Author: shaofaye123, Foresight News

Memecoin is an unavoidable theme in 2024, with classic meme coins like Dogecoin and Shiba Inu seeing an average increase of over 5 times, while emerging meme coins like MooDeng and PNUT have investment returns as high as hundreds of times. The oversupply of tokens and the high circulation and valuation of VC coins have made this bull market a non-reciprocal one. As a result, Memecoin has been exceptionally active in this round, becoming an indicator of on-chain liquidity, a whistleblower for new narratives, and a thermometer for market sentiment.

This year, we have witnessed the transition of Memecoin from frenzied speculation to gradually entering mainstream culture and consensus effects, leading to a great transfer of wealth. In this process, the issuance methods have been continuously innovated, asset types have rapidly evolved, and mainstream acceptance and adoption have driven its vigorous development. Each transformation hides opportunities for wealth accumulation by hundreds or thousands of times. Looking back at the 2024 Memecoin super cycle, let us witness the changes and opportunities of this year together.

Infrastructure Continues to Improve

The prosperity of this Memecoin super cycle is inseparable from the continuous improvement of infrastructure. Whether it is the innovation of B-end underlying issuance methods or the optimization of C-end user experience, both have provided conditions for the rapid influx of funds and the expansion of users in Memecoin.

Innovation in Issuance Methods

Traditional Memecoin issuance methods are similar to ordinary tokens, but as Memecoin operates in the attention economy, market hotspots change rapidly. Currently, the asset issuance cycle is long and complex; user preferences and speculation rhythms on major public chains vary. These factors make it difficult to concentrate market attention and liquidity, making it challenging to quickly push up asset prices in the short term.

PUMP.FUN: The Core Engine of the Super Cycle

This year, the money-raising craze initiated by BOME and SLERF, although its presale model has somewhat changed its issuance method and attracted market attention, has been plagued by frequent rug pulls, and the aforementioned issues remain unresolved. The emergence of PUMP.FUN has effectively addressed this situation, shortening the Memecoin issuance cycle, facilitating continuous capital flow, and gradually concentrating users, laying the foundation for the start of the Memecoin super cycle.

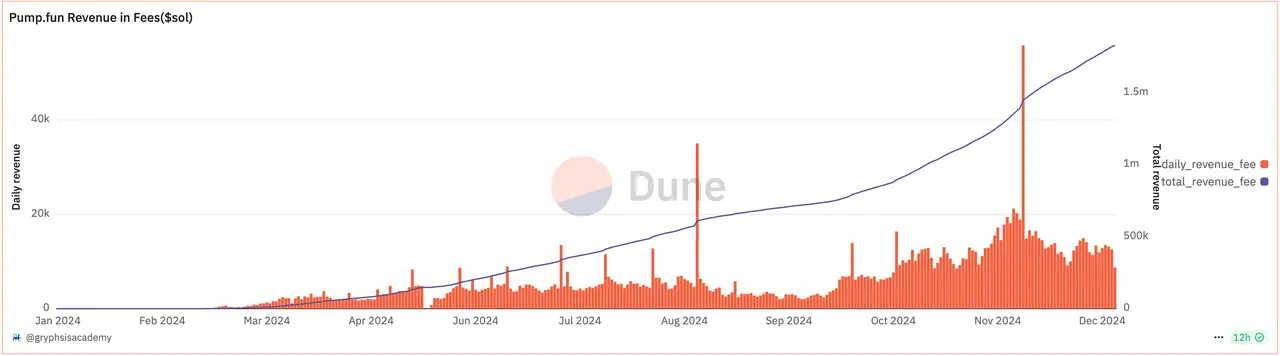

PUMP.FUN was created by founder Alon in January 2024, but it did not gain much attention until April. It has since issued nearly 5 million Memecoins, accounting for nearly 70% of the daily token issuance on Solana, becoming the highest-earning protocol on Solana. As the engine of the Memecoin super cycle, the optimization of asset issuance methods is its core advantage. It allows users to create tokens without any technical knowledge (after the August update, there is no longer a $2 creation fee), and the fair fundraising within the platform combined with a reasonable price curve (Bonding Curve) successfully reduces the cost of asset issuance and increases the speed of asset issuance, effectively solving the problem of rapid capital speculation and attention shifts in the current market.

Moreover, the success of PUMP.FUN lies not only in its innovative mechanism. Its user positioning and product design are also quite excellent. From the user perspective, it addresses the real needs of most people in the Web3 market: "Users want a simpler, faster, and lower-cost way to obtain higher returns." From the product perspective, it is one of the few projects with a complete business loop, with clear and traceable profit sources. (The platform transaction fee before going live on Raydium was 1%, and the "listing fee" during the packaging process on Raydium was 6 SOL.)

Currently, according to Dune data, as of December 23, PUMP.FUN has deployed nearly 5 million Memecoins since its launch, with daily active users reaching up to 300,000 and daily new addresses reaching 170,000. According to DefiLlama data, PUMP.FUN's protocol revenue in the past 30 days has reached a high of $94 million, with cumulative protocol revenue nearing $300 million.

PUMP.FUN Clones Emerge, Continuous Micro-Innovations

PUMP.FUN has initiated this round of the Memecoin super cycle, and the subsequent emergence of clones has made the super cycle even more prosperous.

Sun.pump: The Fifth Standard for Public Chains' Memecoin Launchpad

The influx of capital and market attention has led various public chains to launch PUMP.FUN clones, making Memecoin Launchpad a standard fifth component for public chains.

Major public chain ecosystems have begun to support Memecoin at various levels. On BSC, platforms like Four.meme and Flap attract market attention by continuously launching activities and collaborations; on the Base chain, platforms like Ape.Store, Rug.fun, and Trugly.meme attract user participation through various gameplay; on BTC Layer 2, many clones have emerged, such as LnPUMP.FUN, SatsPUMP.FUN, and CPUMP.FUN. Meanwhile, Sun.pump on the Tron chain has single-handedly driven the "renewed prosperity" of the entire Tron chain. In a short time, hot money surged into the Tron chain, quickly gaining popularity, with on-chain gas prices soaring and the long-dormant TRX price reaching a nearly three-year high. However, TRX has since declined, currently falling back to 0.24 USDT.

As one watches it rise, one also watches it fall. While Memecoin can quickly attract users and bring a wave of benefits to public chains, how to sustain ecological development is worth pondering.

MakeNow.Meme: Optimization of Market-Making Models

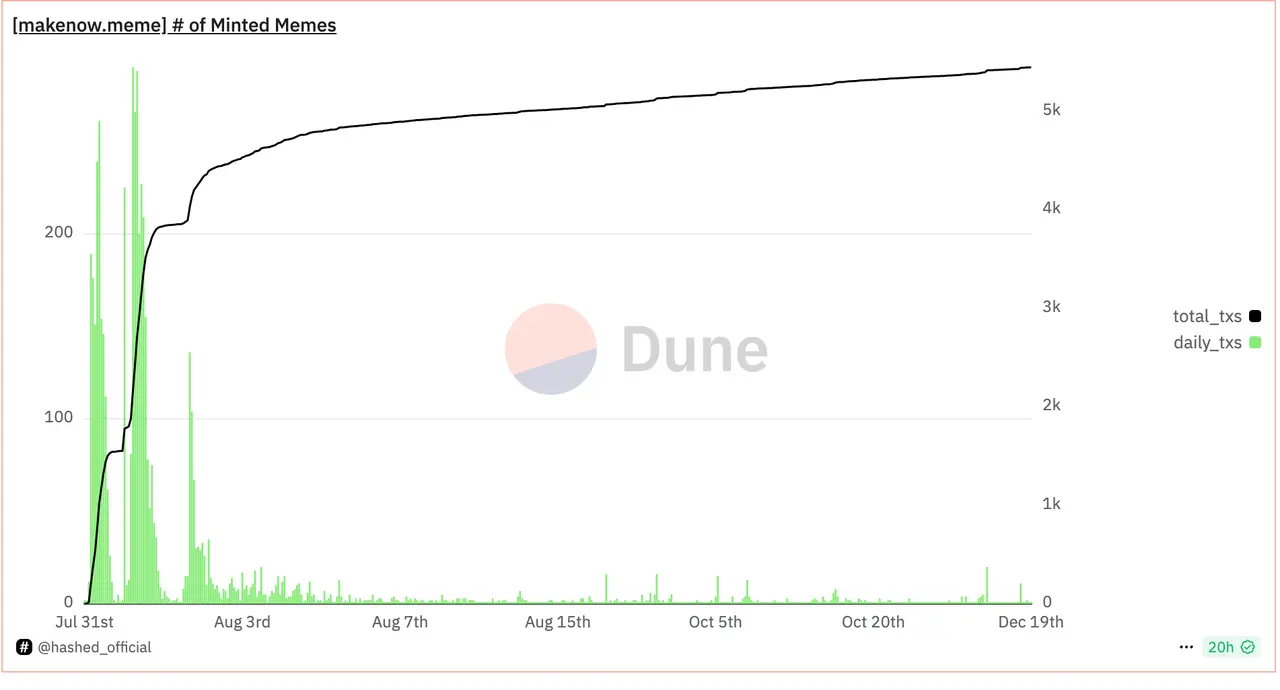

MakeNow.Meme is no longer as hot as it once was, but it garnered widespread attention when it was first launched. It issued over 2,600 Memecoins in one day, generating over 230+ SOL in revenue. Its issuance mechanism, compared to PUMP.FUN, not only simplifies the asset issuance method but also provides a new direction for market-making models.

- Further simplification of asset issuance methods — On Twitter, users can post tweets in a fixed format (starting with the $ symbol and stock code, along with token descriptions/videos/images, etc.) and @ the official account, waiting for the official account to reply with the token contract address in the comments.

- Optimization of market-making models — While the fair launch method appears to require everyone to scan the chain to obtain contracts first, in reality, KOLs and project parties may privately reach agreements with the platform to preemptively buy low-priced tokens.

According to Dune data, MakeNow.Meme gradually faded away just a week after its creation, leading to an outcome of being ignored. This may confirm that the core narrative and main logic of Memecoin still revolve around the pursuit of fairness.

Moonshot: Natural Traffic Backed by DEX Screener

Moonshot was developed by DEX Screener around June this year. Although it is backed by DEX Screener and even embedded in the platform, its data remains sparse compared to PUMP.FUN. Despite having natural traffic support, it seems to have not effectively captured and converted that traffic, failing to display metadata before launch and lacking simple traceability of launch history, resulting in a lack of transparency in functionality.

Its data performance after launch has also been relatively mediocre. This may indicate that while the traffic entry exists, the key lies in how to convert users.

Optimization of User Experience

In addition to innovations in asset issuance methods and capital flow, the optimization of user experience is also a reason for the large-scale explosion of Memecoin in this round.

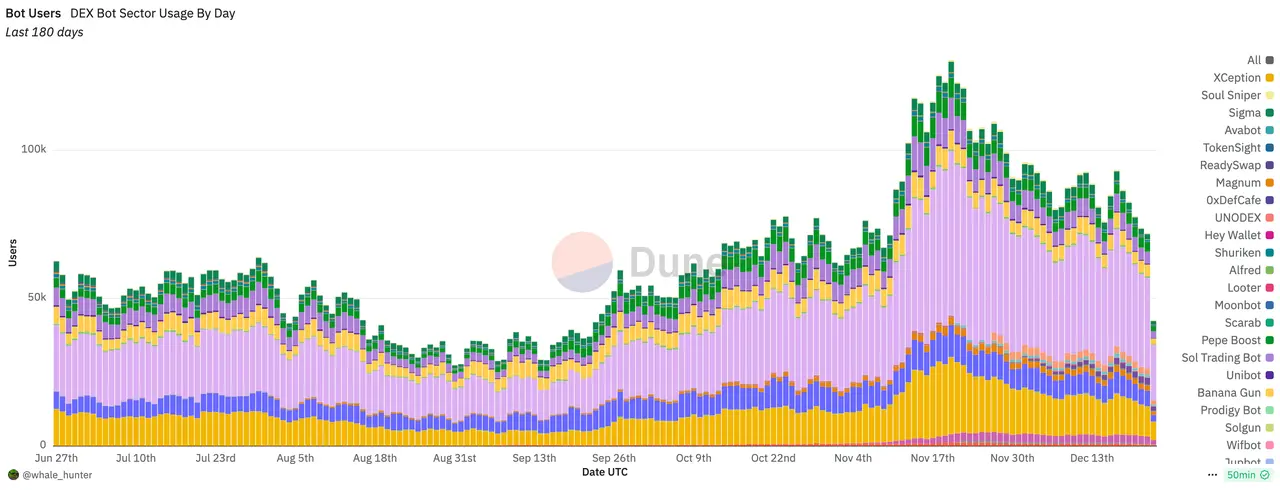

TG Bot: Optimization for Web3 Users

Behind this Memecoin super cycle is the development of tools and on-chain robots, which are rapidly updated through continuous iterations. From sniper tools, dollar-cost averaging, to security checks and correlation analysis, powerful tools and robots safeguard users' on-chain treasure hunting, driving Memecoin towards the masses from the demand side.

During this period, tools for Memecoin trading expanded from mobile to web, catering to different segmented needs. There are professional trading websites compatible with multiple chains, such as gmgn.ai, Bullx, and Photon, as well as convenient TG bots like Banana Gun, Tojan, and Bonkbot. These service tools specifically targeting Memecoin trading have leveraged the Memecoin gold rush, transitioning from a broad approach to a deeper one, with tools for wallet analysis, Twitter monitoring, and security detection becoming increasingly refined, and the product business model being validated. In this process, the number of TG Bot users has also been steadily increasing, with daily active users exceeding 140,000 and daily trading volumes reaching nearly $500 million. Although there is still a long way to go compared to on-chain DEXs, this niche area remains a blue ocean under the influence of the Memecoin super cycle.

MoonShot: Optimization for Web2 Users

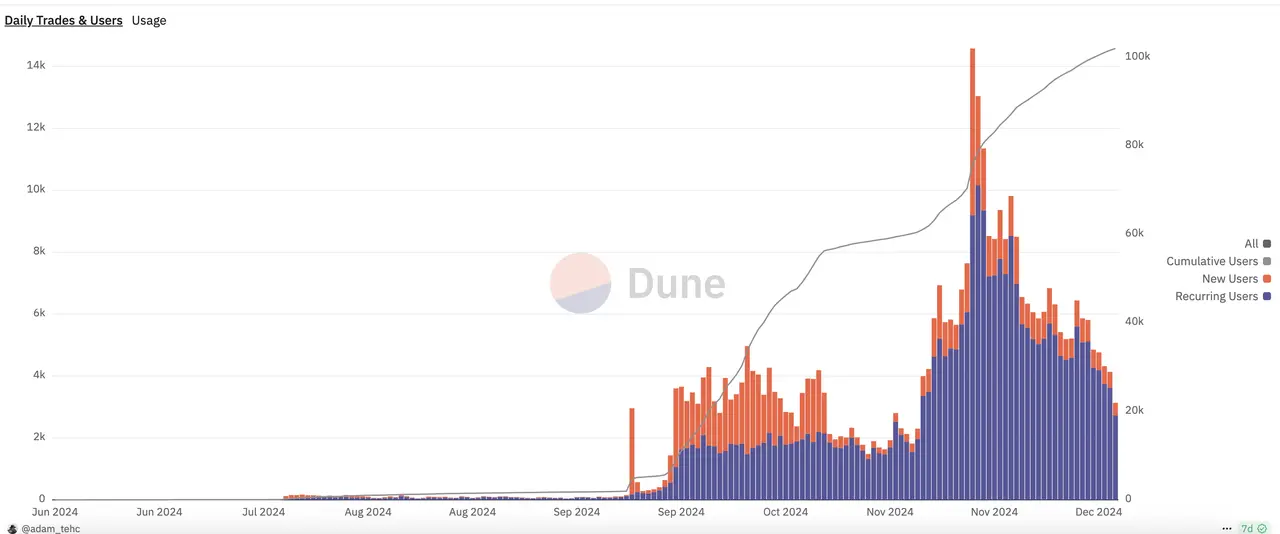

In addition to Web3 users, Memecoin is also the most direct way for Web2 users to enter and understand Web3. However, there are still many issues in Memecoin trading, such as high security risks, a multitude of dispersed platforms, and difficulties in obtaining gas. The MoonShot project, which involves the PUMP.FUN incubation team Alliance DAO, has addressed this issue to some extent.

It is a mobile application focused on meme trading built on the Solana network, allowing users to directly purchase Memecoins through fiat deposit methods like Apple Pay, credit cards, and PayPal. This simplification of the social login and fiat deposit process brings more new users and new funds to the Solana ecosystem, bridging the link between on-chain Memecoin and off-chain funds. However, currently, as the wealth effect diminishes, the user activity on MoonShot is gradually decreasing. How to effectively convert Web2 users remains a persistent issue in the crypto space.

Rapidly Changing Narratives

As a representation of the attention economy phenomenon in the crypto market, Memecoin is experiencing a trend of diversified narrative development under the market boom of 2024. Looking back at various past speculative projects, the themes of Memecoin narratives vary widely. However, each type represents specific market trends, community movements, and capital operation models. Based on past patterns and characteristics, we can roughly categorize them into four types: event-driven derivative Memecoins, community-driven IP Memecoins, celebrity effect-dominated conceptual Memecoins, and cross-domain multidimensional emerging Memecoins. Various types intersect and influence each other, not entirely independent.

Event-Driven Derivative Memecoins

Memecoins triggered by sudden events often attract high attention right from the start, with traffic and funds rapidly pushing up the asset prices of Memecoins during the attention phase. Their rise from occurrence to peak is often sudden and difficult to replicate. Their core characteristics are rapid bursts with high short-term multiples but insufficient sustainability; after the attention fades, they need to find other drivers. Examples like BOME, SLERF, FIGHT, and BAN can be categorized as Memecoins driven by event-led speculation.

BOME (BOOK OF MEME) is a presale project initiated by Pepe meme artist Darkfarm, raising over 10,000 SOL in its presale. Due to widespread attention, the token's trading volume exceeded $200 million upon launch, and within three days of being listed on Binance, its market cap peaked at over $1 billion. Subsequently, SLERF, which adopted the same presale mechanism, experienced a spiral increase in Meme token prices due to an unexpected destruction of LP and airdrop reserve tokens by the DEV, along with subsequent dissemination.

However, if Memecoins triggered by sudden events do not maintain continuous market attention, their prices will converge and decline. The Fight token, derived from the slogan after Trump's assassination, once had a market cap exceeding $80 million, but now, lacking attention, its market cap has dropped by over 90%. The art concept Meme coin BAN, issued by Sotheby's vice president Michael Bouhanna on PUMP.FUN, saw a peak drop of 85% after being listed on Binance.

Community-Driven IP Memecoins

IP-type Memecoins often have strong consensus, forming over a long fermentation period, and can create communities over time. These community-driven IP Memes have shown strong resilience during the fluctuations of 2024. Their rise to new highs may involve a lengthy washout period, with their core characteristics being high community consensus, a strong CULT aura, or demonstrating strong resilience amid repeated ups and downs. Examples include the Cult series POPCAT, SPX, APU, and other established IPs like MEW, NEIRO, and MANEKI.

MEW (cat in a dogs world) is a brave cat that fights against dogs. After its token was launched in March this year, it reached a market cap of $1 billion as a pioneer in the "cat track." Another IP, Maneki (Japanese lucky cat), also referenced its mechanism of 90% liquidity pool and 10% community distribution, causing a brief FOMO. Another example of a community IP Memecoin is Neiro, named after the rescue dog recently adopted by Kabosu, the owner of the late Dogecoin prototype Shiba Inu. The token reached a market cap of nearly $50 million within two days of launch, with its price fluctuating around issues related to the public chain and case sensitivity, with asset speculation continuing from on-chain to exchanges. The lowercase Neiro on Ethereum ultimately triumphed through community support, reaching a market cap of $1.2 billion. Additionally, Murad, as a new star of the super cycle, has a token selection criterion of existing for at least six months and experiencing at least two 70% crashes. Thus, while SPX's short-term rise benefited from its influence, the importance of community IP was the reason for its rebirth amid repeated declines.

Celebrity Effect-Dominated Conceptual Memecoins

The performance of Memecoins is often tied to key figures, as celebrities can promote related ideas through specific Memecoins, and tokens can further gain popularity due to celebrity effects. Their core characteristic is that price fluctuations correlate with the size of the celebrity's influence and the strength of the binding relationship. Examples include DOGE, PNUT, and TERMINUS, led by Musk, as well as others like JENNER and MOTHER.

The behavior and influence of celebrities issuing tokens have changed in this round of the Memecoin super cycle due to the emergence of Pump.fun, with faster rhythms and higher multiples, attracting numerous Web 2 celebrities to participate. Caitlyn Jenner, a member of the Kardashian family, developed the JENNER token, which surged 160 times in one night; American rapper Iggy Azalea's tweet on X, which included the Meme coin MOTHER contract, exploded thirty times in two minutes, with a peak market cap exceeding $200 million. Musk's conceptual coins are particularly focused on by Memecoin players; whenever he posts topics of interest on social media, such as Mars concepts (TERMINUS), government efficiency departments (D.O.G.E), and political concepts (PNUT), related tokens on-chain experience short-term surges.

Cross-Domain Multidimensional Emerging Memecoins

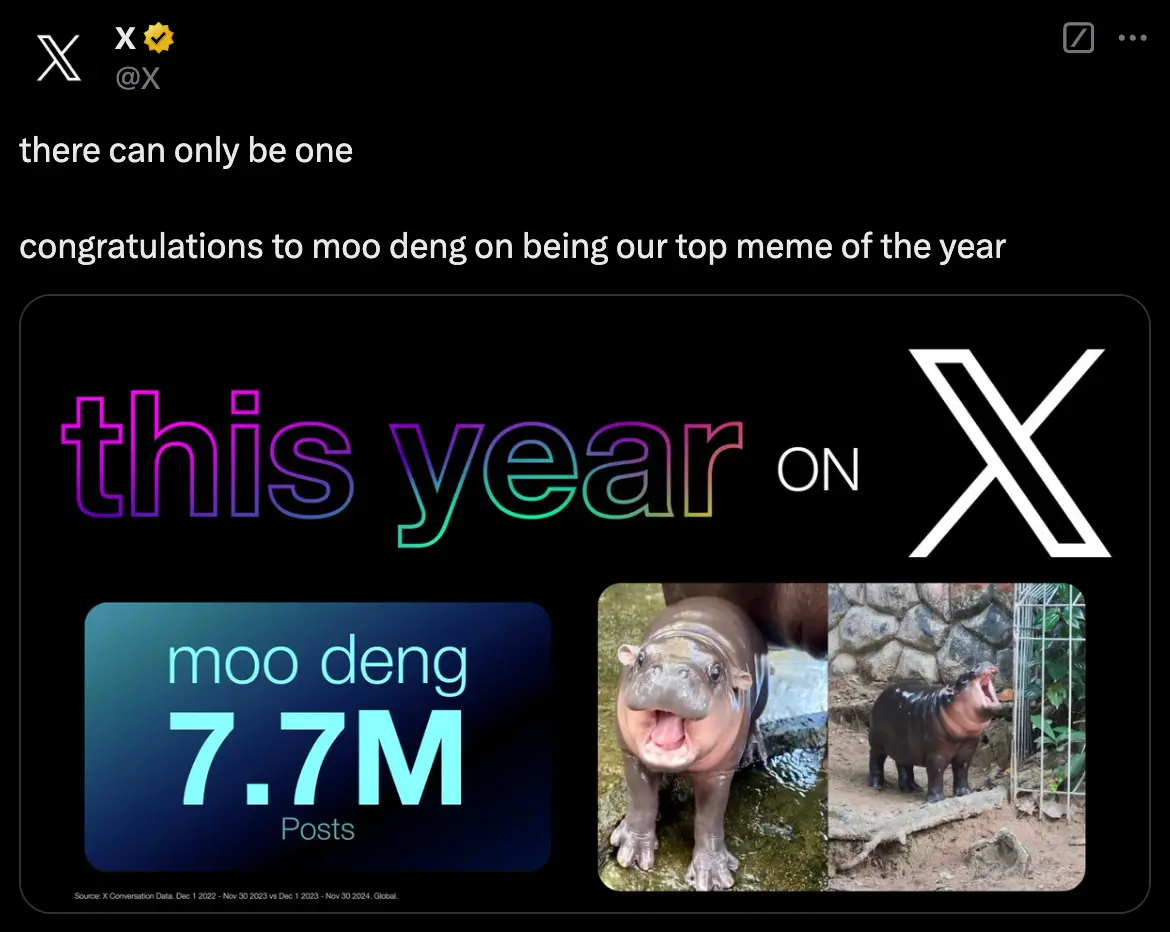

The super cycle speculation of Memecoins this time is no longer limited to native Web3 content but spans multiple fields, covering a broader range of themes and topics. Within various sectors, the types of speculative targets are diverse and quickly form circles, attracting attention from multiple domains. From TikTok traffic to new AI technologies, and even to DeSci (decentralized science) and cutting-edge disciplines like physics, the speculative momentum of Memecoins has rapidly spread, with the areas involved continuously expanding, showing a trend of cross-border integration. Memecoins seem to have become a testing ground for emerging technologies and an experimental field for unverified tracks. The core characteristics of this type of Memecoin are novel narratives and a wide range of outreach. Examples include MOODENG, PESTO, CHILLGUY, GOAT, ACT, VIRTUAL, AIXBT, RIF, and URO.

Moo Deng is a baby hippo born in a Thai zoo, and its naturally meme-worthy expressions have made it a darling on social media platforms like TikTok and Instagram, ultimately being selected as the meme of the year on Twitter. The Moo Deng token on Solana once reached a market cap of $700 million, successfully landing on Coinbase as the smallest Memecoin by market cap, triggering demand for Meme speculation in the Web 2 sector. Following this, the PESTO and CHILLGUY tokens also garnered widespread attention due to their strong Web 2 traffic, with market caps exceeding $500 million at one point.

Subsequently, speculation around AI agents also heated up. GOAT, which launched in June this year, is associated with the AI Bot—Truth Terminal (@truth_terminal), and its market cap surged over $1 billion in a short time. Following that, ACT, ELIZA, and other AI Memecoins quickly captured the minds of on-chain players, with applications related to AI agents like ai16z, zerebro, virtual, and aixbt gradually developing into an ecosystem. Later, Binance announced an investment in BIO, bringing DeSci (decentralized science) into the public eye, and tokens RIF and URO within the experimental Pump.Science platform began a new round of speculation, with market caps exceeding $200 million.

Mainstream Acceptance and Adoption

Memecoin has transitioned from being a marginalized asset to gaining widespread attention from institutions and investors, with its user base continuously growing and capital inflows increasing, gradually gaining recognition and adoption in the mainstream market.

From the perspective of capital inflow, market liquidity is clearly traceable. Numerous institutions have begun to allocate Memecoins; major exchanges have successively listed Memecoins; market makers are actively accumulating Memecoins. As of December 23, 2024, the total market cap of Memecoins has climbed to $230 billion, showing a continuous growth trend. According to a report released by Bybit in June, institutional investors increased their spot holdings by nearly $300 million in the first half of the year. Almost all crypto exchanges have listed various Memecoins, with Binance having listed over 20 Memecoins (including futures and spot) since 2024, 80% of which saw significant market cap growth after being listed on Binance. Five crypto market makers, including Wintermute, GSR Markets, Auros Global, B2C2 Group, and Cumberland DRW, hold Memecoins with a total value exceeding $100 million.

From the perspective of user growth, there has been a significant shift in attitudes. In the first half of the year, A16Z, which was still debating value coins, began to participate in speculation, unexpectedly giving rise to the first AI Memecoin, GOAT. Vitalik Buterin has also expressed his outlook on the future of Memecoins, participating in the promotion and charity work of MooDeng. Pantera partners have publicly acknowledged Memecoins, viewing them as the simplest way for the next generation to experience the latest DeFi applications and introduce them to Web3. Moreover, an increasing number of Web2 users have begun to recognize the value of Memecoins, with initiatives like DeSci's scientific assistance experiments, Dogecoin's ocean trash cleanup plan, and NOT's social tipping and red envelope functions creating a fertile ground for Web2 users to understand and accept Memecoins. According to statistics, from the beginning of 2024 to the end of the year, the global number of Memecoin users has surpassed 50 million and continues to grow.

Conclusion

BTC, as the largest meme coin in the eyes of Web2, has surpassed $100,000, proving its market value. As early participants in Memecoins, are they merely gamblers chasing wealth or forward-thinking investors? Where will Memecoins ultimately head—toward marginalization and gradual extinction, or will they develop further and gradually enter the mainstream?

Cycles alternate and rotate, time tests the truth, and the answers are written in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。