2025 年 7 月 19 日,据 CNBC 报道,Bullish 已正式向美国证券交易委员会(SEC)提交 IPO 文件,计划在纽约证券交易所上市,股票代码为「BLSH」。这是继 Circle、Coinbase 后,又一家加密公司冲击美股市场。

根据招股书披露,截至 2025 年第一季度,Bullish 平台累计交易额已达 1.25 万亿美元,第一季度日均交易额超过 25 亿美元。其中比特币交易量达 1086 亿美元,同比增长 36%。

在币圈最赚钱的 CEX 赛道中,Bullish 并不是一个耳熟能详的名字,但事实上它的「出身」其实非常显赫。

2018 年,EOS 横空出世,号称以太坊的终结者,背后的公司 Block.one 靠着这波热潮进行了一场史上最长、金额最高的 ICO(首次代币发行),一共筹得了惊人的 42 亿美元。

几年后,当 EOS 热度散去,Block.one「另起炉灶」,转头做了一个主打合规、瞄准传统金融市场的加密货币交易平台——Bullish,也因此被 EOS 社区「扫地出门」。

2021 年 7 月,Bullish 正式上线。初期启动资金就包括:Block.one 投入的 1 亿美元现金、16.4 万枚比特币(当时价值约 97 亿美元)和 2000 万枚 EOS;外部投资者还追加了 3 亿美元,包括 PayPal 联合创始人 Peter Thiel、对冲基金大佬 Alan Howard 和加密行业知名投资人 Mike Novogratz 等人。

亲「Circle」远「Tether」,Bullish「志在合规」

Bullish 的定位从一开始就很明确,规模不重要,但是合规很重要。

因为 Bullish 的最终目标并不是在加密世界赚取多少利润,而是要做一家「能上市」的正规交易平台。

在正式运营前,Bullish 就与一家上市公司 Far Peak 达成协议,投资 8.4 亿美元收购该公司 9% 的股份,并进行 25 亿美元的合并,以此实现曲线上市,降低传统的 IPO 门槛。

当时的媒体爆料,Bullish 估值为 90 亿美元。

这家被合并的公司 Far Peak 之前的 CEO Thomas,是 Bullish 的现任 CEO,他有非常强的合规背景:此前曾是纽约证券交易所的首席运营官和总裁,期间表现出色;与华尔街的巨头、首席执行官和机构投资者都建立了深厚的联系;在监管和资本层有广泛资源。

值得一提是,Farley 在 Bullish 对外投资和收购的项目不算多,但在币圈响当当的并不少:比特币质押协议 Babylon、再质押协议 ether.fi、区块链媒体 CoinDesk。

总之可以说,Bullish 是币圈里最想变成「华尔街正规军」的一家交易平台。

但理想很丰满,现实很骨感。合规比他们想象的要难更多。

美国监管态度日益强硬,Bullish 原本的合并上市协议在 2022 年就终止,18 个月的上市计划告吹。Bullish 也曾考虑收购 FTX,以实现快速扩张,但最终未成行。Bullish 被迫寻找新的合规路径——比如转战亚洲和欧洲。

Bullish 在香港 Consensus 大会

Bullish 也在今年年初获得了香港证监会发的 1 类牌照(从事证券交易)和第 7 类牌照(提供自动化交易服务),以及虚拟资产交易平台牌照;此外,Bullish 还得到了德国联邦金融监管局 (BaFin) 颁发的加密资产交易和托管所需的许可证。

Bullish 在全球共有约 260 名员工,其中超过一半驻扎在香港,其余分布在新加坡、美国和直布罗陀等地。

Bullish「志在合规」的另一个明显的表现是:亲「Circle」,远「Tether」。

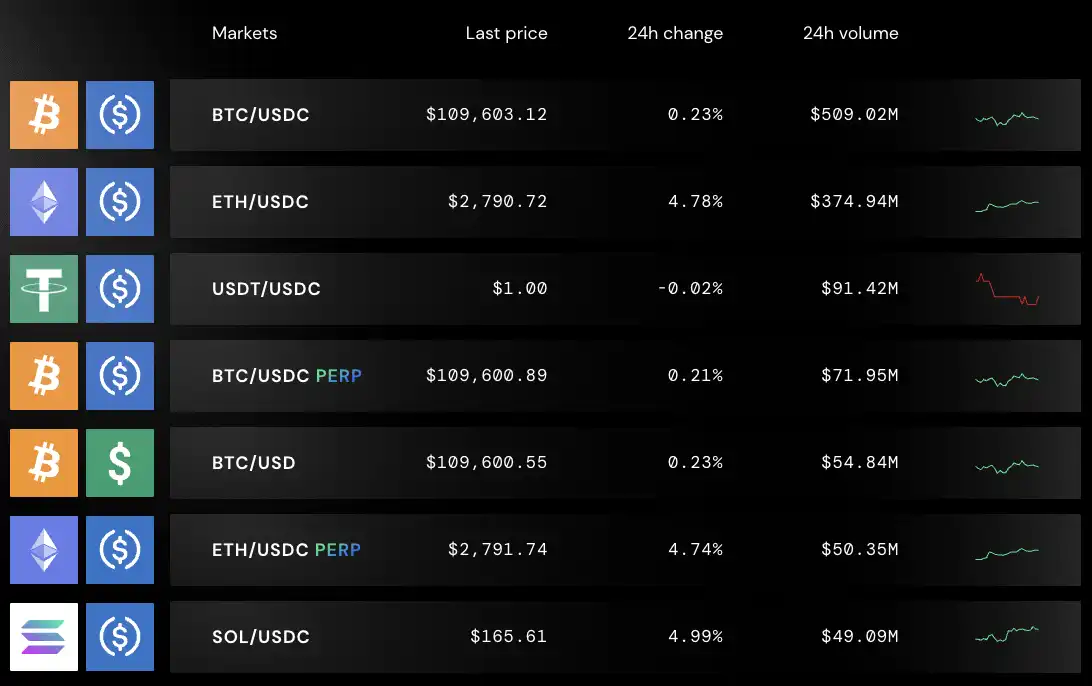

在 Bullish 平台上,前几个交易量最大的稳定币交易对都是 USDC,而非流通规模更大、历史更悠久的 USDT。这背后,反映的正是它在监管态度上的明确站队。

近年来,随着 USDT 不断受到美国 SEC 的监管压力,其市场主导地位开始有所动摇。而另一边,USDC 作为由合规公司 Circle 和 Coinbase 联合推出的稳定币,不仅成功在美股上市,还作为「稳定币第一股」受到资本市场的青睐,股价走势优秀。凭借良好的透明度和监管适配性,USDC 的交易量持续飙升。

根据 Kaiko 发布的最新报告,2024 年 USDC 在中心化交易所(CEX)上的交易量明显上升,仅 3 月就达到 380 亿美元,远高于 2023 年的月均 80 亿美元。其中,Bullish 和 Bybit 是 USDC 交易量最大的两个平台,两者合计就占据了约 60% 的市场份额。

Bullish 和 EOS 的「爱恨情仇」

如果要用一句话来形容 Bullish 和 EOS 之间的关系,那就是前任与现任。

虽然 Bullish 传出秘密提交 IPO 申请的消息后,A(原 EOS)的币价一下上涨了 17%,但事实上,EOS 社区与 Bullish 之间的关系并不好,因为 Block.one 在抛弃 EOS 之后,转身就拥抱了 Bullish。

回到 2017 年,公链赛道正值黄金时代。Block.one 一纸白皮书推出了 EOS,一个喊出「百万 TPS、零手续费」口号的超级公链项目,一时间吸引全球投资者蜂拥而至。一年之内,EOS 就通过 ICO 募集了 42 亿美元,刷新了行业纪录,也燃起了一个属于「以太坊终结者」的幻想。

然而梦开始得快,崩塌也来得迅速。EOS 主网上线后,用户很快发现,这条链并不如宣传那般「无敌」。转账虽然不用手续费,但要质押 CPU 和 RAM,流程复杂,操作门槛高;节点选举也不是想象中的「民主治理」,反而很快被大户和交易所控制,出现了贿选、投票互刷等问题。

但真正使 EOS 加速衰落的,不只是技术问题,更多是来自 Block.one 内部的资源分配问题。

Block.one 原本承诺会拿出 10 亿美元支持 EOS 生态,但实际做的事情却完全相反:大手笔买入美债、囤积 16 万枚比特币、投资失败的社交产品 Voice,还把钱用来炒股、买域名……真正用来扶持 EOS 开发者的,少得可怜。

同时,公司内部的权力高度集中,核心高管几乎全由 Block.one 创始人 BB 及其亲属、朋友组成,形成了一个小圈子式的「家族企业」。2020 年后,BM 宣布离开项目,这也成为 Block.one 与 EOS 关系彻底分裂的前兆。

而真正引爆 EOS 社区怒火的,是 Bullish 的登场。

Block.one 创始人 BB

2021 年,Block.one 宣布推出加密交易平台 Bullish,并宣称已完成 100 亿美元的融资,投资人名单豪华——有 PayPal 联合创始人 Peter Thiel、华尔街资深玩家 Mike Novogratz 等一线资本支持。这家新平台主打合规、稳健,为机构投资者打造加密金融的「桥梁」。

但这家 Bullish,从技术到品牌,几乎与 EOS 没有任何关系——不用 EOS 技术、不接受 EOS 代币、不承认与 EOS 有关联,连最基本的感谢都没有。

对于 EOS 社区来说,这无异于一场公开的背叛:Block.one 利用建立 EOS 而积累的资源,另起炉灶的「新爱」。而 EOS,被彻底留在了原地。

于是,来自 EOS 社区反击开始了。

2021 年底,社区发起「分叉起义」,试图切断 Block.one 的控制。EOS 基金会作为社区代表出面,开始和 Block.one 谈判。但在一个月的时间里,双方讨论了多种方案,但均未达成一致。最后,EOS 基金会联合 17 个节点,撤销 Block.one 的权力地位,将其踢出了 EOS 管理层。2022 年,EOS 网络基金会(ENF)发起法律诉讼,指控其背弃生态承诺;2023 年,社区甚至考虑通过硬分叉方式,把 Block.one 和 Bullish 的资产彻底隔离。

相关阅读:《EOS 节点停止 Block.one 账户释放事件始末:被社区踢走的母公司》。

在 EOS 与 Block.one 分家后,EOS 社区为了当初筹集资金的归属权与其进行了长达数年的诉讼,但目前为止 Block.one 仍拥有资金的所有权和使用权。

所以在很多 EOS 社区人眼中,Bullish 并不是一个「新项目」,而更像是一个背叛的象征,而这个秘密提交 IPO 申请的 Bullish 始终是那个用他们的理想换来现实的「新欢」——光鲜,却可耻。

2025 年,EOS 为了切割过去,正式改名为 Vaulta,在公链基础上建设 Web3 银行业务,同时也将代币 EOS 更名为 A。

富得流油的 Block.one,究竟有多少钱?

我们都知道的是,早期 Block.one 募集了 42 亿美元,成为加密史上最大规模的融资事件。按理说,这笔资金可以支撑 EOS 长期发展,扶持开发者、推动技术创新,让生态持续成长。当 EOS 生态开发者哀求资助时,Block.one 却只甩出了 5 万美元支票——这笔钱还不够支付硅谷程序员两个月的工资。

「42 亿美金去哪了?」社区发问。

2019 年 3 月 19 日 BM 写给 Block.one 股东的邮件中披露了部分答案:截至到 2019 年 2 月,Block.one 持有的资产(包括现金和投资出去的资金)一共为 30 亿美元。这 30 亿里,约 22 亿美元被投资于美国政府债券。

这笔 42 亿美元去了哪?大体上就是三大方向:22 亿美元买国债:低风险、稳收益,确保财富保值;16 万枚比特币;少量炒股和收购尝试:如失败的 Silvergate 投资、购买 Voice 域名等。

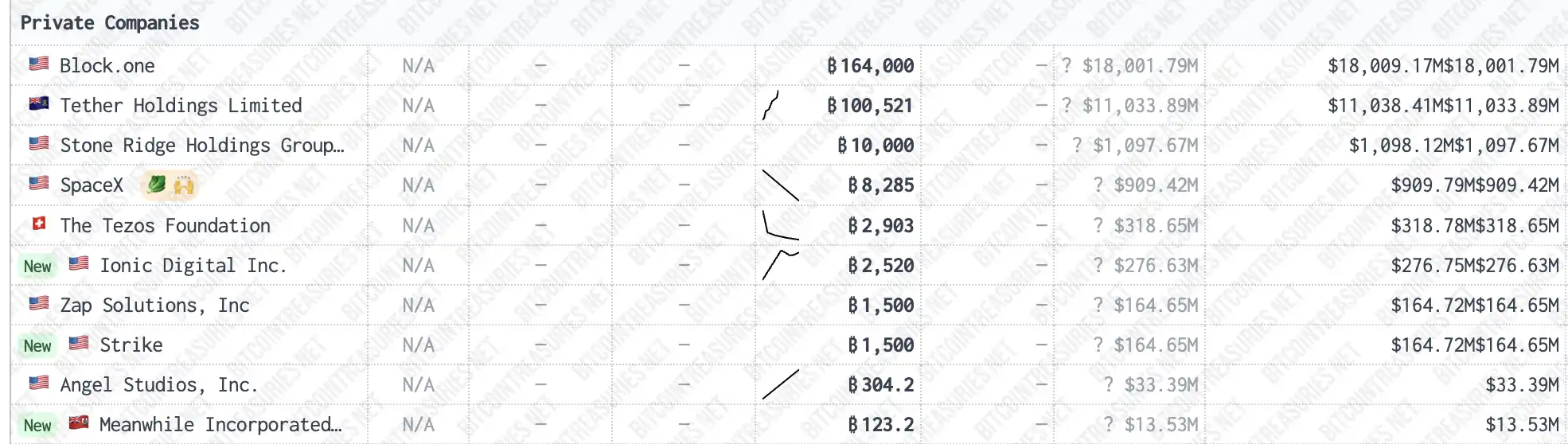

很多人不知道的是,EOS 母公司 Block.one 是目前持有比特币数量最多的私企公司,一共拥有 16 万枚 BTC,比稳定币巨头 Tether 还多 4 万个。

数据来源:bitcointreasuries

按当前价格 117,200 美元计算,这笔 16 万枚 BTC 价值约 187.52 亿美元。也就是说,光是这笔比特币的增值,Block.one 账面上就赚了 145 多亿美元,大约是当年 ICO 融资额的 4.47 倍。

从「现金流为王」的角度上来说,Block.one 今天很成功,甚至可以说是比微策略更有「前瞻性」的公司,也是加密史上最赚钱的「项目方」之一。只不过,它不是靠「建成一个伟大的区块链」,而是靠「如何最大限度地保住本金、扩大资产、顺利退场」。

这正是加密世界讽刺和真实的另一面:在币圈,赢到最后的不一定是「技术最好」和「理想最燃」的那个,而可能是最懂合规、最会审时度势和最擅长留住钱的那个。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。