Organized by: Luan Peng, ChainCatcher

Important News:

- Musk tweeted this morning with frog elements

- Cryptocurrency market cap surpasses the U.S. high-yield bond market in Q4 2024

- OKX plans to conduct TON network upgrade maintenance on January 2 and suspend deposits and withdrawals

- Shanghai police dismantle a virtual currency fraud gang, earning high fees through a fake trading platform

- Data: At least 60 billionaires worldwide have invested in Bitcoin

- U.S. IRS issues temporary tax relief measures for cryptocurrency, benefiting CeFi exchange users in 2025

- Syria proposes legalizing Bitcoin to promote economic recovery

- Ten regions in Russia fully ban cryptocurrency mining starting today

"What important events have occurred in the past 24 hours?"

Musk tweeted this morning with frog elements

Musk tweeted again at 5 AM Beijing time with "Brothers in Arms," accompanied by an image of Pepe as a Roman general.

It is reported that Musk is currently playing the hardcore mode of "Path of Exile 2," at level 85. The core mechanism of hardcore mode is permanent death, meaning that once a character dies, all progress and equipment are permanently deleted. This mechanism provides players with a high level of challenge and a sense of achievement.

Cryptocurrency market cap surpasses the U.S. high-yield bond market in Q4 2024

According to a report by Grayscale Research, in the last quarter of 2024, the cryptocurrency market cap skyrocketed from $1 trillion to over $3 trillion, surpassing the total value of global inflation-linked bond markets. At certain moments, the cryptocurrency market cap was even double that of the U.S. high-yield bond market.

According to an official announcement, OKX will conduct maintenance for the TON network on January 2, 2025, at 10:00 AM (UTC+8). During the maintenance period, deposits and withdrawals will be suspended, and it is expected to be completed by:

- January 3, 6:00 PM (UTC+8) for withdrawal resumption;

- January 3, 6:00 PM (UTC+8) for deposit resumption.

Recently, the Yangpu police in Shanghai successfully cracked a virtual currency contract trading fraud case after meticulous investigation, dismantling a fraud gang of 16 people, with an involved amount exceeding 300,000 yuan.

During interrogation, the suspects confessed to their criminal activities. Based on prior investigation, the special task force fully grasped the gang's modus operandi, where three individuals, including Yang and Yu, infiltrated various virtual currency investment group chats as "investment masters," directing interested individuals to a fake trading platform they set up. They exploited victims' psychology of wanting to "make quick money" by inducing them to conduct multiple trades to earn high fees. Subsequently, they misled victims into raising their investment "profit and loss ratio," making them mistakenly believe that their investment failures were due to their misjudgment of the market, thus defrauding them of money.

Currently, Yang and Yu, along with 14 other suspects, have been subjected to criminal coercive measures by the Yangpu police for suspected fraud, and the case is under further investigation. (Xinmin Evening News)

Data: At least 60 billionaires worldwide have invested in Bitcoin

HODL15Capital stated that at least 60 billionaires worldwide have invested in Bitcoin, indicating that the confidence of global wealthy individuals is continuously increasing.

According to Bitcoin.com, the U.S. Internal Revenue Service (IRS) has issued a temporary relief measure expected to benefit CeFi exchange users in 2025. This relief addresses concerns raised by the final version of Section 6045 regulations for custodial brokers, which will take effect on January 1, 2025, requiring the use of a first-in, first-out (FIFO) accounting method for digital assets unless a preferred method such as highest-in, first-out (HIFO) or Spec ID is chosen.

Shehan Chandrasekera, the tax strategy director at Cointracker, explained the issue, emphasizing that "as of January 1, 2025, almost all CeFi brokers will not be prepared to support Spec ID." This lack of preparation will force many cryptocurrency holders to default to FIFO accounting, potentially leading to a higher tax burden during asset sales. He described, "In a bull market environment, this could be disastrous for many taxpayers, as you would inadvertently sell the earliest purchased assets first (often with the lowest cost basis), while unknowingly maximizing your capital gains."

The IRS's temporary relief allows taxpayers to continue using their records or tax software to identify specific units being sold. The relief period only applies to CeFi transactions from January 1, 2025, to December 31, 2025. After this date, taxpayers will need to formally choose an accounting method with their brokers. Chandrasekera also emphasized the importance of synchronizing tax software with broker settings.

Syria proposes legalizing Bitcoin to promote economic recovery

According to Cryptopolitan, the Syrian Economic Research Center has proposed a plan urging the transitional government to adopt Bitcoin and other digital assets to combat inflation, stabilize the economy, and attract global investment. This proposal comes as the country faces significant reconstruction challenges after decades of war and financial disaster. The focus of the proposal is to position Bitcoin as a lifeline for Syrian citizens and their struggling financial system. It suggests establishing a regulatory framework to legalize the use of Bitcoin in transactions, mining, and financial dealings.

Ten regions in Russia fully ban cryptocurrency mining starting today

Ten regions in Russia have fully banned cryptocurrency mining starting January 1, with three other regions implementing partial bans. The government decree was passed on December 23, stipulating a complete ban on mining from January 2025 to March 2031. In the other three regions, mining will be partially restricted during each heating season (from November 15 to March 15 of the following year, excluding the first year of the ban starting January 1, 2025).

Russian Deputy Prime Minister Alexander Novak stated at the end of December that the number of regions banning cryptocurrency mining could increase if requests are received from governors. Authorities in the Republic of Khakassia have already requested the Ministry of Energy to restrict mining activities in the region.

Vitalik questions Musk over free speech and "banhammer" threats

Ethereum co-founder Vitalik Buterin called on Musk to "cool down," as his platform sparked new free speech controversies amid a heated debate about foreign tech workers.

Musk publicly supported U.S. top companies hiring foreign tech workers, which angered conservatives on X, who believe that employment conditions in the U.S. are becoming increasingly unfavorable for domestic citizens.

Vitalik stated that while he admires Musk's willingness to fight for free speech, he urged Musk to "cool down," tone down the "rhetoric," and stop using the "social media banhammer" to shut down X accounts.

Vitalik said, "It's easy to respect free speech when we agree with the speech, and hard when we find the speech terrible. But the reasons for respecting free speech never change: today the ban is in one party's hands, and tomorrow it may be in another's."

According to statistics from the Web3 asset data platform RootData, the total financing amount in the cryptocurrency market reached $10.112 billion in 2024, an 8.3% increase compared to $9.337 billion in 2023. A total of 1,548 financing events occurred throughout the year, with 102 mergers and acquisitions, a 34.2% increase from 76 in 2023, setting a historical high. The average financing amount was $9.1352 million, with a median financing amount of $4.1 million. In terms of financing scale, projects in the $1-3 million range were the most numerous, totaling 408, followed by 244 in the $5-10 million range and 219 in the $3-5 million range; in terms of financing rounds, seed rounds dominated with 426 occurrences.

From the perspective of track distribution, the infrastructure sector is the most favored by capital, with a total financing amount of $3.995 billion in 2024, an 18.2% increase from $3.379 billion in 2023; the DeFi sector ranks second with $1.493 billion, nearly doubling from $759 million in 2023; the gaming sector's financing increased from $669 million in 2023 to $813 million. Notably, the CeFi sector's financing decreased from $990 million in 2023 to $679 million in 2024. The largest financing event of the year was Stripe's $1.1 billion acquisition of the stablecoin platform Bridge, followed by Bitcoin mining company Iris Energy's $413 million financing, and Avalanche's $250 million OTC financing.

In terms of investment institution activity, Animoca Brands leads with 95 investments, followed by OKX Ventures with 72 and MH Ventures with 56. In terms of leading investments, Polychain was the most active, completing 30 lead investments throughout the year, with Hack VC in second place with 24, and both Lemniscap and Animoca Brands completing 17 lead investments, ranking third.

Usual stated on social media that at 5 PM Beijing time yesterday, the Usual protocol experienced a large-scale sell-off of USD0 triggered by a whale trading in the secondary market. This event raised questions about USD0's ability to maintain its peg to $1. USD0 briefly fell to $0.99 but quickly returned to the $1 peg within seconds, although there was an initial deviation of several basis points (bps) due to ongoing sell-offs, it fully restored its peg after a few hours.

USD0 can always be redeemed at a 1:1 ratio for its underlying collateral assets, ensuring the solvency of the Usual protocol. Currently, all USD0 can be redeemed on a T+0 basis and is supported by highly liquid short-term money market instruments.

The peg has returned to normal. This event was the first significant stress test of USD0's pegging ability, with redemption volumes exceeding the entire TVL (Total Value Locked) of GHO within a few hours, yet the protocol continued to operate as usual. They will continue to optimize processes and improve efficiency, with many exciting updates on the way.

Andrew Kang: 2025 will be the year of AI agents

Andrew Kang, a partner at Mechanism Capital, posted on X: "2025 will be the year of AI agents, 2026 will be the year of humanoid robots, and 2027 will be the year of human-AI integration."

"What are the exciting articles worth reading in the past 24 hours?"

The MicroStrategy model has gained market recognition, with most Bitcoin mining companies issuing convertible bonds to raise funds amid a hot market.

50 Crypto KOLs' 2024 reflections and 2025 predictions

The new year is just around the corner.

The crypto world of 2024 has been full of peaks, with Bitcoin reaching new highs and new narrative melodies sweeping the industry. Some have seized wealth-making opportunities to reach the summit, while others have led trends and plucked the strings of the future.

An obvious trend is that in the rapidly changing pace of the industry, amidst the rise of memes, crypto KOLs are becoming increasingly crucial in discovering new valuable targets, smoothing out information dissemination gaps, and supervising industry issues.

Therefore, at the turn of the year, Odaily Planet Daily has specially invited 50 leading KOLs in the crypto field to review their experiences in 2024, look forward to opportunities in 2025, send messages, and wish readers to accurately capture Alpha in the new year, with wealth rolling in and everything going smoothly!

Grayscale Q1 2025 Select: 20 tokens with high growth potential

The cryptocurrency market surged significantly in Q4 2024, with the FTSE / Grayscale Crypto Sectors Index showing strong market performance. The increase largely reflects the market's positive reaction to the results of the U.S. elections.

Competition in the smart contract platform sector remains fierce. The leading player, Ethereum, has underperformed compared to its second-largest competitor, Solana, and investors are increasingly focusing on other Layer 1 networks, such as Sui and The Open Network (TON).

Grayscale Research has updated its Top 20 token list. This list represents a diversified set of assets in the cryptocurrency industry that may have high potential in the upcoming quarter. New assets added in Q1 2025 include HYPE, ENA, VIRTUAL, JUP, JTO, and GRASS. All assets in the Top 20 list exhibit high price volatility and should be considered high-risk.

MegaETH ecosystem overview: What projects does MegaMafia cover?

Currently, MegaMafia covers 13 projects, along with 15 projects that are built on MegaETH or plan to integrate MegaETH but do not yet belong to MegaMafia.

From a data perspective, which public chains truly experienced a rise in 2024? Which public chains' decline may not be underestimated but rather a genuine downturn?

Meme Popularity Rankings

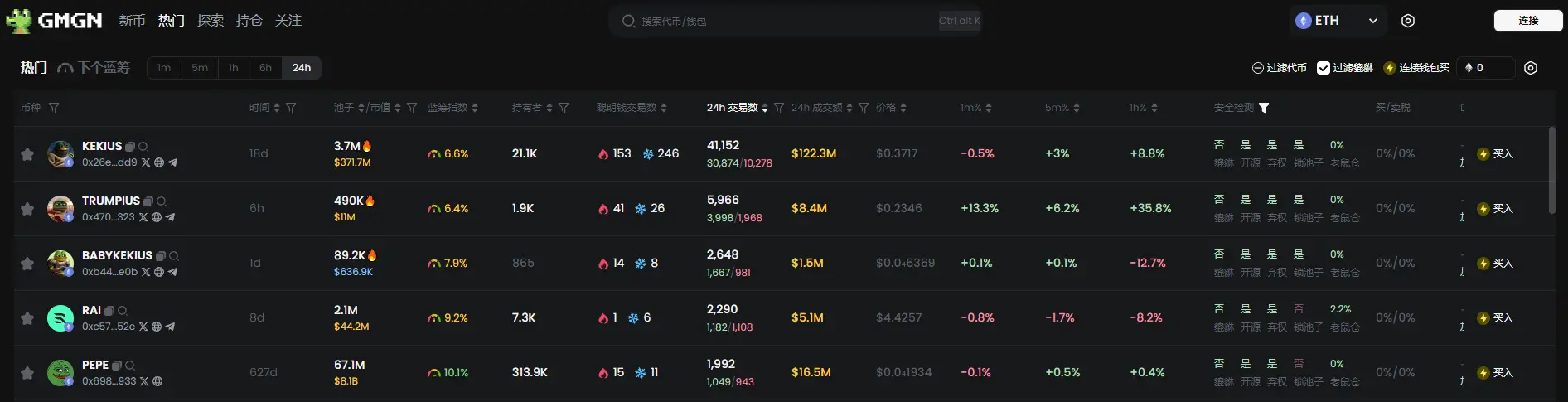

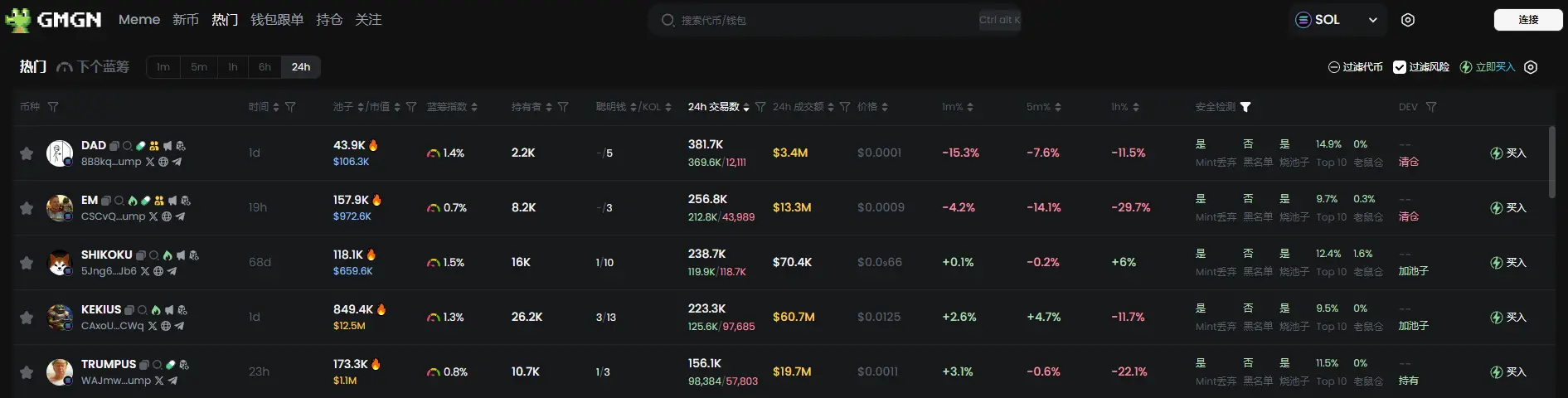

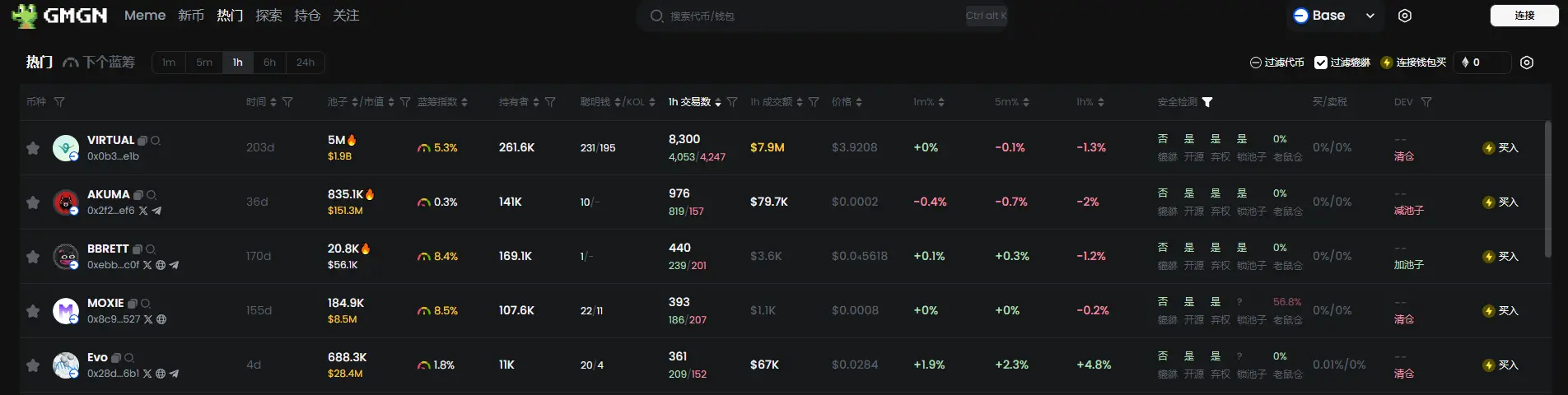

According to the meme token tracking and analysis platform GMGN, as of January 1, 19:30:

In the past 24 hours, the top five popular tokens on Ethereum are: KEKIUS, TRUMPIUS, BABYKEKIUS, RAI, PEPE

In the past 24 hours, the top five popular tokens on Solana are: DAD, EM, SHIKOKU, KEKIUS, TRUMPUS

In the past 24 hours, the top five popular tokens on Base are: VIRTUAL, AKUMA, BBRETT, MOXIE, Evo

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。