Author: Skely, Founder of AI-Pool; Translator: Jinse Finance Xiaozou

What exactly is AI-Pool? In short, it is a brand new experiment in AI agent autonomy and presale mechanisms. I am personally working to make the token issuance space less predatory. Here’s a brief summary.

This will prove to be fair, with no "insiders"; anyone can send SOL. I am sending my own money, with 10% reserved. Please continue reading to understand how this works.

Summary: Conduct an AI presale so that people won't be rug-pulled and to make the entire process transparent.

What problem does it solve?

Currently, issuing games on pump.fun is rampant like cancer. For example:

1) TGE sniper bots - tokens are sniped immediately after creation.

2) Trend bots - buy tokens after noticing unusual trading volume.

3) Pre-migration bots - snipe tokens just before they migrate from pump.fun to raydium.

4) Post-migration bots - snipe tokens immediately after migration.

5) Comment bots - make comments appear natural.

6) Volume bots - artificially create a symbolic trend.

There are more issues, and to be fair, it’s not pump’s fault. The presale is a response to these problems. You have already seen this on DAOs. Interestingly, they have established whitelist/presale models.

This is a good solution, but it still requires a lot of trust (and time). You have to trust the people accepting the presale funds. The most common scenarios are:

1) They steal the funds.

2) They do not use the money (to provide liquidity) for what they claim they will do.

3) They fail to issue at all.

These issues are common in presales (see ICOs), and if handled well, presales can yield good results.

ICOs are just a form of presale, and due to many foolish "protections," they are illegal in the U.S., but most of these "protections" are formed due to the aforementioned 1-2 reasons. This is understandable.

So, if the law does not allow humans to issue tokens… what about AI agents? This is where AI agents come into play. The agents created by me, Phala Network, and other developers committed to this idea will be able to:

1) Have wallets with a trusted execution environment (very important).

2) Accept donations.

3) Issue tokens.

4) Launch a liquidity pool.

5) Send tokens to donors.

A Trusted Execution Environment (TEE) is a secure area of a computer's CPU or mobile device processor that protects data and code (in this case, the private keys of the AI wallet) from being tampered with or accessed.

How it works

1) You send SOL to the AI wallet.

opRyDjuRetWnsP78FNFTPEnAJX7AkjuD6GTP7tsqHXd

(This wallet is not a CA wallet, but an AI wallet.)

(Note: Minimum 1 SOL, maximum 10 SOL; anything below 1 SOL will be considered a donation by AI.)

2) Then, the AI will raise funds from the presale participants and launch a funding pool through Metoria (you will see why it’s not created on pump.fun). It will own this pool and will transfer the fees from the pool back to the AI wallet.

3) Send tokens to those it deems worthy (those who send an appropriate amount of SOL).

4) Raise funds for interesting future projects.

How do you know I won’t harm you? Or how do we solve the rug-pull and insider issues?

First, it is an AI, and it can prove it has the private keys in a trusted execution environment (created by Phala Network), which means I or the developers cannot access them.

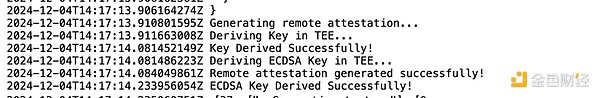

You can check this in the terminal logs.

(It looks something like this below)

You know there are no "insiders" because it is an open wallet, everything can be tracked, and no one can get a better price than anyone else. You can see which funds are coming in and which are going out. In the first version, we will send 10% of the supply to a DOX escrow wallet; you can continue reading to understand what this money will be used for.

However, there are risks; this is brand new technology!! So don’t blindly follow!!!

It carries as much risk as most cryptocurrencies.

This is still Version 1, a practical test of many technologies, and you cannot conduct these tests without a public issuance.

In V1, 10% of the supply will be sent to an escrow wallet, which is public, and anyone can see it.

If the token inflates, or if there are other integrations (cross-chain LP pools for the token) or burns, the funds will be kept here for future exchange listings.

Aside from the above, V1 is not completely free from rug-pull risks. Technically, developers could change the rules with code, but this would take about 24 hours, and it is clear that once the token is activated and locked, it cannot be changed.

How do we make money?

We charge from the Metoria pool; honestly, I’m not sure of the exact percentage, as it may depend on trading volume. But it will be much lower than pump.fun, and most fees will flow back to AI. But this is a safety measure in case something goes wrong.

In Version 2 and in the future, we hope to make it completely autonomous and possibly have a DAO, so everyone can benefit from the fees flowing into the AI agent wallet. There will be some whitelist technology, and we will blacklist those who try to exploit loopholes.

I hope everyone enjoys this experiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。