Since the inception of Bitcoin, it has been positioned as a peer-to-peer payment system. However, its biggest problem is the high price volatility, which prevents it from serving as a payment currency in specific application scenarios. The emergence of stablecoins can precisely compensate for Bitcoin's shortcomings.

Explosive Growth of Stablecoin Application Scenarios

In October 2024, Stripe acquired the stablecoin platform Bridge for $1.1 billion, marking the largest acquisition in the crypto space, signaling the imaginative potential generated by the combination of stablecoins and payments. Additionally, countries such as the EU, Hong Kong, the US, the UK, and Singapore have also introduced relevant policies for stablecoins, providing policy support for market development. As of December 16, 2024, the total issuance of stablecoins has exceeded 200 billion dollars, and according to VanEck's forecast for 2025, the global daily settlement volume of stablecoins is expected to reach an astonishing 300 billion dollars, with the potential of stablecoin-based applications like PayFi increasing daily.

Anticipated Future Market Size for Stablecoin Payments

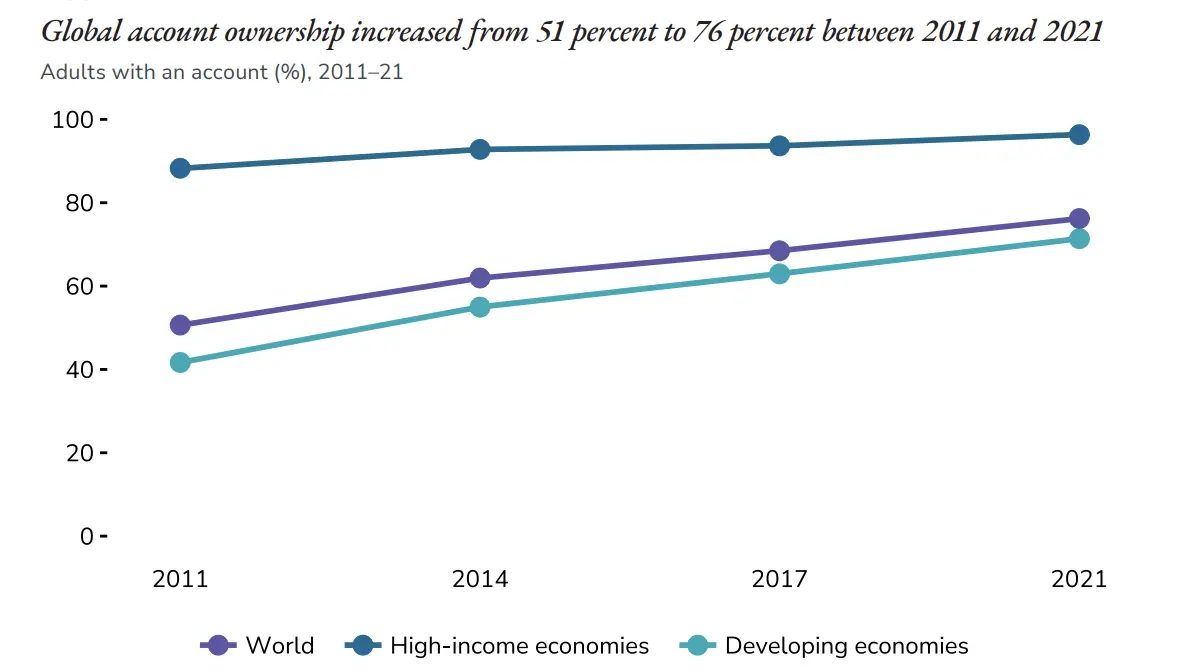

According to World Bank data, only 76.2% of the global population aged 15 and above have bank accounts or mobile accounts, which means that 23.8% of the global population (aged 15+)—approximately 2 billion people—still do not have bank accounts. This segment can enter Web3 through applications like PayFi, becoming users of CEX, DeFi, and other applications, significantly advancing the process of Mass Adoption.

Proportion of the global population with bank accounts in 2021 Source: World Bank Database

Moreover, in the realm of cross-border payments, stablecoins have great potential. According to the Bank for International Settlements (BIS), the global cross-border payment amount exceeded $29 trillion in 2022. Traditional infrastructure is costly and slow, while blockchain-based stablecoin cross-border payments are fast, inexpensive, and can provide 24/7 service.

We believe that stablecoin payments will gradually occupy a larger share of cross-border payments. If they capture 50% of the market, it will expand the overall stablecoin payment volume by 1.88 times; if they capture 80%, it will triple the payment volume.

The Non-US Dollar Stablecoin Market Also Holds Great Potential

Recently, a report from Standard Chartered pointed out that non-US dollar stablecoins are gradually gaining attention, including those from economies with significant currency fluctuations, such as Turkey, where developing stablecoins can reduce exchange rate volatility. Additionally, the BenFen ecosystem not only issues US dollar stablecoins but also stablecoins based on other currencies to capture this market, such as BJPY and BINR.

The First Decentralized Native Stablecoin That Can Directly Pay Gas Fees

BenFen Chain mints multi-currency stablecoins like the US dollar stablecoin BUSD using a brand-new decentralized global collateral method, granting stablecoin holders the identity of "first citizens." This means that the native stablecoin BUSD supports Gas fee payments, eliminating the need to hold the native token of the chain to transfer or trade, thus truly achieving and satisfying the traditional payment transfer habits of most Web2 users in Web3, making it smoother and more convenient. Compared to the centralized issuance models of stablecoins like USDT currently prevalent in the market, BUSD adopts a decentralized issuance method, differentiating itself from USDT, DAI, and USDe. In addition to BUSD, BenFen will also issue stablecoins pegged to other major currencies based on oracles, such as BJPY and BINR.

Issuance Mechanism: 50% Treasury Asset Collateral

At the initialization of the public chain, BenFen will permanently use 50% of BFC as treasury collateral for the issued stablecoins, greatly enhancing the system's security and stability, a feature not found in other public chains. For example, this is akin to Ethereum permanently placing ETH tokens into the treasury to issue stablecoins. Once a user's wallet is connected, they can choose to pay BFC to mint stablecoin BUSD, and upon exit, they can destroy the stablecoin to redeem BFC. Off-chain users can also exchange their USDT/USDC for BUSD at a fixed ratio of 1:1, and when exiting, they can also exchange back to USDT/USDC at the same fixed ratio.

Stability: Multiple Efficient BUSD Price Stabilization Mechanisms

BenFen has designed various price stabilization mechanisms, such as an elastic currency supply mechanism that dynamically adjusts the currency supply based on market demand fluctuations to maintain price stability. The BenFen stablecoin protocol automatically executes through specific algorithms and trigger conditions to dynamically increase or decrease the circulating supply of BUSD. Additionally, there is an exchange rate regression mechanism that relies on the price differences between the assets in the stablecoin treasury and those in the secondary market. When there is a significant price difference, traders can buy assets at a low price and sell them at a high price to realize arbitrage profits. This not only provides profit opportunities for traders but also helps maintain market price stability, ensuring that the stablecoin's value remains close to its pegged value.

The First Public Chain Born Specifically for Stablecoin Payment Scenarios

In terms of technical performance, compared to other commonly used stablecoin transfer public chains, BenFen Chain has outstanding advantages in various aspects, truly making it the first public chain born specifically for stablecoin payment scenarios: in addition to fully integrated decentralized stablecoins, it also offers better security, higher performance, low Gas fees, and a robust consensus mechanism.

Safer: Using a More Secure Programming Language (Move Language)

BenFen Chain is written in Move Language, which has a strict type system that can catch many common errors at compile time, such as type mismatches and null pointer references, thereby enhancing code security. Additionally, Move manages assets through the concept of resources, which have strict lifecycle management, ensuring that resources can only be used and transferred as intended, avoiding many security vulnerabilities such as reentrancy attacks and resource leaks. Besides these advantages, Move also has unique strengths in permission control, immutability, and formal verification, greatly enhancing its security.

Higher Performance: Achieving Sub-Second Latency and Tens of Thousands of Transactions Per Second with Enhanced Consensus Mechanism

BenFen Chain innovatively adopts an enhanced consensus mechanism, combining DAG-based consensus and non-consensus methods to achieve low latency and high TPS while maintaining support for complex contracts, generating checkpoints, and the ability to reconfigure validator sets across epochs.

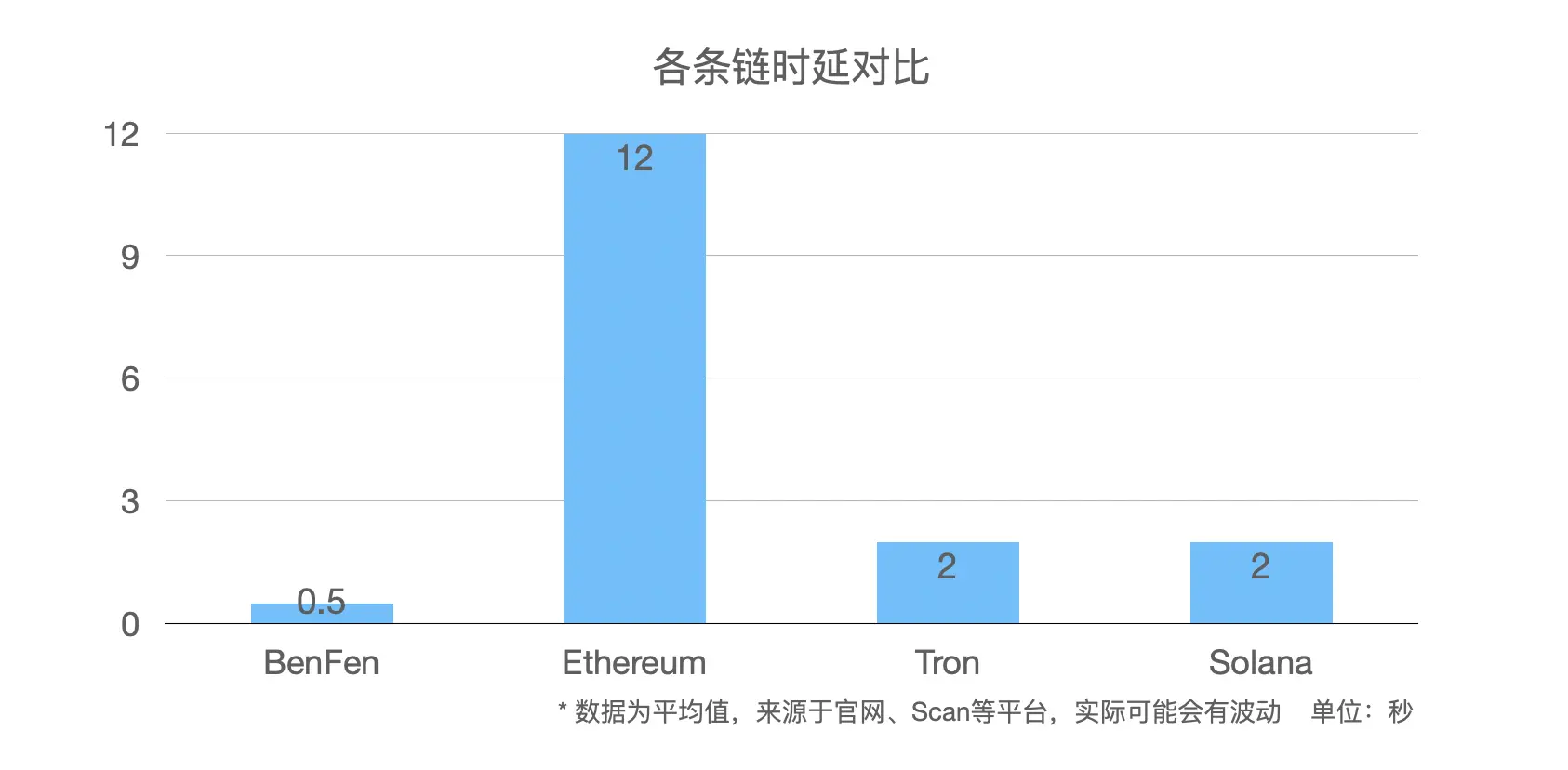

In terms of latency, BenFen Chain can achieve a delay of 0.5 seconds, far faster than Ethereum's 12 seconds, and quicker than Tron and Solana.

Comparison of Latency Across Chains

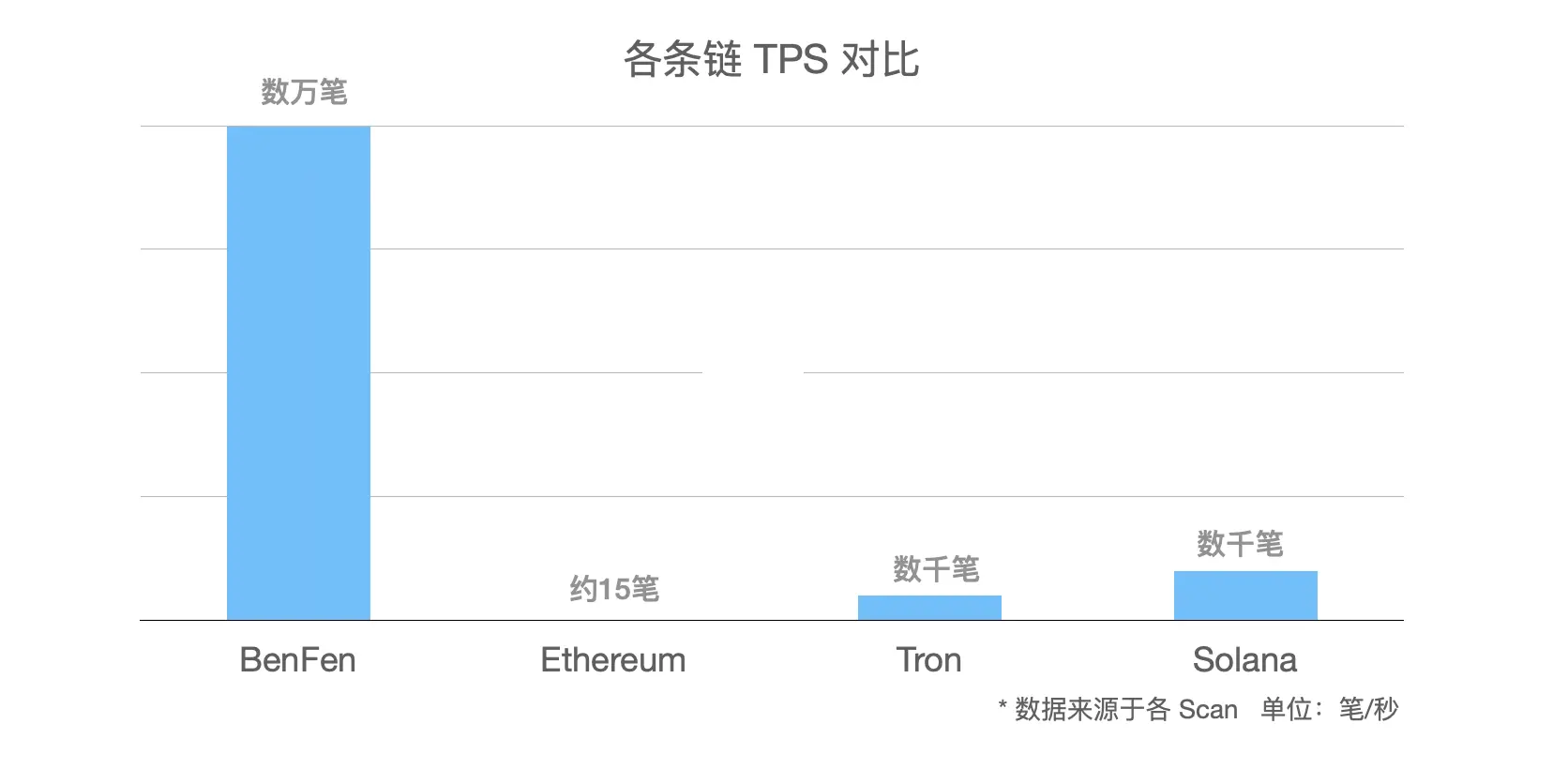

In terms of TPS, BenFen Chain can handle tens of thousands of transactions, surpassing Ethereum, Tron, and Solana.

Comparison of TPS Across Chains

More Convenient Login: BenFen Chain Provides a More Convenient and Secure Login Experience Through zkLogin

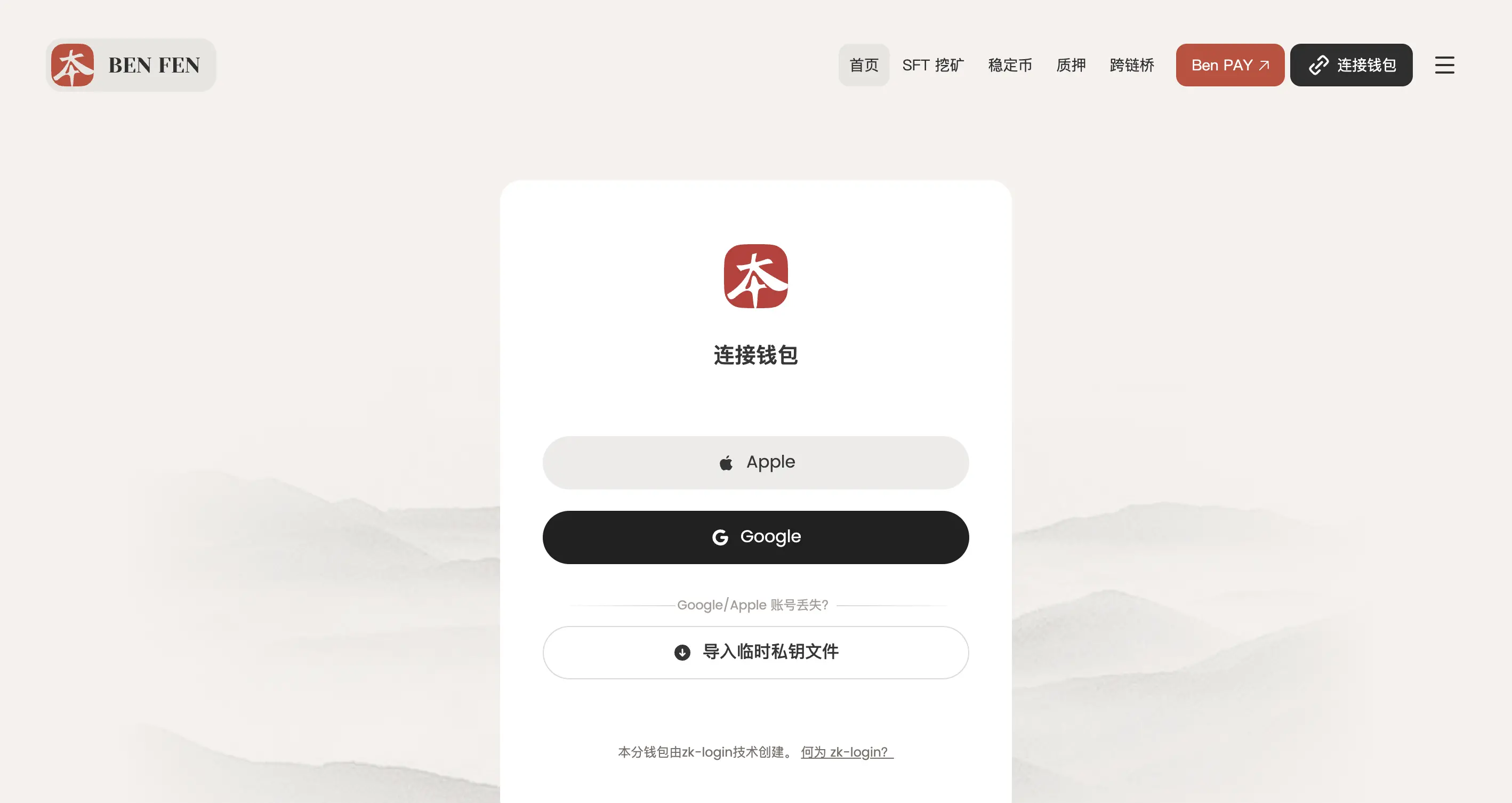

BenFen innovatively introduces the design of zkLogin, providing users with a method for address generation and transaction signing based on third-party authorization. Users can quickly log in using Apple accounts and Google accounts without needing a mnemonic, making it more convenient and faster.

The zkLogin login interface of BenFen Chain

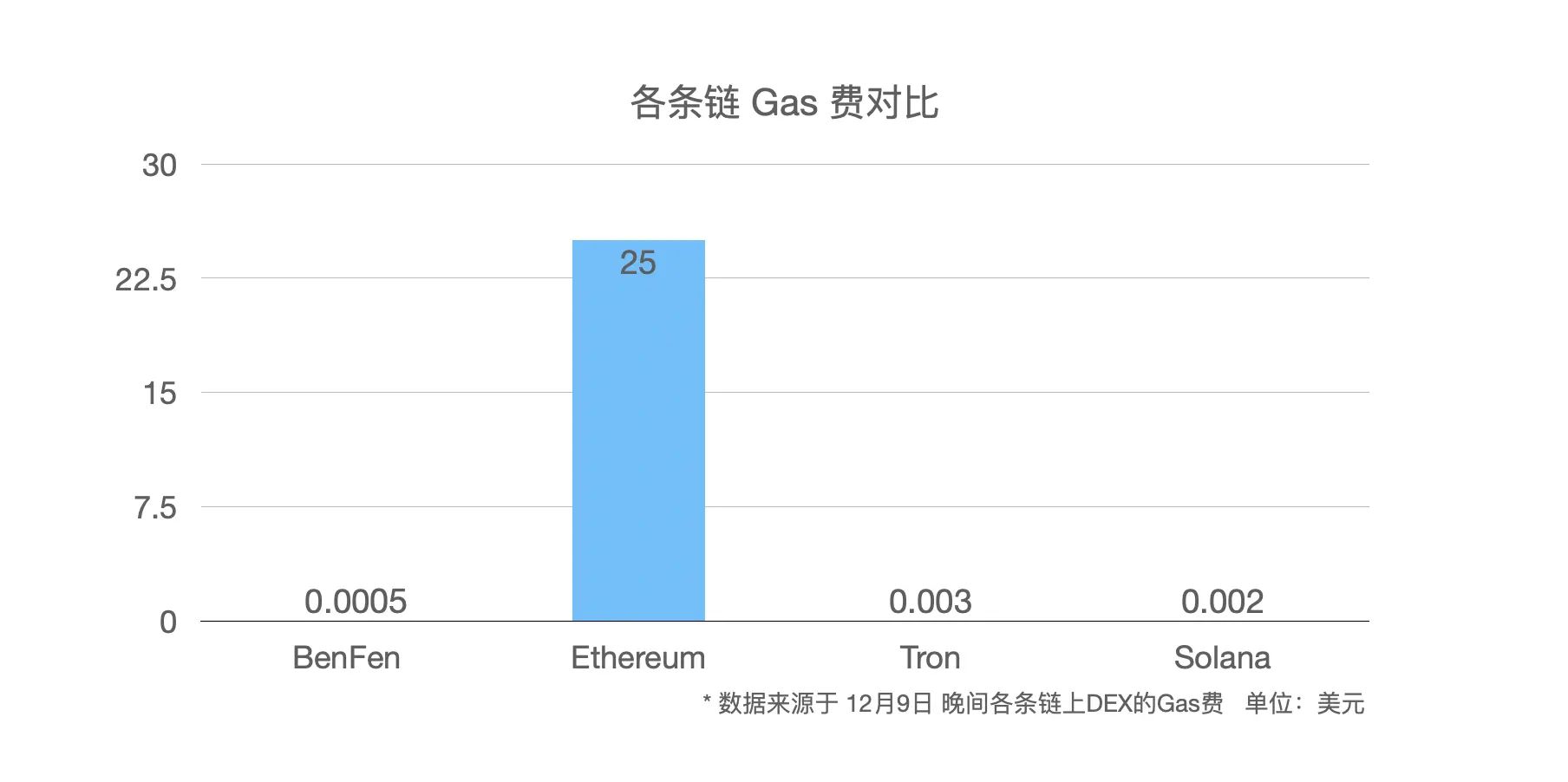

Lower Gas Fees: Multiple Steps to Reduce Gas Costs

BenFen Chain has optimized multiple steps in Gas fees to achieve low Gas costs. For example, each validating node submits their minimum price for processing transactions in each epoch. BenFen Chain automatically sorts the submitted prices and selects the price at the 2/3 position calculated based on the staking ratio as the reference price.

Additionally, when the Gas price submitted by users exceeds the reference price, the difference is considered a tip paid to the network, which can grant users higher priority. Different transactions require varying amounts of computation time for processing and execution.

Finally, BenFen Chain's storage mechanism provides a storage fee refund when transactions delete previously stored objects.

The First Public Chain Focused Solely on Expanding Stablecoin Application Scenarios

Compared to other chains that focus on multiple ecosystems, BenFen is more dedicated to the ecosystem scenarios based on stablecoin applications.

- BenFen Bridge is a native asset cross-chain bridge that is planned to be launched soon on the BenFen Chain.

- BenFen Card is a compliant payment solution integrated into our daily consumption.

- BenFen Pay is a comprehensive payment ecosystem that enables direct cryptocurrency payments, seamless exchanges between digital currencies and fiat currencies, as well as diversified functions such as on-chain guaranteed payments.

- BenFen KYC is an on-chain identity authentication and verification system that aggregates the certification results from major KYC providers, allowing for one-click queries of multi-platform KYC records and peer-to-peer identity information verification channels.

- BenFen C2C is an innovative decentralized escrow trading platform.

In addition, we will collaborate with partners to develop various ecological applications for users, promoting the ecological development and prosperity of the BenFen Chain, and providing greater value to users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。