Original Title: Internet Finance

Author: TheiaResearch, Crypto Kol

Compiled by: zhouzhou, BlockBeats

Editor's Note: This article draws an analogy between the impact of the Internet finance system and that of the Gutenberg printing press, arguing that Internet finance will significantly reduce the cost of financial transactions, break traditional financial monopolies, promote the free flow of global capital, and drive economic growth. Through permissionless cloud servers and smart contracts, Internet finance can optimize capital allocation, risk management, and financial innovation.

The following is the original content (reorganized for better readability):

Our fund philosophy is entirely based on the Internet finance system, which is the cornerstone we are willing to live and die for. We often strive to explain the prospects and significance of the Internet finance system to friends and investors.

This is a challenging task because the existing financial system is largely abstract for consumers—especially for those in developed countries who are satisfied with the current financial infrastructure—while what we are trying to build is still in the conceptual and esoteric future stage.

This article summarizes some of our classic viewpoints, aiming to help you explain the Internet finance system to friends, family, and clients.

We are collaboratively building the Internet Finance System (IFS)—a cloud-based, better financial system that can carry global assets and provide financial services to 8 billion people. We believe that the Internet finance system represents a paradigm shift in global financial activity, just as Gutenberg's printing press brought about a paradigm shift in knowledge production and dissemination.

Unified Servers and Smart Contract Code

We discuss two fundamental differences between the existing financial system and the Internet finance system, which is the most technical part of the article.

You might think that the financial system already operates on the Internet because you can access banking or brokerage services online, but the Internet is merely an interface through which you send orders, just like placing an order at a pizza delivery service. The pizza is not made in the Internet, and neither are your financial transactions.

The existing financial system operates through a series of mutually isolated servers. There are over 90,000 financial institutions globally, most of which use internal servers that cannot be accessed externally. Your bank loan is just an entry in one of these servers. Any asset you own in the global financial system—whether you own it or owe it—is just an entry in these isolated servers.

If you own property in the United States, you may know that your ownership is registered on federal, state, and local servers, and only a few authorized administrators can send transactions to these servers. This is what we refer to as the "permissioned isolated server" problem.

Financial institutions use standards like SWIFT and ACH for transfers and data sharing. However, these standards require multiple steps and human oversight due to differences between the underlying databases. When communicating between cross-border financial institutions, you need to rely on local government entities like central banks and international institutions like the Bank for International Settlements. This process is expensive, cumbersome, and slow, filled with a lot of paperwork and high-paid employees. This is the high transaction cost problem associated with permissioned isolated servers.

Building a financial system on permissioned servers also gives rise to two issues. The first issue is that creating a financial services company is difficult—really difficult. You need to find a "gatekeeper" who can allow you to publish transactions to what we call the network of permissioned isolated servers in the global financial system.

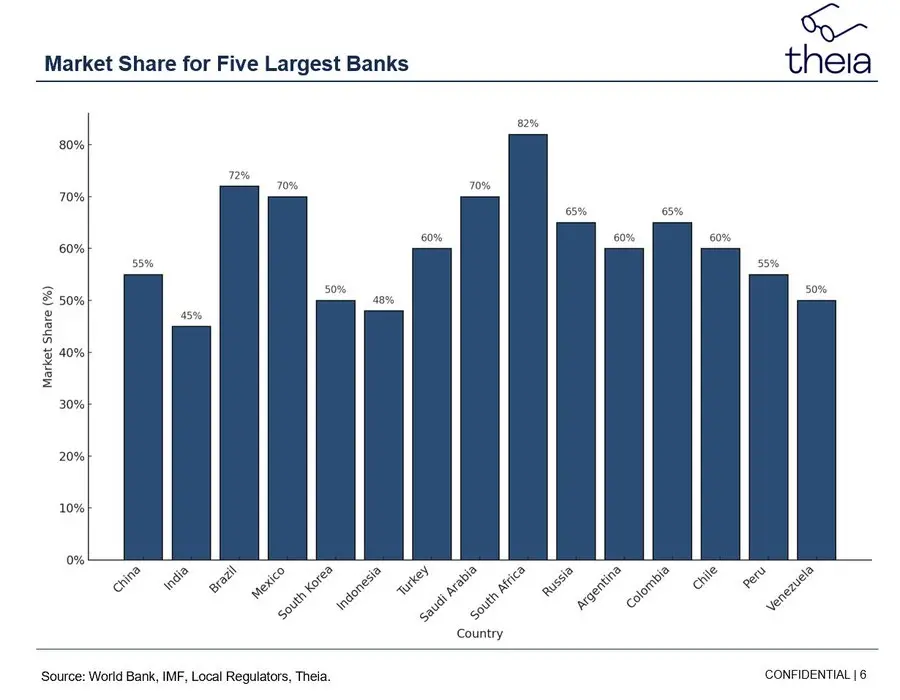

You also have to pay them handsomely. This is the problem of high barriers to entry for financial startups. Another related issue is that financial institutions have privileged access over entire regions. For example, three banks control over 50% of the market share in Colombia, and you need to work with them to lend to businesses in Colombia.

Most emerging economies have similar market structures. Each country has local financial institutions acting as "gatekeepers" to opportunities in their markets, exploiting this privileged position to extract rents. This is what we refer to as the "local banking oligopoly" problem.

Note that so far, we have explained the "permissioned isolated server" problem and how it leads to heavy transaction costs, high barriers for financial startups, and the local banking oligopoly problem.

In a permissioned server system, establishing a financial startup faces high barriers to entry.

Most countries have some financial institutions acting as "gatekeepers" to local opportunities.

Let’s look at one of the core advantages of Internet finance: the ability to make commitments through code. This is the basis of smart contracts. Chris Dixon compares smart contract code to a vending machine, where you can get a bottle of Coke after inserting a dollar. Smart contracts allow you to write code that responds to inputs in a predetermined way. For example, when a smart contract receives a dollar, it can release a bottle of Coke.

Or, when it receives a full principal and interest payment, it can release collateral. Smart contract code can automatically distribute dividends to shareholders, rebalance portfolios, and manage capital structure tables based on preset logic.

The charm of smart contract code lies in its ability to automate most financial activities and expand the design space of financial products you can create. Take escrow agreements as an example. When you buy a house, the escrow agent holds the funds and the property deed until both parties fulfill their commitments (for example, the seller cannot take the money without fulfilling the agreement).

Smart contract code means you no longer need an escrow agent—just an escrow contract that checks both assets and releases them when the appropriate conditions are met. You can automate various types of transactions—such as a loan market that executes penalties and releases collateral according to a payment schedule; life insurance that pays out upon receiving a certified death certificate; copyright contracts that automatically receive streaming payments whenever a song is played on Spotify. The design space is vast.

The existing financial system cannot utilize smart contract code; it relies on a network of isolated, permissioned servers. In contrast, the Internet finance system is built on a permissionless, unified server using smart contract code. So, what does this mean?

The Internet Finance System is a Step Forward for Our Civilization

1. Internet finance allows capital to flow freely across borders.

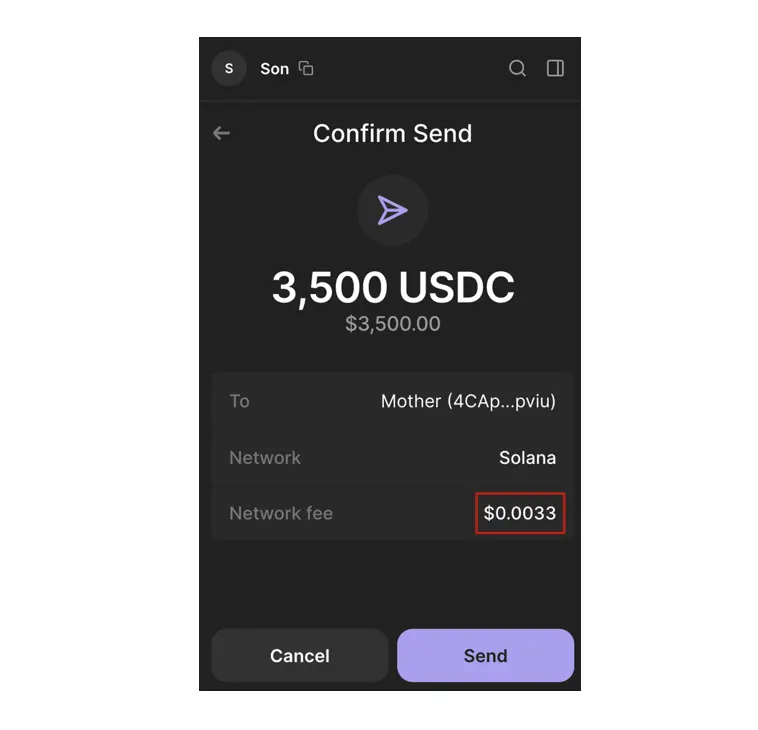

The Internet finance system is global because it is directly built on the open Internet. Physical distance becomes irrelevant. You can make global remittances instantly for less than a cent. Funds in Dubai can invest in auto loans in Colombia. A hotel operator in Indonesia can raise funds from global capital markets without paying high interest to local banks.

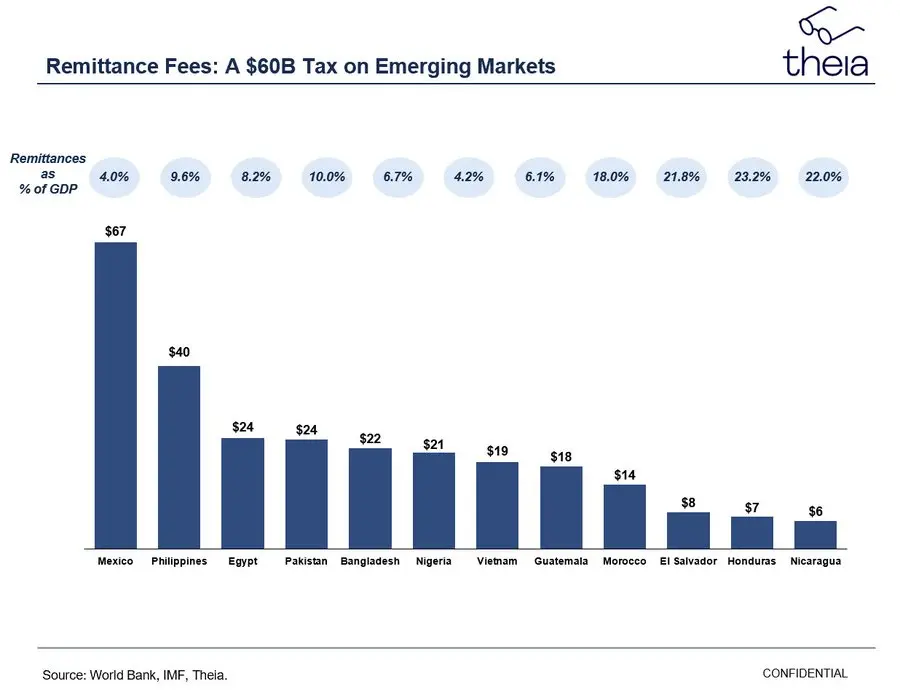

Most people have seen remittance statistics—people send over $900 billion to each other annually, paying an average fee of 7%. The remittance industry is imposing a $60 billion tax on the world. About $670 billion (approximately 75%) of remittances flow to low- and middle-income countries, where remittance amounts can account for over 20% of GDP. Remitting through the Internet incurs no additional costs because Internet finance itself does not recognize borders. A remittance is merely an operation updated to a unified server, and its fee is the same as any transfer between two accounts ($0.01).

Our existing financial system, based on permissioned isolated servers, cannot achieve the free cross-border flow of capital. Each local banking oligopoly exploits its privileged position over remittance recipients—controlling local servers and access points—to extract rents. In the case of remittances, this dynamic is easy to understand because we intuitively know that a hardworking immigrant should not have to pay 7% to send money to their mother. By 2025, the cost of remittances should be less than $0.01.

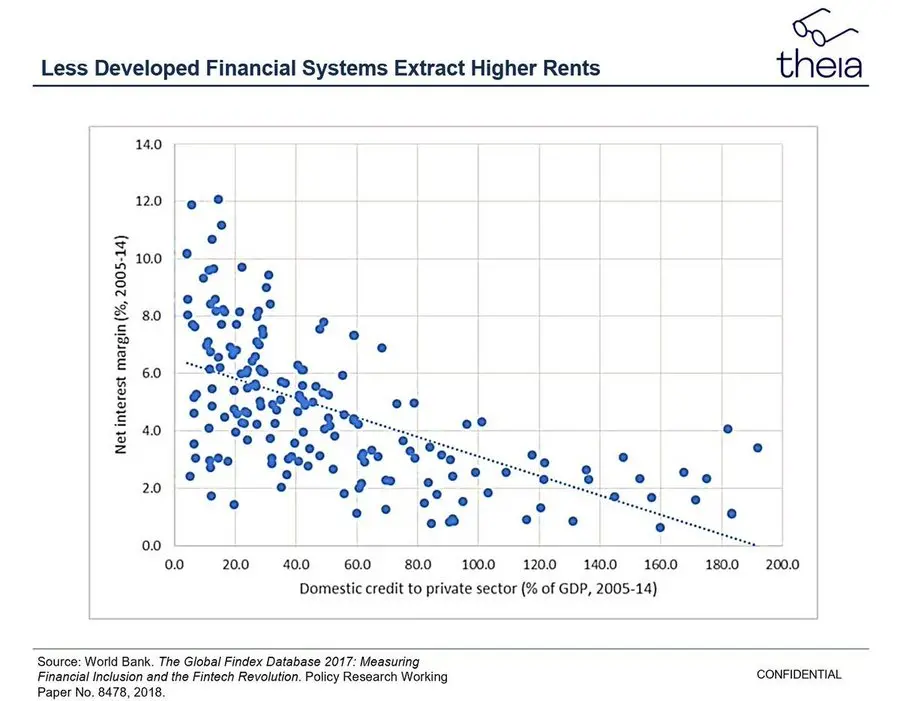

For most of us, observing the same extraction process in various sectors of the global financial system is more difficult because these costs are a more abstract layer. However, we can approximate the true costs of local banking oligopolies by observing the net interest margin (NIM)—the difference between the borrowing cost of financial institutions and their loan charges. In regions where the financial system is less developed, the net interest margin is typically higher—often between 5% and 10%, but this number can be larger.

The economic plight caused by excessive net interest margins cannot be overstated. A banking system with an extractive net interest margin means that the cost of mortgages is higher than it should be. Higher mortgage costs mean fewer people can afford homes, which means fewer homes are built.

This situation can be extrapolated to the entire economy. More expensive business loans mean that diligent entrepreneurs have to pay more "rent" to local banks, resulting in fewer entrepreneurs starting businesses. In Nigeria, a young professional cannot afford a car loan, so she cannot accept a job opportunity 50 minutes away. Extractive net interest margins affect all levels of society, leading to lower GDP growth and fewer job opportunities.

The global Internet finance system addresses this issue by providing larger investors with more high-yield and diversified investment opportunities, especially in less developed economies.

Suppose you operate a diversified high-yield fund in Dubai and believe that Colombian auto loans offer good risk-adjusted returns. Under the existing permissioned, isolated server system, it is not easy for the Dubai fund to access Colombian auto loans. The fund might look for a fund of funds (FoF) in New York that has connections with local credit funds in Colombia, but that already involves three layers of fees.

Under the framework of the Internet finance system, Colombian car dealers issue auto loans directly on the blockchain. This way, they can find the lowest cost of capital, as that is where liquidity is highest. An algorithm can rank Colombian auto loans based on predicted default rates, allowing the Dubai fund to precisely filter the desired investment exposure.

You should envision a globalized system where capital can flow easily around the world for the most efficient uses; a financial system where the net interest margin is compressed to the cost of capital.

Another example—a hotel operator in Indonesia raises funds over the Internet instead of paying high fees to the local banking system. Why do we assume that the hotel operator prefers to raise funds directly on the Internet? This is due to the important concept of auction network effects.

If you want to sell an old gaming console, like the Sega Dreamcast, you would go to the place with the most buyers, as that is where you are most likely to find the highest bidding buyer. Similarly, those looking to buy would also go to the place with the most sellers, because more sellers mean a higher probability of finding someone willing to sell at a reasonable price.

This is why most markets tend to result in a winner-takes-all outcome. The Chicago Mercantile Exchange (CME) dominates the traditional derivatives market, the New York Stock Exchange dominates the U.S. stock and fixed income markets, and eBay dominates the global Sega market.

The auction network effect is why we expect the Internet to become the deepest capital market globally. The Internet will serve as a marketplace between those who need capital and those who have capital to allocate, providing the lowest cost of capital.

We do not mean to imply that national financial regulation and capital controls will disappear in the face of Internet finance. While the fundamental financial system will be globalized and allow for the free cross-border flow of capital, sovereign nations will still overlay their laws and regulations on top of it.

Technology may enable you to do certain things, but that does not mean those things are legal or permitted. You can think of Internet finance as similar to a car; it allows humans to do things they could not do before, but it does not mean they can do so completely free from local laws. However, we expect that national laws will adapt to Internet finance as economic policies and financial regulations consistently evolve with technological advancements.

2. The Internet finance system will improve property rights protection for 5 billion people globally.

The existing global financial system does not provide property rights protection for most people. While some developed economies have strong property rights protections, most emerging markets still rely on assets that are vulnerable to devaluation, expropriation, and arbitrary legal systems for savings.

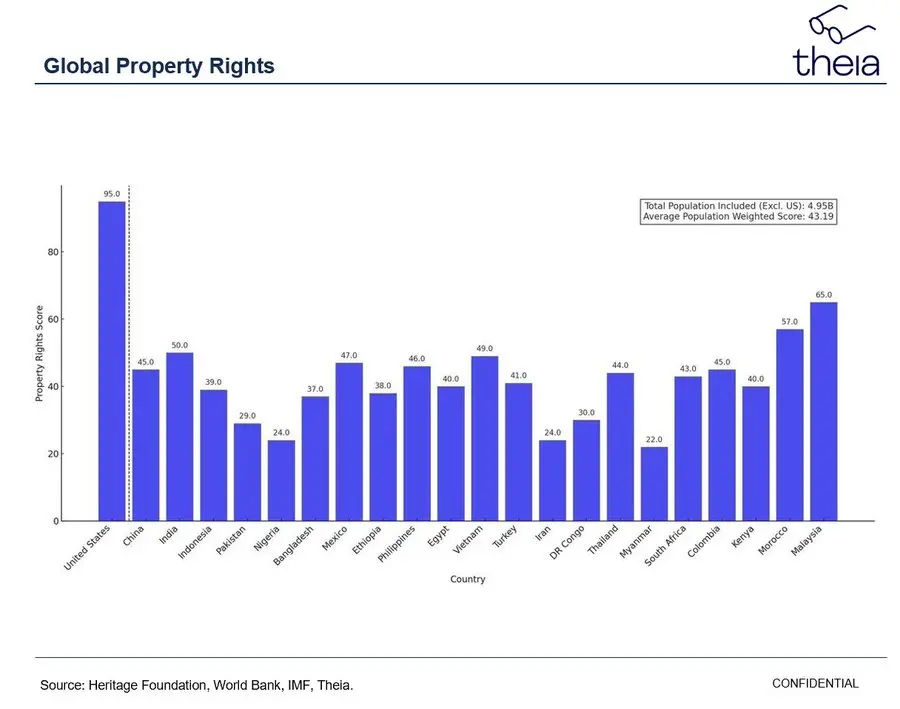

The 20 largest emerging markets in the world have a combined population of over 5 billion, and their heritage foundation property rights scores average below 43. Such a low score means your property rights depend on politics, often influenced by bribery and favoritism. This means you might invest in a piece of land for ten years, only to find that the local governor's brother has added his name to the land registry and become its owner.

A score of 43 means you might invest in a local stock, only to discover that the largest shareholder—a well-connected businessman—has restructured the company at the expense of minority shareholders. This means that your hard-earned business could be expropriated by local network insiders or become uncompetitive due to arbitrary taxes, fines, and restrictions. Investing in countries with weak property rights protection is extremely difficult.

If you live in countries like the United States, Australia, or Europe—where most readers likely reside—you may not fully understand this predicament, as you probably live in a country with a property rights score close to 95.

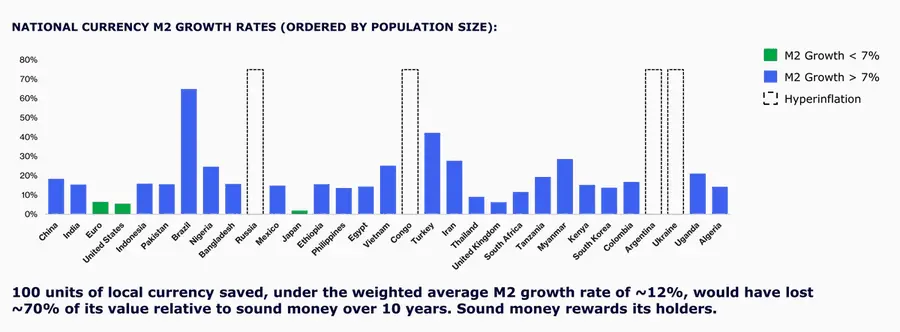

The total population of the 20 largest emerging markets exceeds 5 billion, and their average heritage foundation property rights score is below 43. The issue of weakened property rights protection intertwines with arbitrary monetary supply growth. Over 80% of the global population lives in high-inflation environments—defined as having a monetary supply growth exceeding 12% annually over the past 30 years. Most people are forced to hold their local currency due to limitations in local banking systems and payment channels.

There are many ways to lock capital in fiat currency—such as controlled exchange rates, high fees for converting to dollars, or even direct government orders. These currencies cannot survive without capital controls, as people prefer to hold low-inflation dollars rather than high-inflation local currencies.

In emerging markets, holding dollars is difficult, resulting in the evaporation of savings. On average, local currencies depreciate by 65% against the dollar every fifteen years.

Saving in an environment with weak property rights and high inflation is like climbing an iceberg covered in soap. You can choose to save in pesos, but over time, most of your savings will slowly evaporate; or you can invest in local assets, but then you have to live under the Damocles sword of an arbitrary property rights system.

We haven't even mentioned the issue of financial exclusion. About one-third of adults globally cannot open a bank account, meaning over 1.4 billion adults have no access to any financial system. The number of people without credit and good savings options is even larger.

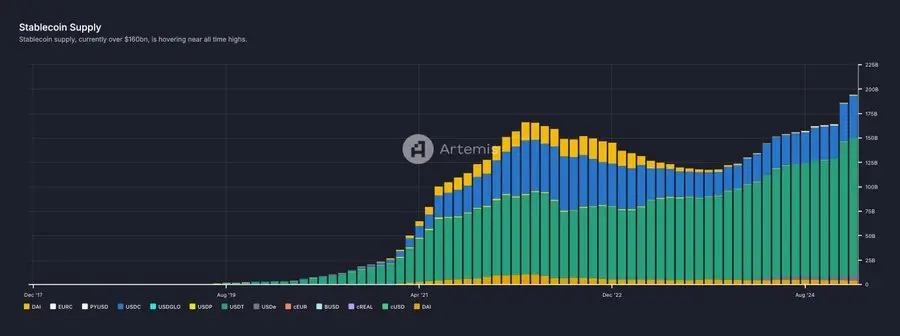

Stablecoins provide an opportunity for these individuals—to hold dollars directly in the Internet finance system without relying on local banking systems. In just five years, the total amount of stablecoins has grown to $200 billion.

The next step in global property rights protection is for the U.S. to allow trusted companies like BlackRock to tokenize real assets such as stocks, bonds, and ETFs through a regulated custodial model. These assets will be held by regulated U.S. institutions, and the government can seize these assets from sanctioned accounts at any time.

Imagine if stocks of Apple, Amazon, Google, and Berkshire Hathaway were all on-chain alongside the S&P 500 and NASDAQ. This would provide better savings options for billions of people globally while expanding the ownership base of U.S. assets.

High-quality assets on the Internet will provide better savings methods for people in emerging markets, which in itself is a positive change. We also expect that emerging markets will strengthen their domestic property rights protection through Internet finance tools. A reformist government could place land registries directly on a global unified property rights server, thus avoiding local government corruption. For example, Uruguayan companies could embed minority shareholder protections directly into their smart contract code, better safeguarding the legal rights of assets.

This may seem like a naive prediction, but from a mathematical perspective, there is ample hope. The long-term crux of property rights issues in emerging markets is that eliminating corruption is very difficult, and even if successful, subsequent governments are likely to overturn these small achievements. Property rights reform is a problem that N governments must collectively address, with each government needing to prioritize property rights from a long-term perspective spanning multiple generations.

The tools of Internet finance will simplify the issue of property rights reform to a problem that can be solved by a single government. As long as there is one reformist government that places land registries in the Internet finance system, that decision will be hard to reverse.

3. The Internet finance system will put global assets on-chain and drive financial innovation.

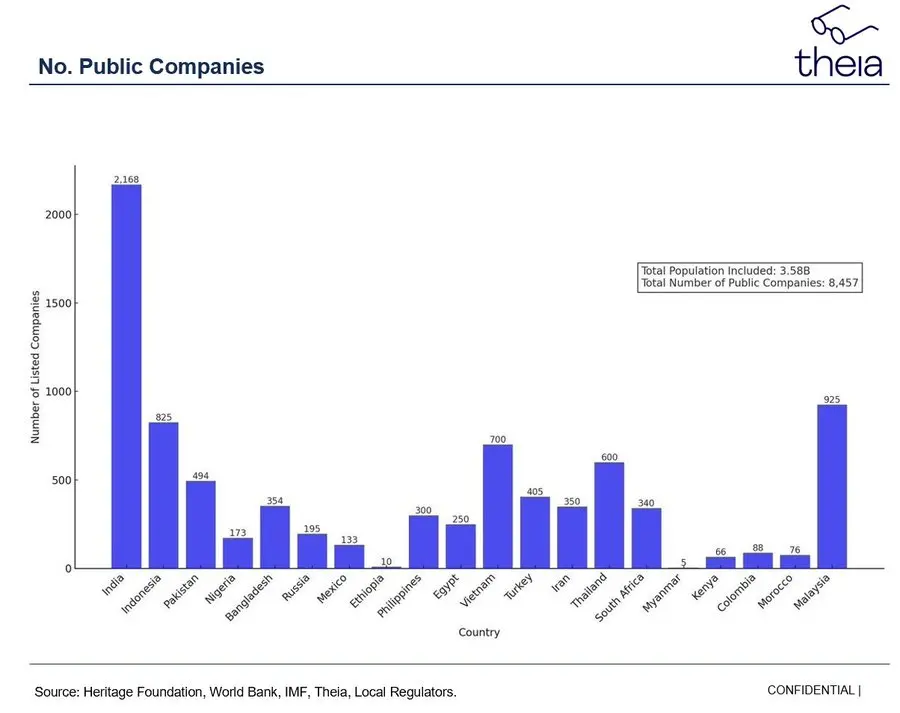

The existing financial system does not allow small companies to access global capital markets. This means smaller companies need to pay higher capital costs and rents to intermediaries. By population, the 20 largest emerging markets include 3.5 billion people and 8,457 publicly listed companies. You cannot connect them; for example, Mexico has a population of 128 million but only 133 listed companies. This is far from enough.

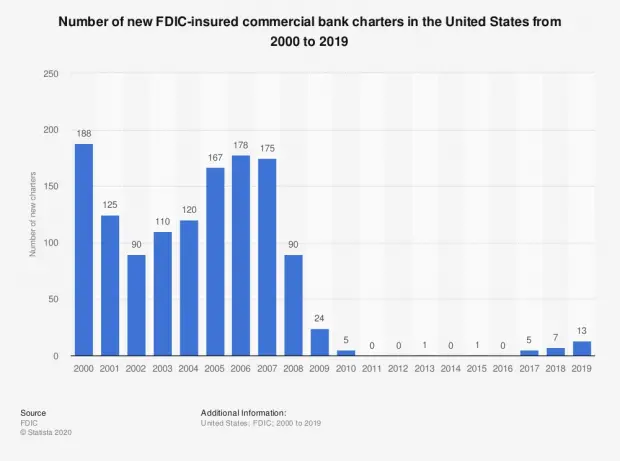

Even in the United States, similar problems exist. The number of publicly listed companies available to investors in the U.S. once exceeded 8,000 but has halved over the past 20 years. The listing process is cumbersome and expensive (over $2 million in fees plus 5-7% of IPO proceeds, along with long-term reporting and compliance costs).

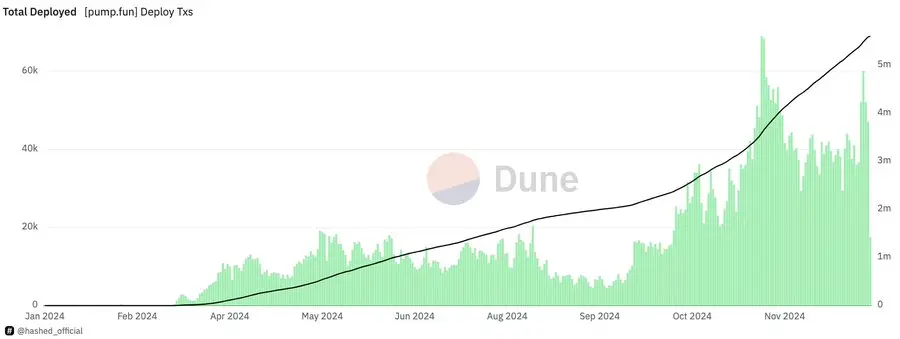

We have begun to see explosive growth in the number of on-chain financial assets. For example, Pump.fun—a Solana-based memecoin launch platform—has launched over 5 million unique tokens since March 2024. Metaplex has launched over 9 million non-fungible tokens (NFTs) in the past three years.

Many observers underestimate the scale of these achievements because they conflate the quality of on-chain assets (mainly memecoins and JPEG NFTs) with the quality of the financial infrastructure behind them. In reality, the true signal is how easy it has become to launch assets on the Internet once the high entry fees that act as liquidity barriers in the traditional financial system are removed.

We anticipate that there will eventually be regulatory requirements for token listings, but any reasonable requirements will lead to a reduction in issuer costs of over 90%.

Since March 2024, the Pump.fun platform has launched over 5 million tokens.

We expect that in the future, small businesses will be able to raise equity and debt financing directly through the Internet. We have already discussed small business owners in emerging markets. Medium-sized enterprises in the U.S. will also be able to trade in liquidity markets, allowing everyone globally to access the best-performing asset classes of the past forty years.

The types of tools for corporate financing will continue to evolve to accommodate cheaper and more flexible infrastructure. Apple could issue a hybrid debt product that makes daily payments based on 10% of each iPhone's sales. Starbucks could issue revenue-sharing tokens solely for its newly opened 200 stores in the Pacific Northwest, with market prices providing management with feedback on the value of expansion plans.

The Cambrian explosion will not only manifest in the growth of asset numbers. We also expect the pace of financial innovation to accelerate significantly. Consider some of the products that already exist in the Internet finance system, which can serve as a harbinger of future developments.

Universal margin accounts allow you to borrow against homes, stocks, Bitcoin, or even assets that qualify only as collateral in a smart contract-based financial system (like music copyright income streams).

Arbitrary options refer to investors drawing a payment chart and designing a matching financial instrument through algorithms by combining existing financial products. Without smart contracts, constructing an arbitrary option requires an experienced options trading team and several lawyers, but using smart contracts can complete it in seconds. The key advantage of arbitrary options is that they provide cheaper, more customized hedging solutions.

Deep and global prediction markets can improve the quality of predictions we use in everyday decision-making. In the 2024 elections, prediction markets demonstrated a strong ability to better predict Biden's unexpected losses and the final election results. Imagine if there had been prediction markets at the onset of COVID-19 or at the beginning of the U.S.-Iraq conflict; prediction markets are better than most experts at integrating information and publicly revealing optimal information. They can help people make better decisions and hedge against global conflicts and adverse election outcomes.

Yield-backed credit cards reduce the risk for lenders while increasing interest rates for borrowers. You can hold property as an NFT and use a credit card to pay, which can increase your mortgage limit to a certain extent. Adding good collateral can lower interest rates by up to 10%.

Decentralized exchanges have reduced the issuance costs of liquid assets by 1,000 times. This is exactly the example we mentioned earlier with Pump.fun and Raydium. DEXs have also lowered trading fees for retail investors, who only need to pay a single basis point fee, unlike retail trading platforms like Coinbase and Robinhood, which charge 1-5%.

Lending protocols allow customers with compatible collateral to borrow, competing with the U.S. corporate debt market. On the Euler platform, anyone with an internet connection can borrow dollars using ETH, with an annual interest rate of less than 7%.

Futarchy is a way to make smarter decisions by leveraging market prediction power. A classic example is a vigorous radical movement demanding the resignation of a company's CEO. The board could establish a futarchy market, allowing investors to buy shares based on whether the current CEO resigns or remains. The board can refer to market prices to help make decisions.

These are just a few examples of "from 0 to 1" innovations in the Internet finance system. The low barrier to entry allows for low-risk experiments in financial design, leading to many failed projects, but also some outstanding innovations. Innovations in the traditional financial system are suppressed by high barriers and experimental costs.

Take University of Chicago professor Steve Budish as an example; he designed batch auctions to address many issues faced by high-frequency trading (HFT). However, Professor Budish failed to persuade any large Wall Street firms to adopt his design because existing financial institutions were unwilling to experiment in the highly valuable high-frequency trading space. In contrast, some startup teams implemented his design directly in the decentralized internet after reading his paper, and some of these teams have achieved quite impressive results.

4. Internet finance is more efficient

Finance is an indispensable part of our civilization, and I greatly appreciate our work in the financial services sector. We strive to understand how society should allocate resources, predict the future, and fund worthy projects. We thoughtfully consider risks and mitigate them as much as possible. As John Maynard Keynes said, we work to overcome the ignorance that shrouds the future and the dark forces of time.

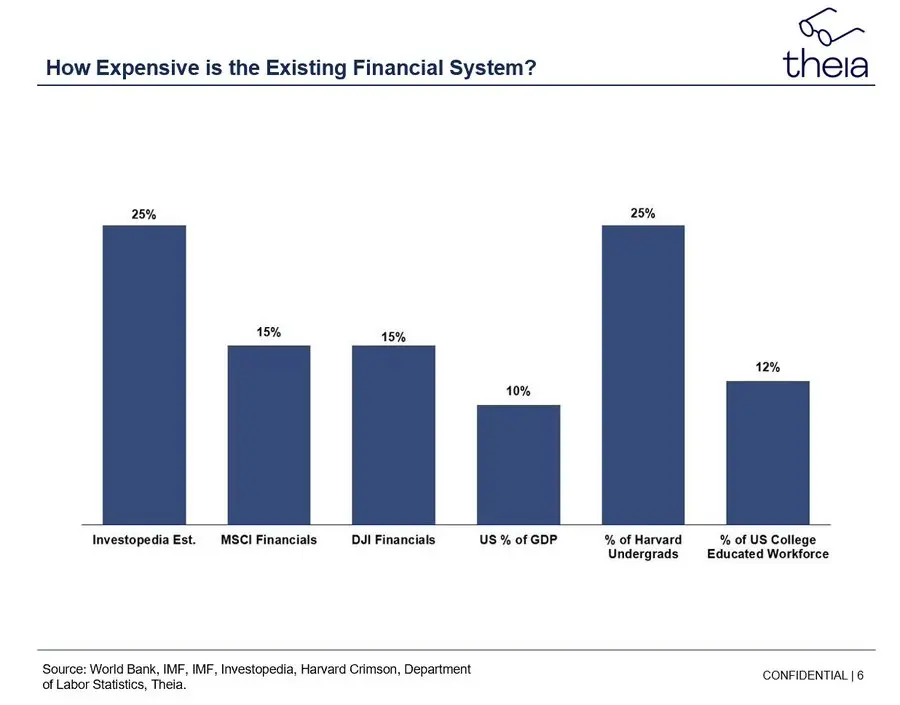

However, we do allocate a significant amount of resources to maintain this permissioned, isolated server financial system. In the U.S. alone, there are 8.5 million financial services workers, accounting for over 12.5% of college-educated workers nationwide. Over the past few decades, about 20% to 30% of Harvard University's undergraduates have entered the financial services field. Even at top institutions like Yale University, the numbers are quite similar.

We can automate a large number of tedious financial tasks through smart contracts. We have already seen that certain protocols, with small teams, have surpassed billions of dollars in trading volume and loan sizes. Kamino manages $2.2 billion in capital with only 20 employees (over $100 million per employee), while Raydium has completed over $550 billion in trading volume with fewer than ten employees. These numbers still underestimate the efficiency of smart contracts, as both Kamino and Raydium can grow assets and trading volume tenfold without significantly increasing team size.

The efficiency of smart contracts is hard to overstate. A machine learning algorithm written by a small team of excellent engineers can underwrite millions of loans globally. A global coffee company in Central America can use an open-source asset-liability matching program to continuously hedge its commodity risks. A cleverly designed order book system could replace an entire floor of traders in Midtown Manhattan. Smart contract code can increase a senior lawyer's productivity tenfold. Imagine a laptop replacing a skyscraper.

The nature of work in financial services will change. Brokerage work will mean designing order book mechanisms rather than connecting traders through phone calls in busy trading halls. Underwriting will mean outstanding analyst-engineer teams writing algorithms and collaborating with large language models (LLMs).

Liquidity investing will mean sifting through hundreds of thousands of financial assets to find a Thai industry leader whose stock should trade at twice its market capitalization. There will be funds specifically targeting prediction markets, attracting the smartest talent. Paperwork will decrease, deep thinking will increase, and financial services workers will be better at what they do best: forecasting, risk management, and capital allocation.

Let’s take a slight detour to look at the financial reporting-industrial complex, a process that has already begun to unfold within it.

In the isolated server financial system, many people are involved in managing financial data. A medium-sized enterprise may have dozens of employees responsible for managing its various core systems (such as point-of-sale systems, enterprise resource planning, etc.). Accounting and finance teams spend hundreds of hours each quarter integrating output data into neat spreadsheets and ensuring they match. Bankers and financial analysts work overtime to understand the data and feed it into financial models. Financial institutions spend months tracking every expense and outlay for auditing. The financial data of our world lives in the ruins of thousands of fragmented spreadsheets.

Internet finance solves this problem by unifying financial data storage on cloud servers. A small team of data scientists only needs to establish a financial reporting structure once for the raw data stream. As the business grows, they only need to spend a few hours each month maintaining the reporting code, and that’s it. We have already seen the prototypes of such systems, with data providers like Dune, Token Terminal, and Artemis achieving this. These data websites have covered the entire sub-sector of the Internet finance system with extremely small team sizes.

I have also benefited from unified on-chain data. I used to spend hundreds of hours building spreadsheet models for industrial trading. This process required a small team, and the result was a static spreadsheet model that only we could operate and update, with each update taking dozens of hours. Now, we only need a few hours to build active real-time models for on-chain businesses that update automatically. We used to spend months on auditing work. Now, we operate an on-chain fund that basically only requires sending a few wallet addresses and answering some questions. The time and energy saved are truly exponential.

5. The Internet finance system will promote faster GDP growth

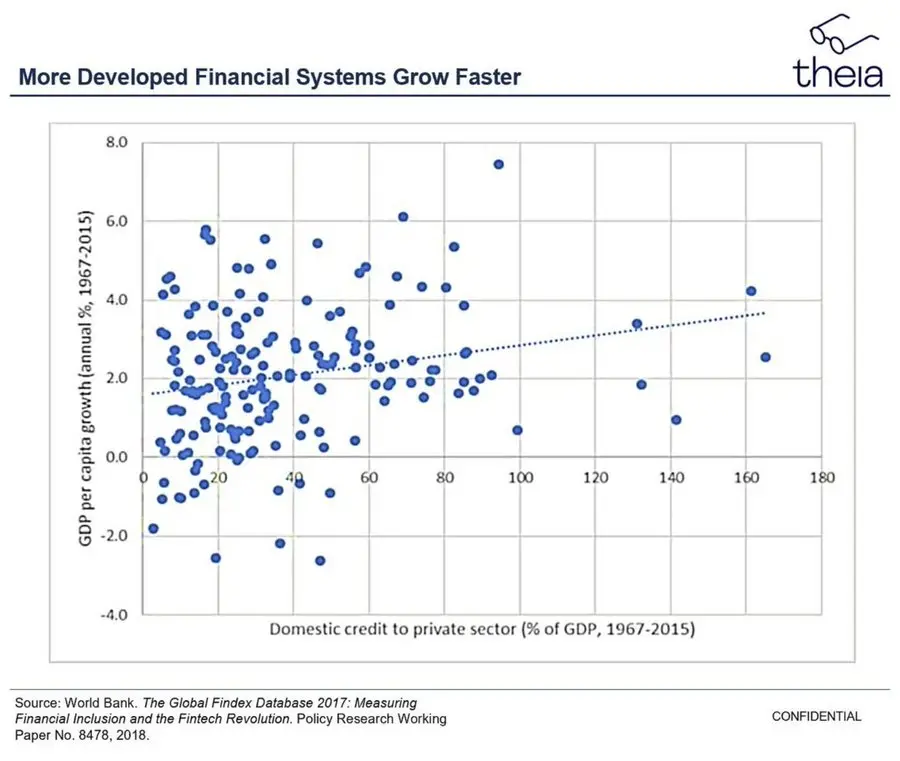

Joseph Schumpeter pointed out that more complex financial systems can facilitate faster economic development, and countless economic papers have empirically validated his assertion since he made this point nearly 100 years ago. While specific estimates vary, doubling the depth of the financial system typically brings about 50 to 100 basis points of annual economic growth over several years.

It is not hard to understand why GDP growth would be faster under the framework of the Internet finance system. Capital can flow across borders to the best opportunities without being hindered by local banking oligopolies. The net interest margin will narrow, thereby lowering real interest rates in emerging markets. The high-quality asset options provided by the Internet make it easier for people in emerging markets to save and invest.

Stronger property rights protection directly drives GDP growth. Our financial services workers can spend more time on high-value forecasting, capital allocation, and risk management. Innovative products like futarchy and prediction markets will bring higher quality information and capital allocation. There will be countless innovations to help businesses better access capital and manage risks.

The famous night maps of North Korea and South Korea illustrate the importance of property rights and inclusive economic systems.

I believe that an additional 75 basis points of GDP growth is entirely possible. This means an increase of $15 trillion in GDP over 20 years. Equivalent to adding the entire economies of the UK, Germany, France, Russia, Italy, Brazil, Spain, and Mexico to the global economy. It is worth a try.

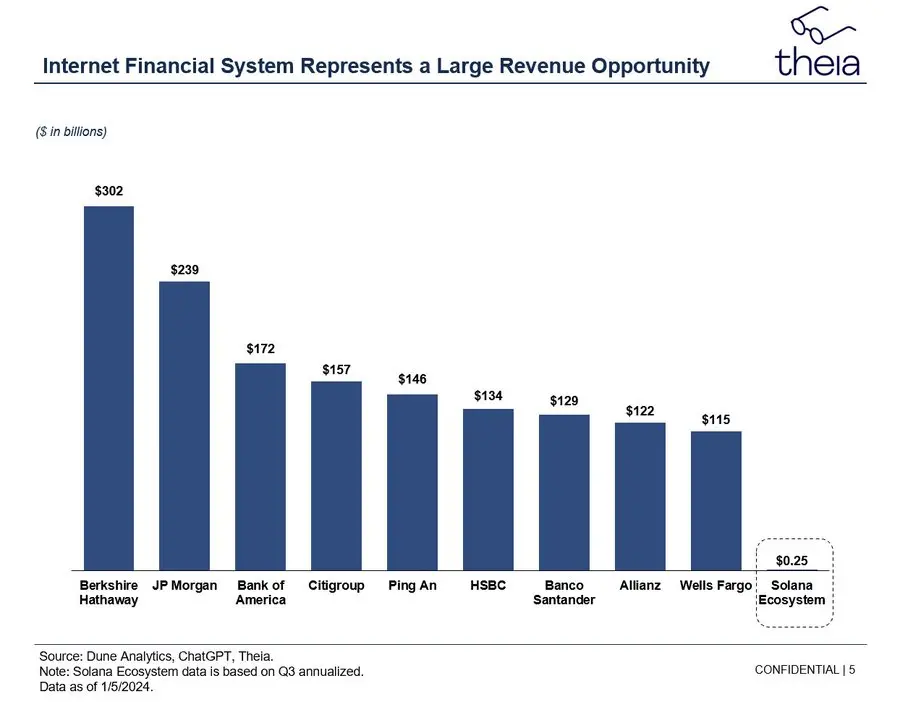

Here, I would like to take this opportunity to make a brief pitch to entrepreneurs and financiers who are preparing to transition into Internet finance. I believe that your personal GDP growth rate will far exceed an additional 75 basis points per year. Entrepreneurs committed to Internet finance and long-term building will reap substantial rewards. The global financial system is so profitable that even a 90% reduction in income would still yield results for startups over generations. Financial services represent the largest and most disruptive market globally.

A better financial system in the cloud

The significance of Internet finance to financial markets is akin to the impact of the Gutenberg printing press on books, education, and civilization. Before Gutenberg invented the printing press, fewer than 1,000 books were printed in Europe each year, and many of the most educated scholars on the continent worked as scribes. Books were virtually inaccessible to all but the wealthiest—Dante Alighieri boasted of owning 20 books—the limited supply of books meant that content was restricted to the Bible and a few classic works.

Everything changed after Gutenberg reduced the cost of printing books by over 90%. In the 50 years following his invention of the printing press, 20 million books were published, sparking a publishing and learning revolution that continues to this day. Writing, buying, and reading books became easier. We witnessed an explosive growth of literary genres and literary geniuses. Global literacy rates rose, and now every college freshman has the opportunity to read Aristotle's Politics.

The purpose of this article is to tell you why we are so optimistic about the Internet finance system. The two core innovations of permissionless, unified cloud servers and smart contract code have lowered transaction costs and entry barriers while dismantling entrenched oligopolistic systems. This is a paradigm shift with far-reaching implications.

This is also why there is so much hype surrounding cryptocurrencies. It is a dream—a noble dream—and it is achievable. The Internet finance system is a hammer against the rigid and predatory financial institutions of the world. It is an open marketplace that replaces them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。