Author: Julian, Web3Future

On December 9, Movement (MOVE) was launched on exchanges such as Binance, Coinbase, and Upbit. On December 10, MOVE reached a peak price of $1.4, and is currently priced around $0.7, with a total market capitalization of $7 billion.

With its launch on all top exchanges and a market cap exceeding $10 billion, along with airdrops and other marketing strategies receiving significant praise from the community, Movement's performance is undoubtedly one of the standout projects in this bull market.

Just two years ago, Movement was a project with a valuation of only $25 million, incubated by the Avalanche (AVAX) team. I wrote this article to summarize the Web3 success journey of the Movement project, hoping it can provide some insights.

The journey of Movement can be summarized in one sentence as a continuous quest for "finding a father." It can be roughly divided into four stages:

Avalanche: Secured incubation resources from Avalanche and brought in star angel investors.

Aptos: Received investment from Aptos, reused Aptos code, and quickly acquired Move lineage.

Binance: Secured endorsement and sponsorship from Binance, leveraging various resources in Asia.

Community: Large-scale airdrops, focusing on community and KOL marketing to gain retail reputation.

Secured incubation resources from Avalanche and brought in star angel investors

Movement's start was quite challenging, as it was established during the worst bear market of 2022. At that time, the Movement team members mainly came from Avalanche and its partners.

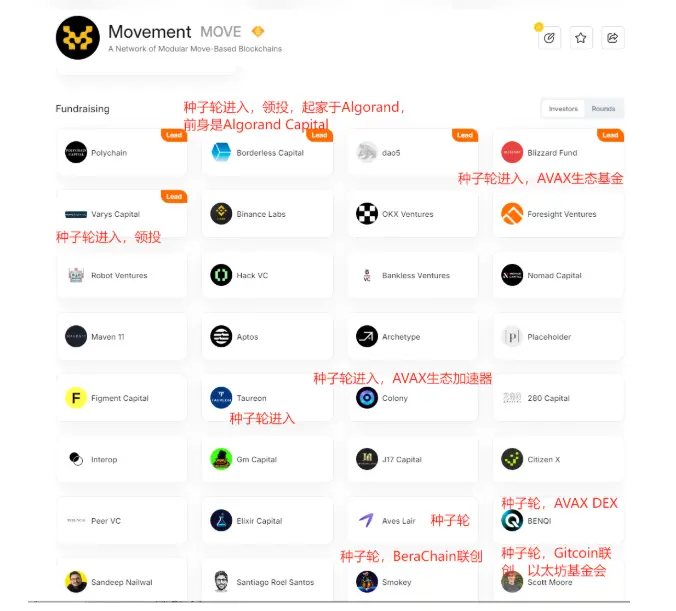

According to early financing introductions, Movement was initially positioned as a community-first modular Move Layer 1, incubated by Ava Labs (the Avalanche development company), with supporters including DEX BENQI on Avalanche, Blizzard Fund (Avalanche ecosystem fund), Colony (Avalanche ecosystem accelerator), and Avalaunch (IDO platform on Avalanche).

Avalanche's backing allowed Movement to secure a number of star angel investors. According to RootData and early financing introductions, Movement's seed investments included several prominent North American institutions and individuals: Borderless Capital, BeraChain co-founder Smokey, Gitcoin co-founder and former Ethereum Foundation member Scott Moore, among others.

In addition to the aforementioned seed round investments, other incomplete statistics show that Movement's seed investors also included well-known figures in the Avalanche community such as the Ulaj Brothers, Jon West (former strategic advisor at the Ethereum Foundation), Jonathan Chang (COO of Nibiru Chain), core contributor to GMX coinflipcanada, founder of blockchain company Gumzilla Theodore Agranat, founder of Vorto Gaming Sonny Azeez, Polychain GP Christian Sullivan, and angel investors from JP Morgan's Crypto Division, as well as market maker Gotbit.

It can be said that Movement not only secured its first pot of gold from Avalanche but also brought in star angel resources from North America. Such a luxurious lineup of investors laid the foundation for Movement's future financing and endorsements. For example, Polychain GP Christian Sullivan, as a seed investor, set the stage for Polychain to lead the next round of investment in Movement.

Received investment from Aptos, reused Aptos code, and quickly acquired Move lineage

Among the many prestigious investors, Aptos is not considered Movement's "father" in terms of endorsement and financial support. People close to Aptos Labs indicated that Aptos's investment in Movement was only $50,000, while others claimed it was $500,000.

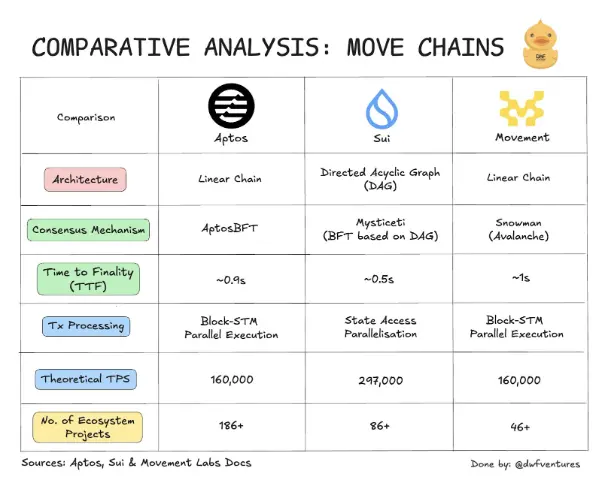

However, Aptos remains an irreplaceable investor for Movement. This is because Movement not only received investment and endorsement from Aptos but also based its development on the Aptos Move programming language, adopting similar architecture and design concepts, allowing for rapid technical development and acquiring "Move lineage."

In terms of architecture, both Aptos and Movement are linear blockchains; in transaction processing TPS, both use the Block-STM optimistic parallel execution engine. Originally, Move, as an open-source language, did not have the same "orthodoxy" as the Ethereum ecosystem.

However, Aptos and Sui, as the earliest Move dual champions originating from Meta Diem, have competitive and differing routes and philosophies. Therefore, both Aptos and Sui are trying to seize their own discourse power and orthodoxy in the Move ecosystem.

For Aptos, investing in Movement and requiring it to base its development on the Aptos Move programming language and adopt similar architecture and design concepts is an important step in strengthening Aptos Move's discourse power. For Movement, quickly reusing Aptos Move development means it does not have to start from scratch to complete the technical development design of a Move public chain.

There is also a small episode here; Movement has also been in contact with Sui. According to investors from Sui's development company, Mysten Labs, their strategy is to personally develop three Move public chains, and investing in other teams' Move public chains is not a high priority.

In June 2024, Mysten Labs announced the launch of a decentralized storage and data availability protocol called Walrus, which is a decentralized storage network built on Sui, featuring a new governance token, WAL. Perhaps in 2025, we will see a third Move public chain developed by Mysten Labs. After Movement, we will definitely see more Move public chains emerge.

Secured endorsement and sponsorship from Binance, leveraging various resources in Asia

Movement also received substantial support from Asian investors, with the key element being the backing from Singapore's Web3 capital. Movement's ability to open up in Asian institutions was undoubtedly significantly aided by Binance's endorsement and sponsorship, which is also why there has been much community discussion about Movement being a VC coin and a "girlfriend coin."

Many community members and Movement partners have stated that Movement may be the "crazy" project second only to IO. In the first half of this year, after securing investment from Binance, Movement leveraged the expectations of being listed on Binance and Dovey Wan's Primitive Ventures to rapidly tap into various institutional resources in Asia, entering with a valuation of $400 million to $1 billion.

After bringing in Binance's investment this year, Movement's logo was also upgraded from black and white to a yellow color very similar to Binance's visual identity. Later, at industry events such as the Blockchain Week in Korea and Singapore, it sponsored a large number of advertising brand exposures.

Regarding the discussion of "girlfriend coins," this is inherently a subjective issue, and I won't analyze it too much. My judgment is that one role of VC institutions is to provide endorsements and hype; Movement has maximized the expectations of Binance and VC endorsements within a reasonable operational range. Movement's success is attributed to seizing the right timing, location, and people, stemming from the project's strong resource integration and operational capabilities.

The two co-founders of Movement, Rushi and Cooper, are both very young entrepreneurs. An investor close to the Movement team once stated that the two founders practiced their pitch skills over 200 times in front of their incubating angel investors before publicly participating in their first event pitch, which is why they possess strong persuasive abilities and communication skills despite their youth.

Additionally, Binance was the last exchange to announce the listing of Movement; prior to this, Movement had already secured listings on Coinbase, Upbit, OKx, and other exchanges. Therefore, it was relatively reasonable for Binance to list the highly anticipated Movement.

Large-scale airdrops, focusing on community and KOL marketing to gain retail reputation

If it were only for the above reasons, Movement could only be considered a successful VC coin. However, Movement's airdrop plan, along with its emphasis on collaboration with the community and KOLs, has earned it an excellent reputation.

In this year's L1/L2 public chain airdrop plans, it has evolved from the early large-scale distribution to low-income guarantees, witch hunts, points systems, and even extreme situations such as "mouse warehouse" airdrops and "electronic beggars," which have created significant opposition between the community and project parties.

Movement's airdrop has, to some extent, reversed the poor state of public chain airdrops. According to Panews statistics, the scale of Movement's airdrop exceeded $1.45 billion, with 98.5% of eligible addresses receiving over $100 in airdrop amounts, and all qualifying addresses received airdrops without any witch hunts. Moreover, there have been no rumors in the community about Movement airdropping to suspected "mouse warehouse" addresses.

In terms of collaboration with the community and KOLs, Movement has also been very proactive, showing none of the arrogance some VC projects have towards the community. For example, Movement conducted a global KOL promotion round with numerous KOLs, hiring influential analysts in the Chinese community, such as Jason Chen Jian and Australian Master Brother, as advisors. These community-focused initiatives have garnered a good marketing reputation.

After all, VC projects are primarily accountable to their sources of power. If a project's success and global expansion hinge on VCs and exchanges, the project parties will only care about the thoughts of VCs and exchanges, rather than valuing communication with the community.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。