Author: shaofaye123, Foresight News

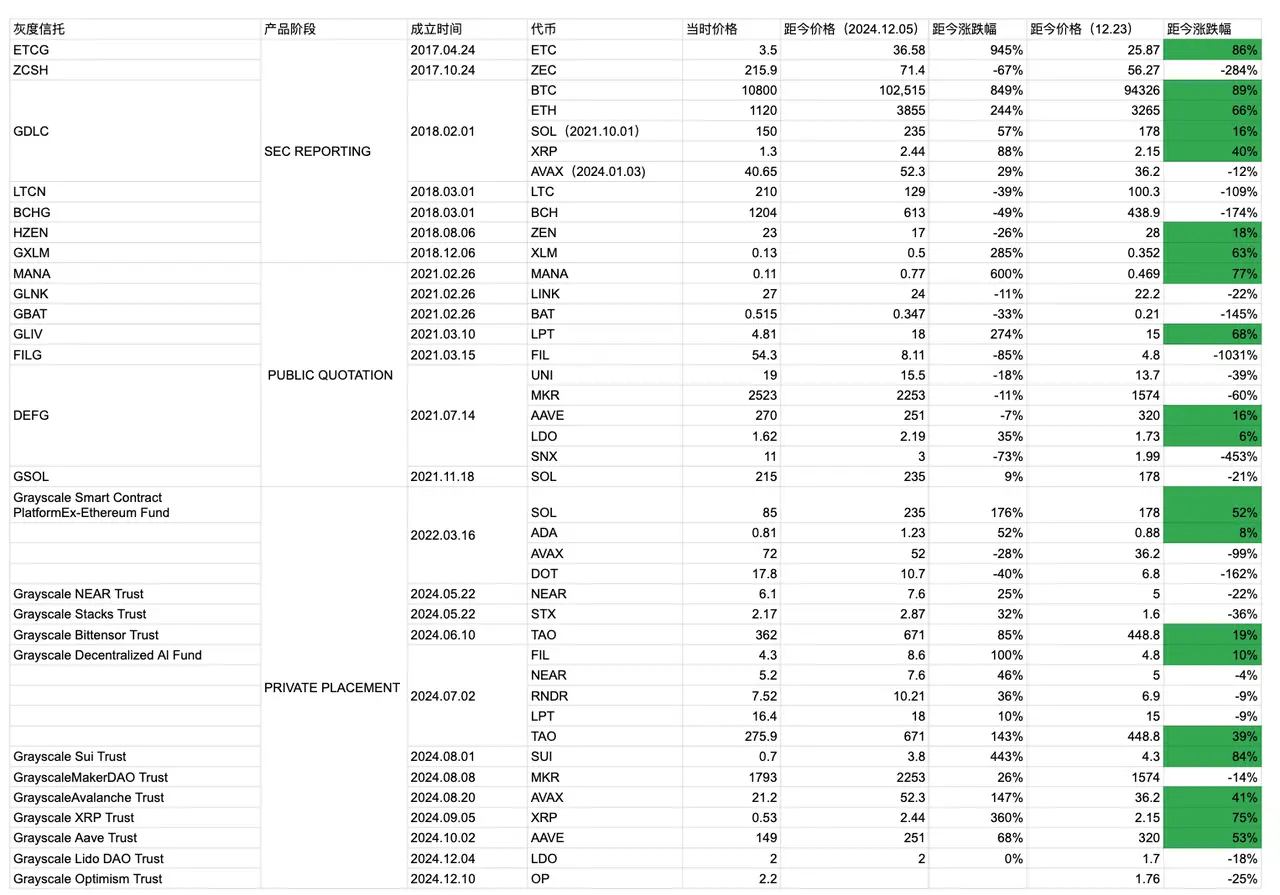

Recently, Grayscale has launched the Optimism Trust Fund and the Lido Trust Fund in succession. Among its trust funds, SUI and ZEN have also continued to rise despite a temporary pullback. Are the trust funds launched by Grayscale really a collection of blue-chip tokens, and will they be profitable in the long run? This article provides an overview of the 26 cryptocurrency trusts currently launched by Grayscale and their investment returns.

Overview of Grayscale Cryptocurrency Trusts

Grayscale is a digital asset management company founded in 2013, primarily offering a variety of cryptocurrency trust funds aimed at providing investors with legitimate and regulated investment channels. As one of the largest cryptocurrency asset management companies in the world, it manages billions of dollars in assets. As of now, Grayscale has launched 26 cryptocurrency trusts.

Grayscale Trust Funds are a series of cryptocurrency investment products offered by Grayscale, allowing investors to indirectly hold cryptocurrencies like Bitcoin and Ethereum without directly purchasing and managing them. Each trust fund is linked to a specific cryptocurrency, such as the Grayscale Bitcoin Trust (GBTC) and the Grayscale Ethereum Trust (ETHE). Through these trust funds, investors can buy and sell shares of cryptocurrency assets on the public market just like traditional stocks.

In addition to single-asset trust funds, Grayscale's bundled cryptocurrency combination funds also have strong investment reference significance. Currently, Grayscale's cryptocurrency trusts, aside from ETFs, are mainly divided into three stages.

- PRIVATE PLACEMENT: Grayscale products are first launched in a private placement format, allowing qualified investors to participate in cryptocurrency investments. The initial lock-up period for shares purchased in private placements is one year. Currently, Grayscale Sui Trust, Grayscale Lido DAO Trust, etc., belong to this stage.

- PUBLIC QUOTATION: A public quotation market format that allows all investors to participate in cryptocurrency investments. However, due to the lack of a continuous repurchase plan, publicly traded shares may trade at a premium or discount to the value of their underlying assets. Currently, MANA, GLNK, DEFG, etc., belong to this stage.

- SEC REPORTING: Grayscale products are the first to report to the SEC. The requirements for reporting to the SEC will further enhance disclosure levels, providing greater transparency for investors and subjecting the products to additional regulatory oversight. Currently, ETCG, ZCSH, HZEN, etc., belong to this stage.

Difficult to Outperform BTC in the Long Run

According to reports, Grayscale had a significant impact on cryptocurrencies during the bull market from 2020 to 2021, when it substantially increased the asset scale of its Bitcoin trust, bringing in a large number of institutional investors into the crypto space. However, the other cryptocurrencies launched by Grayscale during this period performed variably in the short term and have struggled to outperform BTC in the long term.

To track the investment return rates of Grayscale funds, the author recorded the token prices at the time of the trust's launch and the token prices on December 23, creating the chart above. From a temporal perspective, the launch of Grayscale's cryptocurrency trust products was concentrated in 2018 and 2021, which were often peak points or later stages of bull markets. This phenomenon may be related to the lengthy cycle and relatively mature market required for Grayscale to launch its funds. In December of this year, Grayscale began to concentrate on launching trust funds again; whether this time it can break the cycle of short-term peaks remains to be seen.

In terms of investment returns, in the long run, only about 48% of the tokens (including BTC and ETH) show positive investment returns, which is even lower than the random 50% probability of a coin toss. Moreover, their investment return rates are far inferior to BTC, showing a long-term negative expected value (EV).

In the short term, the tokens launched by Grayscale have indeed had glorious moments, but most occurred before their launch. Even though XRP experienced a strong rebound, it has not yet surpassed its previous high, and after three consecutive days of rising, ZEN barely maintains an 18% investment return. While some star tokens have reached peaks after their launch, when viewed from a long-term annualized perspective, after a lengthy 7-year holding period, their interest rates are even below 10%. However, different timing in building positions has a more significant impact on investment returns. If Grayscale concept tokens are accumulated at the bottom during a bear market, almost everyone can outperform the average gains of a bull market. Observing targets that have not shown significant movements at this time may lead to good gains next year.

Grayscale's held tokens have different indicative roles at different cyclical moments, and in this sense, Grayscale's selective approach does indeed exist.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。