The resurgence of the "Exchange + Public Chain" model is not only a combination of technology and resources but has also become a new battleground for leading CEXs to build long-term competitiveness.

In the competition of the broader EVM ecosystem, it seems that a transformation led by exchanges is quietly unfolding.

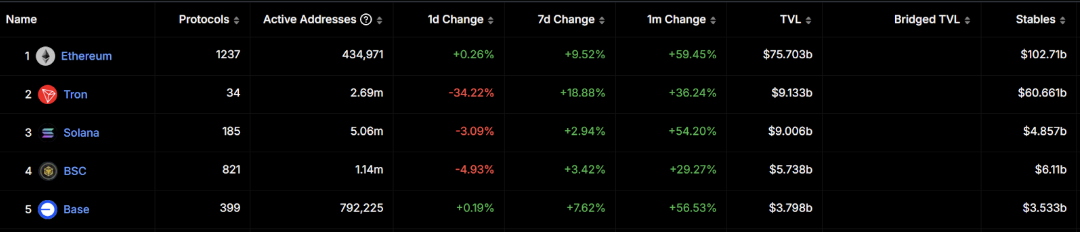

According to DeFiLlama data, as of December 5, BNB Chain and Base ranked second and third in total value locked (TVL) among all broader EVM ecosystems, with $5.7 billion and $3.8 billion respectively, successfully surpassing leading L2 networks like Optimism and Arbitrum, and are redefining the landscape of EVM networks.

In fact, the "Exchange + Public Chain" model is not a new concept, but with the successful practice of Coinbase+Base and the entry of new players like Bitget+Morph and HashKey+HashKey Chain, it is becoming a key weapon in industry competition—exchanges serve as traffic entry points, possessing a natural user base and liquidity advantages, while public chains provide the infrastructure for application development and interaction experience. The combination of the two can significantly enhance the depth and closed-loop of the ecosystem.

From BNB Chain + Binance, Coinbase+Base to Bitget+Morph, the rise of exchange public chains is not only a combination of technology and resources but also a revolution that redefines the industry landscape, seemingly indicating that the next round of competition in the blockchain industry is quietly forming.

Coinbase+Base: The Resurgence of "Exchange + Public Chain"

Why can the old concept of "Exchange + Public Chain" be revitalized?

Base is undoubtedly the most critical catalyst—since its mainnet officially opened in July 2023, it has rapidly risen thanks to Coinbase's brand endorsement and user base, and through technological innovation and consumer narratives, it has provided a new reference for the "Exchange + Public Chain" model.

The initial strategic logic of Base lies in lowering the development threshold, promoting more projects to join the ecosystem through friendly development tools and incentive programs. Its subsequent success is closely tied to its focus on building a "consumer application" narrative, especially around in-depth construction of consumer scenarios:

If we take a closer look at Base, we find that its consumer gene is quite mature, having carved out an unreplicable competitive edge in both the "meme" and "SocialFi" paths, making it a highly competitive network in the L2 space even without the expectation of issuing tokens.

Meme Coin Effect: The "Catalyst" of On-Chain Traffic

First and foremost is the layout in the meme domain. If we review the hot events surrounding Base over the past year, we find that the frequent meme wealth creation myths have become the main lever for driving significant capital and user inflow into Base, almost serving as a clever "marketing strategy" by Base.

In simple terms, from TYBG, Degen to Brett, Base has seen the emergence of "godly projects" or "meme coins" that create wealth effects at regular intervals, directly attracting a large amount of on-chain traffic to Base, to the extent that many meme projects on the Ethereum mainnet have even migrated their contracts to Base.

Moreover, due to the strong wealth effects of various memes breaking into the mainstream, with hundreds or thousands of times in price increases attracting community attention, a significant portion of the funds flowing into Base is centered around the movements of meme coins, further forming a kind of "self-justifying" logic.

Reviewing the current meme coins in the Morph ecosystem

SocialFi Scenarios: The "Breakthrough Point" for Consumer Interaction

Meme coins are just part of Base's success stories. Next, let's look at its performance in SocialFi scenarios—whether it was bringing the extremely valuable explosive community traffic from friend.tech or its leading position in Web3 social applications with Farcaster, Base has firmly established itself as the "new darling" of L2, gradually building a unique ecological advantage.

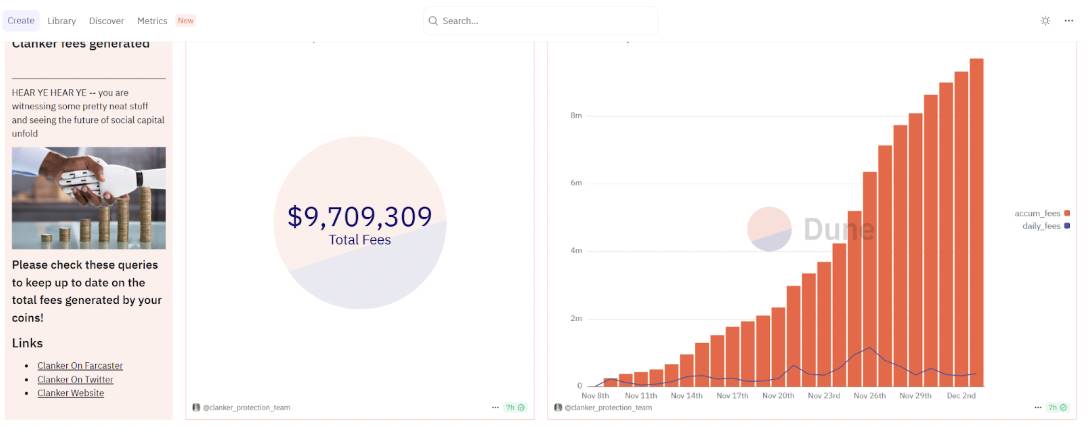

Including the recently popular AI Agent application Clanker, which is essentially an AI token issuance platform based on Farcaster—shortening the token issuance path to just a tweet on Farcaster, this "post and issue tokens" approach has created a lower barrier for token issuance, further amplifying user participation enthusiasm.

According to official information, as of the afternoon of November 27, the number of related meme coins issued within the Clanker system had reached 9,133. Additionally, according to Dune data, Clanker's current protocol revenue has reached $9.7 million, showcasing Base's innovative capabilities in the SocialFi scenario and highlighting its profound understanding of consumer needs.

Overall, Base demonstrates the immense potential of the "Exchange + Public Chain" model in consumer scenarios and provides a clear direction for the industry: by combining the traffic resources of exchanges with the technical support of public chains, Base not only lowers the participation threshold for users and developers but also achieves rapid ecosystem expansion through meme and SocialFi scenarios, driving explosive growth in consumer application scenarios.

This model not only brings significant capital inflow and user stickiness but also indicates that building application narratives around consumers is becoming a booster for ecosystem development and a key code for on-chain growth.

Will Public Chains Become the Main Battleground for Exchanges Again?

Beyond Base and BNB Chain, several new variables worth paying special attention to have emerged in the exchange public chain space, including Bitget+Morph (focusing on consumer scenarios) and HashKey + HashKey Chain (focusing on regulatory compliance), which are also the inevitable direction for CEXs to seek new growth points under market competition and regulatory pressure.

In simple terms, the combination of exchanges and public chains is essentially an efficient resource integration method, possessing natural synergies: exchanges have a large user base, strong liquidity, and rich business resources and market reach, and through public chains, these resources can be directly injected into the on-chain ecosystem, achieving rapid ecological expansion and growth.

At the same time, exchanges can maximize their resource advantages through public chains, such as efficiently connecting on-chain assets with user demands through listings, lowering the barriers for quality new assets to go public. This not only attracts more developers and users to on-chain ecosystem projects but also allows CEXs to diversify their businesses and enhance their risk resistance.

Recently, the centralized exchange cooperation organization launched by Morph has brought mainstream CEXs like Bitget, HTX, MEXC, and Poloniex under one umbrella, allowing projects within the alliance to achieve more efficient resource allocation among CEXs and providing CEXs with better potential on-chain asset listing options.

This synergy not only promotes the ecological construction of Morph but also enhances the market competitiveness of the exchanges within the alliance, especially for traditional exchange models that have long been limited by a single listing process. Morph's innovation undoubtedly provides new ideas for exchange public chain cooperation.

It is worth noting that the CEX field has shown a long-term dominant situation of "one superpower." However, with the tightening of the global regulatory environment and the rise of decentralization trends, new first-tier exchanges are gradually becoming an undeniable force. Platforms like Bitget, KuCoin, and MEXC have won a large user base and market share through differentiated market positioning and flexible strategies.

From this perspective, Morph's focus on consumer scenarios, combined with Bitget's resources, has constructed a highly synergistic ecological closed loop. This integration not only aggregates the resources and strengths of multiple exchanges but may also become an important variable in reshaping the landscape of digital asset trading platforms:

By integrating off-chain exchange traffic with on-chain service capabilities, the two have jointly opened up a complete path from acquiring off-chain users to managing on-chain assets, providing users with a seamless participation experience and allowing developers and users to more efficiently integrate into the ecosystem, building a unique user growth flywheel.

What New Variables Are Being Played in the "Exchange + Public Chain"?

The success of Base is evident, but can new players like Bitget+Morph replicate or even surpass this effect? In fact, beyond technology and hit products, ecological construction is a necessary condition for an L2 to achieve long-term sustainable development.

From Base's success case, it is clear that while improvements in technical performance and the emergence of single-hit products can attract short-term attention, long-term sustainable development relies on more complete ecological construction, especially in-depth layout around consumer scenarios.

Interestingly, in building consumer scenarios, Bitget and Morph's goal is not to replicate Base's deep narrative but to construct ecological differentiation through a broader range of diverse applications, such as supporting on-chain mini-games, meme/social applications, prediction markets, and flow payments, attempting to build a differentiated ecological landscape centered around consumers, breaking the traditional L2 construction model.

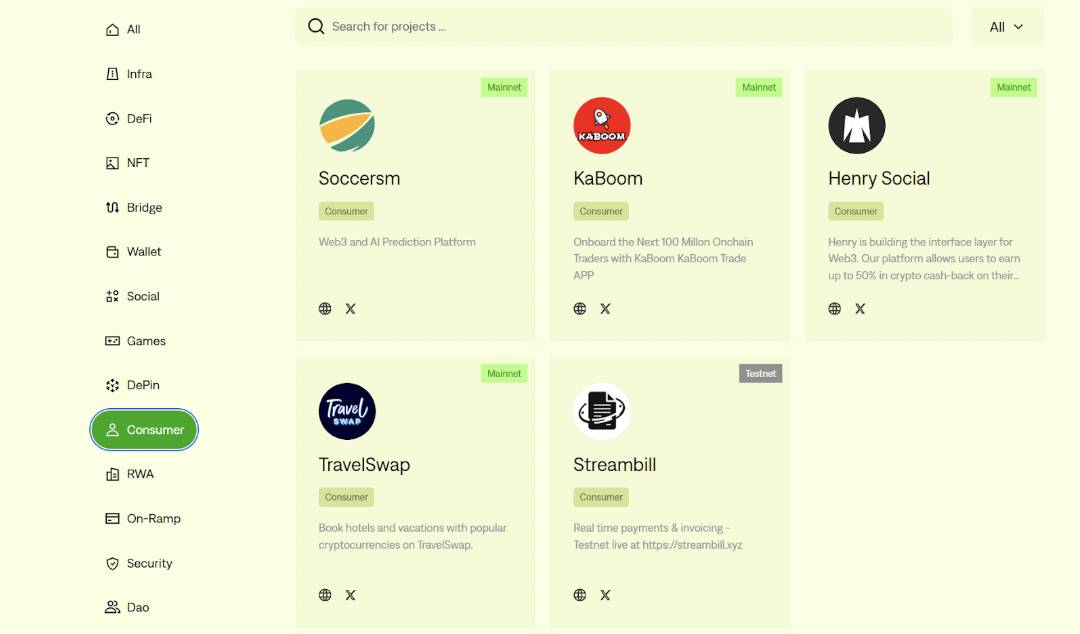

For example, among the DApps that have been launched on the Morph mainnet, in addition to conventional on-chain protocols like cross-chain bridges, liquidity protocols, lending protocols, and NFT trading markets, there are also consumer & social-type DApps like KaBoom and Soccersm.

Taking the meme token ecosystem KaBoom as an example, it plays a core role as a liquidity center and wealth password distribution hub on the Morph chain by providing users with convenient token trading and management functions, allowing Morph to attract traffic from other chains and enticing users to experience more efficient asset management and on-chain interaction.

This allows Morph to not only meet users' needs for multi-chain interaction but also enables developers to more easily integrate multi-chain scenarios into application design. Its accompanying SocialFi features further deepen user participation and on-chain value capture.

Overall, Morph does not limit consumer narratives to a single scenario; these diverse Consumer DApps collectively promote the formation of a multi-faceted ecological closed loop centered around consumers, enhancing user stickiness on-chain and providing developers with rich application building scenarios.

In simple terms, the strategic core of Morph lies in attracting more ordinary users and developers into its ecosystem through innovative designs of tools like Kaboom. From the design philosophy of Kaboom and Morph's ecological narrative, it can be inferred that the joint layout of Bitget and Morph is not merely a one-time L2 construction but may represent a comprehensive strategy aimed at the future landscape of blockchain.

After all, the crypto and Web3 world is not limited to financial use cases. The true breakthrough for the next wave of incremental users in Web3 may not come from the traditional methods we imagine, such as increasingly tedious airdrops or short-term marketing tactics that have already fatigued users, as these methods often fail to sustain long-term user engagement and value creation.

Instead, the real source of user growth should come from authentic consumer scenarios—each consumer has an independent wallet address, linked to real cash flow. Therefore, the design intent of Consumer DApps like Kaboom is very clear: to bring a broader user base into Morph's ecosystem through low-threshold tools and cross-chain support.

This strategy can effectively convert Bitget's exchange traffic into long-term user resources for the on-chain ecosystem. Through Bitget's listing advantages and marketing capabilities, Morph can more efficiently promote its ecological content to a wider market, ensuring continued innovation in consumer scenarios.

Summary

The "Exchange + Public Chain" model is becoming an emerging battleground in the blockchain industry, and their combination is also an efficient resource integration method, as vividly demonstrated in the practices of Base and Morph.

Therefore, the core competitive point of this model ultimately lies in who can more efficiently integrate resources and convert these resources into actual value in on-chain scenarios. Thus, whether Bitget/Morph can demonstrate strong differentiated advantages in user experience, developer support, and market synergy will determine whether they can open a new development direction for the "Exchange + Public Chain" model.

In the future, will this model further consolidate the core position of CEXs? What challenges will it pose to DEXs and decentralized ecosystems? And can new players like Bitget/Morph surpass Base and define the future of this model?

From the current development perspective, this competition has just begun, and the answers may be revealed in the next round of industry reshuffling.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。