Original Title: "Reversing the gender gap: Women who kicked ass in crypto in 2024"

Author: Daniel Ramirez-Escudero, CoinTelegraph

Translation: Bai Shui, Jinse Finance

Driven by the growing institutional adoption and bullish sentiment in the United States, the cryptocurrency market is firmly in a bull market cycle. Bitcoin, once seen as a fringe asset, is now being embraced by major financial institutions.

Women have played a central role in this shift, leading startups, shaping policies, creating educational content, and writing research reports, all helping to drive mainstream adoption of cryptocurrency.

Given its roots in traditionally male-dominated tech and finance sectors, cryptocurrency has long been a male-dominated industry. However, this novel sector represents a fresh and innovative evolution of these fields. Cryptocurrency is now attracting more women, providing a unique opportunity to address the gender imbalance in tech and finance.

The cryptocurrency industry has long been criticized for its "bro" culture, but as the sector matures, it has become more balanced, with women increasingly taking the lead and even surpassing men in certain areas.

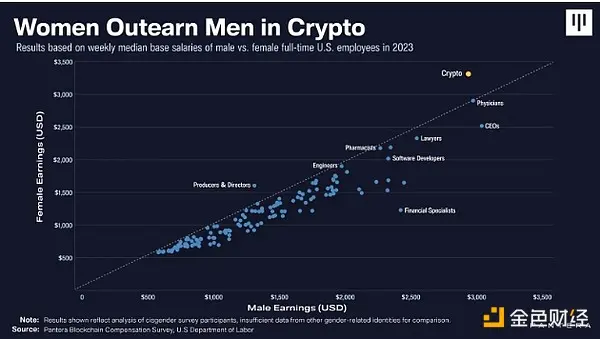

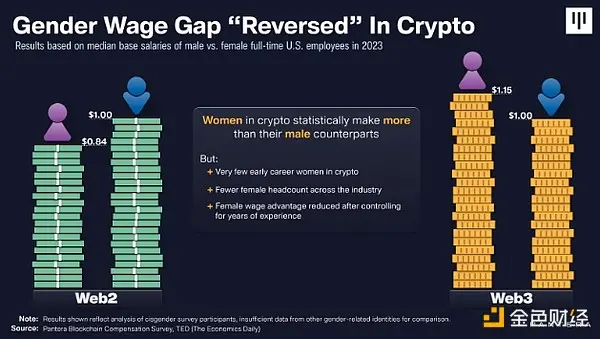

On July 29, a report from cryptocurrency hedge fund Pantera Capital indicated that women's earnings in the industry have begun to exceed those of men, which is clearly an exception to trends in other sectors.

The report noted: "The relatively fair wages in the cryptocurrency field indicate that gender equality is progressing in a larger direction, marking a trend of advancement in this relatively new field."

In the cryptocurrency field, women's earnings exceed those of men. Source: Pantera

While the gender pay gap in the crypto industry may have reversed, women's representation in senior positions remains insufficient, highlighting the persistent glass ceiling in the sector.

The gender pay gap in the cryptocurrency field has reversed. Source: Pantera

Nevertheless, women have seized the opportunity to dive into the cryptocurrency gold rush, and their efforts have borne fruit, making significant contributions across various disciplines and achieving success in the crypto industry.

Senator Cynthia Lummis: A Legislator Supporting Bitcoin

U.S. Senator Cynthia Lummis from Wyoming has become a key figure in the cryptocurrency industry, primarily due to her advocacy for clear and balanced crypto regulations.

Lummis invested in Bitcoin in 2013. Her deep understanding of digital assets and her background as Wyoming's state treasurer have made her a leading voice in the U.S. Senate for innovation and regulatory clarity.

Lummis has been a strong critic of the current anti-cryptocurrency regulatory approach, particularly the enforcement-driven stance of the U.S. Securities and Exchange Commission. This has helped her earn the trust of many in the crypto community.

Her advocacy includes pushing for the classification of Bitcoin and Ethereum as commodities, to be regulated by the Commodity Futures Trading Commission (CFTC) rather than the SEC.

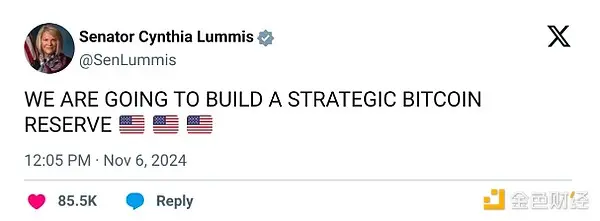

On July 27, 2024, she introduced the Bitcoin Bill at the Bitcoin Nashville Conference. The bill would require the U.S. government to establish a strategic reserve of Bitcoin, purchasing about 5% of the total supply of 21 million Bitcoin and holding it for at least 20 years. She hopes the U.S. will adopt Bitcoin as a reserve asset to hedge against currency devaluation. Lummis stated:

"We have money now, but we will no longer hold it in dollars and assets designed to devalue by at least 2% each year. We will hold it as an asset that will appreciate."

After the 2024 federal elections, with the Republican Party controlling both houses of Congress, she doubled down on her commitment to pass the bill.

Source: Senator Cynthia Lummis

Lummis even suggested that the U.S. could exchange its gold reserves for cryptocurrency instead of waiting to purchase Bitcoin.

The Bitcoin Bill is considered by many to be one of the most optimistic factors in the current Bitcoin cycle and remains a source of excitement in the crypto community.

Blockstream co-founder and CEO, Hashcash inventor Adam Back, predicted that if implemented, Bitcoin's valuation could exceed $1 million.

Source: Adam Back

Basel Ismail, CEO of investment analysis platform Blockcircle, pointed out that if the bill passes in the U.S., it would "send a signal to most G20 countries" to follow suit, triggering a domino effect.

Maya Parbhoe: Creating a New Bitcoin Nation

Suriname presidential candidate Maya Parbhoe has an ambitious vision: to create a Bitcoin nation deeply integrated with cryptocurrency.

Her plans for Suriname go beyond making Bitcoin legal tender—she aims to dissolve the central bank, cut taxes, privatize public services, issue national Bitcoin bonds, and implement widespread deregulation.

In 2023, she collaborated with Bitcoin accelerator Jan3 CEO Samson Mow, playing a crucial role in El Salvador's Bitcoin transformation. She nearly achieved her goal of making Bitcoin legal tender in Suriname, but she stated that corruption undermined her efforts, prompting her to seek change through politics.

In October 2024, she announced her candidacy for the May 2025 elections, promising that if elected, she would adopt the Bitcoin standard in Suriname within a year.

From left: Suriname President Chandrikapersad Santokhi, Maya Parbhoe, and Ben van Hulst.

While many politicians have only recently embraced cryptocurrency, Parbhoe has been involved with Bitcoin for the past decade and firmly believes in Satoshi's values.

In 2014, her curiosity led her to Bitcoin, and she found a lifelong career, as she shared:

"I fell completely down the rabbit hole and decided to dedicate my life to it. If there’s one reason to die on this hill, it’s Bitcoin."

Parbhoe's vision and efforts to eradicate corruption have garnered support from many in the Bitcoin community. However, only time will tell if the momentum she is building is enough to gain power and reshape the future of the nation.

Perianne Boring: Tireless Bitcoin Lobbyist

Elected President Donald Trump made several promises that, if fulfilled, could lead to overwhelming support for cryptocurrency in the country. However, U.S. regulators and politicians have not always been so friendly toward cryptocurrency.

Perianne Boring, founder and CEO of the blockchain advocacy organization the Digital Chamber, has long tirelessly advocated for crypto-friendly policies on the front lines.

The crypto voter bloc has made its voice heard, and we now have a once-in-a-lifetime opportunity to make the U.S. the world capital of cryptocurrency.

——Perianne (@PerianneDC), November 13, 2024

In 2018, Forbes named Boring one of the "50 Most Powerful Women in Tech" in the U.S., representing her strong influence in the field.

Boring is an early adopter who learned about Bitcoin while working on Capitol Hill in 2011. She served as an economic analyst for a member of the House Financial Services Committee, and her political experience and understanding of Bitcoin have enabled her to hold her current position.

She is a staunch advocate for clear crypto policies and has criticized the SEC, as many in the crypto industry view it as "enforcement regulation." She believes the CFTC should regulate cryptocurrency because "cryptocurrency is a commodity."

According to Fox Business, her proactive stance may have placed her on the shortlist for CFTC chair candidates, and if nominated and confirmed, she could potentially craft crypto-friendly regulations.

She could become a key figure in crypto regulation, especially if the "Financial Innovation and Technology Act of the 21st Century" (FIT21) is enacted. FIT21 would clarify the roles of the CFTC and SEC, determining that most digital assets failing the SEC's securities "Howey test" would fall under CFTC jurisdiction, particularly in the spot market.

Natalie Brunell: Educating the Public on Crypto

Natalie Brunell is a well-known figure in the cryptocurrency space, recognized for her role as a Bitcoin advocate and educator.

Brunell hosts Coin Stories, a highly popular Bitcoin-centric podcast where she interviews key figures in Bitcoin and economics. Her work helps connect complex financial concepts with personal stories, making Bitcoin accessible to a broad audience.

Brunell's career began in traditional media, where she worked as an investigative journalist and television reporter for over a decade. After witnessing her family's financial struggles during the 2008 financial crisis, she began to turn to Bitcoin, which led her to question the systemic issues of the traditional financial system.

Since then, her show has invited guests related to cryptocurrency, such as Michael Saylor, Peter Schiff, PlanB, Anthony Pompliano, Willy Woo, Raoul Pal, Dan Held, Peter McCormack, and Jimmy Song.

Her journey from traditional media to a full-time Bitcoin advocate highlights her commitment to reshaping the public's understanding of money and technology.

Lyn Alden: Bitcoin Researcher

Investor and stock analyst Lyn Alden has become a well-known figure in the field of macroeconomic analysis and investment strategy. She actively participates in cryptocurrency thought leader activities, providing her insights and understanding of the cryptocurrency market.

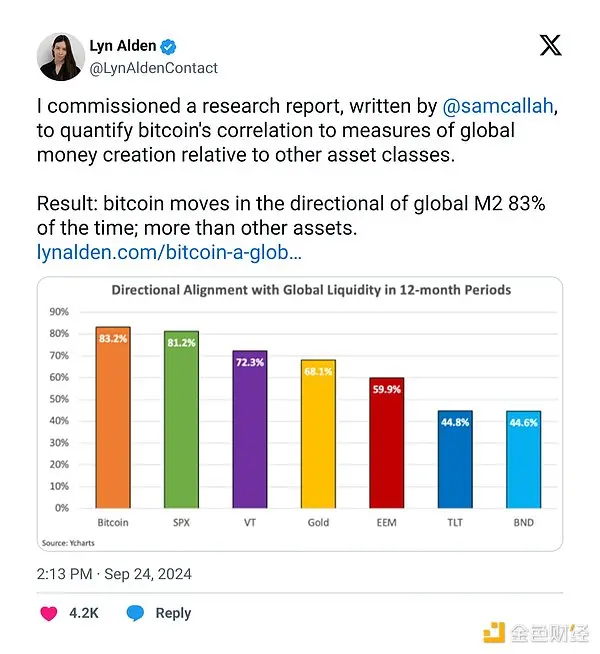

Alden excels at simplifying complex analyses for the average person. In 2024, she commissioned a research report titled "Bitcoin: A Global Liquidity Barometer," exploring the strong correlation between Bitcoin price movements and global liquidity, particularly measuring the M2 money supply, which includes cash, checking deposits, and other types of monetary assets.

The research indicates that Bitcoin aligns with global liquidity trends about 83% of the time, a higher percentage than other major asset classes like gold and stocks.

This perspective highlights Bitcoin's potential to benefit from favorable liquidity conditions while acknowledging its volatility and dependence on broader macroeconomic changes.

Margot Paez: Combating Environmental Misinformation

One of the most common criticisms of cryptocurrency is the negative environmental impact of crypto mining. However, this narrative has begun to shift.

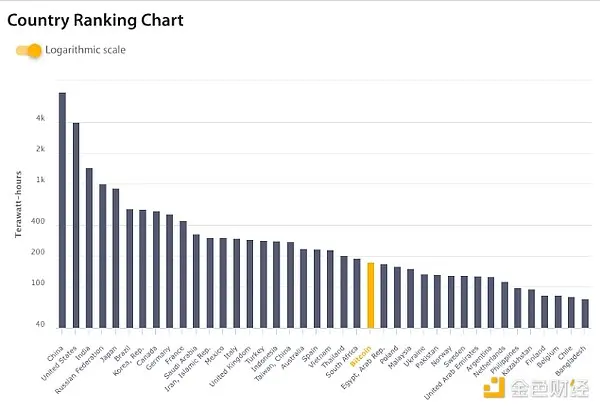

Bitcoin uses proof of work (PoW) as its consensus mechanism, which requires significant computational power to generate new blocks on the blockchain. According to data from the Cambridge Centre for Alternative Finance (CCAF), as of December 17, Bitcoin consumes approximately 185 terawatt-hours annually, more than Egypt and Poland.

Comparison of Bitcoin energy consumption rankings by country. Source: CCAF

Research conducted by Margot Paez, a researcher at the Bitcoin Policy Institute and environmental sustainability consultant, challenges the notion that Bitcoin is harmful to the environment. She argues that, contrary to intuition, Bitcoin's mining flexibility and location-agnostic nature may accelerate the global transition to renewable energy while helping to balance the energy grid.

She has played an active role in data-driven advocacy, contributing to a better understanding of Bitcoin mining.

Ophelia Snyder: Crypto ETF Expert

The rise in Bitcoin prices in 2024 is closely linked to the approval of spot Bitcoin exchange-traded funds (ETFs). BlackRock's BTC ETF has become the most successful ETF it has ever launched, flipping its gold ETF with record capital inflows.

Ophelia Snyder, co-founder and president of 21.co, is a sponsor and associate advisor for ARK Invest's spot Bitcoin and Ethereum ETFs and has been a key figure in establishing multiple ETFs.

On November 1, 2018, she launched the world's first crypto index exchange-traded product in Switzerland through 21.co's subsidiary, 21Shares.

One of Snyder's significant achievements is collaborating with Cathie Wood's ARK Invest to launch a spot Bitcoin ETF in the U.S. Her efforts have played a crucial role in legitimizing crypto assets for traditional investors by providing simple and secure market access.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。