精选要闻

2、David Sacks:7 月 14 日当周为加密周,将审议多项加密法案

3、国泰君安国际与胜利证券盘中涨超 20%,此前同获批提供虚拟资产交易服务

4、Jupiter Studio:反狙击保护机制支持用户自行设置狙击税

Trending 话题

来源:Overheard on CT(tg:@overheardonct),Kaito

HANA:今日关于 Hana 的讨论主要集中在 Hana Network 排行榜的扩展:从原先的前 100 名扩大至前 1000 名参与者,使得小账户更容易上榜并获得奖励。该网络因致力于打造一款面向年轻人、充满娱乐性的交易平台,被誉为「加密界的 TikTok」。此外,还发生了一件趣事:由于算法误读了一条关于「Ghana(加纳)」的推文,印度总理被误认为是 Web3 的「顶级发声者」。社区中也在热烈讨论 $HANA 代币预售的潜在收益,以及即将发放给 Kaito Yappers 的空投。

KAITO:今日 Twitter 上关于 KAITO 的讨论聚焦于 InfoFi 生态系统中的挑战与机遇。用户正在就 KAITO 的算法是否能有效奖励真实互动而非 AI 生成内容展开辩论,有人建议应将链上行为与内容质量结合以提升机制。社区也在探讨 KAITO 在更广泛加密市场中的定位,未来可能上线的新功能和潜在空投也成为热议话题。此外,如何让小账户获得曝光、以及真实互动相较 AI 驱动参与的重要性也被广泛讨论。

INFINEX:Infinex 今日因一次价值 8 万美元的 17 枚 Patron NFT 扫货行为而获得广泛关注,这一动作使其隐含市值升至 5.2 亿美元。此次扫货引发了关于 Infinex Patron 所赋予价值与权益的热议,例如免费 swidges、抢先体验功能以及参与专属社群等。受此推动,Patron NFT 的地板价上涨至 2 ETH,市场情绪转为看涨。同时,Infinex 与其他 DeFi 应用的整合能力和友好的用户界面也被视为吸引力的重要因素。

ECLIPSE:今日围绕 ECLIPSE 的讨论重点是 $ES 空投查询工具的上线以及即将到来的 TGE(代币生成事件)。此次空投引发社区反响不一:部分用户为分配额度感到兴奋,另一些人则因不符合资格而表示失望。同时,关于项目方管理能力和团队成员过往争议的质疑也浮出水面。尽管如此,市场对 TGE 的期待依然高涨,许多用户希望项目能迎来积极进展。

M:MemeCore 因在 Binance Alpha、Kraken、Bitget 等主要交易所上线,以及向符合条件用户发放 1000 枚 M 代币的空投而引发关注。社区热议空投的各个阶段、高年化质押机会,以及 M 作为主网币的潜力。旗舰 Dapp MemeX 上线了 M 的质押功能,并推出用于 PvP 预测游戏的 $stM,这些也成为焦点话题。整体讨论彰显出社区对 M 生态扩张及其创新的「Proof of Sh*t」机制的高度兴趣。

精选文章

1.《Figma 预定今年美股最大 IPO,Republic 上可以买它的私募股权?》

7 月初知名券商 Robinhood 公布了自己的「股票代币化」计划引起了热议,除此之外他们还公布了将开放两家未上市公司 OpenAI 和 SpaceX 的「股权衍生品」的信息。但在他们之前,6 月 25 日,众筹投资平台 Republic 平台抢先宣布,将发售与埃隆·马斯克旗下太空公司 SpaceX 非上市股票表现挂钩的 Mirro Token,而除此之外,还有数十家知名「未上市公司」的选项赫然在列。这家运营近 10 年的老牌众筹平台的镜像代币与 Robinhood 的「股权衍生品」有什么不同呢?我们又该如何在上面寻找一些机会?

2.《四天暴涨 30 倍,BitMine 掀起美股 ETH 储备风潮》

7 月 3 日,比特币矿企 BitMine(股票代码:BMNR) 股价单日收涨超 130%,自 6 月 30 日公司宣布将筹集资金主要用于增持 ETH 以来,短短时间内股价从 4 美元飙涨至 135 美元,涨幅超过 30 倍。这一惊人走势不仅带动了 SharpLink(股票代码:SBET)、Bit Digital(股票代码:BTBT) 等多只概念股的联动上涨,也暗示着一个新的市场趋势正在崛起——以太坊式微策略的兴起,正在逐渐席卷美股市场。

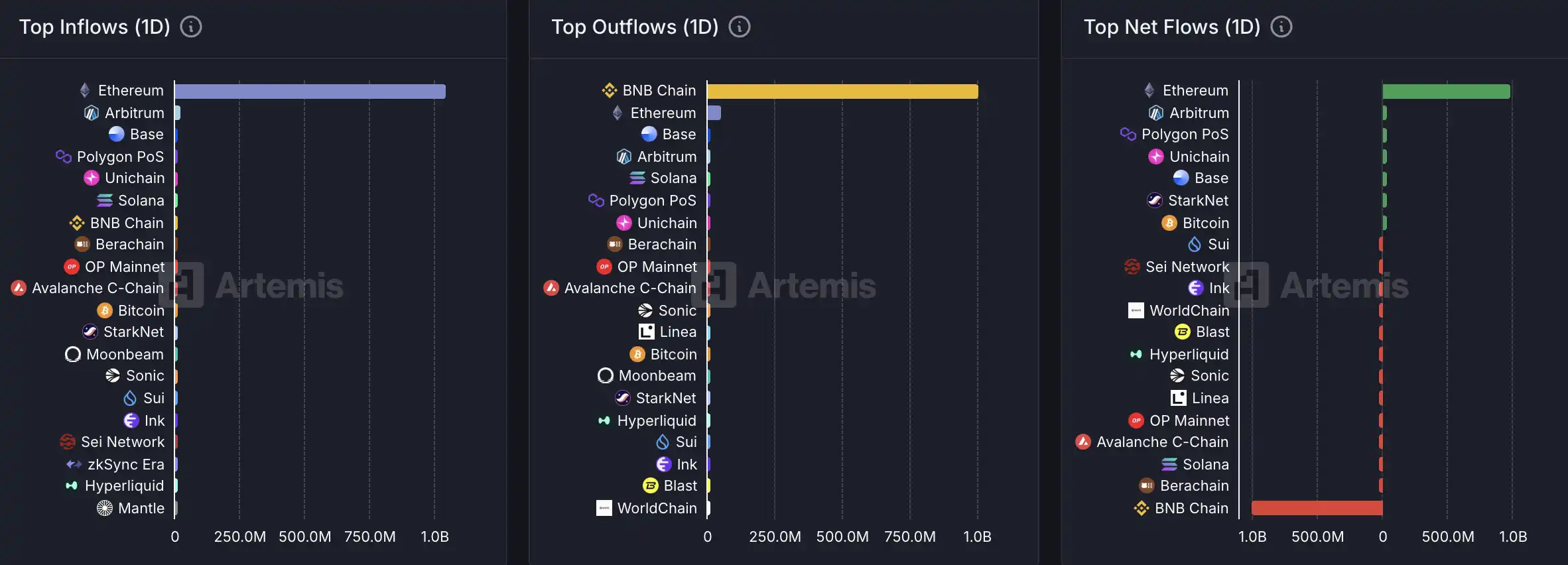

链上数据

7 月 4 日链上资金流动情况

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。