals. They understand deeply that in the crypto market, “correctness” is not a fixed belief but the ability to maintain continuous attention and adapt quickly.

Remember, every investment other than Bitcoin requires active management, constant validation, and the humility to acknowledge mistakes when market conditions change. In such a dynamic market, beliefs should be seen as hypotheses that need to be validated, not as convictions that must be adhered to.

The Power of Independent Thinking

In the whirlpool of opinions on Crypto Twitter, every price fluctuation triggers countless contradictory interpretations. In such an environment, the ability to think independently is particularly scarce and valuable. People often mistake information acquisition for analysis and following opinion leaders for insight. However, when the trading day ends, only your name will appear on your profit and loss statement.

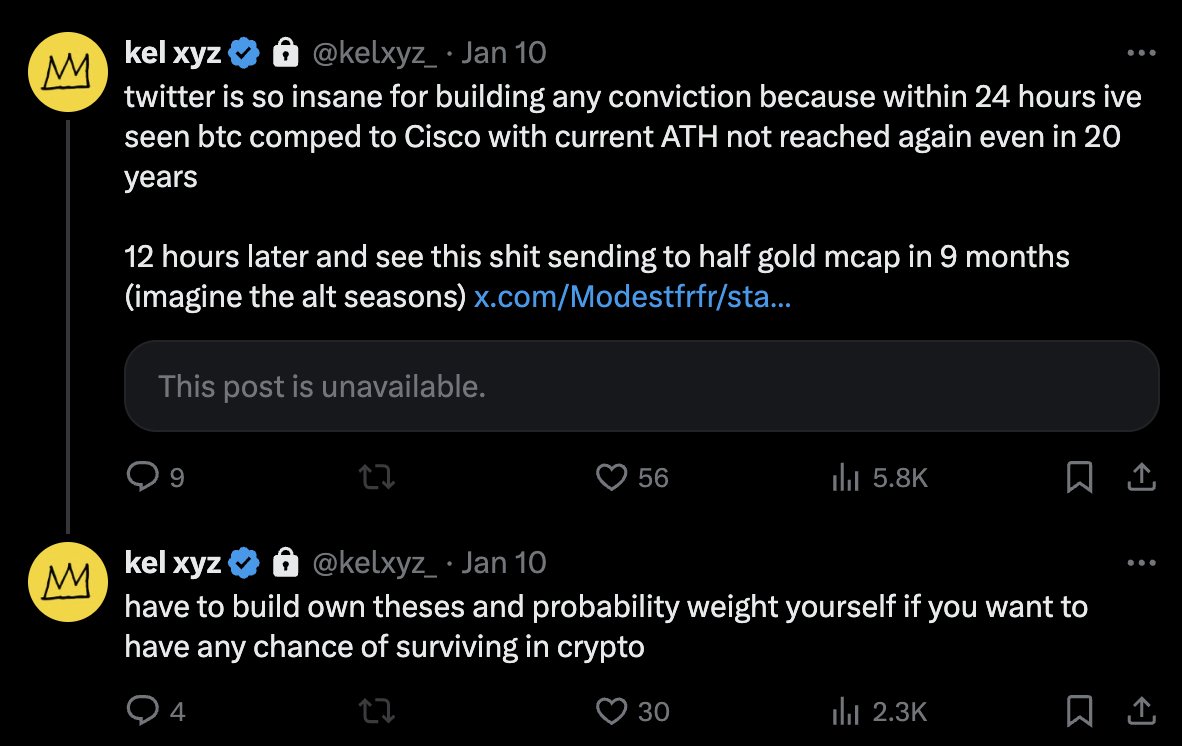

@kelxyz_: “Building beliefs on Twitter is incredibly difficult. Within 24 hours, I saw someone compare BTC to Cisco, claiming that the current historical peak might not be reached again for 20 years. Yet, just 12 hours later, someone predicted that BTC would reach half of gold's market value in 9 months (imagine if such a meme coin market really existed).”

“If you want to survive in the crypto space, you must build your own investment theory and assign weights to it based on probabilities.”

Form your own opinions and become an independent thinker in the market.

In the cryptocurrency market, the market does not care which well-known accounts you follow, nor does it care which “Alpha groups” you have joined (referring to elite communities that provide market insights and trading opportunities). The market will only react based on supply and demand, fear and greed, and the collective behavior of participants based on their beliefs. This is why blindly copying trades can be so dangerous—if you do not understand the underlying logic, you will never be able to judge when to exit, when to add to your position, or more importantly, when the original trading logic has become invalid.

Writing is one of the most powerful tools for cultivating market insight. The process of writing forces you to clarify your thoughts. When you try to articulate your market logic in writing, those seemingly reasonable vague ideas will expose obvious flaws. Only through clear expression can these logics withstand rigorous scrutiny. This also explains why top traders and investors like George Soros and Howard Marks are often also highly influential writers.

@RyanWatkins: “It feels great to pick up the pen and write again.”

The Secret of Messari: Writing Sharpens Thinking.

Messari has become an incubator for top talent in the crypto space precisely because it promotes a culture of regular research and writing. This habit is not just about recording thoughts; it is a process of honing one’s thinking. Every research article, every market analysis, forces the author to examine their views and delve into the core logic of market operations, rather than just skimming the surface.

The key to success in the market is not finding a “mentor” worth following, but cultivating your own voice. Start writing, even if it’s just for yourself. Record every trade you make, explain the logic behind it, and reflect on your mistakes. Challenge your assumptions in public and engage in discussions with others. When new information arises, be brave enough to change your viewpoint. The goal of success is not to be right all the time, but to think clearly and independently.

“Do not imitate others' voices; cherish your own voice. Develop it, treasure it.” —Rick Rubin

In a narrative-driven market, those who can independently construct and analyze narratives often hold a significant advantage. Your writing does not need to be polished or widely popular—it just needs to be authentic and insightful. It is through this process that vague market intuitions can gradually evolve into actionable trading logic, allowing ordinary market participants to grow step by step into market leaders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。