Asia will play a central role in this transformation due to its highly digitalized society, rapidly developing economy, and open attitude towards new technologies.

Author: HASHED

Translated by: Deep Tide TechFlow

Hashed has established and strictly implemented internal policies and procedures aimed at identifying and effectively managing conflicts of interest related to investment activities. This content is for reference only and does not constitute legal, business, investment, or tax advice. Furthermore, any securities or digital assets mentioned are for illustrative purposes only and do not constitute investment advice or an invitation to provide investment consulting services.

Introduction by Simon Kim: Hashed 2025 Investment Proposition and Outlook on U.S. Crypto Policy

We are currently at a critical juncture where technological innovation intersects with policy change. I am pleased to introduce our two important reports: "Hashed 2025 Investment Proposition: Global Blockchain Applications Centered on Asia" and the special report "2025 Trump Second Term: The Future of U.S. Cryptocurrency Industry Policy."

The blockchain industry is at a turning point, with infrastructure development becoming increasingly robust, institutional participation gradually increasing, and unprecedented opportunities emerging. Our investment outlook for 2025 is based on years of witnessing technological innovation, industry challenges, and the cyclical development of market maturity in the global market.

In recent years, our strategic direction has been validated by several important trends: blockchain infrastructure has become more stable and reliable, the stablecoin ecosystem continues to expand, and high-performance networks are gradually fulfilling their promises of convenience and efficiency. These advancements, combined with increased institutional investment and the expansion of the global digital economy, have paved the way for the large-scale application of blockchain technology.

We have divided our investment proposition into three parts:

Review of 2024 Investment Proposition: Providing readers with transparent insights into industry growth and market dynamics through real data analysis.

Vision and Strategic Focus: Clarifying our focus on high-growth markets and emerging opportunities.

Priority Investment Areas: Explained by our investment team on how to build a more inclusive and efficient blockchain ecosystem.

Additionally, Hashed's open research team has specifically analyzed the potential policy directions the U.S. may take regarding crypto assets during Trump's second term in 2025. This report explores key issues such as stablecoin legislation and industry regulation, which could reshape the global market landscape. In the context of an increasingly interconnected global blockchain, understanding these policy trends is crucial for industry development.

Through these two reports, we hope to provide our partners with unique perspectives to help them understand the potential impact of policy changes on market dynamics and investment opportunities. We believe that this combined view of market insights and policy analysis will provide important references for strategic decision-making in 2025 and beyond.

We sincerely invite you to read these two reports and look forward to your feedback and suggestions.

Hashed 2025 Investment Proposition: Centered on Asia, Leading Global Blockchain Applications

Hashed has been committed to ushering blockchain into its golden age—a phase of popularization driven by practical applications and widespread global participation. We believe that Asia, with its highly digitalized society, rapidly developing economy, and open attitude towards new technologies, will play a core role in this transformation. From stablecoins becoming the backbone of the financial system to the gradual maturity of efficient and scalable blockchain technology, the entire ecosystem is ready for real-world applications. We predict that 2025 will mark the starting point for the large-scale application of blockchain, with Asia leading this trend and promoting the realization of a more equitable and transparent distributed ledger technology globally.

Part One: 2024 Investment Proposition: Data Reveals the Real Story

We reviewed the 2024 investment proposition through data analysis, exploring the alignment and discrepancies between actual market performance and expectations. By sorting through key trends, important developments, and lessons learned, we gained deep insights into the latest dynamics of the Web3 industry.

2024 Key Area 1: Infrastructure Development for Large-Scale Blockchain Applications

In 2024, the construction of blockchain infrastructure further matured, focusing on enhancing scalability and user experience. Progress in stablecoins and scalability solutions indicates that specialized technologies are significantly improving the efficiency and user engagement of blockchain applications. While some expectations were not fully realized or presented in different forms, the overall trend is clear: 2024 is a crucial year for blockchain to move towards large-scale applications.

Theories written at the end of 2023 regarding 2024:

- Specialized stablecoins will enter niche markets (such as B2B payments), challenging the dominance of USDT and USDC by providing targeted services.

2024 Review:

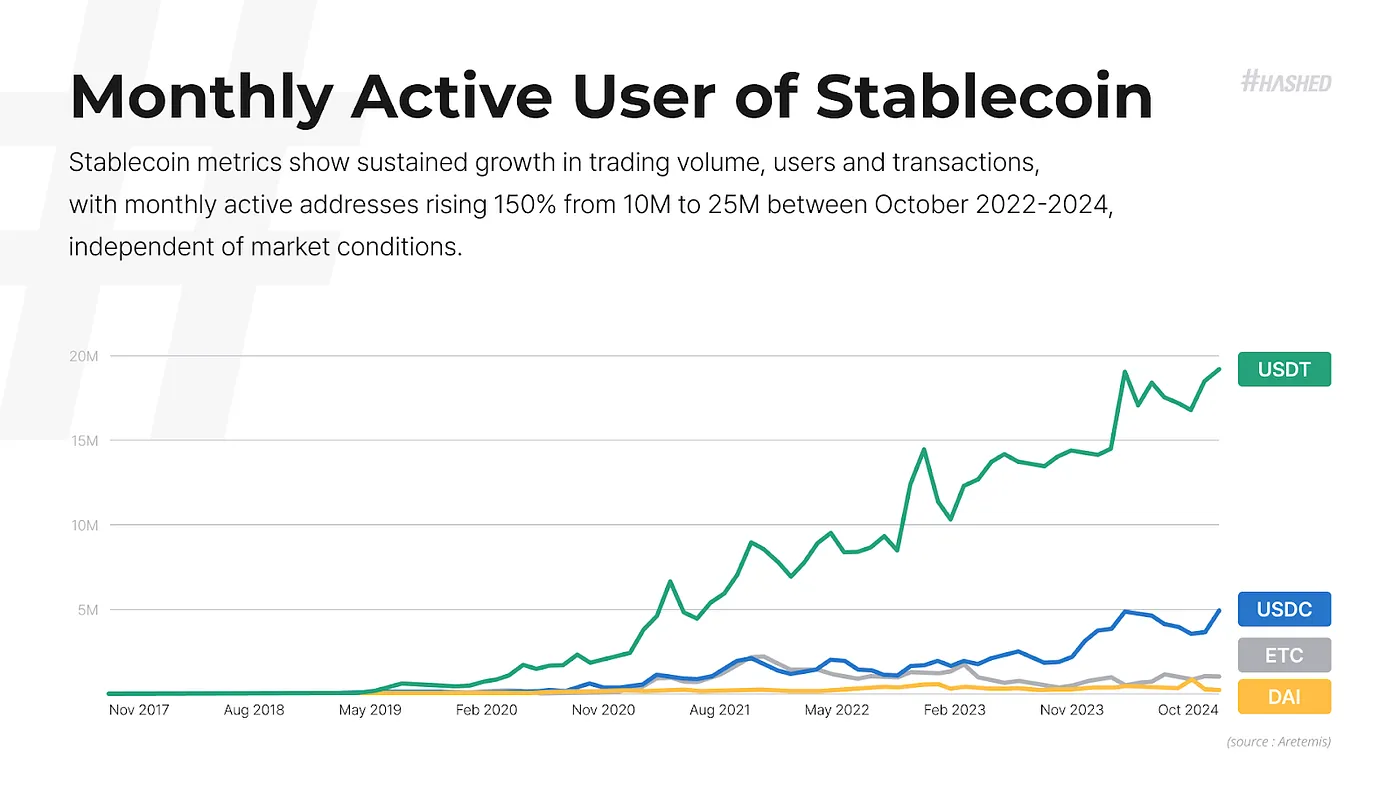

- The trading volume, user count, and transaction numbers of stablecoins have significantly increased, with monthly active addresses rising from 10 million in 2022 to 25 million in 2024, a growth rate of 150%. This growth is unrelated to market volatility, demonstrating strong market demand.

Theories written at the end of 2023 regarding 2024:

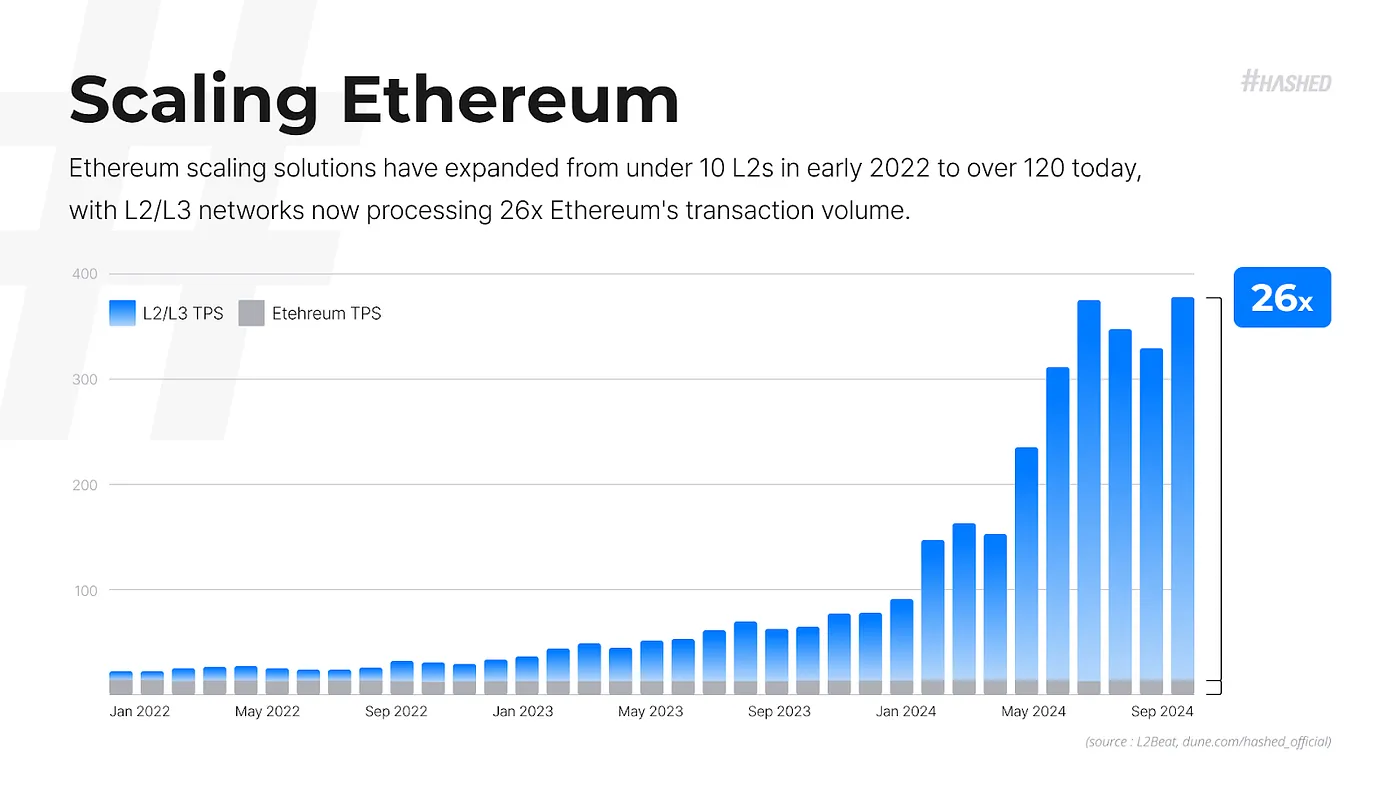

- Layer 3 Rollups will address the computational scalability issues of high-performance decentralized applications, particularly optimizing user experience in gaming and social scenarios.

2024 Review:

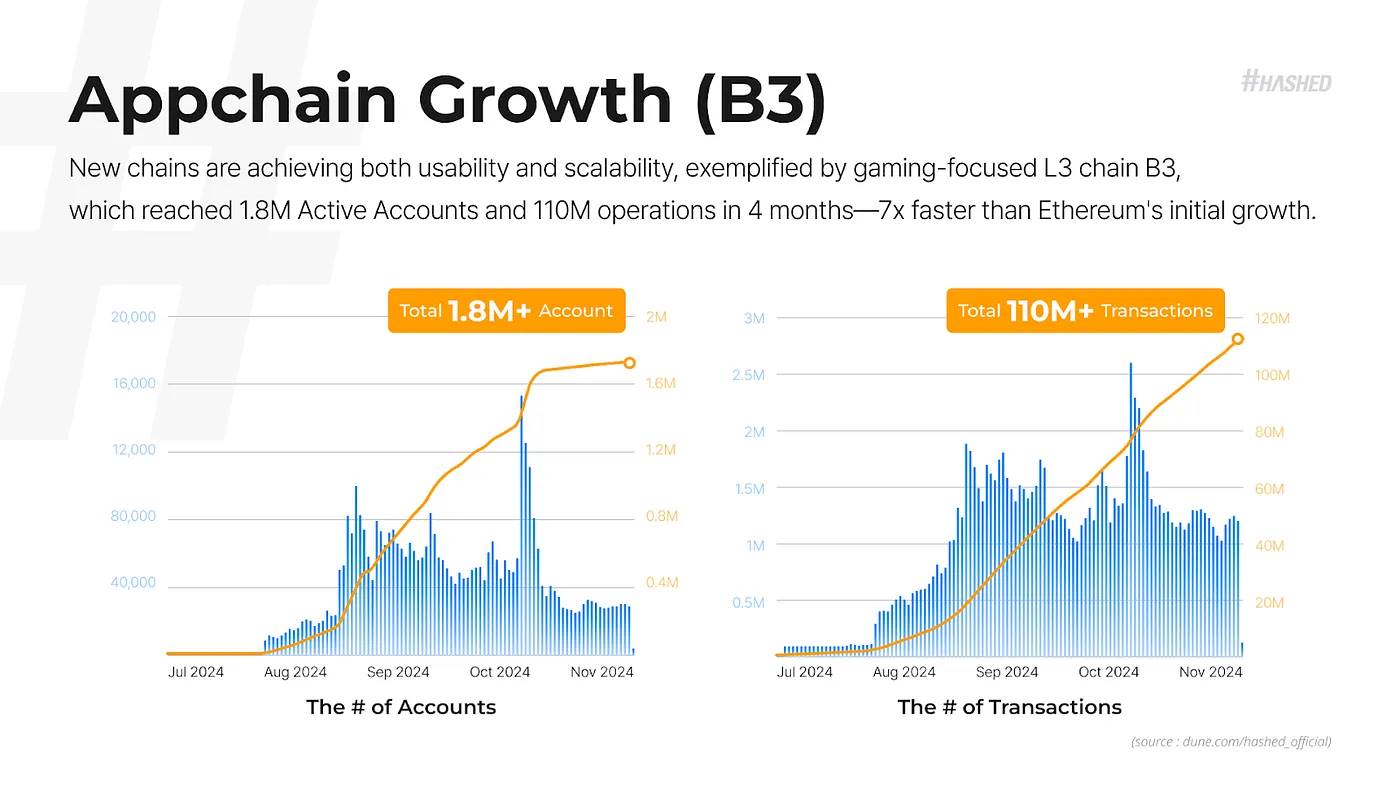

- New blockchain technologies have made breakthroughs in usability and scalability. For example, the gaming-focused Layer 3 chain B3 achieved 1.8 million active accounts and 110 million operations in just four months, growing at a rate seven times that of Ethereum in its early days.

2024 Key Area 2: Maturing Consumer-Facing Products

With further optimization of payment channels and infrastructure, we are optimistic about products that combine AI and blockchain, transparent intellectual property management ecosystems, and the rise of fully on-chain economies. These trends are not only our observations but also a shared understanding among institutions and individual users in the industry. Social data also validates the correctness of this direction, further enhancing our confidence in future developments.

Theories written at the end of 2023 regarding 2024:

- The combination of AI and blockchain will enhance smart contract functionality, data privacy protection, and promote the development of decentralized AI ecosystems, thereby improving decision-making and ownership management.

2024 Review:

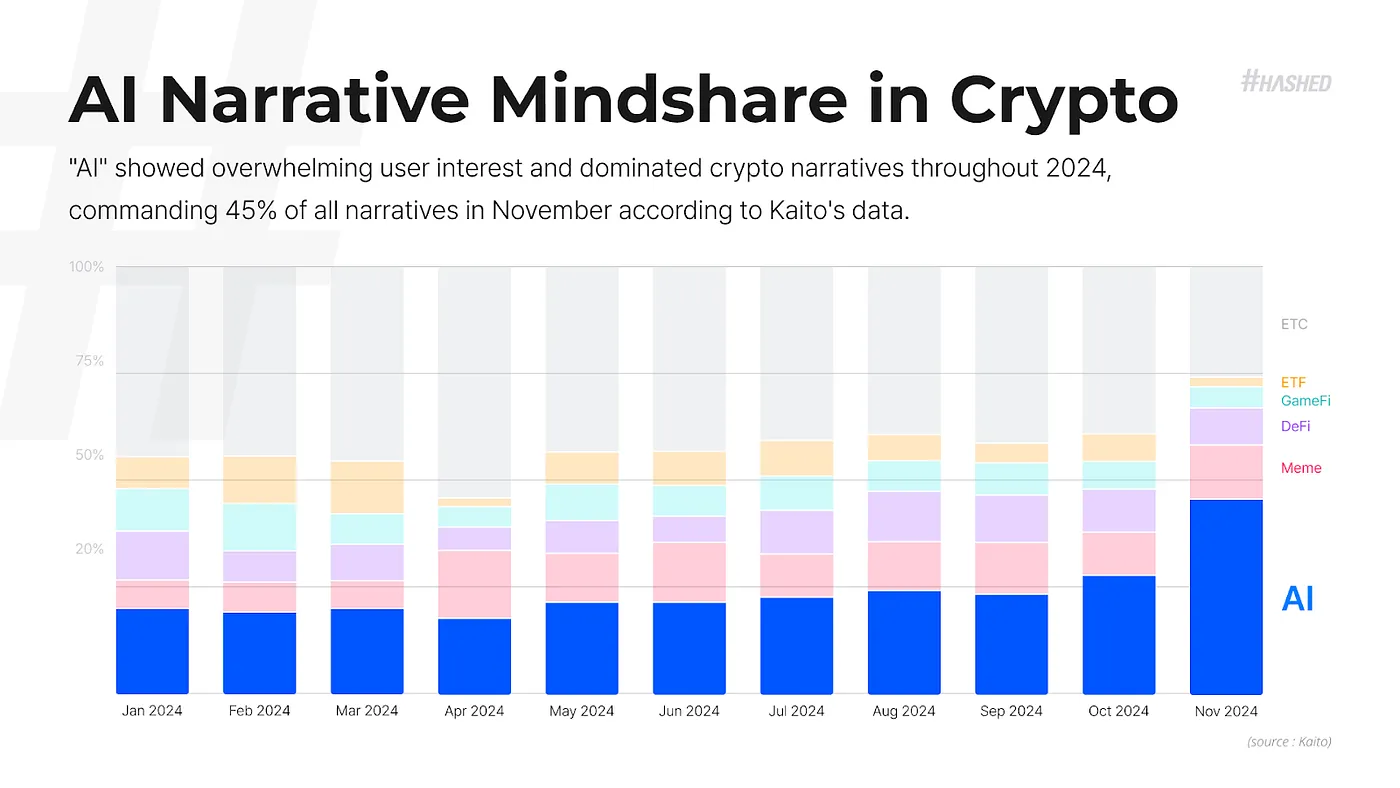

- In 2024, "AI" became a hot topic of interest among users. According to Kaito data, narratives related to AI accounted for 45% in November, becoming the dominant trend in the crypto space.

2024 Key Area 3: Integration of Traditional Finance and Blockchain

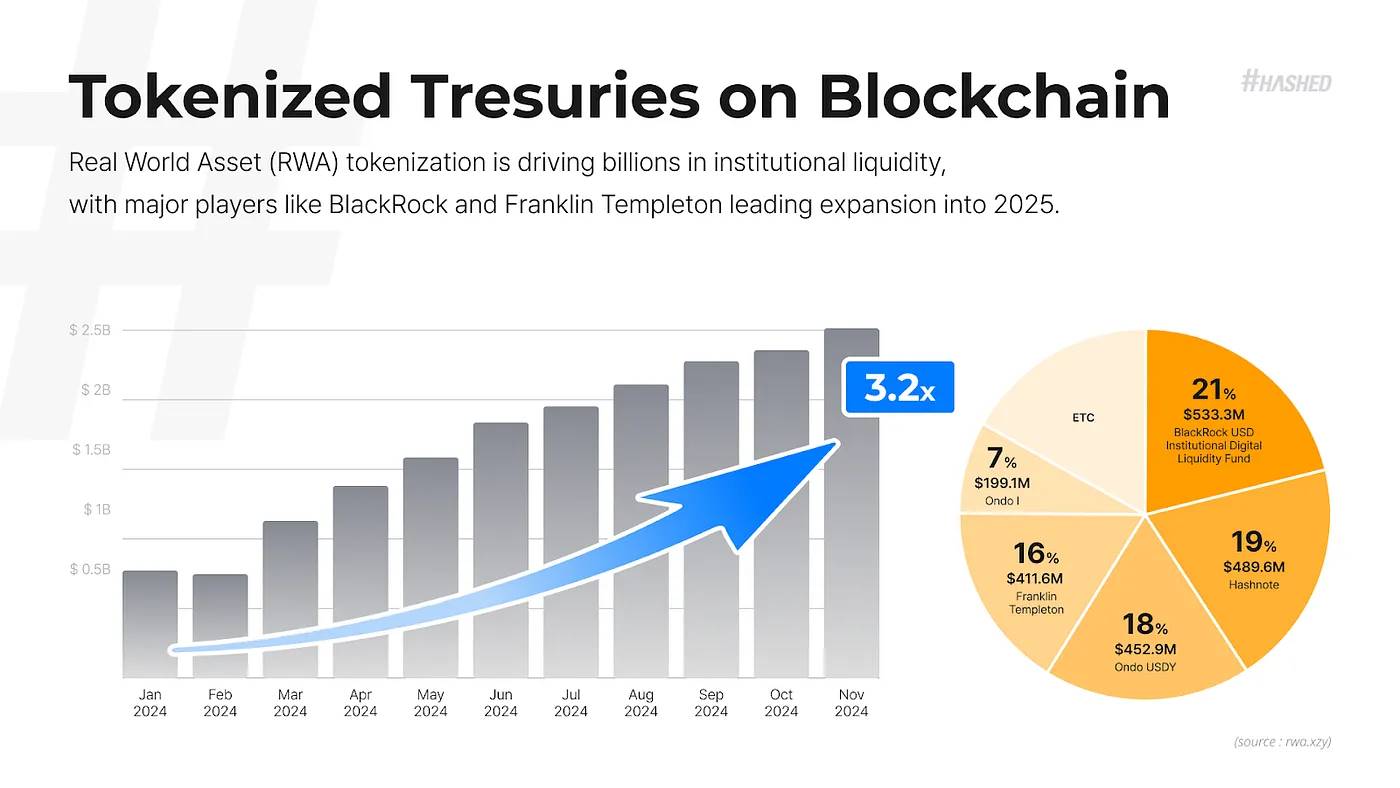

In 2024, the tokenization of real-world assets (RWAs) and advancements in new Bitcoin token standards (such as Ordinals, BRC-20) have driven a deep integration of traditional finance and blockchain. RWAs attracted billions of dollars in institutional funding, with giants like BlackRock and Franklin Templeton leading this trend. Meanwhile, Bitcoin has unlocked new functionalities similar to DeFi through new token standards, accounting for about 60% of network activity, further solidifying its role beyond just a store of value.

Theories written at the end of 2023 regarding 2024:

- The tokenization of real-world assets and securities will become a bridge between traditional finance and blockchain, focusing on compliance and infrastructure development.

2024 Review:

- The tokenization of RWAs attracted billions of dollars in institutional liquidity, with institutions like BlackRock and Franklin Templeton accelerating this trend, planning to continue into 2025.

Theories written at the end of 2023 regarding 2024:

- The Ordinals and BRC-20 standards on Bitcoin will expand its functionalities through data inscription and tokenization, creating new opportunities similar to DeFi.

2024 Review:

- Since 2023, new standards like Ordinals and Runes have driven significant growth in Bitcoin network activity, currently accounting for about 60% of transaction volume.

Part Two: Asia: The Intersection of Belief and Opportunity

Beyond the noise and hype, we delve into why Asia can continue to lead Web3 innovation. From user base to developer ecosystem, Asia's unique advantages make it a core region for blockchain development, and the opportunities are undeniable.

Hashed firmly believes that the golden age of blockchain will not belong solely to a minority in developed countries, but is a global opportunity, especially as a large number of users in Asia will become the main force. They will participate in various economic and non-economic activities on a fair and transparent global distributed ledger. Based on this vision, we have always regarded the Asian consumer market as a strategic focus and made early-stage investment arrangements.

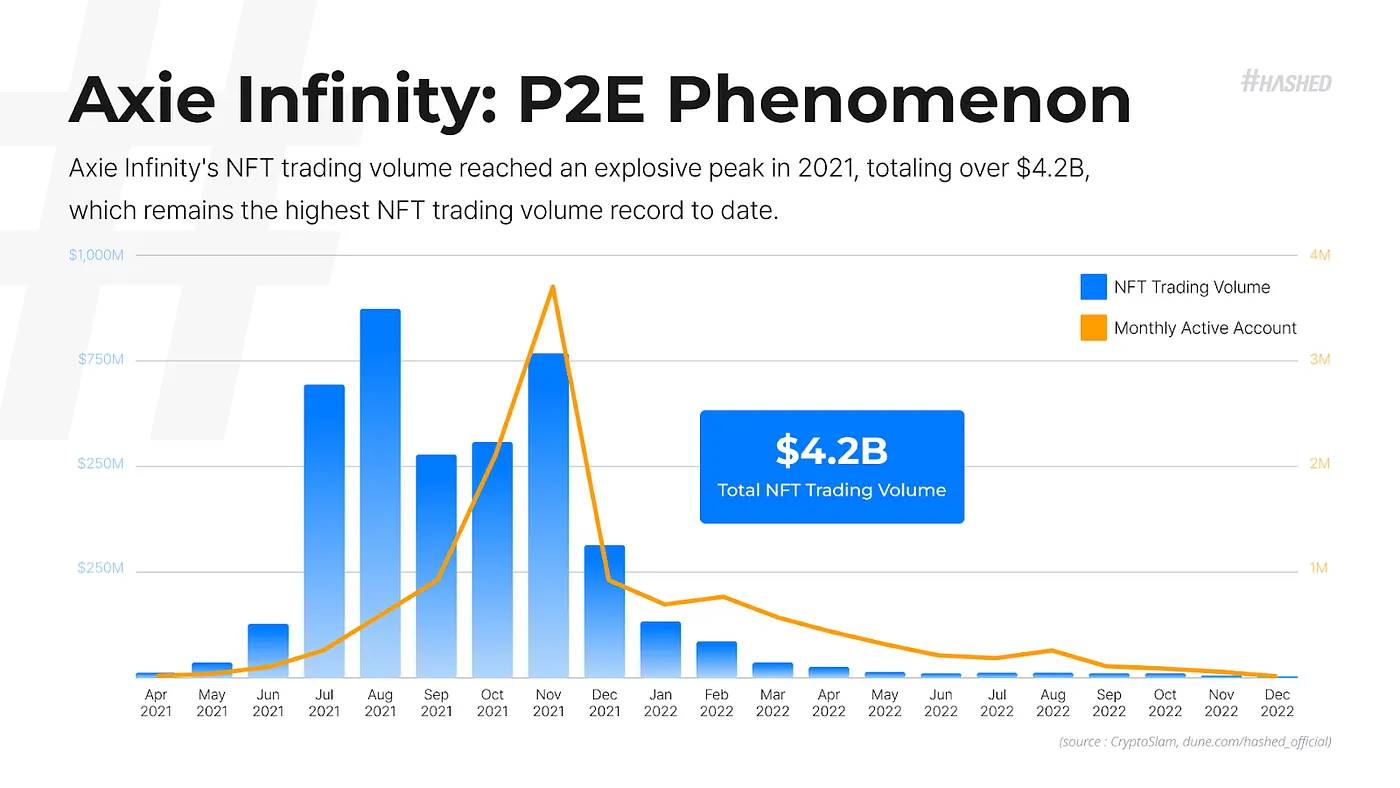

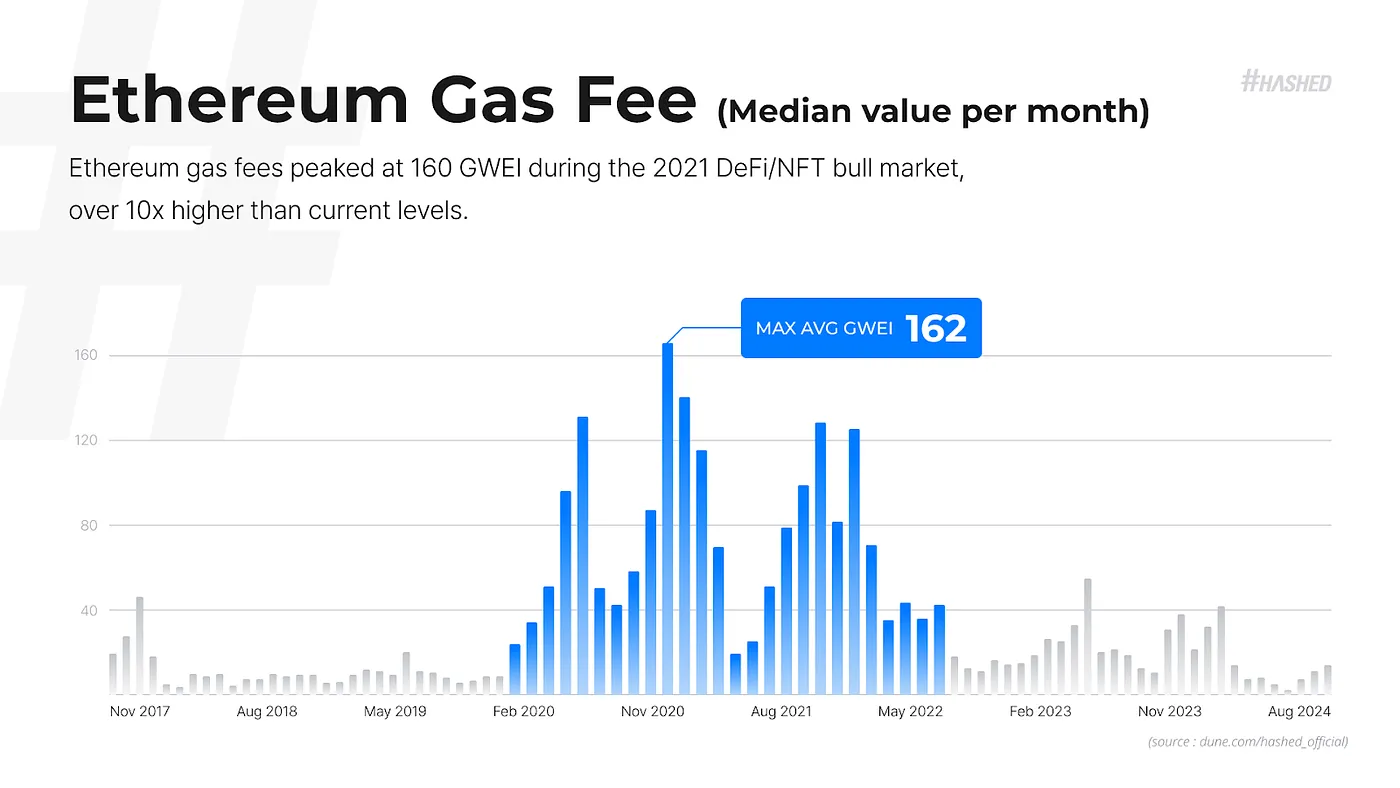

In 2021, we seemed to be on the threshold of the golden age of blockchain. Bitcoin reached an all-time high, and Ethereum's DeFi and NFT ecosystems flourished, driving rapid growth in market capitalization. The rise of altcoins marked typical signs of a bull market. By August 2021, emerging market users in Asia flooded into the blockchain space, and although these regions lacked cryptocurrency experts, user enthusiasm for the technology was high. P2E (play-to-earn) games like Axie Infinity attracted global attention, and the dream of mass adoption seemed within reach. However, as transaction fees soared and networks became congested, Ethereum gradually became a luxury, while other high-throughput "Ethereum killers" also exposed chain-level issues. The growth of Asian users eventually stabilized, and the narrative shifted from frenzy to calm.

However, reality failed to meet expectations. The surge in activity also brought about a sharp increase in transaction fees, leading to network congestion and transforming Ethereum from a public resource into a luxury. At the same time, the so-called "Ethereum killers," despite promoting high throughput, frequently encountered chain-level issues. The continuous influx of Asian users initially seemed promising but ultimately stabilized. Before institutional entry, macroeconomic challenges and multiple market upheavals suppressed growth driven by retail investors. This wave of enthusiasm eventually ended, leaving us with the stories of the previous cycle.

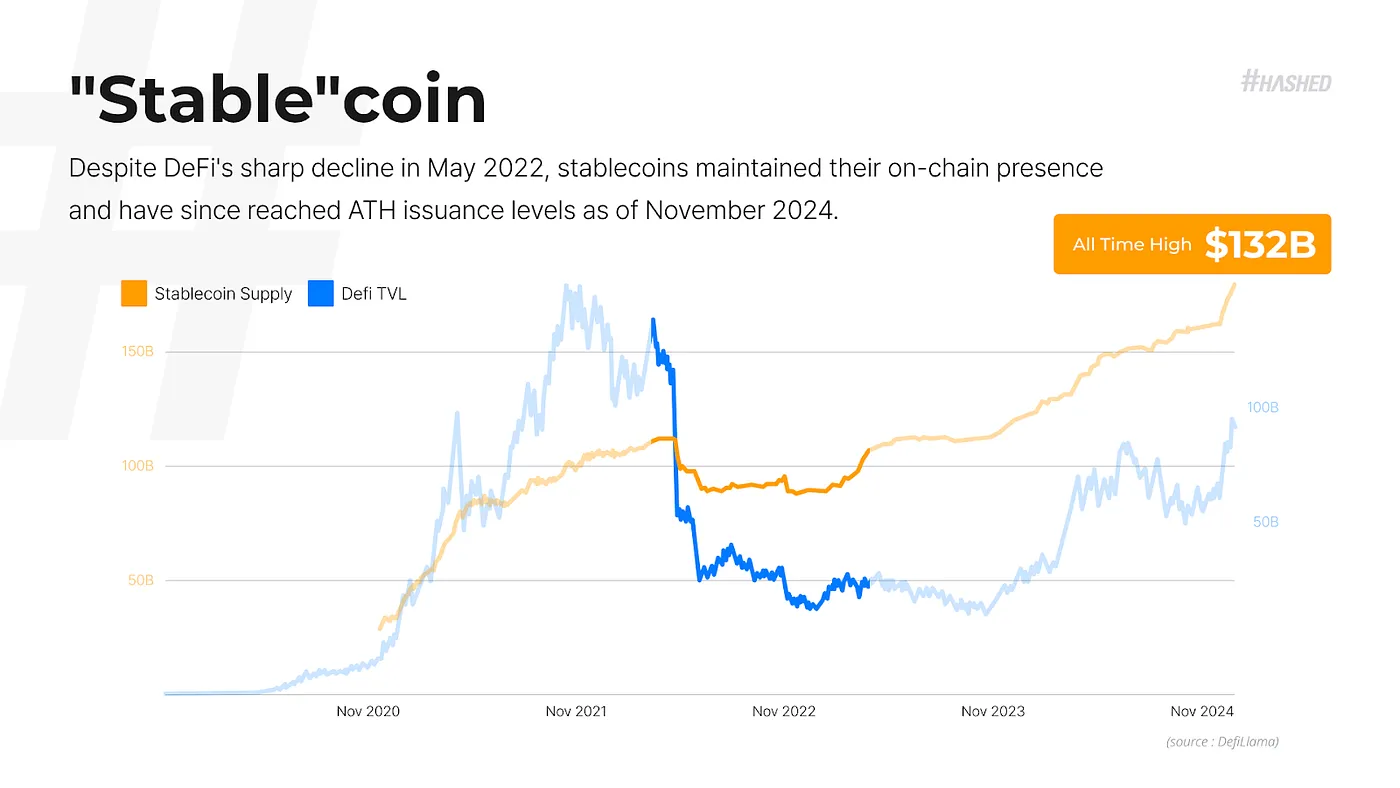

During the subsequent year-long crypto winter—characterized by significant declines in market indicators and a prolonged bear market—one thing remained "stable": stablecoins. Ironically, in this industry that champions decentralization, the most popular assets were fiat-backed stablecoins. Even amid rising interest rates and decoupling from overall market trends, the use of stablecoins remained strong. This phenomenon arose because, despite the slow and costly development of financial and informational infrastructure on the blockchain, users still relied on stablecoins to facilitate actual on-chain value transfers. This indicates that the vision of on-chain value transfer initially proposed by Bitcoin is gradually maturing through its integration with fiat currencies.

At the institutional level, the approval of cryptocurrency ETFs opened the door for institutional funds to enter the blockchain space.

During this period, as the fundamentals of stablecoins continued to solidify, a new wave of high-performance blockchain competitors emerged. These platforms found a balance between integrity, decentralization, practicality, and commercial viability. After being stress-tested during the bear market, the surviving blockchain networks became more robust. Meanwhile, Ethereum's dominance in key metrics began to fragment, with more and more activity shifting to L2 solutions (which was also the original intent of Ethereum's design) and rapidly developing monolithic blockchain ecosystems. Unlike the previous cycle, which was constrained by high transaction fees, the current blockchain ecosystem provides a more accessible environment for the masses, promoting broader user participation.

This change coincided with the deepening application of stablecoin payment networks as a primary financial pillar and the formal establishment of high-performance blockchains as ecosystem-level infrastructure. At the institutional level, the approval of major cryptocurrency ETFs opened the door for institutional investment and accelerated its integration with the mainstream financial system. Unlike the speculative frenzy of the previous cycle, this time institutional interest is more serious, with an increasing number of companies exploring blockchain applications in infrastructure and consumer-facing solutions.

In this revival, Asia's performance is particularly outstanding. Ordinary users are returning to a market with more complete infrastructure, diversified application scenarios, and more efficient value transfer mechanisms. At the same time, major governments and enterprises in regions such as the Middle East, Japan, Hong Kong, and Southeast Asia are beginning to take blockchain technology seriously, marking their shift from speculative interest to strategic positioning. Asia's advantages stem from its unique combination of conditions: high mobile device penetration, a tech-savvy demographic, and a rapidly developing digital economy. Additionally, the cultural preference for gamification and collective participation in Asia perfectly aligns with new consumer-facing application scenarios in blockchain.

We believe this is not merely a simple replay of past cycles but a transformative phase that lays the groundwork for supporting large-scale applications of global distributed ledgers. Asia, with its large, young, and digitally native population, holds a unique advantage in leading this transformation. With an open attitude towards innovation and an active consumer market, Asia will continue to be a core driving force in the future development of blockchain, accelerating the global transition to decentralized systems.

Part Three: 2025: Key Actions

The investment team conducted an in-depth analysis of future trends based on market signals and ecosystem dynamics. We identified key value drivers and growth directions that will shape the next wave of Web3 adoption.

Reshaping Currency: Stablecoins Integrating into Traditional Markets

Author: Simon Kim

In the second quarter of 2024, the trading volume of stablecoins surpassed Visa for the first time, marking their application range expanding from cryptocurrency exchanges and DeFi to B2C and B2B financial sectors. In South Korea, stablecoins now account for 10% of trade settlements, indicating a shift from the gray area to a regulated financial system.

Behind this trend is the incorporation of stablecoins into payment systems by traditional financial institutions to enhance efficiency, reduce payment costs, and accelerate cross-border transactions. Even SWIFT is exploring the integration of stablecoins into existing payment infrastructures, indicating that the global payment system is moving towards real-time settlement.

In addition to payments, stablecoins are creating new opportunities in the lending market. By leveraging the interest rate differentials between high and low-rate countries, stablecoins serve as stable collateral, facilitating cross-border capital flows and enhancing global financial efficiency. At the same time, they provide more financial service opportunities for the unbanked population.

These trends create significant investment opportunities for blockchain infrastructure and application development. Although technological expansion and security enhancements remain urgent priorities, long-term market growth will increasingly depend on regulatory adaptation and the development of institutional frameworks.

Infinite Creators: How Autonomous Digital Entities Disrupt Attention-Driven Social Media

Author: Ryan Kim

Although Web3 social platforms have yet to surpass traditional giants like X.com (formerly Twitter) or TikTok, a revolution led by autonomous digital creators is brewing. These intelligent creators can generate a continuous stream of high-quality content around the clock, breaking through the limitations of human creation.

Looking back at the development of social media, from Facebook's friend networks to TikTok's algorithmic recommendations, platforms have continually evolved to capture user attention. The next phase will be dominated by intelligent entities that, through their integration with smart contracts, will convert user attention into real economic value. Through this mechanism, profits can be redistributed to token holders, building a self-reinforcing attention economy.

This model transforms Web3 social from a traditional speculative model into a true economic engine, making creativity and attention vital components of the value ecosystem, potentially shaking the dominance of current centralized platforms.

The New Paradigm of AI: Decentralized Intelligence

Author: Baek Kim

Currently, centralized computing systems are facing bottlenecks. Opaque governance, data monopolies, and escalating privacy issues necessitate the disruption of traditional frameworks. Decentralized intelligence offers a new solution by sharing power, ownership, and participation through distributed networks.

Key features of this model include:

Data Sovereignty: Users have complete control over their data.

Collaborative Governance: Distributed decision-making mechanisms avoid single points of failure.

Transparent Incentives: Ensuring participants receive fair rewards.

By shifting from closed proprietary systems to open decentralized frameworks, this new model redefines the management of computing resources, enhancing trust and efficiency while embedding accountability into the core of digital ecosystems, making innovation more inclusive.

Data Gold Rush: A $20 Trillion Opportunity Hidden in High-Quality Data

Author: Jun Park

Every leap in technological advancement is accompanied by breakthroughs in key scarce resources:

In the early 2010s, the scarcity of models was addressed through architectures like AlexNet and CNN.

In the late 2010s, the bottleneck of computing power gradually eased with the emergence of large-scale foundational models.

Today, the key to the next generation of technological breakthroughs lies in high-quality data, an underutilized resource that will become the core fuel for future innovation.

Traditional systems often hoard data within closed proprietary frameworks, leading to a significant amount of data resources being ineffectively utilized. Blockchain technology provides a new means to unlock this hidden value:

Ownership and Source Tracking: Ensuring data contributors have control over their data and receive due recognition.

Privacy-Preserving Access: Safely using sensitive datasets while protecting data privacy.

Aligned Incentive Mechanisms: Rewarding data-sharing behaviors through transparent economic models.

For example, Zettablock provides solutions for specific fields through a decentralized data layer, while Story Protocol focuses on source tracking for creative assets. These blockchain-driven frameworks demonstrate how to empower various industries. By unlocking access to non-public data, blockchain-based ecosystems can not only drive innovation but also provide customized solutions for a global market worth $20 trillion, covering multiple sectors from finance to healthcare.

Liberating Ordinary Users: Consumer-Centric Applications Driving Mass Adoption of Blockchain

Author: Edward Tan

The next wave of growth in blockchain technology will be driven by consumer-centric applications that make the experience of using crypto technology as simple and smooth as traditional applications. Just as crypto games attracted millions of users, on-chain services for users are expected to become a key entry point for blockchain into the mainstream market.

By redesigning familiar user processes and incorporating efficiency and transparency, blockchain applications can fundamentally change people's daily interactions. For example, Modhaus transforms ordinary transactions into personalized experiences by tokenizing fan consumption behavior in the entertainment industry, directly facilitating deep interactions between fans and idols. Similarly, mobile interfaces designed for DeFi protocols can simplify user operations, allowing ordinary consumers to easily use decentralized exchanges (DEX), money markets, and other tools, thereby lowering the entry barrier.

To break the monopoly of centralized giants over the ordinary user market, blockchain teams need to focus on user accessibility and guided experiences. By designing applications that align with users' lifestyles, blockchain-based consumer products are expected to drive mass adoption and build a sustainable consumer ecosystem.

Social on Chain: Integrating Instant Messaging Platforms with Decentralized Ecosystems

Author: SJ Baek

With 900 million monthly active users, Telegram and its blockchain TON demonstrate the immense potential of driving Web3 mass adoption through established social platforms. Its growth momentum primarily comes from click-based and hyper-casual games, such as Notcoin, which have attracted tens of millions of users to engage in on-chain interactions. Similarly, Line and Kakao, with over 200 million monthly active users, are attracting developers through the Kaia platform, promoting the development of social, gaming, decentralized finance (DeFi), and real-world asset (RWA) projects, bringing more users into the Web3 ecosystem.

Compared to WeChat's centralized ecosystem, Telegram and TON's open application ecosystem is still in its early stages. This ecosystem is characterized by rapid user growth, but lower user activity and retention rates. However, validated vertical application areas (such as vertical social platforms, mid to heavy gaming, short video content, and social finance) offer significant potential for on-chain user growth and revenue enhancement, while also helping to extend user engagement cycles.

As an open platform, Telegram and TON's operating teams are relatively small, which has led to a lack of key infrastructure, such as social data platforms, application distribution channels, and technical support. To address these shortcomings and enhance the platform's scalability, an intermediary layer needs to be established, supported by dedicated teams or mature applications, to refine these functions and promote further ecosystem development.

Transaction Revolution: Revitalizing High-Growth Assets and Traditional Systems

Author: Dan Park

Blockchain-driven markets are transforming high-growth assets and traditional industries by creating efficient and transparent platforms that address long-standing unmet needs and systemic inefficiencies.

High-Growth Assets: With the rapid growth of demand for emerging resources, the blockchain market is providing trading platforms for these assets. For example, GAIB focuses on trading computing resources to meet the rapidly growing demand in decentralized AI and cloud computing. At the same time, markets for unconventional assets (such as urban air rights) are also unlocking liquidity. These assets are often traded frequently but are fragmented in the market; through blockchain technology, the trading process is simplified, providing opportunities for more participation and innovation.

Modernizing Traditional Infrastructure: Some traditional industries are also modernizing through blockchain technology. Tokenization systems can streamline processes and enhance industry transparency. For instance, multiple platforms are optimizing dollar-based stablecoin ecosystems or introducing real-time data sharing capabilities for stock and commodity trading networks. These improvements not only enhance the efficiency of global trade but also enable more people to participate in markets that have traditionally been difficult to access.

These blockchain markets are not just mediums for transactions; they are also important engines driving the long-term product-market fit (PMF) of blockchain technology. By changing the way industries operate, these platforms open doors to new opportunities for more people while injecting new vitality into traditional systems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。