Author: Xiyou, ChainCatcher

Editor: Nianqing, ChainCatcher

In the past two months, the explosion of Agentfi has once again demonstrated the immense potential of the fusion of "AI + Crypto" (also known as crypto AI). In the recently released 2025 cryptocurrency industry trend forecast, well-known industry institutions such as a16z partners, Messari, and Blockworks have all mentioned that the combination of "AI and crypto" will be a mainstream hotspot in the 2025 crypto market. The intersection of crypto technology and AI is expected to achieve breakthrough progress, driving the rise of numerous AI projects and tokens.

Looking back at 2024, the crypto AI market has welcomed an unprecedented investment boom, with major investment institutions pouring in and investment amounts soaring. In this field, top venture capital firms in the crypto industry, such as Grayscale, Coinbase Ventures, Binance Labs, and a16z, have actively engaged in the layout of "Crypto + AI" projects.

In particular, institutions like Delphi Venture, CoinFund, Coinbase Ventures, Binance Labs, and a16z have not only called for investments but have also taken action, demonstrating their strong optimism for the crypto AI field through multiple investments.

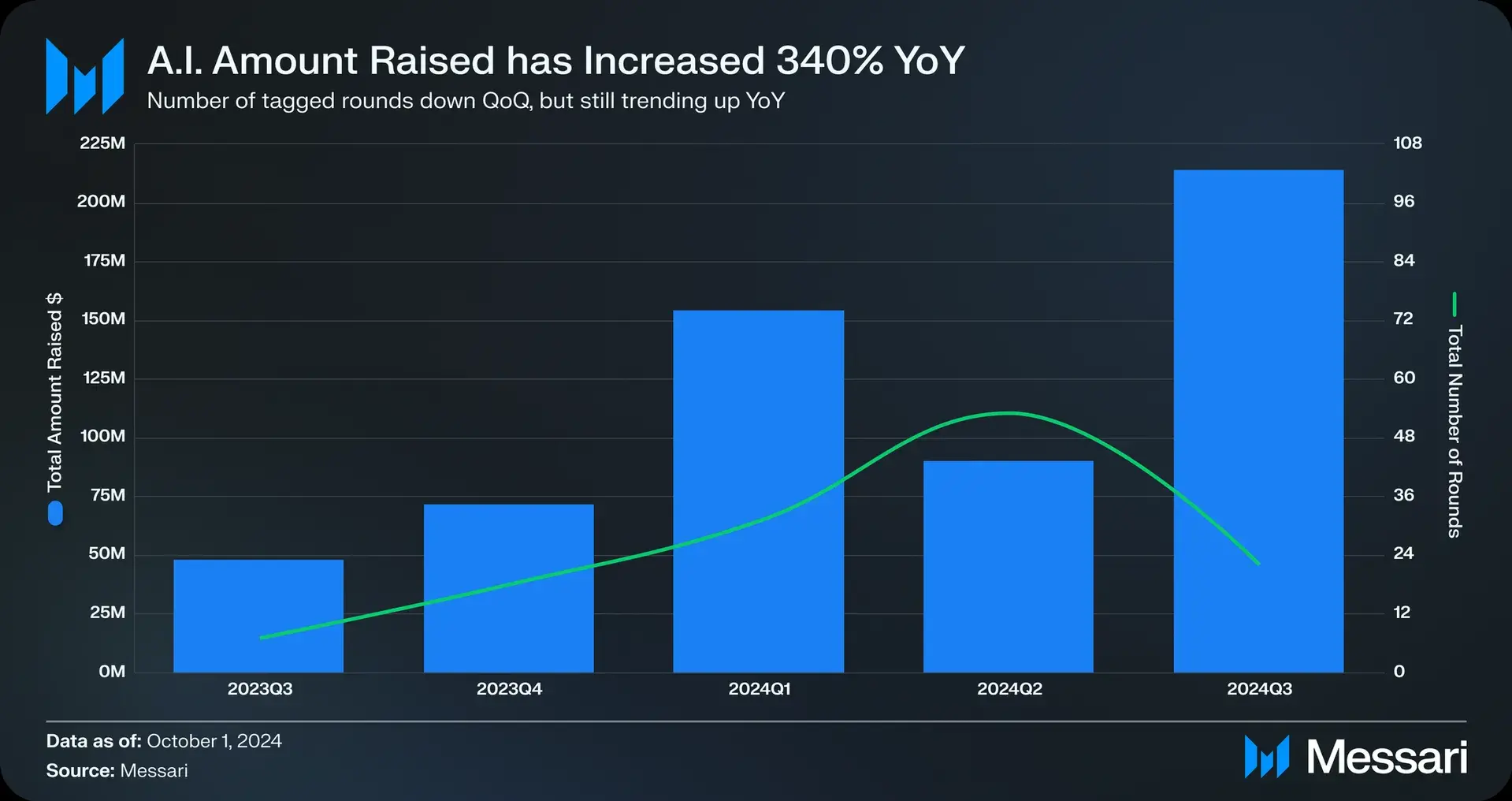

On December 24, Messari's "2025 Crypto Outlook Report" indicated that crypto AI is the most eye-catching emerging investment theme for 2024, with total financing in this field achieving approximately 100% year-on-year growth, and the number of financing rounds increasing significantly by 138%. This article will systematically outline the layout of top crypto VCs in the Crypto + AI field in 2024, as well as the fundamental situation of the specific projects they invested in.

Grayscale, Delphi, Coinbase, Binance Labs, and other crypto investment institutions have all laid out "Crypto + AI"

As the core force driving industry progress and capturing cutting-edge projects, the flow of capital and public investment activities have always been regarded as important indicators for insight into market trends. The crypto AI market in 2024 has also welcomed an investment frenzy, with major investment institutions competing to enter, and the enthusiasm for investing in crypto AI projects is unprecedentedly high, with investment amounts sharply rising.

Many top crypto venture capital institutions, such as Grayscale, Delphi Venture, Coinbase Ventures, Binance Labs, and a16z, have publicly announced their active engagement in the investment layout and strategic deployment of "Crypto + AI" projects.

Earlier this year (January), Tommy, co-founder of Delphi Digital, publicly stated on social media platform X that he is highly optimistic about the combination of Crypto and AI and encouraged relevant project developers to contact him. He also revealed that Delphi Ventures has invested in several cryptocurrency AI projects, including the decentralized GPU project io.net, AI blockchain OG Labs, and the AI venture capital fund Mythos Ventures. In October, its R&D department, Delphi Lab, launched an AI accelerator in collaboration with the NEAR Foundation, aimed at promoting the development of projects at the intersection of AI and Web3.

a16z crypto, as a venture capital fund established by a16z specifically for the crypto field, is often seen as a barometer of the industry. Its relevant leaders have repeatedly stated their support for the integration of crypto and AI projects. As early as March, media reported that a16z was raising a new fund of up to $6 billion, which would focus on investments in the AI field, planning to allocate 15% of the funds specifically for the development of AI infrastructure and applications. In the list of 21 projects selected for the a16z Crypto Fall Crypto Startup Accelerator (a16z CSX) announced in September, five projects are related to crypto AI, including Skyfire, the decentralized AI network OpenGradient, the GPU project Kuzco, the blockchain AI solution Banyan designed for enterprises, and PIN AI. Several AI agents, such as the GOAT (truth_terminal) project that exploded in popularity in October, have received cryptocurrency funding support from a16z crypto partners.

As we entered the second half of the year, more crypto venture capital institutions announced their entry into the crypto AI field, with some institutions establishing dedicated AI funds and others increasing their investments in crypto AI projects.

On June 19, Pantera Capital announced that it is raising a new fund of $1 billion, with over $200 million allocated for investments in AI-related projects. The fund's investment manager, Cosmo Jiang, stated that in the next 10 to 20 years, all crypto companies will become AI companies. Pantera Capital has already allocated 15% to 20% of its capital in its early funds to blockchain projects related to AI.

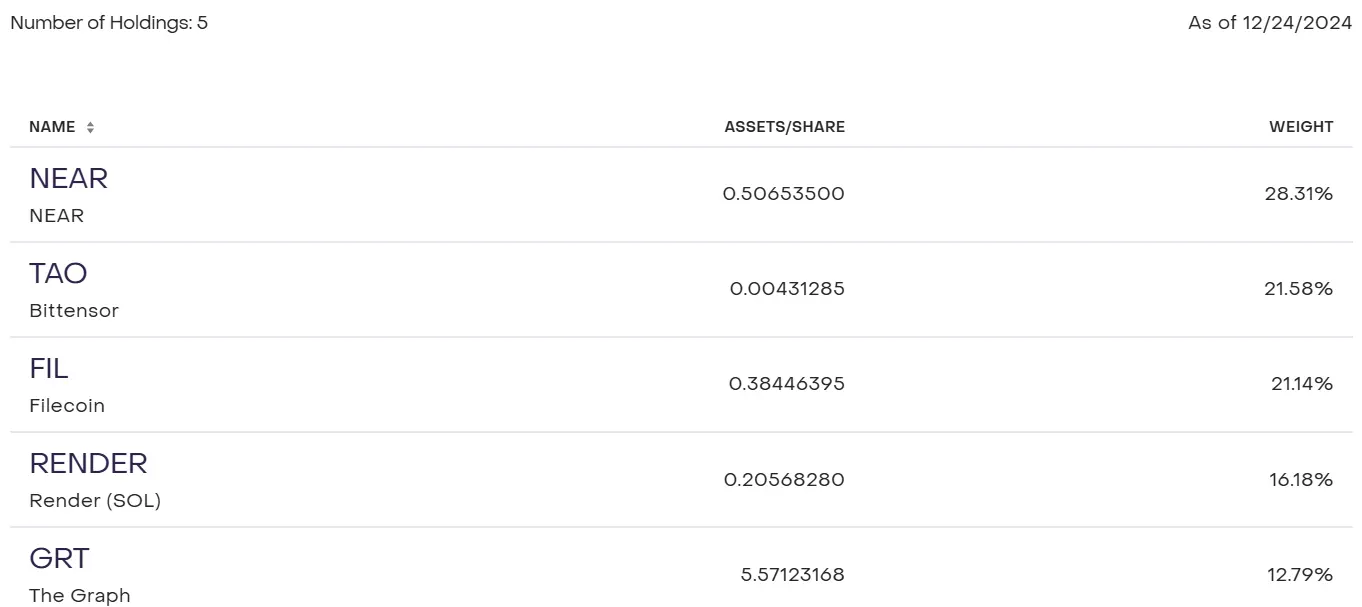

In August, Grayscale launched a new decentralized AI trust fund, the "Grayscale Decentralized AI Fund," focusing on investments in AI-related project tokens. The first batch of selected projects includes AI project tokens such as Bittensor (TAO), Filecoin (FIL), Livepeer (LPT), Near (NEAR), and Render (RNDR), and will be adjusted quarterly based on holdings. As of December 23, the Grayscale AI fund's holdings have included Bittensor (TAO), Filecoin (FIL), Near (NEAR), Render (RNDR), and The Graph (GRT), with total managed assets valued at approximately $1.5 million.

Also in August, Max Coniglio, the investment director of Binance Labs, publicly stated his recent strategy: to promote the development of AI-driven decentralized applications (DApps), and has continuously invested in the decentralized AI network Sahara AI and the AI robot platform MyShell. Max Coniglio believes that the combination of AI and blockchain is a force that cannot be underestimated, and if the two can move towards open-source protocols together, they will jointly create a prosperous new era. In a recent interview, Binance co-founder He Yi expressed that the integration of AI and crypto is leading to a productivity revolution, with its impact far exceeding expectations. Blockchain technology primarily changes labor relations and profit distribution models, while AI is a revolutionary technology that directly enhances user productivity.

In October, Coinbase Ventures also announced that its investment strategy has shifted from solely investing in cryptocurrencies to a deep layout of "Crypto + AI" projects. Its head, Hoolie Tejwani, pointed out that there is a natural complementarity between crypto technology and AI, and these two technologies are closely intertwined like the double helix structure of DNA, laying a solid foundation for the future digital life. In fact, as early as August, Coinbase Ventures had participated in investments in AI agent payment projects Skyfire and Payman.

This series of collective optimism from crypto venture capital institutions regarding the crypto AI field undoubtedly sends a strong signal: in the future market cycle, venture capital institutions will engage in large-scale and far-reaching layouts and bets in the crypto AI field.

According to Messari's Q3 2024 crypto investment and financing report, crypto venture capital institutions injected over $213 million into AI projects in that quarter, achieving a quarter-on-quarter growth of 250% and a year-on-year increase of 340%.

Furthermore, in the freshly released Messari "2025 Crypto Outlook Report" on December 24, a clear trend emerged: investors' interest in the intersection of crypto and AI is growing stronger, and crypto AI has become the most dazzling emerging investment theme for 2024. This field not only achieved approximately 100% year-on-year growth in total financing but also saw a significant increase of 138% in the number of financing rounds. Notably, well-known Web3 accelerator projects such as a16z CSX and Beacon have included many projects from the crypto AI field in their selected lists. This data indicates that more and more venture capital investment firms are entering this emerging field, and the influx of capital will undoubtedly further accelerate the rise of the crypto AI track.

AI Investment Strategies of Crypto Institutions: Preference for Decentralized AI Infrastructure and Application Products

According to investment data from Rootdata platform regarding crypto venture capital institutions in 2024, a16z, Delphi Venture, Coinbase Ventures, Pantera Capital, Binance Labs, Hack VC, and Polychain have all participated in multiple crypto AI projects' financing in 2024. Notably, Coinbase Ventures, Delphi Venture, Binance Labs, and Hack VC have been particularly active, demonstrating their strong optimism for this field through multiple investments.

Coinbase Ventures began to increase its investment in crypto AI projects starting in August, investing in two AI agent payment project infrastructures, Payman and Skyfire; while Binance Labs and a16z Crypto participated in several early projects through both direct investments and incubator programs.

Binance Labs, as the venture capital and incubation department under Binance, often has its invested projects regarded by the crypto community as a wealth code for early coin listings, wielding significant influence. According to the disclosed crypto AI investment projects in 2024, its strategy involves selecting projects for the MVB incubator first, and then further participating in investments. For example, the invested projects NFPrompt (NFP) and MyShell are both from the MVB incubator and are primarily AI application products.

a16z Crypto's parent fund, a16z, has a deep investment history in the AI field, having participated in over $100 million financing for several AI star companies, including Open AI, AI chatbot Character.AI, and AI pharmaceutical company Genesis Therapeutics.

However, according to data from Rootdata, the number of crypto AI projects directly invested in by a16z crypto in 2024 is not many. Only two projects have been disclosed: the AI Agent development network Axal and the AI virtual human creation platform Balance.fun, with Axal being part of the a16z CSX investment. It focuses more on participating through the a16z CSX incubator. In the list of 21 projects selected for the a16z Crypto Fall Crypto Startup Accelerator (a16z CSX) announced in September, five projects are related to crypto AI, including Skyfire, the decentralized AI network OpenGradient, the GPU project Kuzco, the blockchain AI solution Banyan designed for enterprises, and PIN AI.

In the recently released 2025 trend outlook, a16z emphasized that the intersection of crypto and artificial intelligence will be a key focus in the coming year, particularly optimistic about the development of crypto AI Agents. They believe that AI Agents can own and manage their own wallets, perform on-chain transactions such as node validation, and are truly autonomous AI chatbots rather than human-controlled, capable of self-verification and other functions.

ChainCatcher's analysis of the project data involving investment institutions found that the projects participating in investments in 2024 are mostly AI technology infrastructure and application products. Institutions like Polychain and Pantera Capital tend to invest in AI infrastructure, such as decentralized AI networks, GPU tokenization, and AI data; while Hack VC and Binance Labs prefer AI application products.

List of Crypto AI Projects Laid Out by Venture Capital Institutions like Coinbase and a16z in 2024

Coinbase Venture's 2024 Crypto AI Project Investment List

1. AI Agent Payment Tool Payman

Payman is an AI Agent payment proxy solution designed specifically for AI models and developers, created in May this year, aimed at building a payment infrastructure for collaboration between AI and humans. Developers can integrate Payman's payment API to enable their AI Agents to automate payment transactions between AI and humans. Whether AI developers want to pay for human assistance or humans want to receive compensation for collaborating with AI, they can use the Payman API to automate the payment process between both parties.

The core advantage of the Payman product is that it provides AI developers with a complete and sophisticated AI Agent payment proxy system that can autonomously and intelligently handle all payment processes, greatly simplifying operational complexity. Payman supports not only fiat currency payments but also the use of cryptocurrencies as payment methods, such as USDC.

On August 8 of this year, Payman announced the completion of a $3 million pre-seed round of financing, with investors including well-known venture capital institutions such as Visa, Coinbase Ventures, and The Spartan Group. Additionally, the project was selected for Binance Labs' MVB accelerator program as early as July.

Coinbase Ventures' favor for Payman is not only reflected in financial support but also in its repeated public endorsement of the project. At the Devcon2024 offline event held in November this year, Payman collaborated with virtual idols under South Korean entertainment giant HYBE to demonstrate how to achieve seamless payments between AI and humans using the USDC stablecoin.

It is also worth mentioning that the project's co-founder, Tyllen Bicakcic, previously held key developer relations positions at the Uniswap Foundation and Flow blockchain.

2. AI Agent Payment System Skyfire: The Visa of AI

Skyfire is also an AI Agent payment solution system in which Coinbase Ventures has participated in investing. This product was founded by former Ripple executives in June this year. It provides a complete transaction process for AI Agents to operate independently without any human intervention, such as purchasing and completing any goods required for specified tasks.

It is well known that AI Agents will be able to perform functions such as autonomous shopping, ticket booking, route planning, and app listing, but general AI Agents cannot autonomously complete the final payment process, such as paying bills, flight tickets, and website hosting fees. Skyfire aims to solve this pain point by building a comprehensive cryptocurrency payment system for AI Agents, enabling them to autonomously conduct financial operations such as receiving and making payments without any human intervention. For example, when a user provides funds to an AI Agent, it can autonomously use those funds to meet the user's needs, with the entire process requiring no human involvement, just like a real assistant using cash or a credit card to buy coffee. Therefore, Skyfire is regarded as the "Visa" payment center in the AI field, supporting AI Agents in autonomously handling payments, receipts, and savings.

In terms of financing, Skyfire has also performed excellently, receiving strong support from several well-known crypto capital firms. In August, it successfully completed a $8.5 million seed round of financing, attracting investments from well-known institutions such as Circle, Ripple, and Gemini. In September, Skyfire was selected for the a16z Fall CSX accelerator. In October, Coinbase Ventures and a16z Crypto CSX announced a new strategic investment of $1 million in Skyfire.

As of December 21, Skyfire's publicly disclosed cumulative financing amount has reached $9.5 million.

3. Decentralized AI Data Network Vana

Vana is a decentralized data network aimed at creating a platform that allows users to tokenize and trade their personal data and AI models. The project originated from a research project at MIT in 2018, dedicated to building a user-owned data pool network, allowing users to truly own and control their data, autonomously build AI models, freely decide how their data is used, and earn economic returns by contributing data.

Vana has built a decentralized data marketplace for users, allowing them to use smart contracts to control their social data. Whenever their data is used, users can automatically receive rewards. For example, users can provide high-quality data generated on platforms like Google and Reddit to AI developers for model training and earn income from it. This not only effectively addresses the issue of insufficient training data for AI models but also opens up a new avenue for users to earn income through their own data.

On September 18, Vana announced the completion of a $5 million strategic financing round, led by Coinbase Ventures. In April of this year, Vana revealed that it had previously secured $18 million in Series A financing led by Paradigm in October 2022, which had never been disclosed before, and stated that its cumulative financing amount had reached $20 million.

As of December 21, Vana's cumulative financing amount has reached $25 million.

On December 13, Vana (VANA) was launched on Binance Launchpool.

4. Decentralized AI Network OpenGradient

OpenGradient is dedicated to creating a decentralized AI network that supports developers in creating, distributing, and deploying AI models and applications in an open and permissionless manner. OpenGradient not only provides developers with AI development tools but also supports the secure and seamless integration of AI workflows into web3 applications, enabling decentralized and universal access to AI models.

Currently, OpenGradient is building an EVM-compatible blockchain network that allows developers to deploy AI models using Solidity smart contracts. It is regarded as the "HuggingFace" of the Web3 space. Hugging Face is an open-source model library that supports users in sharing various machine learning models and is referred to as the "GitHub of the AI world."

In September of this year, OpenGradient was one of the 21 selected companies for the a16z Crypto Fall Crypto Startup Accelerator (CSX).

On October 10, OpenGradient announced the completion of an $8.5 million seed round of financing, with investments from a16z CSX, Foresight Ventures, Coinbase Ventures, Symbolic Capital, and others.

5. Decentralized AI Model Production Factory Pond

Pond is building a decentralized AI model network that allows any user to easily create their own AI models and tokenize them for profit, regarded as a "decentralized AI model production factory."

In the Web2 world, there is a data modeling and analysis competition platform called Kaggle, which supports developers in competing to build the best AI models, but creators do not have final ownership. Pond aims to solve this problem by not only providing developers with a range of infrastructure needed to create AI models but also allowing creators to own, control, and tokenize their AI models, regarded as an "improved version of Kaggle in the Web3 space."

Unlike most projects based on LLM models, Pond is based on a large GNN (Graph Neural Network) to perform real-time statistics and predictions on on-chain data. Compared to LLM, it is better at processing and generating information. The GNN-based Pond excels at mining relationships between data and extracting valuable information, utilizing the native on-chain data of the crypto industry, and learning and predicting on-chain behavior through technologies like graph neural networks. The predictions of behavior have led to many new business logics, such as token price prediction, AI-enhanced MEV, and DeFi strategies.

On November 7, Pond announced the completion of a $7.5 million seed round of financing, with investment institutions including Archetype, Delphi Ventures, and Coinbase Ventures.

Investment List of a16z Crypto and a16z CSX Accelerator's Crypto AI Projects in 2024:

1. AI Agent Development Network Axal

Axal is dedicated to building a verifiable AI Agent development network for any task, providing users with a complete set of tools to create AI Agents, allowing users to create their own AI Agent intelligent systems by stating their intentions.

In October, Axal announced the completion of a $2.5 million pre-seed financing round, led by CMT Digital, with other participants including a16z Crypto Startup School, Escape Velocity, IDG Vietnam, and Artichoke Capital.

At the same time, Axal launched its flagship product, Axal Autopilot, an AI Agent-driven trading automation platform that provides users with personalized trading strategies, including price tracking, on-chain transaction execution, and yield management.

2. AI Virtual Human Creation Platform Balance.fun (EPAL)

Balance was originally launched by the E-PAL gaming companionship platform in February this year as a Web3 experience infrastructure aimed at providing a smooth transition for Web2 users to Web3. The Balance platform introduces an AI-driven system as a core element, supporting users in creating personalized AI virtual companions that can participate in gaming, learning, entertainment, and even productivity tasks, adapting to individual preferences, behaviors, and needs.

In September this year, E-PAL disclosed that it had successfully completed two rounds of financing led by a16z and Galaxy Interactive, with a total financing amount of $30 million. In November, Balance.fun announced that it had raised over $10 million in sales from institutions through early node sales, with participating institutions including Animoca Brands, Amber Group, and GSR Markets.

Currently, Balance.fun is conducting node sales, with each node priced at $599. According to the roadmap, the token ETP is expected to be issued in January 2025.

3. Decentralized Personal AI Network Infrastructure PIN.AI

PIN AI aims to create an open AI network that can access vast contextual data without restrictions, allowing AI builders to create various useful personal AI applications. It is well known that the reasoning of AI models is limited by the input data, but currently, due to privacy reasons, much data resides on users' personal devices such as phones and computers. PIN AI hopes to mobilize this personal data and support users in creating private AI applications according to their needs, enabling AI developers to provide very everyday and practical AI services such as shopping, organizing travel, and financial planning.

The main goal of the PIN protocol is to achieve an open ecosystem for personal AI applications. It consists of three foundational layers: personal data (focusing on privacy and data ownership), personal AI (useful and trustworthy companion AI on personal devices), and external AI (an open market for AI services).

This allows AI applications to easily access user contextual data and match user intentions with specialized external AI while always protecting user privacy.

On September 10, PIN AI announced the completion of a $10 million pre-seed financing round, with participation from a16z CSX, Hack VC, Blockchain Builders Fund (Stanford Blockchain Accelerator), and other institutions.

Binance Labs' 2024 Crypto AI Project Investment List:

1. AI Content Creation Platform NFPrompt (NFP)

NFPrompt (NFP) is an AI-driven NFT content generation platform that provides creators with AI content creation work for images, videos, pfp, music, and more. It supports users in easily creating stunning works through prompts and generating NFTs for ownership confirmation with one click. It was selected for Binance Labs' sixth incubation program in September 2023, and the NFP token was launched on Binance in December last year, with an announcement of investment from Binance Labs in March this year.

2. Decentralized AI Data Network Privasea

Privasea, originally named Nulink, primarily focused on privacy data computation. It was selected for Binance Labs' fourth incubation program as early as May 2022 and now provides solutions for privacy issues in AI data computation, supporting data privacy and security during AI model computation. Additionally, its launched verification program, ImHuman, functions similarly to WorldCoin and supports converting collected human biometric features into training data for AI models in a privacy-secure manner.

In March this year, Privasea announced the completion of a $5 million seed round of financing, with participation from Binance Labs and others.

3. AI Knowledge Sharing and Search Platform QnA3.AI (GPT)

QnA3.AI (GPT), abbreviated as QnA3, is an AI-driven Web3 knowledge sharing and search platform aimed at providing users with accurate knowledge in the cryptocurrency field. It not only provides information access and retrieval but also offers complex logical analysis functions for users to make trading decisions. It is also one of the projects in Binance Labs' sixth incubation program in September 2023. In February, the QnA3.AI token GPT was launched on OKX, and in March, it announced investment from Binance Labs.

4. AI Robot Platform MyShell

MyShell is building an AI consumer application layer that connects users, creators, and open-source AI researchers. By providing a complete set of AI Agent robot creation tools, it allows users to easily discover or create various applications or robots based on AI Agent technology, such as voice chatbots, language learning assistants, and image generation tools. It is also one of the selected projects in Binance Labs' sixth incubation program in 2023 and completed a $5.6 million seed round financing at a valuation of $57 million in December of the same year.

In March, MyShell announced the completion of an $11 million Pre-A round of financing, with investment institutions including Dragonfly, Delphi Digital, and Bankless Ventures. In August, it announced further investment from Binance Labs.

5. Decentralized AI Network Sahara AI

Sahara AI is a decentralized AI network infrastructure that facilitates the assetization of AI, aiming to help users deploy or build customized and personalized AI products, ensuring that all contributors in the AI chain receive fair ownership and rewards.

In August this year, Sahara AI announced the completion of $43 million in financing, led by institutions including Binance Labs, Pantera Capital, and Polychain Capital.

In the roadmap released on December 24, 2025, Sahara AI stated that it has launched a data service platform and testnet, allowing users to earn rewards through data collection and annotation. The Sahara Chain mainnet is expected to launch in Q3 2025.

Pantera Capital's 2024 Crypto AI Project Investment List:

1. Decentralized AGI System Sentient

Sentient is dedicated to building a decentralized artificial general intelligence (AGI) platform through community contributions, aiming to compete with traditional closed-source AI development models like OpenAI. It supports AI model creators in tokenizing their models and incentivizing users to contribute and expand AI models using Web3 technology, collaboratively building community-contributed open-source AI models.

In July this year, Sentient announced the completion of an $85 million seed round of financing, with investment institutions including Pantera Capital, Framework Ventures, Delphi Ventures, Hack VC, and others.

Delphi Digital's 2024 Crypto AI Project Investment List:

1. Decentralized AI Operating System OG Labs

OG Labs (full name Zero Gravity Labs) initially emerged with a modular AI blockchain narrative, indicating that it has a scalable DA layer to support AI DApps. In March, OG announced the completion of a $35 million pre-seed round of financing, with investment institutions including Hack VC, Animoca Brands, and Delphi Digital participating.

However, in November, OG Labs announced that it had secured $290 million in new funding, including $40 million in seed round financing and a $250 million token purchase commitment. Co-founder Michael Heinrich stated that once the OG token is listed and circulated on cryptocurrency exchanges next year, the project will be able to extract funds from the token commitments.

At the same time, OG Labs has shifted from a modular AI blockchain to building what is called a decentralized AI operating system (dAIOS), aimed at enabling the development of on-chain AI applications, with the previously mentioned modular AI being just one part of it.

According to public statements from the co-founders, the mainnet release of the OG protocol is expected in the first or second quarter of next year.

2. AI Data Collection Platform Grass (GRASS)

Grass is a decentralized network resource sharing and redistribution DePIN platform developed by Wynd Network (a decentralized internet proxy network) that allows people to sell idle internet bandwidth and network data.

Users can automatically share idle bandwidth and personal data by downloading the Grass Chrome browser extension and earn additional rewards, similar to a new concept of earning tokens by utilizing traffic and data. Additionally, Grass will convert the collected personal data into AI datasets for developers to use for AI training. Therefore, Grass is also seen as a decentralized data provision layer for AI.

In September, Grass announced the completion of a Series A financing round, reportedly reaching a valuation of nearly $1 billion, with investment institutions including Hack VC, Polychain Capital, and Delphi Digital, although the specific financing amount was not disclosed. On October 16, the Grass token GRASS was officially launched.

On November 25, Mechanism Capital partner Andrew Kang stated that the development of AI has made data one of the most valuable commodities in the world. Grass has created a data pipeline that most AI companies cannot reach through a crypto incentive mechanism, and at the current growth rate, it is expected to achieve nine-figure high-level revenue next year, potentially exceeding billions of dollars.

3. Decentralized AI Network Allora

Allora, formerly known as Upshot, was originally an NFT price protocol. In February this year, it was renamed Allora and shifted from an NFT evaluation platform to a decentralized AI network.

On the Allora platform, users can evaluate the performance of an AI model under current conditions using multiple AI Agents through prediction tasks, and rewards are allocated based on the quality of the agents' predictions and evaluations. This incentive mechanism allows models on Allora to continuously learn and improve, adjusting as the market evolves.

In June, Allora announced the completion of a $3 million strategic financing round for the decentralized artificial intelligence network Allora Labs, with investment institutions including Archetype, Delphi Ventures, and CMS Holdings. This brings the total financing for the Allora project to $35 million.

4. Decentralized GPU Project io.net (IO)

io.net is a decentralized AI computing power DePIN protocol aimed at addressing the insufficient computing demands in the fields of AI and machine learning by utilizing distributed GPU and CPU resources. It has built a bilateral market around chips, where the supply side consists of GPU and CPU computing power distributed globally, and the demand side includes AI engineers looking to complete AI model training or inference tasks. Its mission is to integrate millions of GPUs into its DePIN network.

In March this year, io.net announced the completion of a $30 million Series A financing round, with investment institutions including Hack VC, Multicoin Capital, Delphi Digital, and Solana Labs. To date, the project has raised a total of $40 million, with a valuation of $1 billion.

In June, the io.net token IO was issued on Binance Launchpool; in October, the IO token was listed on Coinbase.

Hack VC's 2024 Crypto AI Project Investment List:

1. GPU Tokenization Platform Exabits

Exabits aims to unlock over $1 trillion in the AI computing market by tokenizing physical GPUs into investable liquid financial assets. By splitting and tokenizing GPU computing resources, investors can purchase EGPUs representing GPU capacity as assets to earn returns.

Currently, the Exabits platform has created a pathway to GPU-Fi (G-Fi), allowing GPU assets to flow between various financial platforms, thereby improving the capital efficiency of the entire AI ecosystem and democratizing AI computing, enabling anyone to participate in the AI computing economy. According to official information, Exabits has provided enterprise-level GPU resources for companies such as EMC, Viggle, Lepton, IO.NET, Aethir, Akash, MyShell, Nebula Block, and Game Killer.

In February, Exabits announced the completion of a seed round of financing, with specific amounts not yet disclosed. On December 11, Exabits announced the completion of a $15 million seed round financing, led by Hack VC. This financing brings Exabits' total funding to $20 million.

2. GPU Asset Tokenization Platform GAIB

Similar to Exabits, GAIB aims to unlock a trillion-dollar AI computing market by tokenizing GPU assets, changing the traditional GPU financing model. On December 13, it announced the completion of a $5 million seed round financing, with participating investment institutions including Hack VC, Faction, and Aethir.

According to official sources, GAIB has completed prototype development and will launch a pilot project this month, with plans to release an Alpha product and platform token within the next two months.

3. AI Agent Infrastructure Theoriq

Theoriq is a modular and composable AI Agent infrastructure network launched by the Web3 machine learning platform ChainML. It supports any user in creating their own AI Agent without coding by providing relevant AI Agent development infrastructure tools.

In May, ChainML announced that it had raised $6.2 million in a seed round expansion financing, led by Hack VC.

Currently, Theoriq is in a testnet state, and according to the roadmap, it is expected to relaunch the mainnet by the end of 2024.

4. AI Image Generation Robot imgnAI

imgnAI is a consumer-facing AI image generation robot that allows users to automatically generate images through simple text commands, similar to text-to-image models like Midjourney. However, users on the imgnAI platform need to purchase the native token IMGNAI to unlock more creative tools and features.

In January, imgnAI announced the completion of a $1.6 million seed round financing, led by Hack VC, and also developed the Twitter AI Agent virtual character @Naifu.

Polychain's 2024 Crypto AI Project Investment List:

1. Decentralized AI Cloud Platform Hyperbolic

Hyperbolic is building an open AI cloud platform that plans to integrate global GPU computing resources through blockchain technology to address the industry's bottlenecks in AI model computing resource costs and allocation. To this end, Hyperbolic has built a dedicated AI inference service platform and GPU marketplace, allowing developers to call open-source AI models through simple API calls and supporting AI model training and fine-tuning. The GPU marketplace enables GPU computing power to be traded like commodities, allowing users to rent or buy GPUs.

On December 11, Hyperbolic announced the completion of a $12 million Series A financing round, led by Variant and Polychain Capital. As early as July this year, Hyperbolic announced the completion of a $7 million seed round financing, also led by Polychain Capital. To date, Hyperbolic's total financing has reached $20 million.

2. L1 Network Talus Network Designed for AI Agents

Talus Network is an L1 network infrastructure designed specifically for AI Agents, supporting any user in creating their own dedicated AI Agent. It is important to note that this L1 network is designed based on the Move language and has not yet launched its mainnet, but applications can be made to join the testnet.

On November 26, Talus Network announced the completion of a $60 million financing round, raising $15 million, led by Polychain Capital, with participation from Foresight Ventures, Animoca, and others. As early as February this year, it completed a $3 million financing round, also led by Polychain Capital. As of December 24, Talus Network's total disclosed financing has reached $9 million.

3. Decentralized AI Data Network OpenLedger

OpenLedger is a blockchain for AI data that provides the infrastructure for creating specialized language models for specific domains, supporting developers in creating various AI Agents, chatbots, smart driving applications, etc. It collects and manages specific data through its data network and utilizes blockchain technology to attribute rewards to data contributors and creators.

On July 2, OpenLedger announced the completion of an $8 million seed round financing, led by Polychain Capital and others.

4. Decentralized AI Network Ritual

Ritual is a decentralized AI network infrastructure aimed at creating a system that allows for the open and permissionless creation, training, improvement, and trading of AI models. Its provided SDK not only supports developers in seamlessly integrating AI models into any chain-based applications or protocols but also allows users to fine-tune, tokenize, and train AI models using cryptographic schemes.

On April 8, Ritual announced that it had received several million dollars in A1 round financing from Polychain Capital, with specific investment amounts not disclosed. As early as November 2023, it completed a $25 million financing round, with investments from Archetype and others.

The Ritual Chain testnet was launched on November 19, providing developers with a platform to build AI-native applications.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。