Original source: Bitcoin Policy Institute

Translation by: BitpushNews

On December 17, 2024, the Bitcoin Policy Institute drafted an executive order proposing the establishment of a strategic Bitcoin reserve under the U.S. Treasury's Exchange Stabilization Fund (ESF) during the Trump administration, which requires signing after Trump takes office to take effect.

Note from Bitpush: The Bitcoin Policy Institute is a nonpartisan nonprofit organization dedicated to researching the policy and social impacts of Bitcoin and emerging currency networks.

The full text of the executive order is as follows:

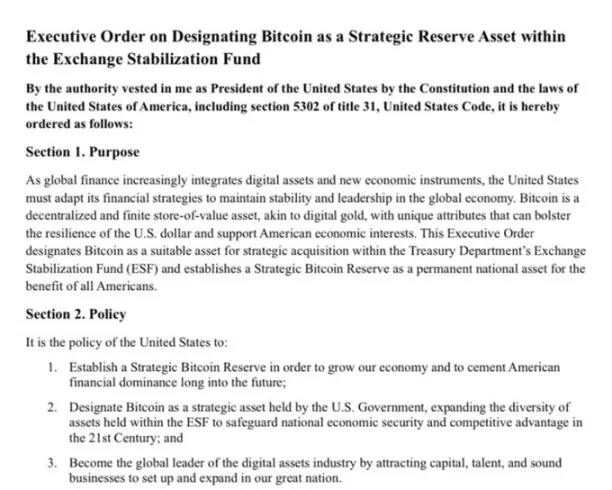

By the authority vested in me by the Constitution and laws of the United States (including Section 5302 of Title 31 of the U.S. Code), I hereby order as follows:

Section 1 Purpose

As the global financial system increasingly integrates digital assets and new economic tools, the United States must adjust its financial strategy to maintain global economic stability and leadership. Bitcoin is a decentralized, limited-value storage asset, akin to digital gold, with unique properties that can enhance the resilience of the dollar and support U.S. economic interests.

This executive order designates Bitcoin as an asset suitable for strategic acquisition within the Treasury's Exchange Stabilization Fund (ESF), establishing a strategic Bitcoin reserve as a permanent national asset for the benefit of all Americans.

Section 2 Policy

The policy of the United States is to:

Establish a strategic Bitcoin reserve to develop our economy and solidify America's future financial dominance;

Designate Bitcoin as a strategic asset held by the U.S. government, expanding the diversity of assets held by the ESF to safeguard national economic security and competitive advantage in the 21st century, and to promote industry development by attracting capital, talent, and voices;

Become a global leader in the digital asset industry, establishing and expanding enterprises in our great nation.

Section 3 Establishing the SBR and Designating Bitcoin as a Strategic Reserve Asset

( a ) Establishing the Strategic Bitcoin Reserve

The Strategic Bitcoin Reserve (SBR) is hereby established, managed by the Secretary of the Treasury, aimed at enhancing the diversity of U.S. reserve assets. To bolster confidence in its mission, the SBR will undergo regular audits, adhere to strict security standards, and implement comprehensive reporting measures to ensure long-term accountability and security.

( b ) Integrating Government Bitcoin Holdings

Within 7 days of the issuance of this order, any Bitcoin under the control of any federal agency (including the U.S. Marshals Service) shall not be sold, exchanged, auctioned, or otherwise pledged, and upon obtaining legal ownership of such Bitcoin (including after a final, unappealable judgment in a criminal or civil forfeiture action favorable to the federal agency), it shall be transferred to the SBR by the head of that federal agency.

( c ) Designating Reserve Assets

Bitcoin is hereby designated as a strategic reserve asset suitable for purchase and holding within the ESF. Within 60 days of the issuance of this order, the Secretary of the Treasury is directed to implement a Bitcoin acquisition plan to acquire and manage Bitcoin within the ESF. The goal of the SBR is to position the United States as the undisputed global leader in Bitcoin holding, innovation, and management, ensuring that U.S. interests, rather than those of foreign competitors, set the standards for global digital asset strategy.

Section 4 Acquisition and Custody Protocols

( a ) Procurement Plan

Pursuant to the authority granted to the Secretary of the Treasury to "manage… credit instruments" under 31 U.S.C. § 5302, the Secretary of the Treasury is hereby directed to allocate no less than $521 billion from the ESF for the strategic procurement of Bitcoin to be included in the SBR, by purchasing debt from suitable counterparties and repaying in Bitcoin. The Secretary shall collaborate with reputable market participants based on agreements that maximize value and minimize risk. The initial acquisition plan should be completed within 365 days of the issuance of this order.

( b ) Custody and Security Protocols

To protect the Bitcoin holdings of the SBR at all stages, the Secretary of the Treasury shall implement a phased custody framework. Within 30 days of the issuance of this order, the Secretary shall confirm that the U.S. government’s existing relationships with reputable and secure custody service providers are sufficient to ensure immediate and reliable storage solutions for Bitcoin within the SBR. The Secretary shall direct that all Bitcoin purchases under the acquisition plan be securely transferred to such custody service providers.

Meanwhile, the Secretary shall coordinate with the National Security Agency, the Cybersecurity and Infrastructure Security Agency, the National Institute of Standards and Technology (NIST), and any other agencies as requested by the Secretary to develop and implement self-custody protocols (including dedicated hardware, guaranteed software, access controls, geographic distribution, multi-signature controls, and physical security measures) aimed at enhancing long-term security, reducing reliance on third parties, and maintaining full sovereign control over the U.S. Bitcoin reserve as a "digital Fort Knox." The Secretary shall ensure that the SBR custody protocols align with ESF audit procedures, strict cybersecurity standards, and cryptographic reserve proof verification to guarantee the integrity of the SBR and the confidence of the American public.

Section 5 Conditions for the Sale of the Strategic Bitcoin Reserve

( a ) Long-term Preservation Principle

The SBR shall serve as a permanent pillar of U.S. financial strength and commitment to the future of the digital economy, in the enduring spirit of our nation's protection of the Fort Knox gold reserve. The Bitcoin held in the SBR shall not be viewed as short-term financial instruments or emergency funds for everyday contingencies, but rather as generational assets supporting the prosperity and security of the United States for decades to come. This is the policy of the United States. The government shall hold (HODL) all Bitcoin acquired in the SBR for at least 25 years from the issuance of this order.

( b ) Strict Limits on Liquidation

The sale or other forms of divestment from the SBR shall only be permitted in the most severe and exceptional circumstances, which clearly exceed ordinary financial volatility or geopolitical uncertainty.

( c ) Strict Approval Procedures

Before any sale is made, the Secretary of the Treasury shall submit a detailed written determination, accompanied by substantial evidence, demonstrating that the proposed liquidation directly addresses a specific national economic or security crisis. This determination must be approved by the President of the United States. The Secretary of the Treasury shall not have the authority to sell, pledge, exchange, or otherwise dispose of any portion of the SBR without explicit authorization.

( d ) Transparent and Controlled Execution

In rare cases where a sale is approved, it shall be conducted in the most prudent and tightly controlled manner to minimize market impact and maintain public confidence. Private, phased transactions or other restrained methods should be prioritized to ensure that even in a crisis, the nation's reputation for financial prudence and responsibility remains intact.

Section 6 Reporting and Transparency

( a ) Public Reserve Proof

The Secretary of the Treasury shall implement a public reserve proof process using cryptographic proofs. These proofs shall be provided quarterly to ensure transparency regarding the ESF's Bitcoin holdings while protecting sensitive security information.

( b ) Annual Report

As part of the annual report on ESF operations required by the Gold Reserve Act, the Secretary of the Treasury shall provide detailed information on the status, performance, and strategic advantages of Bitcoin within the ESF. This report shall also summarize acquisition strategies, custody security measures, and the impact on economic stability, while considering national economic security.

Section 7 Interagency Coordination

The Secretary of the Treasury shall coordinate with the Federal Reserve, the Department of Defense, and other relevant federal agencies to ensure that the acquisition and management of Bitcoin within the ESF align with U.S. national security, economic stability, and cybersecurity standards.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。