Author: Kucoin

Translation: Plain Language Blockchain

Ethena (ENA), as a rising star in the decentralized finance (DeFi) space, leverages blockchain technology to provide innovative financial solutions. The platform aims to enhance the functionality and scalability of financial transactions without relying on traditional banking systems. One of Ethena's core products is USDe, a synthetic dollar that provides stability to the digital financial ecosystem and facilitates integration.

1. Features of USDe

USDe is pegged to the US dollar at a 1:1 ratio, aiming to maintain value stability in the highly volatile cryptocurrency market. This pegging mechanism is particularly important for users who need a reliable medium of exchange or a stable store of value, effectively hedging against the common price volatility risks in the cryptocurrency market.

1) What is Ethena?

Ethena is a DeFi protocol developed on the Ethereum blockchain, focusing on creating a synthetic dollar called USDe. The platform aims to provide a stable, scalable, and censorship-resistant digital currency without relying on traditional banking infrastructure. By adopting a Delta hedging strategy based on Ethereum collateral, Ethena ensures the stability and security of USDe, making it an ideal choice for global trading and savings.

2) Funding Support

Ethena has received strong support from several well-known individuals and institutions in the cryptocurrency and financial sectors. The startup raised $6 million in a seed round led by the prominent venture capital firm Dragonfly, which focuses on the crypto space. Additionally, BitMEX founder Arthur Hayes and his family office Maelstrom also participated in the investment. Other major supporters include well-known crypto derivatives trading platforms such as Deribit, Bybit, OK, Gemini, and Huobi.

3) ENA - Ethena's Native Token

ENA is the native utility token of the Ethena protocol, playing a crucial role in the Ethena ecosystem. Users holding ENA can participate in protocol governance, voting on key decisions regarding risk management frameworks, the composition of supporting assets for USDe, and potential partnerships or integration plans. Furthermore, ENA helps maintain the stability and functionality of USDe through various incentive mechanisms within the platform, serving as a key link in the operation of the entire ecosystem.

4) What is Ethena's synthetic dollar USDe?

USDe is a synthetic dollar issued by Ethena, designed to provide a stable and scalable digital currency pegged to the value of the US dollar. The design goal of USDe is to become a decentralized crypto-native dollar that does not rely on traditional financial infrastructure. Its stability is achieved through a combination of Delta hedging and minting-redeeming arbitrage mechanisms. These features ensure that USDe can serve as a reliable medium of exchange and a store of value in the cryptocurrency market, supporting seamless and efficient transactions in the DeFi space.

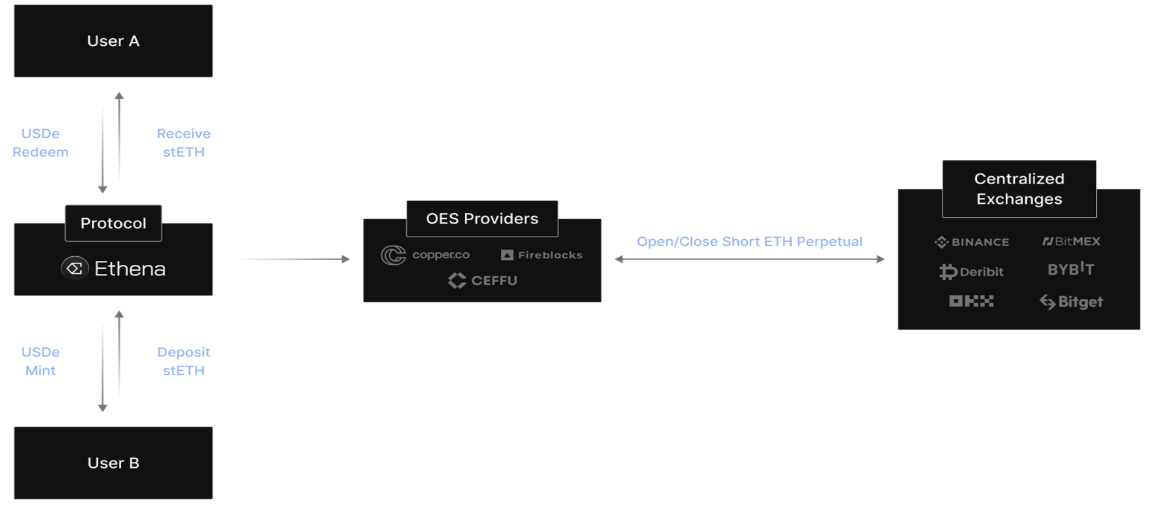

2. How Does the Ethena Protocol Work?

How Ethena's Internet Bonds Work | Source: Ethena Labs' Gitbook

1) Core Concept of Ethena

Ethena utilizes the Ethereum blockchain framework to create a stable, scalable, and censorship-resistant digital currency known as "Internet Bonds." The platform maintains currency stability while providing users with yield opportunities through innovative Delta hedging strategies.

2) Minting USDe

On the Ethena platform, users can use Ethereum or its staked derivatives as collateral to mint USDe. The system automatically establishes a Delta-neutral position to stabilize the value of USDe, shielding it from the volatility of the collateral assets. This process involves opening a short position in the derivatives market equivalent to the value of the staked Ethereum, ensuring that the price fluctuations of the underlying asset are offset by the gains or losses from the derivatives position.

3) Stability of the Delta Neutral Mechanism

The core stability mechanism of USDe is the Delta hedging strategy. This strategy establishes hedging positions in the derivatives market equivalent to the Ethereum collateral, protecting against price fluctuations in the crypto market. This design aims to maintain a stable peg between the synthetic dollar USDe and the US dollar. The adjustment of hedging positions is fully automated, allowing for real-time responses to market changes, thereby ensuring stability.

4) Yield Generation

USDe is not only a stable currency but also provides yield opportunities for holders. The sources of yield primarily include:

- Staking rewards generated from the staked Ethereum;

- Funding rates and basis profits from Delta hedging activities.

This dual yield model makes USDe similar to traditional bonds, becoming an investment that can accumulate value over time, referred to as "Internet Bonds."

5) Risk Mitigation

Although Ethena is committed to creating a stable and secure platform, it also recognizes the inherent risks in DeFi protocols, including smart contract risks, liquidity risks, and risks associated with external platforms. To mitigate these risks, Ethena employs diversified hedging strategies, utilizes multiple custody solutions, and ensures the transparency and verifiability of all transactions and positions through blockchain technology.

3. Mechanism of Ethena's Operation

Here is a specific example illustrating the process of obtaining USDe (synthetic dollar) through staking Ethereum (stETH):

1) User Operations

Deposit stETH: Users deposit stETH worth $100 into the Ethena system (representing Ethereum that has been staked and can earn staking rewards).

Receive USDe: In return, users receive an equivalent amount of USDe, approximately 100 USDe (minus any applicable transaction fees). This is based on a 1:1 pegged exchange rate to the US dollar.

2) Operations of Ethena Labs

Open Short Position: After users deposit stETH, Ethena Labs opens a short perpetual contract position on a derivatives trading platform equivalent to the value of the stETH. This is part of Ethena's Delta hedging strategy to stabilize the value of USDe.

Over-the-Counter Settlement: The stETH deposited by users is managed through an "over-the-counter settlement" system. This mechanism ensures that users' stETH is securely stored outside the trading platform, thereby reducing counterparty risk from potential hacks or bankruptcies of the trading platform.

4) Yield Distribution

The staking rewards generated from users' stETH are collected by Ethena, and the platform converts these earnings into more USDe, returning them to users. This yield distribution model provides users with stable returns, enhancing the attractiveness of USDe as a yield investment tool.

5) Key Points Summary

Stability: Through the Delta hedging strategy (balancing the positions of stETH collateral in the derivatives market), Ethena effectively reduces the volatility risk of collateral assets, ensuring the stability of USDe's peg to the US dollar.

Security and Risk Management: By managing assets through an over-the-counter settlement mechanism, the impact of external threats on user deposits is minimized, providing a safer environment for investors.

Yield Generation: Converting staking rewards into USDe offers users predictable and stable returns, making USDe an ideal passive income tool.

4. Uses of USDe

USDe is primarily used for trade, remittances, and as a stable medium of exchange, simplifying and securing cross-border transactions without the need for traditional financial intermediaries. This makes it an ideal choice for businesses and individuals seeking efficient, low-cost solutions in international trade.

1) USDe as a Medium of Exchange

Ethena's USDe is a stable medium of exchange that can be used for various financial transactions, avoiding the volatility typically associated with other cryptocurrencies. This stability makes USDe particularly suitable for everyday transactions, trading activities, and cross-border payments, especially in scenarios where exchange rate stability is crucial.

2) Savings and Investment Tool

Referred to as "Internet Bonds," USDe is not only a medium of exchange but also a savings tool. By generating yield through staking and hedging operations, USDe offers users investment opportunities similar to traditional bonds but operates within the DeFi market. This feature attracts investors looking to earn passive income while maintaining stable asset liquidity.

3) DeFi Application Scenarios

USDe is crucial in DeFi applications, including borrowing, lending, and yield farming. Its stability and deep integration with the Ethereum blockchain allow it to be used as collateral for loans or as a liquidity asset in decentralized exchanges (DEXs). This versatility broadens its applications within the DeFi ecosystem, promoting safer and more efficient financial services.

4) Hedging and Risk Management

USDe can also serve as a hedging tool against volatility in the cryptocurrency market. In uncertain or adverse market conditions, traders and investors can convert volatile assets into USDe, protecting their investments from significant fluctuations and reducing potential losses while retaining the opportunity to quickly re-enter the market, preparing for future investments.

5) Promoting Cryptocurrency Adoption

By providing a stable, scalable, and censorship-resistant form of currency, USDe supports broader cryptocurrency adoption. It addresses common barriers to cryptocurrency use, such as volatility and complexity, enabling new users to enter the crypto market with greater confidence. The stability of USDe ensures that users can transition seamlessly into a crypto-based financial system without worrying about the direct risks posed by other more volatile cryptocurrencies.

6) Future Outlook

The potential applications of USDe are vast. As the DeFi space continues to evolve, USDe is expected to play a significant role in decentralized borrowing, yield farming, and more complex financial instruments. This could have a profound impact on the entire cryptocurrency market, promoting wider adoption of crypto-based financial solutions by providing greater stability and reliability.

7) Integration into Major DeFi Protocols

Ethena's USDe has been integrated into major DeFi protocols such as MakerDAO, Frax, Curve Finance, and Aave, highlighting its growing importance and potential to reshape financial interactions globally.

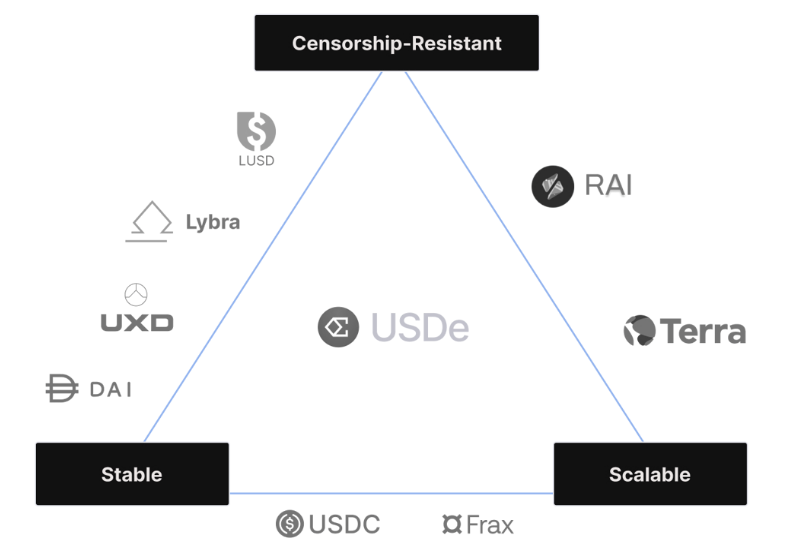

5. Comparison of USDe with Other Stablecoins

Exploring the Comparison of Other Stablecoins with USDe | Source: Ethena Labs' Gitbook

USDe is one of hundreds of stablecoins in the crypto market, pegged to real-world assets (in this case, the US dollar). As a synthetic dollar protocol based on crypto, USDe differs from other stablecoins in the market in the following ways:

1) Stability Mechanism

USDe: Maintains its peg to the US dollar by using a delta hedging mechanism with Ethereum derivatives to offset the volatility of its collateral. This approach ensures the stability of USDe even during significant market fluctuations.

Traditional stablecoins (such as USDT, USDC): Typically rely on fiat reserves to maintain their peg, meaning their stability depends on the sufficiency of the reserves and the financial health of the reserve custodians.

2) Decentralization

USDe: Operates on a decentralized platform with no single entity controlling its issuance or redemption processes, which helps enhance security and reduce the likelihood of censorship or intervention.

Other DeFi stablecoins (such as DAI): DAI also operates on a decentralized framework but employs an over-collateralization mechanism involving a mix of other cryptocurrencies, which may introduce different risks and dependencies.

3) Yield Generation

USDe: Provides intrinsic yield through its "Internet Bonds," with earnings derived from staking Ethereum and price differentials in the derivatives market. This unique feature allows users holding USDe to directly earn returns.

Other stablecoins: Most traditional stablecoins do not directly provide yield; users need to seek returns through external means, such as borrowing platforms or DeFi yield farms.

4) Scalability and Efficiency

USDe: Leverages the Ethereum network, utilizing existing DeFi protocols and infrastructure to achieve high scalability and efficiency, facilitating broader adoption and multi-platform integration.

Other stablecoins: While also having some scalability, traditional stablecoins are often constrained by the reserve management of traditional banking systems, making them slower to adapt to new blockchain technologies.

5) Risk and Transparency

USDe: Offers highly transparent on-chain transaction and position records. However, the complexity of its delta hedging strategy and the potential risks from derivatives market volatility should be noted.

Other stablecoins: The risks of traditional stablecoins typically include counterparty risk, reserve audit transparency issues, and potential regulatory challenges. However, their operational mechanisms are relatively simple, which may lead some users to perceive lower risk.

6. Potential Risks and Challenges of Ethena and USDe

Before participating in the Ethena ecosystem, it is essential to understand the following potential risks and challenges:

1) Regulatory Challenges

Ethena faces regulatory scrutiny similar to many DeFi projects, especially regarding the issuance of synthetic stablecoins like USDe, which may vary by jurisdiction. The current regulatory environment is evolving, and new rules may impact stablecoins and their operational methods. Mitigation Measures: Ethena actively communicates with regulatory bodies and seeks legal compliance in all operational regions, including strict KYC and anti-money laundering (AML) checks for users, particularly those minting and redeeming USDe.

2) Market Acceptance

The adoption of USDe relies on user acceptance and its integration into mainstream DeFi platforms. Market acceptance may be slow, especially when users are cautious about new technologies or face competition from established stablecoins. Mitigation Measures: Ethena promotes the adoption of USDe by establishing strategic partnerships with major DeFi protocols in the crypto ecosystem and providing incentives for early adopters. Additionally, it enhances user confidence in the advantages and operational methods of USDe through educational outreach and transparent operational communication.

3) Technical Challenges

The core technology of Ethena (especially the delta hedging mechanism used to stabilize USDe) is complex and may have technical issues or vulnerabilities. The implementation of such complex mechanisms carries inherent risks, including smart contract vulnerabilities. Mitigation Measures: Ethena reduces risks by conducting extensive testing and commissioning reputable third-party security firms to audit its smart contracts. It also continuously monitors and updates the protocol's infrastructure to ensure robust technical safeguards against potential vulnerabilities.

4) Liquidity and Volatility Risks

Like any financial instrument, the risk of liquidity constraints, especially during market stress or rapid changes in investor sentiment, must be considered. Additionally, while USDe aims to maintain stability, the underlying collateral (ETH and its derivatives) is highly volatile. Mitigation Measures: Ethena addresses liquidity issues by maintaining reserve funds and establishing deep liquidity pools across multiple trading platforms. For volatility, the protocol strictly enforces its neutral hedging strategy to ensure that the synthetic dollar remains pegged even amid fluctuations in the underlying assets.

5) Dependence on Ethereum

As a protocol built on the Ethereum blockchain, Ethena's operations are affected by Ethereum's scalability and gas fees, which may impact transaction costs and speed. Mitigation Measures: Ethena plans to utilize Ethereum's layer two solutions and may consider cross-chain integration to reduce high transaction fees and improve scalability. This not only enhances efficiency but also broadens the protocol's accessibility and user base.

6) Counterparty Risk

Maintaining the stability of USDe through derivatives and other financial instruments means the protocol is exposed to counterparty risk, especially in a decentralized environment where counterparties may not be entirely reliable or transparent. Mitigation Measures: Ethena selects reputable and reliable trading platforms and derivatives partners, ensuring that all positions are over-collateralized while maintaining transparency in hedging activities.

7. Conclusion

Ethena and its USDe stablecoin represent a significant innovation in the decentralized finance space. By leveraging the robust and secure infrastructure of Ethereum, Ethena provides a crypto-native, stable, and scalable digital dollar that not only frees itself from reliance on traditional banking systems but also introduces a yield-generating asset in the form of "Internet Bonds."

USDe employs advanced delta hedging strategies to maintain its stability, distinguishing it from traditional stablecoins and providing users with a reliable store of value while actively generating returns. This innovative approach addresses the volatility typically associated with cryptocurrencies, making USDe a viable solution for everyday transactions, savings, and financial planning in decentralized environments.

As the DeFi space continues to evolve, Ethena's commitment to transparency, security, and user-centric innovation may play a crucial role in shaping its development trajectory. While it remains to be seen whether it can secure a place in the rapidly growing digital finance landscape, its potential to redefine the views and applications of stablecoins and synthetic assets within the DeFi ecosystem is undeniable. The ongoing development, adoption, and integration of Ethena and USDe may set a new standard for stability and functionality in the cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。