Organized by: Fairy, ChainCatcher

Last Week's Performance of Crypto Spot ETFs

US Bitcoin Spot ETF Net Inflow of $457 Million

Last week, the US Bitcoin spot ETF saw a net inflow of $457 million, a decrease compared to the previous two weeks, with a total net asset value reaching $10.97 billion and an average daily trading volume of $5.23 billion. The inflow was mainly from BlackRock's IBIT, which had a net inflow of $1.446 billion.

All 7 ETFs were in a state of net outflow, with the following four ETFs experiencing the largest net outflows:

- Fidelity FBTC had a net outflow of $292 million, with a net asset value of $19.82 billion;

- Ark Invest and 21Shares' ETF ARKB had a net outflow of $171 million, with a net asset value of $4.57 billion;

- Grayscale GBTC had a net outflow of $248 million, with a net asset value of $2 billion;

- Grayscale Bitcoin Trust BTC had a net outflow of $171 million, with a net asset value of $3.7 billion.

Source: Farside Investors

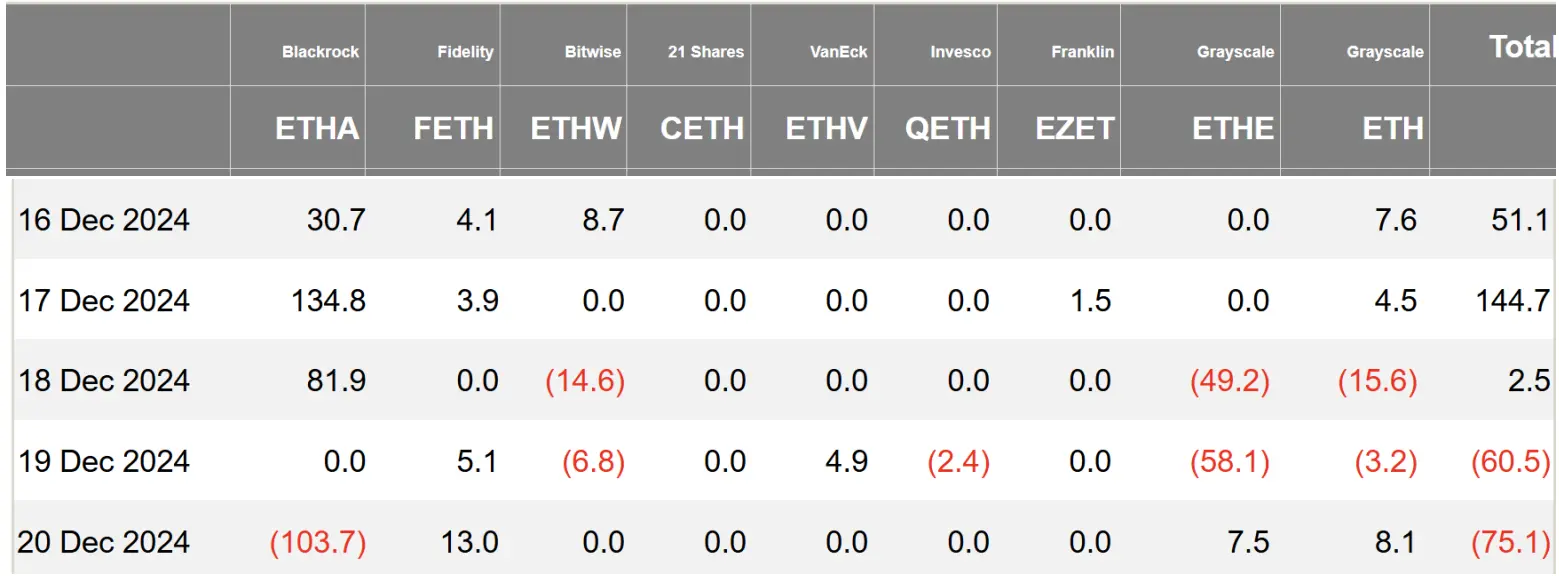

US Ethereum Spot ETF Net Inflow of $62.7 Million

Last week, the US Ethereum spot ETF saw a net inflow of $62.7 million, increasing the total net asset value to $1.215 billion, with an average daily trading volume of $912 million. On December 19, the trading volume of the Ethereum spot ETF reached $1.26 billion, setting a new historical high.

BlackRock's ETHA and Fidelity's FETH were the main contributors to the net inflow, with inflows of $143 million and $26.1 million, respectively. Additionally, 4 ETFs experienced net outflows, with Grayscale ETHE having a net outflow of $99.8 million.

Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 52.74 Bitcoins

The Hong Kong Bitcoin spot ETF experienced capital outflows for the third consecutive week, with a net outflow of 52.74 Bitcoins last week, and a net asset value of $45 million.

The Hong Kong Ethereum spot ETF has shown a trend of capital inflow for three weeks in a row, with a net inflow of 2630 Ethereum, and a net asset value of $6.418 million. On December 20, the single-day net inflow reached 1550 ETH, marking the third highest record in history.

Data: SoSoValue

Performance of Crypto Spot ETF Options

As of December 20, the nominal total trading volume of US Bitcoin spot ETF options reached $1 billion, with a nominal total long-short ratio of 2.38, indicating that bulls are more active in the market. As of December 19, the nominal total open interest of US Bitcoin spot ETF options reached $9.78 billion, with a nominal total open interest long-short ratio of 1.87, further indicating the dominance of the bull market.

Additionally, the implied volatility was 64.76%, reflecting that market expectations for volatility remain high.

Data: SoSoValue

Overview of Crypto ETF Developments Last Week

GraniteShares Submits Leveraged ETF Application for Crypto-Related Companies like MicroStrategy

Asset management company GraniteShares, with over $10 billion in AUM, submitted a new leveraged ETF application to track the stock prices of crypto-related companies such as Riot Platforms, Marathon Digital, MicroStrategy, and Robinhood. These funds will take both long and short positions, with the 2x long ETF generating twice the daily return of the corresponding stocks. For example, when Riot Platform's stock rises by 1%, the GraniteShares 2x Long RIOT ETF will rise by 2%.

Nexo 7RCC Submits S-1 Filing for the World's First Bitcoin and Carbon Credit Futures Mixed ETF

Nexo 7RCC has submitted an S-1 amendment for the world's first Bitcoin and carbon credit futures mixed ETF. The fund will have a portfolio of 80% Bitcoin and 20% carbon credit futures, tracking carbon trading systems such as EU carbon emission allowances, California carbon allowances, and the Regional Greenhouse Gas Initiative. The SEC has approved its 19b-4 filing, which is seen as the ESG version of a Bitcoin ETF. The fund's price movements will be influenced by Bitcoin spot prices, carbon credit allowances, and their futures prices.

US SEC Approves Hashdex to Launch Nasdaq Bitcoin and Ethereum Crypto Index ETF

According to documents released by the US Securities and Exchange Commission (SEC), the SEC has approved the listing of Hashdex Nasdaq Crypto Index US ETF and Franklin Crypto Index ETF. These funds will be listed on Nasdaq and Cboe BZX, allowing investors to indirectly invest in Bitcoin and Ethereum through traditional financial markets. The approval includes comprehensive market monitoring agreements to prevent fraud and manipulation.

Views and Analysis on Crypto ETFs

Glassnode: The Magnitude of Bitcoin's Pullbacks in Bull Market Trends is Gradually Decreasing, Reflecting Increased ETF Demand and Institutional Interest

Glassnode stated, "As the crypto market grows, the magnitude of Bitcoin's pullbacks in bull market trends is gradually decreasing. The deepest pullback in this cycle was -32% (on August 5, 2024), while most pullbacks were around 25% from previous highs, reflecting increased demand for spot ETFs and rising institutional interest."

Bloomberg ETF Analyst: A Wave of Crypto ETFs is Expected Next Year, Starting with a BTC and ETH Combined ETF

Bloomberg ETF analyst Eric Balchunas expects a wave of cryptocurrency ETFs to emerge next year, starting with a BTC + ETH combined ETF, followed by LTC, HBAR, and XRP/Solana.

K33 Research Director: The Scale of US Bitcoin Spot ETFs has Surpassed Gold ETFs

K33 Research Director Vetle Lunde stated, "In the US, the assets under management of Bitcoin ETFs ($129.3 billion) have surpassed those of gold ETFs ($128.9 billion). Although gold has a 20-year first-mover advantage, it has now been overtaken."

BlackRock Executive: Ethereum ETF Demand is Just the "Tip of the Iceberg"

Jay Jacobs, BlackRock's Head of Thematic Investments and Active Equity ETFs in the US, stated in an interview with Bloomberg ETF analyst Eric Balchunas that the demand for Ethereum ETFs is just the "tip of the iceberg," with only a small portion of clients currently holding their Bitcoin (IBIT) and Ethereum (ETHA) ETF products. He added that BlackRock is still focused on bringing new clients to these ETFs rather than launching new ETFs related to other cryptocurrencies.

Against the backdrop of the Federal Reserve possibly announcing interest rate cuts this week and market expectations that the Trump administration may establish a Bitcoin strategic reserve in 2025, analysts expect ETH to break the $5,000 historical high by the end of the year. The ETH price broke through $4,100 this morning, setting a new high for the year, while Bitcoin surpassed $107,000 during the same period. Historically, Ethereum tends to experience a new round of increases 1-2 months after Bitcoin breaks new highs.

The ETF Store President: Invesco Submits Multiple Share Class Structure Applications to SEC, Expected to be a Hot ETF Narrative Next Year

Nate Geraci, President of The ETF Store, posted on X, stating, "Invesco (the fourth-largest ETF issuer) submitted multiple share class structure applications to the US SEC today. Nearly 40 fund companies are currently seeking this structure's iteration. This will become the hottest ETF narrative in 2025 (along with other spot cryptocurrency ETFs)."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。